Best Vancouver, WA Auto Insurance in 2025 (See the Top 10 Companies Here)

State Farm, USAA, and Geico are the best Vancouver, WA auto insurance companies, with monthly starting rates of $50. State Farm is known for its extensive add-ons like emergency road services. USAA leads with its military-focused policies and discounts. Geico has affordable rates and advanced digital tools.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Licensed Insurance Agent

UPDATED: Apr 12, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

18,154 reviews

18,154 reviewsCompany Facts

Full Coverage in Vancouver

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage in Vancouver

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in Vancouver

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsThe best Vancouver, WA auto insurance companies are State Farm, USAA, and Geico, with monthly rates starting at $50. State Farm leads for its superior claims process and extensive add-on coverage, like emergency road services.

USAA is best known for its exclusive service to the military and its flexible coverage for overseas deployment. Geico excels in its affordable rates and several savings opportunities. The table below shows more companies that provide quality service and unique features.

Our Top 10 Company Picks: Best Vancouver, WA Auto Insurance

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $125 | A++ | Local Presence | State Farm | |

| #2 | $115 | A++ | Military Discounts | USAA | |

| #3 | $120 | A+ | Affordable Rates | Geico | |

| #4 | $140 | A+ | Usage-Based Savings | Progressive | |

| #5 | $145 | A+ | Telematics Discounts | Nationwide |

| #6 | $150 | A++ | Comprehensive Coverage | Travelers | |

| #7 | $135 | A+ | Personalized Service | Allstate | |

| #8 | $130 | A++ | Reliable Coverage | Auto-Owners | |

| #9 | $138 | A | Young Driver Discounts | American Family | |

| #10 | $160 | A++ | High-Value Coverage | Chubb |

Our auto insurance guide will focus on Vancouver, WA, auto insurance companies and discuss how different factors affect Vancouver, WA, auto insurance rates.

- State Farm excels in its exclusive add-ons like emergency road services

- A long list of discounts to lower your auto insurance premiums is here

- You can get the auto insurance you deserve for only $50 a month, starting rate

Compare Vancouver, WA auto insurance quotes online by entering your ZIP code in our free comparison tool.

#1 – State Farm: Top Overall Pick

Pros

- Exclusive Add-On Coverage: Offers emergency road services like battery jump-starts and a Steer Clear program for young and new drivers. Check all of these in the State Farm auto insurance review.

- Superior Claims Process: State Farm auto insurance in Vancouver has extensive local agents who make claims hassle-free, and customer satisfaction is high.

- Best Rideshare and Business Coverage: It provides affordable rideshare insurance and business auto coverage for Vancouver business owners.

Cons

- Premium Variations: High-risk drivers or drivers with poor credit experience higher auto insurance premiums in Vancouver than others.

- Customer Service Varies: Some policyholders report slower responses to claims.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Discounts

Pros

- Industry-Leading Military Discounts: A 15% off on a comprehensive plan when the vehicle is stored in a military base while offering lower base premiums than other insurers.

- Flexible for Military Schedules: USAA provides overseas car insurance options and automatic coverage adjustments. The USAA auto insurance review covers more of these policies.

- USAA SafePilot Savings: A telematics-based program that rewards safe driving habits by saving up to 30% on the best Vancouver, WA auto insurance.

Cons

- No Local Branch in Vancouver: Unlike State Farm, USAA does not have a network of local agents in Vancouver to assist customers.

- SafePilot Restrictions: This telematics program is not available in all states, and it differs based on your driving behaviors.

#3 – Geico: Best for Affordable Rates

Pros

- Affordable Premiums: Geico’s monthly rates only start at $52 for minimum coverage, making it the most affordable option in the state.

- Several Discount Opportunities: Geico offers discounts on multi-policy, defensive driving, multi-vehicle, and more. All discounts are listed in the Geico auto insurance review.

- Advanced Online Services: The online platform and mobile app are easy to navigate, making transactions like claims and policy changes in Vancouver, WA, easy.

Cons

- Fewer Add-On Features: It does not provide add-ons like gap insurance and custom equipment coverage on car insurance in Vancouver, WA.

- High-Risk Drivers Higher Premiums: Although Geico is known for its affordability, those drivers with DUIs, violations, and accidents face higher rates than usual.

#4 – Progressive: Best for Usage-Based Savings

Pros

- Snapshot Program: This telematics program offers a 30% discount through tracking your safe driving behaviors using a mobile app or plug-in device.

- Pay-Per-Mile Feature: This feature benefits low-mileage drivers by paying only for the miles they drive. Check the Progressive auto insurance review to see the average payment per day.

- Personalized Rates: Unlike standard policies, Progressive uses its Snapshot app to adjust rates based on customers’ driving habits rather than general risk factors.

Cons

- Strict Behavior Monitoring: Progressive Snapshot tracks driving behaviors so closely that it may feel intrusive to some car insurance policyholders in Vancouver, WA.

- Lower Initial Discount: Some drivers only save 5 to 10% with the Snapshot program, lower than the 30% advertised.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Telematics Discounts

Pros

- Big Telematics Savings: Participants can get an instant 10% off upon enrollment and another 40% off when monitoring safe driving habits.

- No Risk of Price Increase: The SmartRide program rewards safe drivers and offers significant savings on auto insurance in Vancouver.

- User-Friendly Digital Apps: The SmartRide can be used on your mobile phone, so additional devices are unnecessary. Explore more details in the Nationwide auto insurance review.

Cons

- Discount Amount Variations: Telematics savings are up to 40%, but drivers reported not reaching the full discount, as it depends on strict driving habits.

- App Technical Issue: There are reports of incorrect driving habits and less accurate trip tracking of the telematics app, making it less accurate compared to other telematics apps in Vancouver.

#6 – Travelers: Best for Comprehensive Coverage

Pros

- Comprehensive Plans: Travelers’ comprehensive auto insurance plans in Vancouver, WA, cover non-collision damages, such as natural disasters, theft, vandalism, etc.

- Several Add-Ons: It also offers new car replacement, roadside assistance, rental, loan gap insurance, and more. Check all these add-ons in our Travelers auto insurance review.

- Strong Local Presence: Travelers car insurance in Vancouver has established many agencies to assist customers.

Cons

- Higher Full Coverage Rates: Travelers’ full coverage cost starts at $150 in Vancouver, the second-highest rate among the top 10 companies.

- Strict Policies Underwriting: It is less flexible for high-risk drivers, making it not ideal for those who have violations and accidents.

#7 – Allstate: Best for Personalized Service

Pros

- Extensive Local Agent Network: Allstate has multilingual local agents in Vancouver to provide policy offers and customizations.

- Coverage Customization: Allstate car insurance in Vancouver uses personalized plans to assess and meet clients’ needs. Read more about it in the Allstate auto insurance review.

- Comprehensive Consultation: It has long been committed to assessing the varied needs of drivers in Vancouver, both immediate and long-term.

Cons

- Premium Increase Over Time: Some customers report they experienced a gradual monthly increase even without committing violations.

- Policy Complexity: Allstate has a long list of add-ons and policies with terms attached, and learning about them requires the extra effort of consulting with an agent.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#8 – Auto Owners: Best for Reliable Coverage

Pros

- Competitive Pricing: Auto-Owners provides fixed and stable policy rates to prevent sudden price increases. Check the Auto-Owners insurance review to learn more.

- Personalized Local Agent Help: It works directly with independent agents to offer personalized Vancouver, WA auto insurance service and coverage.

- Reliable Add-Ons: The first major accident does not cause a price increase with accident forgiveness and covers diminished car value afterward.

Cons

- Limited Repair Shops: Claims for repair concerns have longer wait times as the company does not have its own repair shop.

- No Online Quote or Policy Management: Working with an agent is required as it doesn’t require getting quotes online or changing policies.

#9 – American Family: Best for Young Driver Discounts

Pros

- Discounts Options: 10% off for teen-safe drivers, 25% off for good students, and additional savings for defensive driving. Learn more in our American Family auto insurance review.

- Young Drivers Customized Coverage: Auto insurance policies in Vancouver allow young drivers to pick low-cost plans that best suit their needs.

- Bundle Savings With Parents: There are huge savings when a young driver is added to the parent’s policy, pairing it with other policies like renters or homeowners.

Cons

- Higher Base Premiums: Minimum coverage car insurance in Vancouver for young drivers is considerably higher than competitors.

- Strict Eligibility for Discounts: Vancouver, WA auto insurance discounts for young drivers require several eligibility conditions.

#10 – Chubb: Best for High-Value Coverage

Pros

- Agreed Value Coverage: Unlike other insurers, policyholders can get the full agreed amount with no depreciation if their car is totaled or stolen.

- Worldwide Rental Coverage: Chubb has extensive rental car coverage, especially for high-profile individuals who frequently travel. Check this policy in the Chubb auto insurance review.

- High Liability Limits: Chubb is known for its exceptionally high liability limits, which can protect clients from major financial losses if accidents occur or even lawsuits.

Cons

- Strict Policy Requirement: Chubb auto insurance in Vancouver may not be offered to standard vehicles or drivers as it focuses on high-value cars and individuals.

- Fewer Discount Options: Unlike other insurers, Chubb is focused on comprehensive protection and does not offer safe driver or bundling discounts on Vancouver auto insurance.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Vancouver, WA Auto Insurance Monthly Rates

The best car insurance in Vancouver, WA, monthly rates can get as high as $125 or more for some Washington motorists. However, you can find lower prices if you look. Let’s start with a look into auto insurance companies’ monthly premiums.

Auto Insurance Monthly Rates in Vancouver, WA by Provider & Coverage Level

If you’re curious about switching, contact an agent so that they can analyze your circumstances and show you the most accurate quote possible. Additionally, premiums differ depending on the company. To determine if you still receive the best cost, look at cheap auto insurance in Vancouver, WA quotes by entering your ZIP code.

Read more: How does an insurance company determine my premiums

The Best Vancouver, WA Auto Insurance Discounts

Shopping around for the best cheap car insurance in Vancouver means looking for better offers with car insurance discounts to lower the monthly bill. We have listed these savings options for you to choose from. Each provider may offer similar discounts but vary in amounts. Check these below.

Auto Insurance Discounts From Top Vancouver, WA Providers

All the insurance companies offer bundling options, but they do differ as some offer higher percentages of discounts. Just for example, Geico, American Family, and Allstate give 25% off, while USAA’s bundling savings are only 10%.

Best Vancouver, WA Auto Insurance Companies

Vancouver, WA auto insurance is $200 cheaper than the national average. However, your auto insurance quotes in Vancouver, WA, will vary based on the company you’re with and your coverage level. The best auto insurance in Vancouver, WA is State Farm.

State Farm is best known for its comprehensive add-ons, such as emergency roadside service (lockout, towing, battery jumpstart, and more) and the Steer Clear program. Customers get the best while ensuring prompt claims response in times of auto-related crisis.

Comment

byu/cDawgMcGrew from discussion

inInsurance

State Farm and USAA are top-notch and affordable car insurance companies in Vancouver, WA, but remember that USAA is exclusive to military auto insurance.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Washington Auto Insurance Coverage Requirements

Driving legally in Vancouver requires auto liability insurance coverage. According to Washington’s Department of Insurance Commissioners, here are the minimum requirements for Washington auto insurance.

Auto Insurance Minimum Coverage Requirements in Washington

| Coverage | Limit |

|---|---|

| Bodily Injury | $25,000 per person / $50,000 per accident |

| Property Damage | $10,000 per accident |

Few drivers can limit their Washington car insurance purchase to just the state-mandatory minimums listed above.

Washington’s minimum coverage meets legal requirements, but higher limits and additional coverage can protect you better from costly accidents and unexpected claims.

Rachael Brennan Licensed Insurance Agent

But know that these are minimums, and they cover very little in case of claims. Check the policies that would benefit you, especially in times of crisis.

Major Factors for Vancouver Auto Insurance

You might feel somewhat helpless once your car insurance company evaluates your quote; after all, almost all the factors they assess are outside your control. Companies that offer auto insurance coverage consider numerous elements while determining insurance prices, including gender, where you live, occupation, education, and current auto insurance coverage options and limits.

Before you continue reading, watch this news report on factors determining auto insurance.

However, there are some things you can do to lower your rates. It’s important to shop around, get quotes from various companies, and compare these to the best and most affordable options.

Your ZIP Code

The location of your vehicle each night also plays a role in your auto insurance rates. Generally, car insurance is more expensive in bigger cities, where the increased number of cars on the road increases the likelihood of an accident. Vancouver’s population is 199,600, and the average household income is $78,156.

Auto Insurance Monthly Rates in Vancouver, WA by ZIP Code

| ZIP | Rates |

|---|---|

| 98686 | $129 |

| 98690 | $120 |

| 98663 | $116 |

| 98688 | $115 |

| 98662 | $111 |

| 98687 | $110 |

| 98689 | $105 |

| 98683 | $102 |

| 98666 | $100 |

| 98682 | $100 |

| 98684 | $99 |

| 98664 | $96 |

| 98665 | $95 |

| 98661 | $92 |

| 98685 | $90 |

| 98660 | $85 |

The variations of monthly rates based on your ZIP code are not that huge, with a difference of a few dollars. There are also ZIP codes that have the same rates, like the 98666 and 98682, for only $100. Be careful on the road and read the ultimate road safety tips.

Automotive Accidents

You may wonder why accidents affect car insurance rates. Vancouver has a lower population than similar Washington state cities, yet its fatal accident statistics are equal to those of nearby cities with larger populations.

This means the accident rate is higher per capita in Vancouver than in similar areas. And this, in turn, means that your insurance rates might be automatically higher each month due to these alarming statistics.

Fatal Accidents in Vancouver, WA

| Category | Count |

|---|---|

| Fatal Crash Vehicles | 52 |

| Fatal Crash Individuals | 42 |

| Fatal Accidents | 42 |

| Fatalities | 42 |

| Fatal Accident Pedestrians | 9 |

| DUI Fatal Crashes | 6 |

There have been 52 fatal vehicle crashes in just a year. Auto insurance companies look closely at this factor as it could mean possible claims in the future, and thus, the monthly rate is high.

Auto Thefts in Vancouver

All insurance agencies have concerns regarding auto theft. This is especially true for drivers living in big cities or anywhere else with high auto theft rates. According to the FBI, 54,187 cars were stolen in Vancouver in 2023. In order to be covered for a stolen vehicle, you’ll need comprehensive coverage on your auto insurance policy.

Auto Thefts in Vancouver, WA

| Vehicle | Count |

|---|---|

| Pickup Trucks | 300 |

| Sedans | 200 |

| SUVs | 160 |

| Motorcycles | 50 |

| Vans | 30 |

| Sports Cars | 20 |

| Electric Vehicles | 10 |

| Luxury Vehicles | 10 |

Vancouver’s most stolen vehicles are pickup trucks, with 300 reported incidents, while luxury cars only had 10 incidents. It’s good that Vancouver, Washington, is not listed among the 15 states with the highest vehicle theft rates.

Your Credit Score

Do you know how your credit score affects your car insurance premiums? Check these monthly rates below for those with good, fair, or bad credit.

Auto Insurance Monthly Rates in Vancouver, WA by Credit Score

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $165 | $195 | $293 | |

| $115 | $135 | $201 | |

| $140 | $160 | $267 | |

| $170 | $200 | $310 | |

| $81 | $99 | $177 | |

| $122 | $142 | $218 |

| $61 | $81 | $174 | |

| $63 | $83 | $179 | |

| $116 | $136 | $212 | |

| $108 | $128 | $204 |

Having a high credit score will get you the lowest possible rates. But your monthly rates can double, triple, or more for every tier lower your credit score takes you.

Your Age and Gender

Gender is one of those funny factors that not all insurance companies agree on. Some companies think men are high-risk drivers (and therefore should have to pay more). Others believe women should be charged higher rates.

Auto Insurance Monthly Rates in Vancouver, WA by Provider, Age, & Gender

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| $500 | $600 | $200 | $220 | $180 | $190 | $160 | $170 | |

| $480 | $580 | $190 | $210 | $170 | $180 | $150 | $160 | |

| $475 | $575 | $182 | $202 | $162 | $172 | $142 | $152 | |

| $490 | $590 | $185 | $205 | $165 | $175 | $145 | $155 | |

| $450 | $550 | $175 | $195 | $155 | $165 | $135 | $145 | |

| $460 | $560 | $180 | $200 | $160 | $170 | $140 | $150 |

| $478 | $578 | $185 | $205 | $165 | $175 | $145 | $155 | |

| $470 | $570 | $180 | $200 | $160 | $170 | $140 | $150 | |

| $495 | $595 | $190 | $210 | $172 | $178 | $148 | $158 | |

| $455 | $555 | $180 | $200 | $160 | $170 | $140 | $150 |

However, most providers no longer calculate rates based on gender. Unfortunately, young drivers who still live at home or alone must pay triple-digit insurance premiums to compensate for their lack of driving experience.

However, you can reduce the sting by qualifying for a good student discount or a driver’s education discount.

Your Driving Record

How many accidents have you had in the last five years? What about speeding tickets? Well, suppose your insurance company has an Accident Forgiveness discount. In that case, you might get one (or more) of these violations ignored the next time you have your monthly premium evaluated by your insurer.

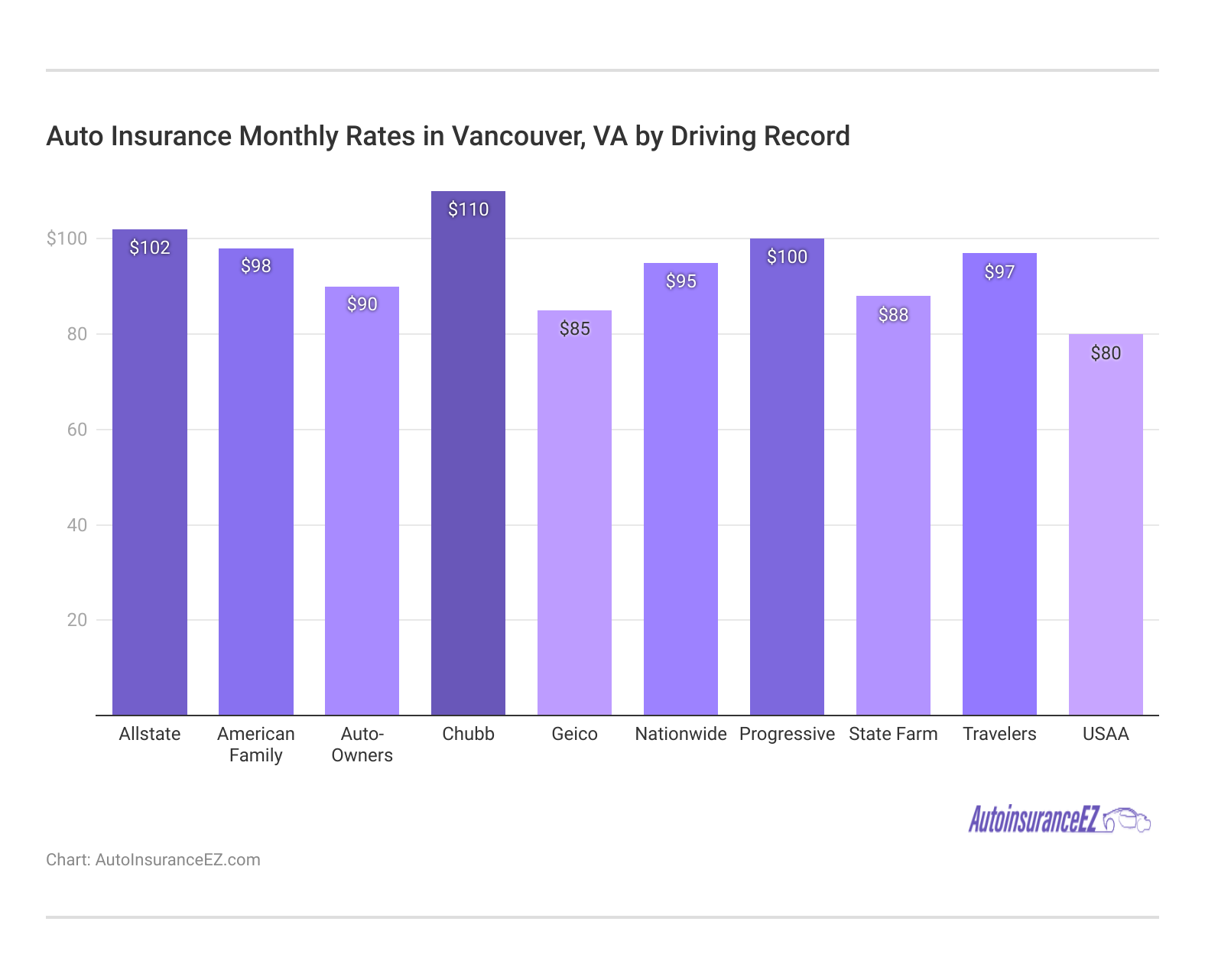

The table shows the monthly auto insurance rates for drivers with a clean record in Vancouver, VA, where Chubb has the highest rate at $110, while USAA offers the lowest at $80. Geico is one of the most affordable options at $85, whereas Allstate and Progressive charge over $100 monthly.

Read more: How Traffic Violations Increase Monthly Rates

Your Vehicle

It’s a golden rule of the insurance industry: the more coverage you need to purchase, the more you’ll pay for your premium each month. And older, cheaper vehicles don’t require as much coverage as new, expensive vehicles usually do. So choose wisely when investing in a new or more expensive car because it will strongly influence your rates.

Auto Insurance Monthly Rates in Vancouver, WA by Vehicle & Coverage Level

| Make & Model | Minimum Coverage | Full Coverage |

|---|---|---|

| BMW 3 Series | $80 | $180 |

| Chevrolet Malibu | $60 | $130 |

| Ford F-150 | $70 | $140 |

| Honda Civic | $50 | $110 |

| Hyundai Elantra | $45 | $100 |

| Mazda CX-5 | $55 | $120 |

| Nissan Altima | $65 | $125 |

| Ram 1500 | $75 | $150 |

| Tesla Model 3 | $100 | $200 |

| Toyota Camry | $52 | $115 |

Regarding vehicle make and model, the Tesla Model 3 is the most expensive vehicle to insure, with a starting rate of $100 for minimum coverage and $200 for full coverage.

Want to get cheap Tesla auto insurance rates quickly?

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Minor Factors for Vancouver Auto Insurance

These factors can also raise or lower your auto insurance premiums, but usually not as significantly as those mentioned above. You should know about these minor indicators, which can still give you the best car insurance.

While minor factors may not impact premiums drastically, understanding them can help you secure the best Vancouver, WA auto insurance rates.

Daniel Walker Licensed Insurance Agent

Now, check and explore the minor factors that still influence your best car insurance in Vancouver, WA.

Your Marital Status

Are you married or soon to be married? Then, talk to your insurance agent about bundling discounts available to you and your spouse. The more insurance policies your provider offers, the more you can bundle together — and the more discounts you can get!

For instance, married couples getting auto insurance together pay $59 on premiums, and single drivers pay an estimated $84. They can save up to $25 a month and $300 a year. This is only for car insurance; bundling car insurance with renters makes so much difference and saves money over time.

Your Driving Distance to Work

Generally, daily commutes only last between 15 and 20 minutes for Vancouver drivers. Depending on your situation, some trips might be shorter (around 10 minutes) or longer (up to 25). More than 75 percent of people use their own truck or car to get around, and 11 percent of residents prefer to carpool.

The table below shows the average annual car insurance rates in Washington State by commute distance.

Auto Insurance Monthly Rates in Vancouver, WA by Annual Mileage

| Insurance Company | 6,000 Miles | 12,000 Miles |

|---|---|---|

| $160 | $165 | |

| $155 | $160 | |

| $100 | $105 | |

| $85 | $90 | |

| $130 | $145 | |

| $140 | $150 |

| $150 | $155 | |

| $145 | $150 | |

| $90 | $95 | |

| $80 | $85 |

How many miles would you cut to see a significant dip in your monthly premium? Well, the truth may surprise you. Even if you slash a massive 5,000 miles off your odometer each year, you’ll get a three to five-percent discount at best.

Read more: Telecommuting Auto Insurance

Your Coverage and Deductibles

What are deductibles, and how much should they be? And are you allowed to raise or lower it? If so, then raising it can lower your monthly premium. However, remember that you must pay that deductible if you have to file a claim, so set some money aside in case of an accident or other issues with your car.

Education in Vancouver, WA

Most residents’ highest level of education is a high school diploma, which about 90 percent of those over age 25 have attained.

Additionally, 28.2 percent of Vancouver residents over 25 have a Bachelor’s degree. If you’re considering returning to school, remember that doing so could lower your auto insurance premium.

Several technical schools, such as the International Hospitality Academy and the two-year Clark College, are located in and around Vancouver and offer practical degrees in shorter timeframes.

For a full university degree, students can check out the Vancouver campus of Washington State University. Of course, if you aren’t necessarily state-loyal, you could commute to Portland and take advantage of the many educational opportunities there, too. While doing that, you can also take advantage of a good student discount on your car insurance.

Don’t let a substandard car insurance provider to persuade you into purchasing an auto insurance policy that isn’t right for you.

The amount of information needed to determine your risk profile can be overwhelming, but comparison websites like ours can simplify the process. Input some specifics below, and we’ll take over from there.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Vancouver, WA Auto Insurance: How We Conducted Our Analysis

We calculated our average rates based on the following metrics: a married, 34-year-old male with good credit, a 12-month history of maintaining auto insurance, a clean driving record, and his own home.

The national average was used to calculate the annual miles driven. The average rates were calculated using a financed 2015 Honda Accord with a pre-installed anti-theft device. Installing this gives you an advantage on auto insurance, as many companies offer anti-theft discounts.

Other companies in the Vancouver, WA, area offer competitive rates. State Farm, USAA, Geico, and Progressive appear frequently in internet searches by Vancouver users.

In Vancouver, WA, State Farm, USAA, Geico, and Progressive offer competitive rates that should be compared to find the best coverage.

Tracey L. Wells Licensed Insurance Agent & Agency Owner

Our data shows that the average annual best car insurance rates in Vancouver, WA, are much cheaper than the national average; however, you should always compare cheap car insurance in Vancouver.

By entering your ZIP code, you can compare auto insurance quotes using the free comparison tool.

Frequently Asked Questions

What is the best car insurance for Washington state?

State Farm offers the best car insurance in Washinton because of its quality service, reasonable rates, and discount opportunities.

Which company offers the best car insurance in Canada?

To determine the best car insurance in Canada, you must assess your needs first. However, Aviva, the CO-operators, and Intact Insurance are notable companies.

How much is car insurance in Vancouver?

Vancouver’s monthly car insurance rates start at $50 for minimum coverage and $140 for comprehensive and collision coverage.

Which coverage is the best for vehicle insurance?

The best vehicle insurance depends on your desired policy and your needs. But it is suggested that you get full comprehensive coverage for full-blast protection and security.

What car insurance is required in WA?

Only liability coverage is mandated in Vancouver, Washington, with a minimum amount of 25/50/10.

How much is car insurance per month in WA?

The monthly rates start at $50 for the minimum and $140 for full coverage. This varies depending on different factors and add-ons you might like. Also, during the coverage period, you can add or remove coverage in the middle of your policy.

Is Allstate a good insurance company?

Yes. Allstate is a good company offering coverage customization and comprehensive consultation from strong local agents.

Which car insurance coverage is the best?

The best coverage is based on your needs as a driver. Shop around and assess the coverage to see if it best suits your desired service.

Is car insurance mandatory in Vancouver?

Yes. To drive around in Vancouver, you must carry the minimum car insurance requirement of 25/50/10.

What are the top 3 auto insurance companies?

The top 3 auto insurance companies are State Farm, USAA, and Geico. Compare car insurance quotes from the top 3 companies by entering your ZIP code.