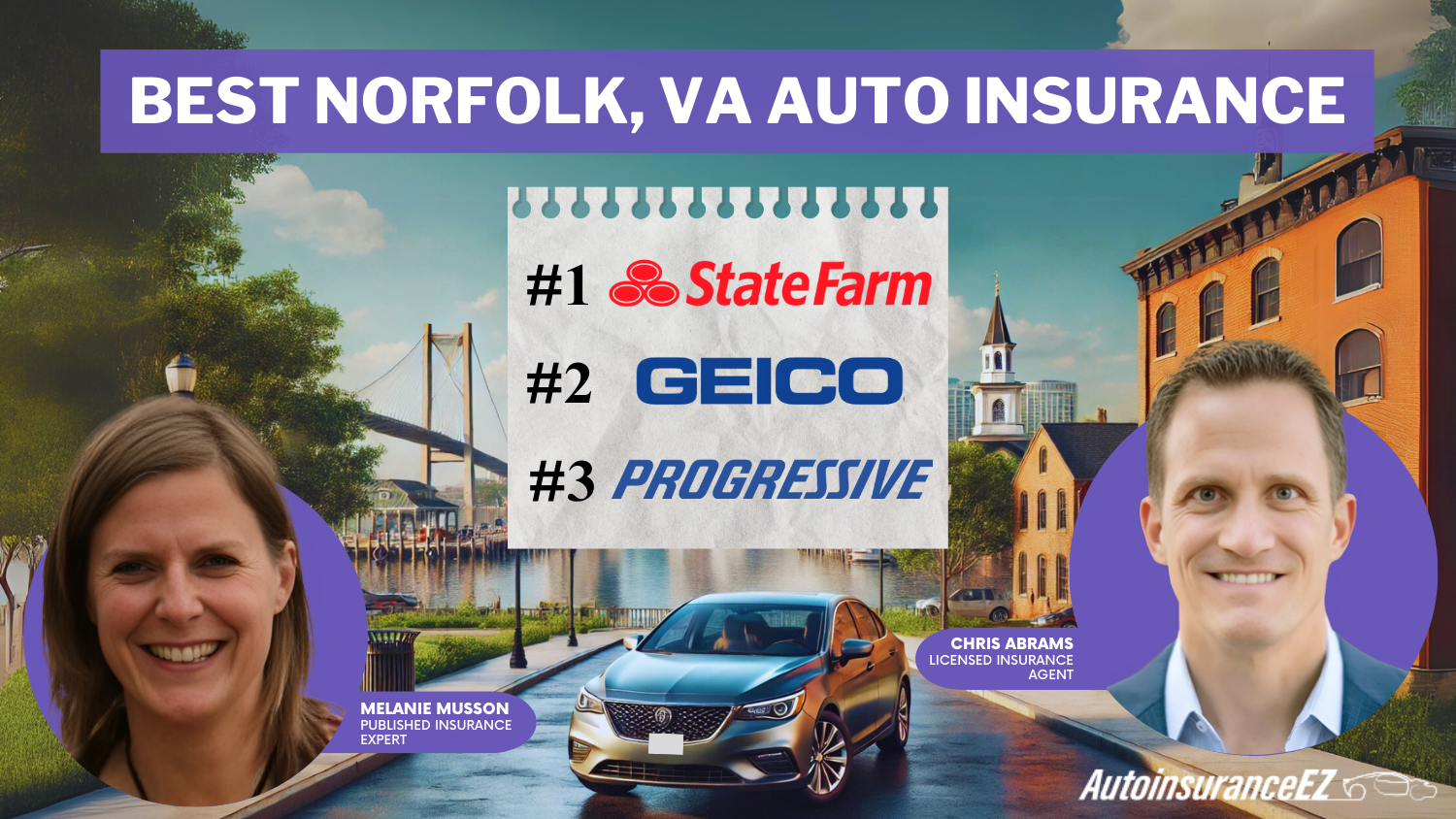

Best Norfolk, VA Auto Insurance in 2025 (Find the Top 10 Companies Here)

These top providers will ensure you enjoy Norfolk, VA's best auto insurance policy. Starting with State Farm that offers the best reliable coverage. Geico offers an affordable price of $38 per month. And Progressive, which deals with flexible coverage set to meet clients' personal needs.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Licensed Insurance Agent

UPDATED: Apr 12, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

18,154 reviews

18,154 reviewsCompany Facts

Full Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsState Farm, Geico, and Progressive are among the top auto insurance providers in Norfolk, VA. They ensure their clients to enjoy a variety options for premium auto insurance with starting rates of $38 monthly.

They offer many choices to meet your auto insurance standards. State Farm provides reliable coverage and bundling discounts for $45 monthly. Geico is known for its affordable rates, and Progress is best for flexible policies. See more of the best auto insurance below.

Our Top 10 Company Picks: Best Norfolk, VA Auto Insurance

| Company | Rank | A.M. Best | Bundling Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | A++ | 17% | Reliable Coverage | State Farm | |

| #2 | A++ | 25% | Affordable Rates | Geico | |

| #3 | A+ | 10% | Flexible Policies | Progressive | |

| #4 | A+ | 25% | Comprehensive Plans | Allstate | |

| #5 | A+ | 20% | Policy Bundling | Nationwide |

| #6 | A++ | 13% | Diverse Coverage | Travelers | |

| #7 | A | 25% | Custom Policies | Liberty Mutual |

| #8 | A | 20% | Personalized Service | Farmers | |

| #9 | A | 25% | Family Plans | American Family | |

| #10 | A+ | 25% | Budget Coverage | Erie |

Get cheap car insurance rates in Norfolk, VA by comparing top providers. Save big while still getting quality coverage and local discounts.

- State Farm, Geico, and Progressive are the top auto insurance in Norfolk, VA

- State Farm provides clients with reliable coverage for a starting rate of $45 monthly

- Geico is known for cheap rates, and Progressive provides flexible policies

Having difficulties selecting the best auto insurance here in Norfolk, VA? Explore our car insurance guide by entering your ZIP code.

#1 – State Farm: Top Overall Pick

Pros

- Bundling Benefits: State Farm offers up to 17% savings when bundling auto insurance with other coverages like renters’ or homeowners’ insurance.

- Top-Notch Support: Known for exceptional customer service, offering quick, reliable help with claims and policy management, making it a top choice for personal attention.

- Strong Reputation: With a history of financial stability and high customer satisfaction, State Farm provides peace of mind for policyholders who value reliability and trust.

Cons

- Limited Savings Options: Offers fewer specialized discounts than competitors, limiting savings for demographics like young drivers or eco-friendly vehicle owners.

- Credit Impact: According to our State Farm auto insurance review, higher premiums for lower credit scores make it less competitive for those improving their finances.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#2 – Geico: Best for Affordable Rates

Pros

- Budget-Friendly Rates: Well known for providing some of the lowest prices for auto insurance, particularly for drivers with clean records and minimal risk factors.

- Tech-Savvy Platform: Geico’s app and website make it easy to manage policies, file claims, and get support anytime. To see more, read our Geico insurance review.

- Reward Discounts: Provides discounts for safe driving, military service, and vehicle safety features, helping customers lower their premiums even further.

Cons

- Personal Touch Lacking: Geico’s digital focus may leave some customers seeking more personalized service.

- Penalty for Risky Drivers: Premiums for drivers with past accidents or traffic violations may face higher insurance premiums, making insurance expensive for high-risk people.

#3 – Progressive: Best for Flexible Policies

Pros

- Flexible Coverage: Allows policyholders to customize auto insurance with add-ons like gap and rideshare coverage.

- Innovative Tracking Program: Monitors driving patterns and offers policyholders discounts for safe driving, allowing them to reduce their premiums in response to responsible driving.

- Leniency for Past Mistakes: Offers competitive rates to drivers with past accidents or violations, appealing to those seeking affordable insurance.

Cons

- Inconsistent Assistance: While generally well-rated, Progressive’s customer service can be inconsistent, leading to frustration during claims or support.

- Costlier for Young Drivers: Higher rates for young drivers make it less appealing for teens and students. See more of it by reading our Progressive auto insurance review.

#4 – Allstate: Best for Comprehensive Plans

Pros

- Protection: Offers a wide range of coverage options, like roadside assistance and accident forgiveness, providing drivers with a comprehensive policy.

- Wide Discount Range: Offers discounts for safe driving, bundling, and anti-theft devices, saving on coverage. To see more, read our Allstate insurance review.

- Financial Strength: Progressive offers competitive rates to drivers with accidents or violations, appealing to those seeking affordable insurance.

Cons

- Premium Cost Concerns: Allstate’s rates can be higher than competitors, especially for drivers without discounts or limited driving history.

- Slow Claims Process: Some customers report delays and inefficiencies in claims, leading to frustration and longer resolution times.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Policy Bundling

Pros

- Bundling Advantage: Offers significant savings when bundling auto with home or renters insurance, lowering overall costs and improving financial management.

- Vanishing Deductible Perk: As mentioned in our Nationwide insurance review, the vanishing deductible lets safe drivers lower their deductible over time, reducing claim costs.

- Reliable Reputation: Nationwide has strong financial stability and good customer reviews suitable for customers looking for reliable insurance providers.

Cons

- Limited Coverage Areas: Not available in all states, which can be a disadvantage for customers who relocate or need coverage in specific regions.

- Tech Limitations: Nationwide’s online platform and app are less advanced, making policy management and claims filing less convenient for tech-savvy users.

#6 – Travelers: Best for travelers Coverage

Pros

- Ideal for Frequent Drivers: Known for serving high-mileage drivers with comprehensive coverage for rentals and long trips.

- Attractive Discounts: Offer many discounts, such as savings for combining policies, having a safe driving record, and using eco-friendly vehicles.

- Flexible Payment Options: Policyholders can manage their money with Travelers’ customizable payment options, which include monthly, quarterly, and annual plans.

Cons

- Costly for High-Risk Drivers: Travelers’ premiums are higher for individuals with poor driving records or multiple violations. To understand better, read our Travelers insurance review.

- Sparse Local Agent Network: Fewer local agents than competitors, which can be challenging for policyholders seeking personal assistance with claims and policy changes.

#7 – Liberty Mutual: Best for Custom Policies

Pros

- Customizable Coverage: Offers personalized insurance policies with flexible coverage options for standard vehicles, RVs, and motorcycles. Read our Liberty Mutual insurance review for more details.

- Accident Forgiveness Program: The Accident forgiveness program prevents rate increases after the first at-fault accident, helping drivers avoid extra costs for minor accidents.

- Specialty Vehicle Coverage: Covers specialty vehicles like RVs, motorcycles, and classic cars, offering comprehensive protection for unique or high-value vehicles.

Cons

- Higher Rates for Young Drivers: This makes it more difficult for teenagers and college students to acquire inexpensive insurance by charging higher premiums for younger, less experienced drivers.

- Limited Discount Variety: Offers fewer discounts than other insurers, limiting potential savings on premiums through safe driving or bundling.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#8 – Farmers Insurance: Best for Personalized Service

Pros

- Personalized Experience: Offers personalized service with local agents. These agents give expert advice and suggest policies that fit customers’ needs.

- Rideshare Coverage Option: Farmers Insurance provides rideshare coverage, filling gaps left by personal auto insurance for Uber and Lyft drivers. To learn more, view Farmers insurance review.

- Diverse Discount Opportunities: Offers discounts for safe driving, homeownership, and bundling, helping policyholders lower premiums while keeping comprehensive coverage.

Cons

- Higher Rates for Risky Drivers: Makes it less competitive for high-risk drivers by charging higher premiums for those with bad records or a history of claims.

- Limited Online Tools: Farmers Insurance’s online platform is less robust than some competitors, which may inconvenience policyholders who prefer managing accounts digitally.

#9 – American Family Insurance: Best for Family Plans

Pros

- Family-Focused Policies: Offer family discounts and programs for young drivers and students, ensuring savings and protection. See how it’s done through our American Family insurance review.

- Exceptional Customer Support: Receives high ratings for customer satisfaction, with attentive service and efficient claims handling, making it popular for those seeking strong support.

- Financial Security: American Family Insurance offers strong and reliable financial security for its policyholders.

Cons

- Limited Geographic Availability: American Family Insurance operates in select regions only, which can be restrictive for customers who relocate or need coverage in other states.

- Urban Rate Increase: Premiums are higher in densely populated cities, making American Family Insurance less competitive for urban drivers.

#10 – Erie Insurance: Best for Budget Coverage

Pros

- Affordable for Budget-Conscious Drivers: Offers affordable auto insurance rates, making it a great choice for drivers seeking savings with quality coverage.

- Customer Satisfaction Leader: Erie earns positive reviews for excellent customer service and an easy claims process, standing out for its focus on customer satisfaction.

- Unique Rate Lock Feature: The rate lock feature prevents premium increases over time, offers financial stability, and reduces stress, especially for those on fixed incomes.

Cons

- Minimal Digital Support: It provides fewer online tools for policy management, which can be inconvenient for customers who prefer digital management.

- Regional Restrictions: Erie operates in select states, limiting its availability to specific geographic areas. See our Erie insurance review to check your place.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Best Virginia, VA Auto Insurance Cost and Discounts

Finding auto insurance that suitable for your budget and needs can be overwhelming and confusing. When searching for auto insurance in Norfolk, VA, it’s essential to understand the car insurance coverage.

Norfolk, VA Auto Insurance Monthly Rates by Provider & Coverage Level

| Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $55 | $140 | |

| $47 | $118 | |

| $42 | $110 |

| $58 | $138 | |

| $38 | $108 | |

| $60 | $145 |

| $48 | $120 |

| $50 | $125 | |

| $45 | $115 | |

| $52 | $135 |

This car insurance guide will help you understand the monthly rates from different providers and coverage levels in Norfolk, VA. It also outlines the discounts available from the top providers in the area.

Auto Insurance Discounts From the Top Providers in Norfolk, VA

| Company | Anti-Theft | Bundling | Good Student | Low Mileage | Safe Driver |

|---|---|---|---|---|---|

| 10% | 25% | 22% | 30% | 18% | |

| 25% | 25% | 20% | 20% | 18% | |

| 15% | 25% | 15% | 30% | 15% |

| 10% | 20% | 15% | 10% | 20% | |

| 25% | 25% | 15% | 30% | 15% | |

| 35% | 25% | 12% | 30% | 20% |

| 5% | 20% | 18% | 20% | 12% |

| 25% | 10% | 10% | 30% | 10% | |

| 15% | 17% | 35% | 30% | 20% | |

| 15% | 15% | 8% | 20% | 17% |

You can now easily compare the top car insurance providers in Virginia and find which Norfolk, VA auto insurance options offer the best value for your money. To discover the most affordable insurance in your area, enter your ZIP code.

Auto Insurance Coverage Options in Virginia

In Virginia, most vehicles, especially leased ones, require a fully comprehensive insurance policy. This is due to the state’s higher required coverage limits.

Virginia Minimum Auto Insurance Coverage Requirements & Limits

| Coverage Type | Minimum Required Coverage |

|---|---|

| Bodily Injury Liability (per person) | $30,000 |

| Bodily Injury Liability (per accident) | $60,000 |

| Property Damage Liability | $20,000 |

| Uninsured/Underinsured Motorist (per person) | $30,000 |

| Uninsured/Underinsured Motorist (per accident) | $60,000 |

| Uninsured Property Damage | $20,000 (with a $200 deductible) |

This table provides information on the auto insurance coverage needed and the cheapest auto insurance options available in the area.

Factors Affecting Auto Insurance Rates in Norfolk, VA

When contacting a new auto insurance company, there are several factors that need to consider . Both minor and major factors can affect your car insurance premium.

Norfolk, VA Auto Insurance by ZIP Code

| ZIP Code | Monthly Rate |

|---|---|

| 23503 | $57 |

| 23505 | $58 |

| 23513 | $58 |

Car insurance varies by state. Depends on your choices on which car insurance are you going to make a deal for the best coverage for an affordable price.

Norfolk, VA Auto Accident & Insurance Claim Statistics

| Factor | Value |

|---|---|

| Accidents per Month | 417 |

| Claims per Month | 317 |

| Average Claim Cost | $500 |

| Percentage of Uninsured Drivers | 12% |

| Vehicle Theft Rate | 25 thefts/month |

| Traffic Density | High |

| Weather-Related Incidents | Moderate |

Safe driving can substantially affect your car insurance. You can have a great safe driver discount if you manage to have a clean and safe driving record.

Norfolk, VA Full Coverage Auto Insurance Monthly Rates by Age & Gender

| Company | Age 17: Female | Age 17: Male | Age 25: Female | Age 25: Male | Age 35: Female | Age 35: Male | Age 60: Female | Age 60: Male |

|---|---|---|---|---|---|---|---|---|

| $245 | $245 | $258 | $271 | $214 | $220 | $214 | $220 | |

| $178 | $210 | $178 | $210 | $120 | $122 | $148 | $150 | |

| $106 | $106 | $97 | $101 | $76 | $78 | $76 | $78 |

| $585 | $585 | $246 | $256 | $171 | $183 | $171 | $183 | |

| $149 | $149 | $138 | $133 | $104 | $106 | $104 | $106 | |

| $267 | $306 | $267 | $306 | $160 | $168 | $211 | $227 |

| $194 | $213 | $194 | $213 | $107 | $113 | $141 | $149 |

| $398 | $398 | $201 | $209 | $131 | $136 | $131 | $136 | |

| $163 | $163 | $144 | $158 | $108 | $108 | $108 | $108 | |

| $131 | $131 | $152 | $165 | $127 | $129 | $127 | $129 |

Your age, driving record, and distance to work are important factors in determining your auto insurance rates. Younger drivers often face the highest insurance costs.

Auto Insurance Monthly Rates in Norfolk, VA by Credit Score

| Company | Good Credit | Fair Credit | Poor Credit |

|---|---|---|---|

| $110 | $130 | $150 | |

| $105 | $125 | $145 | |

| $104 | $124 | $144 |

| $115 | $135 | $155 | |

| $95 | $115 | $135 | |

| $100 | $120 | $140 |

| $102 | $122 | $142 |

| $98 | $118 | $138 | |

| $90 | $110 | $130 | |

| $112 | $132 | $152 |

In Virginia, your credit score significantly impacts your monthly insurance costs. Many providers may double or even triple your payment if you have poor credit. However, nationwide, rates for drivers with bad credit are only slightly higher.

Norfolk, VA Auto Insurance Monthly Rates by Provider & Driving Record

| Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $228 | $321 | $385 | $268 | |

| $166 | $251 | $276 | $194 | |

| $83 | $118 | $153 | $100 |

| $198 | $282 | $275 | $247 | |

| $114 | $189 | $309 | $151 | |

| $248 | $335 | $447 | $302 |

| $164 | $230 | $338 | $196 |

| $150 | $265 | $200 | $199 | |

| $123 | $146 | $160 | $137 | |

| $141 | $199 | $294 | $192 |

These top insurance providers ensure you have the best deals in your best interest. That means you can have all you want on your coverage within your financial limit. There are the best premiums at an affordable price while you enjoy the drive in Norfolk, VA.

Virginia insurance companies view driving violations very seriously. This is important to be aware of, especially for high-risk drivers, you can still compare cheap auto insurance companies with bad records to find various options that fit your needs. To know more about most affordable auto insurance in your area.

Car theft is a concern in your neighborhood. If you don’t have an anti-theft device installed in your vehicle, consider being proactive and getting one installed. It’s important to look for the insurance provider that offers the best coverage for your specific vehicle.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

The Best Auto Insurance in Norfolk, Virginia

Finding the best car insurance should be easier now that you understand how it works and what factors to consider when searching for the best auto insurance in Norfolk, VA, that suits your lifestyle.

State Farm, Geico, and Progressive are the top auto insurance providers in Norfolk, VA, offering affordable pricing, comprehensive policies, and significant discounts tailored to your vehicle needs. Enter your ZIP code to see the best insurance available in your area.

These top auto insurance providers are here to help protect you and your vehicle, offering the best offers, premiums, add-ons, and other benefits at affordable rates.

Heidi Mertlich Licensed Insurance Agent

These companies are the top choice for your vehicle needs in Newport News, VA, and can help you save money. To learn more about how these companies can assist you in saving, please enter your ZIP code.

Frequently Asked Questions

Who has the best auto insurance in Norfolk, VA?

State Farm is often considered the top overall pick in Norfolk, VA due to its reliable coverage and bundling options.

What factors should we consider when selecting an auto insurance provider in Norfolk, VA?

Consider pricing, coverage options, discounts, customer service reputation, and the provider’s financial stability. See affordable premiums by entering your ZIP code now.

What are the most common factors that influence auto insurance rates in Norfolk, VA?

In Norfolk, VA the most common factors that indfluence auto insurance rates are age, driving history, credit score, vehicle type, and location all contribute to determining auto insurance premiums.

How do accident statistics and theft rates in Norfolk impact insurance premiums, and which providers offer the best protections in high-risk areas?

Norfolk, VA auto accident & insurance claim statistics show higher risk. State Farm and Allstate provide strong protection with comprehensive policies and discounts for safe drivers.

What are the minimum auto insurance requirements in Virginia, and how do they affect my coverage choices?

Virginia requires liability insurance with specific minimum coverage limits, which may not be enough for full protection, prompting many to choose higher coverage. Enter your ZIP code, to find the best coverage options for your area.

How does my driving record affect my auto insurance rates in Norfolk, VA?

A clean driving record can lower premiums, while violations and accidents can significantly increase rates.

How do credit scores influence auto insurance premiums in Norfolk, VA?

In Norfolk, VA, a low credit score typically leads to higher auto insurance premiums, but drivers can reduce costs by improving their credit score over time, impacting monthly auto insurance rates in Norfolk.

In what ways does Progressive’s flexible policy structure benefit customers with varying auto insurance needs in Norfolk, VA?

Progressive’s flexible policies enable drivers to adjust coverage based on their specific needs, offering personalized protection for various circumstances in Norfolk, VA, making it best for flexible policies. Enter your ZIP code to find the best coverage options for your area,

What family-oriented benefits does American Family Insurance provide, making it an ideal choice for families in Norfolk, VA?

American Family Insurance offers family plans that bundle auto coverage with other services, providing discounts and comprehensive protection tailored to family needs in Norfolk, VA, making it best for family plans.

What types of auto insurance discounts are available in Norfolk, VA?

Common discounts include safe driver, multi-policy, and anti-theft device discounts, which drivers can access by maintaining a good driving record or bundling policies.