Best Knoxville, TN Auto Insurance in 2025 (See the Top 10 Companies Here)

The best Knoxville, TN auto insurance companies are State Farm, Erie, and Farmers, with a monthly starting rate of $35. State Farm leads for its A++ A.M. Best rating and strong local agents. Erie excels for its affordable premiums, and Farmers offers comprehensive options, including MedPay and uninsured motorist coverage.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

UPDATED: Apr 14, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

18,154 reviews

18,154 reviewsCompany Facts

Full Coverage in Knoxville TN

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 1,883 reviews

1,883 reviewsCompany Facts

Full Coverage in Knoxville TN

A.M. Best Rating

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviews 3,072 reviews

3,072 reviewsCompany Facts

Full Coverage in Knoxville TN

A.M. Best Rating

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviewsState Farm, Erie, and Farmers provide the best Knoxville, TN auto insurance, with a monthly starting rate of $35. With the recent A.M. Best rating of A++, State Farm is the top pick for car insurance in Knoxville. It has a strong local agent presence, making customer service and claims resolution top-notch.

Erie excels for its competitive monthly rates of $37, and Farmers has comprehensive plan options, including PIP, MedPay, and uninsured motorist coverage. The table below shows more auto insurance providers in Knoxville, TN.

Our Top 10 Company Picks: Best Knoxville, TN Auto Insurance

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $116 | A++ | Many Discounts | State Farm | |

| #2 | $96 | A+ | 24/7 Support | Erie |

| #3 | $121 | A | Local Agents | Farmers | |

| #4 | $85 | A | Online App | AAA |

| #5 | $114 | A++ | Accident Forgiveness | Travelers | |

| #6 | $137 | A+ | Usage Discount | Nationwide |

| #7 | $93 | A++ | Custom Plan | Geico | |

| #8 | $144 | A | Customizable Polices | Liberty Mutual |

| #9 | $130 | A++ | Military Savings | USAA | |

| #10 | $157 | A+ | Add-on Coverages | Allstate |

These insurance companies can ensure quality service, affordable rates, and inclusive coverage intended for the unique needs of Knoxville drivers, which are extensively laid out in the pros and cons below.

- State Farm leads with an A++ A.M. Best ratings and strong local agents

- Driving records, credit scores, and age are among the factors that shape premiums

- Lower your auto insurance premiums through savings options like bundling

Learn the basics and extra factors in getting the best cheap auto insurance in Knoxville, TN, in this 10-minute auto insurance buying guide. Get car insurance quotes in Knoxville by entering your ZIP code.

#1 – State Farm: Top Overall Pick

Pros

- Competitive Premiums: The most affordable full coverage plan is only $116 a month, making it the best Knoxville, TN auto insurance.

- High Customer Approval: A recent review shows State Farm has high marks on customer approval for its fast claims resolution, earning A++ ratings from A.M. Best.

- Strong Local Presence: A personalized service to customers through its local agents in Knoxville. Check the State Farm auto insurance review to connect with their agents.

Cons

- Higher Premiums For Some Drivers: State Farm car insurance in Knoxville charges higher premiums for drivers with bad credit and a history of DUIs and accidents.

- Local Agent-Dependent Experience: Although the number of agents is large, the quality of service still varies depending on the agent’s offer and experience.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#2 – Erie: Best for 24/7 Support

Pros

- 24/7 Claims Support: Customers can file a claim over the phone or online anytime. Erie guarantees that help is always available to ensure the best Knoxville, TN, auto insurance.

- Vanishing Deductibles: Erie has rate lock and auto plus features that help policyholders lower deductibles over time through rewards like safe driving perks.

- Competitive Coverage: Erie car insurance in Knoxville offers the best add-ons, such as rideshare and pet injury insurance. Check all the add-on options in the Erie auto insurance review.

Cons

- Customer Service on Extended Hours: While customers can file a claim 24/7, general customer service is only offered during extended hours.

- Fewer Discount Opportunities: It does not offer wide discount options for the best Knoxville, TN auto insurance like State Farm or Allstate.

#3 – Farmers: Best for Local Agents

Pros

- Comprehensive Plan Options: It has all the necessary auto insurance coverages, including PIP, MedPay, and uninsured motorist coverage.

- Extensive Local Presence: Farmers has multiple offices in Knoxville that assist customers with issues and claims. Check the local office locations in the Farmers auto insurance review.

- Efficient Claims Assistance: With the presence of local dedicated agents, claims are quickly processed for faster payouts and repairs, guaranteeing the best Knoxville, TN, auto insurance.

Cons

- Strict Requirements for Some Add-Ons: Some Farmer’s car insurance in Knoxville add-ons, like new car replacement or rideshare insurance, cost more and have strict eligibility requirements.

- Limited Digital Tools: The Farmers mobile app is less advanced than Geico or Progressive, which have more features.

#4 – AAA: Best for Online App

Pros

- Digital Membership & Insurance Cards: These can be accessed through the mobile app as they offer an electronic version of AAA membership and insurance cards.

- Best App Features: The app includes features like a discount finder, travel services, roadside assistance, and a service tracker. The AAA auto insurance review discusses all the features.

- Hassle-Free Claims and Bill Setup: The bills’ autopay option, billing history, and claims can be accessed when processed in one accessible place.

Cons

- AAA App Restrictions: All car insurance features in Knoxville, such as extended towing, are unavailable unless you are an AAA Plus or Premier member.

- Occasional App Glitches: Some users report slow load times and crashes, especially after app updates.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#5 – Travelers: Best for Accident Forgiveness

Pros

- Accident Forgiveness Benefit: This program prevents the premiums from rising after an accident within a specific time due to isolated mishaps to ensure the best Knoxville, TN, auto insurance.

- Savings Opportunities: It offers many discounts you can choose from, including high-tech safety features discounts. Check all the savings options in Travelers auto insurance review.

- Strong Financial Standing: Travelers car insurance in Knoxville secured A++ ratings from A.M. Best, proving its reliable claims reimbursements.

Cons

- No Automatic Accident Forgiveness: Unlike other insurers, which added it automatically, drivers must qualify and pay the extra charge for accident forgiveness.

- Mixed Customer Review: Inconsistent customer experiences with car insurance in Knoxville are reported, especially regarding claims resolution delays.

#6 – Nationwide: Best for Usage Discount

Pros

- SmartRide Program: This is a valuable opportunity to save through a 10% enrollment discount and up to 40% in maintaining safe driving behaviors.

- No Penalties for Risky Driving: Unlike other insurance programs, SmartRide does not raise rates based on driving data. The Nationwide auto insurance review covers more of its rules.

- Customizable Coverage Options: Nationwide offers a variety of coverage options for auto insurance in Knoxville, such as gap coverage, roadside assistance, and accident forgiveness.

Cons

- SmartRide Required Data Sharing: This requires tracking on an app or plug-in device that drivers must agree to, which may raise privacy issues.

- Limited Local Agents: Fewer agents mean less service personalization, which affects prospective customers for Nationwide’s best Knoxville, TN auto insurance.

#7 – Geico: Best for Custom Plans

Pros

- Personalized Coverage Options: Geico offers coverage options such as liability, comprehensive, collision, MBI, MedPay, and PIP. These are listed in more detail in the Geico auto insurance review.

- Mobile Customization Tools: Its website and app let drivers adjust their policy anytime, ensuring they always get the best Knoxville, TN auto insurance.

- Discount Programs for Added Savings: Knoxville drivers can choose discounts to save, such as good student, bundling, safe driver, and more.

Cons

- Discount Eligibility Varies: Many discounts have strict eligibility requirements, and some may not qualify for the maximum savings.

- Higher Rates for High-Risk Drivers: Geico auto insurance policies are more expensive when you have a history of DUIs and accidents.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#8 – Liberty Mutual: Best for Customizable Policies

Pros

- Personalized Coverage Options: Offers a range of coverage choices, including comprehensive, collision, and more. Check all the coverage options in the Liberty Mutual auto insurance review.

- Coverage Customizer Tool: This Liberty Mutual online tool helps assess the potential savings opportunities and coverage plans that suit your budget.

- Local Agent Support: Nicole Dabbs is stationed in Knoxville to provide personalized service by understanding needs and matching them to insurance policies.

Cons

- Gap Insurance Extra Fee: Gap insurance is not included in the standard policies, so drivers who add it must pay an extra fee.

- Higher Premium Rates: Customizing auto insurance policies entails premiums that are more costly than Progressive and Geico.

#9 – USAA: Best for Military Savings

Pros

- Lower Premiums for Military Members: USAA auto insurance in Knoxville has one of the lowest rates for drivers in Knoxville, starting at $47 a month.

- Military-Specific Benefits: Exclusive savings for the military, such as deployment, bundling, and military garaging, are available. All discounts are listed in the USAA auto insurance review.

- Financial Services for Military: USAA, auto insurance in Knoxville, TN, has nationwide free ATM access for claims reimbursements and high-yield savings accounts without monthly charges.

Cons

- Membership Restrictions: Drivers without military connections cannot join, making USAA’s cheap auto insurance in Knoxville, TN, less accessible.

- Limited Options for High-Risk Drivers: Drivers with a history of violations and accidents face higher rates, unlike other insurers with specialized high-risk coverage.

#10 – Allstate: Best for Add-on Coverages

Pros

- Comprehensive Add-On Options: Allstate auto insurance in Knoxville provides various options, including comprehensive collision, personal injury, and roadside assistance.

- Extended Car Care: Additional protection of vehicles, including tire and wheel protection, dent repair, and key replacement coverage. All these are listed in the Allstate auto insurance review.

- Roadside Security Plans: Roadside assistance has extensive coverage, including towing, flat tire assistance, emergency fuel delivery, and more.

Cons

- Service Network Restrictions: Repairs are only done at approved repair shops, making it less flexible for those who prefer their own mechanic.

- Additional Charges: The Allstate auto insurance in Knoxville add-ons will have other charges on top of premiums, or some will even require separate payments.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Best Knoxville, TN Auto Insurance Monthly Rates

Choosing the right car insurance in Knoxville means checking first the monthly premiums. You do not want to pay more for auto insurance than you can afford in the long run. Here are the monthly rates of the top 10 companies for you to check out.

Auto Insurance Monthly Rates in Knoxville, TN by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $44 | $85 |

| $60 | $157 | |

| $37 | $96 |

| $35 | $121 | |

| $50 | $93 | |

| $44 | $144 |

| $38 | $137 |

| $55 | $116 | |

| $75 | $114 | |

| $47 | $130 |

Suppose you’re considering a switch based on price alone. In that case, you’ll want to look into companies like Farmers or Nationwide, which offer the lowest monthly starting premiums in the table, at $35 and $37, respectively.

While affordability is necessary, a lower premium doesn’t always mean the best overall value. Evaluating factors like claims processing can ensure you make the right choice.

Kristen Gryglik Licensed Insurance Agent

Remember that other important factors, such as customer service and discount availability, might make a lower premium less attractive if the other parts of their business aren’t in order.

Read more: Farmers vs. Nationwide: Best Auto Insurance for 2025

Best Knoxville, TN Auto Insurance Discounts

Your typical Knoxville resident might be riding around with a monthly $116 burden just to stay legally covered, the state average for Tennessee auto insurance. But right now, you can lower that to $35 a month! Let us show you how to take advantage of deals in your area.

Auto Insurance Discounts From the Top Knoxville, TN Providers

| Insurance Company | Bundling | Defensive Driving | Good Student | Low Mileage | Safe Driver |

|---|---|---|---|---|---|

| 15% | 14% | 14% | 10% | 10% |

| 25% | 18% | 18% | 30% | 18% | |

| 25% | 5% | 15% | 30% | 15% |

| 20% | 10% | 15% | 10% | 20% | |

| 25% | 15% | 26% | 30% | 15% | |

| 25% | 10% | 12% | 30% | 20% |

| 20% | 12% | 12% | 20% | 12% |

| 25% | 20% | 20% | 30% | 20% | |

| 10% | 17% | 17% | 20% | 17% | |

| 30% | 10% | 10% | 20% | 10% |

These discount options offered by the top car insurance in Knoxville are valuable ways to pay less on your insurance bills. These car insurance discounts are also stackable, which means you can get more discounts on your policies as long as you qualify.

Best Knoxville, TN Auto Insurance Providers

State Farm is the best auto insurance company in Knoxville, TN, and it is known for its extensive local agents across different states, including Tennessee. Moreover, it has recently gained very high customer approval, as proven by A.M. Best Ratings of A++.

Knoxville, Tennessee, serves as the “Gateway to the Smokies” and boasts the status of one of the state’s “most livable” cities. With a strong economic outlook, mild climate, low cost of living, and a thriving culture, Knoxville attracts residents, tourists, and businesses alike.

- Fun fact: Hey, can I borrow your notes? Because Knoxville is #63 on the list of “Top 100 cities with the highest percentage of college students (pop. 50,000+)”. Learn more about Knoxville by clicking here.

Are you in need of cheap auto insurance in Knoxville, TN? From AutoInsuranceEZ.com, you can find the best insurance premiums in your city. In order to obtain free car insurance quotes in Knoxville, TN, available from the leading providers right now, enter in your local ZIP code within the quote box here.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Auto Insurance Coverage Requirements in Tennessee

Driving legally in Knoxville requires the following minimum automobile liability coverage.

Auto Insurance Minimum Coverage Requirements in Tennessee

| Coverage | Limits |

|---|---|

| Bodily Injury | $25,000 per person / $50,000 per accident |

| Property Damage | $15,000 per accident |

Think Liability coverage is all you need? Well, you might want to think again. Liability coverage won’t pay a dime in many situations, such as being the victim of a hit-and-run, getting your vehicle stolen, or suffering damage from severe weather. You could be 100% responsible for those costs if all you carry is Liability coverage.

Major Car Insurance Factors in Knoxville

Companies that provide auto insurance plans evaluate different elements while calculating insurance quotes, including driving experience, geography, credit history, education, and current insurance coverage and limits. Moreover, premiums differ from business to business.

Understanding how insurers calculate rates help you make informed decisions. While some factors are beyond your control, others can be changed to get lower premiums.

Daniel Walker Licensed Insurance Agent

Once your Knoxville car insurance company builds your plan, it considers several factors. Some of these, such as your real age or perhaps your particular address, are extremely hard to change. These factors affect your auto insurance rates, which are discussed below.

Your ZIP Code

The place you store your car each night will probably significantly influence your auto insurance rate. Generally, car insurance is cheaper in non-urban locations merely because fewer cars indicate a smaller possibility that you will get in a collision with another vehicle with high-risk drivers. The population of Knoxville is 198,162, and the typical family earnings are $50,994 in 2023.

Auto Insurance Monthly Rates in Knoxville, TN by ZIP Code

| ZIP | Rates |

|---|---|

| 37934 | $161 |

| 37916 | $137 |

| 37923 | $129 |

| 37919 | $124 |

| 37918 | $121 |

| 37909 | $117 |

| 37912 | $116 |

| 37922 | $114 |

| 37915 | $112 |

| 37920 | $108 |

| 37924 | $108 |

| 37931 | $102 |

| 37921 | $102 |

| 37914 | $94 |

| 37932 | $94 |

| 37938 | $91 |

| 37917 | $88 |

| 37902 | $83 |

The ZIP codes above vary in auto insurance rates in Knoxville. 37934 has the highest monthly rate at $161, and 37920 has the lowest at $108.

Your Credit Score

The table below highlights the monthly insurance premiums for different providers, categorizing them into sound, fair, and bad credit tiers. Check them out.

Auto Insurance Monthly Rates in Knoxville, TN by Credit Score

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $120 | $170 | $220 |

| $130 | $180 | $230 | |

| $110 | $160 | $210 |

| $125 | $175 | $225 | |

| $115 | $165 | $215 | |

| $135 | $185 | $235 |

| $140 | $190 | $240 |

| $122 | $172 | $222 | |

| $132 | $182 | $232 | |

| $100 | $150 | $200 |

USAA offers the lowest rates across all credit categories. At the same time, Nationwide and Liberty Mutual have the highest premiums for bad credit drivers, suggesting that maintaining a good credit score can result in substantial savings on auto insurance in Knoxville.

Read more: Cheap Auto Insurance for a Bad Driving Record

Your Age

And if you think poor credit will raise your rates, the truth is that a poor credit score can’t even hold a candle to how much more you can expect to pay for being a college-age student or, worse, a teenager. Try to ensure you get good grades and take a driver’s education course because discounts are available, such as a good student discount.

Auto Insurance Monthly Rate in Knoxville, TN by Provider, Age, & Gender

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 34 Female | Age: 34 Male |

|---|---|---|---|---|

| $250 | $270 | $120 | $130 |

| $240 | $260 | $110 | $120 | |

| $230 | $250 | $115 | $125 |

| $220 | $240 | $105 | $115 | |

| $205 | $225 | $100 | $110 | |

| $242 | $262 | $125 | $135 |

| $225 | $245 | $120 | $130 |

| $210 | $230 | $110 | $120 | |

| $230 | $250 | $115 | $125 | |

| $200 | $220 | $95 | $105 |

This table displays that younger drivers (age 17) pay significantly higher monthly premiums than older drivers (age 34), with males generally facing slightly higher rates than females. USAA, Geico, and Farmers offer the most affordable rates for young and older drivers, while Liberty Mutual and AAA tend to have higher premiums.

Your Driving Record

Insurance companies calculate your rate based on their financial risk. If you have violations on your driving record, you will likely have to pay for repairs or replace your vehicle after a future accident. However, some companies offer accident forgiveness discounts for motorists with a minor blemish or two on their record. Check out how traffic violations increase car insurance rates below.

Auto Insurance Monthly Rates in Knoxville, TN by Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $100 | $110 | $130 | $180 |

| $120 | $130 | $150 | $200 | |

| $110 | $120 | $140 | $190 |

| $105 | $115 | $135 | $190 | |

| $95 | $105 | $125 | $175 | |

| $125 | $135 | $155 | $210 |

| $115 | $125 | $145 | $200 |

| $108 | $118 | $138 | $193 | |

| $118 | $128 | $148 | $203 | |

| $102 | $108 | $132 | $185 |

Among the car insurance in Knoxville, TN, Geico, USAA, and AAA offer the lowest premium rates for safe drivers. At the same time, Liberty Mutual and Travelers charge the highest premiums, especially for those with violations.

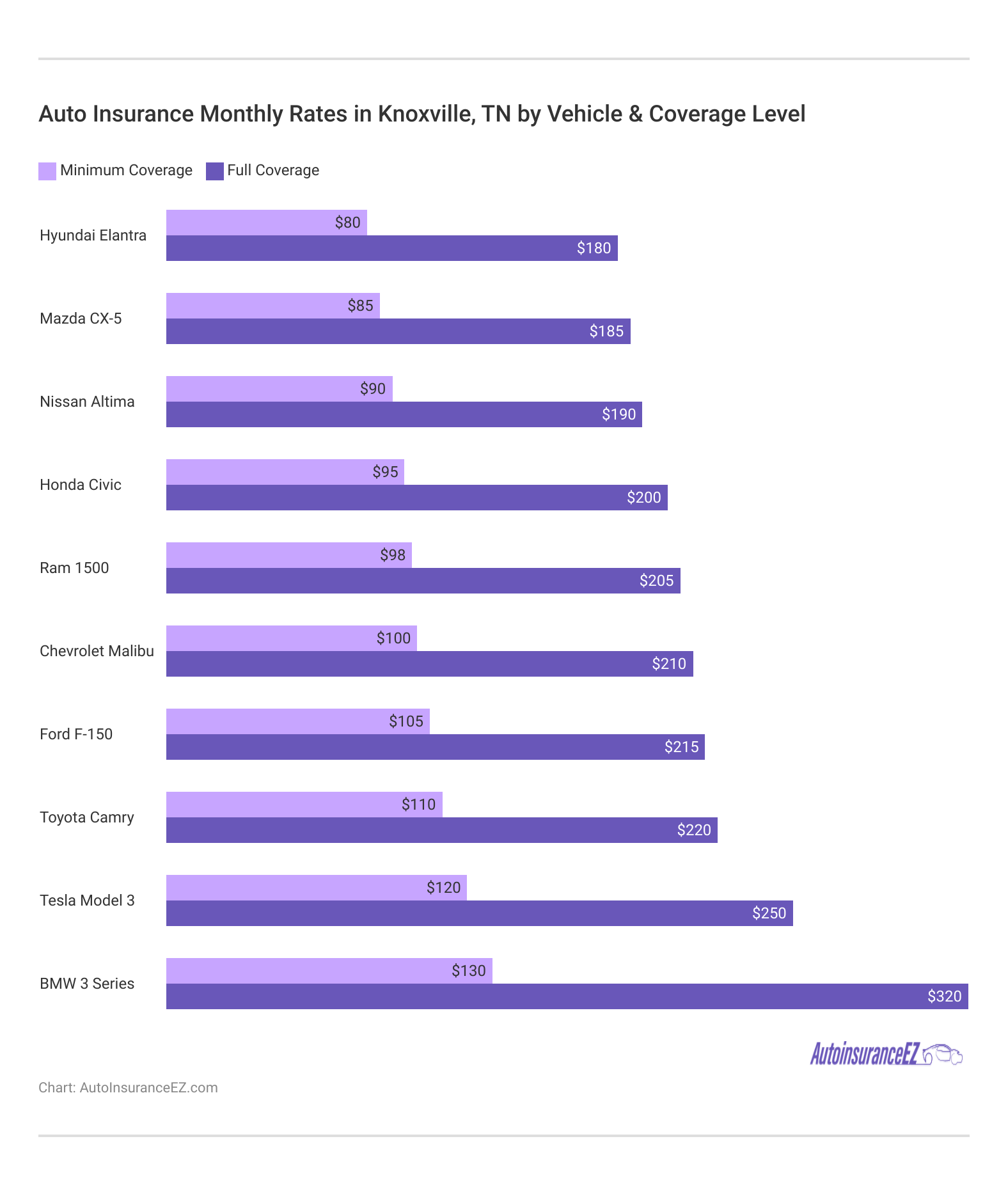

Your Vehicle

Vehicle choice significantly impacts insurance rates, with luxury and electric vehicles costing more to insure due to higher repair costs and theft risk. Check out the table below.

The chart compares minimum coverage vs. full coverage car insurance for different car models. Luxury and high-performance vehicles, such as the BMW 3 Series ($320 for full coverage) and Tesla Model 3 ($250 for full coverage), have the highest premiums.

Meanwhile, insurance costs are lower for more affordable and commonly driven vehicles, such as the Hyundai Elantra ($180 for full coverage) and Mazda CX-5 ($185 for full coverage).

For drivers with classic cars, the video above is intended to help you understand every aspect of insurance for your classic cars, making sure they remain high-value and protected at an affordable cost.

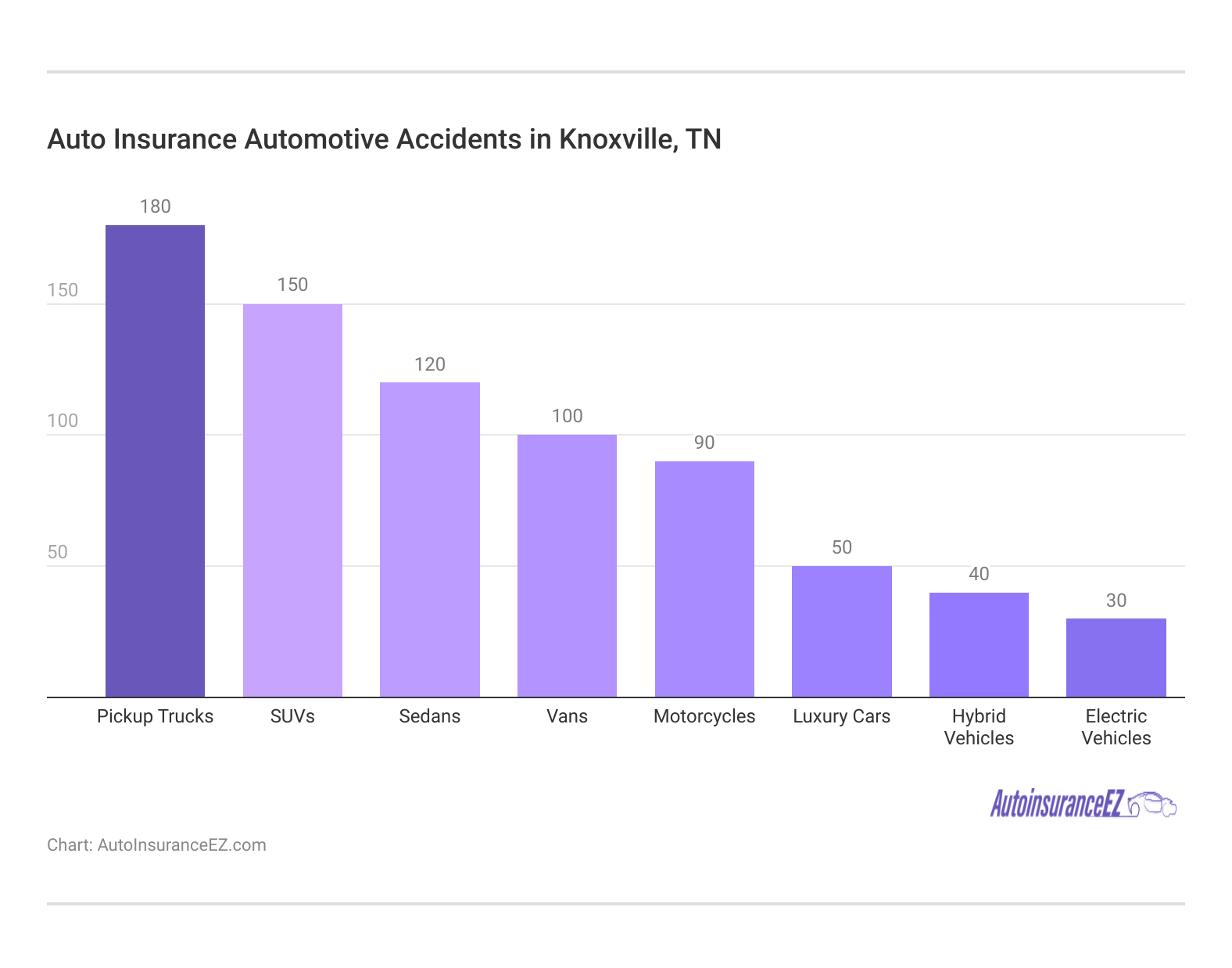

Automotive Accidents

Even though Knoxville has a high population, the equally high fatal accident rate will still inflate your area’s auto insurance premiums. But if you have a fairly clean driving record, you can inquire about safe driver discounts.

Pickup trucks and SUVs have the most accident cases, while electric and hybrid vehicles show fewer accidents, possibly due to advanced safety features or lower driving mileage. Understanding accident trends can help drivers make safer choices when selecting a car.

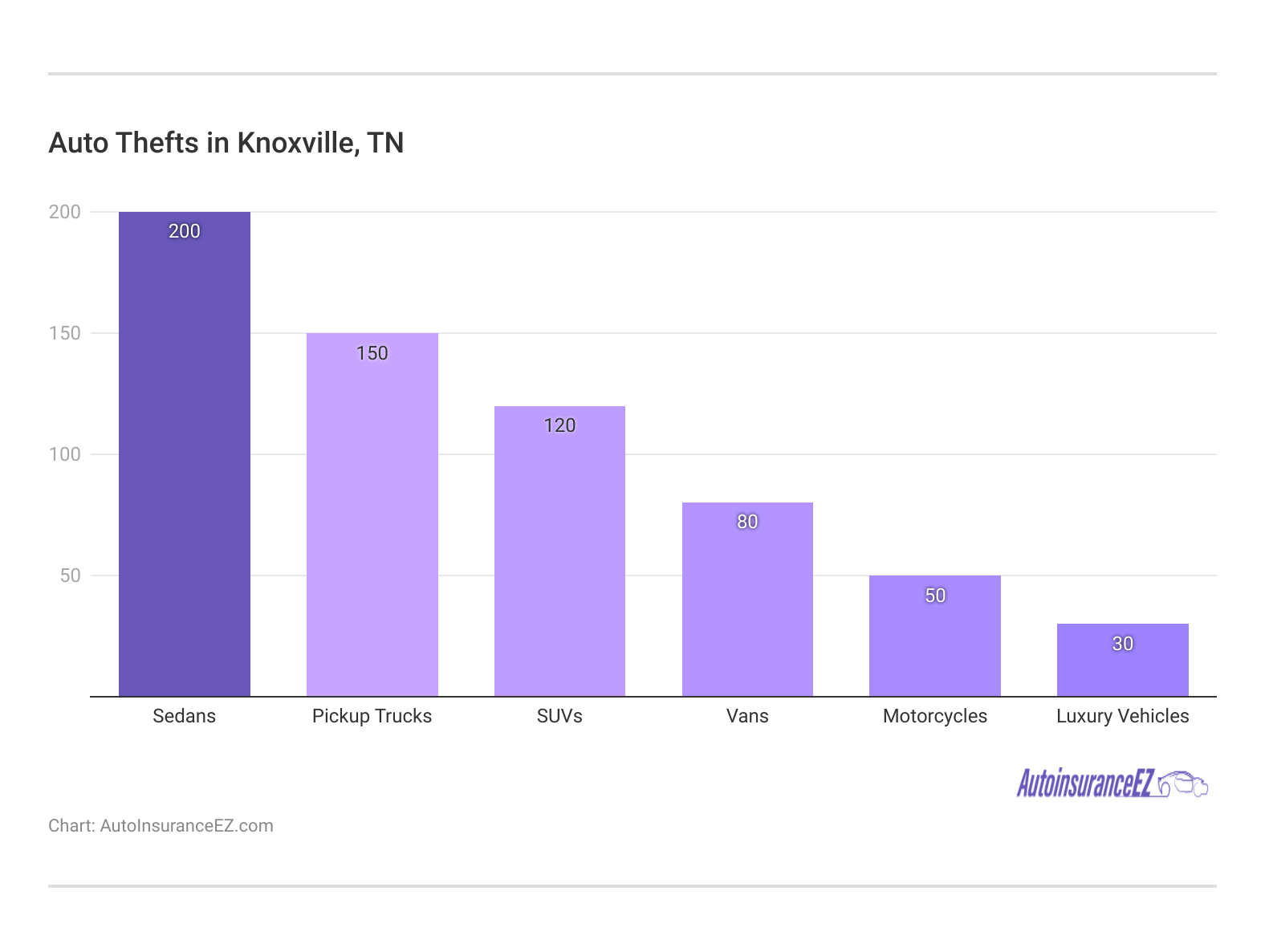

Auto Thefts in Knoxville

Residing in a big city (especially any with a substantial crime rate) can increase your risk of being a victim of auto thieves. Should your regular location have high statistics of auto theft claims filed, you are likely to pay much more for Knoxville, TN, car insurance to counteract these prices.

The total number of stolen motor vehicles in 2023 dropped to 383 in Knoxville. However, the per capita theft rate is still high enough, so protect yourself with comprehensive and collision coverage.

Sedans are the most frequently stolen vehicles in Knoxville, TN, with 200 thefts, followed by pickup trucks (150 thefts) and SUVs (120 thefts). Meanwhile, luxury vehicles (30 thefts) and motorcycles (50 thefts) report the lowest theft rates.

Minor Car Insurance Factors in Knoxville

The following factors may also influence your monthly insurance bill:

- Your Marital Status: Married couples enjoy many financial perks, including insurance bundling. Although single drivers can bundle various insurance policies together for savings, married couples will get the most out of it because there is more to bundle.

- Your Gender: Insurance companies like hard, raw data. Regarding gender and driving, there is very little scientific data that definitively says one gender should be charged more than the other based on proven risk. This is why many companies are phasing out the practice of calculating rates based on gender.

- Your Driving Distance to Work: Commute times in Knoxville aren’t too bad, with average trips lasting between 15 and 23 minutes. Most people behind the wheel drive alone (79%), while around 3-18% carpool. Less than 4% walk.

- Your Coverage and Deductibles: You can raise your deductible for a lower monthly premium. Just put a little money aside in case the worst happens. Because if you raise your deductible and then find yourself needing to file a claim, you will have to pony up that cash before your vehicle gets fixed or replaced.

If you think driving fewer miles annually will save you money on your premiums, you’re correct – but only to an extent. In order to get even a 3-5% discount, you’d have to drive at least 5,000 fewer miles than you did the previous year. That’s at least 14 miles daily for a minor rate reduction.

Comment

byu/analogdrew from discussion

innashville

Some car insurance companies in Knoxville also consider classic cars to raise your premiums because of their unique car parts and the missing safety features that these new car models have. If you have a classic car, check out insurers specializing in auto insurance for classic cars.

Education in Knoxville, TN

Just a little over 28% of Knoxville residents have successfully earned a high school diploma. Similarly, 21% of the population has not yet made their way through all of their high school education. But going back to school or continuing your education after graduation can yield serious benefits in the long run – including the cheapest car insurance in Knoxville, TN, premiums.

Knoxville has four major universities for those looking to advance their education. The University of Tennessee at Knoxville is both the largest and the only one of the four, and it is also a public school. Johnson Bible College and Knoxville College are highly reputable private institutions. The Pellissippi State Technical College is also available for university preparation and two-year degrees.

Choosing the right car insurance must be done with careful consideration. Be cautious of providers that pressure you into purchasing a policy that doesn’t meet your needs.

Jeff Root Licensed Insurance Agent

You should not enable a bad auto insurance provider to persuade you into buying an auto insurance policy that’s not right for you. Yes, the quantity of data needed to determine your personal risk profile can be overpowering, but comparing internet sites such as this may also help make things quicker. Just enter a few details below, and we’ll do the rest.

Read more: Is it bad to get an auto insurance quote online?

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

How We Conducted Our Car Insurance Analysis in Knoxville, TN

We calculated our average rate based on the following metrics: a married, 34-year-old male with good credit, a 12-month history of maintaining auto insurance, a clean driving record, and who owns his own home. Miles driven annually were based on the national average. The average rate was also calculated based on a financed 2015 Honda Accord with a pre-installed anti-theft device.

That sums up the best Knoxville, TN auto insurance. We hope this article has been helpful in getting you the best auto insurance coverage options tailored to your lifestyle and needs. Enter your ZIP code now and compare auto insurance quotes in Knoxville.

Frequently Asked Questions

How much is car insurance in Knoxville, TN?

The car insurance rates in Knoxville, Tennessee, start at $35 monthly.

What is the best car insurance in Tennessee?

State Farm is Tennessee’s best car insurance company, with strong local agents and an A++ rate from A.M. Best.

What is the basic car insurance in Tennessee?

25/50/25 coverage is the basic and minimum car insurance requirement, but additional coverage, such as collision, comprehensive, and uninsured motorist protection, is recommended for better financial protection.

Who has the most affordable car insurance right now?

The most affordable car insurance in Knoxville, Tennessee, right now is Erie, with a minimum rate starting at $37 and full coverage of $96

Why is Tennessee car insurance so high?

Tennessee car insurance is relatively high due to a high rate of uninsured drivers, frequent severe weather events, and rising repair costs. Additionally, urban areas like Nashville and Memphis experience higher accident rates, increasing overall premiums.

Is Geico better than Progressive?

Progressive and Geico are close competitors with varying bundling discounts of 20% and 25% in favor of Geico. Learn more about it in the Geico vs Progressive auto insurance review.

How much is car insurance in Tennessee per month?

Minimum coverage starts at $35 monthly, and full coverage is $96 monthly.

Is Geico cheaper than other insurance?

Geico is known for its affordable rates, but in Knoxville, Erie has the lowest offer of premiums for only $35 a month, while Geico has a $50 starting rate.

Who gives the best car insurance in Knoxville, TN?

State Farm, Erie, and Farmers give the best car insurance companies in Knoxville, TN.

Is Liberty Mutual cheaper than Geico?

Geico has a lower full coverage monthly starting rate of $93 compared to Liberty Mutual, with $144. Compare auto insurance companies using our free online comparison tool.