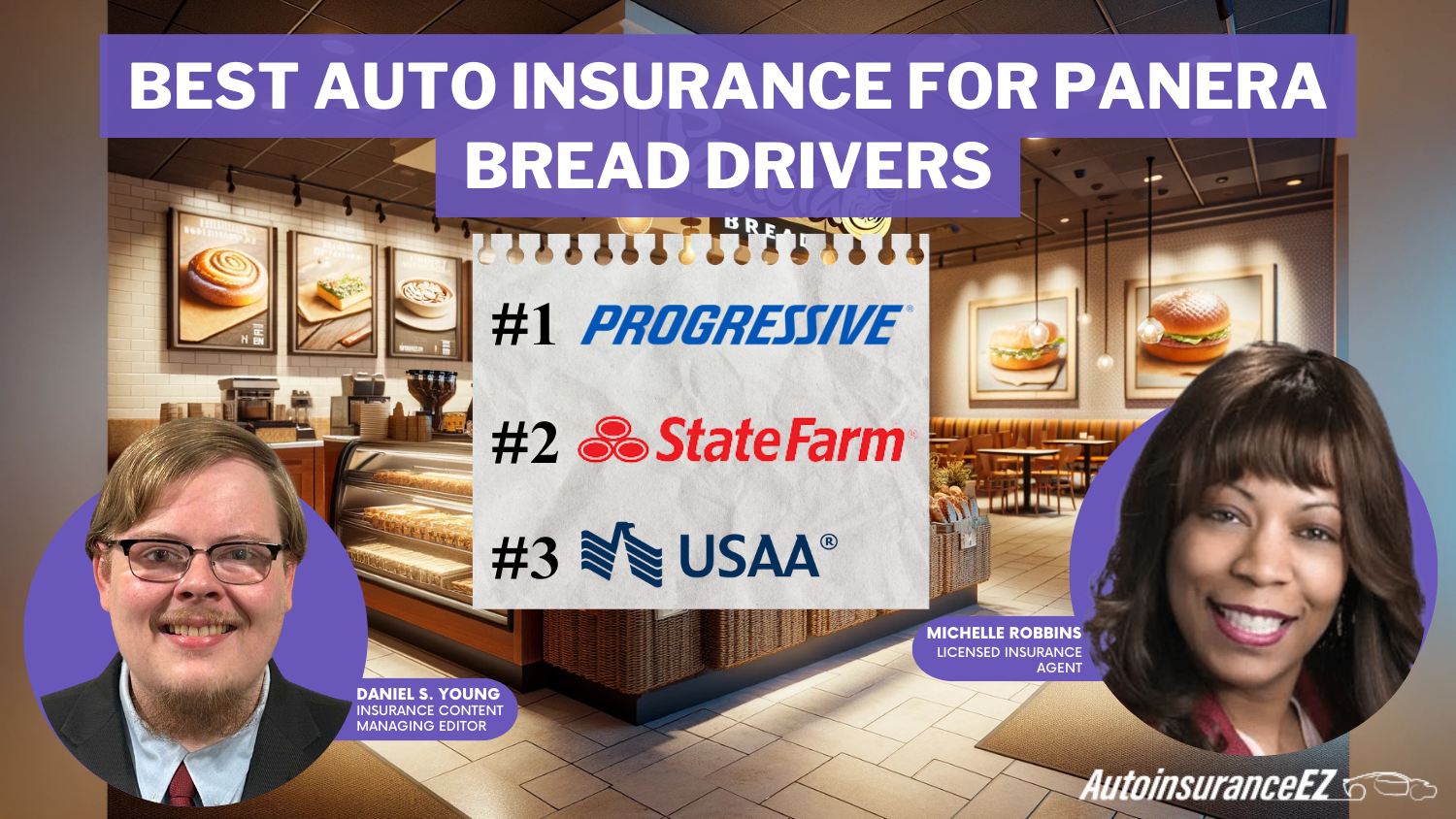

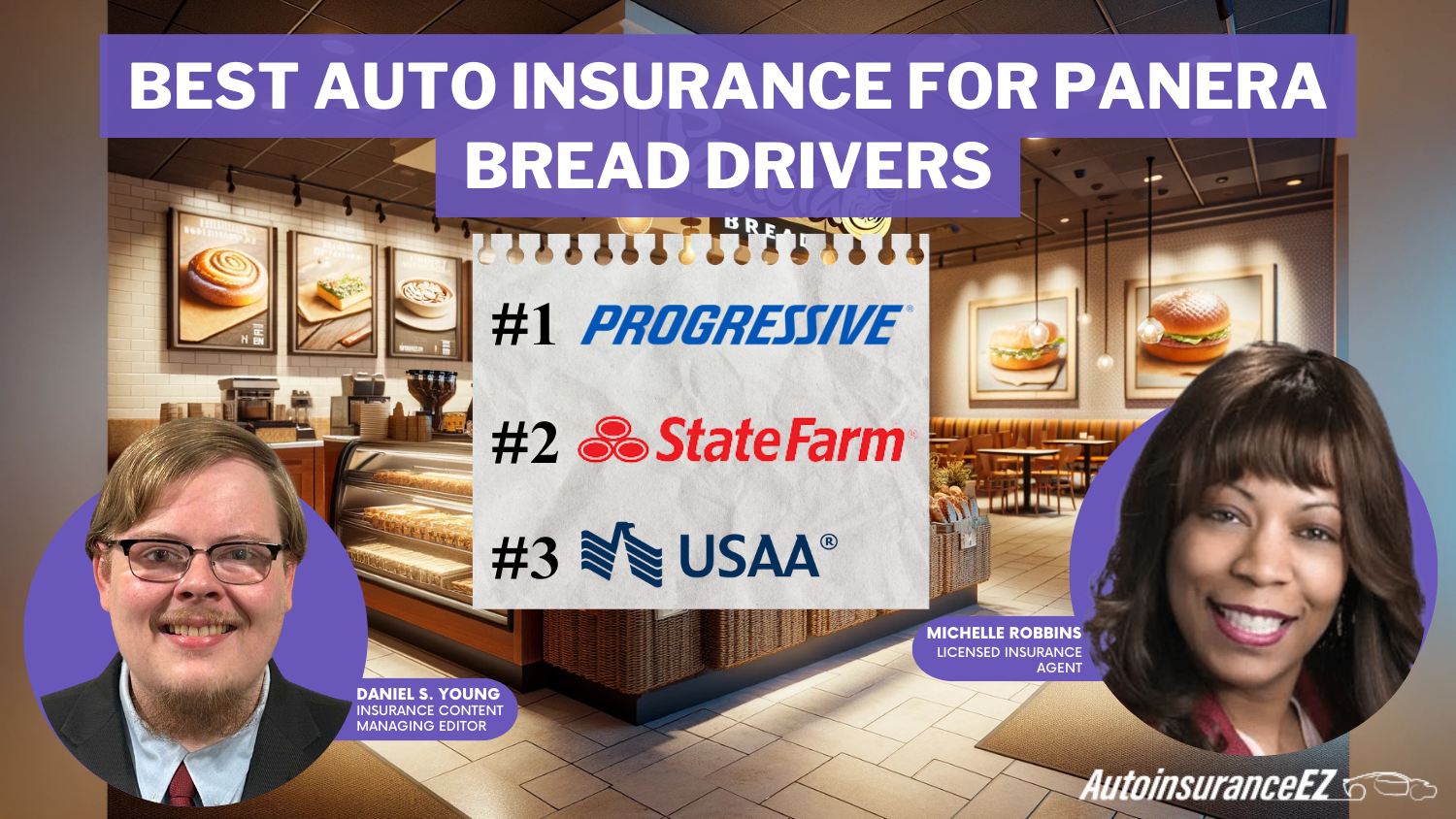

Best Auto Insurance for Panera Bread Drivers in 2025 (Top 10 Companies Ranked)

Progressive, State Farm, and USAA offer the best auto insurance for Panera Bread drivers. Panera Bread car insurance rates start at $50/month. Progressive covers food delivery, and State Farm offers accident forgiveness to prevent rate hikes. USAA is exclusive to military members.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Mar 25, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 25, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

On This Page

13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Panera Bread Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 18,154 reviews

18,154 reviewsCompany Facts

Full Coverage for Panera Bread Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage for Panera Bread Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviewsProgressive, State Farm, and USAA offer the best auto insurance for Panera Bread drivers. Rates start at just $50 per month. Progressive stands out for its food delivery coverage. State Farm provides accident forgiveness to prevent rate hikes. USAA has lower rates and fast claims processing for military members.

Panera Bread does offer commercial auto insurance for its delivery drivers, but having a personal policy with the right provider ensures complete protection. Taking advantage of car insurance discounts can help lower premiums, so compare quotes today to find the best coverage at the lowest.

Our Top 10 Company Picks: Best Auto Insurance for Panera Bread Drivers

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 10% | A+ | Delivery Coverage | Progressive | |

| #2 | 17% | B | Coverage Options | State Farm | |

| #3 | 10% | A | Comprehensive Service | USAA | |

| #4 | 25% | A+ | Full Coverage | Erie |

| #5 | 20% | A+ | Multi-Vehicle Households | Nationwide |

| #6 | 25% | A+ | Reliable-Claims Service | Allstate | |

| #7 | 30% | A+ | High-Customer Satisfaction | Amica | |

| #8 | 25% | A | Home-Auto Discounts | Liberty Mutual |

| #9 | 13% | A | Rideshare Add-Ons | Mercury | |

| #10 | 16% | A++ | Family Policies | Auto-Owners |

Enter your ZIP code into our free comparison tool to compare auto insurance quotes in your area today.

- Panera Bread covers delivery drivers, but personal coverage is still needed

- The best auto insurance includes food delivery coverage

- Progressive offers monthly coverage starting at just $50

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#1 – Progressive: Top Overall Pick

Pros

- Specialized Delivery Insurance: Progressive’s policies are specially made for food delivery drivers to ensure proper coverage at work.

- Snapshot Telematics Discounts: Policyholders save on Progressive insurance through the Snapshot program, which monitors safe driving behavior.

- Extensive Policy Personalization: Progressive insurance offers add-ons such as gap insurance and roadside assistance for added security.

Cons

- Higher Premiums for High-Risk Drivers: Progressive insurance charges higher premiums for drivers with a history of accidents or infractions.

- Complex Claims Process: Drivers have complained that Progressive insurance claims are slower than those of competitors. Read more: Progressive Auto Insurance Review

#2 – State Farm: Best for Coverage Options

Pros

- Accident Forgiveness: State Farm Insurance has accident forgiveness program, which saves from premium increases after the initial at-fault accident.

- Strong Local Presence: With numerous agents to choose from, State Farm Insurance offers personalized service and extensive policy tailoring.

- Telematics Discounts: With Drive Safe & Save, policyholders can lower their insurance costs by safe driving.

Cons

- Limited Rideshare Insurance: State Farm may not cover all aspects of delivery driving unless additional rideshare coverage is purchased.

- Higher Premiums for Young Drivers: Young and inexperienced drivers often pay more with State Farm than other providers. Read our State Farm auto insurance review for more details.

#3 – USAA: Best for Comprehensive Service

Pros

- Special Military Discounts: USAA offers significant discounts to military personnel and their families.

- Fast Claim Resolution: USAA’s speed and competence in handling claims are renowned for keeping vehicles on the road.

- Best Customer Satisfaction: It always scores highly for customer service, providing prompt support to policyholders.

Cons

- Restricted Membership: USAA is only available to military personnel and their families, limiting eligibility. Uncover more details in this USAA auto insurance review.

- Fewer Physical Locations: It has fewer brick-and-mortar branches for in-person assistance, unlike other major providers.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#4 – Erie: Best for Full Coverage

Pros

- Accident Forgiveness: Erie can help you avoid rate hikes following a first-time at-fault accident.

- Comprehensive Insurance Options: Erie offers comprehensive insurance coverage, including personal injury protection and uninsured motorist coverage.

- Rate Lock Feature: Erie Insurance allows policyholders to lock in rates to prevent surprise premium hikes.

Cons

- Limited Availability: Erie is not offered in all states, limiting access for some drivers. Read our Erie auto insurance review to learn more.

- Slower Claims Processing: A few policyholders experience longer-than-usual wait times for Erie Insurance claims.

#5 – Nationwide: Ideal for Multi-Vehicle Families

Pros

- High Multi-Car Discounts: Nationwide offers great discounts to families or multi-car households for insuring all their cars with a single policy.

- SmartRide Telematics Program: Policyholders can reduce their Nationwide insurance rates by engaging in the SmartRide program, which incentives safe driving behavior.

- Excellent Financial Strength: Nationwide insurance boasts an A rating from A.M. Best, ensuring claim payments and long-term assistance to policyholders.

Cons

- Higher Premiums Without Bundling: Nationwide charges higher premiums for those without a home or renters insurance coverage.

- Fewer Local Agent Offices: It has fewer dedicated agents in many areas, so in-person service is less convenient. Explore further in our Nationwide auto insurance review.

#6 – Allstate: Best for Reliable Claims Service

Pros

- Rapid Claim Payments: Allstate facilitates rapid claim payments, reducing wait times for drivers to get repaired or reimbursed.

- Usage-Based Discounts: Customers who use the Drivewise program are eligible for Allstate’s discounts based on good driving behavior.

- Multi-Policy Benefits: Customers who package Allstate insurance with other policies, such as homeowners or renters insurance, are eligible for significant discounts.

Cons

- Higher Starting Premiums: Policies generally begin at a higher rate than some competitors. Get more insights by reading our Allstate auto insurance review.

- Inconsistent Customer Service: While many customers are satisfied, some report challenges with support and claims assistance.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#7 – Amica: Best for High-Customer Satisfaction

Pros

- Highest-Rated Customer Service: Amica consistently ranks among the highest in customer satisfaction and reliability.

- Dividend Policy Option: Certain policyholders are eligible for annual dividend payments, lowering total costs.

- Coverage Add-ons: It provides many coverage add-ons, such as gap insurance and rental reimbursement.

Cons

- Limited Digital Tools: Amica has fewer online and mobile features than larger providers. For further details, read our Amica auto insurance review.

- Higher Initial Costs: Amica may have higher upfront premiums, though discounts can help lower costs over time.

#8 – Liberty Mutual: Best for Home-Auto Discounts

Pros

- Significant Bundling Discounts: Liberty Mutual provides competitive discounts to customers who bundle home and auto policies.

- Alternative Energy Vehicle Discounts: It also offers discounts to hybrid and electric vehicle owners.

- Accident Forgiveness: Policyholders can use accident forgiveness program to prevent increased rates.

Cons

- Expensive for High-Risk Drivers: Liberty Mutual may have higher rates for drivers with past accidents or violations. Discover more by reading our Liberty Mutual auto insurance review.

- Inconsistent Customer Service: Some policyholders report mixed experiences with Liberty Mutual claims support.

#9 – Mercury: Best for Rideshare Add-Ons

Pros

- Affordable Rideshare Insurance: Mercury offers delivery and rideshare drivers budget-friendly protection.

- Multi-Policy Discounts: Policyholders combining auto with home or renters policies can tap into extra savings.

- Flexible Payment Plans: Mercury has flexible payment plans to assist drivers in better managing premium expenses.

Cons

- Statewide Insurance Limitations: Mercury is unavailable nationwide, limiting driver access in some areas. Uncover additional insights in our Mercury auto insurance review.

- Lacks Advanced Technology: The company lacks more digital resources, making online account maintenance less convenient than larger competitors.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#10 – Auto-Owners: Best for Family Policies

Pros

- Substantial Multi-Policy Discounts: Auto-Owners offers significant savings for households insuring multiple drivers.

- Excellent Customer Service: The company is known for personalized service and quick claim resolutions.

- Comprehensive Coverage Options: It provides a wide range of policies, including life and umbrella insurance.

Cons

- Limited Online Services: Auto-Owners has fewer online features than larger national insurers. Read more: Auto-Owners auto insurance review.

- Availability Restrictions: Auto-Owners is not available in every state, limiting access for some drivers.

Coverage Options for Panera Bread Drivers

Panera Bread drivers have the option of minimum liability or full coverage insurance. USAA and Erie provide the cheapest minimum coverage at $50 and $56 a month, but this only covers damages to other people in an accident.

Panera Bread Drivers Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $72 | $134 | |

| $58 | $116 | |

| $61 | $140 | |

| $56 | $94 |

| $69 | $138 |

| $64 | $128 | |

| $60 | $123 |

| $65 | $105 | |

| $62 | $110 | |

| $50 | $100 |

Complete coverage includes more comprehensive protection such as liability, collision, and insurance. Erie and USAA offer the lowest full coverage prices at $94 and $100 per month and cover damage to the vehicle, theft, and other risks.

Drivers should compare coverage options and discounts carefully, as bundling policies or maintaining a clean record can significantly lower monthly auto insurance costs.

Jeff Root Licensed Insurance Agent

Auto-Owners and Liberty Mutual provide monthly coverage for $140 and $138 for individuals seeking added benefits. These options can come with benefits such as accident forgiveness, roadside assistance, and rental reimbursement.

Safety Features That Can Lower Insurance Rates

Insurance providers reduce premiums for vehicles with advanced safety features that lower accident risks. According to the Insurance Institute for Highway Safety (IIHS), automatic emergency braking (AEB) cuts rear-end collisions by 50%, and lane departure warnings reduce crashes by 11%. Auto-Owners and Nationwide offer discounts for these features due to their proven effectiveness in preventing accidents.

Auto Insurance Discounts From the Top Providers for Panera Bread Drivers

| Insurance Company | Available Discounts |

|---|---|

| Safe Driving, Multi-Policy, Early Signing, Anti-Theft, Drivewise (telematics), New Car, Full Pay | |

| Good Driving, Loyalty, Multi-Line, Paid-in-Full, Paperless, Autopay Discounts | |

| Multi-Policy, Good Driver, Safety Features, Anti-Theft, Paid-in-Full, Teen Driver | |

| Safe Driver, Multi-Car, Pay-in-Full, Young Driver, Reduced Usage, Accident-Free |

| Bundling, Early Shopper, Safe Driving, Alternative Energy Vehicle, Violation-Free, Affinity Group |

| Good Driver, Multi-Car, E-Policy, Professional Affiliation, Bundling, Paid-in-Full | |

| Accident-Free, Paperless Billing, SmartRide (telematics), Multi-Policy, Safe Driver, Defensive Driving |

| Multi-Car, Bundling, Snapshot (telematics), Continuous Insurance, Teen Driver, Safe Driver | |

| Good Student, Drive Safe & Save (telematics), Accident-Free, Steer Clear (young drivers), Multi-Car | |

| Bundling, Military, Safe Driver, Loyalty, Telematics (SafePilot), Continuous Insurance |

Anti-theft technology also plays a role in lowering insurance costs. The National Insurance Crime Bureau (NICB) states that vehicles with GPS tracking, engine immobilizers, and audible alarms have a significantly lower theft rate. Liberty Mutual and Erie provide discounts for cars with these security features, as they reduce insurer payouts on stolen vehicles.

Rear ended by Panera delivery driver that doesn’t have insurance.

byu/iflyrocketships inlegaladvice

Telematics-based programs like Progressive’s Snapshot and Nationwide’s SmartRide monitor real-time driving patterns to assess behavior. The National Association of Insurance Commissioners (NAIC) reports that safe drivers who avoid hard braking, excessive speeding, and late-night driving can save between 10% and 40% on premiums through safe driver insurance discounts. Panera Bread drivers who enroll in these programs can cut costs while improving their driving habits.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

High-Risk Driver Insurance: Key Considerations

High-risk driver insurance is required for those with serious traffic offenses, multiple accidents, or DUIs, which tend to result in higher premiums and less coverage. Most states mandate an SR-22 or FR-44 filing, which is proof of insurance, and drivers might have to obtain policies from non-standard carriers that deal in high-risk coverage

Because high-risk policies may be two to three times more expensive than regular auto insurance, comparing quotes from several companies is crucial. Some companies provide discounts for better driving, and usage-based insurance (UBI) programs can assist drivers in providing safe driving to reduce expenses in the long run.

To return to regular insurance, high-risk drivers must keep their record clean, take defensive driving classes, and look into bundling for further savings. Knowledge of coverage limitations, proactive risk management, and understanding car insurance after a DUI can help drivers secure more affordable policies while meeting state insurance requirements.

Panera Bread’s Policy on Delivery Driver Auto Insurance

To drive for Panera Bread, you must provide your own registered vehicle and have an existing personal auto insurance policy. You must also be at least 18 years of age and have a motor vehicle record in good standing. But the biggest question on everyone’s mind is, Does Panera Bread provide delivery driver auto insurance?

Fortunately, the answer is yes. Panera Bread does provide on-the-job commercial auto insurance coverage while you are delivering orders. This means you will not have to purchase additional delivery driver auto insurance on your personal policy when driving for Panera Bread.

Keep in mind Panera Bread will charge delivery drivers a “company vehicle” tax on their paychecks even though you are using your own vehicle. The size of this tax is not known.

Buying Panera Bread Auto Insurance for Delivery Drivers

If you drive for Panera Bread, you’ll be glad they offer commercial auto insurance. This policy ensures you should you get involved in an accident. It eliminates the need to pay extra for adding delivery protection to your car insurance policy, saving you from increased premiums.

But don’t think you’re in the clear if you work for Uber Eats, DoorDash, or Grubhub. Each business has varying car insurance policies, so it pays to check. You might need business vehicle insurance to be fully covered if their coverage isn’t adequate.

If you rent a car, read your contract thoroughly. Some dealerships prohibit the use of their vehicles for deliveries or ride-sharing, so checking restrictions can prevent contract breaches.

Ready to buy auto insurance? Now that you know Panera Bread provides commercial delivery driver auto insurance, enter your ZIP code into our free comparison tool below to find affordable auto insurance quotes from insurance providers in your area.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

What type of insurance does Panera Bread provide for its delivery drivers?

Panera Bread provides commercial auto insurance coverage for its delivery driver while actively delivering orders. This coverage applies only during work-related driving and does not extend to personal use of the vehicle.

Is Panera Bread available on Uber Eats?

Yes, in select areas. Customers can order through the app, with fees based on location and order size. Delivery time depends on store hours and demand. Panera car delivery may also be available in specific places for direct orders.

What insurance does Panera Bread offer employees and drivers?

Panera Bread provides commercial auto insurance for delivery drivers while working. Full-time employees receive medical, dental, and vision coverage. Part-time employees may have limited benefits. Some employee perks are also referred to as bread insurance.

How much do Panera Bread delivery drivers make?

Panera Bread delivery drivers earn between $10 and $15 per hour, including base pay and tips. Earnings can vary based on location, experience, and the number of deliveries completed. Customers choosing Panera for delivery may also tip, increasing a driver’s earnings.

What health insurance does Panera Bread provide?

Full-time Panera Bread employees can access Panera health insurance, including medical, dental, and vision coverage. The details may differ based on your position and where you work.

Enter your ZIP code now to access the most competitive auto insurance quotes for Panera Bread Drivers.

What insurance benefits does Panera Bread offer for delivery drivers?

Panera Bread provides commercial auto insurance for Panera Bread delivery drivers during active deliveries, but it does not cover personal vehicle use. Drivers may also need liability auto insurance for personal coverage. Based on location and employment status, full-time delivery drivers may qualify for health, dental, and vision benefits.

How much does Panera charge for delivery?

Panera Bread’s delivery fees typically range from $1 to $5, depending on the location and order size. A minimum order amount, usually between $8 and $10, is required for delivery. To check the exact fees in your area, enter your Panera Bread ZIP code on their website or app.

How does Panera delivery work?

Customers can order delivery through Panera’s website, mobile app, or third-party platforms like Uber Eats. Depending on the location, orders are fulfilled by either Panera’s in-house drivers or third-party couriers. Delivery fees and availability vary by area. Check out the Panera Bread commercial showcasing their services for a glimpse of Panera’s offerings.

Does State Farm provide coverage for food delivery drivers?

State Farm’s standard personal auto policy does not automatically cover food delivery. However, they offer a rideshare and delivery driver endorsement in some states, which provides additional protection. Drivers working for Panera Bread in Eugene, Oregon, or other food delivery services should check with a local State Farm agent to see if auto insurance coverage for delivery drivers is available in their area.

What is the cost of Panera catering?

Panera catering costs depend on selected menu items, order size, and location. Most orders require a minimum purchase, typically around $50–$100, and delivery fees range from $5 to $25 based on distance. Customers can explore detailed pricing, customize their orders, and schedule deliveries through Panera online catering on Panera’s website or app.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.