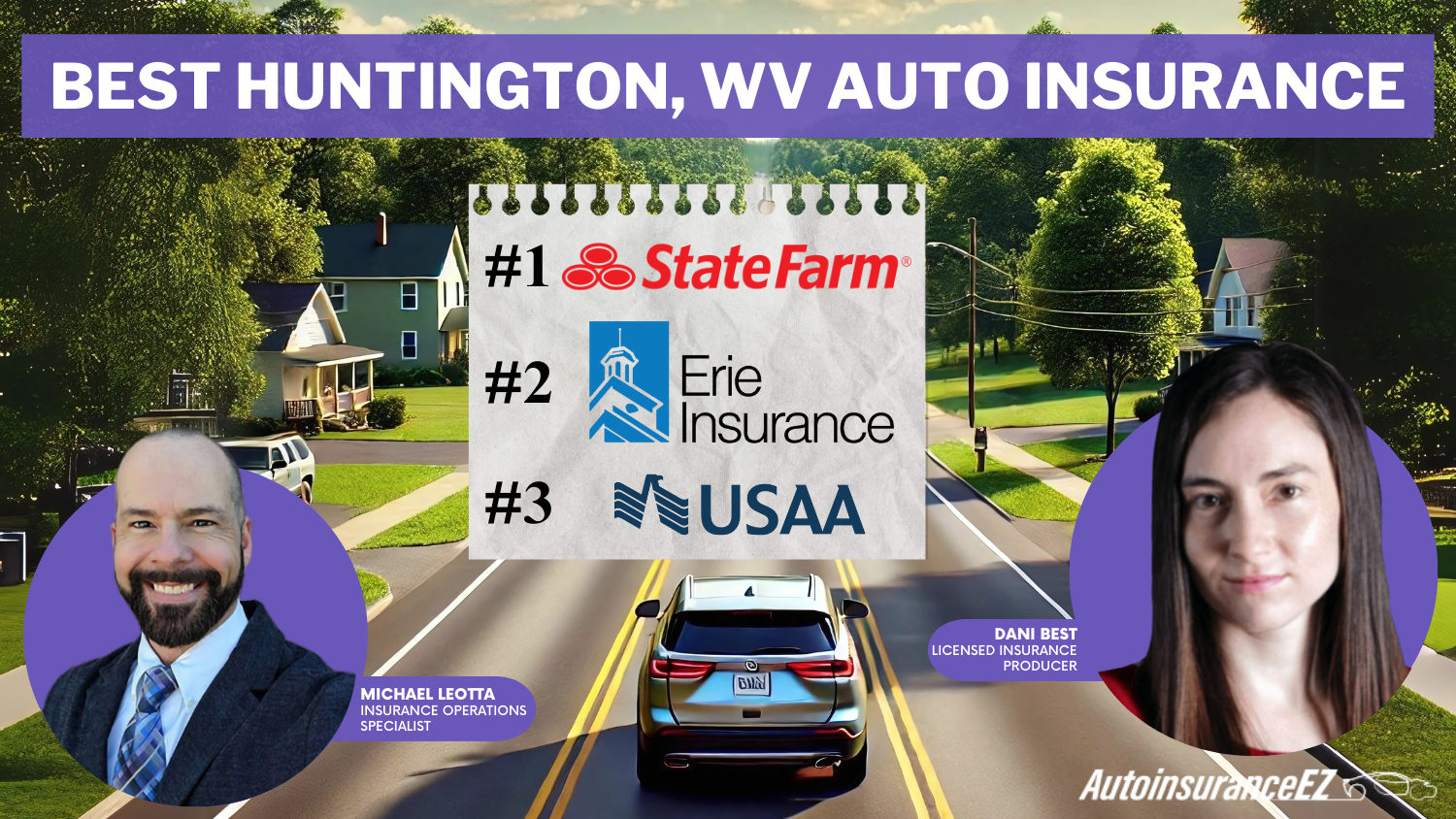

Best Huntington, WV Auto Insurance in 2025 (Top 10 Companies Ranked)

State Farm, Erie, and USAA provide the best Huntington, WV auto insurance, with rates starting at $74/mo. State Farm leads with an A++ rating from A.M. Best proving its strong financial stability. Erie stands out for its rate lock feature. USAA has extensive coverage and discounts for military members.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

UPDATED: Apr 16, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

18,154 reviews

18,154 reviewsCompany Facts

Huntington Full Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 1,883 reviews

1,883 reviewsCompany Facts

Huntington Full Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviews 6,589 reviews

6,589 reviewsCompany Facts

Huntington Full Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviewsThe best Huntington, WV auto insurance providers are State Farm, Erie, and USAA, with monthly rates starting at $74. State Farm is distinguished for its exceptional customer service and auto insurance coverage options.

Erie is renowned for its affordable rates, with a rate lock feature that prevents yearly premium increases. USAA has robust coverage for the military and their families.

Our Top 10 Company Picks: Best Huntington, WV Auto Insurance

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $138 | A++ | Full Coverage | State Farm | |

| #2 | $135 | A+ | Affordable Coverage | Erie |

| #3 | $125 | A++ | Comprehensive Service | USAA | |

| #4 | $130 | A+ | Multi-Driver Households | Nationwide |

| #5 | $132 | A+ | High-Risk Drivers | Progressive | |

| #6 | $145 | A+ | Comprehensive Protection | Allstate | |

| #7 | $150 | A+ | Minimum Coverage | Amica | |

| #8 | $155 | A | Home-Auto Bundling | Liberty Mutual |

| #9 | $142 | A | Personalized Coverage | Mercury | |

| #10 | $140 | A++ | Customer Satisfaction | Auto-Owners |

The table above shows the top 10 car insurance companies in Huntington that offer quality service and budget-friendly premiums.

- State Farm, Erie, and USAA have the best auto insurance in Arlington, WV

- Auto insurance in Arlington starts at $74 a month for minimum coverage

- Comparing top Huntington car insurance providers can help you get the best rates

Compare car insurance options to find the best policy. Use our free comparison tool to find the most affordable Huntington, WV auto insurance rates in your area.

#1 – State Farm: Top Pick Overall

Pros

- Local Agents: State Farm car insurance in Huntington offers personalized service through local agents, making it a great choice for owners who prefer face-to-face interaction.

- 17% Bundling Discount: Bundling policies with State Farm offers a discount for multi-policy coverage. Check out our State Farm auto insurance review for more details.

- Strong Financial Stability: State Farm has an A.M. Best rating of A++, reflecting its solid financial foundation.

Cons

- Limited Online Tools: State Farm’s digital tools might not be as advanced as those of other providers, which could be a drawback for tech-savvy owners.

- Higher Premiums: Rates might be slightly higher than those offered by other companies offering the best auto insurance in Huntington, WV, especially for younger or high-risk drivers.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#2 – Erie: Best for Affordable Coverage

Pros

- Competitive Premiums: Erie car insurance in Huntington is more affordable than competitors, and its rate lock feature prevents an increase even after a year.

- Several Coverage Features: It offers extra benefits at no additional cost, such as personal item and pet coverage. Check all these add-ons in the Erie insurance review.

- Strong Customer Service: Erie receives high customer approval for its quick response to claim resolutions and general concerns, as it ensures the best Huntington, WV auto insurance.

Cons

- Rate Lock Drawback: This Huntington car insurance feature does not apply to all customers, and premiums may still increase if policyholders move, add drivers or cars, or change vehicles.

- No Online Quotes for Some Policies: Erie car insurance in Huntington requires customers to contact an agent to get their desired quote, unlike other insurers that offer online quotes.

#3 – USAA: Best for Comprehensive Service

Pros

- Military Benefits: USAA is known for offering exceptional benefits to military families, making it the best Huntington auto insurance choice for those who are active or retired military.

- A++ A.M. Best Rating: USAA has an A++ rating, showing its strong financial stability. Be sure to read our USAA auto insurance review to see why it’s a trusted choice for coverage.

- 10% Bundling Discount: USAA car insurance in Huntington, WV, offers a solid bundling discount for owners who choose multiple policies.

Cons

- Exclusively for Military: USAA auto insurance in Huntington, WV, only serves military families, meaning non-military owners are excluded from its offerings.

- Limited Availability of Local Agents: While the service is excellent, some owners may prefer more in-person support that USAA may not provide in all locations.

#4 – Nationwide: Best for Multi-Driver Households

Pros

- Bundling Discounts: Nationwide offers great bundling discounts, allowing the best Huntington, WV auto insurance owners to save when combining multiple policies.

- A+ A.M. Best Rating: Nationwide’s strong A+ rating ensures that it is financially sound, providing owners with peace of mind.

- Flexible Coverage: This provider offers flexible coverage options for Huntington car insurance.

Cons

- Higher Premiums for Younger Drivers: Younger drivers may pay higher premiums. Our Nationwide auto insurance review can help assess if their rates suit your needs.

- Limited Local Agent Presence: Owners who prefer in-person interactions with agents might find Nationwide’s limited local agent presence a disadvantage.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#5 – Progressive: Best for High-Risk Drivers

Pros

- Budgeting Tools: Progressive has various budgeting tools, which help Huntington, WV auto insurance owners easily track money flow and keep expenditures under control.

- A+ A.M. Best Rating: With an excellent rating of A+, Progressive is financially sound, making it the best Huntington, WV auto insurance option.

- 10% Bundling Discount: Progressive offers discounts that save money on multiple policies. Check out our Progressive auto insurance review to see your potential savings.

Cons

- Higher Rates for Specific Drivers: Progressive car insurance in Huntington charges higher amounts than expected than other Huntington, WV auto insurance deals.

- Complex Policy Details: Understanding all the Huntington car insurance policy terms might be challenging for some owners without a clear explanation from an agent.

#6 – Allstate: Best for Comprehensive Protection

Pros

- Valuable Add-on Coverage Options: Allstate offers valuable add-on coverage options, which provide additional protection.

- 25% Bundling Discount: Allstate auto insurance in Huntington can offer a competitive bundling discount, benefiting owners who combine their auto insurance with other coverage.

- A+ A.M. Best Rating: Allstate’s A+ rating reflects its great financial strength, making it a reliable choice for Huntington auto insurance.

Cons

- Complex Policies: Some owners might find Allstate’s policy options overwhelming, as they offer a variety of add-ons that can complicate the selection process.

- Potentially High Rates: Allstate’s rates may be higher, particularly for young or high-risk drivers. Our Allstate auto insurance review clarifies their pricing.

#7 – Amica: Best for Minimum Coverage

Pros

- Generous Savings Options: A 30% bundling savings, a 20% good student discount, and 13% for loyal customers. Check all these discounts in the Amica auto insurance review.

- A+ A.M. Best Rating: Amica’s strong financial stability ensures the best Huntington, WV auto insurance.

- Flexible Policy and Features: Policyholders should be able to add features like accident forgiveness and roadside assistance even with minimum coverage.

Cons

- Limited Coverage: Unlike other insurance companies in Huntington, WV, it does not offer SR-22 and usage-based insurance.

- Fewer Local Agents: Amica car insurance in Huntington operates mostly by phone and online, with few agents who assist customers in person.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#8 – Liberty Mutual: Best for Home-Auto Bundling

Pros

- Flexible Coverage: Liberty Mutual car insurance in Huntington offers flexible coverage options for those who wish for a customized approach.

- 25% Bundling Discount: Liberty Mutual offers a discount for combining auto insurance with other policies. Read the Liberty Mutual auto insurance review to learn more.

- A-Rated Financial Stability: Liberty Mutual’s A rating ensures reliability and financial stability in Huntington, WV.

Cons

- Higher Premiums for Some Drivers: Liberty Mutual might be slightly more expensive than the competition, particularly for younger or higher-risk drivers.

- Fewer Local Agent Options: Their digital-first approach may not attract owners who enjoy more personalized, in-person service.

#9 – Mercury: Best for Personalized Coverage

Pros

- Coverage Personalization: Several Huntington, WV auto insurance coverage options and add-ons, such as ride-hailing and mechanical protection, whichever suits their needs.

- Dedicated Local Agents: Customers can rely on local agents to assist them in personalizing their plans to align with their needs and coverage.

- 24/7 Claims Assistance: Mercury auto insurance in Huntington, WV, provides assistance 24/7 for filing, updating, and resolving claims.

Cons

- Availability Restrictions: It is only available in 11 states, so it has limited access and reach to all states. Check all the states in which Mercury Insurance operates.

- Strict Underwriting Options: Customers experience strict requirements to get auto insurance approval, especially high-risk drivers.

#10 – Auto-Owners: Best for Customer Satisfaction

Pros

- High Customer Satisfaction: A 4.7 out of 5 for customer service in U.S. News & World Report 2025 and 87% satisfaction from Insure.com 2025.

- A++ A.M. Best Rate: Auto-owners insurance review discusses its robust financial stability and reliability in efficient claims processing and resolution.

- Local Agents Personalization: Auto-Owners auto insurance in Huntington, WV, use their network of agents to provide real-time assistance and policy personalization.

Cons

- Fewer Digital Tools: Auto-Owners has a mobile app, but it is not as advanced as Geico’s, with more options and features.

- Discount Variations: Discount amounts are not standardized and inconsistent, and they depend on the local agents.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Affordable Auto Insurance Rates in Huntington

Various car insurance agencies in Huntington, WV, offer affordable options for quality coverage. To secure the best deal, it is important to compare auto insurance companies and carefully review their rates and coverage options.

Whether you need basic liability or comprehensive protection, the diverse options for car insurance in Huntington, West Virginia, can meet your specific needs.

Auto Insurance Monthly Rates in Huntington, WV by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $85 | $145 | |

| $88 | $150 | |

| $77 | $140 | |

| $78 | $135 |

| $92 | $155 |

| $83 | $142 | |

| $79 | $130 |

| $75 | $132 | |

| $76 | $138 | |

| $74 | $125 |

Progressive, Auto-owners, and Erie are among the insurers with lower rates in the table for minimum and full coverage. But remember, when getting auto insurance, this is just the first step, do not grab the lowest rate, but also check all the factors, including the claims resolutions and customer service.

The best Huntington auto insurance starts at just $74 per month, with customizable policies to fit your unique needs.

Chris Abrams Licensed Insurance Agent

Take the time to explore car insurance in Huntington, WV, and choose the policy that best aligns with your budget and requirements.

Understanding Huntington Auto Insurance Discounts

When searching for commercial auto insurance, it is important to find the best value while meeting your needs. Low-cost auto insurance can be found in West Virginia without sacrificing coverage for personal vehicles.

Auto Insurance Discounts From Top Providers in Huntington, WV

| Insurance Company | Anti-Theft | Bundling | Good Student | Safe Driver | Loyalty |

|---|---|---|---|---|---|

| 10% | 25% | 22% | 18% | 15% | |

| 18% | 30% | 20% | 15% | 13% | |

| 12% | 16% | 20% | 8% | 10% | |

| 15% | 25% | 15% | 15% | 10% |

| 35% | 25% | 12% | 20% | 10% |

| 12% | 20% | 15% | 8% | 10% | |

| 5% | 20% | 18% | 12% | 8% |

| 25% | 10% | 10% | 10% | 13% | |

| 15% | 17% | 35% | 20% | 6% | |

| 15% | 10% | 10% | 10% | 11% |

These discount opportunities are beneficial to shave a huge amount off your monthly car insurance bill. Watch this video fro more tips on getting the cheaper rates of Huntington car insurance,

Comparing policies helps secure affordable auto insurance in WV or inexpensive auto insurance in West Virginia, ensuring quality protection at a lower price.

Auto Insurance Coverage Requirements in West Virginia

Every state requires a minimum insurance coverage to drive legally. Check this in the table below.

Auto Insurance Minimum Coverage Requirements in West Virginia

| Coverage | Limits |

|---|---|

| Bodily Injury | $20,000 per person / $40,000 per accident |

| Property Damage | $10,000 per accident |

| Uninsured Motorist Bodily Injury | $20,000 per person / $40,000 per accident |

Remember, this is just the minimum; you can go over this requirement if you want more coverage and add-ons on your car insurance, but you can never drive around without carrying this basic requirement.

Read more: Is it a bad idea to just carry minimum coverage auto insurance?

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Key Factors for Choosing the Best Huntington Auto Insurance

When choosing the best auto insurance in Huntington, consider coverage options, customer service, and financial stability. Compare providers known for reliability and excellent customer support, like State Farm.

Also, ensure you review comprehensive and collision coverage for full protection. For those in Huntington, WV, consider Auto repair coverage. Additionally, look for the best affordable Huntington, WV, car insurance and explore options from insurance companies in Huntington, WV. Here is a table for all the factors that shape your car insurance premiums.

Factors Affecting Auto Insurance Premium in Huntington, WI

| Factor | Impact | Description |

|---|---|---|

| Age & Gender | High | Young & male drivers typically pay more |

| Annual Mileage | Moderate | More driving = higher risk = higher premiums |

| Bundling Policies | Low to Moderate | Combining auto & home insurance can lower rates |

| Claims History | High | Frequent claims increase insurance costs |

| Coverage Level | High | Higher coverage means higher costs |

| Credit Score | Moderate to High | Lower scores lead to higher premiums |

| Driving Record | High | Accidents & violations increase rates |

| Location (ZIP Code) | Moderate | Urban areas have higher rates due to theft/accidents |

| Marital Status | Low to Moderate | Married drivers may get lower rates |

| Vehicle Type | Moderate | Luxury & sports cars cost more to insure |

Understanding all the factors that influence auto insurance in Huntington helps drivers control those factors that they can manage. Keeping a good credit score will result in lower premiums and otherwise would give them higher rates that may be too much for them to pay monthly.

Customizing Your Auto Insurance Policy in Huntington

Tailor your auto insurance in West Virginia with flexible options like comprehensive, liability, and collision coverage. Additional services, such as roadside assistance, can be included for extra peace of mind.

Low-cost auto insurance quotes in Huntington offer affordable options without sacrificing quality. Both low-cost car insurance in Huntington and affordable motorcycle insurance in West Virginia ensure you get the right protection at an affordable price.

Customer Experience With Huntington Auto Insurance Providers

Choosing the right provider for Huntington, WV auto insurance options involves more than finding affordable rates; customer service is equally crucial. Whether you’re looking into or exploring Auto insurance services in Huntington, evaluating how insurers handle car accidents and auto claims is important.

Prioritize insurers with strong claims support—savings mean little if help is slow when you need it most.

Michael Leotta Insurance Operations Specialist

Reliable customer support ensures smoother claim processes during stressful times. By researching providers with a strong reputation for responsiveness and efficiency, you can find coverage that offers peace of mind and comprehensive protection.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

A Guide to Choosing the Best Car Insurance in Huntington

Research and compare the top providers to find the best Huntington, WV car insurance. Allstate, Progressive, and State Farm offer many options at all price points, so getting a great coverage-to-cost deal is imperative.

For just $74 per month, we offer the best Huntington, WV auto insurance tailored to your needs, combining affordability with comprehensive coverage.

Ask for discounts to lower your premium, such as a safe driver discount based on a good driving history or bundling other policies to save you money. Use our free comparison tool to find the best Huntington, WV auto insurance.

Frequently Asked Questions

Which type of vehicle insurance is the best?

The best auto insurance is the one that best suits your vehicle. Assess your car and your specific needs so you can tailor your insurance policy to them.

Which company has the cheapest insurance in WV?

USAA has the cheapest insurance in Huntington, WV, with only a $74 monthly starting rate.

Is Progressive a good insurance company?

Yes. Progressive is a good company, best known for its unique budgeting tools, which allow you to select the right coverage for your budget, and several car insurance discounts.

Which insurance is better for an old car?

Liability insurance is usually the best choice for an old car since it covers damage you cause to others and is more cost-effective if your car has a low market value. Full coverage (including comprehensive and collision) might not be worth the extra cost unless the car still holds significant value.

Does Erie Insurance in Huntington, WV, offer a rate lock policy?

Erie Insurance offers the Erie Rate Lock feature in West Virginia, including Huntington. This feature lets you lock in your auto insurance premium, preventing rate increases, even after filing a claim. However, changing policy coverage, adding or removing a driver or vehicle, or changing your address may still lead to a rate increase.

What is the minimum car insurance in WV?

The minimum car insurance requirement to legally drive around WV is 20/40/10.

What is the best auto insurance company?

The best auto insurance companies are State Farm, Erie, and USAA.

Do insurance companies offer business interruption insurance in Huntington, West Virginia?

Many insurance companies in Huntington, WV, offer business interruption insurance policies to help cover lost income and operating expenses during unexpected disruptions. It’s best to contact local agencies to find a policy tailored to your business needs.

What is full coverage auto insurance in WV?

Full coverage auto insurance in West Virginia includes automobile liability coverage, collision, comprehensive, and uninsured/underinsured motorist coverage, offering broader protection but at a higher cost.

Which car insurance coverage is the best?

You should get full comprehensive coverage and add-ons that could benefit you. You can get car insurance quotes by entering your ZIP code here.