Best Gillette, WY Auto Insurance in 2025 (Top 10 Companies Ranked)

The best Gillette, WY auto insurance providers are State Farm, USAA, and Farmers. Gillette, WY car insurance rates start at $16 monthly. State Farm is known for its large network of expert local agents, USAA offers unique perks and discounts for military personnel, and Farmers provides a wide range of coverage options.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Mar 25, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

18,154 reviews

18,154 reviewsCompany Facts

Full Coverage in Gillette WY

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage in Gillette WY

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 3,072 reviews

3,072 reviewsCompany Facts

Full Coverage in Gillette WY

A.M. Best Rating

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviewsState Farm, USAA, and Farmers offer the best Gillette, WY auto insurance, with rates as low as $16 a month. State Farm is the top pick for its wide area of local experts, ensuring customers get a personalized experience.

USAA excels with exclusive military discounts for veterans, active military personnel, and their families, while Farmers stands out for its flexible and broad car insurance coverage options.

Our Top 10 Company Picks: Gillette, WY Auto Insurance

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 17% | B | Affordable Coverage | State Farm | |

| #2 | 10% | A++ | Military Families | USAA | |

| #3 | 20% | A | Coverage Options | Farmers | |

| #4 | 25% | A++ | Budget Savings | Geico | |

| #5 | 25% | A+ | New Vehicles | Allstate | |

| #6 | 25% | A | Unique Discounts | Liberty Mutual |

| #7 | 13% | A++ | Hybrid Vehicles | Travelers | |

| #8 | 5% | A+ | Senior Benefits | The Hartford |

| #9 | 20% | A+ | Bundled Policies | Nationwide |

| #10 | 10% | A+ | Flexible Plans | Progressive |

This article explains how car insurance works and whether you’d like to pay in full or monthly for car insurance. If you’re ready to get the best car insurance in Wyoming, you can enter your ZIP code using our free quote tool.

- Gillette auto insurers offer comprehensive and collision coverage

- State Farm has the lowest Gillette, WY rates, starting at $16 per month

- Wyoming’s minimum liability requirements are 25/50/20

#1 — State Farm: Top Overall Pick

Pros

- Affordable Coverage: This makes it a great choice for drivers seeking budget-friendly options without compromising coverage.

- High Reputation: State Farm’s long history of providing reliable auto insurance in Gillette, WY, ensures its high reputation. For further details, check our State Farm auto insurance review.

- Wide Network of Agents: With numerous local agents, State Farm provides personalized assistance for auto insurance in Gillette, WY.

Cons

- Higher Premiums for Some Drivers: Drivers with less-than-perfect driving records may face higher auto insurance quotes in Gillette, WY.

- Limited Online Tools: State Farm’s online tools may not be as intuitive as some competitors’, making it harder to get auto insurance quotes quickly in Gillette, WY.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#2 — USAA: Best For Military Families

Pros

- Top-Tier Customer Service: The company offers the best Wyoming auto insurance experience for military families in Gillette, WY. Get more information from our USAA auto insurance review.

- Exclusive Military Discounts: USAA’s auto insurance quotes in Gillette, WY, are highly competitive because of discounts for active-duty military personnel and veterans.

- A++ Financial Strength: USAA has an A++ rating from A.M. Best, which means it can provide reliable coverage for drivers in Gillette, Wyoming.

Cons

- No Physical Locations: Without physical locations in Gillette, WY, USAA may not be ideal for drivers who prefer face-to-face interactions.

- Only Available to Military Families: USAA is only available to military families, which limits its accessibility for non-military drivers seeking auto insurance in Gillette, WY.

#3 — Farmers: Best For Coverage Options

Pros

- Numerous Discounts Available: Farmers offers several ways to save on auto insurance in Gillette, WY, such as discounts for multi-vehicle policies and safe drivers.

- Broad Coverage Options: Drivers in Gillette, WY, can choose from various coverage options to fit their needs. For further details, take a closer look at our Farmers auto insurance review.

- A-Rated Financial Strength: Farmers has an A rating from A.M. Best, making it a reliable option for car insurance in Gillette, WY.

Cons

- Expensive for High-Risk Drivers: Farmers’ auto insurance quotes in Gillette, WY, may be higher for high-risk drivers or those with previous claims.

- Limited Online Tools: Farmers’ online tools may not be as advanced as those of other providers, making it harder to get quick auto insurance quotes in Gillette, WY.

#4 — Geico: Best For Budget Savings

Pros

- Budget-Friendly Rates: Geico is an excellent choice for drivers looking for affordable car insurance quotes. For more details, check our Geico auto insurance review.

- Easy Online Process: Geico’s online system makes it easy to obtain quick car insurance quotes in Gillette, WY, with minimal hassle.

- Convenient Mobile App: Geico’s mobile app is convenient for managing auto insurance policies and submitting claims.

Cons

- Limited Local Agents: Geico’s reliance on online services can disadvantage Gillette, WY drivers seeking in-person assistance with auto insurance quotes.

- Expensive for High-Risk Drivers: Geico’s auto insurance quotes in Gillette, WY, may not be the most affordable option for drivers with a poor driving history.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#5 — Allstate: Best for New Vehicles

Pros

- Strong Financial Backing: Allstate has an A+ rating from A.M. Best, demonstrating its financial stability.

- Comprehensive Coverage Options: According to our Allstate auto insurance review, they offer a wide range of coverage options for drivers seeking the best Gillette, WY auto insurance.

- Great New Vehicle Coverage: This company offers new car owners a variety of auto insurance coverage options in Gillette, WY.

Cons

- Limited Coverage for Older Vehicles: Allstate’s coverage for older vehicles may not be as extensive as that of some competitors, leaving motorists with inadequate auto insurance coverage.

- Costs More for High-Risk Drivers: Geico’s auto insurance quotes in Gillette, WY, may not be the most affordable option for drivers with a poor driving history.

#6 — Liberty Mutual: Best for Unique Discounts

Pros

- Unique Discount Programs: These include safe driving and new car unique discounts, which make Liberty Mutual auto insurance review help lower car insurance quotes in Gillette, WY.

- Comprehensive Coverage: The variety of coverage options makes it easy for drivers in Gillette, WY, to find the best auto insurance for their needs.

- 25% Bundling Discount: Liberty Mutual’s bundling discount allows you to save significantly on car insurance quotes in Gillette, WY, by combining auto with other policies.

Cons

- Costs More for Younger Drivers: Liberty Mutual’s car insurance quotes in Gillette, WY, may be higher for younger or less experienced drivers.

- Limited Agents Locally: Liberty Mutual is more challenging for Gillette, WY drivers who prefer in-person support because it has fewer local agents than other insurers.

#7 — Travelers: Best for Hybrid Vehicles

Pros

- Hybrid Vehicle Coverage: Travelers offers specialty coverage for hybrid cars, making it a great choice for eco-friendly drivers.

- A++ Financial Rating: Travelers provides financial stability for car insurance in Gillette, WY, with an A++ rating from A.M. Best. Explore our Travelers auto insurance review for additional insights.

- 13% Bundling Discount: Travelers offers a bundling discount for multi-policy holders, helping drivers save on their auto insurance quotes in Gillette, WY.

Cons

- Limited Local Agents: Travelers have fewer local agents than other companies, which may be inconvenient for those seeking face-to-face service for auto insurance in Gillette, Wyoming.

- Not the Cheapest for High-Risk Drivers: Travelers’ rates for high-risk drivers may be higher than other providers offering car insurance quotes in Gillette, WY.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#8 — The Hartford: Best for Senior Benefits

Pros

- Senior Driver Benefits: The Hartford offers specialized benefits to senior drivers in Gillette, making it a top choice for older adults seeking auto insurance in Gillette, WY.

- A+ Financial Strength: With an A+ rating from A.M. Best, The Hartford is a financially reliable provider of auto insurance in Gillette, WY.

- 5% Bundling Discount: The Hartford helps you save on car insurance quotes in Gillette, WY, when you bundle your auto insurance with other policies.

Cons

- Limited Discounts for Younger Drivers: According to The Hartford auto insurance review, it may not offer as many discounts for younger drivers.

- Fewer Options for High-Risk Drivers: High-risk drivers may find fewer options available for auto insurance in Gillette, WY.

#9 — Nationwide: Best for Bundling Policies

Pros

- High Financial Rating: According to the Nationwide auto insurance review, its high financial rating ensures auto insurance customers enjoy financial safety.

- Wide Variety of Coverage Options: Makes it easy to customize car insurance quotes to meet the needs of customers offering a broad coverage.

- Flexible Options for Payment: Nationwide offers flexible payment plans to make auto insurance premiums easier to manage.

Cons

- Higher Rates for Some Drivers: Nationwide’s auto insurance quotes in Gillette, WY, may be higher for high-risk drivers than those of other providers.

- Limited Availability in Some Areas: While Nationwide is widely available, it may not offer as much localized support in all areas of Gillette, WY.

#10 — Progressive: Best for Flexible Plans

Pros

- Flexible Coverage Options: Progressive offers a wide range of coverage options, allowing drivers to find the best auto insurance quotes in Gillette, WY.

- 10% Bundling Discount: Provides 10% bundling discount for auto insurance with other policies.

- A+ Financial Strength: According to our Progressive auto insurance review, it has an A+ rating from A.M. Best, making it a financially stable option for auto insurance in Gillette, WY.

Cons

- Higher Premiums for High-Risk Drivers: Progressive may offer higher car insurance quotes in Gillette, WY, for high-risk drivers.

- Limited Discounts for Older Drivers: Progressive may not offer as many discount options for older drivers, which could make their auto insurance in Gillette, WY, more expensive.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Gillette, WY Car Insurance Rates & Discounts by Top Providers & Coverage Level

If you plan to get car insurance in Gillette, WY, you should evaluate what is covered and what is not covered by your chosen auto insurance policy. Aside from that, it’s better to contact car insurance agents or brokers in your local area to gauge how much you will pay monthly for car insurance.

Gillette, WY Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $59 | $177 | |

| $39 | $138 | |

| $18 | $80 | |

| $50 | $160 |

| $45 | $130 |

| $28 | $110 | |

| $22 | $100 | |

| $60 | $165 |

| $55 | $150 | |

| $16 | $79 |

Depending on your chosen coverage type, there is a respective equivalent policy coverage; that’s why we suggest getting a more comprehensive plan to meet your future needs and avoid financial burdens.

Auto Insurance Discounts From Top Gillette, WY Providers

| Insurance Company | Anti-Theft | Bundling | Good Student | Loyalty | Safe Driver |

|---|---|---|---|---|---|

| 10% | 25% | 22% | 15% | 18% | |

| 10% | 20% | 15% | 12% | 20% | |

| 25% | 25% | 15% | 10% | 15% | |

| 35% | 25% | 12% | 10% | 20% |

| 5% | 20% | 18% | 8% | 12% |

| 25% | 10% | 10% | 13% | 10% | |

| 15% | 17% | 35% | 6% | 20% | |

| 10% | 5% | 12% | 7% | 8% |

| 15% | 13% | 8% | 9% | 17% | |

| 15% | 10% | 10% | 11% | 10% |

You can also take advantage of discounts cheap Wyoming car insurance companies offer to get the best policy at affordable rates.

Auto Insurance Coverage Requirements in Wyoming

In order to drive legally in Gillette, WY, residents should always carry liability insurance, even if it’s the minimum. Having minimum liability insurance is not bad, as long as you always carry it in case of an unexpected event. With that said the state of Wyoming requires at least 20/50/20 liability coverage.

Auto Insurance Minimum Coverage Requirements in Wyoming

| Coverage | Limit |

|---|---|

| Bodily Injury | $25,000 per person / $50,000 per accident |

| Property Damage | $20,000 per accident |

Bear in mind these mandatory state minimums hardly ever provide sufficient coverage with regard to your average driver. This is because most motorists are driving relatively newer automobiles, continue to make loan repayments, or might even be leasing their vehicles. As well as in the majority of individual cases, you will have to purchase an extensive policy to safeguard your vehicle properly.

For Wyoming drivers looking for stability and excellent service, State Farm’s extensive agent network ensures personalized assistance that online-only insurers often lack.

Chris Abrams Licensed Insurance Agent

There are lots of unfortunate motorists riding around in Gillette at this time, with repayments up to $128 monthly, the reported average for Wyoming auto insurance. However, you will find deals happening in your area that allow you to obtain good coverage for as little as $16/mo*, so we can help you should you need assistance comparing rates today.

Gillette, WY Auto Insurance Monthly Rates by Provider

| Insurance Company | Monthly Rate |

|---|---|

| $72 | |

| $112 | |

| $79 | |

| $68 |

| $44 |

| $96 | |

| $17 | |

| $43 |

| $86 | |

| $22 |

Those that offer auto insurance policies evaluate many elements while determining insurance quotes, like driving experience, zip code, occupation, driving distance to work, and business use of the vehicle. Furthermore, premiums may alter from carrier to carrier. To ensure that you still pay the most affordable fee, look at cheap auto insurance in Wyoming prices online.

Major Car Insurance Factors in Gillette

You may feel slightly helpless as soon as your automobile insurance agency estimates your insurance quote; let’s be honest, almost all of the factors these people calculate for the average cost of auto insurance aren’t issues you can modify or control. Fortunately, however, there are various items that you are in a position to adjust for increased discounts, including location, vehicle accidents, thefts, and so on.

Why is the price of my car so high?

by u/Ry_Dawg41 in r/personalfinance

Learning these factors can help you get the cheapest car insurance in Wyoming for affordable auto insurance costs that fit your needs and budget.

Your Zip Code

Auto insurance providers must know your location or where you usually drive a vehicle to determine the crash probability. The whole thing boils down to a very simple notion: the greater the populace, the more vehicles you’ll encounter on the streets, and the more chances you may have to crash with or perhaps be collided into by yet another motor vehicle.

Gillette, WY Auto Insurance Monthly Rates by ZIP Code

| ZIP | Rates |

|---|---|

| 82716 | $202 |

| 82717 | $210 |

| 82718 | $196 |

Top insurers need this information to determine an auto insurance rate by state. Because the higher the risks are in your area, the greater the probability of your auto insurance quote in Gillette, WY. That’s why getting quotes from different auto insurance providers is still important to get the best affordable rates without compromising coverage.

Automotive Accidents

Given Gillette’s small population, the number of serious accidents probably makes local insurance companies very nervous. When insurance companies get nervous, they tend to raise rates.

Fatal Accidents in Gillette, WY

| Category | Count |

|---|---|

| Fatal Crash Individuals | 1 |

| Fatal Crash Vehicles | 2 |

| Fatalities | 1 |

| Fatal Accidents | 1 |

| Fatal Accident Pedestrians | 1 |

| DUI Fatal Crashes | 1 |

But if you are a relatively safe driver, you might be able to qualify for a safe driver discount, despite living in a town with many accidents. Talk to your agent for more details.

Auto Thefts in Gillette

Obtaining inexpensive auto insurance can be difficult if you are vulnerable to auto theft. Some popular automobile models tend to be appealing to thieves, and motor vehicles are typically left in huge cities. But even if you don’t need it for theft, you might still want to consider adding it to the other benefits.

Car insurance coverage, such as comprehensive and collision auto insurance coverage, can help you better protect your vehicle and avoid future financial loss.

Your Credit Score

You might be wondering how your credit score affects your car insurance premium. If you have a bad credit score in Gillette, most providers will at least double your monthly premium compared to other motorists. Some companies might even consider tripling or quadrupling it.

However, you can still work around this problem by getting quotes from providers like State Farm, which offers reasonable premium car insurance prices for drivers and customers with bad credit.

Your Age

If you are looking for cheap car insurance in Wyoming for students or perhaps a teenage driver, you’ll encounter a difficult process.

Gillette, WY Auto Insurance Monthly Rates by Vehicle & Coverage Level

| Make & Model | Minimum Coverage | Full Coverage |

|---|---|---|

| BMW 3 Series | $150 | $350 |

| Chevrolet Malibu | $120 | $280 |

| Ford F-150 | $130 | $320 |

| Honda Civic | $110 | $250 |

| Hyundai Elantra | $100 | $230 |

| Mazda CX-5 | $120 | $270 |

| Nissan Altima | $115 | $260 |

| Ram 1500 | $140 | $330 |

| Tesla Model 3 | $180 | $420 |

| Toyota Camry | $105 | $240 |

Good student and driver’s education discounts can help lower car insurance rates for teenagers, but young customers will still need to pay much more than adults or seniors. Compare quotes around your area to make sure you still get the best coverage for an affordable cost for your teens.

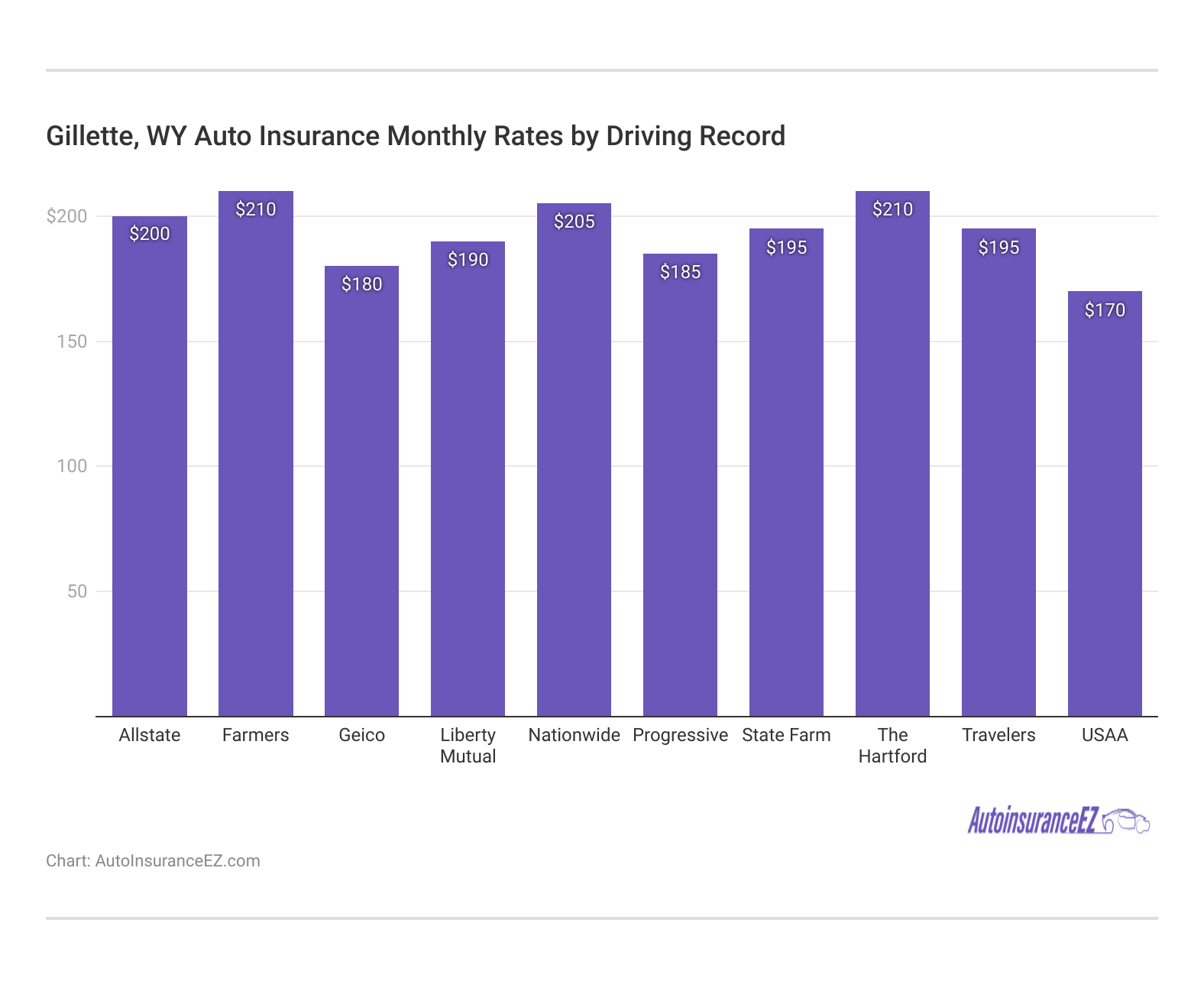

Your Driving Record

Serious driving violations can send your premiums over the top, or you might even get the coverage dropped completely. As well as the lesser breach(s) in your record, you might like to inquire about any sort of accident forgiveness discount.

This lowers your rate by ensuring that the total premium cost does not include a minimum of one minor violation. But if your provider does not offer this kind of discount, it’s not a bad idea to change auto insurance provider after an accident if it helps you secure cheaper rates from other companies. Still, we suggest you thoroughly read your insurance policy before switching.

Your Vehicle

With vehicle insurance, you’re basically wasting money and exposing yourself to economic difficulty should you not purchase enough coverage for the vehicle. For older, cheaper automobiles, sometimes the state minimums are sufficient.

Gillette, WY Auto Insurance Monthly Rates by Vehicle & Coverage Level

| Make & Model | Minimum Coverage | Full Coverage |

|---|---|---|

| BMW 3 Series | $150 | $350 |

| Chevrolet Malibu | $120 | $280 |

| Ford F-150 | $130 | $320 |

| Honda Civic | $110 | $250 |

| Hyundai Elantra | $100 | $230 |

| Mazda CX-5 | $120 | $270 |

| Nissan Altima | $115 | $260 |

| Ram 1500 | $140 | $330 |

| Tesla Model 3 | $180 | $420 |

| Toyota Camry | $105 | $240 |

However, for an extravagant vehicle, you’re likely to wish to purchase multiple kinds of coverage in high amounts, just in case the worst happens.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Minor Car Insurance Factors in Gillette

You might still be wondering how an auto insurance company determines your premiums. The best Gillette, WY auto insurance providers use these major factors to determine your premiums: age, gender, and location. As well as your marital status, gender, driving mileage, deductibles, and education.

These elements determine and affect how insurers calculate your policies and monthly rates, so you should look out for that to get the cheapest car insurance in Wyoming.

Your Marital Status

Have you and your partner begun bundling your different insurance policies together? Well, you need to! Combining car insurance after marriage is a terrific way to lower your household bills. Men and women can bundle, too, especially if they have renters or motorcycle insurance with a similar company.

Your Gender

You might wonder how auto insurance companies determine your premium. Some companies determine your car insurance rates by your gender, but in reality, no factor in how men and women drive makes one more dangerous than the other.

Due to this, many companies no longer know how to charge different rates according to gender. Some still do, but the overcharged gender differs from one company to another.

Your Driving Distance to Work

Because Gillette is such a small town, getting around is quick and easy. Most commutes won’t take longer than 10 or 15 minutes, and some motorists may find that their drive to work might last only 5 minutes. Around 77% of residents drive alone to and from work daily, and almost 15% carpool or ride their bikes, which promotes green commuting.

Are you aware that slashing your annual mileage by 5,000 miles yearly will only enable you to get a 4-6% discount off your premium? This means you’ll have to stop driving as much and cut at least 14 miles daily from your travel. Many people are only on the road if they absolutely have to be, so 14 miles each day is a big sacrifice for this type of small discount.

Your Coverage and Deductibles

Another step to lowering your premium rates is knowing what an auto insurance deductible is and how it works. Raising your deductible is a terrific way to decrease your monthly premium. But ensure you safeguard yourself financially by putting aside a minimum of the price of that deductible in a checking account and not using it unless you are paying for an emergency claim.

Ultimately, how devastating would it be if your vehicle was stuck in the shop and you didn’t have the cash to file claims and repair it?

Education in Gillette, WY

Over 35% of Gillette residents have earned a high school diploma, which is slightly above the state average. An additional 19% have at least one year of college experience. And when these students graduate, do you know what else they will have? Lower auto insurance rates! This is because providers like giving car insurance discounts to drivers with a higher education.

When choosing auto insurance in Gillette, focus on balancing cost with coverage—cheaper policies often mean higher out-of-pocket costs later.

Jimmy Mcmillan Licensed Insurance Agent

Located in the heart of Gillette is the appropriately named Gillette College. It is a two-year school also part of the Northern Wyoming Community College system. Students can earn an associate’s degree or a certificate in a number of fields, including the arts and applied sciences.

Auto insurance is likely one of the most critical purchases you are able to make as a buyer. You should ensure you obtain a genuine, dependable provider who will follow through on their offers. Various auto insurance providers are usually better at this than others, and doing a thorough internet-based investigation can assist you in dividing the favorable from the poor.

Cheap Car Insurance in Gillette, Wyoming: Tips For Affordable Coverage

Shopping for auto insurance shouldn’t be confusing when you use this guide as your reference. By reading this article, you should know how to secure the cheapest Wyoming car insurance. If you’re still confused about how you’ll know you’ve chosen the right coverage, you can always ask around and contact a local agent or broker in your area to help you get affordable car insurance near you.

State Farm, USAA, and Farmers are Gillette, WY’s top auto insurance companies, so we suggest you start with them. Also, getting an insurance quote online won’t affect your credit score, so don’t hesitate to reach out to them online because they offer very affordable coverage costs, and their local expert agents can help you gauge car insurers and choose which best auto insurance company to get your car insurance.

How We Conducted Our Gillette, WY Car Insurance Analysis

We calculated the best Gillette, WY auto insurance average rate based on the following metrics: a married, 34-year-old male with good credit, a 12-month history of maintaining auto insurance, a clean driving record, and who owns his own home. Miles driven annually were based on the national average. The average rate was also calculated based on a financed 2015 Honda Accord with a pre-installed anti-theft device.

Are you in need of cheap auto insurance in Gillette, WY? Enter your ZIP code now to get free car insurance estimates from major Wyoming providers.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

Is car insurance cheaper in Wyoming?

Yes, Wyoming has lower-than-average rates. Get the best Gillette, WY auto insurance from $16 per month.

Is uninsured motorist coverage required in Wyoming?

Wyoming does not require uninsured motorist coverage, but it’s recommended.

What insurance do I need for my car?

We suggest getting more than your state’s minimum requirements. Still, Gillette, Wyoming, requires liability coverage of at least $25K per person, $50K per accident, and $20K for property damage. Find your liability minimum coverage by entering your ZIP code in our free quote tool.

What is the most common type of car insurance?

Liability insurance is the most common and required coverage.

What is the best type of car insurance?

Full coverage car insurance (liability, collision, and comprehensive) offers the most protection.

How much is car insurance in Wyoming?

Rates are $16 monthly for the best Gillette, WY auto insurance, varying by provider and driver profile.

What is the minimum car insurance in Wyoming?

25/50/20 liability auto insurance coverage is the state minimum.

What does 22 mean on a Wyoming license plate?

It represents Teton County, as Wyoming assigns plate numbers by county.

Can a non-resident register a vehicle in Wyoming?

Generally, no. Wyoming requires proof of residency for vehicle registration.

Which auto insurance company has the best claims service?

State Farm is a top pick for the best Gillette, WY auto insurance, offering strong claims service.