Best Charleston, WV Auto Insurance in 2025 (Compare the Top 10 Companies)

The best Charleston, WV auto insurance companies are Erie, State Farm, and Geico. Charleston, WV car insurance rates start at $75/mo. Erie leads with its state-wide affordability to drivers of different age groups. State Farm has numerous local agents, and Geico provides 24/7 roadside assistance.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

UPDATED: Apr 12, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

1,883 reviews

1,883 reviewsCompany Facts

Full Coverage in Charleston

A.M. Best Rating

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviews 18,154 reviews

18,154 reviewsCompany Facts

Full Coverage in Charleston

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in Charleston

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsErie, State Farm, and Geico are the best Charleston, WV auto insurance companies with a monthly starting rate of $75. Erie, the top overall pick in Charleston, West Virginia, is renowned for its statewide affordability across different driver profiles and age groups.

Our Top 10 Company Picks: Best Charleston, WV Auto Insurance

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $144 | A+ | Affordable Coverage | Erie |

| #2 | $138 | A++ | Local Agents | State Farm | |

| #3 | $140 | A++ | Customer Service | Geico | |

| #4 | $125 | A++ | Military Families | USAA | |

| #5 | $130 | A+ | Multi-Driver Households | Nationwide |

| #6 | $160 | A+ | New-Car Coverage | Allstate | |

| #7 | $135 | A+ | High-risk Drivers | Progressive | |

| #8 | $155 | A | Home-Auto Bundle | Liberty Mutual |

| #9 | $149 | A++ | Hybrid-Vehicle Coverage | Travelers | |

| #10 | $152 | A+ | Experienced Drivers | The Hartford |

Looking for the best auto insurance in West Virginia? At AutoInsuranceEZ.com, you will find the lowest-cost insurance policy where you live.

- Erie is known for its affordability to all types of drivers across the state

- Your premiums are determined through factors like your credit score and ZIP code

- The minimum coverage to drive around Charleston is 20/40/10

For free quotes for cheap car insurance near me, enter your local ZIP code in the quote box here.

#1 – Erie: Top Overall Pick

Pros

- Statewide Affordability: At $78 a month, Erie has the most affordable auto insurance in Charleston, WV.

- Tailored Options for Specific Demographics: Erie ensures that all drivers, including teens, seniors, young adults, high-risk drivers, and commercial drivers, get customized rates.

- Rate Lock: No unexpected price hikes unless there is a change in vehicle. Check more in the Erie auto insurance review.

Cons

- Limited Availability: Erie auto insurance is only offered in 12 states, including West Virginia, limiting potential customers.

- No 24/7 Customer Service: While the claims department is open 24/7, the policy change and management department is only open during business hours.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#2 – State Farm: Best for Local Agents

Pros

- Personalized Customer Service: State Farm excels in terms of its local agents, who provide individual consultations and dedicated customer support.

- Convenience and Accessibility: Policyholders can easily communicate their concerns with their local agents in the Charleston, WV, car insurance office.

- Extensive Add-Ons and Discounts: State Farm offers roadside assistance, rideshare, discounts for bundling, and safe drivers. The State Farm auto insurance review explains these in more detail.

Cons

- Customer Service Varies: The local agents are a big plus, but they do not have the same expertise to give customers the best support.

- Limited Roadside Assistance: State Farm auto insurance in Charleston, WV, offers this feature, but it is not as competitive and comprehensive as other insurers’.

#3 – Geico: Best for Customer Service

Pros

- Comprehensive Online Services: Geico mainly operates online, and its 24/7 assistance is available via email, phone, or chat.

- Round-the-Clock Roadside Assistance: This covers needs like fuel delivery, towing, lockout services, and more, and it is available whenever you need it.

- Efficient Claims Response: Geico is known for its quick claims resolution and A++ rating from A.M. Best. Learn more about its prompt claims in this Geico auto insurance review.

Cons

- Low-Mileage Higher Rates: Unlike most insurers, Geico auto insurance in Charleston, WV, does not offer programs like pay-per-mile for low-mileage drivers.

- Fewer Add-Ons Feature: Geico does not offer car insurance features in West Virginia, like gap insurance, new car replacement, and other add-ons.

#4 – USAA: Best for Military Families

Pros

- Military Appreciation Savings: USAA offers exclusive savings for the military, like garaging and deployment discounts, making it the best Charleston, WV auto insurer for the military.

- Complimentary Perks: The military gets no additional charge for rental car coverage and roadside assistance. All perks are discussed in the USAA auto insurance review.

- International Service: Those deployed internationally still get the best Charleston, WV auto insurance policy that USAA offers.

Cons

- Fewer Local Agents: USAA auto insurance does not have physical stores in Charleston and operates by phone or online.

- Non-Military Family Members: Only active-duty military personnel get the best rates and offers, making it less competitive for non-military citizens.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Multi-Driver Households

Pros

- Multi-Vehicle Incentives: Nationwide auto insurance in Charleston, WV, offers significant savings to families with multiple drivers, ranging from 5% to 25%.

- Coverage for Different Drivers: It offers classic car insurance and rideshare. Check all the coverage options in our Nationwide auto insurance review.

- Strong Local Agency: Unlike other insurers, Nationwide has established local agencies such as Capital Insurance Group LLC and Legacy Insurance and Financial.

Cons

- Fewer Digital Features: Nationwide’s mobile app is less advanced and lacks features like claims tracking, making it less competitive than most auto insurance apps in Charleston.

- Varying Discount Per State and Driver: The discount amount is not fixed, and some households may not reach the maximum discounts as advertised.

#6 – Allstate: Best for New-Car Coverage

Pros

- Full Car Replacement: Allstate auto insurance in Charleston, WV, ensures new car replacement if it is totaled within the first two years with the same make and model.

- Security Against Depreciation: Covers the cost of a new car once your owned car depreciates within the first few years while ensuring policyholders are not financially disadvantaged.

- Additional Coverage Options: This option provides gap coverage, loan payoff, protection, roadside assistance, and accident forgiveness. Check all the add-ons in the Allstate auto insurance review.

Cons

- Strict Qualifying Rules: The new car replacement is only for cars 2 model years or newer; beyond this, they are not eligible.

- Customer Service Complaints: Customers have mixed feedback on the response time to delays and, worse, on getting claims approved.

#7 – Progressive: Best for High-Risk Drivers

Pros

- High-Risk Drivers Inclusions: Known for offering auto insurance coverage to drivers with risky profiles that most insurers deny.

- SR-22 Filing Aid: Progressive can file an SR-22 on the driver’s behalf to reinstate their driving privileges after violations. Check the extensive details on Progressive auto insurance review.

- Competitive Pricing: Charleston’s rates are lower than those of other insurers, with estimated average monthly premiums of $257, as it mainly focuses on high-risk drivers.

Cons

- Extra Charging Fees: Filing an SR-22 for auto insurance in Charleston, WV, may result in an additional charge for administrative fees.

- Higher Rates: Although it mainly includes high-risk drivers, cheap auto insurance in WV may not be available with this company.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#8 – Liberty Mutual: Best for Home-Auto Bundle

Pros

- Significant Bundle Savings: Bundling your home and auto policies with Liberty Mutual lets you save $79 monthly on your premiums.

- Single Streamline Management: A simplified single-point contact for policies and billing to make it more manageable. Learn more about it in the Liberty Mutual auto insurance review.

- Coverage Customization: This guarantees that you only get the coverage you need by meeting the specific needs tailored to home and auto insurance in Charleston, WV.

Cons

- Savings Amount Variations: Actual savings on car insurance in West Virginia differ based on coverage, location, and personal profile.

- Rate Increase Over Time: Customers reported experiencing premium increases even without auto insurance claims in Charleston.

#9 – Travelers: Best for Hybrid-Vehicle Coverage

Pros

- Gap Insurance: This covers the gap between the actual cash value and the amount owed in a lease or loan. It is ideal for hybrid cars as they depreciate.

- Hybrid-Vehicle Coverage: Travelers offers special discounts for drivers who lease or own hybrid or electric cars. Check out more on Travelers auto insurance review.

- IntelliDrive Program: Usage-based program that rewards drivers with up to 30% off on Charleston, WV auto insurance for their safe driving practices.

Cons

- Hybrid Discount Varies: The amount that you can save with IntelliDrive varies depending on the state and performance.

- Limited Add-Ons: Some auto insurance in Charleston, WV, add-ons are not offered, such as rideshare, no original equipment, or manufactured coverage.

#10 – The Hartford: Best for Experienced Drivers

Pros

- Lower Premiums for Experienced Drivers: Experienced drivers, mostly 50+ years old, get lower monthly rates because of their long experience in driving.

- Exclusive AARP Perks: It partners with AARP to offer exclusive benefits like a 12-month rate lock and RecoverCare assistance on Charleston, WV auto insurance.

- Car Repair Guarantee: The Hartford has a lifetime guarantee of hassle-free repairs with its affiliated shops. Check all the repair shops available in The Hartford insurance review.

Cons

- Premium Variations: Young drivers and those not qualifying for AARP experienced higher Charleston, WV auto insurance premiums.

- Membership Requirement: The renowned perks for auto insurance in Charleston, like a 12-month rate lock, are only for AARP members.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Best Charleston, WV Auto Insurance Monthly Rates

Checking the monthly rates of auto insurance is the basics. You would not want to purchase insurance that you cannot afford to pay for because it’s like throwing money. The best Charleston, WV car insurance only costs $75 a month. Check the top providers below with their monthly premium rates.

Auto Insurance Monthly Rates in Charleston, WV by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $90 | $160 | |

| $78 | $144 |

| $82 | $140 | |

| $100 | $155 |

| $77 | $130 |

| $76 | $135 | |

| $79 | $138 | |

| $92 | $152 |

| $87 | $149 | |

| $75 | $125 |

Are you getting your insurance coverage from Erie right now? Or State Farm? Then, you may already be getting the best rates. However, switching providers might not be worth the rate decrease if you are happy with your current provider.

The best Charleston, WV insurance policy isn’t just about the lowest price. It’s also about reliable customer service and hassle-free claims processing.

Heidi Mertlich Licensed Insurance Agent

Shopping around car insurance is not just about how much you will pay monthly. Continue to read the page to learn more about these factors and make an informed decision on your auto protection.

Read more: Why auto insurance is so expensive?

Best Charleston, WV Auto Insurance Discounts

Most drivers pay more than $210 monthly on their West Virginia Auto Insurance bill. But if you live in Charleston, you could knock that down to $75 monthly or less! There are special deals available in your area right now that can help you get great discounts. Check the table below for car insurance discounts

Auto Insurance Discounts From the Top Providers in Charleston, WV

| Insurance Company | Accident-Free | Bundling | Defensive Driving | Good Student | Safe Driver |

|---|---|---|---|---|---|

| 25% | 25% | 18% | 18% | 18% | |

| 25% | 25% | 5% | 15% | 15% |

| 22% | 25% | 15% | 26% | 15% | |

| 20% | 25% | 10% | 12% | 20% |

| 20% | 20% | 12% | 12% | 12% |

| 10% | 10% | 10% | 10% | 10% | |

| 17% | 17% | 20% | 20% | 20% | |

| 5% | 5% | 10% | 12% | 8% |

| 13% | 13% | 17% | 17% | 17% | |

| 10% | 10% | 10% | 10% | 10% |

Bundling and telematics programs are common discount options. However, as listed, each provider has many other unique saving opportunities, ensuring you can get the lowest possible rate and save much more over time.

Best Charleston, WV Auto Insurance Companies

Erie offers the best car insurance in Charleston, WV. Customers express their satisfaction with quality services and premium rates.

Comment

byu/Faiyaz113 from discussion

inInsurance

Moreover, it does not limit its affordability to specific age groups but also to seniors or young drivers, even those with record violations and accidents, with the premium rate remaining the same over time.

Charleston isn’t just West Virginia’s largest city and state capital; it also serves as the region’s main hub for transportation, commerce, financial services, retail, and healthcare.

- Fun fact: We go to Grandma’s house. Did you know Charleston is #27 on the list of “Top 100 cities with oldest residents (pop. 50,000+)”? Interested in learning more about Charleston? Click here!

And on top of that, Charleston has a thriving recreation and arts industry. The city is also well-known for its classic architecture, the best of which is easily found in the Village District.

Read more: Average Auto Insurance Cost

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Auto Insurance Requirements in Charleston, WV

Are you worried about getting into an accident with an uninsured motorist? Or perhaps being financially responsible for an accident that is your fault? Then, you can sleep a little easier at night because the legal minimum insurance requirements in West Virginia will cover all these fears. Driving legally in Charleston requires:

Auto Insurance Minimum Coverage Requirements in West Virginia

| Coverage | Limits |

|---|---|

| Bodily Injury | $20,000 per person / $40,000 per accident |

| Property Damage | $10,000 per accident |

| Uninsured Motorist Bodily Injury | $20,000 per person / $40,000 per accident |

But many things, such as bare-bones coverage, won’t protect you from theft. It is important to note that this minimum coverage, as its name implies, could not cover the major issues, add-ons, or features you might be looking for.

Major Auto Insurance Factors in Charleston

Insurance companies in Charleston, WV that underwrite auto insurance policies evaluate numerous variables when determining insurance rates, particularly marital status, accident claims, type of vehicle owned, years of driving experience, and multiple cars and drivers. Also, premiums differ from one company to another.

To determine if you are still getting the lowest rate, compare cheap Charleston auto insurance insurers online.

Maria Hanson Insurance and Finance Writer

When your auto insurance agency prepares to write your insurance plan, it considers numerous specifics. Many of these, for example, your age or perhaps your exact address, are generally impossible to improve. Discussed further, below are the specific factors that affect car insurance rates.

Your ZIP Code

The place you store your car every night will significantly influence your car insurance rate. Usually, car insurance is less expensive in rural areas mainly because a lower number of automobiles indicates a smaller likelihood that you will get in an accident with another automobile and high-risk drivers.

Auto Insurance Monthly Rates in Charleston, WV by ZIP Code

| ZIP | Rates |

|---|---|

| 25305 | $176 |

| 25315 | $176 |

| 25306 | $167 |

| 25311 | $164 |

| 25313 | $151 |

| 25303 | $144 |

| 25314 | $143 |

| 25302 | $143 |

| 25309 | $142 |

| 25312 | $141 |

| 25304 | $138 |

| 25387 | $136 |

| 25320 | $125 |

| 25301 | $105 |

The above rates proved that location significantly determines insurance costs, likely because of traffic density and crime rates.

Your Credit Score

Your credit score predicts how likely you are to pay your bills on time and consistently. Insurance companies love giving discounts to customers who don’t present a financial risk of late or missed monthly payments, which is why drivers with poor credit have difficulty getting a good rate.

Auto Insurance Monthly Rates in Charleston, WV by Credit Score

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $100 | $120 | $150 | |

| $90 | $110 | $140 |

| $85 | $105 | $135 | |

| $110 | $130 | $160 |

| $95 | $115 | $145 |

| $98 | $118 | $148 | |

| $92 | $112 | $142 | |

| $105 | $125 | $155 |

| $120 | $140 | $170 | |

| $88 | $108 | $138 |

Geico and USAA offer cheap car insurance in WV for good credit scores at $85 and $88 monthly, respectively. At the same time, Travelers has the highest rates across all credit levels, reaching $170 for bad credit.

Read more: How credit score affects your car insurance premiums

Your Age

Statistically, youthful motorists are more likely to be in a vehicle-totaling accident within their first 12 months of driving. That is why insurance companies charge higher premiums to young drivers. Here is the difference in rates according to age.

Auto Insurance Monthly Rates in Charleston, WV by Provider, Age, & Gender

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| $420 | $460 | $180 | $200 | $140 | $150 | $120 | $130 | |

| $400 | $440 | $170 | $190 | $130 | $140 | $110 | $120 |

| $355 | $400 | $140 | $160 | $105 | $115 | $90 | $95 | |

| $450 | $490 | $190 | $210 | $150 | $160 | $130 | $140 |

| $370 | $410 | $155 | $170 | $110 | $120 | $95 | $102 |

| $390 | $430 | $160 | $180 | $120 | $130 | $100 | $110 | |

| $360 | $405 | $150 | $162 | $108 | $118 | $92 | $100 | |

| $410 | $450 | $172 | $192 | $135 | $140 | $115 | $125 |

| $380 | $420 | $162 | $185 | $125 | $135 | $105 | $115 | |

| $350 | $390 | $130 | $150 | $100 | $110 | $80 | $90 |

For such reasons, insurance providers are unwilling to sell them low-priced coverage (some providers may refuse them outright). But you will find driver’s education or good student discount rates to help more youthful motorists obtain a more proper cost.

Your Driving Record

West Virginia insurance providers take driving violations seriously. The table below shows how traffic violations increase car insurance rates for DUIs and major accidents.

Auto Insurance Monthly Rates in Charleston, WV by Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $118 | $132 | $158 | $198 | |

| $110 | $125 | $150 | $185 |

| $95 | $110 | $130 | $170 | |

| $115 | $130 | $155 | $190 |

| $105 | $120 | $145 | $180 |

| $100 | $115 | $140 | $175 | |

| $98 | $115 | $140 | $175 | |

| $112 | $128 | $155 | $188 |

| $120 | $135 | $160 | $200 | |

| $90 | $105 | $125 | $165 |

This proves the significant impact of driving infractions on monthly premiums, highlighting the financial savings associated with a clean driving record.

But they’re more lenient with regard to such things as speeding tickets. You may even have the ability to encourage them to ignore a small accident out of your recent past when they offer any “Accident Forgiveness” discount rates.

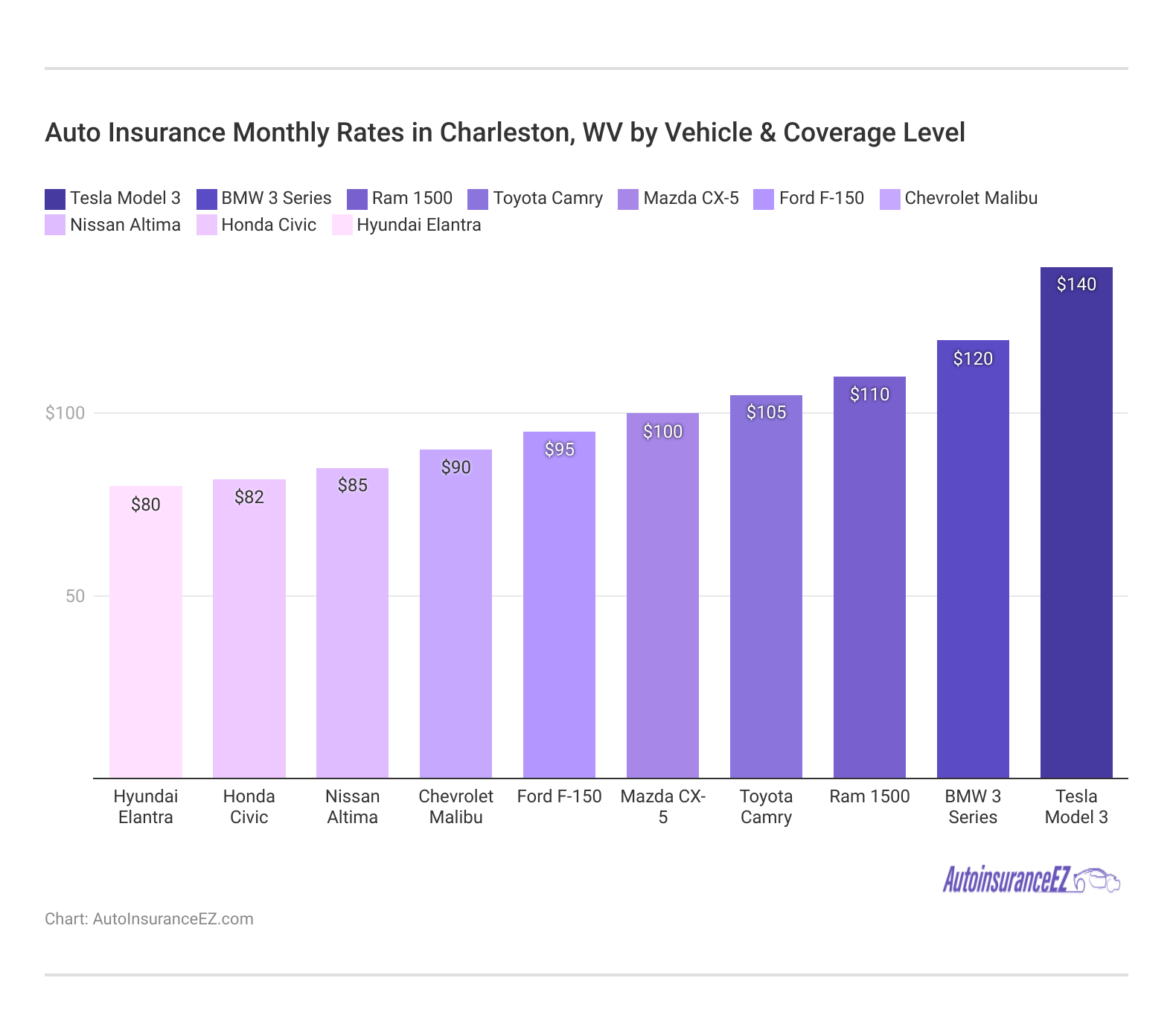

Your Vehicle

The greater the overall cost of your automobile, the greater the insurance policy you’ll have to purchase to safeguard it, period. In some ways, this really costs you less in the long term.

The Tesla Model 3 auto insurance rates have the highest minimum coverage auto insurance rate in Charleston, WV, at $140 per month, while the Hyundai Elantra has the lowest at $80. At the same time, more common sedans like the Honda Civic and Hyundai Elantra offer more affordable coverage.

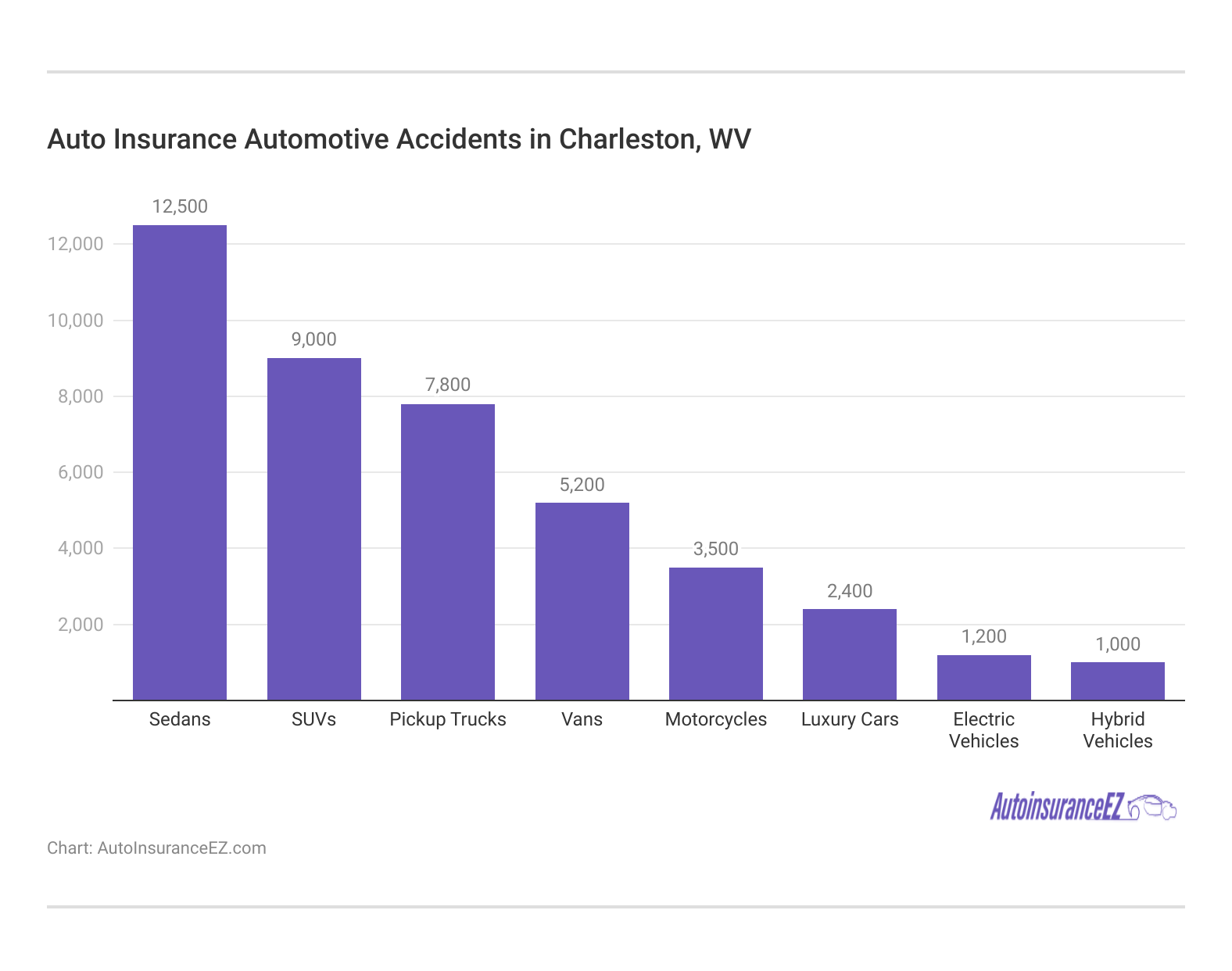

Automotive Accidents

The rate of serious accidents in Charleston is a little high, especially compared to other towns in the same state. Unfortunately, not only does this mean that driving where you live is more dangerous, but local insurance providers are probably raising their rates. But you can talk to your agent about safe driving discounts if you qualify.

Sedans account for the highest number of automotive accidents in Charleston, WV, with 12,500 incidents, followed by SUVs and pickup trucks. In contrast, electric and hybrid vehicles have the lowest accident rates, suggesting that vehicle type may influence risk factors in auto insurance calculations.

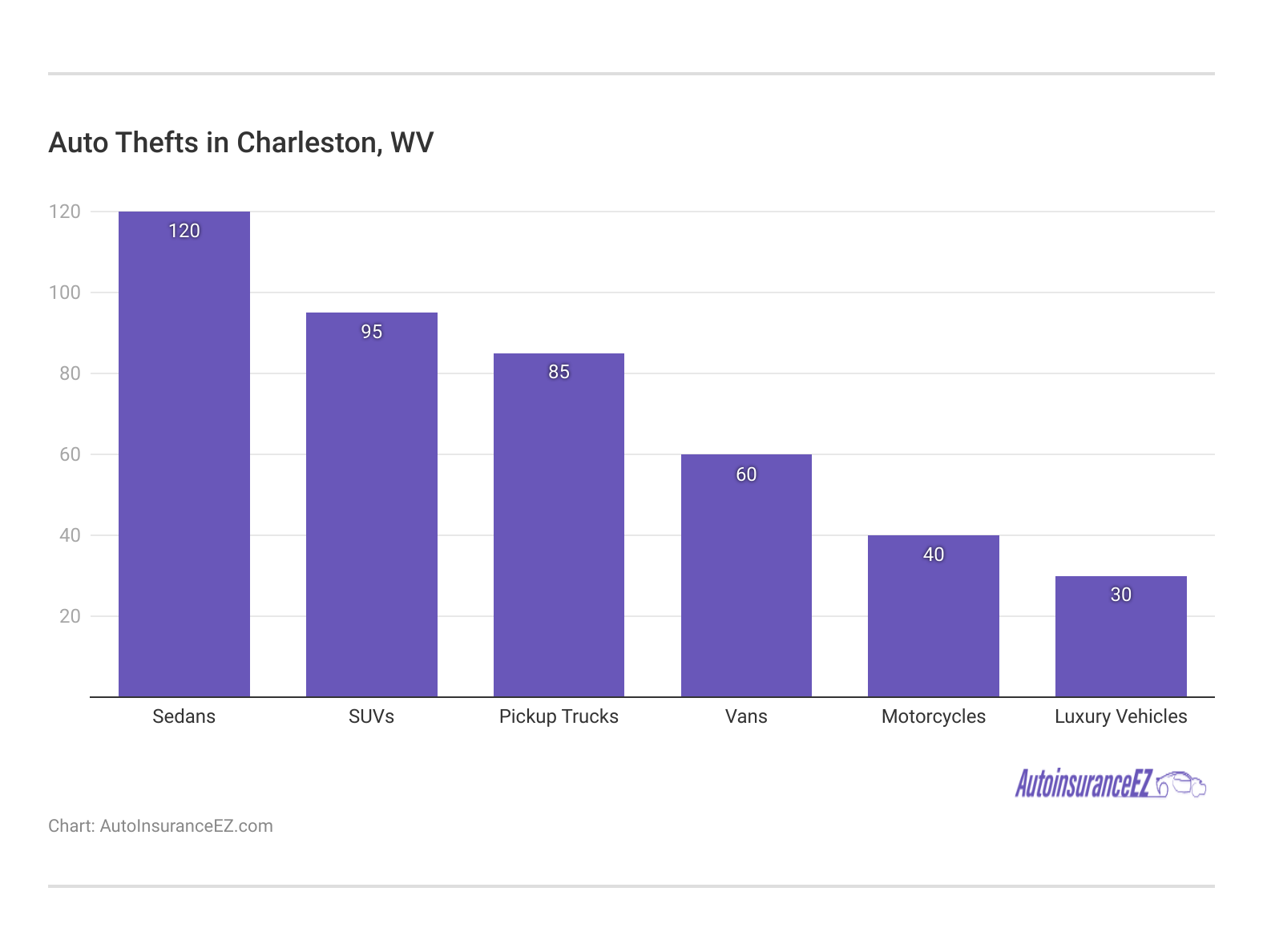

Auto Thefts in Charleston

There were only 137 auto thefts in Charleston in 2023. The table below specifies the vehicles and the number of cases.

The sedan has the most auto thefts in Charleston, with 120 cases reported. It is followed by SUVs and Pickup Trucks, with 95 and 85 cases, respectively.

Anti-theft systems are a powerful way to protect yourself from auto theft. They are moderately affordable, very easy to install, and require no work once equipped.

Jeffrey Manola Licensed Insurance Agent

And best of all, many insurance agencies will provide you with an anti-theft device discount on your automobile insurance simply for having one! Although theft rates are low, you should still consider having comprehensive coverage on your policy.

Minor Auto Insurance Factors in Charleston

West Virginia Drivers also need to keep these factors in mind:

- Your Marital Status: Married people are more likely to bundle insurance plans than single motorists. They can bundle multiple policies together, add homeowner’s or RV insurance to their current bundle, or add their teenage children to some family insurance policy for extra discounts.

- Your Gender: It appears as if each automotive insurance carrier includes a different way of working out how you can calculate premiums by gender – if gender is even included in the equation, to begin with. Each company works by its own algorithm regarding gender and driving.

- Your Driving Distance to Work: Getting around in Charleston is much easier than in most other US cities. Typical commutes should take about 10 to 15 minutes on average. But almost 75% of drivers will be on the road alone in their own vehicle, and sharing the highway with so many other automobiles might have an unfortunate effect on your car insurance rate.

- Your Coverage and Deductibles: If you are thinking about trying to “hack” your payments by raising your deductible, ensure you’re doing so sensibly. Work out how much your brand-new deductible will be, and make certain you have a minimum amount of that much money in the bank staying with you before you decide to change your policy.

Assess these minor factors, or you can get caught between a rock and a hard place if you want to file claims but can’t spend the money for a greater deductible amount.

Read more: What is an auto insurance deductible, and how does it work?

Education in Charleston, WV

The most common level of education in West Virginia is divided between those who possess a high school diploma (27%) and those who hold a bachelor’s degree (nearly 18% of the population). For those lucky few with a higher education, paying their auto insurance premiums is a little less painful because many providers enjoy offering lower rates to highly educated motorists.

There are a few major universities in and around the Charleston area that can meet the educational needs of almost any prospective student. West Virginia State University and the West Virginia University Institute of Technology are public colleges; WVSU is only a short commute away and offers both associate and bachelor’s degrees, while WVUIT specializes in business technology and engineering. The University of Charleston is also a private college with a prestigious MBA program.

Indeed, the amount of information needed to approximate your risk profile may be mind-boggling, but comparison websites like this can help simplify things. Simply enter a few factors below, and we’ll do the rest. Learn about car insurance for students and start getting savings.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

How We Conducted Our Charleston, WV Auto Insurance Analysis

We calculated our average rate based on the following metrics: a married, 34-year-old male with good credit, a 12-month history of maintaining auto insurance, a clean driving record, and his own home. Miles driven annually were based on the national average. The average rate was also calculated based on a financed 2015 Honda Accord with a pre-installed anti-theft device.

There you have it! Everything you should know when choosing the best Charleston, WV auto insurance.

We hope this 10-minute auto insurance buying guide helps you get the security you want. Enter your ZIP code to start comparing quotes and get the cheapest car insurance in West Virginia.

Frequently Asked Questions

Which company is the best for car insurance?

Which insurance company is the best? Erie offers the best car insurance for its rate lock features and affordability across the state.

What are the top 4 auto insurance companies?

The top 4 auto insurance companies are Erie, State Farm, Geico, and USAA.

What insurance is required in West Virginia?

West Virginia requires a minimum liability coverage of 20/40/10.

What is the average cost of auto insurance in WV?

The average cost of auto insurance in WV is $134 per month.

Which type of vehicle insurance is the best?

The best type of car insurance depends on your needs, but full coverage is the most appropriate plan to cover all your needs. Of course, please check if you can use it, or else you will be paying for something that is not beneficial to you.

Which is the most reliable car insurance company?

Erie is the most reliable auto company in Charleston, West Virginia.

What are the top 3 auto companies?

The top 3 auto insurance companies are Erie, State Farm, and Geico. Enter a few details in our free online tool and compare rates from these insurers.

Which insurance company has the highest customer satisfaction?

Geico is the insurance company with the highest customer satisfaction. Get more information in our Geico DriveEasy app review.