Best Arlington, VA Auto Insurance in 2025 (See the Top 10 Companies Here)

The best Arlington, VA, auto insurance companies are Geico, State Farm, and Progressive, with rates starting at $35 per month. Geico is rated A++ by A.M. Best and offers a 25% bundling discount. See how Arlington, VA, drivers can save through coverage options provided by State Farm and Progressive.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Licensed Insurance Agent

UPDATED: Apr 15, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,154 reviews

18,154 reviewsCompany Facts

Full Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsGeico, State Farm, and Progressive are the best Arlington, VA auto insurance with starting rates of $35 per month for comprehensive yet affordable premium.

These top providers offer significant discounts, competitive pricing, and military benefits for Arlington, VA, drivers and residents.

Our Top 10 Company Picks: Best Arlington, VA Auto Insurance

| Company | Rank | A.M. Best | Bundling Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | A++ | 25% | Best Tech Experience | Geico | |

| #2 | A++ | 17% | Extensive Coverage | State Farm | |

| #3 | A+ | 10% | Flexible Options | Progressive | |

| #4 | A+ | 20% | Vanishing Deductible | Nationwide |

| #5 | A+ | 25% | Accident Forgiveness | Allstate | |

| #6 | A++ | 13% | Strong Multi-Policy | Travelers | |

| #7 | A++ | 10% | Military Benefits | USAA | |

| #8 | A+ | 25% | High Satisfaction | Erie |

| #9 | A | 20% | Reliable Service | Farmers | |

| #10 | A | 25% | Customizable Coverage | Liberty Mutual |

Learn how to save through your area’s different cheap car insurance rates and understand how these providers top the list for best Arlington, VA auto insurance.

- The best Arlington, VA auto insurance are Geico, State Farm, and Progressive

- Geico provides affordable and cheap rates for only $42 per month

- State Farm and Progressive are known for extensive coverage and flexible options

This car insurance guide outlines the pros and cons of leading auto insurance providers in Arlington, assisting drivers in finding suitable coverage for their needs. Enter your ZIP code to see availability.

#1 – Geico: Top Overall Pick

Pros

- Budget-Friendly Rates: Geico is known as one of Arlington region’s lowest rate providers.

- Exclusive Bundling Discounts: Aside from a 25% discount, Arlington residents can save money through multiple policies.

- User-Friendly Digital Tools: With the help of the mobile app and tools, Geico provides convenient Norther Virginia policy management.

Cons

- Limited In-Person Support: Unlike other insurers in Arlington, as mentioned in our Geico auto insurance review, they rely more on digital service.

- Higher Costs for Risky Drivers: Residents in Arlington with previous claims may pay more than the expected amount of their premiums.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#2 – State Farm: Best for Extensive Coverage

Pros

- Extensive Coverage Options: State Farm caters to protections, which include rideshare insurance, which is ideal for Arlington drivers.

- Strong Local Agent Network: State Farm is ideal for personalized service since it can be found anywhere in the region of Arlington.

- Financially Secure Provider: This insurer is a trusted company in Arlington, VA for long-term security because of its high A.M. Best rating of A++.

Cons

- Higher Rates for Single Policies: As mentioned in our State Farm auto insurance review, State Farm offers expensive standalone coverage for Arlington drivers.

- Digital Experience Lags Behind: State Farm’s online tools and apps are less advanced compared to other insurers in Virginia.

#3 – Progressive: Best for Flexible Options

Pros

- Name Your Price Tool: Arlington drivers can save through this tool and customize the policy to fit their needs and budget. See more of this through our Progressive auto insurance review.

- Diverse Discount Programs: Progressive provides savings for multi-policy holders, safe drivers, and continuous coverage.

- High Level of Customization: Those who need unique insurance in Virginia can enjoy specialized policies.

Cons

- Inconsistent Claims Service: Policyholders in Arlington report delays in claims processing.

- Credit Score Impacts Premiums: Residents in Arlington pay increasing rates because of their low credit scores.

#4 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible Rewards Safe Driving: This feature encourages good driving habits for Arlington drivers by minimizing deductibles over time.

- SmartRide Program for Low-Mileage Drivers: As per our Nationwide auto insurance review, this offers discounts to drivers in Arlington who practice safe habits.

- Wide Range of Coverage Options: This is ideal for Arlington, Virginia, drivers of a new car since it includes accident forgiveness and gap insurance.

Cons

- Fewer In-Person Locations: Face-to-face consultation in Arlington is more complex because of the limited agent availability.

- Not Ideal for High-Risk Drivers: Drivers in Virginia with multiple violations and accidents may pay higher premiums.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#5 – Allstate: Best for Accident Forgiveness

Pros

- Accident Forgiveness Reduces Rate: Allstate assists Arlington drivers to avoid sudden increases in their premiums after an accident.

- Claim Satisfaction Guarantee: A partial refund can be enjoyed by customers in Arlington, VA, who are unhappy with their claims experience.

- Many Policy Add-Ons Available: The policy available includes rental reimbursement, new car replacement, and roadside assistance for protection.

Cons

- More Expensive than Budget Providers: According to our Allstate auto insurance review, Geico and Progressive offer much lower rates for Arlington residents.

- Mixed Reviews on Claims Processing: Delays in getting their claims resolved are being reported by policyholders in Arlington, Virginia.

#6 – Travelers: Best for Strong Multi-Policy

Pros

- Lower-Than-Average Premiums: Travelers provides budget-friendly auto coverage for Arlington drivers.

- Discounts for Hybrid and Electric Vehicles: By minimizing green vehicles’ rates, Travelers support drivers in Arlington who are eco-friendly.

- Financially Strong Company: Because of its stable A++ financial rating, it is known as a trusted insurer in Virginia, ensuring a reliable payout.

Cons

- Limited Acceptance of High-Risk Drivers: As mentioned in our Travelers auto insurance review, drivers with multiple violations may find it hard to secure premiums.

- Smaller Local Presence: Compared to Allstate and State Farm, this offers fewer agents available for personalized service in Arlington.

#7 – USAA: Best for Military Benefits

Pros

- Exclusive Military Savings: This feature is made to provide veterans and their families with the most affordable rates.

- Highly Rated for Customer Satisfaction: According to our USAA auto insurance review, this consistently receives an A++ mark for excellent policy management from A.M. Best.

- Top-Tier Financial Strength: This ensures peace of mind for policyholders in Arlington through great financial stability.

Cons

- Restricted to Military Families: Offers great discounts to only military families and limited to most Arlington residents.

- Limited Physical Locations: This feature relies more on online and phone service than on face-to-face assistance.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#8 – Erie: Best for High Satisfaction

Pros

- Highly Rated for Service: Erie is the best for customer service and claims satisfaction. Understand it better through our Erie auto insurance review.

- Rate Lock Program Prevention: Even after the accident, this feature stabilizes premium costs in Arlington.

- Affordable Full Coverage Policies: Erie often provides lower full coverage rates than other competitors in Arlington, Virginia.

Cons

- Limited Availability Outside States: Erie has limited accessibility, which may be a drawback for other residents in Arlington.

- Less Advanced Digital Tools: Erie’s online account management is not as good as that of other insurers in Virginia.

#9 – Farmers: Best for Reliable Service

Pros

- Highly Responsive Customer Support: Farmers is excellent in offering great customer service in Arlington, Virginia.

- New Car Replacement Coverage: A totaled vehicle in Virginia can be replaced with a brand-new one with the help of this feature.

- Multiple Discount Opportunities: Opportunities include habits of safe driving and good students.

Cons

- Not the Cheapest Option: Farmers is more expensive than Progressive and Geico for similar levels, as mentioned in our Farmers auto insurance review.

- Higher Premiums for Risky Drivers: Farmers is not the best choice for drivers in Arlington with multiple claims or accidents.

#10 – Liberty Mutual: Best for Customizable Coverage

Pros

- Flexible Coverage Options: Better car replacement and disappearing deductibles are unique add-ons being offered in Virginia.

- RightTrack Program Rewards Safe Driving: Low-risk drivers in the area of Arlington can enjoy 20% telematics-based discounts.

- Attractive Bundling Discounts: Those drivers in Virginia who can combine auto, home, and renters insurance can save a 25% discount.

Cons

- Higher Base Rates Than Some Competitors: Budget-focused insurers in Arlington focus more on providing lower initial premium quotes.

- Inconsistent Claims Handling: Slow or challenging claims processes are being reported by some policyholders in Virginia. Read more through our Liberty Mutual auto insurance review.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Cost of Car Insurance in Arlington, Virginia

Our car insurance guide focuses on providing the best and cheapest auto insurance in your area, specifically in Arlington, VA. We will help you get the most affordable price for your policy.

Arlington, VA Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $73 | $201 | |

| $40 | $105 |

| $110 | $248 | |

| $42 | $107 | |

| $95 | $225 |

| $67 | $180 |

| $56 | $160 | |

| $50 | $123 | |

| $48 | $132 | |

| $35 | $122 |

This highlights the auto insurance monthly rates by provider & coverage level and the auto insurance discounts from the top providers in the area.

Ways to Save on Car Insurance in Arlington, Virginia

One way to save on car insurance is to understand the discounts offered by different insurance providers.

Auto Insurance Discounts From the Top Providers in Arlington, VA

| Company | Anti-Theft | Bundling | Good Driver | Good Student | UBI |

|---|---|---|---|---|---|

| 10% | 25% | 25% | 20% | 30% | |

| 25% | 25% | 23% | 15% | 30% |

| 10% | 20% | 30% | 15% | 30% | |

| 25% | 25% | 26% | 15% | 25% | |

| 35% | 25% | 20% | 15% | 30% |

| 5% | 20% | 40% | 15% | 40% |

| 25% | 10% | 30% | 10% | $231/yr | |

| 15% | 17% | 25% | 25% | 30% | |

| 15% | 13% | 10% | 8% | 30% | |

| 15% | 10% | 30% | 10% | 30% |

Read more about saving big by comparing auto insurance companies. Begin now by entering your ZIP code.

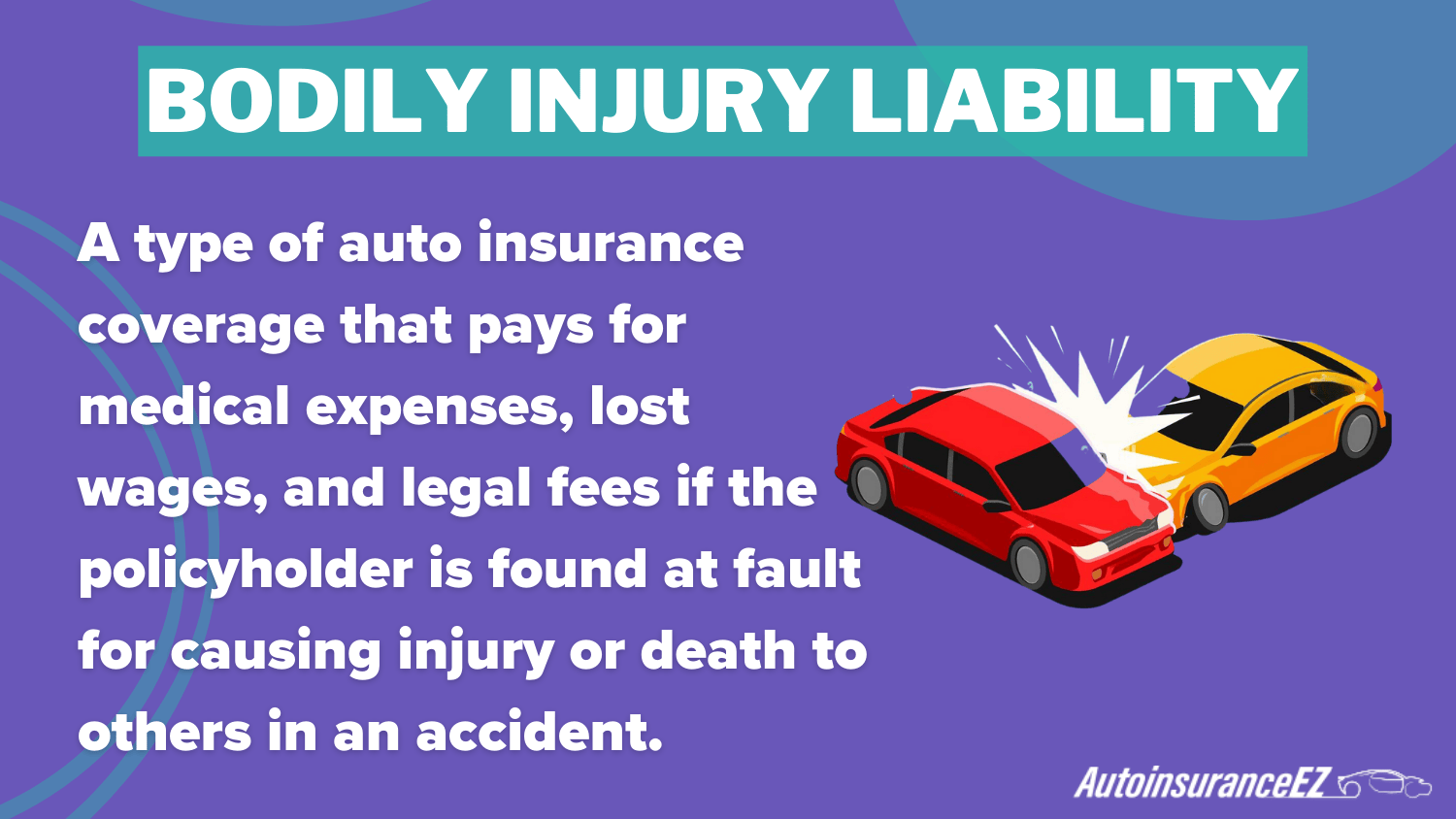

Auto Insurance Coverage Options in Arlington, VA

The coverage requirements and most common insurance limits vary across different categories. The minimum and essential requirement for bodily injury liability is around $25,000 to $50,000, given that the most common coverage amounts to $100,000 to $300,000.

Property damage liability has a required minimum of 20,000, with a more common coverage amount of 50,000. Uninsured motorist bodily injury coverage follows the same structure as bodily injury liability, with a minimum of 25,000/50,000 and a common limit of 100,000/300,000.

Auto Insurance Coverage Requirements in Virginia

| Coverage Type | Minimum Limits |

|---|---|

| Bodily Injury Liability | $30,000 per person / $60,000 per accident |

| Property Damage Liability | $20,000 per accident |

Medical payment coverage is not required but is commonly set at $5,000. Collision coverage is also not mandatory, though a $250 deductible is typical. Similarly, comprehensive coverage is not required, but many policies include it with a zero deductible.

Liability protects you if the accident is found to be either partially, mostly, or even wholly your fault. It pays out damages to the accident victims, including property damage and medical expenses.

Arlington, VA Auto Insurance Monthly Rates by Credit Score

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $168 | $208 | $271 | |

| $108 | $150 | $252 |

| $107 | $133 | $189 | |

| $115 | $133 | $177 | |

| $187 | $208 | $292 |

| $122 | $142 | $208 |

| $177 | $192 | $287 | |

| $123 | $133 | $474 | |

| $97 | $108 | $174 | |

| $99 | $117 | $192 |

If you don’t have enough liability coverage to pay out their claims against you, then the injured party/parties can come after you in court and seize your assets, such as your home.

Read more: UM/UIM Auto Insurance Coverage

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Factors Affecting your Auto Insurance Coverage in Arlington, VA

There are several minor and major factors which get evaluated when you approach a new car insurance company for the first time. And these factors can greatly impact your car insurance premium and coverage.

Arlington, VA Report Card: Auto Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| Average Claim Size | B | Moderate claim costs |

| Traffic Density | B | Moderate traffic congestion |

| Uninsured Drivers Rate | B | Moderate percentage uninsured |

| Vehicle Theft Rate | C | Slightly higher theft rates |

| Weather-Related Risks | C | Frequent snow and rain |

Your ZIP code and social security number, for instance, can affect how much you pay for your insurance. Another factor is automotive accidents.

Arlington, VA Auto Insurance Monthly Rates by ZIP Code

| ZIP | Rates |

|---|---|

| 22207 | $145 |

| 22211 | $142 |

| 22204 | $140 |

| 22209 | $138 |

| 22202 | $135 |

| 22213 | $133 |

| 22206 | $132 |

| 22201 | $130 |

| 22205 | $128 |

| 22203 | $125 |

The less likely you are to get into a serious accident when you get behind the wheel, the more likely you are to get an affordable monthly premium offered to you by an auto insurance company.

Arlington, VA Auto Accident & Insurance Claim Statistics

| Factor | Value | |

|---|---|---|

| Accidents Per Year | 2,500 | |

| Claims Per Year | 2,000 | |

| Average Claim Size | $12,000 | |

| Percentage of Uninsured Drivers | 10% | |

| Vehicle Theft Rate | 75 thefts/year | |

| Traffic Density | High | |

| Weather-Related Incidents | Moderate |

In addition, there are auto thefts in your area. If you don’t have an anti-theft device installed on your vehicle, you might want to be proactive and get one installed.

Another set of factors to be considered are your age, driving record, and driving distance to work. Younger drivers, for better or worse, are charged some of the highest auto insurance rates imaginable.

Arlington, VA Auto Insurance Monthly Rates by Provider, Age, & Gender

| Insurance Company | Age 17: Female | Age 17: Male | Age 34: Female | Age 34: Male |

|---|---|---|---|---|

| $500 | $600 | $150 | $160 | |

| $450 | $550 | $140 | $150 |

| $478 | $578 | $148 | $158 | |

| $475 | $575 | $138 | $148 | |

| $495 | $595 | $155 | $165 |

| $460 | $560 | $145 | $155 |

| $480 | $580 | $140 | $150 | |

| $470 | $570 | $145 | $155 | |

| $490 | $590 | $150 | $160 | |

| $455 | $555 | $135 | $145 |

Insurance companies are scared of their lack of experience behind the wheel, and the statistical data shows that they are not only more likely to get into an accident and file a claim, but they are also more likely to get into an expensive one.

Arlington, VA Auto Insurance Monthly Rates by Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $80 | $100 | $150 | $200 | |

| $75 | $95 | $140 | $190 |

| $85 | $110 | $160 | $210 | |

| $70 | $90 | $130 | $180 | |

| $80 | $100 | $150 | $200 |

| $78 | $98 | $145 | $195 |

| $82 | $105 | $155 | $205 | |

| $65 | $85 | $125 | $175 | |

| $88 | $110 | $165 | $215 | |

| $72 | $92 | $135 | $185 |

If you are a safe driver with a clean record, you have another reason to look forward to getting discounts for your auto insurance policy. But if you’ve had a ticket or an accident within the last few years – especially if you filed a claim as a result – it will count against you, making your monthly premiums more expensive.

Fatal Accidents in Arlington, VA

| Category | Count |

|---|---|

| Fatal Crash Vehicles | 11 |

| Fatalities | 7 |

| Fatal Crash Individuals | 7 |

| Fatal Accidents | 6 |

| DUI Fatal Crashes | 5 |

| Fatal Accident Pedestrians | 2 |

Lastly, it’s one thing to get a low-mileage discount by reporting your miles to your insurance company based on your own estimates. Start saving by entering your ZIP code as your first step.

Read more: Anti-Theft Device Discount

The Best Auto Insurance in Arlington, Virginia

Geico, State Farm, and Progressive top the list for the best Arlington, VA auto insurance, providing budget-friendly yet competitive pricing, extensive and comprehensive policies, and substantial discounts tailored to your vehicle needs.

To save on car insurance, understand what each provider excels at, their A.M. Best rating, and discounts they offer.

Daniel Walker Licensed Insurance Agent

To conveniently shop for your requirements, enter your ZIP code and start comparing what these providers are best known for to help you save time and money.

Read more: Auto Insurance Coverage

Frequently Asked Questions

What are the best car insurance companies in Arlington?

Geico, State Farm, and Progressive provide the best car insurance options in Arlington, VA. Geico provides the cheapest coverage, State Farm offers extensive coverage, and Progressive is known for its flexible policies.

What are the key factors that influence auto insurance premiums in Arlington, VA?

Auto insurance rates in Arlington, VA, are influenced by factors like credit score, driving record, age, and location. Still, drivers can lower their costs by maintaining a clean record, bundling policies, and finding affordable car insurance Arlington discounts. See more affordable rates by entering your ZIP code.

How do Virginia’s minimum auto insurance coverage requirements compare to other states?

Virginia’s minimum coverage for car insurance in Arlington, VA, is 25/50/20 for liability and uninsured motorist protection, but drivers seeking the best car insurance should consider comprehensive coverage for better financial security.

Read more: Minimum Car Insurance Requirements

What role does credit score play in determining auto insurance rates in Arlington, VA?

Credit scores impact your car insurance premium in Arlington like how ZIP code and driving history affect how much you pay for your car insurance quotes in Arlington, VA. Specifically, the lower the score, the higher the rates.

How does Arlington’s insurance claim rate affect the cost of auto insurance for residents?

High accident and insurance claim rates contribute to rising auto insurance costs in Arlington, making it crucial for drivers to compare car insurance quotes in Arlington, VA, to find the best car insurance in Arlington, VA. Read more about accidents by entering your ZIP code.

What specific discounts are offered in Arlington, Virginia?

Top car insurance companies in Arlington, VA, provide discounts for bundling, safe driving, and anti-theft devices, with Geico and USAA offering some of the cheapest coverage.

Read more: Safe Driver Discount

What benefit does USAA offer to Arlington, Virginia drivers?

USAA stands out for military personnel by offering exclusive discounts and benefits on auto insurance in Arlington, making it a great option for service members looking for cheap car insurance in Arlington.

What are the pros and cons of purchasing the state’s minimum required auto insurance?

While the minimum state-required car insurance in Arlington, VA, meets legal requirements, drivers seeking the best car insurance should consider full coverage policies to ensure greater financial protection. Get more financial protection by entering your ZIP code.

How do ZIP codes within Arlington, VA, impact auto insurance premiums?

Various ZIP codes affect Arlington auto insurance rates due to crime rates, accident statistics, and traffic congestion. That’s why it is important to learn how to compare rates.

Read more: Compare Auto Insurance Companies

What strategies can young or high-risk drivers in Arlington, VA use to secure more affordable auto insurance rates?

Young and high-risk drivers looking for cheap car insurance in Arlington, VA, can save by maintaining your record clean by taking defensive driving courses, and choosing vehicles that qualify for the best rates.