Will my auto insurance cover locksmiths? (2025 Coverage Details)

Will my auto insurance cover locksmiths? Auto insurance often covers locksmith services if you have roadside assistance, which costs as low as $5/month. Roadside assistance coverage usually includes charges for calling a locksmith, while insurance for lost keys is part of comprehensive coverage.

Read more

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

Licensed Agent & Financial Advisor

UPDATED: Jan 28, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 28, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

On This Page

Will my auto insurance cover locksmiths? Many auto insurance policies cover locksmith services, particularly if you have roadside assistance. This valuable coverage often costs around $5/month and can help pay for locksmith fees when you’re locked out of your vehicle.

Companies like Geico, Farmers, and USAA usually offer this service, but some may require comprehensive and collision insurance to qualify. It’s essential to review your specific policy to understand what’s covered.

For example, Allstate and Progressive provide similar coverage, ensuring emergency help is available. To find the best rates and coverage for locksmith services, comparing quotes from various insurance providers is a smart move.

Read our guide to learn auto insurance covers locksmith services and how much it costs. Also, we’ll compare auto insurance companies that provide coverage for locksmith fees.

Stop overpaying for auto insurance. Enter your ZIP code above to find out if you can get a better deal.

- Auto insurance may cover locksmith services if you have roadside assistance

- Coverage for locksmith fees varies by provider, so check your policy

- Some companies require comprehensive insurance for locksmith coverage

Auto Insurance Coverage for Locksmiths

Yes, if you have the right auto insurance coverage. Emergency roadside assistance is an extra coverage that can be added to most auto insurance policies. It will cover locksmit fees.

Some auto insurance companies provide roadside assistance automatically with your policy, but with most it’s an option. Emergency roadside assistance (also known as roadside assistance) covers a variety of issues in addition to locksmith fees, like a dead battery.

Most auto insurance policies offer locksmith coverage through roadside assistance, typically available for around $5 a month.

Brad Larson Licensed Insurance Agent

Furthermore, if you’re locked out of your car, it’s important to know whether your auto insurance covers locksmith services. Geico’s emergency road service coverage and roadside assistance provided by the Kentucky Farm Bureau may offer lockout assistance, but coverage can vary, so it’s essential to review your policy.

Costs for locksmith services can vary by location, like locksmith services in Hastings, Michigan, so checking reviews of locksmith agents can help you find a reliable option. The average cost of hiring a locksmith for a car depends on factors such as the time and difficulty of the job, and some insurance policies may reimburse these costs.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Auto Insurance Companies That Cover Locksmiths

You’ll find that roadside assistance is an option that you can usually choose to add to your quote. The cost of emergency roadside assistance varies from company to company, but you can add it to your insurance policy for a few dollars per year.

Check out how much roadside assistance costs at some of the best auto insurance companies in the United States.

Comparing Roadside Assistance Costs at Top Car Insurance Companies

| Insurance Company | Monthly Addition Cost | Need collision or comprehensive coverage? | Roadside Assistance Phone Number |

|---|---|---|---|

| Allstate Towing and Labor Cost | $125 per occurrence | X | 877-597-3393 |

| Farmers Towing and Road Service | $23/month | ✅ | 800-435-7764 |

| Geico Emergency Road Service Coverage | $16/month | ✅ | 800-424-3426 |

| Progressive Roadside Assistance | $16/month | X | 830-816-2002 |

| State Farm Emergency Road Service | $5/month | X | 877-627-5757 |

| USAA Roadside Assistance | $24/month | ✅ | 800-531-8555 |

Some of the top auto insurance companies require collision and comprehensive insurance to get access to roadside assistance. Geico, Farmers, or USAA require customers to carry collision and comprehensive insurance if they want emergency roadside assistance.

Additionally, knowing which auto insurance companies cover locksmith services is essential if you’re locked out of your car. Farmers’ auto insurance towing and road service typically include lockout assistance, while AAA insurance services for locksmith needs also offer reliable support. Always check your policy to confirm coverage details.

Also, roadside assistance provided by locksmiths can be invaluable in emergencies. However, costs for emergency locksmith services can vary based on factors like location and job complexity. Some insurance companies cover these expenses fully, while others may only reimburse part of them, so reviewing your policy can help you avoid unexpected costs.

Read more: Do You Need Roadside Assistance Coverage?

Motor Clubs Pay for Locksmith Fees

You can join a motor club rather than add more coverage to your auto insurance policy. Emergency roadside assistance isn’t expensive in most cases, but adding more coverage drives up monthly rates.

Roadside Assistance Costs From the Top Motor Clubs

| Roadside Assistance | Monthly Rates |

|---|---|

| $7 |

| $8 | |

| $9 | |

| $6 | |

| $10 | |

| $5 |

Compared to auto insurance rates, roadside assistance is more affordable. In most cases, you’ll pay once per year rather than in monthly installments.

Motor Club roadside assistance is also known for covering services like recharging a dead battery and changing tires.

Subsequently, when considering whether motor clubs will pay for locksmith fees, it’s important to review the services they offer. Many motor clubs partner with fully insured locksmith services, ensuring reliable assistance during a lockout. Understanding insurance coverage for lost keys is also crucial, as some policies may reimburse locksmith fees while others may not.

Let’s compare emergency roadside assistance costs from the top motor clubs in the nation. As you explore motor club services or auto insurance options, be sure to compare the key factors involved in car insurance comparison shopping. Look for plans that cover insurance for key fob replacement and other lockout services to maximize savings.

By carefully reviewing your options, you can choose a motor club or insurance policy that effectively meets your needs for locksmith fees. Explore roadside assistance discounts to find the best deals and save on essential services like locksmith fees.

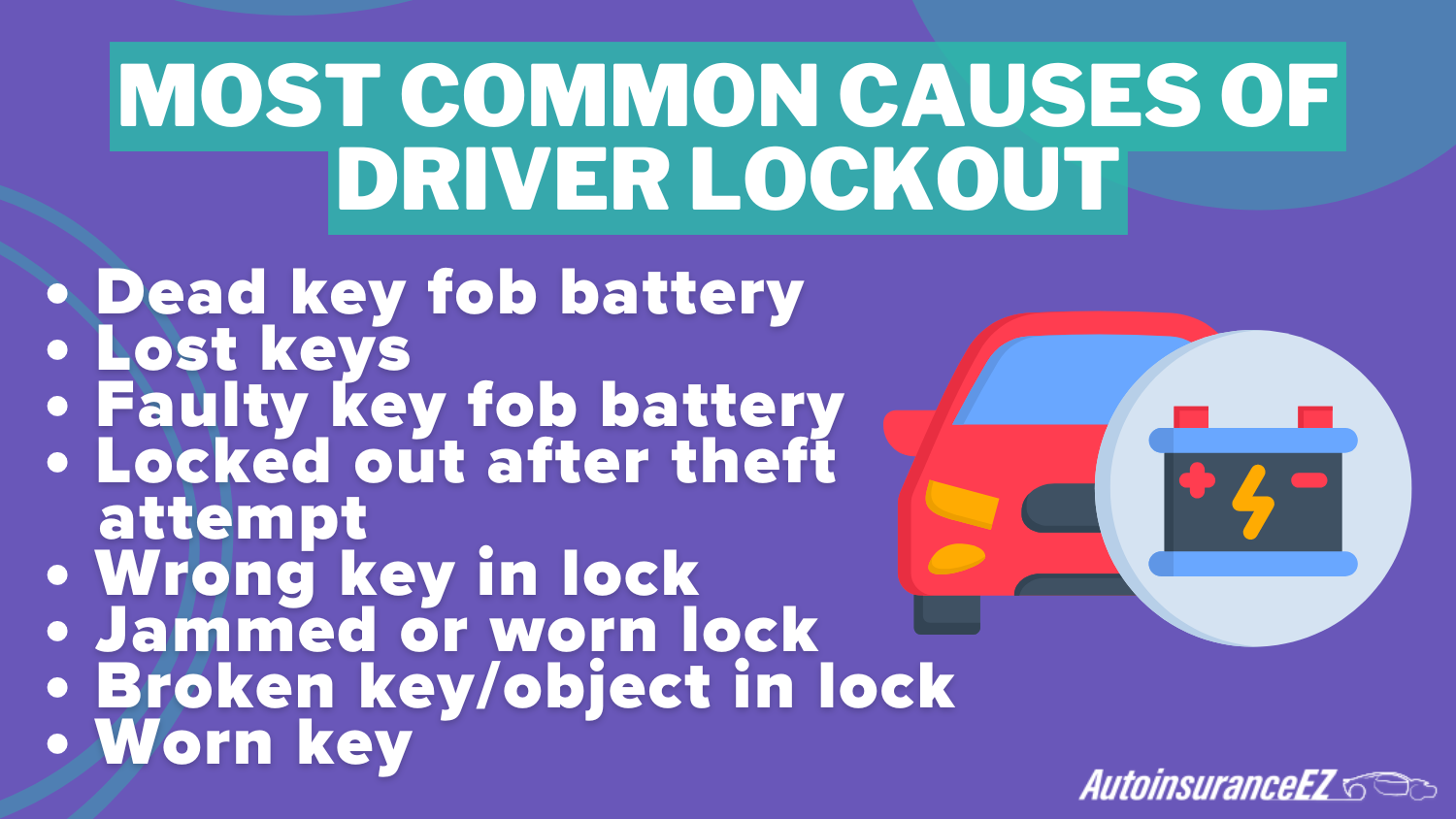

The Most Common Causes of Driver Lockout

Driver lockouts can occur for a variety of reasons, and many auto insurance companies recognize this by providing coverage for locksmith services through their roadside assistance programs.

Common causes of lockouts include a dead key fob battery, lost car keys, a malfunctioning key fob battery, being locked out due to attempted car theft, inserting the wrong key into the lock, a worn-out or jammed lock, a broken key or object stuck inside the lock, and a worn-down key.

To address these situations, insurance providers often offer specific policies that can be very helpful. For instance, the Allstate insurance policy for locked keys in cars includes coverage that can assist in these scenarios. Additionally, the towing coverage offered by Allstate auto insurance may help cover locksmith expenses when you need immediate assistance.

When exploring your options, it’s wise to conduct a comparison of car key insurance policies to understand the coverage limits and benefits offered by different plans. Many car insurance policies provide coverage for key replacement, ensuring you receive support when unexpected lockout situations arise.

Check out our guide on high-risk drivers to discover affordable coverage options and expert tips for handling insurance challenges.

Auto Insurance Companies That Cover Keys Locked in a Car

Yes, auto insurance companies generally cover incidents where keys are locked inside a car, as this situation is typically included under emergency roadside assistance. Most policies ensure that car insurance provides coverage for key replacement, which helps you manage the costs associated with getting back into your vehicle.

Additionally, if your car is still running, your auto insurance company may send someone to unlock your vehicle and even add fuel if needed.

However, it’s essential to be aware of any charges for calling a locksmith, as some insurance policies may impose specific terms regarding coverage limits or fees associated with locksmith services. Always review your policy details to understand what is covered and what costs you may be responsible for.

Read more: Allstate vs. American Family: Best Auto Insurance

Auto Insurance Coverage for Replacement Keys

Whether auto insurance covers replacement keys depends on your provider and the type of coverage you have. Typically, lost or stolen keys are covered under comprehensive insurance. Some policies, such as those that include Allstate lockout assistance service, can also help if you’re locked out of your vehicle.

Additionally, opting for a key replacement add-on in a car insurance policy ensures that the cost of replacing lost or stolen keys is specifically covered. If your key fob needs to be reprogrammed, using your roadside assistance can help reduce the associated costs. Always review your policy details to understand your coverage options.

Learn how installing security features can help you save with an anti-theft device discount, offering lower premiums and better protection for your vehicle.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Who to Call to Unlock my Vehicle for Free

If you don’t have roadside assistance through an auto insurance company or motor club, here are some free options to unlock your vehicle:

- Call a friend or family member to bring a spare key

- Use your car’s warranty service, which may cover locksmith and towing services

- Contact your cell phone carrier for roadside assistance

- Check with your credit card company to see if they cover locksmith services or offer coverage for lock replacement

It’s also helpful to review your insurance policy for an auto insurance quote for key coverage, which can help with future key replacement or locksmith services. Keep this information handy in case your auto insurance doesn’t provide roadside assistance.

Read more: Average Auto Insurance Cost

Auto Insurance Coverage for Locksmith Services

Auto insurance can cover locksmith fees under certain circumstances, particularly through optional emergency roadside assistance add-ons. This feature is not included in standard policies but typically provides services such as locksmith services specifically for cars, towing, tire changes, and fuel delivery. The cost for this add-on ranges from $5 to $15 per year.

When considering the costs associated with hiring a locksmith, it’s essential to note that having comprehensive and collision coverage may be necessary to access emergency roadside assistance. Many insurance companies offer affordable options for auto locksmith services by bundling roadside assistance with other benefits, making it a convenient choice for drivers.

Organizations like AAA also provide similar services, including free locksmith services for cars, making membership an attractive option for those who frequently need assistance.

Always review your policy for coverage specifics, including limits and exclusions, as some policies may not cover the full cost of locksmith services. Investing in roadside assistance could save you time and money, providing peace of mind in emergency situations.

Uncover affordable auto insurance rates from the top providers by entering your ZIP code below.

Frequently Asked Questions

Does Progressive insurance cover locksmith fees?

Yes, it does. Progressive provides emergency roadside assistance for customers who have liability insurance. Full coverage isn’t required.

Does Geico insurance cover keys locked in a car?

The answer is yes. Geico covers keys locked in your vehicle under its roadside assistance coverage. If you’re just looking for coverage to drive legally, enter your ZIP code below to compare cheap auto insurance quotes near you.

Does Geico cover locksmith fees?

Yes, it does. However, Geico customers must have full coverage auto insurance.

Read more: Geico Auto Insurance Review

Does Allstate cover locksmith fees?

Yes. Allstate provides roadside assistance for its customers with liability coverage and beyond.

How much does Progressive roadside assistance cost if it’s not included in my coverage?

Progressive roadside assistance typically costs around $16 annually, but the exact price may vary based on your policy and location.

How can I add roadside assistance to my Progressive policy?

You can add roadside assistance to your Progressive policy by contacting your agent or updating your policy through Progressive’s online portal or mobile app. Check out our Progressive auto insurance review to explore affordable roadside assistance options that can enhance your coverage.

Does Geico provide coverage for key fob replacement?

Yes, Geico provides coverage for key fob replacement under its comprehensive insurance, but it’s best to confirm the details with your specific policy.

Does using Geico roadside assistance increase your premium?

Using Geico roadside assistance generally doesn’t increase your premium, but it’s important to review your policy terms, as excessive claims may affect future rates.

How much does it cost to hire a locksmith for a car?

The cost to hire a locksmith for a car ranges from $50 to $150, depending on the location, time of day, and complexity of the job.

Read more: Progressive Snapshot Program Review

What happens if you refuse to pay a locksmith?

If you refuse to pay a locksmith, they may withhold services or take legal action to recover the owed amount, depending on the situation.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

Licensed Agent & Financial Advisor

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.