Best Richmond, VA Auto Insurance in 2025 (Top 10 Companies Ranked)

Allstate, Geico, and Progressive offer the best Richmond, VA auto insurance, starting at $68 a month. Allstate is our top choice for its comprehensive coverage and 80% claims satisfaction rate. Geico is known for competitive rates across various driver types, while Progressive stands out for its SR-22 insurance for high-risk drivers.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

UPDATED: Apr 15, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

11,638 reviews

11,638 reviewsCompany Facts

Full Coverage in Richmond

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in Richmond

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage in Richmond

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsAllstate, Geico, and Progressive offer the best Richmond, VA auto insurance, starting at $68 monthly. Allstate leads with its inclusive coverage, low rates, and reliable claims processing and payouts.

Geico is renowned for competitive pricing across all drivers’ profiles, and Progressive is best for high-risk coverage flexibility, offering SR-22 insurance. There are more companies that provide excellent service and strong security in Richmond, Virginia. Listed below are the top 10 providers.

Our Top 10 Company Picks: Best Richmond, VA Auto Insurance

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | A+ | Extensive Discounts | Allstate | |

| #2 | 25% | A++ | Affordable Rates | Geico | |

| #3 | 10% | A+ | Flexible Options | Progressive | |

| #4 | 20% | A+ | Wide Coverage | Nationwide |

| #5 | 10% | A++ | Military Focus | USAA | |

| #6 | 20% | A | Customizable Policies | Farmers | |

| #7 | 25% | A | Robust Discounts | Liberty Mutual |

| #8 | 17% | A++ | Customer Satisfaction | State Farm | |

| #9 | 13% | A++ | Comprehensive Coverage | Travelers | |

| #10 | 5% | A+ | Exclusive Benefits | The Hartford |

This 10-minute auto insurance buying guide to the best auto insurance in Richmond, VA, aims to help you get the auto insurance you deserve.

- Allstate offers inclusive coverage across all drivers’ profiles in Richmond

- There are huge savings options, such as bundling to lower your premiums

- The premium rates are so affordable that they only start at $68 a month

Start comparing auto insurance quotes in Richmond, VA, by entering your ZIP code in our free comparison tool.

#1 – Allstate: Top Overall Pick

Pros

- Modifiable Policy Choices: Various policy enhancements are available, including vanishing deductibles, bundling options, and safe-driving perks of auto insurance in Richmond.

- Reliable Claims Processing: Allstate has an 80% rate on claims resolution in Richmond, VA. Check the Allstate auto insurance review for their claims procedures.

- All-Inclusive Coverage: With rates starting at $79, applicants can get extensive coverage plans and add-ons like new car replacement and accident forgiveness.

Cons

- Higher Deductibles: Comprehensive and collision claims on auto insurance in Richmond result in higher out-of-pocket bills before the plan covers them.

- Drivewise Savings Limitation: Although this program initially lowers premiums, customers report minimal savings compared to other insurers’ usage-based features.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#2 – Geico: Best for Affordable Rates

Pros

- Lower Monthly Premiums: The minimum and full coverage rates are the most affordable insurance in Richmond, Virginia, at only $68 and $124, respectively.

- Competitive Pricing Across Driver Profiles: Geico car insurance in Richmond is cost-effective regardless of driver profiles, even for those with tickets and accidents.

- Generous Savings Opportunities: Available savings options include 25% for safe driving and 15% for military personnel. Learn more in this Geico auto insurance review.

Cons

- Fewer Local Support: Geico car insurance in Richmond offers limited in-person customer service, mainly doing business over the phone and online.

- Limited Add-On Features: Vanishing deductibles and new car replacement that insurers usually offer are unavailable in Geico.

#3 – Progressive: Best for Flexible Options

Pros

- Flexible Coverage Plans: Gap insurance, rideshare, pet injury, and custom parts & equipment are Progressive’s specialized offers.

- Deductible Savings Bank: A claim-free period could mean deductibles drop by $50, a long-term savings. The Progressive auto insurance review provides more details on this.

- High-Risk Coverage Flexibility: Progressive exclusively offers SR-22 filing for high-risk drivers, accident forgiveness, and lower rates for those with DUIs and accidents.

Cons

- Old and High-Mileage Vehicles Rate: Unlike USAA and Geico, Progressive car insurance in Richmond charges more for older cars and vehicles with high mileage.

- Mixed Satisfaction from Customers: Customers report delays in claims response and inconsistency in support, resulting in lower customer satisfaction.

#4 – Nationwide: Best for Wide Coverage

Pros

- Personalized Policy Features: To provide a more personalized experience, a $100 to $500 savings on vanishing deductibles for every claim-free year and a total loss deductible waiver are available.

- Coverage for High-Risk and Specialized Vehicles: Specialty vehicle coverage includes rideshare, classic and collector cars, high-performance, and luxury vehicles.

- Telematics Personalized Savings: A 40% discount for the SmartRide Program and significant savings for SmartWise. Check more on this in our Nationwide auto insurance review.

Cons

- Limited Telematic Coverage: Smartwise and Smartride programs are not offered in all states and areas, limiting savings.

- Less Affordable Plans for Risky Drivers: Drivers with accidents, tickets, and DUIs pay higher premiums than Progressive, which focuses on high-risk policies.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#5 – USAA: Best for Military Focus

Pros

- Exclusive Military Savings Opportunities: The military can save through its exclusive discounts for deployment, military garaging, and family and legacy discounts.

- Additional Perks: USAA car insurance in Richmond offers roadside assistance and rental car reimbursement on auto insurance that requires no extra charge.

- Overseas Deployment Coverage: USAA went the extra mile by providing policies beyond U.S. borders. The extensive details of this policy are available in our USAA auto insurance review.

Cons

- Membership Restrictions: Civilians cannot qualify. USAA provides auto insurance in Richmond exclusively to the military, veterans, and their families.

- Limited In-Person Agents: USAA Insurance in Richmond, VA, operates mainly online or by phone as it has fewer physical stores in Richmond.

#6 – Farmers: Best for Customizable Policies

Pros

- Policy Customization Benefits: Policyholders can choose the coverage and features that best suit their needs, like OEM parts, customized equipment, new car replacement, and loss of use coverage.

- Extra Personalization Features: Savvy driver, elite, and enhanced coverage package. Learn more about them in Farmers auto insurance review.

- Competitive Discounts: A 20% bundling savings, a 30% signal telematics program, and special savings for students or young drivers added to a family plan for more affordable car insurance in VA.

Cons

- Slower Claims Procedure: Customers have mixed reviews on the speed of the claims procedure, reporting long wait times and repair approvals.

- Less-advanced Mobile App: Compared to Progressive and Geico’s mobile apps, the farmer’s app has fewer features for customers.

#7 – Liberty Mutual: Best for Robust Discounts

Pros

- Extensive Discount Options: More than 15 discounts are available, such as being a good student, bundling, and early shopping. The Liberty Mutual insurance review outlines all 15 savings options.

- Customizable Deductibles: The deductibles fund program lets drivers lower their deductibles by $100 each year when the conditions are met.

- Inclusion of Different Driver Profiles: Teenagers, seniors, and drivers with past claims and DUIs are welcome to meet their auto insurance needs.

Cons

- Higher Base Premiums: Liberty Mutual’s base rate is higher than most insurers. It is still higher than even with its discounts.

- Claims Issue: There are reported cases of slower claim processing and inconsistent service of the best Richmond, VA, auto insurance, depending on the agent.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#8 – State Farm: Best for Customer Satisfaction

Pros

- Leading Customer Satisfaction Ratings: State Farm ranked #1 in customer satisfaction in mid-Atlantic regions, including Virginia, and has an A++ rating from A.M. Best for financial stability.

- Superior Claims Handling and Payouts: The mobile app, online portal, and in-person agents process claims. Learn more in this State Farm auto insurance review.

- Largest Local Agents Network: It has the most substantial local presence nationwide, with over 19,000 agents, to assist in policies, claims, and coverage recommendations.

Cons

- No Gap Insurance: State Farm does not provide traditional gap insurance but offers payoff protection only to customers financed through the State Farm bank.

- Fewer Telematics Savings: State Farm car insurance in Richmond does not offer comprehensive telematics savings since the Drive Safe and Save program is only for new or young drivers.

#9 – Travelers: Best for Comprehensive Coverage

Pros

- Comprehensive Coverage for Various Risks: Travelers go the extra mile with numerous coverage options like fire and explosions, theft and vandalism, falling objects, and glass repair and replacement.

- Optional Coverage for Extra Security: For more comprehensive coverage, Travelers offers gap, premier new car replacement, and ridesharing. Read more in our Travelers auto insurance review.

- Good Customer Ratings: This is proven by the A++ ratings from A.M. Best, and customers report on their efficient claims reimbursements.

Cons

- Limited Accident Forgiveness: Unlike other insurers with broader coverage, Travelers’ accident forgiveness is not available to all drivers and in every state.

- Reduced Access to In-Person Support: Travelers car insurance in Richmond has fewer local agents in Richmond than State Farm and Allstate.

#10 – Harford: Best for Exclusive Benefits

Pros

- Exclusive AARP Member Benefits: It offers special perks like lifetime renewability and 12-month rate protection. Check more on this in our The Hartford auto insurance review.

- Superb Claims Processing: Hartford’s claims adjuster is renowned for its fair settlements and faster response than other insurers.

- Competitive Pricing and Savings: AARP members get lower monthly rates and receive bundling savings of up to 20% and safe driving incentives.

Cons

- Higher Premiums for Non-Members: Younger drivers or non-AARP members may find the rates higher and could get cheaper offers from other providers.

- No Usage-Based Discounts: Hartford auto insurance in Richmond does not have any program related to telematics, which could give more savings for safe drivers.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Best Richmond, VA Auto Insurance Monthly Rates

The best Richmond, VA, auto insurance rates depend significantly on the insurer and type of coverage. The table below presents the details. Check it out.

Auto Insurance Monthly Rates in Richmond, VA by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $79 | $136 | |

| $74 | $125 | |

| $68 | $124 | |

| $76 | $135 |

| $77 | $134 |

| $75 | $127 | |

| $69 | $129 | |

| $76 | $133 |

| $71 | $131 | |

| $81 | $139 |

Geico stood out among the top insurance companies with the lowest and most affordable minimum and full coverage rates, $68 and $124, respectively. USAA marked the highest monthly rate, $81 for minimum and $139 for full coverage.

Get affordable coverage without overpaying with companies like USAA and Geico, as both ensure affordability and adequate coverage.

Kristen Gryglik Licensed Insurance Agent

Discover how much insurance coverage you need in order to pay only what you can use.

Discounts for the Richmond, VA Auto Insurance

While checking these providers’ monthly rates, do not worry if they are outside your budget. You can choose many options on how to lower auto insurance premiums and save a lot of money monthly. Here is the list of discounts you can avail of.

Auto Insurance Discounts From the Top Providers in Richmond, VA

| Insurance Company | Accident-Free | Bundling | Defensive Driving | Good Driver | Safe Driver |

|---|---|---|---|---|---|

| 25% | 25% | 10% | 25% | 18% | |

| 15% | 20% | 10% | 30% | 20% | |

| 22% | 25% | 15% | 26% | 15% | |

| 20% | 25% | 10% | 20% | 20% |

| 20% | 20% | 10% | 40% | 12% |

| 10% | 10% | 31% | 30% | 10% | |

| 17% | 17% | 15% | 25% | 20% | |

| 10% | 5% | 10% | 15% | 8% |

| 13% | 13% | 20% | 10% | 17% | |

| 10% | 10% | 5% | 30% | 10% |

In addition to the popular bundling option, you can also be eligible for safe driving, good student, defensive driving, vehicle safety, and many more.

Best Richmond, VA Auto Insurance

All things considered, Allstate is the top overall pick for auto insurance in Richmond, Virginia. This is mainly because it offers inclusive plans and add-ons like accident forgiveness and new car replacements. Moreover, it is known for processing claims and payouts at a whopping 80% rate.

It is best to check the bundling options for other insurance needs, such as life, health, and home insurance, as you can save big on your premiums. Allstate offers bundling savings of 25%, which is a huge cut.

Comment

byu/Yipyip34 from discussion

inInsurance

Although Geico offers 25% in bundling car and renters insurance, it primarily operates online. This gives Allstate an edge over its in-person agents, who provide real-time assistance to customers who prefer to be guided in policy management.

Richmond is the capital city of Virginia and one of the state’s oldest towns. Its history can be traced back nearly 400 years to early American colonization. Today, Richmond is a booming metropolis that spans the land area of three different counties and many successful social and industrial development projects.

- Fun fact: Attention, single guys! Richmond is #30 on the list of “Top 100 cities with the largest percentage of females (pop. 50,000+)”. Learn more about Richmond by visiting here.

Looking for the best auto insurance companies in Virginia? With AutoInsuranceEZ.com, you might find the cheapest insurance premiums within your town.

Read more: Allstate vs. Geico Review

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Auto Insurance Coverage Requirements in Virginia

Like some US states, Virginia only requires liability and some uninsured motorist coverage in order to drive legally. Driving legally in Richmond requires:

Auto Insurance Coverage Requirements in Virginia

| Coverage Type | Minimum Limits |

|---|---|

| Bodily Injury Liability | $30,000 per person / $60,000 per accident |

| Property Damage Liability | $20,000 per accident |

However, unlike other states, the minimum coverage you must purchase is higher than in nearby states. As you can see, it requires 25/50/20.

Major Car Insurance Factors in Richmond

Companies that underwrite auto insurance plans contemplate numerous factors while determining the best auto insurance rates in Virginia, including marital status, geography, credit report, education, and current insurance coverage and limits. On top of that, premiums differ among providers. To ensure you’re still paying the cheapest price, assess cheap auto insurance premiums over the Internet.

The best way to get the cheapest policy is to shop around, since auto insurers in Richmond determine rates based on different factors.

Chris Abrams Licensed Insurance Agent

You could feel helpless when your car insurance company is pricing your rate; after all, almost everything they analyze isn’t an issue you can alter or control. Thankfully, however, there are a few things that you may be able to modify to increase the discounts.

Your ZIP Code

The spot where you store your automobile nightly will probably significantly influence your auto insurance rate. Generally, car insurance costs less in outlying areas merely because fewer automobiles mean a smaller possibility that you will get in a wreck with another automobile. The population of Richmond is 214,114, plus the average family earnings are $39,193.

Auto Insurance Monthly Rates in Richmond, VA by ZIP Code

| ZIP | Rates |

|---|---|

| 23222 | $114 |

| 23223 | $114 |

| 23224 | $114 |

| 23260 | $114 |

| 23297 | $114 |

| 23219 | $113 |

| 23220 | $111 |

| 23298 | $111 |

| 23234 | $107 |

| 23225 | $106 |

| 23232 | $105 |

| 23227 | $104 |

| 23237 | $104 |

| 23230 | $103 |

| 23236 | $103 |

| 23221 | $102 |

| 23226 | $102 |

Though the ZIP code is one of the major factors considered in auto insurance, the rates in Richmond, VA, do not really have a huge gap, unlike other states and counties.

Read more: Factors that Affect Your Car Insurance Premium

Automotive Accidents

Take a look at the accident statistics below. Richmond has some of the lowest per capita accident statistics in the entire state. And in cities with lower accident rates, insurance premiums automatically drop. But ask your provider if you might be eligible for a safe driver discount, just in case.

Fatal Accidents in Richmond, VA

| Category | Count |

|---|---|

| Fatal Crash Vehicles | 58 |

| Fatalities | 34 |

| Fatal Accidents | 33 |

| Fatal Crash Individuals | 33 |

| Fatal Accident Pedestrians | 12 |

| DUI Fatal Crashes | 5 |

The data on fatal accidents in Richmond, VA, reveals that there were 33 fatal accidents, resulting in 34 fatalities, with 12 pedestrians involved and 5 DUI-related crashes. These numbers on the deadly accidents on road safety measures, increased awareness of DUI dangers, and enhanced pedestrian protection to reduce fatal incidents.

Auto Thefts in Richmond

Acquiring the best auto insurance in Richmond, Virginia, can be tough if you’re vulnerable to auto theft. Specific trendy automobile models tend to appeal to thieves, as do motor vehicles frequently left in big cities. The total number of stolen automobiles in 2023 was 1,578 for Richmond.

Auto Thefts in Richmond, VA

| Vehicle | Count |

|---|---|

| Sedans | 200 |

| SUVs | 150 |

| Compact Cars | 125 |

| Trucks | 100 |

| Luxury Vehicles | 75 |

| Minivans | 50 |

| Motorcycles | 50 |

Unfortunately, the number of thefts in Richmond, VA, is obviously high. Watch out, Sedan owners. This vehicle had the most reported cases of theft, with 200 incidents. This high theft rate means you should invest in comprehensive coverage with as low a deductible as you can afford. You can also install an anti-theft device on your car, which gives you protection and an anti-theft discount at the same time.

Your Credit Score

In many states, insurance providers charge very harsh penalties and/or raise premiums sky-high if you happen to have a poor credit score. Virginia is no exception. Some drivers with poor credit can expect as much as double the monthly payment as others.

Auto Insurance Monthly Rates in Richmond, VA by Credit Score

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $98 | $128 | $178 | |

| $110 | $140 | $190 | |

| $88 | $120 | $160 | |

| $108 | $138 | $185 |

| $95 | $122 | $170 |

| $102 | $125 | $175 | |

| $90 | $120 | $155 | |

| $105 | $135 | $180 |

| $100 | $130 | $170 | |

| $85 | $110 | $150 |

The difference between good, fair, and bad credit rates is obvious. Bad credit results in much higher rates than good and fair credit. In State Farm alone, the difference is $35 to $65. Imagine paying $155 monthly instead of $90 because you have bad credit.

Read more: How Your Credit Score Affects Your Car Insurance Premiums

Your Age

Unfortunately, like many other young drivers across the country, teenage drivers in Virginia are saddled with high monthly rates. This is due to their lack of driving experience and inherently higher risk. A car insurance discount for good students can help reduce the burden.

Auto Insurance Monthly Rates in Richmond, VA by Provider, Age, & Gender

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| $420 | $439 | $135 | $136 | $109 | $103 | $109 | $109 | |

| $294 | $362 | $82 | $97 | $82 | $83 | $74 | $75 | |

| $585 | $558 | $116 | $121 | $100 | $100 | $87 | $92 | |

| $248 | $315 | $88 | $92 | $72 | $69 | $56 | $62 |

| $538 | $585 | $130 | $149 | $127 | $129 | $110 | $118 |

| $279 | $330 | $92 | $101 | $85 | $86 | $74 | $76 | |

| $550 | $567 | $77 | $80 | $64 | $61 | $56 | $56 | |

| $239 | $272 | $70 | $80 | $63 | $63 | $56 | $56 |

| $534 | $675 | $74 | $80 | $72 | $73 | $66 | $67 | |

| $189 | $204 | $56 | $61 | $44 | $43 | $39 | $39 |

As you can see, USAA offers the lowest rate in all age groups. But remember, this company is military-focused, which means your rates may be higher than these numbers if you do not fall into this category. You can check the Hartford and Liberty Mutual.

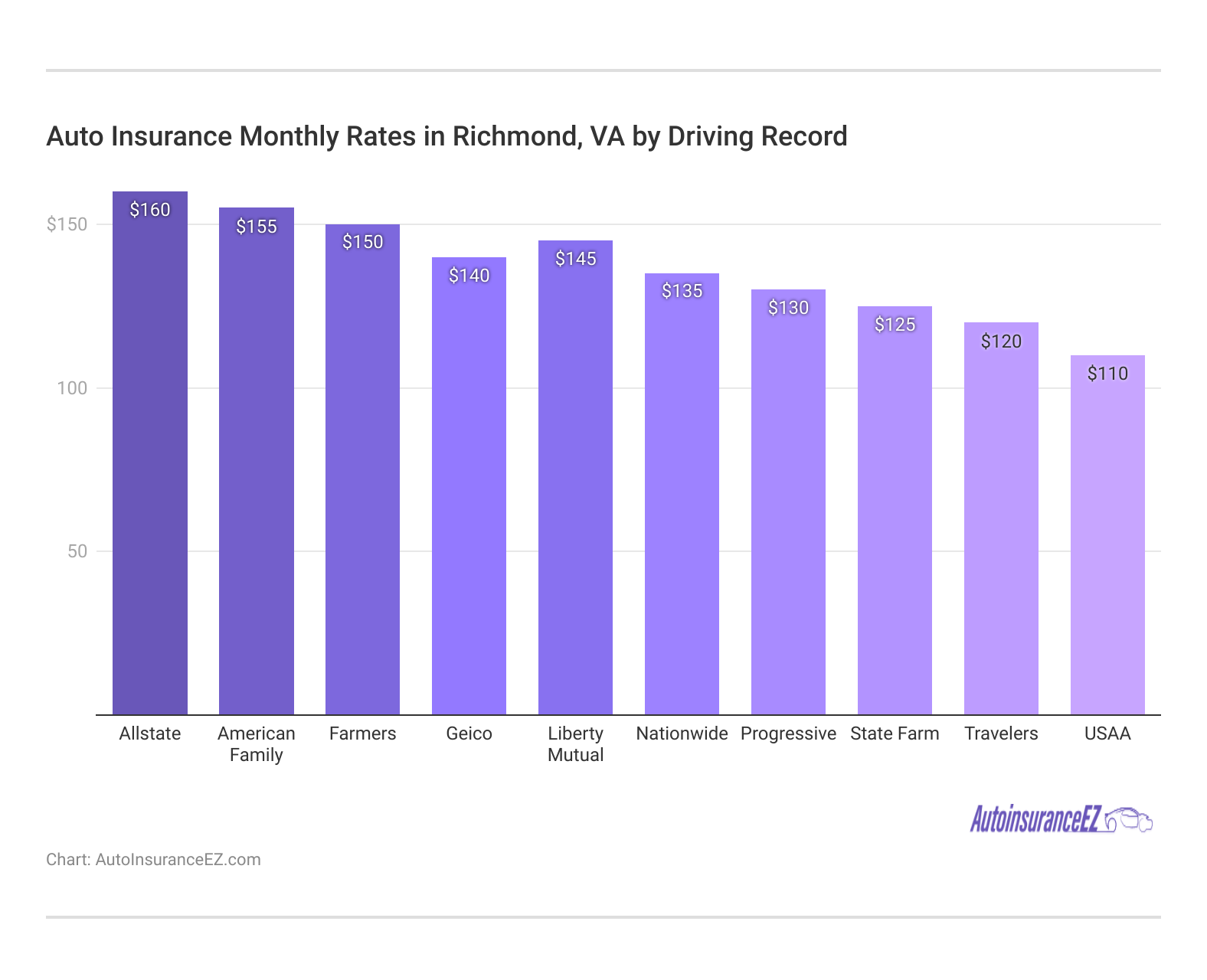

Your Driving Record

A serious accident on your record could double your monthly rate, and many providers won’t offer coverage for serious violations (like a major at-fault accident). Look at the rates below that are affected by the driving records.

Allstate has the highest rate at $160, while USAA offers the lowest at $110, highlighting significant price variations among insurers. Check with your company and ask about a new discount that’s going around: it’s called Accident Forgiveness, and it could save you some money if you don’t have anything too extreme on your driving record.

Read more: Cheap Auto Insurance for a Bad Driving Record

Your Vehicle

There aren’t many scenarios where you can get away with carrying the state minimum coverage on, say, a Porsche or a Ferrari. Then again, why would you want to? Carrying anything less than a luxury insurance policy for a luxury vehicle will cost you more in theft, maintenance, and repairs than it will in monthly premiums over the long term.

Auto Insurance Monthly Rates in Richmond, VA by Vehicle & Coverage Level

| Make & Model | Minimum Coverage | Full Coverage |

|---|---|---|

| BMW 3 Series | $140 | $300 |

| Chevrolet Malibu | $105 | $220 |

| Ford F-150 | $112 | $250 |

| Honda Civic | $90 | $190 |

| Hyundai Elantra | $85 | $180 |

| Mazda CX-5 | $110 | $230 |

| Nissan Altima | $95 | $210 |

| Ram 1500 | $115 | $240 |

| Tesla Model 3 | $130 | $280 |

| Toyota Camry | $100 | $210 |

The BMW 3 Series has the highest full coverage cost, at $300, while the Hyundai Elantra has the lowest, at $180. This shows how vehicle type impacts insurance pricing.

Minor Car Insurance Factors in Richmond, VA

Don’t forget about these lesser but still fairly important factors:

- Marital Status: If you’re sick of ridiculously high insurance prices in Virginia, try bundling your auto policy as domestic partners. You can also get bundling discounts for boat, RV, or motorcycle insurance.

- Gender: Car insurance companies in Richmond are slowly but surely moving away from the old practice of charging men and women different rates. Yes, a handful of companies still do, but getting them to agree on which gender deserves to be charged more is almost impossible.

- Driving Distance to Work: Depending on several factors, commuting around Richmond might take a little while. Most trips will last between 18 and 31 minutes for most drivers, and many of those people will drive to work alone in their truck or car (about 73%, to be specific).

- Coverage and Deductible: Raising your deductible is a great way to take some financial risk off your insurance provider. And in turn, they’ll reward you with a lower premium. But do yourself a favor, and save up a little money first. Because you’ll be stuck if the worst happens and you suddenly don’t have the money to pay your deductible.

Moreover, Less than 25% carpool in certain areas, and only 4% take the bus. You may have heard a rumor about how driving fewer miles can lower your rates. Well, that rumor is true. However, you’d have to cut somewhere between 15-20 miles out of your daily driving just to see a 3-4% discount.

Understanding and strategically managing these elements—such as bundling policies, reducing daily mileage, or adjusting deductibles—can help drivers secure better rates and optimize their insurance coverage.

Education in Richmond, VA

Nearly one-quarter of the Richmond population has yet to successfully complete their secondary education, while another 24% has earned a high school diploma. In addition, 19% have pursued a four-year education and earned a degree that will entitle them to auto insurance savings for the foreseeable future! Little do you know, car insurance for students has an impact and saves you a dollar.

Virginia Commonwealth University is one of the largest schools in Richmond, with an average annual enrollment of over 24,000 students, a prestigious medical school, and more than 150 different degrees for curious students to pursue.

There are also private universities, such as Virginia Union University, which is affiliated with the Baptist Church and boasts diverse students. For the pupil who wants a practical degree in half the time, try looking into J. Sergeant Reynolds or the John Tyler Community College.

Take the time to do your research and get coverage that offers good value for your money.

Michael Leotta Insurance Operations Specialist

Of course, the sum of related information needed to approximate your own risk profile might be too much to handle, but comparison websites such as this can help make your search quicker. Simply submit a few details below, and allow us to take it from there.

Read more: Car Insurance for Students: Saving 101

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

How We Conducted Our Car Insurance Analysis

We calculated our average rate based on the following metrics: a married, 34-year-old male with good credit, a 12-month history of maintaining auto insurance, a clean driving record, and his own home. Miles driven annually were based on the national average. The average rate was also calculated based on a financed 2015 Honda Accord with a pre-installed anti-theft device.

That concludes the extensive information about getting the right type of auto insurance, add-ons, and rates for the best Richmond, VA, auto insurance.

You can also get quick quotes for affordable car insurance in VA by entering your ZIP code in our free online tool.

Frequently Asked Questions

What is the best auto insurance in Virginia?

Allstate offers the best auto insurance in Richmond, Virginia, because of its overall quality of policies and service, inclusive plans, and prompt claims payouts.

What car insurance coverage do I need in Virginia?

The state only requires liability insurance and uninsured motorist coverage with minimum requirements of 25/50/20.

Which insurance company is best for car insurance?

The best insurance in Richmond, Virginia, is Allstate, which offers fast claims and inclusive plans; Geico, which offers affordable rates for all types of drivers’ profiles; and Progressive, which excels at providing coverage for high-risk drivers.

What are the top 3 auto insurance companies?

The top 3 auto insurance companies are Allstate, Geico, and Progressive.

What insurance coverage is best for my car?

The best coverage for a car is comprehensive and collision insurance, covering you, your vehicle, and another car that might be involved in the accident in case you cause it. But if that is too much for you, assess your needs and tailor them to your insurance plans. Your needs are the best standard in choosing the best coverage for you.

How much is car insurance in Virginia?

The car insurance rate in Virginia starts at $68 a month for minimum coverage.

Who is the most trusted insurance company?

The most trusted insurance company is Allstate, following its customer satisfaction rate and claims response speed.

Is Progressive Insurance good?

Yes. Progressive is a good company and is mainly renowned for including policies for high-risk drivers offering SR-22.

Which policy is better for car insurance?

This depends on so many factors. The best policy is the policy that is best suited to your needs. Check with your insurance provider to learn about the types of automobile insurance that are best for you.

What is the best but cheapest car insurance?

Geico is the best and cheapest in Richmond, VA, providing security and accessibility to drivers with tight budgets.

Enter your ZIP code to get your online auto insurance quotes in Richmond now.