Best Arlington, TX Auto Insurance in 2025 (Top 10 Companies Ranked)

State Farm, Geico, and Progressive provide the best Arlington, TX auto insurance, starting at $56/mo. State Farm excels with its real-time assistance from 20 local agents. Geico offers advanced digital tools for filing claims. Progressive allows customers to set their premiums through the Name Your Price tool.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Licensed Insurance Agent

UPDATED: Apr 16, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

18,154 reviews

18,154 reviewsCompany Facts

Full Coverage in Arlington

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in Arlington

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage in Arlington

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsState Farm, Geico, and Progressive have the best Arlington, TX, auto insurance with a monthly starting rate of $56. State Farm offers real-time assistance with its 20 local agents in Arlington.

Geico offers competitive premiums and advanced digital tools. Progressive’s Name Your Price tool lets customers set a budget for their coverage needs. The table below summarizes all these top-quality insurance companies in TX.

Our Top 10 Company Picks: Best Arlington, TX Auto Insurance

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $153 | A++ | Reliable Coverage | State Farm | |

| #2 | $183 | A++ | Low Premiums | Geico | |

| #3 | $185 | A+ | Innovative Tools | Progressive | |

| #4 | $234 | A+ | Extensive Discounts | Allstate | |

| #5 | $256 | A | Customizable Options | Farmers | |

| #6 | $129 | A++ | Exceptional Service | USAA | |

| #7 | $166 | A+ | Consistent Value | Nationwide |

| #8 | $255 | A | Flexible Coverage | Liberty Mutual |

| #9 | $192 | A++ | Strong Discounts | Travelers | |

| #10 | $210 | A+ | Senior Benefits | The Hartford |

These insurance companies provide the best coverage at affordable premiums, ensuring that Arlington drivers can purchase the car security they deserve.

- State Farm, Geico, and Progressive offer top auto insurance in Arlington

- Bundling auto with other policies helps lower your Arlington premiums

- You can get auto insurance in Arlington for only $56 a month

Are you looking for cheap auto insurance in Arlington, TX? You only need to enter your ZIP code in our free online comparison tool to compare TX car insurance quotes.

#1 – State Farm: Top Overall Pick

Pros

- Comprehensive Coverage Options: The company offers diverse coverages, such as liability, collision, and comprehensive coverage. All coverage options are discussed in the State Farm review.

- Financial Strength and Customer Satisfaction: With a superior A++ rating from A.M. Best, it ranks above the regional average in terms of customer satisfaction.

- Extensive Local Presence: State Farm auto insurance in Arlington has over 20 local agents who ensure policyholders get the assistance they need.

Cons

- Fewer Add-Ons: State Farm car insurance in Arlington has fewer add-ons, as gap insurance and vanishing deductibles are unavailable.

- Higher Rates for Some Drivers: Young and high-risk drivers pay higher premiums for car insurance in Arlington, TX.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

# 2 – Geico: Best for Low Premiums

Pros

- Competitive Premiums: Geico car insurance in Arlington starts at only $83 a month, making it a consistently affordable option.

- Advanced Digital Tools: A website and mobile app that lets customers file a claim and manage a policy. Check the Geico auto insurance review for all the mobile app’s features.

- High Customer Satisfaction: J.D. Power’s 2022 Claims Satisfaction Study proved Geico’s high customer approval for efficient claims handling, ensuring the best Arlington, TX, auto insurance.

Cons

- Limited Local Agents: Customers should mainly do operations with Geico online as it has fewer local offices, leading to less in-person service.

- Less Coverage Personalization: Although it provides all the basic Arlington car insurance coverages, it lacks add-ons like new car replacement, gap, and vanishing deductibles.

# 3 – Progressive: Best for Innovative Tools

Pros

- Name Your Price Tool: A unique tool that provides Arlington car insurance coverage based on the customer’s budget.

- Snapshot Program: A UBI program that personalizes the premiums based on actual driving habits. Check the rules in the Progressive auto insurance review.

- 24/7 Claims Reporting and Tracking: Progressive mobile app and website allow customers to track and file claims, providing transparency and timely updates.

Cons

- Snapshot Program Drawback: While the program is meant to save on premiums through its rewards, tracked bad driving habits cause hikes in car insurance premiums in Arlington.

- Limited Coverage: The Name Your Price tool, though cheap, may cause you to get insurance that does not cover major accidents.

# 4 – Allstate: Best for Extensive Discounts

Pros

- Extensive Discount Programs: Many savings options are available for auto insurance in Arlington, such as early signing, safe driving, EZ play plan, and new car discounts.

- Deductible Rewards: For accident-free insurance, deductibles decrease by $100 annually, up to $500. Check the conditions to qualify in our Allstate auto insurance review.

- Several Coverage Options: Allstate offers a wide range of personalization options through its add-ons, such as rideshare, classic car, and sound system coverage.

Cons

- Strict Eligibility to Some Discounts: The maximum $500 reward on deductibles takes several years to earn, and a safe-driving bonus check is not offered in all policies.

- Higher Rates for High-Risk Drivers: Allstate’s auto insurance premiums in Arlington, TX, are higher for drivers with a record of DUIs, accidents, and bad credit.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

# 5 – Farmers: Best for Customizable Options

Pros

- Flex Personal Auto Policy: This policy enables drivers to select the policies that align with their needs, including accident forgiveness and declining deductibles.

- Customized Vehicle Parts Coverage: Farmers car insurance in Arlington covers protection and enhancements on customized parts like rims, stereo systems, and safety devices.

- Add-Ons Opportunities: It offers add-ons like glass deductible buyback. Check the Farmers auto insurance review to see the list of add-ons for the best Arlington, TX auto insurance.

Cons

- Mixed Customer Service Feedback: Some customers experienced and reported longer wait times for claims resolution than State Farm and USAA.

- Fewer Discount Opportunities: Unlike Allstate and Progressive, it offers few savings options for new, loyal, and old customers of Arlington auto insurance.

# 6 – USAA: Best for Exceptional Service

Pros

- Efficient Claims Resolution: USAA auto insurance in Arlington has responsive and efficient claims resolution compared to all its competitors, as noted in the J.D. Power 2022 study.

- Comprehensive Coverage: A long list of coverage meets the needs of the military and their families, like accident forgiveness and rideshare.

- Strong Financial Stability: USAA car insurance in Arlington, TX, has an A+ rating from A.M. Best, which proves its financial stability in customer claims.

Cons

- Membership Restrictions: USAA is exclusive to the military and their families. Check the eligibility in the USAA auto insurance review.

- Limited Local Agents: USAA car insurance in Arlington, TX, mainly operates by phone and online, limiting in-person customer interaction in complex claims cases.

# 7 – Nationwide: Best for Consistent Value

Pros

- Competitive and Stable Premiums: Nationwide car insurance rates in Arlington are competitive and stabilize over time, especially for long-term customers.

- Comprehensive Coverage: Customers can personalize coverage based on their needs and choose from comprehensive, collision, PIP, medical benefits, and uninsured motorist coverage.

- Several Discount Opportunities: Valuable discounts are available, such as bundling and the SmartRide Program. Check more in the Nationwide auto insurance review.

Cons

- Expensive Premiums: Younger drivers and those with a history of accidents may experience higher Arlington auto insurance rates.

- Less Regional Presence: Nationwide car insurance in Arlington, TX, has few local agents in Arlington, limiting the face-to-face service to customers.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

# 8 – Liberty Mutual: Best for Flexible Coverage

Pros

- Customized Coverage Options: Liberty Mutual auto insurance in Arlington can be customized to each policyholder.

- Optional Add-On Coverages: Flexible add-ons include gap coverage, new car coverage, rental car reimbursement, and more. Check it all out in the Liberty Mutual auto insurance review.

- 12-Month Rate Lock: While other insurers adjust rates in 6-month periods, Liberty Mutual offers a 12-month plan option that stabilizes pricing for the entire year.

Cons

- Higher Deductibles for Some Coverages: Some policyholders experienced higher deductibles than the standard car insurance in Arlington, TX.

- Cancellation Fees: Terminating a policy before renewal has its corresponding cancellation fees, as experienced by some customers.

# 9 – Travelers: Best for Strong Discounts

Pros

- Diverse Discount Opportunities: Travelers auto insurance in Arlington provides more options to lower premiums through bundling, safe driver, multi-car, good students, and more.

- Affinity Group Discount: Up to 15% off is offered to employers/companies, organizations, and alumni association members to help them get the best Arlington, TX, auto insurance.

- Extra Coverage Perks: Travelers lets drivers customize coverage, including gap, premier road assistance, and new car replacement. Check out all its perks in Travelers auto insurance review.

Cons

- Discount Amount Variations: Some customers reported discounts that differ from what was advertised and may not be offered in all states.

- Mixed Customer Service Experience: Customers experienced varied claims wait times, delays in resolution, or even difficulty reaching adjusters.

# 10 – The Hartford: Best for Senior Benefits

Pros

- Exclusive AARP Member Benefits: A partnership that offers seniors unique benefits, such as a 10% discount for being a member in Texas.

- Additional Savings Opportunities: Other discount options, such as good payer, safe driver, and bundling, are also provided. Check it all out in the Hartford auto insurance review.

- Competitive Rates for Seniors: AARP members save an average of $577 on Arlington car insurance as the company implemented age-based premiums.

Cons

- Higher Rates for Some Seniors: Although it specializes in senior auto insurance, the rates for those with a history of accidents and DUIs are higher, and some rates still increase over time.

- Membership Restrictions: The Harford’s auto insurance in Arlington offers all the perks to AARP members who pay a membership fee.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Best Arlington, TX Auto Insurance Monthly Rates

Getting the best Arlington, TX, auto insurance means ensuring its monthly premiums are within your budget. Here are the rates from the top 10 insurance companies you can choose from.

Auto Insurance Monthly Rates in Arlington, TX by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $94 | $234 | |

| $97 | $256 | |

| $83 | $183 | |

| $112 | $255 |

| $74 | $166 |

| $79 | $185 | |

| $69 | $153 | |

| $101 | $210 |

| $89 | $192 | |

| $56 | $129 |

USAA, State Farm, and Progressive offer cheap car insurance in Arlington, TX. But don’t forget that there’s much more to car insurance in Arlington, TX, than paying the cheapest premium.

Affordability is the primary factor to evaluate when getting car insurance, but you should also consider aspects like good customer service and high claims payouts.

Daniel Walker Licensed Insurance Agent

What about those with poor customer support experience and who have trouble filing claims, since you opted for the least expensive provider? Make sure to consider these important components before you decide to switch companies.

Read more: 10-Minute Auto Insurance Buying Guide

Best Arlington, Texas Auto Insurance Discounts

There are many ways to lower your auto insurance premiums if you think they are still out of your budget. Check the discount options below from the top providers.

Auto Insurance Discounts From Top Arlington, TX Providers

| Insurance Company | Anti-Theft | Bundling | Good Student | Multi-Car | Safe Driver |

|---|---|---|---|---|---|

| 10% | 25% | 22% | 25% | 18% | |

| 10% | 20% | 15% | 20% | 20% | |

| 25% | 25% | 15% | 25% | 15% | |

| 35% | 25% | 12% | 25% | 20% |

| 5% | 20% | 18% | 20% | 12% |

| 25% | 10% | 10% | 12% | 10% | |

| 15% | 17% | 35% | 20% | 20% | |

| 10% | 5% | 12% | 25% | 8% |

| 15% | 13% | 8% | 8% | 17% | |

| 15% | 10% | 10% | 10% | 10% |

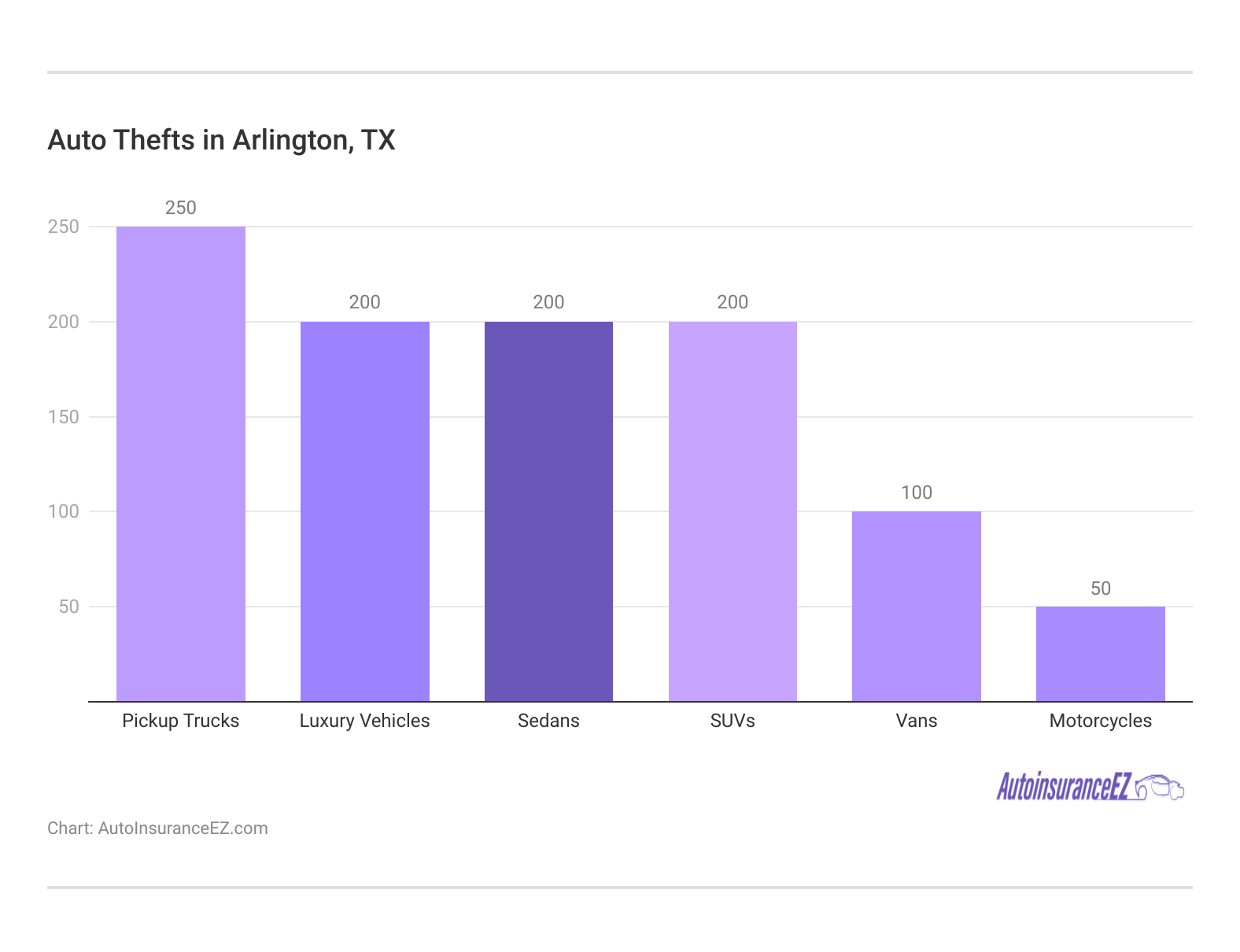

Anti-theft and bundling are good options as they do not require extra effort; you just need to bundle the policies you need, like auto and home insurance. Anti-theft discounts lower your rates and give you extra protection with the rising number of auto thefts in Arlington.

Best Arlington, TX Auto Insurance Companies

State Farm provides the best Arlington auto insurance. It is known for its extensive local agents who provide real-time assistance with customers’ concerns. State Farm also has high customer approval and strong claims resolution, with an A.M. Best A++ rating.

Moreover, it offers inclusive coverage such as comprehensive and collision coverage, liability, underinsured motorists, and more.

Arlington is about halfway between Dallas and Fort Worth. It is home to several sporting venues, including the Cowboys football stadium, the Texas Rangers, and the International Bowling Hall of Fame.

- Fun Fact: Did you know that Arlington is the #1 largest US city without any form of public transportation?

In addition to professional sports, high school football is a very popular pastime in Arlington.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Auto Insurance Coverage Requirements in Texas

Driving legally in Arlington requires:

Auto Insurance Minimum Coverage Requirements in Texas

| Coverage | Limits |

|---|---|

| Bodily Injury Liability | $30,000 per person / $60,000 per accident |

| Property Damage Liability | $25,000 per accident |

It may seem inconvenient that Texas has higher liability auto insurance minimums than other states. However, that higher protection can save you from expensive financial obligations in the future. This coverage can prove useful if you ever enter into a significant accident and/or be hurt by an underinsured driver.

Texas’ higher liability coverage requirements are designed to protect drivers from severe financial losses. While premiums seem higher, they prevent own expenses during an accident.

Scott W. Johnson Licensed Insurance Agent

Finding affordable insurance in Arlington might appear difficult, with the typical motorist paying $135 monthly for car insurance in Texas. But living in your area, you can get rates as little as $88 a month! We’ll gladly demonstrate ways to get the cheapest rate possible.

Major Car Insurance Factors in Arlington

Companies offering insurance coverage consider numerous factors when establishing car insurance quotes in Arlington, TX, including marital status, driving violations, credit reports, miles driven yearly, and theft protection devices. Premiums might also vary from one company to another. Assess cheap auto insurance Arlington, TX, quotes online to ensure you still get the best cost.

Any time your motor vehicle insurance provider prepares to develop your plan, they consider numerous specifics. Some, like how old you are or maybe your specific region, are usually difficult to vary. Here are various other examples:

Your ZIP Code

Where you park your vehicle every night will have a major influence on your automobile insurance rate. Generally, automobile insurance is less expensive in rural regions because a lower number of automobiles signifies a reduced possibility that you will get in an accident with another automobile. The population of Arlington is 398,431, and the average household income is $73,519.

Auto Insurance Monthly Rates in Arlington, TX by ZIP Code

| ZIP | Rates |

|---|---|

| 75051 | $311 |

| 76019 | $288 |

| 76005 | $269 |

| 76016 | $192 |

| 76014 | $190 |

| 76013 | $182 |

| 76018 | $177 |

| 76010 | $173 |

| 76006 | $172 |

| 76001 | $171 |

| 76015 | $158 |

| 76002 | $157 |

| 76017 | $155 |

| 76012 | $142 |

| 76011 | $141 |

| 76112 | $88 |

75051 has the highest monthly rate at $311, and 76001 has the lowest at $171. The differences likely reflect factors such as traffic density, crime rates, and accident statistics, which impact insurers’ risk assessment.

Read more: Auto Insurance Rates by State

Your Credit Score

Check out the chart below to see how credit score affects car insurance premiums. Motorists with excellent credit ratings typically pay under half of the other motorists’ monthly premiums. Your credit rating is among the most critical factors determining your monthly premium.

Auto Insurance Monthly Rates in Arlington, TX by Credit Score

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $150 | $200 | $250 | |

| $160 | $210 | $260 | |

| $140 | $190 | $240 | |

| $155 | $205 | $255 |

| $152 | $202 | $252 |

| $145 | $195 | $245 | |

| $135 | $185 | $235 | |

| $162 | $212 | $262 |

| $165 | $215 | $265 | |

| $130 | $180 | $230 |

Credit score significantly impacts auto insurance rates in Arlington, with those with bad credit paying up to $100+ more per month than those with good credit. USAA and State Farm offer the lowest rates across all credit levels, while Travelers and The Hartford have the highest premiums for bad credit customers, reinforcing how insurers assess financial responsibility as a risk factor

Your Age

Are you looking for coverage for any youthful driver? Well, regrettably, you are fighting a constant fight. Due to their youth and insufficient driving experience, they’re much more prone to being in an accident. And average insurance costs for teenage motorists tend to be more costly due to this.

Auto Insurance Monthly Rates in Arlington, TX by Provider, Age, & Gender

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 34 Female | Age: 34 Male |

|---|---|---|---|---|

| $350 | $375 | $150 | $155 | |

| $360 | $390 | $160 | $165 | |

| $340 | $370 | $140 | $145 | |

| $375 | $410 | $170 | $175 |

| $330 | $365 | $145 | $150 |

| $355 | $395 | $155 | $160 | |

| $335 | $375 | $150 | $155 | |

| $365 | $405 | $160 | $165 |

| $345 | $380 | $150 | $155 | |

| $315 | $355 | $135 | $140 |

Arlington car insurance rates are significantly higher for 17-year-olds than 34-year-olds, with male teens paying more than female teens across all providers. USAA offers the cheapest rates for both age groups ($315 for 17-year-old females and $135 for 34-year-old females).

At the same time, Liberty Mutual has the highest car insurance for teenagers ($375 for females and $410 for males), indicating a strong correlation between age, gender, and risk assessment.

Your Driving Record

Had a ticket or two in your record? Then, you are most likely to have to pay more than you ought to for automotive insurance. This is also true should there be providers in your area who offer accident forgiveness discount rates, even if your current insurer doesn’t.

Auto Insurance Monthly Rates in Arlington, TX by Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $120 | $130 | $145 | $200 | |

| $115 | $125 | $140 | $190 | |

| $110 | $120 | $135 | $180 | |

| $128 | $138 | $158 | $218 |

| $122 | $132 | $147 | $202 |

| $118 | $128 | $143 | $195 | |

| $112 | $122 | $138 | $182 | |

| $130 | $140 | $155 | $220 |

| $125 | $135 | $150 | $210 | |

| $105 | $115 | $125 | $170 |

USAA offers the lowest rates for a clean record ($105) and car insurance after a DUI ($170), while Liberty Mutual ($128) and The Hartford ($130) charge the highest for a clean record. A DUI significantly increases rates, with The Hartford ($220) and Liberty Mutual ($218) having the highest costs.

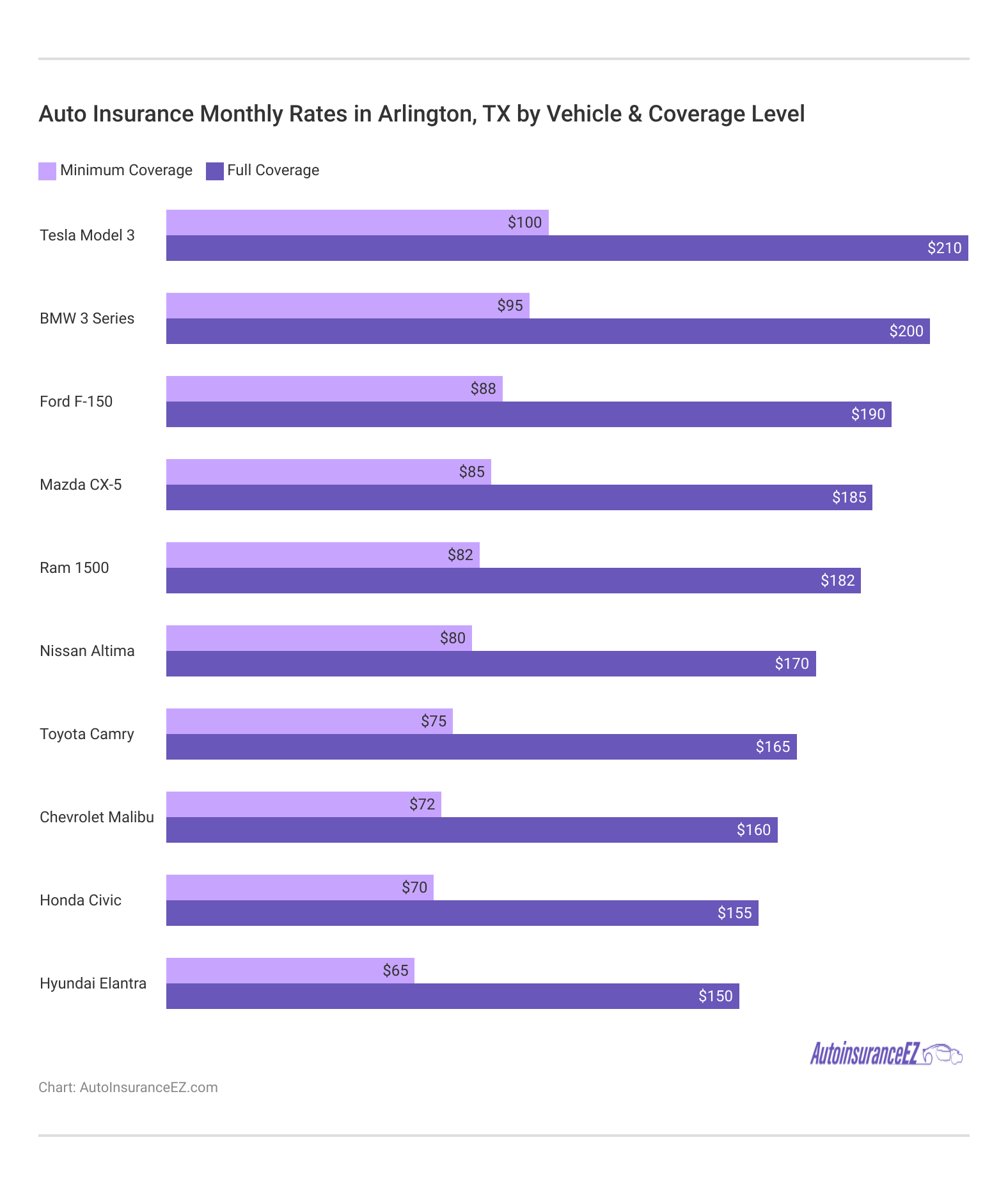

Your Vehicle

Luxury cars are costly not just on their own but also for insurance. The reason behind this is that you have to purchase a more comprehensive policy, and you also have to purchase coverage in larger amounts to safeguard your automobile correctly.

The Tesla Model 3 has the highest full coverage cost ($210/month), and the Hyundai Elantra has the lowest ($150/month). Luxury and high-performance vehicles like the BMW 3 Series ($200) and Ford F-150 ($190) are the most expensive cars to insure. At the same time, more common sedans like the Honda Civic ($155) and Chevrolet Malibu ($160) are more affordable to insure.

Automotive Accidents

You’d think that a more crowded city with more motorists – places like Chicago or Los Angeles – would have the highest fatal accident statistics, right? Well, the truth is that Texas is one of the deadliest states when it comes to automotive accidents. This fact will cause insurance providers to charge much higher rates unless you qualify for a safe driver discount.

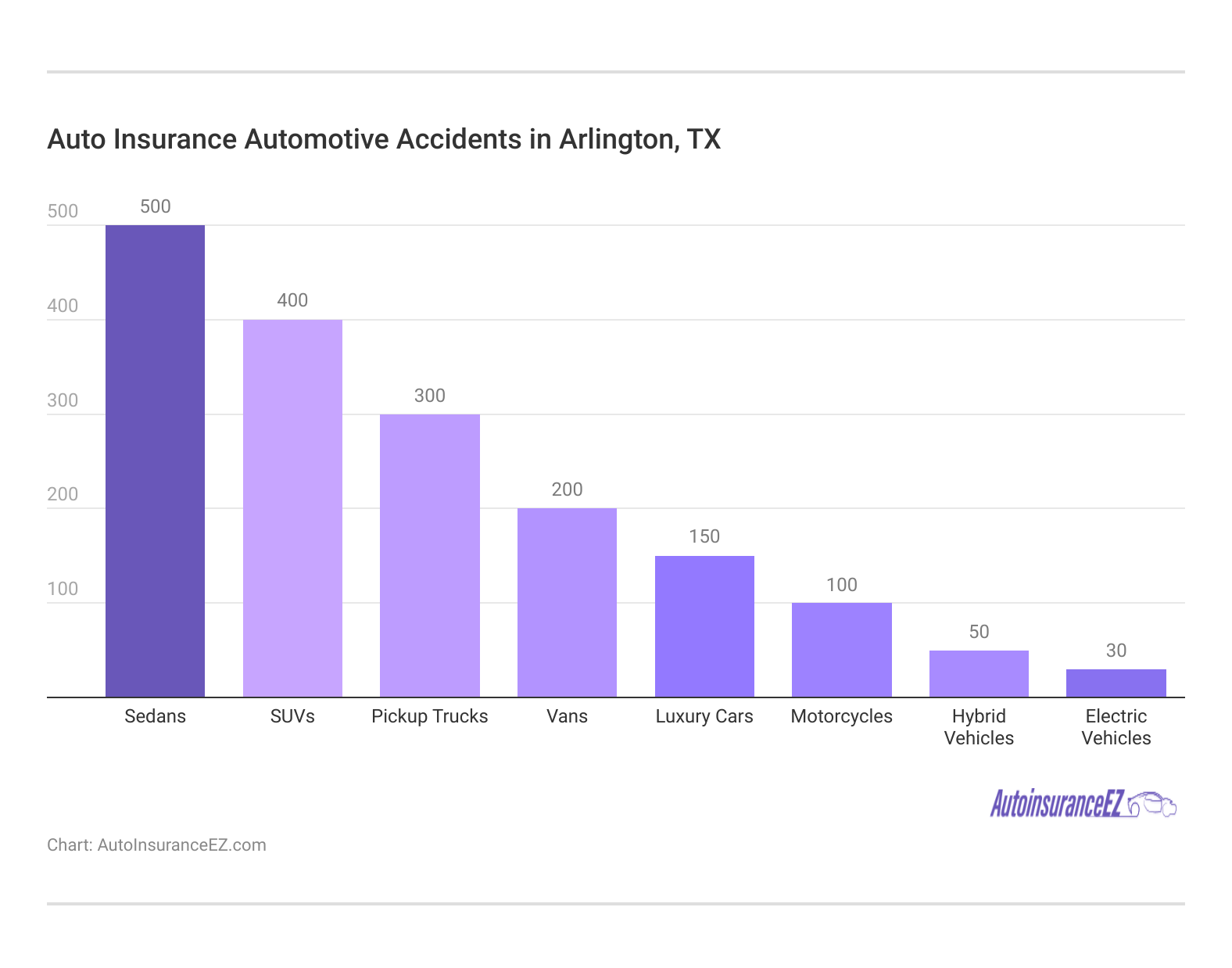

Sedans have the highest number of automotive accidents (500) in Arlington, followed by SUVs (400) and pickup trucks (300), indicating that these vehicle types may face higher risks on the road. Electric vehicles (30) and hybrid vehicles (50) have the fewest accidents, possibly due to lower numbers on the road or safer driving behaviors.

Auto Thefts in Arlington

In Arlington, there were 115,013 auto thefts in 2023. These numbers encourage car owners to purchase comprehensive coverage for extra protection against auto theft. Check the detailed auto theft case below.

Anti-theft technology tends to be a great way to guard yourself from auto theft. They can be moderately inexpensive, simple to get in, and, once equipped, demand little effort from you. And best of all, many insurance agencies will provide you with a discount on your vehicle insurance just by having one!

Read more: 15 Cities With the Highest Vehicle Theft Rates

Minor Car Insurance Factors in Arlington

Don’t be concerned; more factors affect car insurance premiums that you can adjust to modify. These are extensively discussed below.

Your Marital Status

Are you currently married? Do you and your partner bundle your car and renters insurance plans together? Otherwise, you must consider doing this since you can acquire some serious discount rates. You may also bundle additional insurance plans if your provider provides them.

Your Gender

It could appear unlikely, but statistics reveal no significant risk between genders that affects car insurance rates. Fortunately, insurance providers are taking these details into account and are beginning to charge women and men nearly equal rates.

Your Driving Distance to Work

Getting around in Arlington can be a little tricky. The average commute time for most drivers can last anywhere from 30 to 35 minutes, and nearly 80% of locals depend upon their own vehicles for transportation. This means you’ll be sharing the road with more cars (and raising your chances of getting into a wreck). Around 15% of motorists carpool.

Is the vehicle you drive registered for business? You may have to pay an excessive amount of money to insure it. Business automobiles typically cost 10-12% more to insure than automobiles for private use. And driving fewer miles to school or work every year is only going to help you save around 3-4%.

Read more: Telecommuting Auto Insurance

Your Coverage and Deductibles

You may not give your deductible much thought; however, if you know how to adjust it, you may see huge monthly savings.

The bigger your deductible is, the less you’ll pay every month. But simply bear in mind that, should you file claims, you must fork over that cash.

Education in Arlington, TX

Arlington is a very well-educated city; nearly 22% of the population has successfully earned a bachelor’s degree, while an additional 21% has completed all four years of high school and earned a diploma. And the more education you have, the more your car insurance rates will improve!

Arlington has several high-quality institutions for higher learning, which may explain why its populace is so educated. The University of Texas has a campus in Arlington, one of the state’s largest public universities. Arlington Baptist College and Tarrant County College are also available for those who want a private option.

You mustn’t allow an undesirable vehicle insurance provider to persuade you into getting a vehicle insurance policy that is not right for you. Indeed, the quantity of information needed to determine your risk profile may be overpowering, but comparison web pages like this can help simplify things. Simply type in a few details below and allow us to do the rest.

Read more: Car Insurance for Students

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

How We Conducted Our Car Insurance Analysis in Arlington, TX

We calculated our average rate based on the following metrics: a married, 34-year-old male with good credit, a 12-month history of maintaining auto insurance, a clean driving record, and his own home. Miles driven annually were based on the national average. The average rate was also calculated based on a financed 2015 Honda Accord with a pre-installed anti-theft device.

When choosing auto insurance, consider factors beyond just price. Look at the claims process and available discounts to ensure you get the best coverage for your needs.

Jeff Root Licensed Insurance Agent

We hope this best Arlington, TX auto insurance guide helps you get the insurance you deserve. You can start calculating your monthly quotes for the type of auto insurance coverage you need by entering your ZIP code.

Frequently Asked Questions

Which company has the best car insurance in Texas?

State Farm has the best car insurance in Texas for its quality service and extensive local agents.

What is the most trusted car insurance company?

State Farm, Geico, and Progressive are the most trusted car insurance companies in Texas.

How much is car insurance in Arlington, TX?

Car insurance rates in Arlington start at $56 a month for minimum coverage and $129 for full coverage car insurance.

Which company has the lowest auto insurance rates in Texas?

USAA offers the lowest auto insurance in Texas, offering minimum and full coverage.

What are the top 3 insurance companies?

State Farm, Geico, and Progressive are the top insurance providers in Arlington.

Why is car insurance in Texas so expensive?

Texas car insurance rates are expensive due to its higher minimum car insurance requirements, many uninsured drivers, and severe weather conditions. Arlington has heavy traffic and many accidents, leading to higher premium rates.

What is the minimum car insurance required in Texas?

30/60/25 is the minimum car insurance required to drive legally around Texas.

What is the number 1 safest car company?

Genesis GV70 is the number 1 safest car company in 2025.

What is the number one car brand in Texas?

The number one car brand in Texas is the Ford F-Series. Compare Ford car insurance rates now.

How much is car insurance in Texas per month?

Car insurance rates in Texas range between $84 and $299 a month. Get TX car insurance quotes now by entering your ZIP code.