Cheap Auto Insurance in South Dakota for 2025 (10 Most Affordable Companies)

Geico, USAA, and State Farm are the top providers of cheap auto insurance in South Dakota. Geico offers the lowest SD car insurance rates, starting at $9/mo. USAA serves only military members and their families. State Farm has excellent customer support. These insurers meet South Dakota's auto insurance requirements.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Licensed Insurance Agent

UPDATED: Apr 8, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

19,116 reviews

19,116 reviewsCompany Facts

SD Minimum Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 6,589 reviews

6,589 reviewsCompany Facts

SD Minimum Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 18,154 reviews

18,154 reviewsCompany Facts

SD Minimum Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviewsThe top picks for cheap auto insurance in South Dakota are Geico, USAA, and State Farm. Geico’s lowest rates begin at only $9 per month.

Geico offers low-cost coverage, while USAA specializes in military families. StateFarm excels with excellent local agent service.

Our Top 10 Company Picks: Cheap Auto Insurance in South Dakota

| Insurance Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $9 | A++ | Low Rates | Geico | |

| #2 | $10 | A++ | Military Focus | USAA | |

| #3 | $11 | B | Local Agents | State Farm | |

| #4 | $12 | A+ | Teen-Friendly | Nationwide |

| #5 | $16 | A++ | Telematics Program | Travelers | |

| #6 | $17 | A+ | Budgeting Tools | Progressive | |

| #7 | $18 | A | Accident Forgiveness | Farmers | |

| #8 | $22 | A+ | Driving Discounts | Allstate | |

| #9 | $24 | A | Tailored Policies | American Family | |

| #10 | $37 | A | Custom Options | Liberty Mutual |

All three cheap auto insurance companies meet South Dakota’s auto insurance standards, providing solid and affordable protection.

- USAA provides excellent coverage options tailored for military families

- Affordable policies meet South Dakota’s required minimum liability coverage

- Geico offers comprehensive and reliable coverage to South Dakota drivers

Enter your ZIP code to compare affordable auto insurance rates in South Dakota and find the best coverage options tailored to your needs.

#1 – Geico: Top Overall Pick

Pros

- Affordable Monthly Rates: Geico offers extremely low rates, starting at just $9 monthly for minimum coverage auto insurance in South Dakota.

- Strong Financial Stability: With an A++ rating from A.M. Best, Geico provides high confidence in its ability to cover claims.

- Excellent Low-Cost Options: Geico’s affordable pricing structure makes it an excellent choice for budget-conscious drivers seeking cheap auto insurance in South Dakota.

Cons

- Limited Local Agents: Geico operates mainly online and through phone services, but it lacks local agents in some areas of South Dakota.

- Fewer Specialized Discounts: In certain situations, Geico’s discounts may not be as varied or specialized as those of other providers. Access the complete picture in our “Geico Auto Insurance Review.”

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#2 – USAA: Military Focus Expert

Pros

- Affordable Rates for Military Families: USAA provides highly competitive rates starting at $10 per month for minimum coverage auto insurance, focusing on military members and their families.

- A++ Financial Strength: USAA’s A++ rating from A.M. Best reflects its strong financial standing, ensuring reliable service for military families in South Dakota.

- Exclusive Military Benefits: USAA offers specialized benefits and discounts, making it the best choice for military personnel looking for affordable insurance in South Dakota.

Cons

- Membership Requirement: USAA is only available to military members and their families, which limits accessibility for non-military individuals in South Dakota.

- Fewer Physical Locations: USAA’s online-only model may limit face-to-face service. Learn more about the company in our USAA auto insurance review.

#3 – State Farm: Local Agent Expert

Pros

- Strong Local Agent Network: State Farm has an extensive network of local agents, making it easy for drivers in South Dakota to get personalized advice and assistance.

- Competitive Pricing: State Farm offers minimum coverage starting at $11 monthly with flexibility for SD drivers. Explore this further in our State Farm auto insurance review.

- Bundling Discounts: State Farm offers significant savings for bundling auto and home insurance policies, which is ideal for customers who need multiple types of coverage.

Cons

- Limited Discounts for Teen Drivers: While State Farm offers some discounts, its options for teen drivers may not be as extensive as competitors’.

- Higher Rates for Certain Drivers: Some drivers may find their rates slightly higher than other budget-friendly insurers in South Dakota.

#4 – Nationwide: Teen-Friendly Expert

Pros

- Great for Teen Drivers: Nationwide offers special discounts and coverage options for teen drivers, making it a top choice for families in South Dakota with young drivers.

- Affordable Rates: Minimum coverage auto insurance starts at just $12 per month, providing an affordable option for drivers seeking budget-friendly coverage.

- A+ Financial Stability: With an A+ rating from A.M. Best, Nationwide ensures financial stability and reliable claim handling in South Dakota.

Cons

- Fewer Comprehensive Discounts: Nationwide’s discount offerings may be more limited than other insurers, particularly for customers with low-risk profiles.

- Potential for Higher Premiums: Some drivers may face higher premiums due to coverage needs or vehicle type. To enhance your knowledge, read our Nationwide auto insurance review.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#5 – Travelers: Telematics Program Expert

Pros

- Telematics Program for Lower Rates: Travelers offers a telematics program, allowing drivers to save money based on safe driving behaviors, starting at $16 a month for minimum coverage.

- Excellent Customer Service: Travelers have an A++ rating from A.M. Best, Which Means It provides reliable customer service and claims assistance in South Dakota.

- Flexible Coverage Options: Travelers offers a wide range of coverage options, making it easy for drivers to customize policies to fit their needs.

Cons

- Limited Availability of Discounts: Some Travelers’ discounts may be less effective without telematics participation. Our Travelers auto insurance review covers more details.

- Rates May Be Higher for Some Drivers: Depending on their driving habits, some drivers might find Travelers’ rates to be higher than those of other providers in South Dakota.

#6 – Progressive: Budgeting Tools Expert

Pros

- Comprehensive Budgeting Tools: Progressive offers various budgeting tools to help drivers manage their monthly premiums effectively, starting at $17 a month for minimum coverage.

- A+ Financial Strength: With an A+ rating from A.M. Best, Progressive ensures reliable coverage and support for drivers in South Dakota.

- Wide Range of Discounts: Progressive offers discounts for safe driving, bundling, and more, helping customers lower their premiums. For additional information, see our “Progressive Auto Insurance Review.”

Cons

- Higher Premiums for Certain Drivers: Some drivers, particularly those with less-than-ideal driving histories, may find Progressive’s rates higher than those of other insurers.

- Fewer Local Agent Options: Progressive’s service is primarily handled online, which may be inconvenient for customers who prefer in-person assistance.

#7 – Farmers: Accident Forgiveness Expert

Pros

- Accident Forgiveness: Farmers offers accident forgiveness, meaning a customer’s first accident won’t affect their premiums, starting at $18 monthly for minimum coverage.

- Strong Financial Stability: With an A rating from A.M. Best, Farmers offers reliable claims handling and customer service in South Dakota.

- Personalized Service: Farmers offer tailored insurance policies to fit drivers’ needs. For additional insights, refer to our Farmers auto insurance review.

Cons

- Higher Rates for Some Drivers: Farmers’ premiums can be higher for certain drivers or vehicle types compared to more budget-friendly options.

- Limited Discounts: While Farmers offers accident forgiveness, it may offer fewer discounts overall than competitors in South Dakota.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#8 – Allstate: Driving Discounts Expert

Pros

- Excellent Driving Discounts: Allstate offers several discounts for safe driving, including its Safe Driving Bonus, with minimum coverage starting at $22 per month.

- A+ Financial Strength: Allstate has an A+ rating from A.M. Best, which means it offers policyholders a strong and reliable financial foundation.

- Comprehensive Coverage Options: Allstate offers a wide array of coverage options, making it easier to customize a policy to fit individual needs.

Cons

- Higher Base Premiums: Allstate’s base premiums, starting at $22 per month, can be relatively higher than other insurers in South Dakota.

- Less Flexibility in Discounts: Allstate’s discounts may be less flexible than those of competitors. Read our Allstate auto insurance review to find out more.

#9 – American Family: Tailored Policies Expert

Pros

- Tailored Insurance Policies: American Family offers tailored coverage starting at $24 per month for minimum protection. Explore further with our American Family auto insurance review.

- Financial Strength: American Family’s A rating from A.M. Best ensures economic stability and reliable coverage in South Dakota.

- Additional Coverage Options: American Family offers additional coverage options, such as roadside assistance and rental car reimbursement, enhancing policyholder value.

Cons

- Higher Premiums: Some drivers may find that American Family’s premiums are higher than those of other South Dakota insurance companies.

- Limited Discount Options: American Family may offer fewer discounts than other major insurers, limiting potential savings.

#10 – Liberty Mutual: Custom Options Expert

Pros

- Highly Customizable Coverage: Liberty Mutual offers flexible and customizable coverage options, starting at $37 a month for minimum coverage, catering to a wide range of driver needs.

- Financial Strength: Liberty Mutual’s A rating from A.M. Best ensures solid financial backing for South Dakota drivers.

- Multiple Discounts: Liberty Mutual offers a variety of discounts, including bundling policies and insuring multiple vehicles. Explore further details in our Liberty Mutual auto insurance review.

Cons

- Higher Base Rates: Liberty Mutual’s base premiums, starting at $37 per month, can be considerably higher than some competitors in South Dakota.

- Less Competitive Pricing for Low-Risk Drivers: Drivers with low-risk profiles may find Liberty Mutual’s pricing less competitive than that of other insurers with more affordable rates.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

The Ultimate South Dakota Car Insurance Guide (Costs + Coverage)

With more shoreline than Florida, rolling hills, mountains, and plains, it’s no wonder that camping is South Dakota’s favorite pastime. Often referred to as the “Land of Plenty,” the “Land of Infinite Variety,” and “the blizzard state,” South Dakota is home to the Mount Rushmore National Memorial, which hosts over two million tourists and visitors per year.

Auto Insurance for learner’s permit / provisional license question – South Dakota

byu/sodakdave inInsurance

South Dakota is the fifth least populated state in America while simultaneously being the fifth least densely populated state in the U.S. South Dakota has approximately 880,000 residents and more than 940,000 registered vehicles. But while driving a car, a motorcycle, or an RV up and down South Dakota’s scenic shoreline, you must remember one very important driving detail: You need car insurance.

Finding the right type of car insurance and a decent provider can be daunting and time-consuming- and that’s exactly why we put together this ultimate guide to South Dakota car insurance. Sometimes, looking for a provider can be difficult.

We can supply you with the top 8 insurance providers in your area, whether you live in a big city like Sioux Falls, Rapid City, or Aberdeen, or a lesser-populated area such as Watertown or Brookings. In this guide, we’ll cover car insurance coverage, laws, risks of the road, and more. Don’t go away! Car insurance coverage, rates, and the best Aberdeen, SD, auto insurance options are up first.

South Dakota Car Insurance Coverage and Rates

How do you know what type of insurance is right for you? Do you think you might be paying too much for your car insurance policy? We want you to know exactly what you’re paying for and why you’re paying for it. But before we get into insurance coverage laws and regulations, let’s explore South Dakota’s car culture.

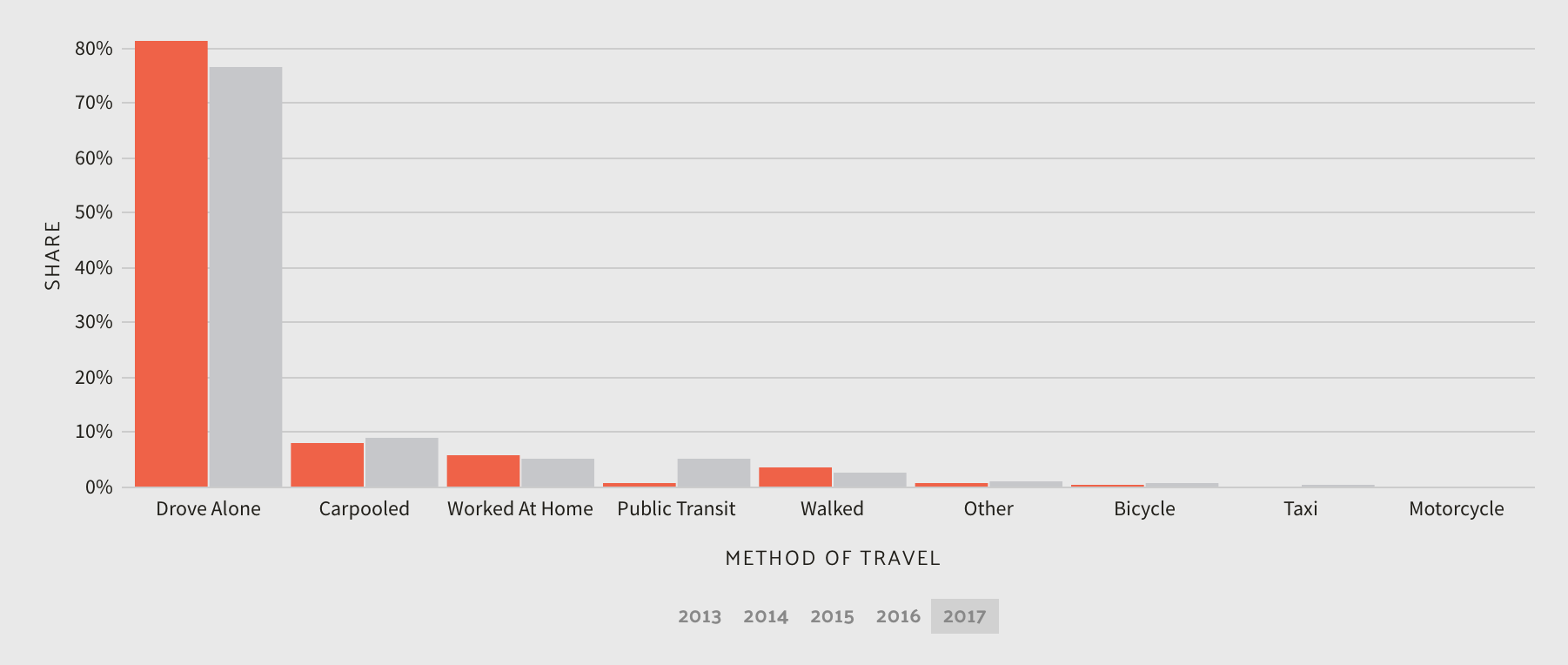

South Dakota’s Car Culture

South Dakota has two major sections: East River and West River. Most of the state’s population lives in East River, so the back roads in West River are often lonely.

With a state this size, South Dakota drivers rely heavily on their vehicles to get from the East River to the West River and back. Many workers commute to bigger cities like Pierre and Sioux Falls, but the popular mode of transportation remains the automobile. South Dakota is a popular destination for campers and skiers, making vehicles sturdy enough to pull a pop-up trailer or carry a roof rack a common choice among locals.

With this in mind, understanding the different types of car insurance is crucial to ensure the right coverage. The Ford F150, the most purchased vehicle in the state, often requires policies that meet auto insurance South Dakota requirements and align with the average cost of car insurance in South Dakota.

South Dakota Minimum Coverage

Every driver in the state of South Dakota must have car insurance. This is a law set up to protect every driver from going bankrupt if and when they are involved in an accident. But there are many different policies, so how do you know which one is right for you?

What is the best way to get the cheapest auto insurance quote?

byu/CheetahDesperate6146 inInsurance

That part is easy! Drivers in South Dakota are required to carry at least a minimum liability insurance policy. This insurance policy is there to work as a safety net- it’s not guaranteed to make sure you escape all injuries when you fall, but it’s there to keep you from cracking open your skull on the pavement.

In other words, minimum coverage helps you cover the costs of damages resulting from an accident, but it is likely not going to cover all of the costs of incurred damages. The requirements for minimum liability coverage in the state of South Dakota are as follows:

- $25,000 liability coverage for bodily injury or death of one person in an accident caused by the owner/driver of the insured vehicle

- $50,000 liability coverage for total bodily injury or death liability in an accident caused by the owner/driver of the insured vehicle

- $25,000 liability coverage for property damage per accident caused by the owner/driver of the insured vehicle

This is also sometimes referred to as the 25/50/25 policy. Note that South Dakota requires twice as much money for personal injury as it does for property damage.

South Dakota drivers must carry minimum liability coverage since the state is considered at-fault, ensuring financial protection in accidents caused by the driver.

Scott W. Johnson Licensed Insurance Agent

Now that you know you need to carry at least the minimum amount of insurance required, don’t you want to know why you need to take it? When we say South Dakota is an at-fault state, we mean that anyone who causes a car accident is liable for covering any costs of property damages and personal injury bills that resulted from that accident.

If you caused an accident and three people were injured, you’re responsible for their medical bills. Hopefully, your minimum liability policy covers the costs, but $100,000 won’t go far with hospital bills. That’s why we recommend exploring auto insurance coverage options through the best South Dakota auto insurance company, even if you’re seeking cheap car insurance in South Dakota.

Forms of Financial Responsibility

A form of financial responsibility is just a form that proves you can be and will be held liable in the case of an accident. This is also known as “proof of insurance.” Have you ever been pulled over, and the police officer asked for your registration and proof of insurance? He’s checking to see that you obey the law by carrying insurance.

Acceptable forms of proof of insurance are:

- Valid liability insurance ID cards

- Copy of your current car’s insurance policy

- Valid insurance binder (a temporary form of car insurance)

- Electronic insurance ID cards

You could face serious penalties if caught driving without proof of insurance.

According to the South Dakota Department of Public Safety Motor Vehicle Division, a conviction for driving without proof of insurance is considered a “Class 2 Misdemeanor” punishable by 30 days in jail, a $100 fine, or both.

In addition, the offender’s driver’s license will be suspended for at least 30 days and for up to one year, depending on how to get insurance on your driver’s license to meet state requirements and regain driving privileges.

Premiums as a Percentage of Income

Your insurance premium is the amount you will pay for your yearly insurance policy. But what is the average premium in South Dakota, and what percentage of a person’s income is spent on car insurance annually?

In 2014, South Dakota residents spent an average of $744.28 per year on their car insurance policy.

South Dakota’s average income per capita in the same year (2014) was $41,825.00. This means drivers in South Dakota spend an average of 1.78 percent of their total disposable income a year on car insurance alone. When comparing this average to surrounding states, North Dakotans pay about $20 more yearly, and Nebraskans pay about $60 more per year for car insurance.

This rate isn’t that high, considering the national average car insurance premium is around $981 annually. In 2012, South Dakotans only paid 1.67 percent of their income for their car insurance policy. The trend shows rates increase every year due to various factors that affect your car insurance premiums. Since these statistics were recorded in 2014, rates are likely higher now.

Core Car Insurance Coverage in South Dakota

The above data is pulled directly from the National Association of Insurance Commissioners. This data is from 2015, so you can expect rates to be higher in 2019 and so on. Carrying minimum coverage will keep you out of prison, but it might not keep you from owing thousands of dollars to repair someone’s car when an accident happens.

Coverage Type and Costs in South Dakota

| Coverage Type | Monthly Cost |

|---|---|

| Liability | $25 |

| Collision | $17 |

| Comprehensive | $22 |

| Combined | $64 |

It’s always a great idea to carry more than the minimum required—your wallet will thank you down the road. Looking to enhance your existing policy? Up next, we will cover the types of auto insurance coverage, add-ons, and endorsements.

Additional Liability Coverage in South Dakota

Loss Ratio for South Dakota

| Loss Ratio | 2012 | 2013 | 2014 |

|---|---|---|---|

| Medical Payments (MedPay) | 70% | 73% | 70% |

| Uninsured/Underinsured Motorist Coverage (UUM) | 52% | 46% | 58% |

Medpay, uninsured, and underinsured motorist coverage are all optional plans to add to your minimum insurance policy. At the moment, it’s easy to disregard them because you think you’ll never need them.

But really, these add-ons are very important to have.

Here’s why:

7.70 percent of motorists in South Dakota are uninsured. This means the state is ranked 42nd in the U.S. for uninsured drivers.

Let’s say you’re minding your own business one day, and suddenly, you’re hit by an uninsured driver. You need to go to the hospital because you broke your leg and you have pieces of shard stuck in your hands. Your car was totaled. Since South Dakota is technically an at-fault state, the person who hit you must call his or her insurance company.

This person is an uninsured driver, so there is no insurance company to call. This person doesn’t have thousands of dollars for your medical bills and a totaled vehicle, so what happens? The driver that hit you goes bankrupt while they’re attempting to pay your bills. This is where uninsured or underinsured motorist insurance coverage steps in. But what is the loss ratio?

The loss ratio shows how many claims, including automobile liability coverage, were paid versus unpaid. This matters because insurers don’t always pay 100% of claims. For example, MedPay and uninsured claims typically see 50-80% payouts.

If a company is paying too many claims (over 100 percent usually) than that company could be at serious risk of going bankrupt, and you don’t want that because then, you’ll never get your claim paid. On the other hand, if a company hasn’t paid out enough claims (under 50 percent), your insurance company might scam you.

This could mean that the company receives premiums from thousands of clients yearly and does not pay out half of the filed claims it receives. So, what should you look for when finding a new provider? Ensure the provider’s loss ratio is between 60 and 100 percent, and you should be good to go.

Add-ons, Endorsements, and Riders

MedPay and uninsured liability insurance are just two options to add to a basic policy.

Click on the links below to learn more about each type of car insurance.

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-As-You-Drive or Usage-Based Insurance

Buy one add-on, or buy them all! You’re never limited to how much car insurance you can buy: the more, the merrier.

Now that you understand all of the different types of car insurance, it’s time to start talking about factors that can affect your insurance rate. How do you get the best rate? Can you control the rate at all? What companies have the best rates? All that and more – up next.

Demographic Rates – Male vs. Female vs. Age

Even though it probably shouldn’t, gender and marital status can affect your rate. Age affects your rate as well, but we understand that the younger you are, the less experience you have, and the less likely you are to be in a car accident.

South Dakota Auto Insurance Monthly Rates by Age and Gender

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| $774 | $887 | $285 | $298 | $263 | $260 | $243 | $249 | |

| $500 | $678 | $191 | $225 | $184 | $185 | $166 | $168 | |

| $710 | $762 | $246 | $253 | $213 | $213 | $195 | $204 | |

| $471 | $523 | $198 | $189 | $192 | $193 | $187 | $190 | |

| $968 | $1,143 | $330 | $375 | $317 | $321 | $287 | $307 |

| $480 | $598 | $224 | $241 | $197 | $199 | $178 | $185 |

| $724 | $802 | $225 | $230 | $191 | $181 | $166 | $171 | |

| $496 | $610 | $195 | $213 | $173 | $173 | $156 | $156 | |

| $776 | $1,071 | $194 | $208 | $182 | $183 | $171 | $173 | |

| $401 | $449 | $166 | $177 | $129 | $128 | $121 | $85 |

Men typically pay more for car insurance than women, and rates usually decrease once you get married. But what other factors related to auto insurance coverage can affect your car insurance rate?

Cheapest Rates by Zip Codes in South Dakota

Where you live can also affect your rate, making it essential to choose the right coverage.

Cheapest rate by Zip Code in South Dakota

| ZIP Code | City | Monthly Rates |

|---|---|---|

| 57064 | Tea | $111 |

| 57106 | Sioux Falls | $111 |

| 57201 | Watertown | $112 |

| 57006 | Brookings | $112 |

| 57108 | Sioux Falls | $113 |

| 57107 | Sioux Falls | $113 |

| 57197 | Sioux Falls | $113 |

| 57007 | Brookings | $113 |

| 57105 | Sioux Falls | $114 |

| 57110 | Sioux Falls | $114 |

Cheapest Rates by Cities in South Dakota

Below is a list of cities in South Dakota with the cheapest insurance rates, including available car insurance discounts to help you save.

Cheapest Rates by Cities in South Dakota

| City | Monthly Rates |

|---|---|

| Watertown | $289 |

| Vermillion | $296 |

| Brookings | $298 |

| Alcester | $298 |

| Bruce | $299 |

| Elk Point | $299 |

| Beresford | $299 |

| Volga | $299 |

| Flandreau | $299 |

| Sinai | $299 |

| Madison | $3,592 |

| Aurora | $3,593 |

| Burbank | $3,594 |

| Winfred | $3,596 |

| White | $3,597 |

| Egan | $3,599 |

| Hudson | $3,599 |

| De Smet | $3,602 |

| Brandon | $3,604 |

| Jefferson | $3,604 |

| Fairview | $3,604 |

| Monroe | $3,611 |

| Lake Preston | $3,611 |

| Arlington | $3,611 |

| Rutland | $3,612 |

| Trent | $3,612 |

| Salem | $3,613 |

| Badger | $3,614 |

| Elkton | $3,615 |

| Marion | $3,615 |

| Chancellor | $3,616 |

| Canistota | $3,616 |

| Colman | $3,617 |

| Oldham | $3,618 |

| Ramona | $3,618 |

| Nunda | $3,621 |

| Viborg | $3,622 |

| Hurley | $3,624 |

| Erwin | $3,625 |

| Valley Springs | $3,628 |

| Dell Rapids | $3,629 |

| Bridgewater | $3,629 |

| Centerville | $3,629 |

| Tea | $3,632 |

| North Sioux City | $3,632 |

| Spencer | $3,634 |

| Wakonda | $3,634 |

| Fedora | $3,635 |

| Garretson | $3,637 |

| Davis | $3,637 |

| Worthing | $3,639 |

| Montrose | $3,639 |

| Canton | $3,644 |

| Aberdeen | $3,644 |

| Iroquois | $3,647 |

| Wentworth | $3,649 |

| Virgil | $3,650 |

| Yale | $3,650 |

| Gayville | $3,652 |

| Parker | $3,653 |

| Howard | $3,654 |

| Carthage | $3,654 |

| Cavour | $3,654 |

| Lennox | $3,656 |

| Freeman | $3,659 |

| Colton | $3,663 |

| Volin | $3,664 |

| Hitchcock | $3,664 |

| Renner | $3,665 |

| Harrisburg | $3,667 |

| Humboldt | $3,667 |

| Wolsey | $3,669 |

| Canova | $3,670 |

| Emery | $3,673 |

| Astoria | $3,674 |

| Tripp | $3,676 |

| Hartford | $3,676 |

| Woonsocket | $3,677 |

| Hazel | $3,681 |

| Chester | $3,681 |

| Alpena | $3,683 |

| Lane | $3,683 |

| Clear Lake | $3,683 |

| Sioux Falls | $3,684 |

| Delmont | $3,686 |

| Kaylor | $3,686 |

| Baltic | $3,687 |

| Crooks | $3,687 |

| Parkston | $3,689 |

| Irene | $3,690 |

| Brandt | $3,690 |

| Castlewood | $3,691 |

| Toronto | $3,693 |

| Kranzburg | $3,693 |

| Carpenter | $3,693 |

According to this list, Watertown has the cheapest insurance rate.

Best South Dakota Car Insurance Companies

With thousands of car insurance providers, how do you know which one to choose? You may select the one with the cheapest rates, but what other things should you look for when finding a new company to ensure you?

To get the best South Dakota car insurance, focus on finding a provider that offers a balance of affordable rates, comprehensive coverage, and strong customer service.

Schimri Yoyo Licensed Agent & Financial Advisor

This section will discuss customer service satisfaction, complaints, A.M. Best ratings, and continuous coverage insurance discounts. Don’t go away—financial ratings are up first.

The 10 Largest Insurance Companies Financial Ratings in South Dakota

As shown in the table below, the A.M. Best ratings prove a company’s financial strength, and based on these ratings, these companies are some of the best in the business.

The 10 Largest Companies in South Dakota Ratings

| Company | AM Best Rating | Direct Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|---|

| State Farm Group | A++ | $107,435 | 66% | 20% |

| Progressive Group | A+ | $75,757 | 59% | 14% |

| American Family Insurance Group | A | $52,467 | 59% | 10% |

| Farmers Mutual Insurance Co of NE | A | $27,061 | 63% | 5% |

| Nationwide Corp Group | A+ | $26,794 | 58% | 5% |

| Farmers Insurance Group | NR | $25,241 | 53% | 5% |

| USAA Group | A++ | $23,416 | 79% | 4% |

| Iowa Farm Bureau Group | NR | $20,892 | 62% | 4% |

| DeSmet Insurance Group | NR | $18,654 | 78% | 3% |

| Geico | A++ | $17,660 | 74% | 3% |

All of these companies stay in the loss ratio safe zone, maintaining percentages over 50% and under 100%, which is important when determining how much insurance coverage you need for proper protection without overspending.

South Dakota Companies with the Best Ratings

After you’ve just been in an accident, the last thing you want to deal with is a nasty insurance agent questioning you over the phone- that’s why customer service is a huge deal when it comes to being in the insurance industry.

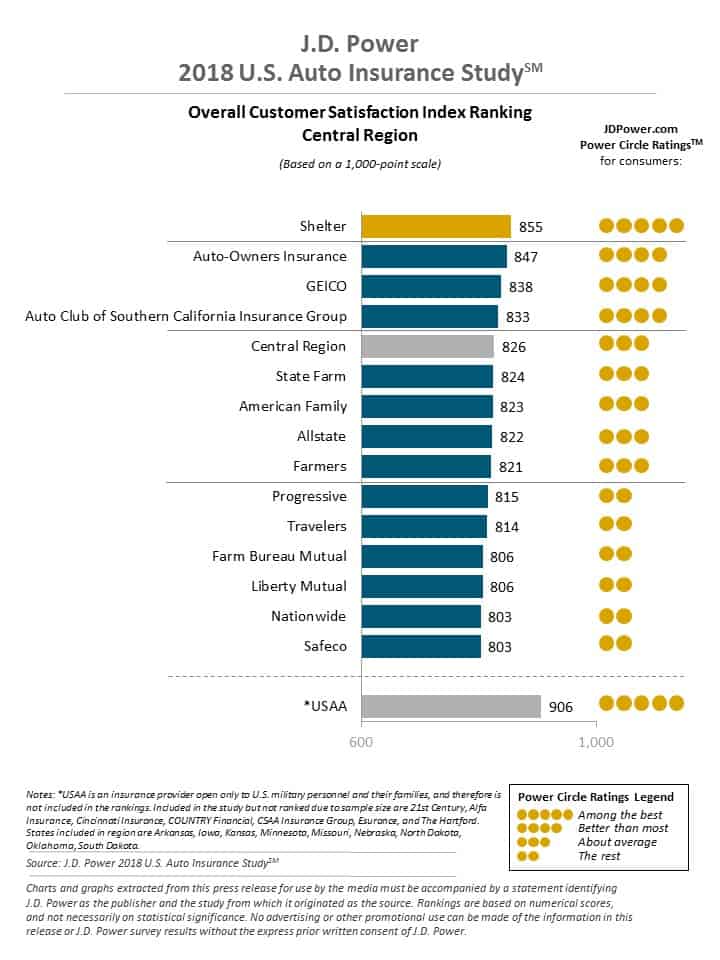

The chart below by J.D. Power ranks some of the best car insurance companies in South Dakota and the surrounding region. These rankings are based on five categories: interaction, policy offerings, price, billing process and policy information, and claims.

Besides USAA, a company that only serves military members and their families, Shelter Insurance was ranked as the number one provider in Arkansas, Kansas, Minnesota, Missouri, Nebraska, North Dakota, Oklahoma, and South Dakota. It offers flexible coverage and competitive auto insurance deductible options.

Complaint Statistics for the Top Ten Largest Insurance Companies in South Dakota

The complaint statistics below are credited to the NAIC.

Complaints for the Top Ten Largest Companies in South Dakota

| Company | National Median Complaint Ratio | Company Complaint Ratio 2017 | Total Complaints 2017 |

|---|---|---|---|

| State Farm Group | 1 | 0.44 | 1482 |

| Progressive Group | 1 | 0.75 | 120 |

| American Family Insurance Group | 1 | 0.79 | 73 |

| Farmers Mutual Insurance Co of NE | N/A | N/A | N/A |

| Nationwide Corp Group | 1 | 0.28 | 25 |

| Farmers Insurance Group | 1 | 0 | 0 |

| USAA Group | N/A | N/A | N/A |

| Iowa Farm Bureau Group | 1 | 0.77 | 32 |

| DeSmet Insurance Group | N/A | N/A | N/A |

| Geico | N/A | N/A | N/A |

Every company receives complaints, but what truly matters is how a vehicle insurance provider manages and resolves those complaints.

South Dakota Car Insurance Rates by Company

After looking at the data below, I see that State Farm and Progressive Northern usually carry the cheapest average annual rates. Most of these rates are well below the national average.

Auto Insurance Monthly Rates by Provider in South Dakota

| Insurance Company | Monthly Rates | Compared to State Average | Percentage Compared to State Average |

|---|---|---|---|

| $173 | -$12.02 | -6.47% | |

| $189 | $3.02 | +1.62% | |

| $184 | -$1.91 | -1% | |

| $199 | $13.38 | +7% | |

| $210 | $24.38 | +13.12% |

| $127 | -$48.38 | -27.57% |

| $264 | $78.09 | +30% | |

| $175 | -$10.00 | -5.41% | |

| $215 | $29.38 | +15.75% | |

| $148 | -$37.01 | -20% |

Let’s get back to factors affecting your car insurance rate, such as how traffic violations increase car insurance rates, leading to higher premiums.

Commute Rates by Company in South Dakota

How far you drive daily is another important factor affecting your car insurance rate.

Imported from Manual Input

| Insurance Company | 10 Miles Commute, 6000 Monthly Mileage | 25 Miles Commute, 12000 Monthly Mileage |

|---|---|---|

| $385 | $404 | |

| $333 | $341 | |

| $313 | $313 | |

| $241 | $247 | |

| $624 | $624 |

| $227 | $227 |

| $311 | $311 | |

| $187 | $196 |

The difference between driving ten miles a day and 25 miles per day can affect your car insurance rate by a few hundred dollars. But you might also wonder, will my auto insurance cover other cars if you drive them frequently or for longer distances? This could influence your overall coverage and costs.

Coverage Level Rates by Companies in South Dakota

Some car insurance companies will give you a break on your policy’s cost if you buy more car insurance than just the minimum policy required.

South Dakota Auto Insurance Monthly Rates by Provider & Coverage Type

| Insurance Company | Low Coverage | Medium Coverage | High Coverage |

|---|---|---|---|

| $383 | $393 | $406 | |

| $341 | $347 | $325 | |

| $300 | $310 | $329 | |

| $237 | $243 | $251 | |

| $613 | $623 | $636 |

| $215 | $226 | $241 |

| $304 | $309 | $322 | |

| $185 | $191 | $197 |

Low coverage costs are typically only a couple hundred dollars cheaper than high coverage. However, reckless driving and auto insurance rates are closely related, and having better coverage could pay off significantly if you’re involved in a serious accident, especially when factoring in the risks of high-risk driving behaviors.

Credit History Rates by Companies in South Dakota

A good credit report will likely help you save some dough regarding your insurance policy. Take a look at the table below and see for yourself.

South Dakota Auto Insurance by Credit Score

| Insurance Company | Poor Credit History | Fair Credit History | Good Credit History |

|---|---|---|---|

| $479 | $375 | $326 | |

| $434 | $313 | $265 | |

| $354 | $298 | $286 | |

| $395 | $201 | $136 | |

| $904 | $542 | $426 |

| $275 | $216 | $190 |

| $360 | $299 | $276 | |

| $279 | $167 | $129 |

Many people don’t realize that your credit score can affect many aspects of your life. For instance, credit scores affect auto insurance rates. Good news for South Dakotans: They have the second-highest average credit scores of any state.

According to Experian, in 2017, South Dakota’s average credit score was 700. That’s a pretty good score and above the national average of 675.

When it comes to your insurance rate, the cash difference between having a good credit history and a poor credit history can be hundreds, if not thousands of dollars.

If you have had trouble with your credit score in the past, don’t worry—the sooner you fix it, the sooner your car insurance rate will decrease.

Driving Record Rates by Companies in South Dakota

The very first question car insurance companies often ask when giving you a quote is, “Have you been given a speeding ticket or been in an accident in the last three years?”

A person’s driving record is often one of the most significant factors when deciding a rate.

South Dakota Auto Insurance Monthly Rates by Provider & Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $326 | $365 | $379 | $504 | |

| $245 | $280 | $360 | $464 | |

| $267 | $319 | $337 | $329 | |

| $154 | $154 | $260 | $408 | |

| $526 | $638 | $652 | $679 |

| $164 | $190 | $228 | $326 |

| $269 | $324 | $363 | $290 | |

| $179 | $191 | $203 | $191 |

If you are convicted of just one DUI, you’re looking at paying thousands more per year for your insurance policy. Car insurance after a DUI will drastically increase, and you’ll likely have to pay hundreds of dollars in fines. You may also face jail time, as drinking and driving is a serious crime in South Dakota.

How Much Auto Insurance Costs in South Dakota

This guide explores the varying costs of auto insurance in South Dakota and provides insights into finding the most affordable rates in different cities, such as Aberdeen, Rapid City, Sioux Falls, and Watertown.

Find the Cheapest Insurance in Your City

| Find the Cheapest Insurance in Your City |

|---|

| Aberdeen, SD |

| Rapid City, SD |

| Sioux Falls, SD |

| Watertown, SD |

Understanding these factors, including how accidents affect car insurance rates, can help residents secure the best coverage for their needs and budgets.

Number of Insurers in South Dakota

You may wonder, “What’s the difference between domestic and foreign insurance?”

Number of Insurers in South Dakota

| Domestic | Foreign | Total Number of Licensed Insurers |

|---|---|---|

| 16 | 834 | 850 |

South Dakota domestic insurance laws are formed under South Dakota state law, which may differ from laws in other states. Foreign insurance laws, regulated at the federal level, apply uniformly across the U.S. While discussing state-specific regulations, let’s also consider the average auto insurance cost in South Dakota and how these laws can impact premiums.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

South Dakota State Laws

Sometimes, it can be complicated and overwhelming to be aware of every law written in any given state at any time in history. Some rules have been repealed, and some have just been put into practice, but every resident of South Dakota is required to follow these laws—even if the law seems kind of crazy or unknown.

To help you avoid getting fined or going to jail, we want to discuss specific driving laws and why following them is crucial. Even if you think you know all about South Dakota state laws, it’s still a good idea to refresh your memory. First, we’ll start with car insurance laws and the advantages of adding roadside assistance to your coverage.

Car Insurance Laws in South Dakota

Have you ever wondered how insurance laws are formed? According to the NAIC, state laws considerably influence auto insurance. Each state determines the type of tort law and threshold (if any) that applies, the type and amount of liability insurance required, and the system used for approving insurer rates and forms.

In South Dakota, car insurance rates/forms must be filed with and approved by the state insurance department before they can be used. This system ensures that companies aren’t just making up a random amount of money to charge their clients for their car insurance policies. Approval can be through a deemer provision, which indicates approval if rates/forms are not denied within a specified number of days.

Windshield Coverage

Although it’s not a law that an insurance company in South Dakota must replace a broken windshield without a deductible, individual companies may offer this option with a comprehensive coverage plan.

We’ve all been there: you’re driving down the road, and bam! Your windshield gets hit with a tiny rock that leaves a baseball-sized crack. More than likely, that crack is unfixable, and your whole windshield needs to be replaced.

If you have to pay a deductible or go through insurance to get it repaired, here are some laws you should be aware of.

- The consumer has the right to choose a repair vendor

- Aftermarket crash parts allowed with written notice in an estimate

If you live somewhere out west where the wind can be reckless, getting a comprehensive plan might be a good idea so you never need to pay out of pocket to fix a broken windshield.

High-Risk Insurance

No one’s perfect; accidents happen. That’s what insurance is there for in the first place. However, if you are caught driving without insurance, you may need to get what is called SR22 insurance or high-risk insurance.

A South Dakota SR-22 car insurance certificate, or financial responsibility insurance form, is proof that a driver is financially responsible for carrying the minimum car insurance required by the state.

SR-22 car insurance must be carried by uninsured drivers involved in an accident they caused that resulted in damages or injuries for which they failed to pay compensation. You may also be required to get SR-22 insurance if the following applies:

- You are a driver with unsatisfied judgments

- drivers whose licenses were revoked

- drivers who are under mandatory insurance supervision

- drivers with three or more mandatory insurance violation convictions on their driving record

Don’t forget: if you are required to get SR-22 insurance, your rates will likely increase.

Low-Income Insurance

South Dakota does not have a program to help out low-income families needing car insurance. However, there are other ways to save on your policy. Check out these discounts listed below:

- Student Discount

- Military Discount

- Homeowner’s Discount

- Multi-Car Discount

- Good Driver Discount

Don’t get down if your rate isn’t where you want it because of an accident; be sure to shop around for a company with an accident forgiveness program.

Automobile Insurance Fraud in South Dakota

The Insurance Information Institute defines fraud as “hard” or “soft.” Complex fraud occurs when someone deliberately fabricates claims or fakes an accident.

Soft insurance fraud, also known as opportunistic fraud, occurs when people pad legitimate claims, for example, or, in the case of business owners, list fewer employees or misrepresent their work to pay lower premiums for workers’ compensation.

Auto insurance fraud and claim buildup added between $4.8 billion and $6.8 billion to closed auto injury claim payments in 2007, according to the Insurance Research Council’s November 2008 study, Fraud and Buildup in Auto Insurance Claims: 2008 Edition.

Auto insurance fraud is a serious crime in the state of South Dakota and can be punishable by jail time and fines. Worried about committing insurance fraud? Don’t pad your claims and don’t fake an accident, and you should avoid car insurance fraud altogether.

Statute of Limitations in South Dakota

The statute of limitations law is how a state determines how long you can wait until it is too late to file a claim after an accident. This law protects both the driver and the insurance company. In South Dakota, you have three years after you get into an accident to file a claim for personal injury and six years to file a claim for property damage.

Don’t wait to file your claims! If too much time passes and an insurance company cannot process your claim because of the statute of limitations, you will be forced to cover the costs of damages and medical bills yourself.

South Dakota State Specific Laws

Here’s one weird state-specific driving law in South Dakota: A driver can be charged with a DUI even if he or she is not technically driving the vehicle. What do we mean?

If you are sitting in a parked car and are under the influence of alcohol, you can be charged with a DUI. Even if you are not behind the wheel, you can be convicted of a DUI.

Vehicle Licensing Laws

At this point, you probably know what a license is. But have you ever heard of a REAL ID?

By 2020, everyone wishing to fly domestically must have a REAL ID to get through airport security. Although you don’t need this ID to vote, you still will need it to fly.

Penalties for Driving Without Insurance

You should know that South Dakota law requires every driver to carry car insurance. But what are the penalties if you are caught driving without car insurance?

It doesn’t matter if it’s your first time driving without insurance or your seventh. The penalties are always the same.

- Fine: $100 and/or 30 days imprisonment

- License suspension for 30 days to one year

- Filing proof of insurance (SR-22) with the state for three years from the date of conviction

Failure to file proof of insurance after being convicted of driving without it will result in the suspension of your vehicle registration, license plates, and driver’s license. If you have car insurance but don’t carry proof of insurance, you could still face some of the same penalties. Acceptable forms of proof of insurance are:

- Copy of your current car’s insurance policy

- Electronic car insurance card

- Valid liability insurance ID cards

- Valid insurance binder (a temporary form of car insurance)

If you have a hard time remembering to carry a copy of your insurance card, ask your provider if they offer online access. Keeping a digital copy on your phone can be a lifesaver, ensuring you always have it available, which is one of the key driving tips for road safety in an emergency.

Teen Driver Laws in South Dakota

South Dakota is the only state in the U.S. where you can get a driver’s permit at 14. The table below has more laws about teen driving.

| Driver's Permit Laws | Time/Age |

|---|---|

| Mandatory Holding Period | 6 months (3 months with driver education) |

| Minimum Supervised Driving Time | None |

| Minimum Age | 14 Years Old |

South Dakota also has some rules for keeping young drivers and those with driver’s permits safe while on the road.

| Driver's License Restrictions | Time/Age |

|---|---|

| Nighttime restrictions | 10 p.m.-6 a.m. |

| Passenger restrictions (family members excepted unless noted otherwise) | None |

| Minimum age at which restrictions may be lifted | |

| Nighttime restrictions | until age 16 (min. age: 16) |

| Passenger restrictions | None |

License Renewal Procedures

If you are a 25-year-old or 95-year-old driver, you must renew your license every five years.

Proof of adequate vision is required at every renewal for those 65 and older and for those renewing their license in person.

All drivers may renew their license every other time online or by mail.

New Residents

If you are a new resident in South Dakota, you must transfer your driver’s license within 90 days. If you have a Commercial Driver’s License (CDL), you have 30 days.

You’ll also need to let your provider know you will need South Dakota car insurance. Please be aware that some insurance providers don’t cover drivers in certain states. Remember that South Dakota’s minimum liability car insurance requirements are:

- $25,000 liability coverage for bodily injury or death of one person in an accident caused by the owner/driver of the insured vehicle

- $50,000 liability coverage for total bodily injury or death liability in an accident caused by the owner/driver of the insured vehicle

- $25,000 liability coverage for property damage per accident caused by the owner/driver of the insured vehicle

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Negligent Operator Treatment System

The South Dakota Legislature defines negligent or reckless driving as “Any person who drives any vehicle upon a highway, alley, public park, recreational area, or upon the property of a public or private school, college, or university carelessly and heedlessly in disregard of the rights or safety of others, or without due caution and circumspection and at a speed or in a manner to endanger or be likely to endanger any person or property, is guilty of reckless driving.”

In South Dakota, reckless driving is a Class 1 misdemeanor. If you are convicted of careless driving, your license may be revoked for 30 days or more, and you may need to pay fines. Your car insurance rates will skyrocket if you have a reckless driving misdemeanor. If you don’t want that, don’t mess with the law, and be responsible every time you get behind the wheel.

South Dakota Rules of the Road

If you’re going to be driving in South Dakota on vacation, or even if you’re just passing through, you’ll need to know the rules of the road. What do we mean by rules of the road? Keep reading to find out more.

Fault vs No-Fault

South Dakota is considered to be an at-fault state. We discussed this above in more detail, but basically, it follows the principle, “if you break it, you buy it.”

If you cause a car accident, damage another person’s vehicle or property, and/or cause them personal injury, no-fault auto insurance helps cover medical expenses regardless of fault. However, you are still required to cover repair costs if you’re at fault, so having more insurance than the law requires is always better. Going bankrupt over an accident is no fun.

Seat Belt and Car Seat Laws

South Dakota wants its drivers to be safe while on the road. Read the laws in the table below to learn more about seatbelt requirements.

South Dakota Seat Belt Laws

| Seat Belt Laws | Requirements |

|---|---|

| Effective Since | January 1, 1995 |

| Primary Enforcement | no |

| Age/Seats Applicable | 18+ years in front seat |

| 1st Offense Max Fine | $20 |

Children also need to be safely buckled in at all times while driving. If you’re unsure about child car seat safety, keep reading below.

Car seat laws in South Dakota

| Type of Car Seat Required | Age |

|---|---|

| Car Seat | 4 years and younger and less than 40 pounds |

| Adult Belt Permissible | 5 through 17 years; all children 40+ pounds, regardless of age |

| Preference for Rear Seat | law states no preference for rear seat |

| Maximum Base Fine | $25 |

The fine for breaking these car seat laws is $25 plus fees. Keep your child safe while on the road. It’s always better to be safe than sorry.

If you were wondering if riding in the cargo area of a truck is illegal in South Dakota, it is not. However, the state doesn’t advise doing this because it is highly unsafe.

Keep Right and Move Over Laws

Most states in the U.S. say that if you want to drive slow, keep right or move over. However, South Dakota has no law that says you must get over if you travel slower than the average traffic speed around you. You can legally drive at a minimum speed of 40 miles per hour on interstates or highways.

Now, if you’re driving next to someone driving much slower than the speed limit, the South Dakota state legislature says you may pass that person under these conditions:

- When the vehicle overtaken is making or about to make a left turn

- Upon a street or highway with unobstructed pavement, not occupied by parked vehicles, of sufficient width for two or more lines of moving vehicles in each direction

- Upon a one-way street, or upon any roadway on which traffic is restricted to one direction of movement, where the roadway is free from obstructions and of sufficient width for two or more lines of moving vehicles

A violation of these laws above is a class 2 misdemeanor.

Speed Limit Laws

South Dakota has some of the highest speed limits in the country. Below are its maximum speed limit laws.

Speed Limit laws in South Dakota

| Type of Roadway | Speed Limit |

|---|---|

| Rural Interstates | 80 mph |

| Urban Interstates | 80 mph |

| Other Limited Access Roads | 70 mph |

| Other Roads | 70 mph |

Speeding is often the most common type of traffic violation. If you get caught going over the speed limit, you will be fined and possibly incur points on your driving record, and your car insurance company will be notified and most likely raise your rates.

Ridesharing

Ridesharing insurance can be expensive, but finding cheap rideshare insurance is important if you plan on working for a ridesharing company like Uber or Lyft in South Dakota, as it’s required by law. You can read more about ridesharing laws and insurance here.

Automation on the Road

What is automation? As defined by the IIHS, automation involves using radar, cameras, and other sensors to perform parts or all of the driving tasks on a sustained basis instead of the driver. One example is adaptive cruise control, which continually adjusts the vehicle’s speed to maintain a minimum following distance.

Automation on the road is revolutionizing transportation by improving safety, optimizing traffic flow, and minimizing driver-related accidents.

Chris Abrams Licensed Insurance Agent

Features such as automatic braking, which acts as a backup if the human driver fails to brake, or blind spot detection, which provides additional information to the driver, aren’t considered automation under this definition. South Dakota has no laws on vehicle automation, but you can check back with IIHS every so often to see if this has changed.

Safety Laws in South Dakota

It’s important to know about the safety laws in your home state. In this section, we want to ensure you know South Dakota’s DUI, impaired driving and distracted driving laws.

DUI Laws

In 2017, there were 35 alcohol-impaired driving fatalities in South Dakota.

South Dakota DUI laws

| Name for Offense | Driving under the influence (DUI) |

|---|---|

| BAC Limit | 0.08 |

| High BAC Limit | 0.17 |

| Criminal Status | 1st-2nd class 1 misdemeanors, 3rd in 10 years class 6 felony, 4th in 10 years class 5 felony, 5th+ class 4 felonies |

| Look Back Period | 10 years |

Below are the penalties for drinking and driving based on the number of offenses.

DUI Penalties in South Dakota

| Number of Offense | ALS or Revocation | Imprisonment | Fine | Other |

|---|---|---|---|---|

| 1st Offense | 30 days - 1 year | no minimum, but up to 1 year | $2,000 minimum | |

| 2nd Offense | 6 months minimum; restricted permit eligible | no minimum, but up to 120 days | $2,000 minimum | if caught driving while license suspended, 3 days in county jail not able to be suspended |

| 3rd Offense | 1 year from date of imprisonment release; restricted permit eligible | no minimum, but up to 2 years | $4,000 | if caught driving while license suspended, 10 days in county jail not able to be suspended |

| 4th Offense | 2 years, restricted permit elegible |

If you are convicted of drinking and driving just one time, you can face jail time, lose your driver’s license, and pay $2,000 in fines—on top of seeing a dramatic increase in your car insurance rates. According to the “15 Worst U.S. Counties for Drunk Driving,” these consequences are especially serious in areas with high incidents. Don’t drink and drive; it’s not worth risking your life or someone else’s.

Marijuana-Impaired Driving Laws

In the state of South Dakota, if you are under 21 years old, there is a zero-tolerance policy for driving while using THC and metabolites. If you’re over the age of 21 and you’re using drugs of any kind while driving, you can be penalized for impaired driving.

Distracted Driving Laws

It is illegal for all drivers to text while driving. Studies have shown that texting while driving is almost always worse than drinking and driving.

Imported from Manual Input

| Hand-held ban | Young drivers all cellphone ban | Texting Ban | Enforcement |

|---|---|---|---|

| no | learner's permit and intermediate license holders | all drivers | secondary |

If you break these laws, you could be fined some serious dough. Texting can wait. Don’t bet your life on a few seconds while looking down at your phone.

Driving in South Dakota

Now that we’ve covered South Dakota’s safety, car insurance, and driving laws, let’s dive into road risks. Do you know your area’s vehicle theft rates? Which cars are stolen most? Why do road fatalities happen? Stay tuned—we’re starting with vehicle theft.

Vehicle Theft in South Dakota

The table below shows the most popular types of vehicles that are stolen.

Vehicle Thefts in South Dakota

| Make/Model | Year of Vehicle | Thefts |

|---|---|---|

| Chevrolet Pickup (Full Size) | 1994 | 52 |

| Ford Pickup (Full Size) | 2001 | 47 |

| Chevrolet Impala | 2004 | 24 |

| Dodge Pickup (Full Size) | 2001 | 23 |

| Honda Civic | 1996 | 23 |

| GMC Pickup (Full Size) | 1994 | 22 |

| Chevrolet Malibu | 2003 | 20 |

| Chevrolet Pickup (Small Size) | 1997 | 17 |

| Ford Taurus | 2006 | 17 |

| Jeep Cherokee/Grand Cherokee | 1999 | 17 |

The data from the table below is pulled directly from the FBI. This list shows how many vehicles were stolen in what city in 2016. Check to see how many cars are stolen in your area per year.

South Dakota Stolen Vehicles by City

| City | Motor vehicle theft |

|---|---|

| Aberdeen | 37 |

| Alcester | 0 |

| Avon | 0 |

| Belle Fourche | 0 |

| Beresford | 0 |

| Box Elder | 11 |

| Brandon | 1 |

| Brookings | 36 |

| Burke | 0 |

| Canton | 2 |

| Chamberlain | 0 |

| Clark | 2 |

| Deadwood | 0 |

| Eagle Butte | 0 |

| Flandreau | 6 |

| Freeman | 0 |

| Hermosa | 0 |

| Hot Springs | 0 |

| Huron | 17 |

| Kadoka | 0 |

| Lead | 0 |

| Lennox | 1 |

| Leola | 0 |

| Madison | 4 |

| Martin | 3 |

| Menno | 0 |

| Miller | 0 |

| Mitchell | 48 |

| Mobridge | 8 |

| North Sioux City | 3 |

| Parkston | 0 |

| Philip | 0 |

| Pierre | 28 |

| Rapid City | 250 |

| Rosholt | 0 |

| Scotland | 0 |

| Sioux Falls | 618 |

| Sisseton | 0 |

| Spearfish | 13 |

| Springfield | 0 |

| Sturgis | 7 |

| Summerset | 1 |

| Tea | 3 |

| Tripp | 0 |

| Tyndall | 0 |

| Vermillion | 17 |

| Viborg | 0 |

| Wagner | 1 |

| Watertown | 34 |

| Whitewood | 1 |

| Winner | 3 |

| Worthing | 0 |

| Yankton | 12 |

Some of these cities had zero theft. That’s not a typo; that’s the truth. Installing an anti-theft device could also qualify you for an anti-theft device insurance discount, further reducing your premiums.

Road Fatalities in South Dakota

No one likes to talk about something as depressing as death rates, but sometimes it’s important to know so we can prevent accidents and fatalities from happening later. In this next section, we will discuss fatality statistics: where they happen the most, what plays a role in a fatality, and why they happen in the first place.

Fatal Crashes by Weather Condition and Light Condition

Did the South Dakota weather play a role in traffic fatalities? Look below to find out.

Fatal Crashes by Weather Condition and Light Condition

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 56 | 2 | 36 | 2 | 2 | 98 |

| Rain | 1 | 0 | 3 | 1 | 0 | 5 |

| Snow/Sleet | 4 | 0 | 1 | 0 | 0 | 5 |

| Other | 1 | 0 | 0 | 0 | 0 | 1 |

| Unknown | 0 | 0 | 2 | 0 | 0 | 2 |

| TOTAL | 62 | 2 | 42 | 3 | 2 | 111 |

Most of these fatal crashes happened in broad daylight. Some happened at night in the dark. But as far as we can tell, crazy weather wasn’t a factor when it came to preventing death after a crash.

Fatalities (All Crashes) by County

Here’s a list of the number of traffic fatalities per county from 2013-2017 in South Dakota.

Fatalities (All Crashes) by County in South Dakota

| County Name | Fatalities 2013 | 2014 | 2015 | 2016 | 2017 | Fatalities Per 100k Population 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Aurora County | $4 | $1 | $3 | $2 | $0 | $147 | $36 | $109 | $73 | $0 |

| Beadle County | $2 | $1 | $4 | $0 | $2 | $11 | $6 | $22 | $0 | $11 |

| Bennett County | $1 | $1 | $1 | $0 | $0 | $29 | $29 | $29 | $0 | $0 |

| Bon Homme County | $2 | $2 | $0 | $3 | $0 | $29 | $29 | $0 | $43 | $0 |

| Brookings County | $7 | $4 | $2 | $4 | $3 | $21 | $12 | $6 | $12 | $9 |

| Brown County | $2 | $4 | $1 | $1 | $1 | $5 | $10 | $3 | $3 | $3 |

| Brule County | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Buffalo County | $0 | $0 | $0 | $1 | $0 | $0 | $0 | $0 | $49 | $0 |

| Butte County | $1 | $2 | $1 | $2 | $3 | $10 | $20 | $10 | $20 | $30 |

| Campbell County | $1 | $0 | $1 | $2 | $0 | $73 | $0 | $71 | $144 | $0 |

| Charles Mix County | $5 | $1 | $1 | $1 | $3 | $54 | $11 | $11 | $11 | $32 |

| Clark County | $3 | $1 | $0 | $1 | $0 | $83 | $27 | $0 | $27 | $0 |

| Clay County | $1 | $2 | $2 | $1 | $0 | $7 | $14 | $15 | $7 | $0 |

| Codington County | $2 | $5 | $2 | $2 | $2 | $7 | $18 | $7 | $7 | $7 |

| Corson County | $3 | $3 | $0 | $1 | $2 | $71 | $72 | $0 | $24 | $48 |

| Custer County | $1 | $3 | $5 | $2 | $1 | $12 | $36 | $59 | $23 | $12 |

| Davison County | $2 | $0 | $3 | $2 | $1 | $10 | $0 | $15 | $10 | $5 |

| Day County | $4 | $2 | $2 | $0 | $1 | $72 | $36 | $36 | $0 | $18 |

| Deuel County | $1 | $2 | $0 | $0 | $0 | $23 | $47 | $0 | $0 | $0 |

| Dewey County | $3 | $0 | $0 | $0 | $1 | $54 | $0 | $0 | $0 | $17 |

| Douglas County | $0 | $0 | $0 | $1 | $0 | $0 | $0 | $0 | $34 | $0 |

| Edmunds County | $0 | $3 | $6 | $2 | $2 | $0 | $76 | $150 | $51 | $51 |

| Fall River County | $2 | $1 | $1 | $0 | $2 | $29 | $15 | $15 | $0 | $30 |

| Faulk County | $0 | $0 | $2 | $1 | $0 | $0 | $0 | $87 | $43 | $0 |

| Grant County | $2 | $3 | $1 | $1 | $3 | $28 | $42 | $14 | $14 | $42 |

| Gregory County | $2 | $3 | $2 | $0 | $0 | $47 | $71 | $48 | $0 | $0 |

| Haakon County | $1 | $1 | $0 | $0 | $0 | $53 | $54 | $0 | $0 | $0 |

| Hamlin County | $1 | $1 | $1 | $1 | $0 | $17 | $17 | $17 | $17 | $0 |

| Hand County | $2 | $0 | $1 | $1 | $0 | $59 | $0 | $30 | $30 | $0 |

| Hanson County | $1 | $1 | $7 | $1 | $1 | $29 | $29 | $207 | $30 | $29 |

| Harding County | $1 | $1 | $1 | $0 | $2 | $79 | $80 | $79 | $0 | $161 |

| Hughes County | $1 | $0 | $1 | $1 | $3 | $6 | $0 | $6 | $6 | $17 |

| Hutchinson County | $1 | $1 | $2 | $0 | $0 | $14 | $14 | $28 | $0 | $0 |

| Hyde County | $0 | $0 | $0 | $3 | $0 | $0 | $0 | $0 | $224 | $0 |

| Jackson County | $0 | $2 | $3 | $3 | $6 | $0 | $61 | $91 | $91 | $182 |

| Jerauld County | $0 | $0 | $0 | $0 | $2 | $0 | $0 | $0 | $0 | $99 |

| Jones County | $1 | $1 | $1 | $1 | $2 | $103 | $104 | $109 | $107 | $214 |

| Kingsbury County | $1 | $2 | $0 | $1 | $2 | $20 | $40 | $0 | $20 | $40 |

| Lake County | $2 | $2 | $0 | $1 | $2 | $17 | $17 | $0 | $8 | $16 |

| Lawrence County | $7 | $6 | $8 | $10 | $8 | $28 | $24 | $32 | $40 | $31 |

| Lincoln County | $5 | $5 | $4 | $3 | $6 | $10 | $10 | $8 | $6 | $11 |

| Lyman County | $3 | $1 | $0 | $3 | $0 | $78 | $26 | $0 | $77 | $0 |

| Marshall County | $0 | $1 | $1 | $1 | $1 | $0 | $21 | $21 | $21 | $21 |

| Mccook County | $2 | $2 | $1 | $0 | $2 | $36 | $36 | $18 | $0 | $36 |

| Mcpherson County | $1 | $0 | $0 | $0 | $0 | $41 | $0 | $0 | $0 | $0 |

| Meade County | $7 | $6 | $6 | $4 | $3 | $27 | $22 | $22 | $15 | $11 |

| Mellette County | $2 | $1 | $2 | $0 | $0 | $98 | $48 | $99 | $0 | $0 |

| Miner County | $1 | $0 | $1 | $0 | $0 | $43 | $0 | $45 | $0 | $0 |

| Minnehaha County | $11 | $14 | $10 | $9 | $12 | $6 | $8 | $5 | $5 | $6 |

| Moody County | $1 | $3 | $4 | $0 | $1 | $16 | $47 | $62 | $0 | $15 |

| Pennington County | $9 | $13 | $16 | $10 | $17 | $9 | $12 | $15 | $9 | $15 |

| Perkins County | $1 | $1 | $0 | $0 | $1 | $33 | $33 | $0 | $0 | $34 |

| Potter County | $0 | $0 | $0 | $1 | $1 | $0 | $0 | $0 | $44 | $45 |

| Roberts County | $4 | $2 | $4 | $5 | $5 | $39 | $19 | $39 | $49 | $49 |

| Sanborn County | $1 | $1 | $1 | $0 | $1 | $43 | $43 | $43 | $0 | $41 |

| Shannon County | $6 | $2 | $6 | $14 | $11 | $0 | $0 | $0 | $0 | $0 |

| Spink County | $1 | $0 | $0 | $1 | $2 | $15 | $0 | $0 | $16 | $31 |

| Stanley County | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Sully County | $0 | $0 | $1 | $0 | $1 | $0 | $0 | $71 | $0 | $71 |

| Todd County | $1 | $2 | $0 | $1 | $1 | $10 | $20 | $0 | $10 | $10 |

| Tripp County | $0 | $1 | $0 | $1 | $0 | $0 | $18 | $0 | $18 | $0 |

| Turner County | $0 | $4 | $1 | $2 | $2 | $0 | $49 | $12 | $24 | $24 |

| Union County | $2 | $0 | $2 | $2 | $1 | $14 | $0 | $13 | $13 | $7 |

| Walworth County | $1 | $4 | $2 | $3 | $0 | $18 | $72 | $37 | $55 | $0 |

| Yankton County | $3 | $9 | $7 | $3 | $6 | $13 | $40 | $31 | $13 | $26 |

| Ziebach County | $3 | $2 | $0 | $0 | $0 | $105 | $70 | $0 | $0 | $0 |

Traffic Fatalities Rural vs Urban

Most people think fatal crashes happen more in the city than they do in the country. This might be because there are many more vehicles on the road in the city, so it only makes sense that more vehicles mean better chances for someone to get into an accident.

Traffic Fatalities Rural vs Urban in South Dakota

| Area | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Rural | 108 | 120 | 127 | 96 | 117 | 118 | 115 | 114 | 103 | 109 |

| Urban | 13 | 11 | 13 | 15 | 16 | 17 | 21 | 20 | 13 | 20 |

| Total | 121 | 131 | 140 | 111 | 133 | 135 | 136 | 134 | 116 | 129 |

This might be true of crashes in general, but it is not the case when it comes to fatal crashes, especially those involving fatal crasher drowsy driving. There are many more emergency services located in cities than in rural areas, so even if you are badly injured in a crash, you are more likely just minutes away from receiving the care you need to survive.

Fatalities by Person Type

Who dies in car accidents the most? Is it people who are riding a motorcycle? Pedestrians? Truck drivers? Read below for info on fatalities by person type.

Fatalities by Person Type in South Dakota

| Category | Person Type | 2013 | 2014 | 2015 | 2016 | 2017 | Total |

|---|---|---|---|---|---|---|---|

| Occupants | Passenger Car | 43 | 41 | 38 | 29 | 37 | 29 |

| Light Truck - Pickup | 26 | 36 | 29 | 27 | 24 | 19 | |

| Light Truck - Utility | 20 | 19 | 18 | 21 | 19 | 15 | |

| Light Truck - Van | 11 | 6 | 9 | 4 | 15 | 12 | |

| Large Truck | 2 | 4 | 1 | 2 | 6 | 5 | |

| Other/Unknown Occupants | 2 | 2 | 1 | 5 | 2 | 2 | |

| Total Occupants | 104 | 108 | 96 | 88 | 103 | 80 | |

| Motorcyclists | Total Motorcyclists | 22 | 17 | 31 | 22 | 16 | 12 |

| Nonoccupants | Pedestrian | 9 | 9 | 6 | 6 | 10 | 8 |

| Total Nonoccupants | 9 | 11 | 7 | 6 | 10 | 8 | |

| Bicyclist and Other Cyclist | 0 | 2 | 1 | 0 | 0 | 0 | |

| Total | Total | 135 | 136 | 134 | 116 | 129 | 100 |

Fatalities by Crash Type

What kinds of vehicles are most likely to be involved in a fatal crash?

Imported from Manual Input

| Crash Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Total Fatalities (All Crashes) | 135 | 136 | 134 | 116 | 129 |

| (1) Single Vehicle | 76 | 78 | 72 | 74 | 69 |

| (2) Involving a Large Truck | 18 | 21 | 13 | 5 | 21 |

| (3) Involving Speeding | 38 | 30 | 31 | 37 | 31 |

| (4) Involving a Rollover | 50 | 52 | 54 | 57 | 58 |

| (5) Involving a Roadway Departure | 87 | 95 | 87 | 81 | 93 |

| (6) Involving an Intersection (or Intersection Related) | 32 | 21 | 24 | 16 | 19 |

Five-Year Fatality Trend For The Top 10 Counties in South Dakota

Five Year Fatality Trend by County for South Dakota

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Pennington County | 9 | 13 | 16 | 10 | 17 |

| Minnehaha County | 11 | 14 | 10 | 9 | 12 |

| Shannon County | 6 | 2 | 6 | 14 | 11 |

| Lawrence County | 7 | 6 | 8 | 10 | 8 |

| Jackson County | 0 | 2 | 3 | 3 | 6 |

| Lincoln County | 5 | 5 | 4 | 3 | 6 |

| Yankton County | 3 | 9 | 7 | 3 | 6 |

| Roberts County | 4 | 2 | 4 | 5 | 5 |

| Brookings County | 7 | 4 | 2 | 4 | 3 |

| Butte County | 1 | 2 | 1 | 2 | 3 |

Fatalities Involving Speeding by County

Speeding is another sad and preventable cause of traffic fatalities.

Fatalities Involving Speeding by County in South Dakota

| County | Fatalities 2013 | 2014 | 2015 | 2016 | 2017 | Fatalities Per 100k Population 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Aurora County | $1 | $0 | $0 | $0 | $0 | 36.81 | 0 | 0 | 0 | 0 |

| Beadle County | $0 | $0 | $1 | $0 | $0 | $0 | $0 | $6 | $0 | $0 |

| Bennett County | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Bon Homme County | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Brookings County | $1 | $1 | $1 | $1 | $1 | $3 | $3 | $3 | $3 | $3 |

| Brown County | $0 | $1 | $0 | $0 | $0 | $0 | $3 | $0 | $0 | $0 |

| Brule County | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Buffalo County | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Butte County | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Campbell County | $0 | $0 | $0 | $1 | $0 | $0 | $0 | $0 | $72 | $0 |

| Charles Mix County | $2 | $0 | $0 | $1 | $1 | $22 | $0 | $0 | $11 | $11 |

| Clark County | $1 | $0 | $0 | $0 | $0 | $28 | $0 | $0 | $0 | $0 |

| Clay County | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Codington County | $2 | $3 | $2 | $1 | $0 | $7 | $11 | $7 | $4 | $0 |

| Corson County | $2 | $0 | $0 | $0 | $0 | $48 | $0 | $0 | $0 | $0 |

| Custer County | $0 | $2 | $0 | $1 | $0 | $0 | $24 | $0 | $12 | $0 |

| Davison County | $0 | $0 | $2 | $0 | $0 | $0 | $0 | $10 | $0 | $0 |

| Day County | $0 | $0 | $2 | $0 | $1 | $0 | $0 | $36 | $0 | $18 |

| Deuel County | $0 | $1 | $0 | $0 | $0 | $0 | $23 | $0 | $0 | $0 |

| Dewey County | $1 | $0 | $0 | $0 | $1 | $18 | $0 | $0 | $0 | $17 |

| Douglas County | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Edmunds County | $0 | $3 | $0 | $1 | $0 | $0 | $76 | $0 | $25 | $0 |

| Fall River County | $0 | $0 | $0 | $0 | $1 | $0 | $0 | $0 | $0 | $15 |

| Faulk County | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Grant County | $0 | $0 | $0 | $0 | $1 | $0 | $0 | $0 | $0 | $14 |

| Gregory County | $2 | $2 | $2 | $0 | $0 | $47 | $47 | $48 | $0 | $0 |

| Haakon County | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Hamlin County | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Hand County | $1 | $0 | $0 | $1 | $0 | $30 | $0 | $0 | $30 | $0 |

| Hanson County | $0 | $0 | $4 | $0 | $1 | $0 | $0 | $118 | $0 | $29 |

| Harding County | $0 | $1 | $0 | $0 | $1 | $0 | $80 | $0 | $0 | $81 |

| Hughes County | $0 | $0 | $0 | $1 | $1 | $0 | $0 | $0 | $6 | $6 |

| Hutchinson County | $0 | $1 | $1 | $0 | $0 | $0 | $14 | $14 | $0 | $0 |

| Hyde County | $0 | $0 | $0 | $3 | $0 | $0 | $0 | $0 | $224 | $0 |

| Jackson County | $0 | $0 | $2 | $2 | $0 | $0 | $0 | $61 | $61 | $0 |

| Jerauld County | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Jones County | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Kingsbury County | $0 | $1 | $0 | $0 | $0 | $0 | $20 | $0 | $0 | $0 |

| Lake County | $1 | $0 | $0 | $0 | $0 | $8 | $0 | $0 | $0 | $0 |

| Lawrence County | $1 | $0 | $2 | $5 | $2 | $4 | $0 | $8 | $20 | $8 |

| Lincoln County | $2 | $0 | $1 | $2 | $3 | $4 | $0 | $2 | $4 | $5 |

| Lyman County | $1 | $1 | $0 | $2 | $0 | $26 | $26 | $0 | $51 | $0 |

| Marshall County | $0 | $0 | $1 | $1 | $0 | $0 | $0 | $21 | $21 | $0 |

| Mccook County | $1 | $1 | $1 | $0 | $0 | $18 | $18 | $18 | $0 | $0 |

| Mcpherson County | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Meade County | $3 | $5 | $1 | $0 | $1 | $11 | $19 | $4 | $0 | $4 |

| Mellette County | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Miner County | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Minnehaha County | $3 | $3 | $0 | $3 | $3 | $2 | $2 | $0 | $2 | $2 |

| Moody County | $0 | $1 | $0 | $0 | $0 | $0 | $16 | $0 | $0 | $0 |

| Pennington County | $2 | $2 | $4 | $4 | $3 | $2 | $2 | $4 | $4 | $3 |

| Perkins County | $0 | $0 | $0 | $0 | $1 | $0 | $0 | $0 | $0 | $34 |

| Potter County | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Roberts County | $2 | $0 | $2 | $2 | $0 | $20 | $0 | $20 | $20 | $0 |

| Sanborn County | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Shannon County | $4 | $0 | $1 | $0 | $7 | $0 | $0 | $0 | $0 | $0 |

| Spink County | $0 | $0 | $0 | $0 | $1 | $0 | $0 | $0 | $0 | $16 |

| Stanley County | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Sully County | $0 | $0 | $0 | $0 | $1 | $0 | $0 | $0 | $0 | $71 |

| Todd County | $0 | $1 | $0 | $1 | $0 | $0 | $10 | $0 | $10 | $0 |

| Tripp County | $0 | $0 | $0 | $1 | $0 | $0 | $0 | $0 | $18 | $0 |

| Turner County | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Union County | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Walworth County | $1 | $0 | $1 | $1 | $0 | $18 | $0 | $18 | $18 | $0 |

| Yankton County | $1 | $0 | $0 | $2 | $0 | $4 | $0 | $0 | $9 | $0 |

| Ziebach County | $3 | $0 | $0 | $0 | $0 | $105 | $0 | $0 | $0 | $0 |

Fatalities in Crashes Involving an Alcohol-Impaired Driver (BAC = .08+) by County

Drunk driving plays a major role when it comes to fatal crashes.

Alcohol Impaired Fatalities in South Dakota

| County | Fatalities 2013 | 2014 | 2015 | 2016 | 2017 | Fatalities Per 100k Population 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Aurora County | $1 | $0 | $1 | $0 | $0 | $37 | $0 | $36 | $0 | $0 |

| Beadle County | $0 | $1 | $3 | $0 | $0 | $0 | $6 | $17 | $0 | $0 |

| Bennett County | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Bon Homme County | $1 | $1 | $0 | $0 | $0 | $14 | $14 | $0 | $0 | $0 |

| Brookings County | $1 | $4 | $1 | $0 | $0 | $3 | $12 | $3 | $0 | $0 |

| Brown County | $0 | $0 | $1 | $0 | $0 | $0 | $0 | $3 | $0 | $0 |

| Brule County | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Buffalo County | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Butte County | $0 | $1 | $0 | $1 | $2 | $0 | $10 | $0 | $10 | $20 |

| Campbell County | $0 | $0 | $0 | $1 | $0 | $0 | $0 | $0 | $72 | $0 |

| Charles Mix County | $5 | $1 | $1 | $1 | $1 | $54 | $11 | $11 | $11 | $11 |

| Clark County | $1 | $0 | $0 | $0 | $0 | $28 | $0 | $0 | $0 | $0 |

| Clay County | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Codington County | $1 | $0 | $0 | $1 | $0 | $4 | $0 | $0 | $4 | $0 |

| Corson County | $0 | $0 | $0 | $0 | $1 | $0 | $0 | $0 | $0 | $24 |

| Custer County | $0 | $1 | $2 | $0 | $0 | $0 | $12 | $24 | $0 | $0 |

| Davison County | $0 | $0 | $2 | $0 | $0 | $0 | $0 | $10 | $0 | $0 |

| Day County | $0 | $0 | $2 | $0 | $1 | $0 | $0 | $36 | $0 | $18 |

| Deuel County | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Dewey County | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Douglas County | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Edmunds County | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Fall River County | $1 | $1 | $1 | $0 | $1 | $15 | $15 | $15 | $0 | $15 |

| Faulk County | $0 | $0 | $2 | $0 | $0 | $0 | $0 | $87 | $0 | $0 |

| Grant County | $1 | $2 | $0 | $1 | $0 | $14 | $28 | $0 | $14 | $0 |

| Gregory County | $1 | $0 | $0 | $0 | $0 | $24 | $0 | $0 | $0 | $0 |

| Haakon County | $0 | $1 | $0 | $0 | $0 | $0 | $54 | $0 | $0 | $0 |

| Hamlin County | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Hand County | $0 | $0 | $1 | $0 | $0 | $0 | $0 | $30 | $0 | $0 |

| Hanson County | $0 | $0 | $0 | $1 | $1 | $0 | $0 | $0 | $30 | $29 |

| Harding County | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Hughes County | $0 | $0 | $0 | $1 | $0 | $0 | $0 | $0 | $6 | $0 |

| Hutchinson County | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |