Best Green Bay, WI Auto Insurance in 2025 (Top 10 Company Ranking)

State Farm, AAA, and Allstate offer the best Green Bay, WI auto insurance, with a starting rate of $45/mo. State Farm excels with its local agents that provide personalized service. AAA stands out for its 24/7 roadside assistance. Allstate offers comprehensive add-ons such as gap and rideshare coverage.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Apr 16, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

18,154 reviews

18,154 reviewsCompany Facts

Full Coverage in Green Bay

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 3,027 reviews

3,027 reviewsCompany Facts

Full Coverage in Green Bay

A.M. Best Rating

Complaint Level

Pros & Cons

3,027 reviews

3,027 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage in Green Bay

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviewsThe best Green Bay, WI auto insurance companies are State Farm, AAA, and Allstate, with a monthly starting rate of $45. State Farm excels with its large network of local agents offering coverage personalization.

AAA insurance provides 27/7 roadside assistance wherever the policyholder is located. Allstate offers extensive coverage add-ons, such as gap coverage, roadside assistance, and rental car reimbursement. Check more Green Bay insurance companies below.

Our Top 10 Company Picks: Best Green Bay, WI Auto Insurance

| Company | Rank | Monthly Rate | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $147 | A++ | Many Discounts | State Farm | |

| #2 | $122 | A | Online App | AAA |

| #3 | $152 | A+ | Add-on Coverages | Allstate | |

| #4 | $116 | A++ | Accident Forgiveness | Travelers | |

| #5 | $145 | A | Local Agents | Farmers | |

| #6 | $174 | A++ | Custom Plan | Geico | |

| #7 | $117 | A+ | Usage Discount | Nationwide |

| #8 | $185 | A | Customizable Policies | Liberty Mutual |

| #9 | $166 | A++ | Military Savings | USAA | |

| #10 | $200 | A+ | 24/7 Support | Erie |

These top car insurance companies in Green Bay ensure not only reasonable rates but also a strong financial standing, proven by high ratings from A.M. Best.

- State Farm, AAA, and Allstate have the best Green Bay, WI auto insurance

- You can lower auto insurance premiums with several discounts, like bundling

- Evaluate customer service and claims payout when buying auto insurance

Looking for cheap auto insurance in Green Bay, WI? We understand that searching for the right auto insurance provider can be a bit of a hassle. We’re here to help you find cheap auto insurance.

To obtain free car insurance rates from the top-rated providers, enter your Green Bay ZIP code in our free online tool and search for cheap car insurance in Green Bay, WI. The tool will compare quotes from multiple Green Bay, WI car insurance companies.

#1 – State Farm: Top Pick Overall

Pros

- Generous Range of Discounts: State Farm auto insurance in Green Bay offers discounts for lower premiums, such as bundling, Steer Clear program, and more.

- Coverage Personalization: Policyholders can get coverage for rideshare, rental, car, and more. Check all coverages in the State Farm review.

- Strong Financial Standing: State Farm is the largest insurer in the U.S., ensuring the best Green Bay, WI auto insurance.

Cons

- Higher Premiums for Some Drivers: State Farm auto insurance minimum rates in Green Bay can be expensive for high-risk drivers.

- Fewer Digital Options: The mobile app lacks many necessary features that other insurance companies in Green Bay, WI.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#2 – AAA: Best for Online App

Pros

- Top-ranked Mobile App: Users have had a positive experience and received feedback on AAA’s mobile app, which has extensive features. Check it out in the AAA review.

- 24/7 Roadside Assistance: Policyholders can always request towing, flat tire change, fuel delivery, and other assistance with Green Bay, WI, car insurance.

- High Customer Ratings: AAA ranks high in claims satisfaction and general customer service, making it one of the best Green Bay, WI auto insurance companies.

Cons

- Annual Fee for Members: AAA auto insurance in Green Bay offers plans to its members only, who pay an annual fee of $50 to $130.

- Roadside Assistance Limitations: AAA established a call limit per year for every customer, and exceeding that results in extra fees.

#3 – Allstate: Best for Add-On Coverage

Pros

- Extensive Add-On Options: Allstate offers rideshare, gap, roadside assistance, and rental car reimbursement. The Allstate auto insurance review explains each add-on.

- 25% Bundling Benefit: Combining car insurance with other policies, such as home and renters, not only saves money but also simplifies policy management.

- Local Experts: Allstate car insurance in Green Bay has expert agents providing coverage customization and general customer service.

Cons

- Expensive Premiums With Add-Ons: Adding more coverage to the policy will increase the policyholder’s overall premiums.

- Potential Rate Hikes: Policyholders experienced increase in their auto insurance premiums in Green Bay over time, even after one claim.

#4 – Travelers: Best for Accident Forgiveness

Pros

- Accident Forgiveness Program: No premium increase after one at-fault accident and one minor violation for every three years.

- Premier Responsible Driver Plan and Coverage: This plan offers decreasing deductibles and a total loss deductible waiver. Learn the rules for this plan in Travelers’ auto insurance review.

- Local Availability In Green Bay: Travelers has established a strong presence of car insurance in Green Bay with its Green Bay Insurance Center Inc., located at 417 S Monroe Ave.

Cons

- Accident Forgiveness Limitations: The rule is one accident in three years; getting more violations and accidents in that period still increases the rates.

- Customer Service Inconsistency: Customers reported slow resolutions on claims and long waiting periods to approve accident forgiveness benefits.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#5 – Farmers: Best for Local Agents

Pros

- Strong Network Of Local Agents: Farmers auto insurance in Green Bay has a strong local presence, with knowledgeable professionals.

- Policy Customization: Farmers car insurance in Green Bay provides policy customization based on the different needs of the customers through face-to-face consultations.

- Several Discount Options: Farmers offers discounts for safe drivers, bundling, good students, alternative-fuel vehicles, and more. Check it all out in the Farmers auto insurance review.

Cons

- Higher Premiums Than Competitors: Farmers’ auto insurance in Green Bay, WI, tends to be more expensive than insurers like Progressive and Geico.

- Strict Cancellation Policy: Farmers charge fees for mid-term cancellations, unlike State Farm, which allows customers to cancel without penalties.

#6 – Geico: Best for Custom Plans

Pros

- Customizable Policies: Geico offers a wide range of coverage, including liability, medical, UIM, and more. Check all the coverages in the Geico insurance review.

- Wide Discount Options: Customers get affordable auto insurance in Green Bay with discounts like safe driver, good student, vehicle safety, and bundling.

- Advanced Online Tools: Geico simplifies the operations of Green Bay, WI auto insurance with its advanced digital tools, which allow users to calculate coverage, get online quotes, and more.

Cons

- Few Local Agents: Geico primarily operates online, so it has fewer agents than most insurance companies in Green Bay.

- Lacks Specialty Coverage: It currently does not offer gap insurance, new car replacement, or OEM parts coverage.

#7 – Nationwide: Best for Usage Discounts

Pros

- SmartRide Program: Nationwide rewards safe driving with immediate savings and performance-based discounts. Check the eligibility in the Nationwide auto insurance review.

- Mobile App Integration: Nationwide car insurance in Green Bay utilizes a user-friendly mobile app, which provides feedback on users’ driving habits.

- Local Expert Support: A network of experts guides customers in policy customization, discounts, and perk enrollments.

Cons

- High-Mileage Drivers Restrictions: Drivers in Green Bay, WI, who commute high miles get a lower discount for good driving habits.

- Short-Term Monitoring For SmartRide: The program only tracks driving habits for a few months; changed driving behaviors over time will not reflect in the long-term incentives.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#8 – Liberty Mutual: Best for Customizable Policies

Pros

- Extended Auto Protection: Liberty Mutual offers liability, comprehensive, collision, MedPay, and UIM. Check all coverages in the Liberty Mutual auto insurance review.

- Unique Add-Ons: Besides basic coverage, Liberty Mutual auto insurance in Green Bay provides better car and new car replacement, a deductible fund, and accident forgiveness.

- Savings Opportunities: Policyholders can save on their premiums with discount opportunities like bundling, vehicle safety, and the RightTrack Program.

Cons

- Higher Rates: Policy customization often comes with higher rates, such as the new car replacement and better car replacement.

- Complex Policy Rules: More customized coverage means managing complicated policies that sometimes confuse customers.

#9 – USAA: Best for Military Savings

Pros

- Competitive Military Benefits: Military personnel, veterans, and their families get lower premiums and generous discount options. Check the USAA auto insurance review for details.

- Strong Financial Standing: USAA auto insurance in Green Bay, WI, has A++ ratings from A.M. Best, ensuring its excellent financial ability for claims reimbursements.

- Military-Specific Perks: Military members stationed overseas still get auto insurance coverage and a storage discount for deployed members.

Cons

- Restricted Memberships: Perks, and benefits are limited to active military, veterans, and their families.

- Limited Local Experts: There is less in-person support for getting the best Green Bay, WI auto insurance, as USAA mainly operates online and over the phone.

#10 – Erie: Best for 24/7 Support

Pros

- 24/7 Customer Support: Erie provides a round-the-clock customer support and earns a high rank in J.D. Power with a score of 844 out of 1000.

- Rate Lock Feature: Erie car insurance in Green Bay is renowned for its unique rate lock feature that prevents random rate increases. Check all its rules and eligibility in the Erie insurance review.

- Several Coverage Options: It offers a wide range of coverage options from basic policies to add-ons, including travel expense, pet injury coverage, and windshield repair.

Cons

- Limited Coverage Availability: Erie’s auto insurance in Green Bay, WI, is only available in 12 states, limiting coverage in other states.

- Claims Issue: Customers have experienced challenges with claims resolutions, long delays, and less robust digital support.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Best Green Bay, WI Auto Insurance Monthly Rates

Premiums differ from company to company. Check the cheap Green Bay auto insurance below for the lowest price and the right coverage.

Auto Insurance Monthly Rates in Green Bay, WI by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $47 | $122 |

| $45 | $152 | |

| $77 | $200 |

| $95 | $145 | |

| $48 | $174 | |

| $58 | $185 |

| $63 | $117 |

| $71 | $147 | |

| $57 | $116 | |

| $60 | $166 |

Allstate, AAA, and Geico are among the insurers that offer the lowest rates for minimum and full coverage. Remember that these rates also vary depending on your purchase policy and add-ons. This next table will show the average monthly rates offered by companies in Green Bay.

Auto Insurance Monthly Rates in Green Bay, WI by Provider

| Insurance Company | Average Monthly Rate |

|---|---|

| $275 | |

| $115 | |

| $290 | |

| $140 | |

| $201 |

| $348 |

| $229 | |

| $161 | |

| $147 |

Is your insurer charging you above the average rate? Let’s examine a comparable table, this time for coverage levels.

Auto Insurance Monthly Rates in Green Bay, WI by Coverage Level

| Insurance Company | High | Med | Low | Average |

|---|---|---|---|---|

| $160 | $130 | $110 | $133 |

| $155 | $125 | $105 | $128 | |

| $140 | $115 | $95 | $116 |

| $165 | $135 | $115 | $138 | |

| $130 | $110 | $90 | $110 | |

| $175 | $140 | $120 | $145 |

| $145 | $120 | $100 | $122 |

| $135 | $110 | $95 | $113 | |

| $150 | $125 | $105 | $127 | |

| $120 | $100 | $85 | $102 |

Do they have a friendly customer support system? Can they shell out on claims as outlined in your agreement? Make certain you search the websites of all your prospective insurance providers prior to making your final decision because choosing the right insurance provider goes beyond its rates alone.

Discounts for the Best Green Bay, WI Auto Insurance

If the monthly auto insurance premiums are beyond your budget and you want to purchase the specific coverage, then this one is for you. You can choose many options to lower your auto insurance premiums. Check out this table below.

Auto Insurance Discounts From Top Providers in Green Bay, WI

| Insurance Company | Anti-Theft | Bundling | Claim-Free | Early Signing | Good Student |

|---|---|---|---|---|---|

| 8% | 15% | 10% | 7% | 14% |

| 10% | 25% | 10% | 10% | 22% | |

| 15% | 25% | 12% | 5% | 15% |

| 10% | 20% | 9% | 6% | 15% | |

| 25% | 25% | 12% | 5% | 15% | |

| 35% | 25% | 8% | 7% | 12% |

| 5% | 20% | 14% | 8% | 18% |

| 15% | 17% | 11% | 10% | 35% | |

| 15% | 13% | 13% | 6% | 8% | |

| 15% | 10% | 20% | 7% | 10% |

The most common way is to bundle car insurance with home, life, or health insurance policies. More discounts are available in every insurance provider listed above. So sit back, the extensive discount opportunities are on their way.

For industry leaders like Allstate and AAA, bundling insurance policies can lead to huge savings, often reducing overall costs by up to 25%.

Daniel Walker Licensed Insurance Agent

These companies emphasize that combining auto, home, or life insurance streamlines coverage and unlocks exclusive discounts for policyholders.

Best Green Bay, WI Insurance Companies

State Farm stands out in Green Bay, WI, for car insurance. It has a large network of local experts to assist customers in their coverage and policy customization. It also has A++ A.M. Best, which provides security in car insurance claims and payouts.

The city of Green Bay is diversifying into various service sectors. Green Bay jobs are booming, and Green Bay school districts are reputable.

Fun Fact: If you’re a waffle fan, you’ll love Green Bay. It is ranked #17 on the list of “Top 101 ZIP codes with the largest percentage of Belgian first ancestries.”

The city is also home to the well-known professional football team, the Green Bay Packers.

Read more: How To File An Auto Insurance Claim

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Auto Insurance Coverage Requirements in Wisconsin

Driving legally in Green Bay requires:

Wisconsin Auto Insurance Coverage Requirements

| Coverage | Limits |

|---|---|

| Bodily Injury Liability | $50,000 per person / $100,000 per accident |

| Property Damage Liability | $15,000 per accident |

| Uninsured Motorist Bodily Injury | $100,000 per person / $300,000 per accident |

Don’t forget that automobile liability coverage is very limited. Your insurance will only pay for claims when you get into an accident you are considered responsible for (when the accident is not the other driver’s fault).

If your vehicle is stolen, or you enter into any accident brought on by another person, your insurance won’t shell out on any claims.

For many motorists, especially individuals with imperfect credit or perhaps a tainted driving history, average monthly Wisconsin car insurance rates are often as high as $91 or more.

However, with a favorable credit record and clean driving record, you can get insured for approximately $45 monthly in Green Bay. Be sure to shop around and discuss savings options with your insurance agent to get the best rates possible.

Major Car Insurance Factors in Green Bay

Companies that provide you with auto insurance policies evaluate numerous variables while establishing insurance prices, including driving experience, ZIP code, occupation, miles driven each year, and business use of the vehicle.

Understanding these variables like driving record and geographic location can help policyholders make informed decisions to lower their rates potentially.

Scott W. Johnson Licensed Insurance Agent

Experts say even small changes in annual mileage or occupation can significantly impact the cost of coverage. Are you paying more than the average for your demographic? Learn more about the factors that affect car insurance premiums below.

Your ZIP codes

When your car insurance agency prepares to write your insurance plan, it considers several aspects. Some of these, like your age or perhaps your precise region, are difficult to modify. Another factor that determines your rate is your ZIP code. The following table shows the average rate for the ZIP codes in Green Bay, WI.

Auto Insurance Monthly Rates in Green Bay, WI by ZIP Code

| City | ZIP | Rates |

|---|---|---|

| Green Bay | 54937 | $217 |

| Green Bay | 54974 | $219 |

| Green Bay | 54980 | $230 |

| Green Bay | 54968 | $241 |

| Green Bay | 54983 | $244 |

| Green Bay | 54969 | $247 |

| Green Bay | 54966 | $251 |

The table below shows the Wisconsin ZIP codes with the 25 cheapest annual auto insurance rates.

Auto Insurance 25 Cheapest Monthly Rates in Wisconsin by ZIP Code

| City | ZIP | Rates |

|---|---|---|

| Antigo | 54110 | $213 |

| Appleton | 54952 | $212 |

| Berlin | 54304 | $211 |

| Brandon | 54915 | $213 |

| Brokaw | 54140 | $213 |

| Clam Lake | 53083 | $210 |

| Elm Grove | 54313 | $212 |

| Genesee Depot | 54303 | $212 |

| Genoa | 54155 | $213 |

| Kendall | 54136 | $209 |

| Kenosha | 53073 | $214 |

| Larsen | 54913 | $214 |

| Madison | 54311 | $209 |

| Manawa | 54115 | $210 |

| Milwaukee | 53081 | $208 |

| Milwaukee | 53020 | $214 |

| Minocqua | 54113 | $210 |

| New Glarus | 54301 | $210 |

| Ojibwa | 53085 | $209 |

| Oostburg | 54914 | $214 |

| Plymouth | 54956 | $212 |

| Racine | 53044 | $210 |

| Readfield | 54130 | $208 |

| Wisconsin Dells | 54123 | $212 |

| Woodman | 54302 | $212 |

And here are Wisconsin’s 25 most expensive ZIP codes for auto insurance.

Auto Insurance 25 Most Expensive Monthly Rates in Wisconsin by ZIP Code

| City | ZIP | Rates |

|---|---|---|

| Brookfield | 54439 | $297 |

| Bruce | 53202 | $342 |

| Brule | 53207 | $293 |

| Butte Des Morts | 54818 | $304 |

| Cobb | 54532 | $297 |

| Dallas | 53219 | $302 |

| Downsville | 53208 | $355 |

| Durand | 53211 | $312 |

| Eagle River | 53218 | $376 |

| Eau Galle | 53203 | $365 |

| Lake Nebagamon | 53214 | $296 |

| Land O Lakes | 53212 | $398 |

| Lime Ridge | 53215 | $347 |

| Maiden Rock | 53233 | $388 |

| Maple | 53210 | $396 |

| Mason | 53224 | $330 |

| Merrimac | 54434 | $298 |

| Pepin | 53204 | $381 |

| Poplar | 53209 | $367 |

| Port Wing | 53216 | $418 |

| Presque Isle | 53225 | $332 |

| Solon Springs | 53222 | $315 |

| South Range | 53223 | $330 |

| Stockholm | 53205 | $401 |

| Sturtevant | 53206 | $425 |

Are you paying too much for auto insurance in your ZIP code? Automobile insurance companies need to know your address, or the places you will likely drive most often, to estimate the prospect of a crash.

It comes down to a simple concept: the greater the population, the greater the number of cars there will be while traveling, and therefore, the more likely you are to get in a wreck with different motor vehicles. The population of Green Bay is 105,744, and the general household earnings are $66,950 in 2023. Thus, it is important to understand the driving tips for road safety.

Your Credit Score

Many people don’t understand how important their credit rating is when figuring out their car insurance premiums. If you have a bad credit score, your monthly rate will be much higher than the payment of a driver fortunate enough to have an excellent credit rating.

Auto Insurance Monthly Rates in Green Bay, WI by Credit Score

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $85 | $102 | $136 |

| $90 | $108 | $144 | |

| $80 | $96 | $128 |

| $88 | $106 | $140 | |

| $75 | $90 | $120 | |

| $92 | $110 | $146 |

| $87 | $104 | $138 |

| $83 | $100 | $133 | |

| $86 | $103 | $136 | |

| $70 | $84 | $112 |

As you can see, the premiums for good credit have almost doubled compared to bad credit premiums. It essentially shows you that maintaining a good credit score can lead to huge savings instead of paying more on insurance when you actually can do something about it. Remember to get a credit check before buying your insurance policy.

Read more: How Your Credit Score Affects Your Car Insurance Premiums

Your Gender and Age

As for age, the more youthful and less experienced a driver you are, the greater your chances of getting involved in an accident. However, teenage motorists can help eliminate some of their insurance charges by working hard to get good student discount and taking motorists’ and defensive driving courses. Check more in the video below.

Before we continue, let’s examine a table showing some rate differentials based on age and/or gender.

Auto Insurance Monthly Rates in Green Bay, WI by Provider, Age & Gender

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| $526 | $528 | $157 | $159 | $147 | $150 | $123 | $128 |

| $538 | $687 | $161 | $174 | $159 | $167 | $149 | $163 | |

| $414 | $420 | $68 | $70 | $59 | $65 | $53 | $55 |

| $707 | $734 | $162 | $168 | $142 | $143 | $126 | $134 | |

| $288 | $310 | $77 | $78 | $83 | $93 | $89 | $104 | |

| $424 | $475 | $125 | $135 | $118 | $129 | $96 | $108 |

| $504 | $779 | $287 | $334 | $234 | $245 | $196 | $206 |

| $299 | $376 | $111 | $127 | $98 | $98 | $88 | $88 | |

| $421 | $425 | $135 | $150 | $100 | $105 | $90 | $95 | |

| $256 | $294 | $123 | $134 | $96 | $95 | $85 | $89 |

Contrary to outdated stereotypes, based on most insurance providers, there is no difference in risk between men and women motorists. If your provider charges different rates, they should add up to a maximum of 2-3 percent. Some companies reward female motorists, while other providers charge less for men.

Your Driving Record

The more violations you have on your record, the more likely you are to file a claim, leading your provider to charge you higher premiums. Check the table below for the rate difference on one violation alone.

Auto Insurance Monthly Rates in Green Bay, WI by Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $41 | $49 | $58 | $82 |

| $61 | $73 | $85 | $120 | |

| $22 | $26 | $30 | $42 |

| $30 | $36 | $42 | $60 | |

| $35 | $42 | $49 | $70 | |

| $50 | $60 | $70 | $100 |

| $55 | $66 | 77 | $110 |

| $64 | $77 | $90 | $128 | |

| $28 | $34 | $40 | $56 | |

| $25 | $30 | $35 | $50 |

But if you have too many citations or commit a serious violation, such as a first-offense DUI that affects car insurance after DUI, you could lose your coverage altogether.

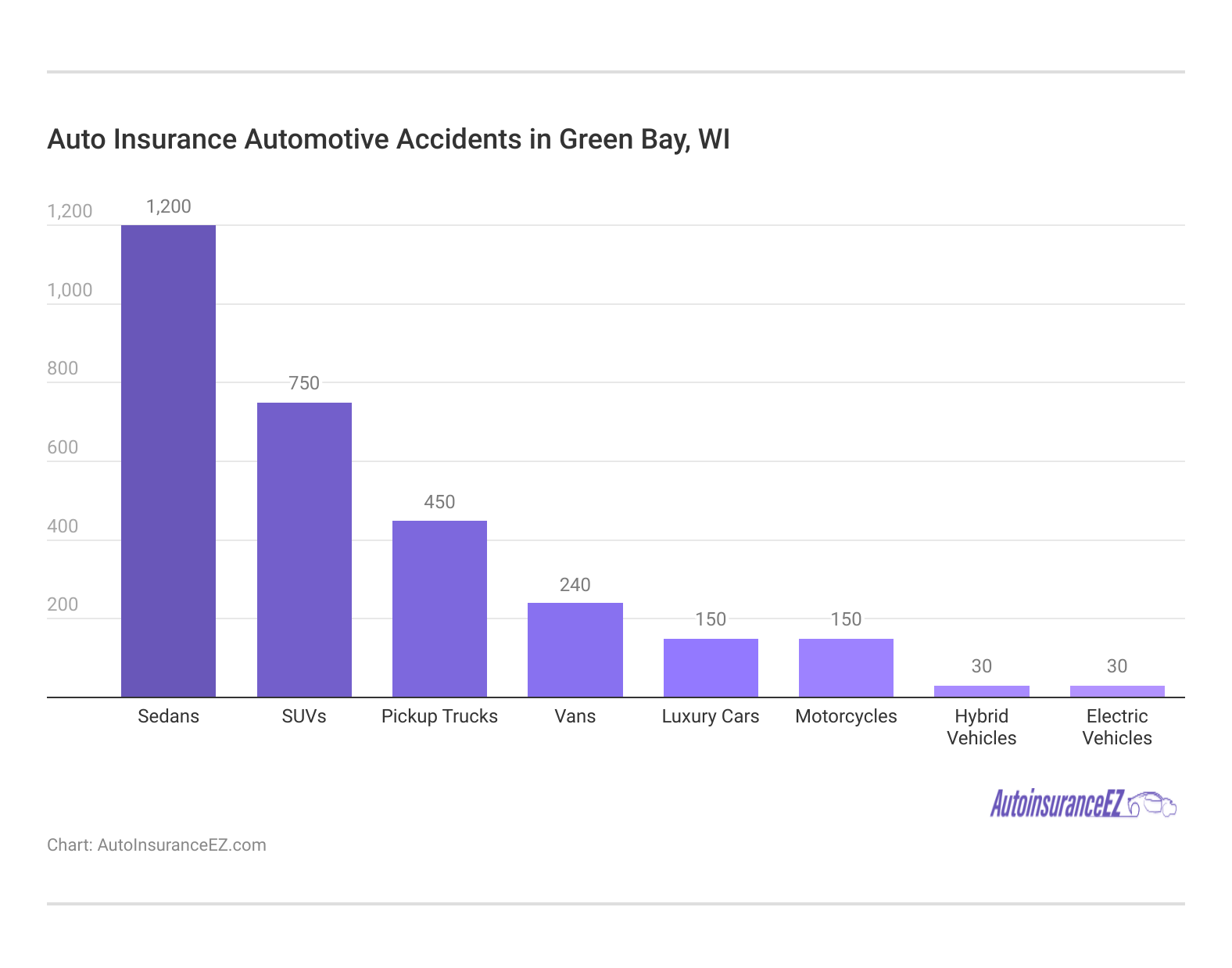

Automotive Accidents

Auto insurance claims and accident rates vary by vehicle type, influencing Green Bay, WI coverage costs. Check this out.

Sedans account for the highest number of accidents, followed by SUVs and pickup trucks, while hybrid and electric vehicles have the fewest incidents. Understanding these trends can help drivers determine their insurance needs and vehicle safety.

Auto Theft in Green Bay

Finding the best Wisconsin auto insurance company can be tough if you are vulnerable to auto theft. Several popular automobiles are attractive to thieves, and automobiles frequently parked in huge urban centers can also be seen as targets.

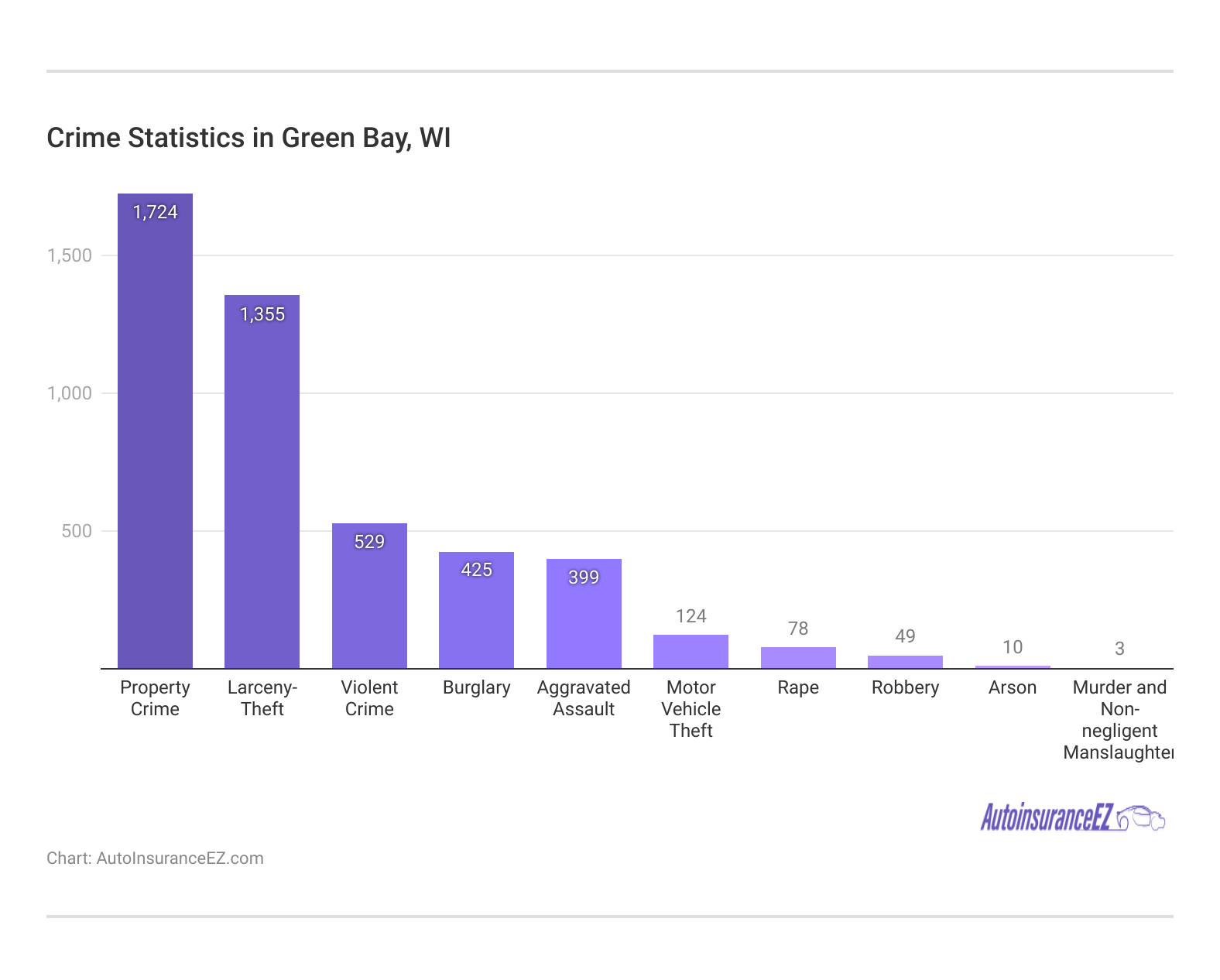

Even if you aren’t worried about auto theft, you still might want to consider the other benefits of comprehensive coverage on your policy. Let’s examine the FBI’s most recent data on crime, including theft, in Green Bay, which is from 2023.

Next is a video from the Green Bay Press Gazette and CBS 5 showing an unfortunate recent rise in automobile theft. Information on how to contact local police is included.

This video reiterates just how important it is to carry Comprehensive coverage.

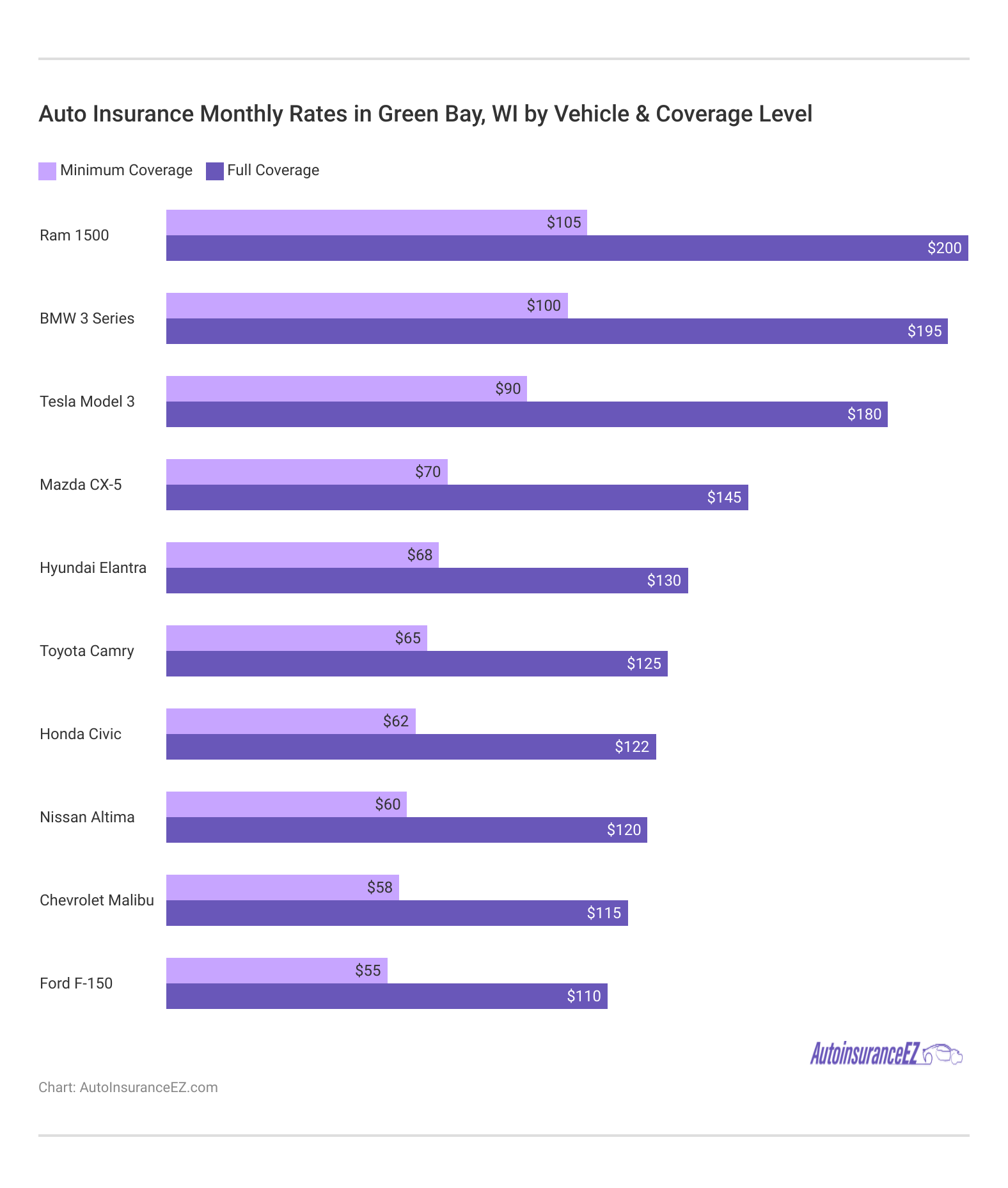

Your Vehicle’s Make and Model

What you drive is one of the most substantial factors. Expensive luxury vehicles aren’t just more expensive to insure and cost more to replace.

Oddly, you will want to protect an expensive car with additional insurance coverage. The more coverage you buy, the more premiums you will pay.

Read more: The Most Expensive Cars To Insure

Your Marital Status

Marital status is also a factor, albeit a minor one. If an individual factors in marital status, their insurance policy might differ by one to two percent. However, married couples can save money by bundling multiple policies insured by the same best Wisconsin auto insurance company.

Combining car insurance after marriage frequently gives discount rates in exchange for bundling multiple financial products together.

Your Education

Education is another aspect that insurance companies consider when calculating rates. Many of the adults living in Green Bay have a high school diploma hanging on the wall — 35 percent, in fact. Another 17 percent of the population has not yet completed their high school education.

If you’re a Green Bay resident with less than a college education, you may want to consider returning to school to save money on your car insurance.

Justin Wright Licensed Insurance Agent

The University of Wisconsin-Green Bay is a satellite campus of the statewide University of Wisconsin system. Students can pursue degrees that start at the associate level and go all the way up to the graduate level.

Students might want to look into St. Norbert College for a private university. Conversely, working adults looking for a technical or vocational education might be interested in the Northeast Wisconsin Technical College.

Providers love giving preferential rates to highly educated drivers. However, you shouldn’t allow an insurance provider to persuade you into an auto insurance policy that is not best for you.

The amount of data needed to assess your personal risk profile can be overpowering, but comparing internet sites like this may also help make things less complicated. Enter your ZIP code below to instantly compare Green Bay, WI auto insurance companies and find a great car insurance quote.

Read more: Car Insurance for Students

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Driving in Green Bay, WI

Before we move on to road conditions in Green Bay, it is important to note how much time one spends on the road.

Traffic and Commute

Driving around Green Bay is fairly simple, and some insurers offer cheap pay-per-mile insurance. Most trips last between 10 and 20 minutes, with an average of around 15 minutes for most drivers.

Additionally, 80 percent of residents prefer to use their own mode of transportation alone when getting to and from work, while around nine percent carpool.

Your provider may ask you how many miles you anticipate driving each year, or why you’re driving in the first place (school/work/pleasure, etc.).

However, the largest factor they will consider is whether or not your vehicle is for business. Business vehicles are charged 10-12 percent more on premiums than vehicles used to get to work and/or school.

Road Conditions

The following bullet points pertain to road conditions throughout Green Bay in 2023.

- Mediocre Share: 24 percent

- Fair Share: 8 percent

- Good Share: 25 percent

- Poor Share: 43 percent

- Vehicle Operating Costs (VOC): $795

These deteriorated road conditions increased vehicle operating costs (VOC) for drivers. Specifically, the average motorist in this region incurred an additional $909 annually due to growing auto depreciation, extra repair expenses, higher fuel consumption, and tire wear.

Read more: Ultimate Road Safety Guide (How to Drive Safely)

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Traffic Congestion in Green Bay, WI

The following table gives a rundown on traffic congestion in Green Bay.

Traffic Congestion in Green Bay, WI

| Traffic Congestion Criteria | Traffic Congestion Statistics |

|---|---|

| Most Congested City in the World Ranking | Not ranked among the top 500 most congested cities |

| Most Congested City in the Country Ranking | Not ranked among the top 100 most congested U.S. cities |

| Driving time spent in congestion in 2024 | 16 hours per year |

| Cost of congestion per driver | $33/month |

| Inner city last mile speed | 22 mph |

For such a large city, fatal accidents in Green Bay are statistically very low. As a driver, this means that you are probably already paying some of the lowest insurance rates in the state. Providers often automatically lower rates for drivers living in cities with safe roads.

That sums up everything you need to know to get the best Green Bay, WI auto insurance and all the ways to lower your premiums through car insurance discounts. Enter your ZIP code and start comparing rates in Green Bay, Wisconsin.

Frequently Asked Questions

Which car insurance company is the best?

State Farm is the best car insurance company in Green Bay, Wisconsin, because its extensive local agents provide customized policies for Green Bay drivers.

What type of car insurance gives you the most coverage?

Full comprehensive coverage gives the most coverage in car insurance, which is ideal for drivers in Green Bay.

What are the top 3 insurance companies?

State Farm, AAA, and Allstate are among the top 3 auto insurance companies in Green Bay. Learn more in the Allstate vs. State Farm Auto Insurance Review.

Which car insurance coverage is the best?

The best car insurance coverage depends on each driver’s needs, but it is recommended that they get full comprehensive coverage.

What is the most popular car insurance company?

State Farm is the most popular and the largest car insurance company in the United States.

Who pays the most for car insurance?

Young drivers, high-risk drivers, those with poor credit, luxury or sports car owners, residents of high-crime areas, and people choosing low deductibles or high coverage limits pay the most for car insurance. Learn more about car insurance after DUIs.

Which company offers the best auto insurance coverage?

State Farm offers the best auto insurance coverage with a long list of add-ons to purchase.

Does State Farm in Green Bay, WI, have a reliable network of agents?

Yes, State Farm has a reliable network of agents in Green Bay, WI, with highly rated professionals like Joel Emmerich, Christina Lindauer, and Tiona Petrouske known for excellent customer service.

Which car insurance company has the highest claim settlement ratio?

In Green Bay, WI, Acuity Insurance is highly rated for its claim settlement performance, earning an A+ from the Wisconsin Collision Repair Professionals. Erie Insurance also ranks high in customer satisfaction, indicating strong assistance in car accidents and auto claims.

Which company normally has the cheapest car insurance?

Allstate offers the cheapest car insurance with a monthly starting rate of $45. Enter your ZIP code to start comparing rates from multiple car insurers in Green Bay.