Best Houston, Texas Auto Insurance in 2025 (Top 10 Companies Ranked)

Geico, State Farm, and USAA are the best Houston, Texas auto insurance providers. Car insurance rates in Houston, TX start at $50/mo. Geico is known for its 25% bundling discount and a convenient app. State Farm has excellent customer assistance, while USAA offers comprehensive coverage options for the military.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Licensed Insurance Agent

UPDATED: Apr 18, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in Houston

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,154 reviews

18,154 reviewsCompany Facts

Full Coverage in Houston

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage in Houston

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviewsThe best Houston, Texas auto insurance companies are Geico, State Farm, and USAA. With rates starting at $50 per month, these companies prioritize drivers in Houston, Texas, through customer service and convenient online management.

Learn how to find significant car insurance discounts through these companies’ best features, including flexible payment options, unique coverage, and personalized local service.

Our Top 10 Company Picks: Best Houston, Texas Auto Insurance

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $121 | A++ | Online Management | Geico | |

| #2 | $113 | B | Customer Service | State Farm | |

| #3 | $107 | A++ | Comprehensive Coverage | USAA | |

| #4 | $128 | A+ | Flexible-Payment Options | Allstate | |

| #5 | $115 | A+ | Prior Incidents | Progressive | |

| #6 | $119 | A+ | Unique Coverage | Nationwide |

| #7 | $117 | A | Customizable-Coverage Packages | Farmers | |

| #8 | $135 | A | Homeowners Bundling | Liberty Mutual |

| #9 | $111 | A+ | Personalized-Local Service | Erie |

| #10 | $123 | A | High-Risk Driver | The General |

Read through our car insurance guide to help you find the best coverage for your vehicle needs and save big on your car insurance in Houston, TX. Begin comparing rates in Houston, Texas now by entering your ZIP code.

- Geico, State Farm, and USAA offer the best Houston, Texas, auto insurance

- Geico tops the list with its affordable rates for only $63 per month

- State Farm and USAA are the best options for customer service and coverage

#1 – Geico: Top Overall Pick

Pros

- Affordable Rates: Geico is one of the most budget-friendly coverage providers in Texas, which is ideal for drivers who want to save.

- Bundling Discounts to Maximize Savings: When you combine your policies, Geico will offer you great discounts.

- Convenient Digital Experience: Geico’s mobile app makes policy management convenient, as mentioned in our Geico auto insurance review.

Cons

- Limited Local Agent Access: Geico is not ideal for drivers who prefer personal assistance in Houston.

- Higher Costs for High-Risk Drivers: Drivers with traffic violations and accidents pay higher rates.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#2 – State Farm: Best for Customer Service

Pros

- Exceptional Customer Support: According to our State Farm auto insurance review, it provides 24/7 assistance with claims and any other questions.

- Diverse Savings Programs: State Farm provides discount opportunities to drivers in Houston, Texas.

- Strong Local Presence: State Farm is available anywhere in the area, assisting drivers with their needs.

Cons

- Higher Rates for Younger Drivers: New drivers in Houston, Texas, can find significantly cheaper options from competitors.

- Less Online Flexibility: This may seem a drawback for busy Houston drivers who want to do business online.

#3 – USAA: Best for Comprehensive Coverage

Pros

- Ideal for Military Members: USAA is the best option for active service members and veterans in Houston.

- Highly Rated Claims Processing: As stated in our USAA auto insurance review, the company is known for its excellent claims processing.

- Affordable Rates for Responsible Drivers: Drivers with no history of violations in the Houston area can save on their coverage.

Cons

- Exclusive Membership Requirements: USAA is limited to the general public since it is only available to military personnel.

- Few In-Person Locations: It does not provide face-to-face assistance, forcing drivers to rely on phone support.

#4 – Allstate: Best for Flexible-Payment Options

Pros

- Accident Forgiveness: Drivers in Houston, Texas, will pay low and stable rates after their first accident.

- Cash Rewards for Safe Driving: Allstate provides a bonus twice a year for drivers practicing safe driving habits.

- Well-Connected Agent Network: Representatives in Houston assist drivers 24/7, as mentioned in our Allstate auto insurance review.

Cons

- Higher Premiums Than Competitors: Allstate is not always affordable, which Houston drivers may see as a drawback.

- Limited Self-Service Features: When you need to change or adjust your policy, contacting an agent is required.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#5 – Progressive: Best for Prior Incidents

Pros

- Customizable Coverage: The Name Your Price tool, as further discussed in our Progressive auto insurance review, helps drivers save even more on their premiums.

- Savings for Safe Drivers: The Snapshot program rewards safe drivers through discounts.

- Comprehensive Policy Add-Ons: Comprehensive options, including other policy add-ons, make this feature flexible for drivers in Houston, Texas, making it one of the best providers.

Cons

- Premiums Increase Over Time: Drivers in Houston report a sudden increase in their rates.

- Inconsistent Customer Experiences: Many drivers faced challenges with their claims support and handling.

#6 – Nationwide: Best for Unique Coverage

Pros

- Deductible Reduction for Safe Drivers: The program named “Vanishing Deductible” helps residents in Houston save money.

- Annual Policy Reviews for Better Coverage: Nationwide ensures that drivers in Houston, Texas, get the cheapest premiums for their needs.

- Financially Stable and Reliable: Nationwide is a good choice for Texas residents based on its notable history of claims handling.

Cons

- Not Always the Cheapest Option: Some drivers can find more affordable rates from Geico or Progressive.

- Limited Local Agent Availability: As mentioned in our Nationwide auto insurance review, there are limited in-person offices compared to State Farm.

#7 – Farmers: Best for Customizable Coverage

Pros

- Extensive Coverage Options: Farmers is known for providing unique add-ons like rental car reimbursement.

- Strong Local Presence: Agents are widely available, assisting drivers in choosing the best car insurance plan.

- Exclusive Discounts for Certain Professions: As our Farmers auto insurance review suggests, the company offers great savings for teachers and doctors.

Cons

- High Rates for Younger Policyholders: Teen drivers in Houston, Texas, may find lower rates from other competitors in Houston.

- Less Robust Online Features: Digital apps for managing tools are not as advanced as some competitors.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#8 – Liberty Mutual: Best for Homeowners Bundling

Pros

- Custom Policies: Liberty Mutual provides tailored add-ons, as further discussed in our Liberty Mutual auto insurance review.

- RightTrack Program for Safe Drivers: Liberty Mutual rewards safe drivers in Houston, Texas, with significant discounts.

- Highly Rated Claims Handling: It ensures peace of mind for policyholders in Houston through an efficient claim handling process.

Cons

- Premiums Can Be Expensive: Drivers in Houston, Texas, with low credit scores will pay higher rates.

- Unexpected Rate Increases: Customers in the Houston area report a sudden increase in their premiums.

#9 – Erie: Best for Personalized-Local Service

Pros

- Low Rates: Erie offers affordable premiums for local drivers in Houston, Texas, along with unique discounts.

- Personalized Customer Service: Agents in the Houston area can assist you with your driving needs whenever you wish.

- Deep Understanding of Local Risks: Erie is an expert on weather conditions, accident trends, and insurance laws in Texas.

Cons

- Membership Fee Required: According to our Erie auto insurance review, drivers must be members of Erie to access the policy.

- Only Available Within Texas: This feature is not ideal for residents and households living in Texas who are planning to relocate.

#10 – The General: Best for High-Risk Drivers

Pros

- Great for High-Risk Drivers: The General is known for providing coverage even for drivers with records of violations.

- Quick and Easy Online Quotes: According to The General auto insurance review, their online comparison tool helps drivers in Texas easily compare rates.

- Flexible Payment Plans: It offers various payment options for different financial situations.

Cons

- Higher Premiums for Low-Risk Drivers: Drivers in Houston, Texas, with good records, may seek more affordable rates with competitors.

- Fewer Policy Customizations: The General has limited add-ons in comparison with other prominent insurers.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

The Cost of Car Insurance in Houston, Texas

It can be difficult at times to find the best and most affordable insurance coverage that perfectly fits your vehicle’s needs and requirements.

Houston, Texas Auto Insurance Monthly Rates by Provider & Coverage Level

This car insurance guide will answer all your questions, including why car insurance is so expensive, how you can lower your rate, and how much car insurance really costs, through the tables below about auto insurance monthly rates by provider & coverage level and auto insurance discounts from the top providers in Houston, Texas.

Auto Insurance Discounts From the Top Providers in Houston, Texas

Read further to learn more about how you can save with your car insurance coverage and determine the different factors affecting your car insurance rates.

Read more: How to Lower Your Auto Insurance Premiums

Factors Affecting Car Insurance Rates in Houston, Texas

There are many factors that may affect your car insurance premium in Houston, Texas, that you should consider. One of which is your gender and age. Car insurance companies look at your age and gender first when considering your car insurance rate.

Houston, Texas Report Card: Auto Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| Discounts & Savings Opportunities | B | Many discounts available but not all qualify |

| State Minimum Coverage Rates | B- | Rates are above average but still competitive |

| Rate Trends | C | Premiums are rising due to claims and weather risks |

| Traffic & Accident Rates | C- | Heavy traffic and high accident rates increase costs |

| Credit Score Impact | D+ | Poor credit leads to steep rate hikes |

| Uninsured Drivers | D | Many uninsured drivers increase overall risk |

Usually, car insurance companies will charge inexperienced teenage drivers the most for a policy because they are the most likely age group to cause an accident or to receive a traffic ticket.

However, once a young driver turns 25, their rate will likely decrease if they’ve kept a clean driving record. As we discussed, there is a significant cost difference between what a 17-year-old might pay for car insurance and what a 60-year-old could pay for the same policy.

Monthly Rate based by Age in Houston

| Age | Monthly Rate |

|---|---|

| Age: 17 | $783 |

| Age: 25 | $316 |

| Age: 35 | $251 |

| Age: 60 | $240 |

But what about gender, and how does it influence your car insurance rate? In Houston, Texas, male drivers are charged more in their monthly rates, while female drivers pay lower policy premiums per month.

Your marital status can also influence your auto insurance rate. Car insurance providers often see married couples as more responsible and less likely to get into a car accident – that’s why their rates are usually cheaper than those who are single.

Houston Auto Insurance Rates by Age & Gender

| Demographic | Monthly Rates |

|---|---|

| 17-year-old female | $713 |

| 17-year-old male | $853 |

| 25-year-old female | $307 |

| 25-year-old male | $325 |

| 35-year-old female | $248 |

| 35-year-old male | $256 |

| 60-year-old female | $233 |

| 60-year-old male | $246 |

| Average | $398 |

The table above will help you better understand how the factors that affect car insurance premiums, such as your age, marital status, and gender, can impact your car insurance rate. Another factor that may impact your car insurance rate is the place where you live or your ZIP code.

The reason behind this is that crime scenes and disasters are vulnerable factors that insurance companies consider.

Best Car Insurance Companies in Houston, Texas

In seeking the best car insurance company in Houston, Texas, one must consider the factors affecting your premium, including the cheapest car insurance rates by company, commute rates, coverage level rates, credit history rates, and driving record rates.

| Factor | Value |

|---|---|

| Monthly Auto Accidents | $5,000 |

| Fatal Accidents per Month | 15 |

| Injury Accidents per Month | 900 |

| Property Damage Claims per Month | 3,000 |

| Average Claim Amount | $8,000 |

| Percentage of Uninsured Drivers | 25% |

| Auto Theft Rate (per 100,000) | $500 |

| Most Common Accident Cause | Speeding & Distracted Driving |

These factors will help you find the ideal premium and coverage for your vehicle needs. However, not all car insurance companies base rates on the same criteria.

Some companies might consider a person’s credit score more important than where they live, while other companies might charge them more because they drive a certain type of vehicle.

Cheapest Auto Insurance Monthly Rates by Company in Houston, Texas

| Insurance Company | Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male | Average |

|---|---|---|---|---|---|---|---|---|---|---|

| $304 | $306 | $300 | $300 | $809 | $974 | $375 | $390 | $469 | $469 | |

| $256 | $287 | $243 | $280 | $717 | $945 | $376 | $431 | $442 | $442 | |

| $226 | $245 | $220 | $252 | $498 | $513 | $245 | $242 | $305 | $305 | |

| $196 | $199 | $173 | $183 | $555 | $712 | $230 | $249 | $312 | $312 |

| $206 | $195 | $184 | $188 | $867 | $967 | $245 | $246 | $387 | $387 | |

| $185 | $185 | $165 | $165 | $448 | $572 | $202 | $207 | $266 | $266 | |

| $140 | $141 | $135 | $133 | $398 | $431 | $186 | $198 | $220 | $220 |

In this car insurance guide, we have gathered information that will help you make the best choice when searching for a car insurance company.

To find the most affordable and best Houston, Texas, car insurance premium, learn how to compare the features they are best known for.

Kristen Gryglik Licensed Insurance Agent

This guide also highlighted Geico, State Farm, and USAA as the best Houston, Texas auto insurance companies, offering the cheapest car insurance rates. Find out more about these best companies in Houston, Texas by entering your ZIP code.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

What are the top three auto insurance companies in Houston, Texas?

The top auto insurance companies in Houston, Texas, are Geico, State Farm, and USAA. They offer competitive rates in the area. Geico provides the best bundling discounts.

How do certain factors impact car insurance premiums in Houston, Texas?

Auto insurance rates in Houston, TX, vary based on age, gender, and marital status, with younger drivers, males, and single individuals typically paying higher Houston car insurance rates than older, married drivers. See more of these factors that impacts your auto insurance in Houston, Texas by entering your ZIP code.

Why is car insurance in Houston, Texas, more expensive compared to other locations?

The average amount of auto insurance in Houston, TX, is higher than in many other cities due to factors like traffic congestion, accident frequency, crime rates, and severe weather risks in Harris County auto insurance assessments.

Read more: Car Accidents and Car Claims

How can Houston drivers lower their car insurance premiums?

Premiums can be lowered by drivers looking for the best auto insurance rates in the area of Houston by maintaining a clean driving record, improving credit scores, policy bundling, and using discounts from auto insurance companies.

What role does a driver’s ZIP code play in determining their auto insurance rates?

Houston auto insurance rates vary by ZIP code, such as auto insurance 77083, because insurers assess risk levels based on crime rates, accident history, and weather-related hazards in different areas. Find out how much discount you can save in Houston, Texas by entering your ZIP code.

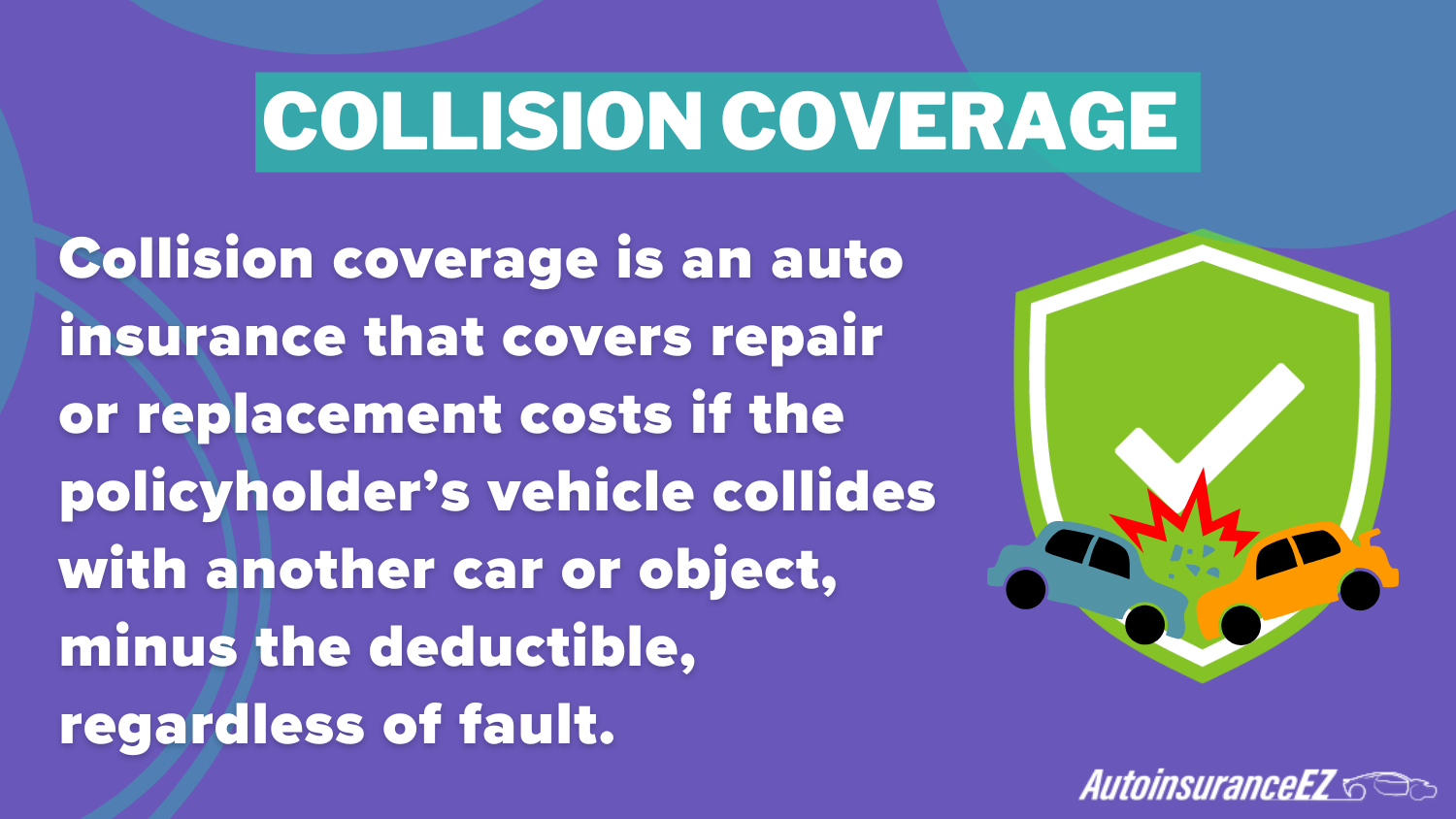

What coverage options do the top-ranked auto insurance companies in Houston offer?

Coverage level is one factor affecting your average car insurance cost. Top companies in Houston, Texas, offer full coverage, liability-only policies, and add-ons such as accident forgiveness.

Why do teenage drivers in Houston generally pay higher car insurance rates?

Teenage drivers can face higher Houston auto insurance rates because of their inexperience and risk of accidents. However, they can lower their costs through discounts like good student, defensive driving course, and choosing affordable providers like Freeway Insurance on 45 North.

What are the advantages of bundling insurance policies, and which provider offers the best bundling discounts in Houston?

Bundling policies like home and auto insurance in Houston, Texas, can help drivers save significantly, with Geico and State Farm offering some of the best car insurance rates in Houston through bundling discounts. Save significantly through these policies in Houston, Texas by entering your ZIP code.

How does a driver’s credit score affect car insurance premiums?

Car insurance rates in Houston, TX, are affected by credit scores. Insurers consider lower scores a higher risk, and some Harris County car insurance providers weigh this factor more than others.

Read more: How your Credit Score Affects your Car Insurance Premium

What are the key differences in customer service, complaint levels, and financial strength among the best insurance companies in Houston?

The best auto insurance rates in Houston, Texas, depend on factors. Geico has the most affordable Houston car insurance costs, State Farm is known for customer service, and USAA is for extensive coverage.