Best Sioux Falls, SD Auto Insurance in 2025 (Your Guide to the Top 10 Companies)

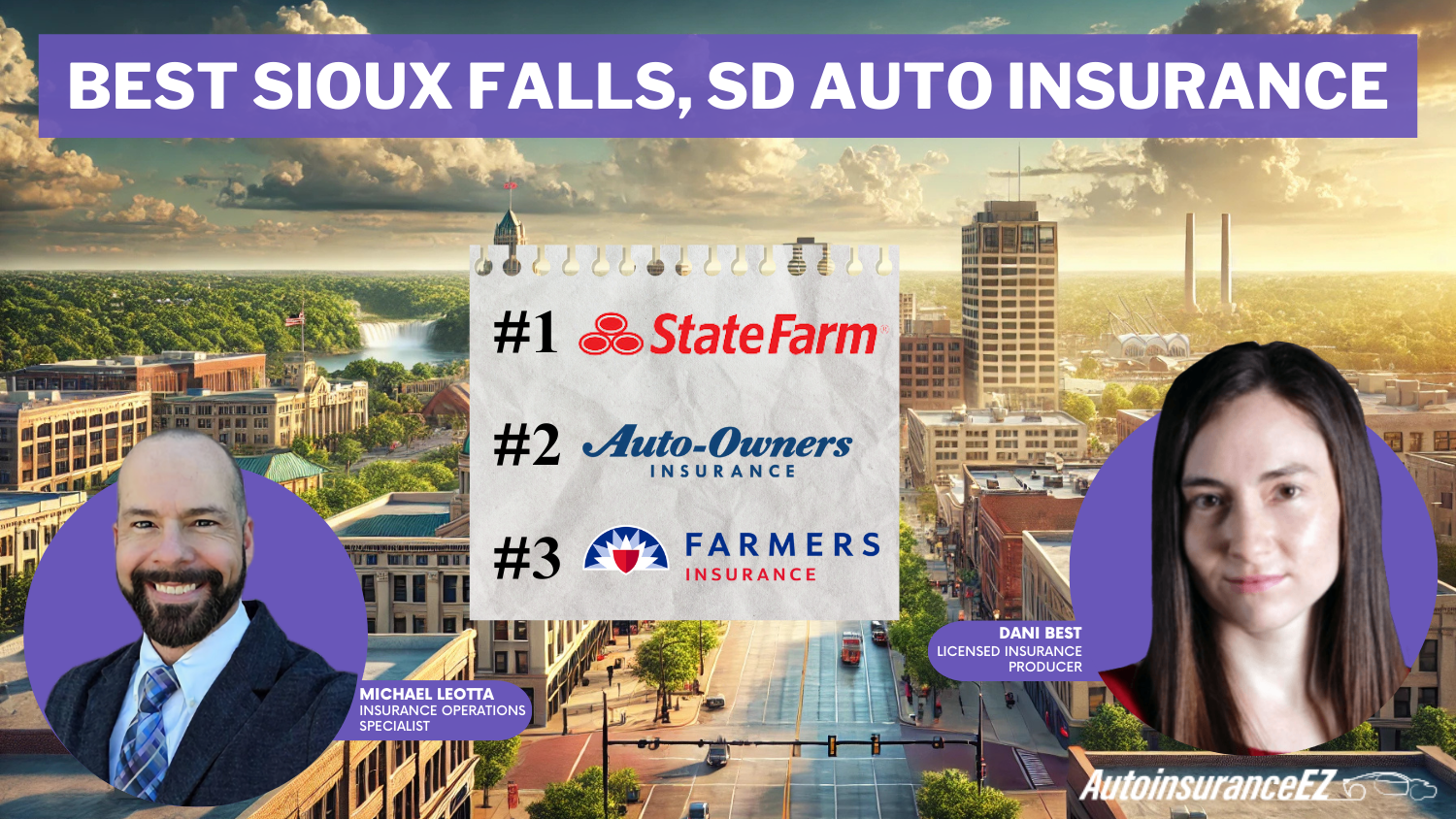

The best Sioux Falls, SD, auto insurance are State Farm, Auto-Owners, and Farmers. Rates start as low as $79 per month. They offer affordability, great coverage, and satisfaction. State Farm excels with accident forgiveness, Auto-Owners with bundling discounts, and Farmers with customizable policies. Compare and save now.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

UPDATED: Jan 28, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

18,154 reviews

18,154 reviewsCompany Facts

Full Coverage in Sioux Falls SD

A.M. Best

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 563 reviews

563 reviewsCompany Facts

Full Coverage in Sioux Falls SD

A.M. Best

Complaint Level

Pros & Cons

563 reviews

563 reviews 3,072 reviews

3,072 reviewsCompany Facts

Full Coverage in Sioux Falls SD

A.M. Best

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviewsThe best Sioux Falls, SD auto insurance providers are State Farm, Auto-Owners, and Farmers. They offer the best combination of good coverage, customer service, and affordability.

State Farm tops the list with comprehensive coverage options and accident forgiveness benefits. Auto-Owners provide significant bundling discounts, but Farmers offers customized plans according to individual needs.

Our Top 10 Company Picks: Best Sioux Falls, SD Auto Insurance

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 17% | B | Loyalty Programs | State Farm | |

| #2 | 16% | A++ | Claim Service | Auto-Owners | |

| #3 | 20% | A | Customizable Policies | Farmers | |

| #4 | 13% | A++ | Extensive Coverage | Travelers | |

| #5 | 25% | A+ | Bundling Policies | Allstate | |

| #6 | 10% | A+ | Customizable Coverage | Progressive | |

| #7 | 13% | A | Multi-Policy Discounts | Mercury | |

| #8 | 25% | A | Flexible Policy | Liberty Mutual |

| #9 | 5% | A+ | Senior Discounts | The Hartford |

| #10 | 20% | A+ | Customer Satisfaction | Nationwide |

These providers offer competitive options with various types of auto insurance coverage and monthly rates as low as $79 for every driver in Sioux Falls. Stop overpaying for auto insurance. Enter your ZIP code to find out if you can get a better deal.

- Discover customized coverage designed for Sioux Falls drivers’ needs

- Compare top insurers offering the best Sioux Falls, SD auto insurance

- State Farm offers the best value, with rates starting at $79/month

#1 – State Farm: Top Overall Pick

Pros

- Strong Local Presence: State Farm boasts a strong network of agents in Sioux Falls, South Dakota, offering personalized service.

- Affordable Rates for Good Drivers: Offers competitive rates for Sioux Falls drivers with good records. Check out our State Farm auto insurance review to learn more.

- Excellent Customer Service: State Farm is famous for handling prompt claims and local South Dakota support.

Cons

- Limited Discounts: State Farm has fewer discounts than other regional providers.

- High-Risk Drivers Pay More: In South Dakota, premiums are higher for those with bad driving records.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#2 – Auto-Owners: Best for Bundling

Pros

- Great Bundling Discounts: Offers significant savings for combining auto and home insurance in Sioux Falls, South Dakota.

- High Customer Satisfaction: Consistently receives high ratings for claims service in South Dakota.

- Local Agent Support: Strong network of agents familiar with Sioux Falls regulations and needs. Explore our Auto-Owners auto insurance review to get more details.

Cons

- Limited Online Tools: Less robust digital options for policy management compared to competitors in Sioux Falls.

- Not Available Everywhere: Coverage might not extend to rural areas outside Sioux Falls, South Dakota.

#3 – Farmers: Best for Customizable Coverage

Pros

- Flexible Policy Options: Farmers offers a wide range of add-ons and endorsements for drivers in Sioux Falls, South Dakota.

- Good Discounts: Discounts are available for safe driving, multi-policy, and more in Sioux Falls.

- Accessible Local Agents: Multiple offices in Sioux Falls for personalized assistance. Read our Farmers auto insurance review to find out more.

Cons

- Higher Premiums: Policies tend to be pricier than other insurers in South Dakota.

- Mixed Claims Experience: Some customers in Sioux Falls report slow claims processing.

#4 – Travelers: Best for Coverage Options

Pros

- Wide Coverage Options: Travelers offers specialized coverage types for Sioux Falls, South Dakota drivers.

- Good for New Cars: Offers accident forgiveness and new car replacement options in Sioux Falls. Discover our Travelers auto insurance review for further insights.

- Strong Financial Stability: Backed by a solid financial foundation, ensuring claim payouts in South Dakota.

Cons

- Average Customer Service: Travelers has received mixed reviews for claims handling in Sioux Falls.

- High Premiums for High-Risk Drivers: Rates can increase significantly for violations in South Dakota.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#5 – Allstate: Best for Comprehensive Tools

Pros

- Robust Digital Tools: Sioux Falls drivers benefit from Allstate’s mobile app and online policy management.

- Discount Opportunities: Wide range of discounts for safe drivers, new customers, and more in South Dakota.

- Strong Claims Satisfaction: Positive reviews for claims handling and payouts in Sioux Falls. Browse our Allstate auto insurance review to gain more information.

Cons

- Expensive for Some Drivers: Rates for younger or high-risk drivers in South Dakota can be higher.

- Local Availability Variability: Service quality can depend on the specific Allstate agent in Sioux Falls.

#6 – Progressive: Best for Competitive Pricing

Pros

- Affordable Rates: Progressive is known for offering competitive premiums for drivers in Sioux Falls, South Dakota.

- Usage-Based Insurance: The Snapshot program rewards safe drivers in South Dakota. For additional details, refer to our Progressive auto insurance review.

- Great Online Experience: Offers a seamless digital platform for policy management and quotes in Sioux Falls.

Cons

- Higher Rates for Accidents: Rates can increase significantly after an at-fault accident in Sioux Falls.

- Mixed Agent Availability: Fewer local agents in Sioux Falls compared to some competitors.

#7 – Mercury: Best for Budget Drivers

Pros

- Affordable Premiums: Mercury offers some of the lowest rates for drivers in Sioux Falls, South Dakota. Visit our Mercury auto insurance review to get the full scoop.

- Focus on Essentials: Great for drivers who need basic coverage at an affordable price in Sioux Falls.

- Good Discount Options: South Dakota offers Discounts for bundling, multi-car policies, and more.

Cons

- Limited Availability: Mercury coverage is less widespread in Sioux Falls than larger insurers.

- Basic Customer Service: Lacks the personalized service level of competitors in South Dakota.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#8 – Liberty Mutual: Best for Comprehensive Discounts

Pros

- Excellent Discounts: This company offers many savings opportunities, including military, student, and bundling discounts for Sioux Falls drivers.

- Strong Digital Tools: Easy-to-use app for policyholders in South Dakota. Please look at our Liberty Mutual auto insurance review to understand more.

- Customizable Policies: Options to tailor coverage to individual needs in Sioux Falls.

Cons

- Higher Premiums: There are higher premiums compared to other competitors for some of the South Dakota drivers.

- Inconsistent Local Support: It depends on the agent experiencing service in Sioux Falls.

#9 – The Hartford: Best for AARP Members

Pros

- For Seniors: This company specializes in plans and discounts for elder drivers in Sioux Falls, South Dakota.

- Wonderful Claims Service: Known for very hassle-free claims processing in South Dakota.

- Lifetime Renewability: Covers renewal of the policy for qualifying drivers in Sioux Falls. Consult our The Hartford auto insurance review to learn more.

Cons

- Exclusive to AARP Members: Only available to AARP members, limiting availability in Sioux Falls.

- Premiums May Be High: Costs can be higher than average for younger drivers in South Dakota.

#10 – Nationwide: Best for Broad Coverage

Pros

- Side Review: This company offers personalized policy reviews for Sioux Falls, South Dakota, drivers. For more insights, dive into our Nationwide auto insurance review.

- Good Accident Forgiveness: Helps drivers avoid premium hikes after their first at-fault accident in Sioux Falls.

- Wide Range of Coverage Options: Includes rare add-ons like vanishing deductible in South Dakota.

Cons

- Limited Local Agents: Sioux Falls has fewer offices than other major insurers.

- Higher Premiums for Specialty Coverage: Add-ons can drive up costs in South Dakota.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Insurance Coverage Requirements in South Dakota

In Sioux Falls, Nationwide and State Farm are in a bidding war to attract customers. But remember: price isn’t everything.

Sioux Falls, SD Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $95 | $148 | |

| $92 | $143 | |

| $98 | $137 | |

| $107 | $167 |

| $98 | $148 | |

| $79 | $133 |

| $78 | $139 | |

| $79 | $134 | |

| $84 | $142 |

| $89 | $155 |

You’re paying for a service, and you should do your homework before deciding which company offers the best service at a reasonable price.

Auto Insurance Discounts From the Top Providers in Sioux Falls, SD

| Insurance Company | Available Discounts |

|---|---|

| Safe Driver, Bundling, Safety Features | |

| Multi-policy, Safe Driver, Paid-in-full | |

| Safe Driver, Multi-car, Bundling | |

| Bundling, Safe Driving, Homeownership |

| Safe Driver, Multi-car, Anti-theft | |

| Multi-car, Bundling, Anti-theft |

| Snapshot Program, Bundling, Safe Driver | |

| Safe Driver, Bundling, Safety Features | |

| Multi-policy, Anti-theft, Bundling |

| Safe Driver, Bundling, Multiple Vehicles |

Companies that supply South Dakota auto insurance policies evaluate various variables, including marital status, zip code, credit report, education, and theft protection devices, to determine insurance rates.

Sioux Falls, SD Report Card: Auto Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| Uninsured Drivers Rate | A+ | Fewer uninsured drivers reduce risk |

| Vehicle Theft Rate | A | Lower theft rates reduce premiums |

| Traffic Density | B | Moderate congestion impacts premiums |

| Average Claim Size | B- | Above-average annual insurance cost |

| Weather-Related Risks | C | Harsh winters increase accident risks |

In addition, premiums differ among providers. Examine cheap car insurance in South Dakota online to ensure you’re still paying the best cost.

Major Car Insurance Factors in Sioux Falls

Several factors affect your car insurance premium, determining how your rate is calculated. But not all of it is out of your control;

In Sioux Falls, where vehicle theft is a notable concern, comprehensive coverage is an essential layer of protection that drivers shouldn’t overlook.

Daniel Walker Licensed Insurance Agent

You can take action to influence which discounts you are eligible to acquire. Listed below are some of these elements in greater detail:

Your Zip Code

Where you park your car each night will likely significantly impact your car insurance rate. Generally, auto insurance is cheaper in rural locations simply because a lesser number of vehicles signifies a reduced chance that you’ll get into a collision with another vehicle. The population of Sioux Falls is 164,676, plus the normal household income is $51,158.

Automotive Accidents

Even though Sioux Falls is a respectable town, the rate of serious accidents in the area is thankfully low. And this is good news for more than just the obvious reasons.

Sioux Falls, SD Fatal Accidents

| Category | Count |

|---|---|

| Fatal crashes involving drunk persons | 0 |

| Pedestrians involved in fatal accidents | 0 |

| Fatal accident count | 7 |

| Fatalities | 10 |

| Vehicles involved in fatal crashes | 11 |

| Persons involved in fatal crashes | 16 |

Insurance providers often lower their rates in cities and towns where drivers are less likely to get into a serious (and expensive) accident.

Auto Thefts in Sioux Falls

Almost all insurance companies worry about auto theft, especially motorists in larger cities.

The greater the populace, the higher the probability you will have to file an auto theft claim. In recent years, there were 264 stolen cars in Sioux Falls.

Sioux Falls, SD Auto Accident & Insurance Claim Statistics

| Factor | Value |

|---|---|

| Accidents Per Year | 5,000 |

| Claims Per Year | 3,000 |

| Average Claim Size | $5,500 |

| Percentage of Uninsured Drivers | 12% |

| Vehicle Theft Rate | 250 thefts/year |

| Traffic Density | Moderate |

| Weather-Related Incidents | Moderate |

These numbers reflect some of the highest auto theft rates in the entire state—and they’re also a sign that you might want to add Comprehensive coverage to your policy.

Your Credit Score

In some states, the difference between good and poor credit can cause fluctuations in your monthly rate. Luckily, South Dakota motorists don’t see too many drastic increases in premiums for having poor credit.

Sioux Falls, SD Auto Insurance Monthly Rates by Provider & Credit Score

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $148 | $173 | $213 | |

| $145 | $175 | $205 | |

| $160 | $190 | $220 | |

| $158 | $188 | $218 |

| $150 | $180 | $210 | |

| $140 | $170 | $200 |

| $143 | $172 | $202 | |

| $135 | $165 | $195 | |

| $162 | $192 | $212 |

| $155 | $185 | $215 |

Some providers in the state don’t factor in credit scores at all, which can save you big if you can get them to issue you a policy.

Your Age

The older you are, the more driving practice you have. And as they say, practice makes perfect. For this reason, insurance companies are willing to offer much cheaper premiums to older drivers.

Sioux Falls, SD Auto Insurance Monthly Rates by Provider, Age, & Gender

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| $520 | $510 | $190 | $180 | $175 | $170 | $155 | $150 | |

| $510 | $495 | $185 | $175 | $160 | $155 | $145 | $140 | |

| $530 | $520 | $195 | $185 | $182 | $175 | $160 | $155 | |

| $540 | $530 | $200 | $190 | $185 | $180 | $165 | $160 |

| $515 | $505 | $188 | $170 | $170 | $165 | $152 | $145 | |

| $525 | $515 | $190 | $182 | $168 | $160 | $155 | $150 |

| $535 | $525 | $195 | $180 | $180 | $172 | $158 | $153 | |

| $505 | $500 | $180 | $170 | $165 | $160 | $150 | $142 | |

| $545 | $535 | $202 | $192 | $177 | $167 | $153 | $148 |

| $550 | $540 | $205 | $195 | $188 | $178 | $162 | $158 |

Teenagers and students, however, can pay an arm and a leg for their coverage without any driving education or Good Student discounts.

Read More: How to Teach Your Teen to Drive

Your Driving Record

Some driving violations are more serious than others. Depending on how your insurance company evaluates risk, you might see a 300% premium increase for a serious crime, such as a DUI, or be denied coverage in general.

Sioux Falls, SD Auto Insurance Monthly Rates by Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $150 | $165 | $185 | $235 | |

| $145 | $160 | $175 | $220 | |

| $135 | $155 | $180 | $245 | |

| $140 | $170 | $190 | $250 |

| $153 | $150 | $170 | $215 | |

| $160 | $175 | $195 | $240 |

| $138 | $165 | $185 | $225 | |

| $132 | $152 | $172 | $210 | |

| $155 | $160 | $180 | $230 |

| $148 | $172 | $192 | $252 |

On the other hand, a speeding ticket or a minor accident might raise your monthly payment by only 1-2%, or even as little as 0% if they offer an accident forgiveness discount.

Your Vehicle

The more expensive your vehicle is, the more it will cost to insure. This is because you will have to (or at the very least, be strongly encouraged) to purchase a variety of coverages in sufficiently high amounts to cover every possible scenario.

Sioux Falls, SD Auto Insurance Monthly Rates by Vehicle & Coverage Level

| Make & Model | Minimum Coverage | Full Coverage |

|---|---|---|

| 2024 BMW 3 Series | $145 | $345 |

| 2024 Chevrolet Silverado | $183 | $208 |

| 2024 Ford F-150 | $185 | $214 |

| 2024 Honda Accord | $177 | $200 |

| 2024 Hyundai Elantra | $189 | $375 |

| 2024 Jeep Grand Cherokee | $191 | $380 |

| 2024 Mercedes-Benz C-Class | $150 | $360 |

| 2024 Nissan Altima | $186 | $215 |

| 2024 Subaru Outback | $187 | $216 |

| 2024 Toyota Camry | $180 | $212 |

It’s mandatory on leased vehicles. Additionally, luxury and high-end vehicles often have pricier replacement parts and repair costs, further driving up insurance premiums.

Minor Car Insurance Factors in Sioux Falls

Of course, tweaking some of the factors below, as highlighted in our ultimate road safety guide, can add up to some extra savings over time:

Your Marital Status

Finding a life partner is a beautiful thing. And bundling your auto policy with that of your spouse can add up to some beautifully low rates. You can compound the savings even more if you go with a large company offering many different types of financial services to bundle together.

Your Gender

As more statistical data shows no legitimate increase in risk between male and female drivers, many insurance providers are phasing out the practice of charging alternative rates based on gender alone. And even if you find an old-fashioned company that still does, you’re probably not paying more than 1-3% extra.

Your Driving Distance to Work

Sioux Falls is well known for delightfully short commute times. On average, the typical motorist can expect to spend between 12 and 17 minutes behind the wheel. Close to 90% of residents will get around in their automobile, while close to 8-13% will carpool.

Choosing the right auto insurance policy involves more than just comparing prices; it’s about balancing affordability with adequate protection for your needs.

Michelle Robbins Licensed Insurance Agent

Most people believe a strong connection exists between driving fewer miles yearly and significantly lower automobile insurance rates. There is indeed a connection, but unfortunately, it isn’t as strong as you might think. A dramatic 5,000-mile-per-year decrease may only net a 4-6% discount.

Your Coverage and Deductibles

Yes, it’s true: raising your collision or comprehensive coverage deductible can lower your monthly premiums.

However, it can be risky if you are not a very safe driver and have to file a claim (but not enough money in the bank to pay your deductible).

Education in Sioux Falls, SD

Sioux Falls is a well-educated city, with nearly 29% of residents holding a high school diploma and 20% having bachelor’s degrees, which can positively influence car insurance rates.

Has anyone established residency in South Dakota with a personal mailbox and then registered their vehicle and gotten insurance?

byu/DickieJohnson invandwellers

The city offers diverse educational opportunities, including public institutions like the USDSU system and private colleges like Augustana College and the University of Sioux Falls. Comparing auto insurance providers can simplify finding the best policy for your needs.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Top Auto Insurance Picks for Sioux Falls

State Farm, Auto-Owners, and Farmers lead the way as the best auto insurance providers in Sioux Falls, SD, with rates starting at $79 per month. State Farm stands out with accident forgiveness, auto owners excel in bundling discounts, and Farmers offer highly customizable coverage.

Factors like ZIP codes, driving history, and vehicle type influence premiums, while the city’s low accident rates and higher auto theft statistics highlight the importance of comprehensive coverage. Comparing quotes and leveraging discounts can help drivers find the best deals.

Read our “Cheap Auto Insurance in South Dakota” for more information. Enter your ZIP code into our free quote tool to find the best auto insurance providers for your needs and budget.

Frequently Asked Questions

What factors influence auto insurance rates in Sioux Falls, SD?

Factors like ZIP code, driving history, credit score, vehicle type, and age significantly affect Sioux Falls, SD car insurance rates. Local variables, such as accident rates and theft statistics, also impact premiums, so shopping for the cheapest car insurance in South Dakota is essential.

Learn more by exploring our “Compare Auto Insurance Companies.”

Which auto insurance company is the best overall in Sioux Falls, SD?

State Farm is considered the best car insurance in South Dakota, especially for auto insurance in Sioux Falls, SD customers. Its competitive rates, strong coverage options, and excellent customer service make it a top pick for those seeking the best car insurance in South Dakota can provide.

What is the significance of the A.M. Best rating mentioned in the article?

A.M. Best ratings help consumers evaluate the financial strength of insurance companies offering car insurance Sioux Falls, SD policies. Choosing a provider with a high A.M. Best rating ensures reliability and claims payout capability for your car insurance in Sioux Falls.

Why is the ZIP code important for determining auto insurance premiums?

ZIP codes affect car insurance premiums in Sioux Falls, South Dakota, because factors like population density, accident rates, and theft incidents vary by area. For instance, rural areas may offer cheaper car insurance than urban locations.

Gain deeper insights by reading our “Comprehensive and Collision Coverage.”

What discounts are available for auto insurance in Sioux Falls, SD?

Discounts on car insurance in Sioux Falls, SD, include safe-driving discounts, good student savings, and bundling policies. These savings help customers access cheap car insurance or the cheapest South Dakota auto insurance rates.

Stop overpaying for auto insurance. Enter your ZIP code to find out if you can get a better deal.

How does auto theft in Sioux Falls affect insurance rates?

The area’s relatively high auto theft rate makes Comprehensive coverage essential for auto insurance policies in Sioux Falls, SD. Drivers should consider adding this coverage when looking for the best car insurance in South Dakota to ensure they are fully protected.

Why are younger drivers charged higher premiums in Sioux Falls?

Younger drivers typically pay more for car insurance quotes in South Dakota due to their lack of experience. However, discounts like good student savings can help reduce premiums, ensuring younger drivers can access cheap auto insurance in South Dakota.

Dig into our “How does an insurance company determine my premium?” for a complete overview.

Can credit scores impact auto insurance rates in South Dakota?

Credit scores can affect rates for cheap car insurance in South Dakota, though the impact is less significant than in other states. Some companies offering the cheapest car insurance in South Dakota policies do not use credit scores, which can benefit drivers.

How does driving distance to work affect insurance premiums?

Short commutes, which are common in Sioux Falls, may lower car insurance premiums for customers. While the connection between miles driven and rates is limited, lower annual mileage may still help secure cheap car insurance in Sioux Falls, SD.

What types of coverage are required in South Dakota?

South Dakota requires liability coverage for bodily injury and property damage. For added protection, consider adding Comprehensive and Collision coverage to your car insurance in Sioux Falls, SD policy to ensure it meets your needs.

See our “Automobile Liability Coverage” to gain more clarity.

How does bundling insurance policies benefit drivers in Sioux Falls?

Bundling auto policies with home or life insurance can lower rates significantly for auto insurance Sioux Falls customers. It’s a great way to secure the cheapest auto insurance in South Dakota without compromising coverage.

What should drivers in Sioux Falls do to get the best insurance rates?

Comparing car insurance quotes from multiple providers is key to finding cheap car insurance in South Dakota. Maintaining a clean driving record, choosing the right coverage, and seeking discounts can also help you secure the cheapest South Dakota car insurance.

Please find the best auto insurance company near you by entering your ZIP code into our free quote tool.