Geico offers low-cost coverage with discounts for safe driving and safety features. Travelers average $25 per month for full coverage. State Farm provides affordable policies with support from local agents. Insurance quotes vary based on driving history, vehicle type, and location.

Cheap Auto Insurance in Pennsylvania for 2025 (Save Money With These 10 Companies)

Geico offers cheap car insurance in Pennsylvania, with rates starting at $23/month for minimum coverage. Premiums vary based on factors like ZIP code, credit, and driving history. Compare quotes to find the most affordable car insurance in Pennsylvania.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Apr 12, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage in Pennsylvania

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 1,733 reviews

1,733 reviewsCompany Facts

Min. Coverage in Pennsylvania

A.M. Best Rating

Complaint Level

Pros & Cons

1,733 reviews

1,733 reviews 18,154 reviews

18,154 reviewsCompany Facts

Min. Coverage in Pennsylvania

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviewsGeico, Travelers, and State Farm offer some of the cheapest auto insurance rates in Pennsylvania.

Our Top 10 Company Picks: Cheap Auto Insurance in Pennsylvania

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $23 | A++ | Basic Coverage | Geico | |

| #2 | $25 | A++ | Frequent Commuters | Travelers | |

| #3 | $26 | B | Customer Service | State Farm | |

| #4 | $29 | A+ | Full Coverage | Nationwide |

| #5 | $36 | A | Young Drivers | American Family | |

| #6 | $44 | A | Comprehensive Coverage | Farmers | |

| #7 | $49 | A+ | New Drivers | Allstate | |

| #8 | $50 | A+ | Custom Coverage | Progressive | |

| #9 | $73 | A | Custom Discounts | Liberty Mutual |

| #10 | $78 | A+ | Low Rates | Erie |

Compare providers to find cheap auto insurance in Pennsylvania. Take advantage of discounts, drive safely, and select the right coverage to lower your premium.

Read More:

Comparing multiple quotes from various providers is essential to find a policy that best fits individual needs and budgets.

- Geico offers the lowest average rates in Pennsylvania

- Pennsylvania’s average monthly premium is $29 for minimum coverage

- Premiums vary by ZIP code, credit score, and driving history

Below, we highlight cheap auto insurance options in Pennsylvania and the providers with the lowest rates. Enter your ZIP code to compare free quotes.

#1 – Geico: Top Overall Pick

Pros

Pros

- Affordable Rates: Geico offers some of the cheapest auto insurance in Pennsylvania, with monthly premiums starting as low as $23. This makes it an ideal choice for cost-conscious drivers. Learn more by reading our Geico insurance review

- Multiple Discounts: Geico auto insurance in Pennsylvania offers a range of discounts, including safe driver rewards and vehicle safety feature discounts, which can help you save more on cheap auto insurance.

- Strong Digital Tools: Geico’s efficient online platform allows easy access to policy management, making it a convenient choice for drivers looking for cheap car insurance online in PA.

Cons

- Higher Rates for Younger Drivers: Geico’s affordable rates may not extend to younger drivers, who can face higher premiums for their lack of driving experience.

- Longer Claims Processing: While Geico offers affordable premiums, some customers have reported longer wait times for claims to be processed.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#1 – Travelers: Cheapest Coverage Rates

Pros

Pros

- Discount-Based Savings: Travelers’ IntelliDrive program rewards safe driving habits, providing lower premiums for those who maintain a good driving record. This makes it a strong option for cheap auto insurance in Pennsylvania. Learn more by reading our review of Travelers

- Solid Customer Service: Travelers auto insurance has a strong reputation for customer service. It ensures policyholders have access to assistance when needed, enhancing the value of their affordable auto insurance.

- Flexible Coverage Options: Travelers offers a wide range of coverage options, including comprehensive and collision coverage, ensuring you get cheap auto insurance with the coverage you need.

Cons

- Higher Rates for Riskier Drivers: Drivers with past accidents or violations may find Travelers’ premiums higher than those of other providers.

- Limited Digital Tools: Travelers’ online tools are not as advanced or user-friendly as some competitors, which may affect the convenience of managing your cheap auto insurance in Pennsylvania.

#3 – State Farm: Cheapest For Safe Drivers

Pros

Pros

- Personalized Service: State Farm’s vast network of local agents provides personalized service, making it a top choice for those seeking affordable auto insurance in Pennsylvania with a personal touch. Read more in our full review on State Farm’s auto insurance

- Safe Driving Discounts: State Farm offers several discounts, including savings for good drivers, helping you lower your premium and access cheap auto insurance.

- Strong Financial Stability: With a solid financial reputation, State Farm provides peace of mind, ensuring reliable claims processing and support for policyholders seeking affordable auto insurance.

Cons

- Higher Premiums for Young Drivers: Despite its low rates, State Farm’s premiums may be higher for young drivers than those of competitors like Geico.

- Limited Digital Options: State Farm offers fewer digital tools for policy management compared to fully online providers, which may not be as convenient for some drivers seeking cheap auto insurance in Pennsylvania.

#4 – Nationwide: Cheapest For Accident Forgiveness

Pros

Pros

- Innovative Discount Programs: Nationwide’s Vanishing Deductible program rewards safe drivers by reducing deductibles with each claim-free year, making it an appealing option for cheap auto insurance in Pennsylvania. You can learn more in our Nationwide auto insurance review.

- Wide Coverage Options: Nationwide provides various coverage options, from basic liability to comprehensive plans, ensuring affordability without sacrificing protection.

- Consistent Customer Support: Nationwide is known for its reliable customer service, which helps drivers easily manage their affordable auto insurance policies.

Cons

- Claims Processing Delays: While Nationwide offers affordable coverage, some customers have noted that claims can take longer to process than those of other providers.

- Inconsistent Premiums: Premiums can vary significantly based on your location and driving history, potentially affecting the affordability of your coverage.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#5 – American Family: Cheapest for Loyalty Savings

Pros

Pros

- Customizable Coverage: American Family’s variety of coverage options ensures drivers can find cheap auto insurance in Pennsylvania that meets their specific needs, including specialized policies for home and auto bundling. Find out more about American Family in our American Family review.

- Strong Customer Satisfaction: American Family’s high customer satisfaction ratings make it a reliable option for affordable auto insurance, with a focus on personal agent relationships.

- Multiple Discounts: American Family offers various discounts, including bundling policies, allowing policyholders to lower their premiums and get the most affordable coverage.

Cons

- Higher Premiums for Young Drivers: Like many insurers, American Family’s premiums may be higher for young drivers, reducing their affordability.

- Limited Digital Management Tools: American Family’s digital platforms are not as robust as other companies, limiting the convenience of managing cheap auto insurance policies online.

#6 – Farmers: Cheapest for Family Drivers

Pros

Pros

- Hybrid and Electric Car Discounts: Farmers offers competitive rates for hybrid and electric vehicles, making it an excellent choice for those looking for cheap auto insurance in Pennsylvania with sustainable vehicle options. Check out our online Farmers review for more information.

- Wide Coverage Variety: Farmers provide an array of coverage options and add-ons, including roadside assistance and rental car coverage, ensuring affordable and reliable protection.

- Local Agent Network: Farmers’ network of local agents offers personalized service to help customers find affordable coverage that fits their needs.

Cons

- Higher Rates for High-Risk Drivers: Farmers’ premiums may be higher for drivers with a history of accidents or violations, affecting the affordability of their coverage.

- Limited Discounts: While Farmers offers discounts for electric and hybrid cars, it lacks some of the other discount options available from competitors.

#7 – Allstate: Cheapest For Detailed Coverage

Pros

Pros

- Safe Driver Incentives: Allstate’s Drivewise program offers discounts for safe driving, making it a good option for drivers seeking cheap auto insurance in Pennsylvania who maintain a clean record. Read more about this provider in our Allstate auto insurance review.

- Multiple Policy Bundling: Bundling home, auto, and other insurance types with Allstate can lower overall premiums, adding more savings to their affordable auto insurance policies.

- Strong Customer Service: Allstate offers solid customer service through a network of local agents, ensuring support when managing affordable auto insurance.

Cons

- Higher Premiums for New Drivers: Allstate’s rates may be less affordable for young and inexperienced drivers.

- Less Flexibility in Payment Plans: Allstate’s payment options can be less flexible than some online-based insurers, affecting its affordability for certain drivers.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#8 – Progressive: Cheapest Rates for Coverage Options

Pros

Pros

- Personalized Premiums: Progressive’s Snapshot program uses telematics to personalize premiums based on individual driving habits, helping you secure cheap auto insurance in Pennsylvania. Our complete Progressive review goes over this in more detail.

- Wide Range of Coverage Options: Progressive offers a variety of coverage options, ensuring drivers can find the right protection without sacrificing affordability.

- 24/7 Claims Assistance: Progressive’s round-the-clock claims assistance ensures that policyholders can easily file claims at any time, improving the accessibility of affordable auto insurance.

Cons

- Rates for High-Risk Drivers: Progressive’s rates may be higher for high-risk drivers, making it less affordable for those with past accidents or DUIs.

- Inconsistent Premiums: Premiums may vary widely based on driving history, which could lead to less predictable pricing for customers seeking affordable auto insurance.

#9 – Liberty Mutual: Many Unique Coverages

Pros

Pros

- Bundle and Save: Liberty Mutual provides significant savings for bundling auto and home insurance policies, helping you get cheap auto insurance in Pennsylvania while securing additional coverage. Liberty Mutual company review.

- New Car Replacement Coverage: Liberty Mutual’s new car replacement coverage helps drivers get a brand-new vehicle in case of a total loss, offering peace of mind with affordable auto insurance policies.

- Accident Forgiveness: Liberty Mutual offers accident forgiveness, which helps prevent rate increases after your first accident.

Cons

- Higher Premiums for Younger Drivers: Liberty Mutual’s premiums can be higher for younger drivers, making it less affordable for some customers.

- Limited Discounts for Low-Risk Drivers: Drivers without a history of accidents or violations may find fewer opportunities to lower their premiums with Liberty Mutual.

#10 – Erie: Cheapest For Full Coverage

Pros

Pros

- Strong Customer Support: Erie is known for its excellent customer service. It offers reliable assistance for claims and policy management, which enhances the affordability of its auto insurance coverage. Our Erie insurance review explores the company’s affordable coverage and discounts.

- Customizable Coverage: Erie car insurance in PA offers a wide range of coverage options, including umbrella policies, allowing drivers to customize their cheap auto insurance in Pennsylvania.

- Local Agent Availability: Erie’s network of local agents ensures personalized customer service to find the best affordable auto insurance for your needs.

Cons

- Limited Availability: Erie is not available in all states, reducing its accessibility for some drivers seeking affordable auto insurance.

- Higher Premiums for Riskier Drivers: Erie’s rates can be higher for high-risk drivers, which may affect its affordability for certain customers.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Auto Insurance Coverage and Rates in Pennsylvania

We know that the most affordable auto insurance policy is the one we need.

Pennsylvania Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $49 | $148 | |

| $36 | $108 | |

| $78 | $125 |

| $44 | $131 | |

| $23 | $68 | |

| $73 | $219 |

| $29 | $86 |

| $50 | $149 | |

| $26 | $76 | |

| $25 | $75 |

How do you know which policy features matter to you? A plan should offer enough auto insurance coverage and still be affordable. You need to know which features to skip and which to keep. This guide will help you decide.

Insurance Premium Rates by Gender – Male vs. Female Rates

Now that you have reviewed the different insurance options, let’s examine the factors that impact your premium rate.

A better standing on these factors can help you secure more discounts.

Pennsylvania Car Insurance Monthly Rates by Age & Gender

| Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| $574 | $641 | $196 | $202 | $174 | $172 | $160 | $163 | |

| $296 | $314 | $135 | $139 | $107 | $108 | $102 | $101 | |

| $420 | $465 | $150 | $155 | $120 | $125 | $108 | $110 |

| $681 | $743 | $199 | $216 | $157 | $165 | $143 | $158 | |

| $290 | $312 | $112 | $113 | $100 | $104 | $96 | $100 | |

| $455 | $495 | $175 | $182 | $144 | $149 | $130 | $135 |

| $413 | $498 | $144 | $154 | $114 | $118 | $99 | $115 |

| $646 | $711 | $157 | $160 | $123 | $119 | $104 | $106 | |

| $273 | $335 | $115 | $128 | $104 | $104 | $94 | $94 | |

| $350 | $433 | $121 | $126 | $114 | $118 | $97 | $101 |

Insurers in Pennsylvania don’t differentiate based on gender but consider age when calculating premiums. Teen drivers typically pay the highest premiums, but shopping around can help find the most economical rate.

Insurance Rates by Zip Code in Pennsylvania

Insurance premiums vary by zip code as insurers factor in local data. For example, if car thefts are frequent in your area, insurers may increase your premium.

25 Most Expensive Zip Codes in Pennsylvania

| Zip Code | City | Average by Zip Code | Most Expensive Company | Most Expensive Rate | 2nd Most Expensive Company | 2nd Most Expensive Rate | Cheapest Company | Cheapest Rate | 2nd Cheapest Company | 2nd Cheapest Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 16823 | Bellefonte | $260 | Travelers | $469 | Liberty Mutual | $403 | USAA | $115 | Geico | $151 |

| 16801 | State College | $263 | Travelers | $502 | Liberty Mutual | $403 | USAA | $115 | Geico | $151 |

| 16803 | State College | $267 | Travelers | $517 | Liberty Mutual | $403 | USAA | $115 | Geico | $151 |

| 17844 | Mifflinburg | $267 | Travelers | $472 | Liberty Mutual | $403 | USAA | $122 | Geico | $171 |

| 16828 | Centre Hall | $267 | Travelers | $467 | Liberty Mutual | $403 | USAA | $115 | State Farm | $165 |

| 16802 | University Park | $267 | Travelers | $513 | Liberty Mutual | $403 | USAA | $115 | Geico | $151 |

| 16870 | Port Matilda | $267 | Travelers | $484 | Liberty Mutual | $442 | USAA | $115 | Geico | $151 |

| 17013 | Carlisle | $268 | Travelers | $518 | Liberty Mutual | $364 | USAA | $130 | Geico | $158 |

| 17015 | Carlisle | $268 | Travelers | $518 | Liberty Mutual | $364 | USAA | $130 | Geico | $158 |

| 17837 | Lewisburg | $268 | Travelers | $488 | Liberty Mutual | $403 | USAA | $122 | Geico | $171 |

| 17065 | Mount Holly Springs | $269 | Travelers | $501 | Liberty Mutual | $399 | USAA | $130 | Geico | $158 |

| 16826 | Blanchard | $270 | Travelers | $469 | Liberty Mutual | $442 | USAA | $115 | State Farm | $172 |

| 17842 | Middleburg | $270 | Travelers | $476 | Liberty Mutual | $403 | USAA | $122 | Geico | $171 |

| 17887 | White Deer | $271 | Travelers | $535 | Liberty Mutual | $403 | USAA | $122 | State Farm | $169 |

| 17266 | Walnut Bottom | $271 | Travelers | $514 | Liberty Mutual | $399 | USAA | $130 | Geico | $158 |

| 17324 | Gardners | $272 | Travelers | $488 | Liberty Mutual | $399 | USAA | $130 | Geico | $179 |

| 17343 | McKnightstown | $272 | Travelers | $476 | Liberty Mutual | $403 | USAA | $128 | Geico | $179 |

| 17007 | Boiling Springs | $273 | Travelers | $526 | Liberty Mutual | $399 | USAA | $130 | Geico | $158 |

| 17241 | Newville | $273 | Travelers | $501 | Liberty Mutual | $399 | USAA | $130 | Geico | $158 |

| 16827 | Boalsburg | $273 | Travelers | $535 | Liberty Mutual | $403 | USAA | $115 | Geico | $151 |

| 17050 | Mechanicsburg | $273 | Travelers | $554 | Liberty Mutual | $364 | USAA | $130 | Geico | $158 |

| 17055 | Mechanicsburg | $273 | Travelers | $567 | Liberty Mutual | $364 | USAA | $130 | Geico | $158 |

| 16875 | Spring Mills | $274 | Travelers | $469 | Liberty Mutual | $442 | USAA | $115 | State Farm | $174 |

| 17889 | Winfield | $274 | Travelers | $535 | Liberty Mutual | $403 | USAA | $122 | Geico | $171 |

| 17870 | Selinsgrove | $274 | Travelers | $551 | Liberty Mutual | $403 | USAA | $122 | Geico | $171 |

The 25 most expensive zip codes are all in Philadelphia.

25 Least Expensive Zip Codes in Pennsylvania

| Zip Code | City | Average by Zip Code | Most Expensive Company | Most Expensive Rate | 2nd Most Expensive Company | 2nd Most Expensive Rate | Cheapest Company | Cheapest Rate | 2nd Cheapest Company | 2nd Cheapest Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 16823 | Bellefonte | $260 | Travelers | $469 | Liberty Mutual | $403 | USAA | $115 | Geico | $151 |

| 16801 | State College | $263 | Travelers | $502 | Liberty Mutual | $403 | USAA | $115 | Geico | $151 |

| 16803 | State College | $267 | Travelers | $517 | Liberty Mutual | $403 | USAA | $115 | Geico | $151 |

| 17844 | Mifflinburg | $267 | Travelers | $472 | Liberty Mutual | $403 | USAA | $122 | Geico | $171 |

| 16828 | Centre Hall | $267 | Travelers | $467 | Liberty Mutual | $403 | USAA | $115 | State Farm | $165 |

| 16802 | University Park | $267 | Travelers | $513 | Liberty Mutual | $403 | USAA | $115 | Geico | $151 |

| 16870 | Port Matilda | $267 | Travelers | $484 | Liberty Mutual | $442 | USAA | $115 | Geico | $151 |

| 17013 | Carlisle | $268 | Travelers | $518 | Liberty Mutual | $364 | USAA | $130 | Geico | $158 |

| 17015 | Carlisle | $268 | Travelers | $518 | Liberty Mutual | $364 | USAA | $130 | Geico | $158 |

| 17837 | Lewisburg | $268 | Travelers | $488 | Liberty Mutual | $403 | USAA | $122 | Geico | $171 |

| 17065 | Mount Holly Springs | $269 | Travelers | $501 | Liberty Mutual | $399 | USAA | $130 | Geico | $158 |

| 16826 | Blanchard | $270 | Travelers | $469 | Liberty Mutual | $442 | USAA | $115 | State Farm | $172 |

| 17842 | Middleburg | $270 | Travelers | $476 | Liberty Mutual | $403 | USAA | $122 | Geico | $171 |

| 17887 | White Deer | $271 | Travelers | $535 | Liberty Mutual | $403 | USAA | $122 | State Farm | $169 |

| 17266 | Walnut Bottom | $271 | Travelers | $514 | Liberty Mutual | $399 | USAA | $130 | Geico | $158 |

| 17324 | Gardners | $272 | Travelers | $488 | Liberty Mutual | $399 | USAA | $130 | Geico | $179 |

| 17343 | McKnightstown | $272 | Travelers | $476 | Liberty Mutual | $403 | USAA | $128 | Geico | $179 |

| 17007 | Boiling Springs | $273 | Travelers | $526 | Liberty Mutual | $399 | USAA | $130 | Geico | $158 |

| 17241 | Newville | $273 | Travelers | $501 | Liberty Mutual | $399 | USAA | $130 | Geico | $158 |

| 16827 | Boalsburg | $273 | Travelers | $535 | Liberty Mutual | $403 | USAA | $115 | Geico | $151 |

| 17050 | Mechanicsburg | $273 | Travelers | $554 | Liberty Mutual | $364 | USAA | $130 | Geico | $158 |

| 17055 | Mechanicsburg | $273 | Travelers | $567 | Liberty Mutual | $364 | USAA | $130 | Geico | $158 |

| 16875 | Spring Mills | $274 | Travelers | $469 | Liberty Mutual | $442 | USAA | $115 | State Farm | $174 |

| 17889 | Winfield | $274 | Travelers | $535 | Liberty Mutual | $403 | USAA | $122 | Geico | $171 |

| 17870 | Selinsgrove | $274 | Travelers | $551 | Liberty Mutual | $403 | USAA | $122 | Geico | $171 |

Bellefonte and State College have the cheapest zip codes in Pennsylvania. Compare auto insurers to find the cheapest quotes for your location.

Auto Insurance Rates by City in Pennsylvania

Take a look at the tables below to see if your city has expensive or cheap insurance rates.

10 Most Expensive Cities in Pennsylvania

| City | Average by City | Most Expensive Company | Most Expensive Rate | 2nd Most Expensive Company | 2nd Most Expensive Rate | Cheapest Company | Cheapest Rate | 2nd Cheapest Company | 2nd Cheapest Rate |

|---|---|---|---|---|---|---|---|---|---|

| Philadelphia | $7,482 | Travelers | $15,126 | Liberty Mutual | $12,539 | USAA | $2,954 | Geico | $4,621 |

| Sharon Hill | $6,393 | Travelers | $13,460 | Liberty Mutual | $8,630 | USAA | $2,363 | Nationwide | $4,103 |

| East Lansdowne | $6,347 | Travelers | $12,468 | Liberty Mutual | $8,630 | USAA | $2,511 | Nationwide | $4,211 |

| Collingdale | $6,270 | Travelers | $12,886 | Liberty Mutual | $8,630 | USAA | $2,511 | Nationwide | $4,212 |

| Millbourne | $6,232 | Travelers | $12,161 | Liberty Mutual | $8,630 | USAA | $2,208 | Nationwide | $4,242 |

| Bensalem | $5,764 | Travelers | $12,296 | Liberty Mutual | $8,345 | USAA | $1,908 | Geico | $3,569 |

| Cheltenham | $5,734 | Travelers | $12,437 | Liberty Mutual | $7,630 | USAA | $2,456 | Nationwide | $3,836 |

| Elkins Park | $5,727 | Travelers | $12,174 | Liberty Mutual | $7,630 | USAA | $2,155 | Nationwide | $3,745 |

| Chester | $5,723 | Travelers | $12,415 | Liberty Mutual | $8,630 | USAA | $2,363 | Geico | $3,596 |

| Glenolden | $5,720 | Travelers | $12,888 | Liberty Mutual | $8,630 | USAA | $2,396 | State Farm | $3,491 |

Unsurprisingly, Philadelphia is the most expensive city.

10 Least Expensive Cities in Pennsylvania

| City | Average by City | Most Expensive Company | Most Expensive Rate | 2nd Most Expensive Company | 2nd Most Expensive Rate | Cheapest Company | Cheapest Rate | 2nd Cheapest Company | 2nd Cheapest Rate |

|---|---|---|---|---|---|---|---|---|---|

| Bellefonte | $3,116 | Travelers | $5,623 | Liberty Mutual | $4,826 | USAA | $1,385 | Geico | $1,816 |

| Houserville | $3,157 | Travelers | $6,028 | Liberty Mutual | $4,826 | USAA | $1,385 | Geico | $1,816 |

| Park Forest Village | $3,205 | Travelers | $6,206 | Liberty Mutual | $4,826 | USAA | $1,385 | Geico | $1,816 |

| Mifflinburg | $3,205 | Travelers | $5,668 | Liberty Mutual | $4,835 | USAA | $1,468 | Geico | $2,052 |

| Centre Hall | $3,208 | Travelers | $5,601 | Liberty Mutual | $4,826 | USAA | $1,385 | State Farm | $1,980 |

| University Park | $3,211 | Travelers | $6,155 | Liberty Mutual | $4,826 | USAA | $1,385 | Geico | $1,816 |

| Port Matilda | $3,213 | Travelers | $5,804 | Liberty Mutual | $5,302 | USAA | $1,385 | Geico | $1,816 |

| Carlisle | $3,217 | Travelers | $6,210 | Liberty Mutual | $4,364 | USAA | $1,561 | Geico | $1,898 |

| Lewisburg | $3,224 | Travelers | $5,861 | Liberty Mutual | $4,835 | USAA | $1,468 | Geico | $2,052 |

| Mount Holly Springs | $3,238 | Travelers | $6,005 | Liberty Mutual | $4,802 | USAA | $1,561 | Geico | $1,898 |

Bellefonte, which has the cheapest zip code, is also the cheapest city.

Auto Insurance Rates by Monthly Commute in Pennsylvania

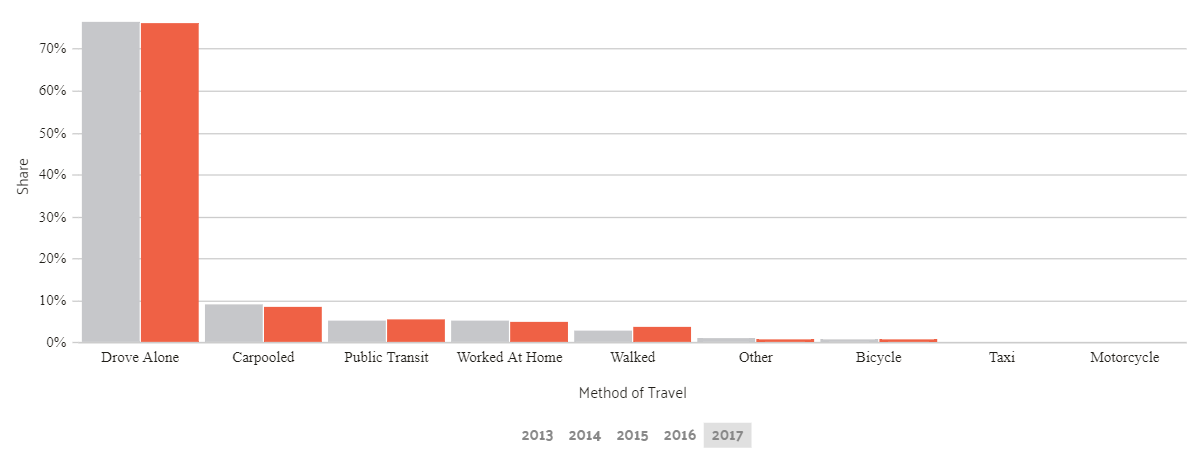

The monthly commute distance in Pennsylvania directly impacts auto insurance premiums, with longer commutes often leading to higher rates.

Pennsylvania Average Annual Auto Insurance Rates Based on Communte

| Insurance Company | Monthly Rate for 10 Miles Commute | Monthly Rate for 25 Miles Commute |

|---|---|---|

| $145 | $154 | |

| $214 | $220 | |

| $222 | $235 | |

| $233 | $233 |

| $325 | $338 | |

| $371 | $371 | |

| $492 | $518 |

| $653 | $653 |

Many insurers provide auto insurance discounts if your monthly commute is around 6,000 miles.

Auto Insurance Rates by Credit History in Pennsylvania

Auto insurers consider your credit score while calculating the premium rate.

Pennsylvania Car Insurance Monthly Rates by Credit History

| Insurance Company | Good Credit | Fair Credit | Poor Credit |

|---|---|---|---|

| $170 | $200 | $230 | |

| $160 | $190 | $220 | |

| $150 | $180 | $210 |

| $175 | $210 | $240 | |

| $140 | $170 | $200 | |

| $210 | $240 | $280 |

| $165 | $195 | $225 |

| $180 | $210 | $250 | |

| $150 | $180 | $210 | |

| $220 | $250 | $290 |

In Pennsylvania, USAA and Nationwide might provide the best rate if you have a poor credit record.

However, in case your credit score is good, you can also consider Geico and State Farm for a better rate.

Read More: How Your Credit Score Affects Your Auto Insurance Premiums

Auto Insurance Rates by Driving Record in Pennsylvania

Auto insurance premiums in Pennsylvania are higher for drivers with a history of accidents or violations.

Pennsylvania Car Insurance Monthly Rates by Provider & Driving Record

| Insurance Company | Good Credit | Fair Credit | Poor Credit | One DUI |

|---|---|---|---|---|

| $228 | $268 | $321 | $385 | |

| $166 | $194 | $251 | $276 | |

| $83 | $100 | $118 | $153 |

| $198 | $247 | $282 | $275 | |

| $114 | $151 | $189 | $309 | |

| $248 | $302 | $335 | $447 |

| $164 | $196 | $230 | $338 |

| $150 | $199 | $265 | $200 | |

| $123 | $137 | $146 | $160 | |

| $141 | $192 | $199 | $294 |

Your driving record is an important risk indicator for an insurer. A DUI or an at-fault accident might increase your premium rates. Factors that affect your auto insurance include your driving history, vehicle type, and location.

Cheapest Auto Insurance Companies in Pennsylvania

How do you choose among the many insurers in the market?

While getting the cheapest car insurance is important, you should also consider factors like customer reviews and the company’s financial strength.

Consider customer reviews, financial stability, and quotes when choosing an insurer, as even small differences can impact your premium.

Tracey L. Wells Licensed Insurance Agent & Agency Owner

The Reddit post below expresses frustration with Progressive’s rising premiums despite minimal coverage, no accidents, and low mileage. The user seeks cheaper, reputable insurance options and can switch providers to find the best car insurance rates in PA.

On average, USAA and Geico are the cheapest auto insurance companies in Pennsylvania.

Cheapest Car Insurance Companies in Pennsylvania

| Company | Monthly Rate | Compared to State |

|---|---|---|

| $332 | -$50 | |

| $320 | -$114 | |

| $364 | -$60 |

| $367 | -$36 | |

| $217 | -$1,429 | |

| $402 | -$72 |

| $233 | -$1,234 |

| $371 | $417 | |

| $229 | -$1,290 | |

| $654 | $3,808 |

Your premium rate may differ.

Remember, any slight difference in factors can significantly change the premium rate.

Auto Insurance Costs in Pennsylvania

Finding affordable auto insurance in your city is crucial for peace of mind on Pennsylvania’s roads. However, navigating insurance options can be overwhelming, whether you’re in Allentown, Erie, Philadelphia, Pittsburgh, or Reading.

| Find the Cheapest Insurance in Your City |

|---|

| Allentown, PA |

| Erie, PA |

| Philadelphia, Pennsylvania |

| Pittsburgh, PA |

| Reading, PA |

This guide will help you secure the cheapest quotes without sacrificing quality or coverage.

Premiums as a Percentage of Income

To save on premiums, compare your quotes with the state average. The benchmark premium rate helps analyze an insurer’s offer.

The benchmark premium rate will help you analyze an insurance quote that you may receive from an insurer.

| Percentage of Income | 2014 | 2013 | 2012 |

|---|---|---|---|

| Pennsylvania | 2.24% | 2.28% | 2.23% |

| National Average | 2.40% | 2.43% | 2.34% |

On average, premiums take up a lower share of income than the national percentage. However, these averages may not apply to your situation. You can also use online comparison tools to find the cheapest quotes and discounts available.

Financial Ratings of the Leading Insurance Companies

We may not always have the time or expertise to analyze the financial strength of an insurance company.

That’s why we use A.M Best auto insurance ratings to assess the financial health of leading insurers in Pennsylvania.

A.M. Credit is one of the most reputed insurance credit rating agency.

| Companies | A.M. Rating |

|---|---|

| State Farm Group | A++ |

| Erie Insurance Group | A+ |

| Allstate Insurance Group | A+ |

| Progressive Group | A+ |

| Nationwide Corp Group | A+ |

| Geico | A++ |

| Liberty Mutual Group | A |

| Travelers Group | A+ |

| USAA Group | A++ |

| Farmers Insurance Group | A |

Read more: Erie Auto Insurance Review

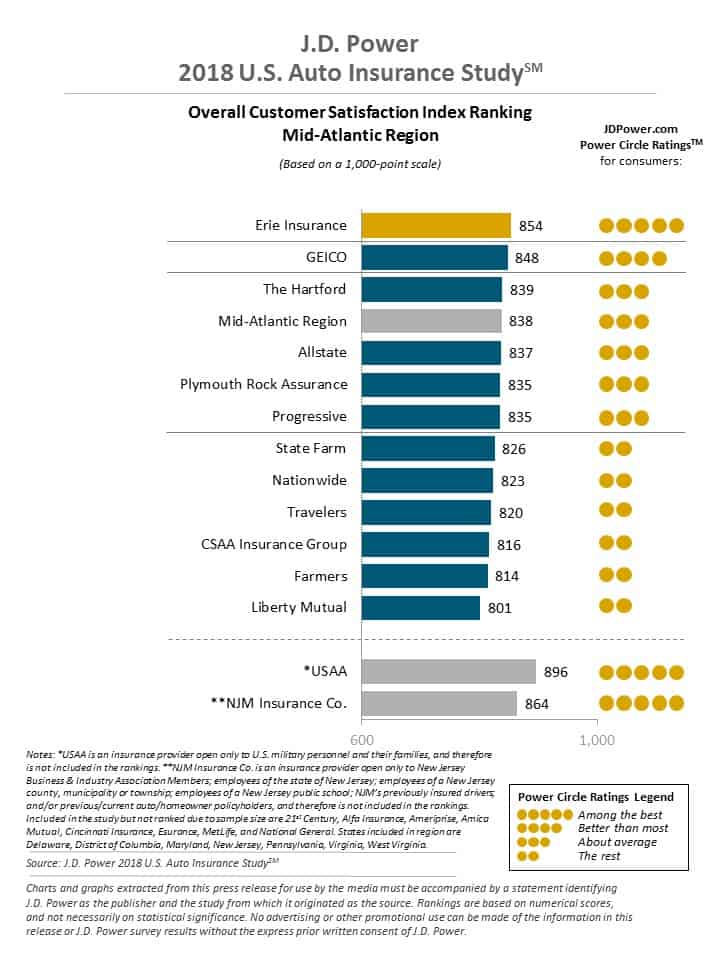

Customer Satisfaction Rating of Leading Auto Insurance Companies

Browsing forums, opinion polls, and customer reviews can help you find which auto insurance companies offer the best customer satisfaction.

Instead, we are leveraging the J.D. Power Customer Satisfaction Ratings.

Most insurers have respectable ratings, but Erie and Geico have the best customer satisfaction in the region.

Auto Insurance Companies with Most Complaints in Pennsylvania

Another important metric to review is the number of complaints received. It’s better to compare insurance companies based on their approach to handling complaints.

| Companies | National Median Complaint Ratio | Company Complaint Ratio 2017 | Total Complaints 2017 |

|---|---|---|---|

| State Farm Group | 1 | 0.44 | 1482 |

| Erie Insurance Group | 1 | 0.7 | 22 |

| Allstate Insurance Group | 1 | 0.5 | 163 |

| Progressive Group | 1 | 0.75 | 120 |

| Nationwide Corp Group | 1 | 0.28 | 25 |

| Geico | 1 | 0.68 | 333 |

| Liberty Mutual Group | 1 | 5.95 | 222 |

| Travelers Group | 1 | 0.09 | 2 |

| USAA Group | 1 | 0.74 | 296 |

| Farmers Insurance Group | 1 | 0 | 0 |

While all companies receive complaints, how they handle them is more important.

Largest Auto Insurance Companies in Pennsylvania

| Companies | Market Share |

|---|---|

| State Farm Group | 20.35% |

| Erie Insurance Group | 13.19% |

| Allstate Insurance Group | 11.42% |

| Progressive Group | 10.01% |

| Nationwide Corp Group | 8.99% |

| Geico | 8.08% |

| Liberty Mutual Group | 4.85% |

| Travelers Group | 3.84% |

| USAA Group | 3.42% |

| Farmers Insurance Group | 2.20% |

Number of Insurers in Pennsylvania

Pennsylvania has 166 domestic and 929 foreign insurance companies licensed to operate.

| Type of Insurer | Count |

|---|---|

| Domestic | 166 |

| Foreign | 929 |

This includes both auto and other insurance providers.

Minimum Insurance Coverage Requirements in Pennsylvania

Before choosing the right affordable insurance coverage, it’s important to understand Pennsylvania’s insurance laws.

Pennsylvania offers a ‘choice’ insurance model—drivers can select either full tort or limited tort coverage, which affects compensation in case of injury.

Understanding Pennsylvania’s full tort and limited tort options helps you choose affordable, cheap auto insurance with the right coverage.

Chris Abrams Licensed Insurance Agent

With full tort, you can sue for damages if another driver injures you. Under limited tort, you’re part of the no-fault system—your insurer covers medical expenses regardless of who caused the accident.

Under limited tort, your right to sue for injuries is limited. You can only file a lawsuit if the injury is severe, such as serious impairment or permanent disfigurement. All vehicles registered in Pennsylvania must carry minimum liability insurance. Check Geico’s website to see how their coverage meets state requirements.

Pennsylvania law requires the following minimum liability insurance, regardless of your coverage choice:

- $15,000 for injury or death of one person in an accident or $30,000 per accident that results in injury or death of more than one person

- $5,000 property damage protection when you’re at fault

In case you choose a no-fault plan, you also have to purchase medical payments coverage:

- $5,000 medical benefits protection that covers you or your passengers in case of an accident, regardless of fault

While minimum liability coverage keeps you compliant, it may not be financially wise. If you’re at fault in an accident and lack sufficient coverage, you’ll have to pay the difference for damages beyond your policy limit.

Minimum liability protection is required because it covers damage you cause to others. For example, if you rear-end a car, your insurer will cover the third party up to your policy limit. However, $5,000 may not cover damages to a luxury car, and you’ll need to pay the excess.

To protect yourself against financial injury, purchase liability insurance above the state-mandated minimum.

Forms of Financial Responsibility

Vehicle liability insurance is mandatory in Pennsylvania. A lapse in coverage may result in registration suspension.

Driving without insurance is financially risky, and you could face fines, license suspension, or revocation of your license plate and registration. To avoid suspension, pay a $500 fine and a restoration fee. Alternatively, you can apply for self-insurance with PennDOT.

To get approved for self-insurance, you would submit the following to PennDOT:

- Financial statements that show your latest financial condition

- Minimum collateral of $50,000 for one vehicle

Read More: Automobile Liability Coverage

Core Auto Insurance Coverage in Pennsylvania

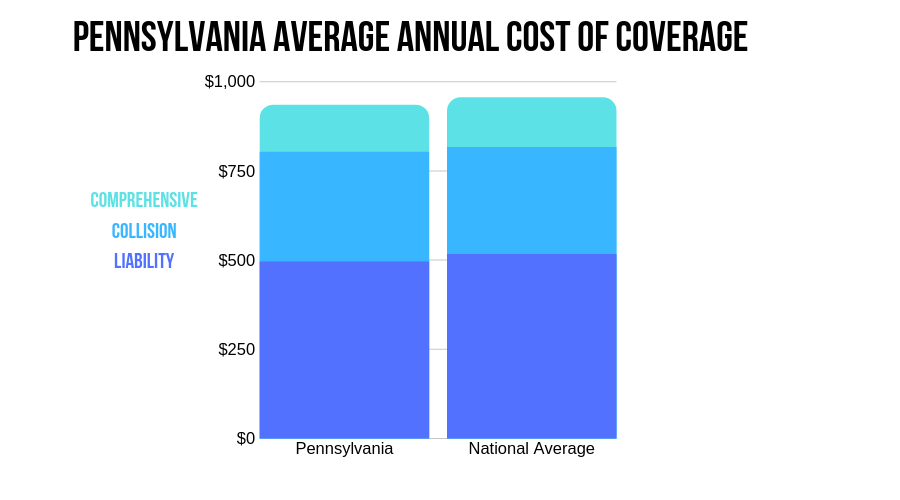

The lower share of income is due to higher disposable income and a lower average premium than the national average.

Core Car Insurance Coverage in Pennsylvania

| Percentage of Income | Disposable Income (Average) | Full Coverage Premium (Average) |

|---|---|---|

| Pennsylvania | $42,414 | $950 |

| National Average | $40,859 | $982 |

According to data from the National Association of Insurance Commissioners, the average premium for full coverage is $950, which is more than $30 less than the national average.

Auto insurance premiums in Pennsylvania are at par with the national average.

However, you can further save by using the following methods:

- Optimize your deductible

- Have all your cars in a single policy

- Complete a certified defensive driving course

- Equip your cars with safety equipment such as an anti-theft alarm

- Reduce your annual mileage

Additional Liability Coverage in Pennsylvania

If you opt for no-fault insurance, you must purchase the medical benefits rider.

| Loss Ratio (%) | 2014 | 2013 | 2012 | |||

|---|---|---|---|---|---|---|

| PA | US | PA | US | PA | US | |

| PIP | 69.95 | 69.41 | 73.47 | 74.69 | 73.99 | 82.31 |

| Med Pay | 11.97 | 74.05 | 236.43 | 76.85 | 98.02 | 78.49 |

| Uninsured/Underinsured | 58.12 | 67.33 | 60.74 | 67.22 | 61.55 | 67.55 |

Pennsylvania law does not require PIP or uninsured motorist coverage, but it is prudent to consider these add-ons for additional financial protection in case of an accident.

Medical Payments

Medical Payment coverage is expected to cover your medical expenses in case of an accident up to the limits of your policy. The ‘MedPay’ coverage pays you regardless of who was at fault in an accident.

Personal Injury Protection (PIP)

You can opt for PIP, which includes medical payments, lost wages, funeral expenses, and more.

MedPay and PIP are primary benefits that provide medical coverage in case of an accident.

The difference is that PIP also provides additional coverages such as lost wages and funeral expenses.

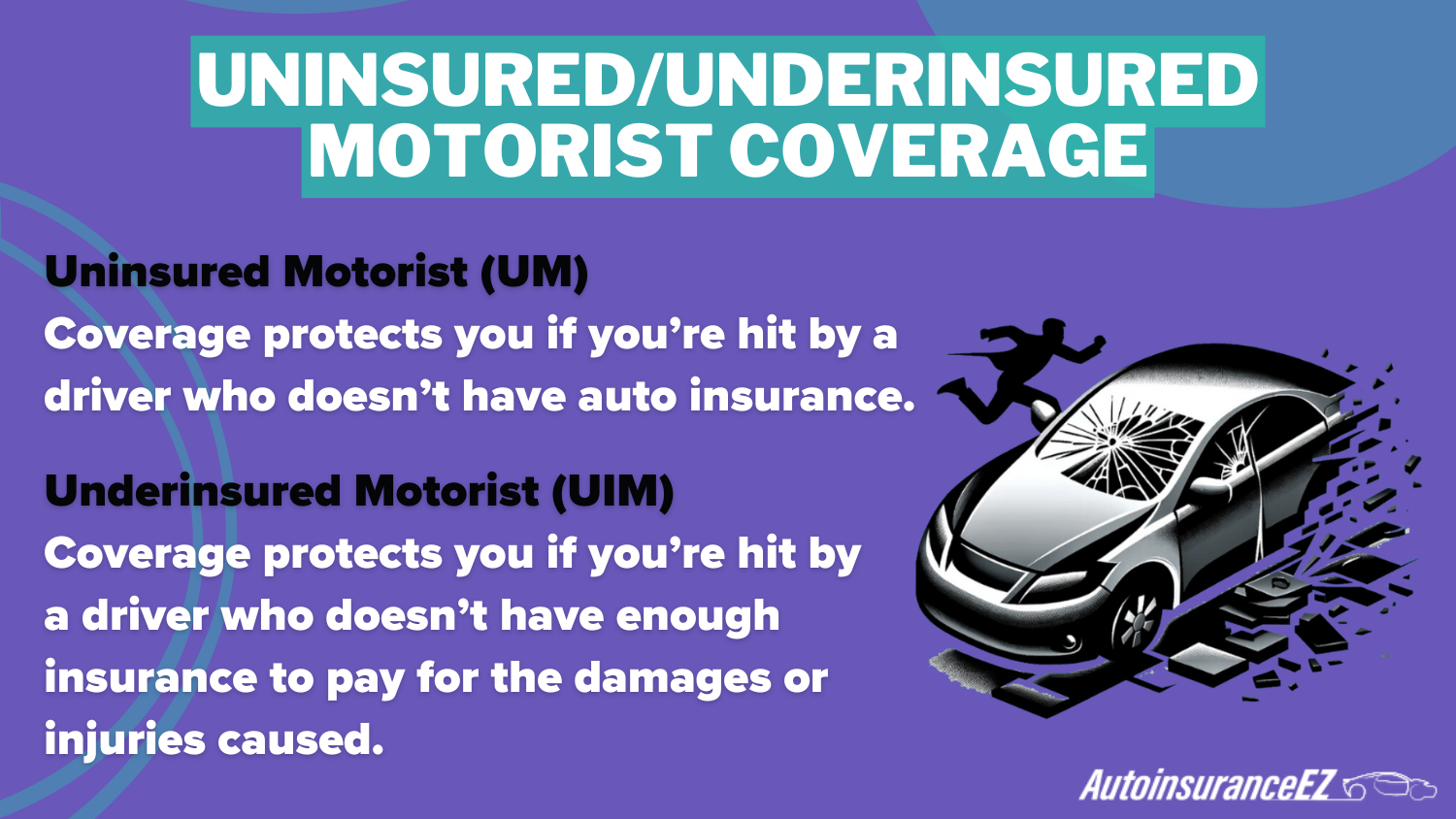

Uninsured/Underinsured Motorist Coverage

More than 7 percent of drivers in Pennsylvania have no insurance or less than the required coverage.

If an uninsured driver hits you, they can’t file a claim with their insurance. If they lack the assets to cover damages, they may declare bankruptcy.

Who will pay for the damages? This is why you should consider uninsured/underinsured coverage.

It’s also crucial that the insurer can settle the claim.

Loss Ratio is a good indicator of whether your insurer can pay a claim. It compares total premiums earned by an insurer to total claims settled.

- A high ratio may indicate that although the insurer is likely to settle your claim, your premium may increase.

- A low loss ratio could suggest that the insurer may not settle your claim.

The loss ratio is in line with the national average, indicating that legitimate claims are likely to be settled.

Add-ons, Endorsements, and Riders

Consider the following add-ons and riders that cater to your specific requirements when selecting your coverage:

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Rental Reimbursement

- Modified Car Insurance Coverage

- Classic Car Insurance

- Non-Owner Car Insurance

- Pay-As-You-Drive or Usage-Based Insurance

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Pennsylvania State Laws

Staying informed about Pennsylvania’s automotive laws is important for maintaining a clean driving record. We’ll quickly recap the most relevant laws to help you secure the cheapest quotes and stay safe on the road.

Auto Insurance Laws in Pennsylvania

According to the National Association of Insurance Commissioners, State laws determine the tort rule, minimum liability insurance requirement, and approval system used by insurers.

In Pennsylvania, insurers must seek prior approval from the state insurance department before using insurance rates and forms.

Let us further review specific laws governing auto insurance in the State of Independence.

Windshield Coverage Laws in Pennsylvania

In Pennsylvania, there is no specific law governing insurers’ provision of windshield coverage as part of the policy.

However, insurance providers may provide windshield protection as part of comprehensive coverage.

High-Risk Insurance in Pennsylvania

Insurers could deny you auto insurance coverage if you were involved in multiple DUI convictions or at-fault accidents.

With a poor driving record, insurance companies consider you a risk and will not offer you a policy in the voluntary market.

How do you find coverage in such a scenario?

Well, you can opt for Pennsylvania’s Assigned Risk Plan (ARP), which assigns high-risk drivers to insurance companies based on a quota.

The premium rate under ARP is almost always more expensive than the voluntary market; however, the policy coverage remains identical.

The quota is calculated based on the amount of business each insurance company writes in the state.

To be eligible to apply for insurance under ARP, you must prove that you searched for auto insurance in the voluntary market for a minimum of 60 days without success.

Within ARP, you may also qualify for the Clean Risk Rate (CRR). Eligibility criteria for CRR are:

- No more than $1,150 paid by the insurance on your behalf

- No more than three traffic violations

- No suspension or revocation of driver’s license

- You must have held the license for three years

You should aim to keep a clean driving record and access the voluntary market for a cheaper premium rate.

Low-Cost Auto Insurance in Pennsylvania

Drivers with clean records receive premium discounts, including the safe driver discount. The table below lists auto insurance discounts from top providers in Pennsylvania.

Auto Insurance Discounts From the Top Providers in Pennsylvania

| Insurance Company | Available Discounts |

|---|---|

| Safe Driver, Multi-Policy, New Car, Anti-Theft, Good Student, Smart Student, Paperless, Early Signing, Responsible Payer, Senior Discount | |

| Multi-Policy, Teen Driver, Good Student, Loyalty, Auto Safety Equipment, Low Mileage, Steer Into Savings, Bundling, Defensive Driving | |

| Safe Driver, Multi-Policy, Pay-in-Full, Young Driver, Accident Prevention, Reduced Usage, Senior Discount, First Accident Forgiveness |

| Multi-Car, Safe Driver, Signal Usage, Homeowner, Alternative Fuel, Affinity Group, Mature Driver, Pay-in-Full, Business/Professional Group | |

| Multi-Vehicle, Good Student, Federal Employee, Defensive Driving, Military, Anti-Theft, Emergency Deployment, Membership, New Vehicle | |

| Early Shopper, Multi-Policy, New Graduate, Good Student, Alternative Energy Vehicle, Anti-Theft, Paperless, Affinity Group, Hybrid Vehicle |

| Accident-Free, Family Plan, Good Student, SmartRide, Paperless, Safe Driver, Multi-Policy, Vanishing Deductible, Defensive Driving |

| Multi-Car, Continuous Insurance, Snapshot, Teen Driver, Paperless, Homeowner, Pay-in-Full, Safe Driver, Loyalty Rewards, Bundling | |

| Safe Driver, Accident-Free, Anti-Theft, Good Student, Multi-Policy, Drive Safe & Save, Steer Clear (for young drivers), Loyalty, Homeowner | |

| Safe Driver, Multi-Policy, Continuous Coverage, Homeowner, Good Payer, Hybrid/Electric Vehicle, New Car, Paid-in-Full, Student Away at School |

Pennsylvania doesn’t offer a low-cost insurance program. The state recommends shopping around for the cheapest insurance.

Auto Insurance Fraud in Pennsylvania

Auto insurance fraud is a serious crime in Pennsylvania. It drives up premiums as insurers offset losses. The state classifies it as a felony, punishable by up to seven years in prison and $15,000 in fines. Common fraud includes staging accidents, inflating claims, filing false theft reports, and misrepresenting information on applications.

Here are the broad types of insurance fraud:

We need to be vigilant against insurance fraud. If you have witnessed a scam or were a victim of one, please report the crime here:

- The Pennsylvania Office of The Attorney General Insurance Fraud Section (717-787-0272)

- The National Insurance Crime Bureau (1-800-TEL-NICB (1-800-835-6422))

Statute of Limitations

The statute of limitations in Pennsylvania is two years for personal injury and property damage.

But what is a statute of limitation?

It is the time until which you can sue a third party for damages after an accident.

In Pennsylvania, you have two years after an accident to step out of the no-fault system and sue the third party for personal injury or property damage. Don’t wait until it’s too late.

Vehicle Licensing Laws

You cannot drive or buy auto insurance without a valid driver’s license.

If your license is up for renewal, consider a REAL ID-compliant version.

The next section explains Pennsylvania’s license renewal process. You can also use online comparison tools to find the cheapest insurance options available.

REAL ID implementation in Pennsylvania

Have you heard about REAL ID?

It’s a federal requirement for entering federal buildings or boarding domestic flights starting October 2020.

Pennsylvanians can choose a REAL ID-compliant driver’s license for this purpose. If you received your license after September 2003, PennDOT may already have your documents on file.

You can apply for REAL ID online. If PennDOT has your documents, you can complete the process entirely online.

If you do not have the updated documents with PennDOT, you will need to visit a REAL ID Center near you.

The other federally acceptable IDs are:

- US Passport

- Foreign Passport

- U.S. Military ID

- Permanent Resident Card (Green Card)

Penalties for Driving Without Insurance in Pennsylvania

It is mandatory to maintain liability insurance for all registered vehicles. If you are found operating a motor vehicle without the minimum liability insurance, you can face several penalties.

Let us review the penalties and challenges you may face if you are caught driving without insurance:

- Financial Penalty: If you are found operating a car without liability insurance, you would have to pay a fine of anywhere between $100 to $500. For repeat occurrences, the penalty can increase to as high as $1,000. You will also have to pay license and registration restoration fees.

- License Suspension: You can face three months of license suspension, which can potentially increase to six months. However, it can also include registration suspension and vehicle impounding.

- Jail: If you are a repeat offender or caused an accident without insurance, you can be jailed for a period of time.

- Financial Repercussion: Regardless of the penalty, you are putting yourself at substantial financial risk by driving without insurance. If you cause a serious accident, you will have to pay for the damages out of pocket, which can potentially consume your financial assets.

- Impact on Insurance Policy: If you were ever caught driving without insurance, you might find that insurers are not too keen to write you a policy, or your premium rate may increase substantially.

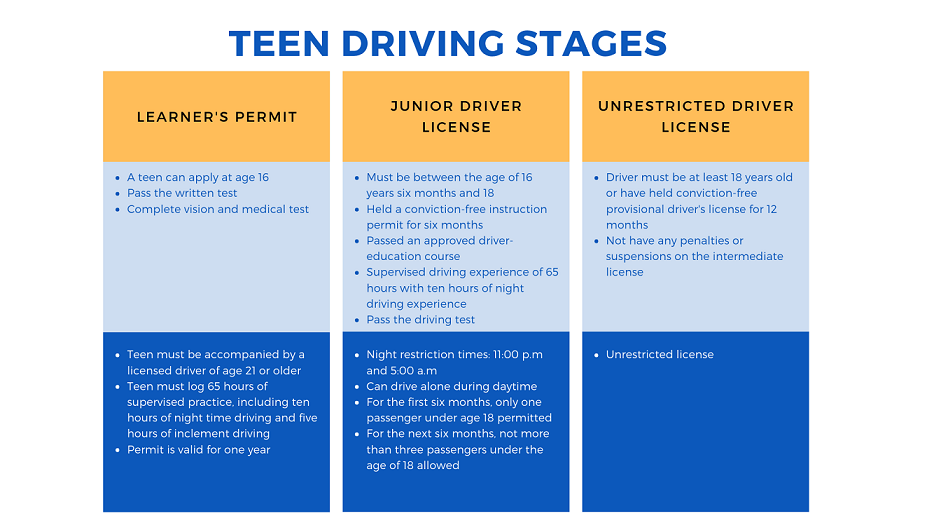

Teen Driving Laws

Approximately 100,000 teens aged between 16 and 17 are licensed annually in Pennsylvania.

Pennsylvania uses a three-stage licensing process for teen drivers. At 16, teens can apply for a learner’s permit, which allows them to drive under supervision.

To qualify for a Junior License, drivers must complete 65 hours of supervised driving—10 at night and 5 in bad weather—pass a road test, and complete driver’s education. The Junior License restricts nighttime driving and limits passengers.

To get a full license, teens must be 18 or hold a Junior License for at least 12 months with a clean record. If applying before October 2020, consider getting a REAL ID-compliant license.

License Renewal Procedure

In Pennsylvania, an unrestricted driver’s license is valid for four years. Drivers over 65 can choose a two- or four-year renewal cycle. You can renew your license online without needing to visit the DMV office.

New Resident Licensing Procedure

If you have just moved to Pennsylvania, you must obtain the PA driver’s license within 60 days of establishing residency in the state.

You have to visit the nearest DMV to exchange the out-of-state driver’s license for a PA driver’s license. However, you do not have to write the knowledge test if you have a valid out-of-state driver’s license.

Rules of the Road in Pennsylvania

Following road rules is critical for safety and maintaining a clean driving record, which prevents premium increases.

Here’s a quick recap of the road rules in Pennsylvania.

Fault vs. No-Fault

Pennsylvania is a choice state. You can opt for full tort or limited tort insurance. With limited tort, you save on the premium but give up your right to sue for small damages. Full tort allows you to keep the right to sue for damages.

Read More: How to Lower Your Auto Insurance Premiums

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Seatbelt and Car Seat Laws

Seat belts and airbags are crucial for passenger safety. Drivers and front-seat passengers must wear seatbelts or face a $10 fine for the first offense.

Children under two must use

Wearing seat belts and ensuring proper child restraints is not only crucial for safety but also helps keep insurance rates low by avoiding penalties and accidents.

Daniel Walker Licensed Insurance Agent

Children eight and older can use an adult seatbelt. The driver is responsible for ensuring child restraint, and a $75 penalty will be assessed for non-compliance.

Keep Right and Move Over Laws

You must keep right unless passing a vehicle turning right or driving slowly.

You must also vacate the closest lane or slow down when an emergency vehicle with flashing lights is stopped.

Speed Limits

The speed limit in Pennsylvania is 70 mph on rural and urban interstates and other limited access roads.

| Type of Road | Speed Limit (mph) |

|---|---|

| Rural Interstates | 70 |

| Urban Interstates | 70 |

| Other limited access road | 70 |

| Other roads | 55 |

All other roads have a speed limit of 55 mph.

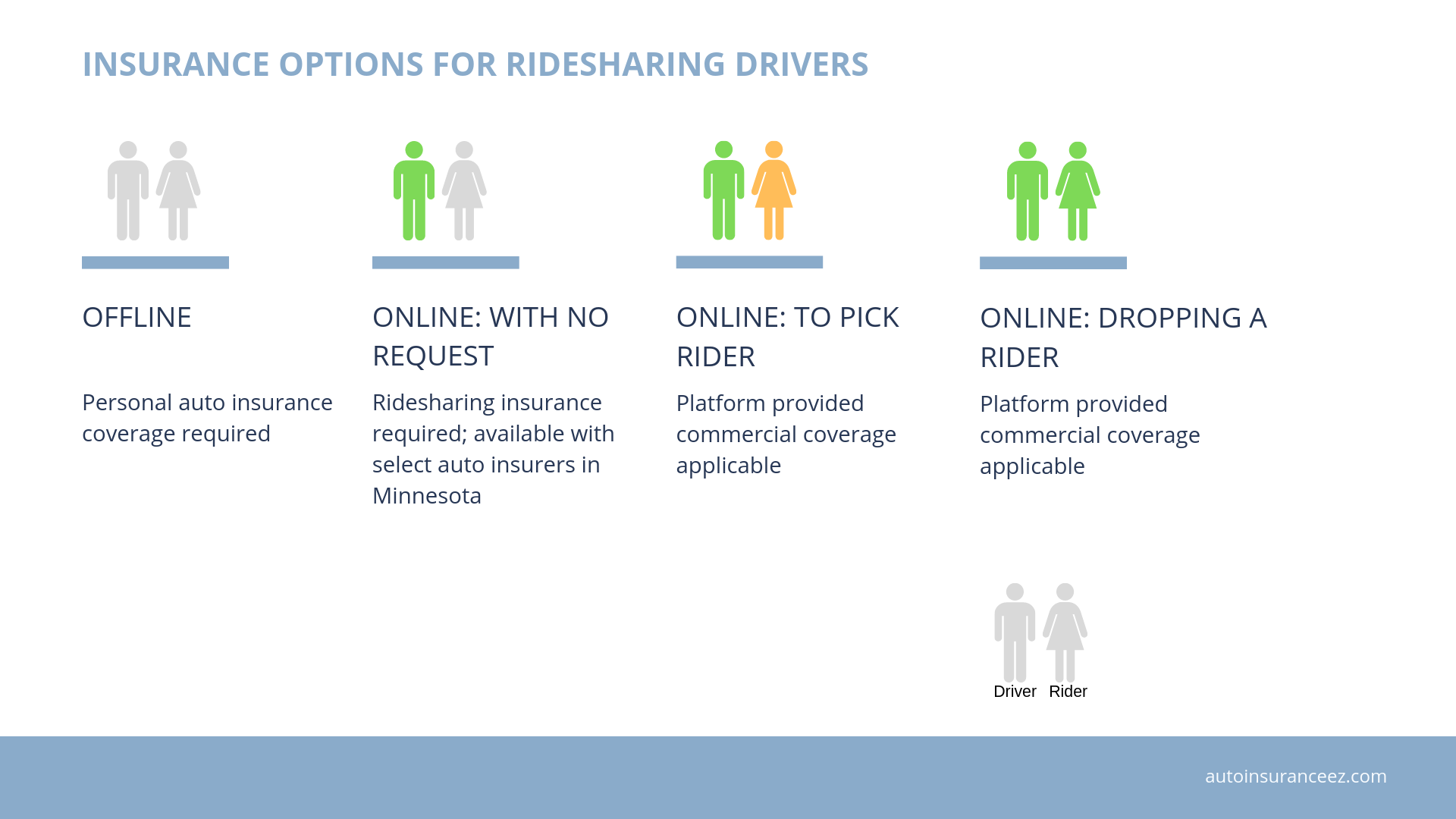

Ride-Sharing Laws

If you drive for Uber, Lyft, or any other ridesharing company, you need to know the types of coverage required to drive in Pennsylvania.

- First, when you are offline, you must maintain your private auto insurance and inform your provider that you drive for a ridesharing company.

- Next, when picking up or dropping off a passenger, Uber/Lyft provides $1,000,000 liability and collision coverage, with a deductible of $1,000 to $2,000.

- The last bit is when logged into the app but not accepting a ride, you need to purchase ‘gap insurance.’ In Pennsylvania, Erie, Geico, Liberty Mutual, and Progressive offer gap insurance.

Automation on the Road

Pennsylvania recently approved its first automated car road tests in October 2018. Uber and Aurora are using this opportunity to test their cars in the state.

Safety Laws

A reckless or impaired driver is a danger to everyone on the road. Pennsylvania enforces strict laws to prevent such behavior.

Read More: Driving Tips for Road Safety

DUI Laws in Pennsylvania

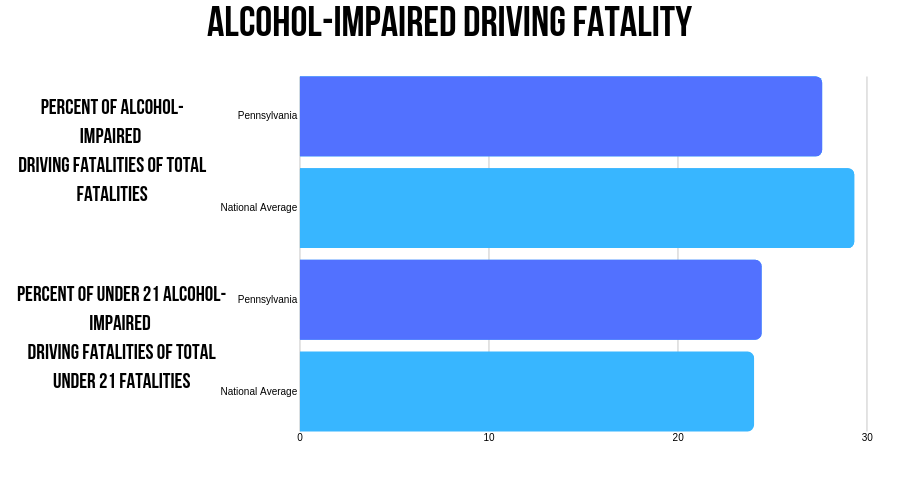

In 2017, there were 314 alcohol-impaired driving fatalities on the road in Pennsylvania. Thirty-one of these fatalities were drivers below the age of 21.

With alcohol-related fatalities at par with the national average, we see strict penalties to deter people from drunk driving in Pennsylvania.

| OFFENSE | DRIVING PRIVILEGES | IMPRISONMENT | FINE | OTHER |

|---|---|---|---|---|

| FIRST | No minimum | Up to six months probation | $300 | Alcohol highway safety school |

| SECOND | One year license revocation | five days to six months | $300-$2,500 | Alcohol highway safety school; one year of IID |

| THIRD | One-year license revocation | ten days to two years | $500-$5,000 | Alcohol highway safety school; one year of IID; treatment when ordered |

The lookback period in Pennsylvania is ten years.

The lookback period is the time frame in which any offense is counted as subsequent offense and attracts a harsher penalty.

Marijuana-Impaired Driving Laws

In Pennsylvania, law enforcement can book a person if his or her marijuana residue is THC per se (1 nanogram) or more.

Remember: If you ingest Marijuana, you can have residue for days, weeks or even month. This may result in a DUI charge.>

Read More: Auto Insurance After A DUI

Distracted Driving Laws

Pennsylvania laws don’t prohibit drivers from using handheld devices or cellphones. However, you are not allowed to use text messaging while driving.

Distracted driving is a primary offense in Pennsylvania, and you can be stopped and fined. Vehicle safety tips advise staying focused on the road to avoid accidents caused by distractions.

Driving in Pennsylvania

You can control some factors to get a better premium rate, but not all.

| Pennsylvania Statistics Summary | Details |

|---|---|

| Road Miles in Pennsylvania | Vehicle Miles: 99,882 millions Miles of Roadway: 120,039 |

| Vehicles | Registered Vehicles: 10,108,442 Motor Vehicle Thefts: 13,040 |

| Population | 12,807,060 |

| Most Popular Vehicle in Pennsylvania | Honda CR-V |

| Uninsured%/Underinsured% | 7.60% |

| Total Driving Related Deaths | Speeding Fatalities: 468 DUI Fatalities: 314 |

| Full Coverage Average Premiums | Liability: $495.02 Collision: $307.31 Comprehensive: $132.01 Full Coverage: $934.34 |

| Cheapest Provider | USAA |

Car theft, fatality rates, and traffic congestion also impact your rates, as they directly correlate with the likelihood of a claim.

Pennsylvania’s Car Culture

Pennsylvania has a rich automotive history showcased through its various museums. The Keystone State is also home to the iconic Pocono Raceway that hosts IndyCar and NASCAR races.

Unfortunately, the racing heritage is slightly extended to the public roads, with drivers sometimes exceeding the speed limit by more than 10 miles per hour.

Slow down and follow the rules! It’s for everyone’s safety.

Vehicle Theft in Pennsylvania

Honda Accord was the most stolen vehicle in Pennsylvania.

| Make & Model | Year of Vehicle | Thefts |

|---|---|---|

| Honda Accord | 1997 | 544 |

| Honda Civic | 1998 | 539 |

| Ford Pickup (Full Size) | 2006 | 303 |

| Toyota Camry | 2014 | 269 |

| Nissan Altima | 2015 | 261 |

| Chevrolet Impala | 2006 | 224 |

| Toyota Corolla | 2014 | 210 |

| Chevrolet Pickup (Full Size) | 2003 | 203 |

| Jeep Cherokee/Grand Cherokee | 1999 | 188 |

| Chevrolet Malibu | 2015 | 159 |

| City | Motor vehicle theft |

|---|---|

| Abington Township, Montgomery County | 28 |

| Adamstown | 0 |

| Adams Township, Butler County | 0 |

| Akron | 0 |

| Albion | 0 |

| Aldan | 1 |

| Aleppo Township | 0 |

| Allegheny Township, Blair County | 4 |

| Allegheny Township, Westmoreland County | 0 |

| Allentown | 282 |

| Altoona | 33 |

| Ambler | 3 |

| Ambridge | 7 |

| Amity Township | 1 |

| Annville Township | 2 |

| Apollo | 0 |

| Archbald | 0 |

| Armagh Township | 1 |

| Ashley | 2 |

| Aspinwall | 1 |

| Aston Township | 9 |

| Athens | 1 |

| Athens Township | 1 |

| Avalon | 6 |

| Avis | 0 |

| Avoca | 1 |

| Avonmore Boro | 0 |

| Baden | 0 |

| Baldwin Borough | 15 |

| Bally | 0 |

| Bangor | 5 |

| Beaver | 4 |

| Beaver Falls | 18 |

| Bedford | 1 |

| Bedminster Township | 1 |

| Bell Acres | 0 |

| Bellevue | 11 |

| Bellwood | 1 |

| Ben Avon | 0 |

| Ben Avon Heights | 0 |

| Bensalem Township | 68 |

| Berlin | 0 |

| Bern Township | 3 |

| Berwick | 6 |

| Bethel Park | 3 |

| Bethel Township, Berks County | 3 |

| Bethlehem3 | 48 |

| Bethlehem Township | 10 |

| Biglerville | 0 |

| Birdsboro | 1 |

| Birmingham Township | 1 |

| Blairsville | 1 |

| Blair Township | 1 |

| Blakely | 1 |

| Blawnox | 0 |

| Blossburg | 0 |

| Boyertown | 4 |

| Brackenridge | 2 |

| Braddock | 0 |

| Braddock Hills | 0 |

| Bradford | 7 |

| Bradford Township | 0 |

| Brecknock Township, Berks County | 1 |

| Brentwood | 8 |

| Briar Creek Township | 0 |

| Bridgeville | 1 |

| Bridgewater | 0 |

| Brighton Township | 0 |

| Bristol | 12 |

| Bristol Township | 76 |

| Brockway | 1 |

| Brookhaven | 1 |

| Brookville | 1 |

| Brownsville | 4 |

| Bryn Athyn | 0 |

| Buckingham Township | 5 |

| Buffalo Township | 3 |

| Buffalo Valley Regional | 0 |

| Burgettstown | 2 |

| Bushkill Township | 1 |

| Butler Township, Butler County | 6 |

| Butler Township, Luzerne County | 1 |

| Butler Township, Schuylkill County | 0 |

| Caernarvon Township, Berks County | 4 |

| California | 1 |

| Callery | 0 |

| Caln Township | 10 |

| Cambria Township | 3 |

| Cambridge Springs | 0 |

| Camp Hill | 1 |

| Canonsburg | 0 |

| Canton | 0 |

| Carbondale | 5 |

| Carlisle | 11 |

| Carnegie | 15 |

| Carrolltown | 0 |

| Carroll Township, Washington County | 5 |

| Carroll Township, York County | 0 |

| Carroll Valley | 0 |

| Cass Township | 2 |

| Castle Shannon | 4 |

| Catasauqua | 5 |

| Catawissa | 0 |

| Cecil Township | 2 |

| Center Township | 6 |

| Central Berks Regional | 15 |

| Central Bucks Regional | 9 |

| Chambersburg | 20 |

| Charleroi Regional | 3 |

| Chartiers Township | 3 |

| Cheltenham Township | 34 |

| Cherry Tree | 0 |

| Chester | 100 |

| Chester Township | 15 |

| Cheswick | 1 |

| Chippewa Township | 4 |

| Christiana | 1 |

| Churchill | 2 |

| Clarion | 2 |

| Clarks Summit | 0 |

| Clearfield | 3 |

| Cleona | 1 |

| Clifton Heights | 7 |

| Coaldale | 0 |

| Coal Township | 3 |

| Coatesville | 26 |

| Cochranton | 0 |

| Colebrookdale District | 4 |

| Collegeville | 1 |

| Collier Township | 1 |

| Collingdale | 24 |

| Colonial Regional | 7 |

| Columbia | 12 |

| Conemaugh Township, Cambria County | 1 |

| Conemaugh Township, Somerset County | 0 |

| Conewago Township, Adams County | 0 |

| Conewango Township | 1 |

| Conneaut Lake Regional | 1 |

| Connellsville | 7 |

| Conoy Township | 0 |

| Conshohocken | 13 |

| Conway | 2 |

| Conyngham | 0 |

| Coopersburg | 4 |

| Coplay | 1 |

| Coraopolis | 7 |

| Cornwall | 0 |

| Corry | 4 |

| Coudersport | 0 |

| Courtdale | 0 |

| Covington Township | 1 |

| Crafton | 5 |

| Cranberry Township | 5 |

| Crescent Township | 2 |

| Cresson | 0 |

| Cresson Township | 0 |

| Croyle Township | 1 |

| Cumberland Township, Adams County | 0 |

| Cumru Township | 10 |

| Curwensville | 1 |

| Dallas | 0 |

| Dalton | 1 |

| Danville | 1 |

| Darby | 40 |

| Darby Township | 7 |

| Darlington Township | 0 |

| Delano Township | 0 |

| Delaware Water Gap | 0 |

| Delmont | 0 |

| Denver | 1 |

| Derry Township, Dauphin County | 7 |

| Dickson City | 2 |

| Dormont | 8 |

| Douglass Township, Berks County | 3 |

| Douglass Township, Montgomery County | 3 |

| Downingtown | 10 |

| Doylestown Township | 8 |

| Dublin Borough | 0 |

| Du Bois | 2 |

| Duboistown | 0 |

| Dunbar | 0 |

| Duncansville | 0 |

| Dunmore | 9 |

| Dunnstable Township | 0 |

| Dupont | 0 |

| Duquesne | 22 |

| Duryea | 4 |

| Earl Township | 2 |

| East Bangor | 0 |

| East Bethlehem Township | 1 |

| East Brandywine Township | 1 |

| East Cocalico Township | 6 |

| East Conemaugh | 0 |

| East Coventry Township | 1 |

| East Earl Township | 1 |

| Eastern Adams Regional | 0 |

| Eastern Pike Regional | 4 |

| East Fallowfield Township | 0 |

| East Franklin Township | 0 |

| East Hempfield Township | 2 |

| East Lampeter Township | 12 |

| East Lansdowne | 4 |

| East Marlborough Township | 0 |

| East Norriton Township | 13 |

| Easton | 32 |

| East Pennsboro Township | 2 |

| East Petersburg | 0 |

| East Pikeland Township | 1 |

| East Rochester | 0 |

| East Taylor Township | 1 |

| Easttown Township | 5 |

| East Union Township | 0 |

| East Vincent Township | 0 |

| East Washington | 0 |

| East Whiteland Township | 2 |

| Ebensburg | 2 |

| Economy | 1 |

| Eddystone | 2 |

| Edgewood | 1 |

| Edinboro | 2 |

| Edwardsville | 0 |

| Elderton | 0 |

| Elizabethtown | 0 |

| Elizabeth Township | 2 |

| Elkland | 0 |

| Elk Lick Township | 0 |

| Ellwood City | 7 |

| Emlenton Borough | 0 |

| Emmaus | 5 |

| Emporium | 0 |

| Emsworth | 0 |

| Ephrata | 5 |

| Ephrata Township | 2 |

| Erie | 104 |

| Etna | 3 |

| Everett | 4 |

| Exeter Township, Berks County | 4 |

| Fairfield | 1 |

| Fairview Township, Luzerne County | 2 |

| Fairview Township, York County | 6 |

| Falls Township, Bucks County | 41 |

| Fawn Township | 4 |

| Ferguson Township | 2 |

| Findlay Township | 2 |

| Fleetwood | 4 |

| Ford City | 1 |

| Forest City | 1 |

| Forks Township | 2 |

| Forty Fort | 2 |

| Foster Township, McKean County | 0 |

| Foster Township, Schuykill County | 0 |

| Fountain Hill | 4 |

| Fox Chapel | 2 |

| Frackville | 3 |

| Franconia Township | 1 |

| Franklin | 5 |

| Franklin Park | 1 |

| Franklin Township, Beaver County | 0 |

| Franklin Township, Carbon County | 2 |

| Franklin Township, Columbia County | 0 |

| Frazer Township | 1 |

| Freedom | 1 |

| Freedom Township | 1 |

| Freemansburg | 1 |

| Freeport | 0 |

| Gaines Township | 0 |

| Galeton | 0 |

| Gallitzin | 0 |

| Gallitzin Township | 0 |

| Garrett | 0 |

| Geistown | 0 |

| Gettysburg | 2 |

| Girard | 1 |

| Girardville | 0 |

| Glassport | 9 |

| Glenolden | 4 |

| Granville Township | 2 |

| Great Bend | 0 |

| Greencastle | 0 |

| Greenfield Township, Blair County | 0 |

| Greensburg | 8 |

| Green Tree | 0 |

| Greenville | 5 |

| Grove City | 2 |

| Halifax | 1 |

| Hamburg | 5 |

| Hampden Township | 3 |

| Hanover | 4 |

| Hanover Township, Luzerne County | 3 |

| Harmar Township | 3 |

| Harrisburg | 135 |

| Harrisville | 0 |

| Hartleton | 0 |

| Harveys Lake | 0 |

| Hatfield Township | 16 |

| Haverford Township | 29 |

| Hawley | 0 |

| Hazleton | 27 |

| Hegins Township | 1 |

| Heidelberg | 1 |

| Heidelberg Township, Berks County | 0 |

| Hellam Township | 3 |

| Hellertown | 3 |

| Hemlock Township | 1 |

| Hempfield Township, Mercer County | 3 |

| Hermitage | 13 |

| Highspire | 0 |

| Hilltown Township | 7 |

| Hollidaysburg | 1 |

| Homestead | 18 |

| Honesdale | 1 |

| Honey Brook | 0 |

| Hopewell Township | 3 |

| Horsham Township | 21 |

| Houston | 1 |

| Hughestown | 0 |

| Hughesville | 0 |

| Hulmeville | 1 |

| Hummelstown | 6 |

| Huntingdon | 1 |

| Independence Township, Beaver County | 0 |

| Independence Township, Washington County | 0 |

| Indiana Township | 4 |

| Indian Lake | 0 |

| Ingram | 0 |

| Irwin | 4 |

| Jackson Township, Butler County | 0 |

| Jackson Township, Cambria County | 0 |

| Jackson Township, Luzerne County | 2 |

| Jamestown | 0 |

| Jeannette | 0 |

| Jefferson Hills Borough | 8 |

| Jefferson Township, Lackawanna County | 0 |

| Jefferson Township, Mercer County | 0 |

| Jefferson Township, Washington County | 0 |

| Jenkins Township | 6 |

| Jennerstown | 0 |

| Jermyn | 1 |

| Jessup | 0 |

| Jim Thorpe | 2 |

| Johnsonburg | 0 |

| Johnstown | 19 |

| Kane | 1 |

| Kenhorst | 3 |

| Kennett Square | 7 |

| Kennett Township | 1 |

| Kidder Township | 2 |

| Kilbuck Township | 0 |

| Kingston | 6 |

| Kingston Township | 1 |

| Kiskiminetas Township | 0 |

| Knox | 0 |

| Kutztown | 5 |

| Lake City | 0 |

| Lancaster | 81 |

| Lancaster Township, Butler County | 0 |

| Lancaster Township, Lancaster County | 11 |

| Lanesboro | 0 |

| Langhorne Manor | 0 |

| Lansdale | 5 |

| Lansdowne | 16 |

| Lansford | 2 |

| Latrobe | 4 |

| Laureldale | 2 |

| Lawrence Park Township | 1 |

| Lawrence Township, Clearfield County | 3 |

| Lawrence Township, Tioga County | 0 |

| Lebanon | 49 |

| Leetsdale | 3 |

| Leet Township | 0 |

| Lehigh Township, Northampton County | 2 |

| Lehigh Township, Wayne County | 0 |

| Lehman Township | 1 |

| Lewistown | 5 |

| Liberty | 1 |

| Ligonier | 1 |

| Limerick Township | 9 |

| Linesville | 0 |

| Lititz | 1 |

| Little Beaver Township | 0 |

| Littlestown | 1 |

| Lock Haven | 1 |

| Locust Township | 0 |

| Logan Township | 6 |

| Loretto | 0 |

| Lower Allen Township | 7 |

| Lower Burrell | 4 |

| Lower Frederick Township | 3 |

| Lower Gwynedd Township | 9 |

| Lower Heidelberg Township | 1 |

| Lower Merion Township | 50 |

| Lower Moreland Township | 6 |

| Lower Paxton Township | 19 |

| Lower Pottsgrove Township | 8 |

| Lower Providence Township | 13 |

| Lower Salford Township | 0 |

| Lower Saucon Township | 1 |

| Lower Southampton Township | 6 |

| Lower Swatara Township | 0 |

| Lower Windsor Township | 8 |

| Macungie | 2 |

| Madison Township | 1 |

| Mahoning Township, Carbon County4 | 3 |

| Mahoning Township, Montour County | 1 |

| Malvern | 0 |

| Manheim | 4 |

| Manheim Township | 18 |

| Manor | 1 |

| Manor Township, Lancaster County | 6 |

| Mansfield | 0 |

| Marcus Hook | 3 |

| Marietta | 0 |

| Marion Township, Beaver County | 0 |

| Marion Township, Berks County | 0 |

| Marlborough Township | 0 |

| Marple Township | 5 |

| Martinsburg | 0 |

| Marysville | 0 |

| Masontown | 1 |

| Mayfield | 0 |

| McAdoo | 2 |

| McCandless | 3 |

| McDonald Borough | 1 |

| McSherrystown | 0 |

| Meadville | 7 |

| Mechanicsburg | 1 |

| Media | 1 |

| Mercersburg | 0 |

| Meshoppen | 3 |

| Middleburg | 2 |

| Middlesex Township, Butler County | 3 |

| Middlesex Township, Cumberland County | 1 |

| Middletown | 0 |

| Middletown Township | 29 |

| Midway | 1 |

| Mifflinburg | 0 |

| Mifflin County Regional | 7 |

| Milford | 0 |

| Millbourne | 0 |

| Millcreek Township, Lebanon County | 1 |

| Millersburg | 0 |

| Millersville | 0 |

| Mill Hall | 0 |

| Millvale | 1 |

| Millville | 0 |

| Minersville | 3 |

| Mohnton | 0 |

| Monaca | 7 |

| Monessen | 9 |

| Monongahela | 6 |

| Monroeville | 21 |

| Montgomery | 0 |

| Montgomery Township | 3 |

| Montoursville | 2 |

| Montour Township | 1 |

| Moon Township | 4 |

| Moore Township | 4 |

| Moosic | 11 |

| Morrisville | 10 |

| Morton | 0 |

| Moscow | 0 |

| Mount Carmel | 3 |

| Mount Carmel Township | 0 |

| Mount Gretna Borough | 0 |

| Mount Holly Springs | 1 |

| Mount Joy | 3 |

| Mount Lebanon | 9 |

| Mount Oliver | 2 |

| Mount Pleasant Township | 1 |

| Mountville | 0 |

| Muhlenberg Township | 8 |

| Muncy Township | 0 |

| Murrysville | 1 |

| Nanticoke | 5 |

| Nanty Glo | 0 |

| Narberth | 2 |

| Neshannock Township | 1 |

| Neville Township | 0 |

| New Beaver | 0 |

| New Berlin | 0 |

| Newberry Township | 10 |

| New Bethlehem | 0 |

| New Brighton | 5 |

| New Castle | 39 |

| New Castle Township | 0 |

| New Cumberland | 2 |

| New Garden Township | 7 |

| New Hanover Township | 4 |

| New Holland | 6 |

| New Hope | 2 |

| New Sewickley Township | 6 |

| Newtown Township, Bucks County | 4 |

| Newtown Township, Delaware County | 4 |

| New Wilmington | 0 |

| Norristown | 58 |

| Northampton | 5 |

| Northampton Township | 14 |

| North Beaver | 1 |

| North Belle Vernon | 3 |

| North Braddock | 1 |

| North Catasauqua | 3 |

| North Cornwall Township | 2 |

| North Coventry Township | 5 |

| Northeast, Bradford County | 0 |

| North East, Erie County | 3 |

| Northeastern Regional | 2 |

| Northern Berks Regional | 9 |

| Northern Cambria Borough | 1 |

| Northern Lancaster County Regional | 11 |

| Northern Regional | 2 |

| Northern York Regional | 37 |

| North Franklin Township | 1 |

| North Hopewell Township | 0 |

| North Huntingdon Township | 27 |

| North Lebanon Township | 5 |

| North Londonderry Township | 0 |

| North Middleton Township | 1 |

| North Sewickley Township | 4 |

| North Strabane Township | 7 |

| Northumberland | 1 |

| North Versailles Township | 7 |

| North Wales | 0 |

| Northwest Lancaster County Regional | 2 |

| Norwood | 2 |

| Oakdale | 0 |

| Oakland | 0 |

| Oakmont | 3 |

| O'Hara Township | 4 |

| Ohio Township | 0 |

| Ohioville | 0 |

| Oil City | 1 |

| Old Forge | 3 |

| Old Lycoming Township | 1 |

| Oley Township | 1 |

| Orwigsburg | 1 |

| Otto Eldred Regional | 0 |

| Oxford | 3 |

| Palmerton | 1 |

| Palmer Township | 8 |

| Palmyra | 4 |

| Patterson Township | 3 |

| Patton | 0 |

| Patton Township | 0 |

| Penbrook | 5 |

| Penn | 0 |

| Penndel | 0 |

| Penn Hills | 76 |

| Pennridge Regional | 0 |

| Penn Township, Butler County | 3 |

| Penn Township, Westmoreland County | 1 |

| Penn Township, York County | 4 |

| Pequea Township | 1 |

| Perkasie | 1 |

| Peters Township | 0 |

| Philadelphia | 5,493 |

| Phoenixville | 8 |

| Pine Creek Township | 1 |

| Pitcairn | 2 |

| Pittsburgh | 818 |

| Pittston Township | 4 |

| Plains Township | 5 |

| Pleasant Hills | 1 |

| Plumstead Township | 9 |

| Plymouth Township, Montgomery County | 22 |

| Pocono Mountain Regional | 22 |

| Pocono Township | 10 |

| Polk | 0 |

| Portage | 0 |

| Port Carbon | 0 |

| Portersville | 0 |

| Portland | 0 |

| Port Vue | 1 |

| Pottstown | 55 |

| Pottsville | 18 |

| Pringle | 1 |

| Prospect | 0 |

| Pulaski Township, Lawrence County | 2 |

| Punxsutawney | 1 |

| Pymatuning Township | 1 |

| Quakertown | 3 |

| Quarryville | 1 |

| Raccoon Township | 0 |

| Radnor Township | 10 |

| Rankin | 6 |

| Reading | 190 |

| Redstone Township | 0 |

| Reserve Township | 2 |

| Rice Township | 0 |

| Richland Township, Bucks County | 12 |

| Richland Township, Cambria County | 2 |

| Ridgway | 2 |

| Ridley Park | 4 |

| Ridley Township | 17 |

| Ringtown | 0 |

| Riverside | 1 |

| Roaring Brook Township | 3 |

| Roaring Creek Township | 0 |

| Roaring Spring | 0 |

| Robinson Township, Allegheny County | 10 |

| Robinson Township, Washington County | 0 |

| Rochester | 5 |

| Rochester Township | 3 |

| Rockledge | 0 |

| Roseto | 2 |

| Ross Township | 9 |

| Rostraver Township | 8 |

| Royersford | 1 |

| Rural Valley | 0 |

| Rush Township | 1 |

| Ryan Township | 1 |

| Salem Township, Luzerne County | 0 |

| Salisbury Township | 13 |

| Saltsburg | 0 |

| Sandy Township | 4 |

| Saxton | 0 |

| Sayre | 1 |

| Schuylkill Haven | 1 |

| Schuylkill Township, Chester County | 4 |

| Scottdale | 2 |

| Scott Township, Allegheny County | 3 |

| Scott Township, Columbia County | 0 |

| Scott Township, Lackawanna County | 0 |

| Scranton | 108 |

| Selinsgrove | 1 |

| Seward | 0 |

| Sewickley Heights | 0 |

| Shaler Township | 6 |

| Shamokin | 7 |

| Shamokin Dam | 0 |

| Sharon | 21 |

| Sharon Hill | 15 |

| Sharpsville | 1 |

| Shenandoah | 3 |

| Shenango Township, Lawrence County | 6 |

| Shenango Township, Mercer County | 1 |

| Shillington | 3 |

| Shinglehouse | 0 |

| Shippensburg | 2 |

| Shippingport | 0 |

| Shiremanstown | 0 |

| Shohola Township | 0 |

| Silver Spring Township | 2 |

| Sinking Spring | 2 |

| Slate Belt Regional | 3 |

| Slatington | 2 |

| Slippery Rock | 0 |

| Smethport | 0 |

| Solebury Township | 2 |

| Somerset | 3 |

| Souderton | 2 |

| South Abington Township | 2 |

| South Annville Township | 0 |

| South Beaver Township | 0 |

| South Buffalo Township | 0 |

| South Centre Township | 0 |

| South Coatesville | 2 |

| Southern Regional Lancaster County | 2 |

| Southern Regional York County | 1 |

| South Fayette Township | 0 |

| South Fork | 0 |

| South Greensburg | 0 |

| South Heights | 0 |

| South Londonderry Township | 0 |

| South Pymatuning Township | 0 |

| South Strabane Township | 6 |

| Southwestern Regional | 4 |

| Southwest Regional, Fayette County | 3 |

| Southwest Regional, Greene County | 0 |

| South Whitehall Township | 19 |

| South Williamsport | 0 |

| Springdale | 1 |

| Springettsbury Township | 21 |

| Springfield Township, Delaware County | 9 |

| Springfield Township, Montgomery County | 6 |

| Spring Garden Township | 36 |

| Spring Township, Berks County | 6 |

| Spring Township, Centre County | 0 |

| State College | 9 |

| St. Clair Township | 1 |

| Steelton | 26 |

| Stockertown | 0 |

| Stoneboro | 0 |

| Stowe Township | 13 |

| Strasburg | 1 |

| Stroud Area Regional | 31 |

| Sugarcreek | 1 |

| Sugarloaf Township, Luzerne County | 2 |

| Summerhill Township | 0 |

| Summit Township | 0 |

| Sunbury | 16 |

| Susquehanna | 0 |

| Susquehanna Regional | 2 |

| Susquehanna Township, Dauphin County | 12 |

| Swarthmore | 0 |

| Swatara Township | 13 |

| Swissvale | 14 |

| Swoyersville | 1 |

| Sykesville | 0 |

| Tamaqua | 7 |

| Tarentum | 5 |

| Tatamy | 0 |

| Taylor | 3 |

| Terre Hill | 0 |

| Throop | 2 |

| Tiadaghton Valley Regional | 0 |

| Tidioute | 0 |

| Tinicum Township, Bucks County | 0 |

| Tinicum Township, Delaware County | 14 |

| Tioga | 0 |

| Titusville | 0 |

| Towamencin Township | 0 |

| Towanda | 0 |

| Trainer | 0 |

| Tredyffrin Township | 10 |

| Troy | 0 |

| Tullytown | 0 |

| Tulpehocken Township | 0 |

| Tunkhannock Township, Wyoming County | 0 |

| Turtle Creek | 2 |

| Tyrone | 0 |

| Union City | 1 |

| Uniontown | 10 |

| Union Township, Lawrence County | 0 |

| Upland | 6 |

| Upper Allen Township | 2 |

| Upper Burrell Township | 2 |