Best Cheyenne, WY Auto Insurance in 2025 (10 Standout Companies)

State Farm, USAA, and Geico offer the best Cheyenne, WY auto insurance, with rates starting at $83 a month. State Farm is our top pick for its expert local support. USAA excels for its special military perks, while Geico stands out for its affordable Cheyenne, WY auto insurance policies.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

UPDATED: Mar 25, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

18,154 reviews

18,154 reviewsCompany Facts

Full Coverage in Cheyenne WY

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage in Cheyenne WY

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in Cheyenne WY

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsState Farm, USAA, and Geico offer the best Cheyenne, WY auto insurance, with minimum coverage starting as low as $83 a month. State Farm is our top pick for its expert local support and vast network of agents.

USAA comes second for its exclusive benefits for active military personnel and veterans. Geico offers affordable plans for Cheyenne, WY drivers, even for full coverage.

Our Top 10 Company Picks: Best Cheyenne, WY Auto Insurance

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 17% | B | Local Support | State Farm | |

| #2 | 10% | A++ | Military Benefits | USAA | |

| #3 | 25% | A+ | Affordable Rates | Geico | |

| #4 | 25% | A | Customizable Coverage | Liberty Mutual |

| #5 | 15% | A | Agent Access | Safeco | |

| #6 | 25% | A+ | Comprehensive Options | Allstate | |

| #7 | 20% | A | Discount Variety | Farmers | |

| #8 | 10% | A+ | High-Risk Coverage | Progressive | |

| #9 | 20% | A+ | Bundling Savings | Nationwide |

| #10 | 10% | A | SR-22 Assistance | The General |

Can’t wait to find affordable Cheyenne, WY auto insurance? Enter your ZIP code into our free quote tool above to start comparing Cheyenne, WY auto insurance quotes.

- Cheyenne, WY auto insurance rates average $83 monthly

- Wyoming state minimum liability auto insurance requirements are 25/50/20

- Factors such as age and ZIP code impact your Cheyenne, WY auto insurance rates

#1 — State Farm: Top Overall Pick

Pros

- Strong Customer Service: Local agents provide personalized service for policyholders looking for car insurance quotes in Cheyenne, WY.

- Good Student Discounts: Young drivers can save money with good student discounts.

- Drive Safe & Save Program: Policyholders can earn discounts by enrolling in State Farm’s safe driving telematics program.

- Accident Forgiveness: Helps prevent significant rate increases after a minor accident. You can check the full details in our State Farm auto insurance review.

Cons

- Strict Underwriting for High-Risk Drivers: State Farm is less forgiving of poor driving records when setting rates.

- High Minimum Coverage Rates: Car insurance quotes in Cheyenne, WY for minimum coverage are higher than some competitors.

- Rate Increases After Claims: Policyholders often experience rate hikes following claims.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#2 — USAA: Best For Military Benefits

Pros

- Top-Tier Digital Tools: The mobile app and online platform are among the best for policy management and claims handling.

- Multiple Discount Opportunities: Offers discounts for bundling, safe driving, and vehicle safety features. Learn more about these discounts by reading our USAA auto insurance review.

- Cheapest Overall Rates: USAA consistently offers the cheapest auto insurance in Cheyenne, WY.

Cons

- No Local Agents: USAA does not have physical branches in Cheyenne, WY, which may be a downside for those who prefer in-person service.

- Strict Claims Process: Some policyholders report a strict claims approval process with USAA.

#3 — Geico: Best For Affordable Rates

Pros

- Lowest Minimum Coverage Rates: Geico offers some of the cheapest auto insurance quotes in Cheyenne, WY for minimum coverage.

- Competitive Rates for Young Drivers: Geico has affordable rates for teen and young adult drivers in Cheyenne, WY. Learn more by reviewing our Geico auto insurance review.

- Military Discounts: Geico offers some of the best Wyoming auto insurance discounts for active military members and veterans.

Cons

- Higher Full Coverage Rates: While minimum coverage is cheap, full coverage policies can be more expensive than competitors’ policies.

- Strict Eligibility for Discounts: Some discounts have strict qualification requirements, limiting savings for some drivers.

#4 — Liberty Mutual: Best For Customizable Coverage

Pros

- Comprehensive Coverage Options: Offers a range of full coverage options for those seeking solid auto insurance in Cheyenne, WY.

- Accident Forgiveness: Available to qualifying policyholders, preventing premium hikes after a first at-fault accident.

- New Car Replacement: Liberty Mutual provides new car replacement, ensuring drivers receive full value for their new vehicle if totaled.

Cons

- Rate Increases Over Time: Policyholders report gradual rate increases even without claims or violations. For more information, read our Liberty Mutual auto insurance review.

- Expensive for High-Risk Drivers: Liberty Mutual tends to charge more for drivers who have accidents or traffic violations.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#5 — Safeco: Agent Access

Pros

- RightTrack Telematics Program: Drivers can save money by enrolling in RightTrack, Safeco’s safe driving telematics program. For further details, check our Safeco auto insurance review.

- Claims-Free Discount: Drivers who remain accident-free can qualify for lower car insurance quotes in Cheyenne, WY, over time.

- Competitive Bundling Discounts: Significant discounts are available for policyholders who bundle home and auto insurance policies.

Cons

- Fewer Local Agents: Safeco has fewer local representatives, making it less convenient for drivers who prefer in-person assistance.

- Limited Online Quote Tools: Less user-friendly and detailed compared to other major insurers in Cheyenne, WY.

#6 — Allstate: Comprehensive Agents

Pros

- Roadside Assistance: Offers robust roadside assistance for policyholders looking for additional security for their auto insurance in Cheyenne, WY.

- Accident Forgiveness: Allstate provides accident forgiveness programs to keep rates stable after a minor at-fault accident in Cheyenne, WY.

- New Car Replacement: Drivers with newer vehicles can benefit from Allstate’s new car replacement coverage, which ensures a full payout for a brand-new car instead of a depreciated value.

Cons

- Expensive Minimum Coverage: Allstate offers one of the highest minimum coverage auto insurance quotes in Cheyenne, WY. To learn more, read our Allstate auto insurance review.

- High Premiums for High-Risk Drivers: Those with poor driving records may find Allstate’s rates less competitive when shopping for car insurance quotes in Cheyenne, WY.

#7 — Farmers: Discount Variety

Pros

- Diminishing Deductible: Safe drivers can reduce their deductibles over time with Farmers’ diminishing deductible program. Find additional details in our Farmers auto insurance review.

- Comprehensive Policy Add-Ons: Drivers can add rideshare and glass coverage features to their best Wyoming auto insurance policy.

- Multi-Policy Discounts: Policyholders who bundle homeowners, renters, or life insurance can secure lower auto insurance rates in Cheyenne, WY.

- Good Student Discounts: Farmers provide substantial discounts for students with good academic records.

Cons

- Strict Underwriting for Discounts: Some discounts require strict eligibility, making it harder for all drivers to qualify.

- Less Competitive Rates for High-Risk Drivers: Those with accidents or violations may find Farmers’ rates less competitive than some of the best Wyoming auto insurance providers.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#8 — Progressive: High-Risk Coverage

Pros

- Customizable Policies: Easily customize to create a personalized car insurance policy in Cheyenne, WY. Explore additional information in our Progressive auto insurance review.

- Name Your Price Tool: A unique pricing tool allows policyholders to find coverage that fits their budget while still meeting legal requirements.

- Multi-Vehicle Discounts: Progressive offers discounts to households with multiple cars, enabling them to save on the best Wyoming auto insurance policies.

Cons

- Snapshot May Increase Rates: The Snapshot program can raise rates for drivers who do not meet its safe driving criteria.

- Discounts May Be Hard to Qualify For: Some discounts require strict eligibility, limiting savings for certain drivers in Cheyenne, WY.

#9 — Nationwide: Bundling Savings

Pros

- Competitive Full Coverage Rates: Offers affordable full coverage auto insurance quotes in Cheyenne, WY.

- Vanishing Deductible: Safe drivers can benefit from decreasing deductibles over time, reducing out-of-pocket costs.

- SmartRide Telematics Program: Policyholders can get the best Wyoming auto insurance policies by participating in the SmartRide program, which tracks and rewards safe driving behavior.

Cons

- Higher Minimum Coverage Rates: Nationwide’s minimum coverage rates are higher than those of some competitors.

- Rate Increases Over Time: Some policyholders report that rates increase significantly after the first policy term. Browse our Nationwide auto insurance review for further information.

#10 — The General: SR-22 Assistance

Pros

- Competitive Rates for High-Risk Drivers: The General specializes in providing affordable auto insurance quotes in Cheyenne, WY, for drivers with accidents, tickets, or poor credit.

- Fast Online Quotes: The General’s online system allows for quick quotes and easy policy sign-up. Look into our The General auto insurance review for more details.

- Accepts Most Drivers: Offers coverage to nearly all drivers, even those who may be denied by other insurers.

Cons

- Fewer Policy Options: Limited options for customization compared to other major national providers.

- Mixed Customer Reviews: While affordable for high-risk drivers, The General receives mixed ratings for customer service and claims handling.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Cheyenne, WY Insurance Rates & Discounts by Provider & Coverage Type

Cheap auto insurance rates don’t have to be hard to come by. Some of the leading insurance companies in Cheyenne, WY, are State Farm, USAA, and Geico. These insurers use factors like your age and gender to determine your car premiums.

Cheyenne, WY Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $280 | $235 | |

| $140 | $138 | |

| $120 | $189 | |

| $144 | $231 |

| $131 | $188 |

| $190 | $194 | |

| $147 | $239 | |

| $126 | $103 | |

| $131 | $185 | |

| $83 | $85 |

The table above shows the type of coverage level from the best Wyoming auto insurance companies. This table can help you decide between the top car insurers in Cheyenne, WY.

Aside from that, discounts can help you secure the cheapest Wyoming car insurance.

Auto Insurance Discounts From the Top Providers in Cheyenne, WY

| Insurance Company | Available Discounts |

|---|---|

| Multi-Policy, Safe Driving Bonus, Good Student, TeenSMART (for young drivers), EZ Pay Plan | |

| Multi-Policy, Good Driver, Anti-Theft, Student, Smart Driver (defensive driving course) | |

| Multi-Vehicle, Bundling, Good Driver, Military, Defensive Driver Course | |

| Multi-Policy, Safe Driver, New Vehicle, Student, Pay-in-Full |

| Multi-Policy, Safe Driver, Anti-Theft, Accident-Free, Smart Ride (usage-based program for safe driving) |

| Multi-Policy, Safe Driver, Snapshot (based on driving habits), Bundling | |

| Multi-Policy, Good Driver, Anti-Theft Device, Early Signing, New Car | |

| Multi-Policy, Safe Driver, Vehicle Safety Features, Good Student, Steer Clear (for young drivers) | |

| Multi-Vehicle, Good Driver, Safe Driver, Pay-in-Full, Low Mileage, Military Discount | |

| Multi-Vehicle, Safe Driver, Bundling (auto and home), Military Discount, New Vehicle |

Discounts offered by top insurers in Wyoming, such as multi-vehicle, multi-policy, or good student, can help you lower your monthly insurance premiums even further. You just have to be smart in picking the best Cheyenne, WY auto insurance that is suited for your needs, especially your budget.

State Farm stands out as the best option for auto insurance in Cheyenne, WY, thanks to its strong local agent support and reliable claim service.

Michelle Robbins Licensed Insurance Agent

Read through our guide to better understand what goes into calculating your premiums and learn the best way to compare car insurance quotes from top providers in Cheyenne, WY.

Auto Insurance Coverage Requirements in Wyoming

Virtually every state has auto insurance laws. Wyoming, as a tort or at-fault state, requires drivers to carry a 20/50/20 level of liability insurance to drive legally in the state.

Take a look at the table below to find out the specific minimum Wyoming auto insurance limits.

Auto Insurance Minimum Coverage Requirements in Wyoming

| Coverage | Limit |

|---|---|

| Bodily Injury | $25,000 per person / $50,000 per accident |

| Property Damage | $20,000 per accident |

Wyoming only mandates that its motorists carry a liability policy, and the required amounts aren’t particularly high. Liability insurance only covers damages to the other person when you are at fault for causing the accident.

However, the state minimum limits will not be enough for most motorists. Individuals driving newer cars or who might be worried about thievery or damage from inclement weather should consider adding comprehensive and collision coverage to their policy.

Always compare multiple Cheyenne auto insurance quotes before signing your name on the dotted line to ensure you are still being charged the best rate.

Major Cheyenne, Wyoming Auto Insurance Factors

As mentioned, each time your auto insurance provider prepares to craft your insurance plan, they consider several factors affecting your car insurance rates. Depending on your individual demographics, the quotes you receive might look very different from those of your neighbors.

Being able to take this information to your advantage can help you secure the best car insurance in Cheyenne, Wyoming. Now you know the secret to finding cheap auto insurance. You should always compare quotes and pick your Cheyenne insurance agency very carefully.

Your Zip Code

Where you live and park your car daily will impact your auto insurance premium. Companies can better evaluate the likelihood of an automobile accident by examining your neighborhood’s population density, crime, and crash statistics.

The larger the human population in your ZIP code, the more automobiles there will be on the road when traveling. Therefore there are more opportunities for you to hit or get hit by a different vehicle. Is your ZIP code causing your auto insurance rates to increase? Find out in the table below.

Cheyenne, WY Auto Insurance Monthly Rates by ZIP Code

| ZIP | Rates |

|---|---|

| 82002 | $244 |

| 82009 | $162 |

| 82007 | $157 |

| 82001 | $155 |

| 82003 | $106 |

| 82070 | $96 |

Fortunately, according to the ZIP code, your insurance rates in Cheyenne, WY, do not change drastically. Obviously, Wyoming auto insurance rates depend on what state, city, or town you live in. The auto insurance cost is relatively reasonable since Cheyenne is Wyoming’s capital.

Automotive Accidents in Cheyenne, WY

If you live in a region with higher-than-average automobile accidents, your insurance rates will be higher than average, highlighting how an accident can change car insurance rates. Remember, insurance is all about risk management. If you often drive on dangerous roads, you are riskier to insure.

Fatal Accidents in Cheyenne, WY

| Category | Count |

|---|---|

| Fatal Crash Individuals | 7 |

| Fatal Crash Vehicles | 9 |

| Fatalities | 7 |

| Fatal Accidents | 7 |

| Fatal Accident Pedestrians | 5 |

| DUI Fatal Crashes | 2 |

Fortunately, the fatal accident statistics for Cheyenne aren’t out of control. However, they are a little higher than the city’s population. Sometimes, numbers like this can scare insurance companies into raising rates. You can try to mitigate this by keeping your driving record clean and asking about safe driver discounts.

Auto Thefts in Cheyenne, WY

Insurance companies will also evaluate the crime rates in your neighborhood when establishing your premiums. Living in a large urban center, especially if there is a substantial rate of crime, can increase your likelihood of being a target of auto thieves.

If your overall area has substantial statistics of theft claims, you are likely to spend more on your auto insurance to offset these prices. A comprehensive policy is the only coverage that will protect you if your car is stolen, and it is not a state requirement in Wyoming.

Auto Thefts in Cheyenne, WY

| Vehicle | Count |

|---|---|

| Full-Size Pickup Trucks | 50 |

| SUVs | 40 |

| Compact Pickup Trucks | 30 |

| Sedans | 20 |

| Motorcycles | 10 |

| Other Vehicles | 10 |

Investing in a fuller coverage policy will always cost more monthly than a basic policy. However, you’ll be able to pick and choose a more customized, well-rounded policy that meets all of your needs. Even if you’re not worried about car theft, you can gain some fundamental protection benefits by adding comprehensive coverage to your auto insurance policy.

Depending on what safety features are installed in your vehicle, you may already qualify for an anti-theft device discount.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Best Auto Insurance for Credit History Rates in Cheyenne, WY

Did you know that having bad credit can cause your insurance rates to increase? If you have bad credit, you might pay three times as much as motorists with good credit pay.

The graph below shows how your credit score affects your car insurance premiums. The monthly average auto insurance rates in Cheyenne are.

Cheyenne, WY Auto Insurance Monthly Rates by Credit Score

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $160 | $200 | $250 | |

| $130 | $160 | $230 | |

| $110 | $150 | $220 | |

| $170 | $210 | $280 |

| $140 | $170 | $240 |

| $150 | $180 | $260 | |

| $120 | $150 | $220 | |

| $145 | $185 | $255 | |

| $180 | $220 | $300 |

| $70 | $100 | $160 |

If you live in Cheyenne and have poor credit, look for cheap Wyoming car insurance companies that do not consider credit scores. Remember, bad credit does not last forever. You’ll slowly increase your credit score by making your monthly payments on time. Eventually, your insurance rates will go down as a result.

Your Gender & Age

The truth is, your gender and age do impact what you pay for auto insurance in Cheyenne, Wyoming. However, while age makes a huge difference, gender does not actually matter that much.

Statistically, young drivers cause more accidents than older, more experienced drivers. Because teenage drivers lack experience and tend to be riskier on the road, companies charge them higher rates than average.

Take a look at the graph below to see how much a 17-year-old pays in monthly insurance fees versus a 34-year-old in Cheyenne, Wyoming.

Cheyenne, WY Auto Insurance Monthly Rates Comparison by Provider & Age

| Insurance Company | Age: 17 | Age: 34 |

|---|---|---|

| $400 | $220 | |

| $380 | $200 | |

| $320 | $140 | |

| $370 | $180 |

| $340 | $160 |

| $360 | $170 | |

| $330 | $150 | |

| $350 | $180 | |

| $390 | $210 |

| $300 | $130 |

If you are a young driver in Cheyenne, you can look forward to a severe rate drop once you turn 25. Until then, consider bundling your policy with your parents, or you can check out how much car insurance for teenagers by getting a quote from top auto insurance providers in Cheyenne, WY.

If that is not an option, safe driver discounts and good student discounts can help lower your annual premiums.

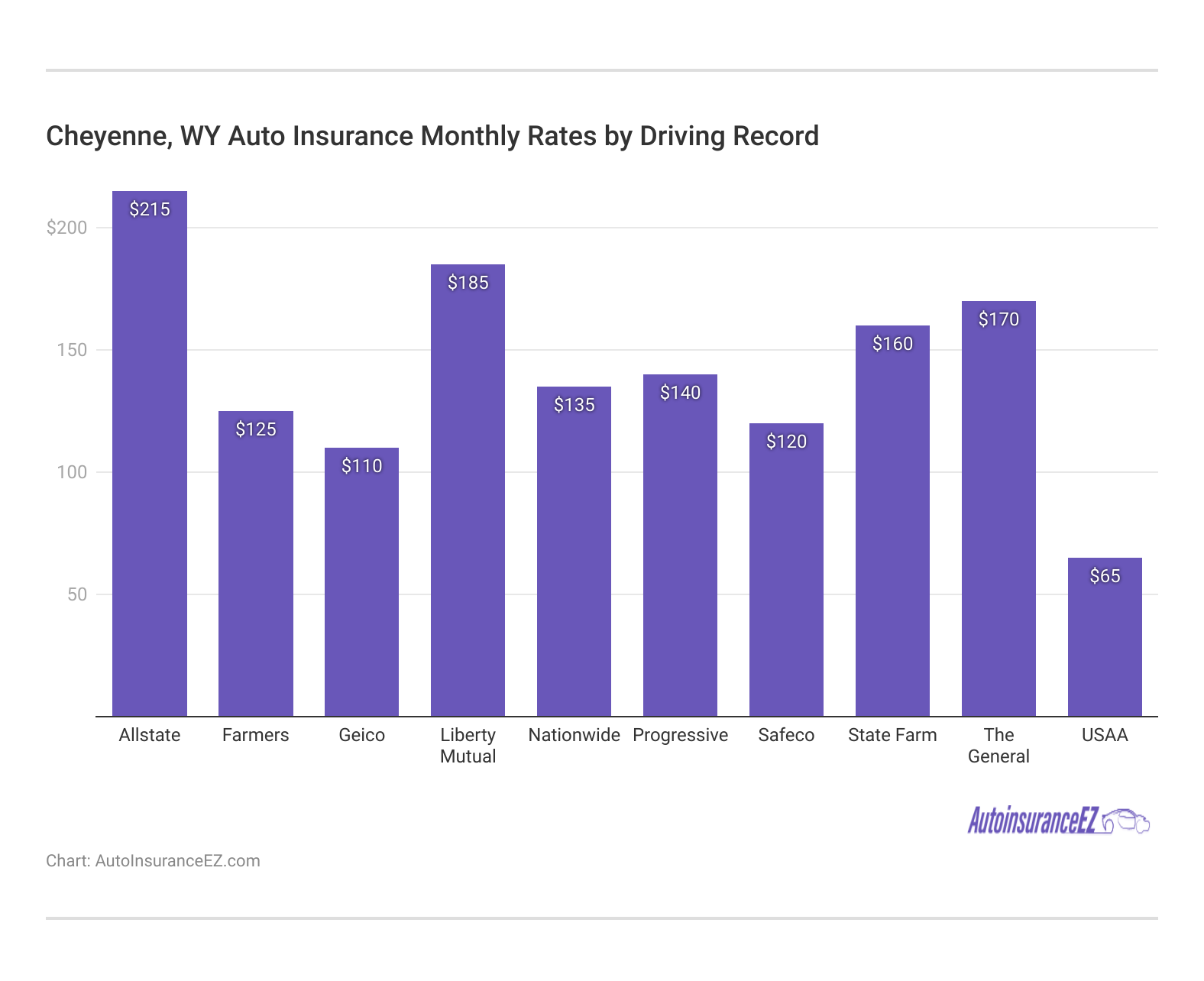

Best Auto Insurance for Driving Record Rates in Cheyenne, WY

Your driving history is a great way for insurance companies to tell how risky a driver you are. If you have a clean driving record, you will receive lower average rates than those on the road with imperfect driving records.

How much does a single driving violation impact your monthly auto insurance rates in Cheyenne? Find out in the graph below.

As you can see, safe driving always pays off. Not only does it help keep your rates low and the roads safe, but you can even qualify for auto insurance discounts.

Consider asking companies about accident forgiveness programs if you have only one or two violations. Accident forgiveness is a newer kind of discount marketed by some providers to benefit their clients.

Those with a less-than-perfect driving history can get some minor violations forgiven whenever their insurance provider calculates their monthly premiums.

Vehicle Make and Model and Auto Insurance Rates in Cheyenne, WY

The make and model of your vehicle can have quite an impact on your overall auto insurance rates. While every Wyoming resident can purchase auto insurance at any coverage level above the state minimum, drivers of luxury vehicles usually choose full car insurance coverage they can afford to protect their assets better.

Logically, this makes sense; it isn’t really a wise idea to insure an expensive vehicle with only $20,000 worth of liability.

Take a look at the graph below for a clearer idea of how different monthly auto insurance rates are in Cheyenne for an economy sedan versus a pricier luxury vehicle.

Cheyenne, WY Auto Insurance Monthly Rates by Vehicle & Coverage Level

| Make & Model | Minimum Coverage | Full Coverage |

|---|---|---|

| BMW 3 Series | $110 | $245 |

| Chevrolet Malibu | $82 | $175 |

| Ford F-150 | $95 | $210 |

| Honda Civic | $75 | $150 |

| Hyundai Elantra | $80 | $160 |

| Mazda CX-5 | $92 | $190 |

| Nissan Altima | $85 | $180 |

| Ram 1500 | $100 | $215 |

| Tesla Model 3 | $120 | $265 |

| Toyota Camry | $90 | $185 |

As you can see, cheap cars in Cheyenne, Wyoming, are always more affordable to insure than luxury, expensive vehicles. But for better protection and to avoid financial loss, you must consider getting.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Minor Car Insurance Factors in Cheyenne, Wyoming

We covered the major factors that impact your Cheyenne, WY auto insurance rates. However, there are some minor considerations that you should also look into.

When choosing the best Wyoming auto insurance, prioritize insurers like State Farm that offer a balance of competitive rates, solid financial backing, and personalized service.

Kristen Gryglik Licensed Insurance Agent

For example, your marital status, commute length, and education level can all change your monthly auto insurance rates. To ensure you’re still getting the best coverage for an affordable cost, it’s not a bad idea to get quotes online from top providers. Keep reading to learn more.

Marital Status and Auto Insurance Rates in Cheyenne, WY

Bundling all your financial items together under the same company can result in some very useful discount rates, and married people can benefit from these discounts.

Married people usually need many different insurance policies, from homeowners insurance to auto and life insurance. Bundling everything together will lead to major savings because the company will compensate you for all of the extra business.

Some car insurance companies in Cheyenne offer discounts to newlyweds who buy a joint policy or combine car insurance after marriage.

Best Auto Insurance for Commute Rates in Cheyenne, WY

Cheyenne residents may already know how easy it is to get around in their city. However, some companies might charge you a higher auto insurance rate if you drive substantially more than the average person.

The vast majority of drivers will only spend 10 or 15 minutes behind the wheel each way to work. Rarely are some commutes as short as 5 minutes or as long as 20 minutes. More than 81 percent of drivers use their own car and drive alone to work. Another 12 percent choose to carpool with coworkers or use rideshare.

If you happen to have a longer than average commute length, you may pay between 2 to 3 percent more for auto insurance through certain companies. Keep this in mind while you compare shop, as it might help you determine which company is right for you.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Best Auto Insurance for Coverage Level Rates in Cheyenne, WY

If you want a fuller coverage policy but are on a tighter budget, consider raising your deductible. But what’s a deductible? A deductible is the amount you pay in an accident before your car insurance provider covers the rest.

For example, you may have been in a car collision with another vehicle and damaged your car. Your car insurance policy has a $1000 deductible, and the cost of repair for your automobile is around $3,500. You must pay for the $1000 repair cost before your insurance provider can cover the $2,500.

Cheyenne, WY Auto Insurance Monthly Rates by Provider & Coverage Type

| Insurance Company | Liability | Comprehensive |

|---|---|---|

| $95 | $240 | |

| $85 | $215 | |

| $60 | $190 | |

| $115 | $270 |

| $92 | $232 |

| $80 | $220 | |

| $75 | $210 | |

| $90 | $230 | |

| $110 | $250 |

| $50 | $170 |

This only means that low deductibles will increase your monthly premium, whereas high deductibles will decrease your rates. However, if your deductible is too high, it could make it difficult for you to process claims should you wreck your vehicle, especially if you are financially vulnerable.

If you have deductibles as part of your auto insurance policy, are you aware of how costly yours are off the top of your head? Deductibles are essential numbers that you ought to take the time to learn about and better understand.

Education and Auto Insurance in Cheyenne, WY

Many drivers may not know it, but your education level can impact your auto insurance rate. The more education you have, the lower your rates will cost in the long run.

The most popular form of education in Cheyenne is a high school diploma. Nearly 27 percent of residents have one, followed by 19 percent of citizens who have earned one or more years of college experience.

There are plenty of opportunities for those willing to commute to pursue higher education. Laramie County Community College, which has its roots in Cheyenne, offers students the opportunity to earn a two-year degree.

Certain auto insurance companies are much better at this than others, and conducting a diligent internet search may help you separate the good from the poor. By comparing auto insurance companies near you or online, you can get the best insurance coverage suited to your needs and budget.

Tips for the Best Cheyenne, WY Auto Insurance

Finding the best Cheyenne, WY auto insurance shouldn’t be difficult. You can start by contacting a local broker or agent and comparing car insurance in WY. Getting quotes online isn’t too bad; it’ll make it easier for you when you shop around the internet.

State Farm, USAA, and Geico are some of the many insurance companies in Cheyenne, Wyoming, that offer customers really low-cost policies with incredible customer service support to help guide you through getting the best Wyoming auto insurance.

Additionally, being knowledgeable of the factors that can either increase or decrease your monthly car insurance costs may help you get the best deal for full protection for your needs and avoid financial drawbacks in the future.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

How We Conducted Our Auto Insurance Analysis

We calculated the best Cheyenne, WY auto insurance rates based on a married 34-year-old male with good credit, a 12-month history of maintaining auto insurance, a clean driving record, and who owns his own home. The miles driven annually were based on the national average. The average rate was also calculated based on a financed 2015 Honda Accord with a pre-installed anti-theft device.

Read more: Cheap Auto Insurance

Are you looking to buy Cheyenne, WY, auto insurance? Find cheap Cheyenne, WY auto insurance rates by entering your ZIP code into our free tool.

Frequently Asked Questions

What is the cheapest liability insurance in Wyoming?

Carrying minimum insurance liability auto insurance is not considered bad in Wyoming. Local auto insurance companies like Geico and State Farm often offer the lowest liability-only car insurance in Cheyenne, WY.

What is the cheapest car insurance in Wyoming?

Geico and USAA typically offer the lowest rates for the best car insurance in Wyoming. Get the lowest and the best Wyoming auto insurance by typing your ZIP code in our free quote tool.

Which type of vehicle insurance is best?

Full coverage is ideal for most drivers, while liability-only is the cheapest option.

What is the penalty for driving without insurance in Wyoming?

Fines up to $750, possible license suspension, and SR-22 insurance filing requirement.

What is the minimum auto insurance in Wyoming?

25/50/20 – $25,000 to each person, $50,000 for accident bodily injury, and $20,000 for property damage.

Do you need insurance to register a car in Wyoming?

Yes, you must show proof of Cheyenne, WY car insurance, to register a vehicle.

Is Wyoming a good state to buy a car?

Yes, low sales tax, lower fees, and simple registration make Wyoming a good state to buy a car.

Is Wyoming a no-fault insurance state?

Wyoming is not a no-fault state, meaning the person responsible for the accident pays for damages.

How much is car insurance in Cheyenne, Wyoming?

The average cost of car insurance in Cheyenne, WY, is around $100–$150 per month but varies based on age, driving history, and coverage. See how you can save for the best Cheyenne, WY auto insurance near you by entering your ZIP code.

Does a car title need to be notarized in Wyoming?

No, Wyoming does not require notarization for a vehicle title transfer.