Best Hillsboro, OR Auto Insurance in 2025 (See the Top 10 Companies Here)

State Farm, Geico, and Progressive provide the best Hillsboro, OR auto insurance, with a starting rate of $34/mo. State Farm excels for its strong local agents and bundling discounts. Geico has competitive premiums for all types of drivers. Progressive offers SR-22 filing for high-risk drivers.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Apr 15, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

18,154 reviews

18,154 reviewsCompany Facts

Full Coverage in Hillsboro OR

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in Hillsboro OR

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage in Hillsboro OR

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsThe best Hillsboro, OR auto insurance companies are State Farm, Geico, and Progressive, with a monthly starting rate of $34. State Farm excels in its extensive network of local agents offering real-time customer support and prompt claims response.

Geico is renowned for its competitive rates across different driver profiles, and Progressive has a specialized program for high-risk drivers and SR-22. Here is the table for your reference to explore more of the best Oregon Hillsboro auto insurance companies.

Our Top 10 Company Picks: Best Hillsboro, OR Auto Insurance

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $95 | A++ | Customer Service | State Farm | |

| #2 | $94 | A++ | Budget Drivers | Geico | |

| #3 | $118 | A+ | Flexible Options | Progressive | |

| #4 | $146 | A | Local Agents | Farmers | |

| #5 | $134 | A+ | Comprehensive Plans | Allstate | |

| #6 | $152 | A | Bundled Discounts | Liberty Mutual |

| #7 | $87 | A++ | Military Families | USAA | |

| #8 | $105 | A+ | New Drivers | Nationwide |

| #9 | $112 | A++ | Safe Drivers | Travelers | |

| #10 | $127 | A | Customized Coverage | American Family |

Are you looking for the cheapest car insurance in Oregon? With AutoInsuranceEZ.com, you’ll find the best insurance policy in this extensive guide we made just for you.

- The top auto insurers in Hillsboro are State Farm, Geico, and Progressive

- Auto insurance coverage in Hillsboro, Oregon, starts at only $34 a month

- Several factors determine auto insurance rates in Hillsboro, like credit score and age

To get free car insurance quotes from the top-rated providers in Hillsboro, enter your ZIP code in the quote box here.

#1 – State Farm: Top Overall Pick

Pros

- Strong Local Agents: State Farm is known for its large number of agents that offer coverage personalization for car insurance in Hillsboro, OR.

- Stackable Savings Options: State Farm offers different ways to lower premiums, like the Steer Clear program and bundling. More discounts are listed in the State Farm auto insurance review.

- High Customer Satisfaction Rates: The claims response is efficient, and customer service is available 24/7, making it the best Hillsboro, OR auto insurance.

Cons

- No Custom or High-End Vehicles Plans: State Farm does not offer coverage for specialized vehicles, which is not ideal for those who own luxury or modified cars.

- Limited Online Policy Management: It heavily relies on local agents to adjust auto insurance policies or claims in Hillsboro, OR, making it less flexible.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#2 – Geico: Best for Budget Drivers

Pros

- Consistent Competitive Rates: Geico offers low rates to drivers with different profiles, including young, seniors, and high-mileage commuters.

- Generous Savings Opportunities: A 25% discount on bundling and another 25% on good drivers. All the discounts you need to know are in our Geico auto insurance review.

- Easy Mobile Tool: Geico’s mobile app for car insurance in Hillsboro is the best in the industry for getting quotes, filing claims, and managing policies.

Cons

- Lesser Add-Ons: It has fewer options for customizable add-ons, such as unavailable gap coverage for car insurance in Hillsboro, Oregon.

- Long Claims Response: Customers reported experiencing delays in claims resolution of car insurance in Hillsboro, Oregon.

#3 – Progressive: Best for Flexible Options

Pros

- Name Your Price Tool: This allows policyholders to set a budget for their car insurance in Hillsboro, Oregon, and choose coverage within their price range.

- Best for High-Risk Drivers: Progressive auto insurance in Hillsboro is the best option for those with accidents, tickets, and DUIs. It can also file an SR-22 on your behalf.

- Stackable Discounts: Snapshot, bundling, and good students are the few discount options mentioned. Check out all the ways to save in the Progressive auto insurance review.

Cons

- Higher Rates to Some Drivers: Progressive, unlike Geico and Nationwide, charges higher premiums to those with bad credit scores.

- Fewer Local Agents: It primarily operates online, so agents are available but fewer than the best Hillsboro, OR auto insurance competitors.

#4 – Farmers: Best for Local Agents

Pros

- Extensive Local Agent Network: Farmers Insurance in Hillsboro, Oregon, has strong local agents who assist customers in face-to-face consultations.

- Community and Customer-Oriented: The local agents recommend policies based on the driver’s varied factors and specific road risks, ensuring drivers get the best auto insurance in Hillsboro.

- Coverage Personalization: Wide options for coverage levels and add-ons like EOM parts and customized equipment. Discover all the options in Farmers auto insurance review.

Cons

- Varying Discounts: Some savings options are not offered in every state, and it could also depend on the local agents that customers work with.

- Slow Claims Processing: Customers experience long wait times for claims resolution, especially in complex car insurance incidents.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#5 – Allstate: Best for Comprehensive Plans

Pros

- Robust Comprehensive Coverage: The comprehensive policy includes many options, such as theft, fire damage, and weather-related incidents. Check it all in the Allstate auto insurance review.

- Unique Add-Ons: To enhance your Hillsboro, OR auto insurance protection, it also provides new car replacement, custom equipment, and sound system insurance.

- Safe Driving Perks: A significant rate decrease on the Drivewise auto insurance program and another bonus check for a clean record every six months.

Cons

- Strict Requirements for Discounts: Drivers may be required to stay accident-free for an extended period to be eligible for the safe driving bonus checks.

- Customization Price Increase: Adding more auto insurance features and add-ons increases the overall premiums, making it less budget-wise.

#6 – Liberty Mutual: Best for Bundled Discounts

Pros

- Large Bundle Savings: Liberty Mutual offers a 25% significant discount to policyholders who bundle other policies like home, condo, etc.

- Policy Customization: It enables drivers to adjust deductibles, include coverage, and add-ons like better car replacement, ensuring the best Hillsboro, OR auto insurance.

- Advanced Online Tools: Customers can file claims, manage policies, and track discounts in the mobile app. The Liberty Mutual auto insurance review discusses all the features.

Cons

- Discount Varies by State: Liberty Mutual’s car insurance in Hillsboro, Oregon, may not offer the highest bundling savings compared to other locations.

- Customization Issues: Some auto insurance policies, like State Farm or Nationwide, are not as flexible, which could increase costs.

#7 – USAA: Best for Military Families

Pros

- Exclusive Offers and Perks: This is only available to active military veterans and their families, offering flexible coverage and deployment discounts.

- Leading Affordable Premiums: USAA has consistently low rates with a 15-30% difference from competitors. The exact rates for different plans are in the USAA auto insurance review.

- Reliable Claims Response: Known for prompt claims processing wherever the policyholders are stationed, making sure it delivers the best Hillsboro, OR auto insurance.

Cons

- No Physical Branches: USAA car insurance in Hillsboro mainly operates online or over the phone without in-person agents to assist customers.

- Less Competitive Rates for High-Risk Drivers: USAA is known for its low rates, but those with accidents, violations, and DUIs may get higher premiums.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#8 – Nationwide: Best for New Drivers

Pros

- Competitive Add-Ons: Nationwide car insurance in Hillsboro offers accident forgiveness for the first at-fault accident and vanishing deductibles that reduce yearly.

- SmartRide Program Incentives: Safe drivers with good driving habits can receive up to 40% off monthly rates. Learn more about this program in our Nationwide auto insurance review.

- SmartMiles Feature for Low-Mileage Drivers: This pay-per-mile program is intended for those who drive less, such as students and young professionals.

Cons

- Expensive Rates for Inexperienced Drivers: The base rate for new drivers is higher than that of Geico and Progressive, which offer the cheapest car insurance in Oregon.

- Mixed Customer Review: Despite the company’s strong reputation for car insurance in Hillsboro, some customers reported experiencing delays in claims response.

#9 – Travelers: Best for Safe Drivers

Pros

- IntelliDrive Program: A telematics-based feature that rewards drivers with safe driving habits with a 30% discount.

- Clean Record Perks: Zero violations, accident-free, and good payer discounts are more savings options for safe drivers. Check all the discounts in Travelers auto insurance review.

- Stable Claims Service: With an A++ rating from A.M. Best, Travelers ensures round-the-clock support and efficient claims handling for the best Oregon Hillsboro auto coverage.

Cons

- Intellidrive Drawbacks: Risky behaviors monitored in the Intellidrive auto insurance feature in Hillsboro can raise premiums.

- Gap Insurance Exclusion: Although it offers gap insurance, only the original owner of the leased car and cars bought from a new car dealer are eligible.

#10 – American Family: Best for Customized Coverage

Pros

- Customizable Coverage: A wide choice of policy add-ons is available, including gap coverage, rental reimbursement, and emergency roadside assistance.

- Personalized Value Savings: There are several ways to lower premiums, such as bundling and safe driver discounts. The American Family auto insurance review covers more of these.

- Strong State Presence: American Family car insurance in Hillsboro has dedicated agents who provide 24/7 claims processing and customer service in Oregon.

Cons

- Less Advanced Digital Tools: American Family has a mobile app, but it lacks features like instant policy adjustment that the best Hillsboro OR auto insurance competitors have.

- Limited Coverage Outside Focus Regions: It is not available in all states, so its drawbacks are for those who travel and plan to relocate.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Best Raleigh, NC Auto Insurance Monthly Rates

The first step in getting the best Raleigh, OR, auto insurance is determining the monthly rates. We have listed below the minimum and full coverage rates from the top 10 insurance companies for you to discover.

Auto Insurance Monthly Rates in Hillsboro, OR by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $56 | $134 | |

| $52 | $127 | |

| $58 | $146 | |

| $34 | $94 | |

| $66 | $152 |

| $52 | $105 |

| $40 | $118 | |

| $40 | $95 | |

| $57 | $112 | |

| $35 | $87 |

Geico and USAA offer the lowest rates for minimum coverage, starting at $34 and $35, and full coverage starts at $94 and $87, respectively. Remember to get the insurance coverage you need that suits your budget. Do not pay for extra when you cannot use it in the future.

Balancing cost and coverage is key—minimum coverage saves money, but comprehensive coverage offers greater protection.

Tracey L. Wells Licensed Insurance Agent & Agency Owner

Getting the best auto insurance in Hillsboro, OR, requires considering cost and coverage. Always compare options and choose a policy that aligns with your budget and risk factors. But don’t let a cheap price fool you into signing up with a company that doesn’t care about customer service or paying out claims.

Read more: Geico vs. USAA: Best Auto Insurance

Hillsboro, OR Auto Insurance Discounts

Most Oregon drivers pay around $87 on a monthly basis for their automotive insurance policies. However, living in Hillsboro can get you low rates, starting at $34 a month! Keep reading, and we’ll show you how to get great Oregon auto insurance deals.

Auto Insurance Discounts From Top Hillsboro, OR Providers

| Insurance Company | Bundling | Good Student | Low Mileage | Loyalty | Safe Driver |

|---|---|---|---|---|---|

| 25% | 18% | 30% | 15% | 18% | |

| 25% | 18% | 20% | 18% | 18% | |

| 20% | 15% | 10% | 12% | 20% | |

| 25% | 26% | 30% | 10% | 15% | |

| 25% | 12% | 30% | 10% | 20% |

| 20% | 12% | 20% | 8% | 12% |

| 10% | 10% | 30% | 13% | 10% | |

| 17% | 20% | 30% | 6% | 20% | |

| 10% | 17% | 20% | 9% | 17% | |

| 13% | 17% | 20% | 11% | 17% |

These are all the ways to lower your monthly auto insurance bills. Although each insurer offers various discounts, checking how much you can save before taking advantage of them is important.

Best Hillsboro, OR, Auto Insurance Providers

State Farm offers the best Hillsboro, OR auto insurance. It is known for offering in-person consultations and assisting customers with issues. It established local agents and an office in Hillsboro. However, local agents vary in attitude, offer, and expertise, so if you have issues with your agents, you can always change.

Comment

byu/Jmorris106 from discussion

inInsurance

Moreover, it has a long list of discounts, such as bundling and steer clear programs, that you can take advantage of to lower your premiums even further.

Once home to the Kalapuya Indians, Hillsboro is now famous for being home to what is known as the “silicon forest”, a small congregation of high-tech companies just outside of Portland.

- Fun fact: single women, look no further! Hillsboro is #20 on the list of “Top 100 cities with the largest percentage of males (pop. 50,000+)”. Are you intrigued by learning more about Hillsboro? Click here!

The fertile land surrounding the city is essential for its agricultural industry, including local wineries. Other profitable industries include retail sales and healthcare.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Auto Insurance Coverage Requirements in Oregon

Here are the minimum car insurance requirements for driving legally in Oregon.

Auto Insurance Minimum Coverage Requirements in Oregon

| Coverage | Limits |

|---|---|

| Bodily Injury | $25,000 per person / $50,000 per accident |

| Property Damage | $20,000 per accident |

| Uninsured Motorist Bodily Injury | $25,000 per person / $50,000 per accident |

| Personal Injury Protection | $15,000 per accident |

Just because Oregon’s state minimums are higher than in most other states doesn’t mean your coverage needs to be more expensive. And besides, having those extra coverages protects you from uninsured motorists.

Major Car Insurance Factors in Hillsboro

Auto insurance carriers evaluate different factors when calculating insurance quotes, including driving experience, zip code, type of vehicle owned, driving distance to work, and current insurance coverage and limits. Moreover, premiums differ from provider to provider. To verify you’re still getting the cheapest premium, compare the cheapest car insurance in Oregon online.

While some insurance factors are fixed, others—like your driving record and coverage choices—can be optimized to lower your premiums.

Jeff Root Licensed Insurance Agent

Even though some of these specific things aren’t actually something you can do something about, a few of them are elements you can change for the better. Here are some factors that can affect your automobile insurance premium.

Your ZIP Code

The spot where you park your vehicle every night will probably seriously influence your rates from auto insurance in Hillsboro. Usually, auto insurance costs less in rural regions merely because fewer cars indicate a reduced chance that you’ll get into a collision with some other vehicle.

Auto Insurance Monthly Rates in Hillsboro, OR by ZIP Code

| ZIP | Rates |

|---|---|

| 97124 | $145 |

| 97008 | $142 |

| 97006 | $140 |

| 97007 | $138 |

| 97123 | $135 |

The populace of Hillsboro is 107,730, plus the normal family income is $98,891 as of 2023. The good thing about the rates in Hillsboro car insurance based on the ZIP code is that there is no huge gap. You can only see a difference of a few dollars.

Read more: Factors that Affect Your Car Insurance Premiums

Your Credit Score

Most people don’t realize how important their credit score is when determining their automobile insurance premiums. If you have poor credit, your monthly rate can be as high as double or triple that of someone with an excellent credit history.

Check the table below to learn more about how credit score affects car insurance premiums.

Auto Insurance Monthly Rates in Hillsboro, OR by Credit Score

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $125 | $160 | $250 | |

| $120 | $155 | $240 | |

| $130 | $170 | $260 | |

| $115 | $150 | $230 | |

| $140 | $180 | $270 |

| $135 | $175 | $265 |

| $130 | $170 | $260 | |

| $125 | $160 | $240 | |

| $120 | $155 | $230 | |

| $125 | $160 | $245 |

Auto insurance rates in Hillsboro, OR, vary based on credit scores, with lower rates for good credit and significantly higher premiums for bad credit. Geico offers the lowest rate for good credit at $115, while Liberty Mutual has the highest rate for bad credit at $270.

Your Age

Statistically speaking, young and inexperienced drivers are the most likely to get into an accident. That’s why older drivers get charged lower monthly rates – because the insurance company is not taking on a huge financial risk by insuring them. If you are a young teenage driver, try looking into good student discounts, as well as Drivers Ed and defensive driving courses.

Auto Insurance Monthly Rates in Hillsboro, OR by Provider, Age, & Gender

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 34 Female | Age: 34 Male |

|---|---|---|---|---|

| $130 | $135 | $180 | $185 | |

| $125 | $130 | $170 | $175 | |

| $180 | $185 | $225 | $230 | |

| $100 | $105 | $150 | $155 | |

| $140 | $145 | $190 | $195 |

| $120 | $125 | $170 | $175 |

| $132 | $138 | $182 | $188 | |

| $155 | $160 | $210 | $215 | |

| $145 | $150 | $190 | $195 | |

| $135 | $140 | $185 | $190 |

Auto insurance rates in Hillsboro, OR, vary based on provider, age, and gender, with younger drivers facing significantly higher premiums than older drivers. Geico offers the lowest rate for 17-year-old females at $100, while Farmers Insurance has the highest rate for 34-year-old males at $230.

Your Driving Record

The more violations you have on your record, the more likely you are to file a claim – which will lead your provider to charge you higher premiums. But if you have only a minor accident on your record, ask your agent about Accident Forgiveness discounts.

Auto Insurance Monthly Rates in Hillsboro, OR by Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $150 | $175 | $200 | $250 | |

| $142 | $167 | $192 | $242 | |

| $133 | $158 | $175 | $233 | |

| $125 | $150 | $167 | $217 | |

| $145 | $170 | $195 | $245 |

| $150 | $175 | $200 | $250 |

| $135 | $160 | $178 | $235 | |

| $117 | $133 | $150 | $192 | |

| $130 | $155 | $170 | $220 | |

| $140 | $165 | $178 | $240 |

There has been an increase in traffic violations, with the highest premiums for drivers with a DUI. State Farm offers the lowest rate for a clean record at $117, while Allstate and Nationwide charge the highest for a DUI at $250.

Read more: How Traffic Violations Increase Car Insurance Rates

Your Vehicle

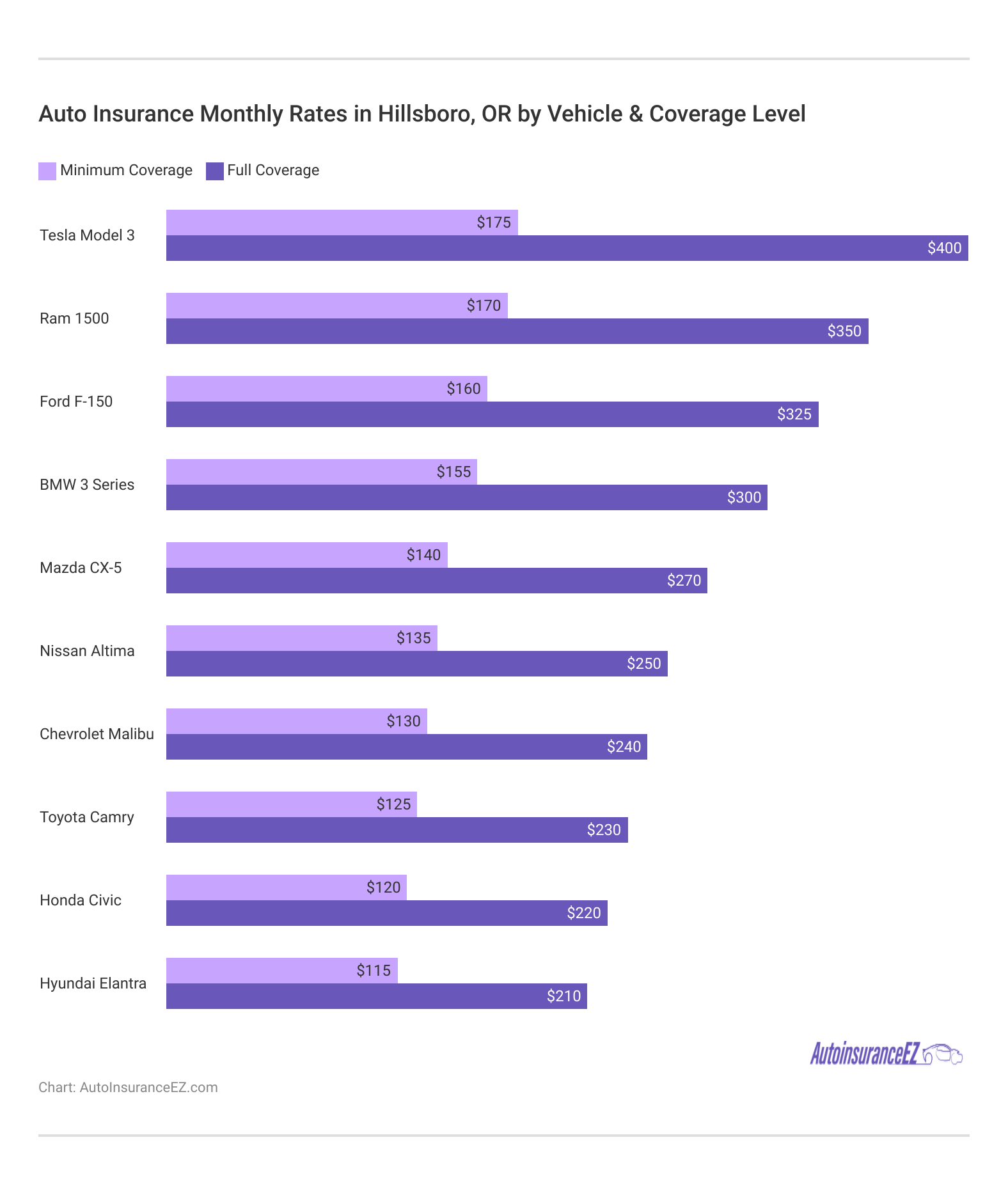

Naturally, you’ll have to pay more for your insurance when you are insuring an expensive, luxury vehicle. Such cars cost more to replace or repair, should you file a claim, and you will need more than just the state minimum coverage in order to protect your investment.

Premium rates in Hillsboro, OR, vary based on vehicle type and coverage level, with full coverage costing significantly more than minimum coverage. The Tesla auto insurance rates are the highest for full coverage at $400 monthly, while the Hyundai Elantra has the lowest at $210 monthly.

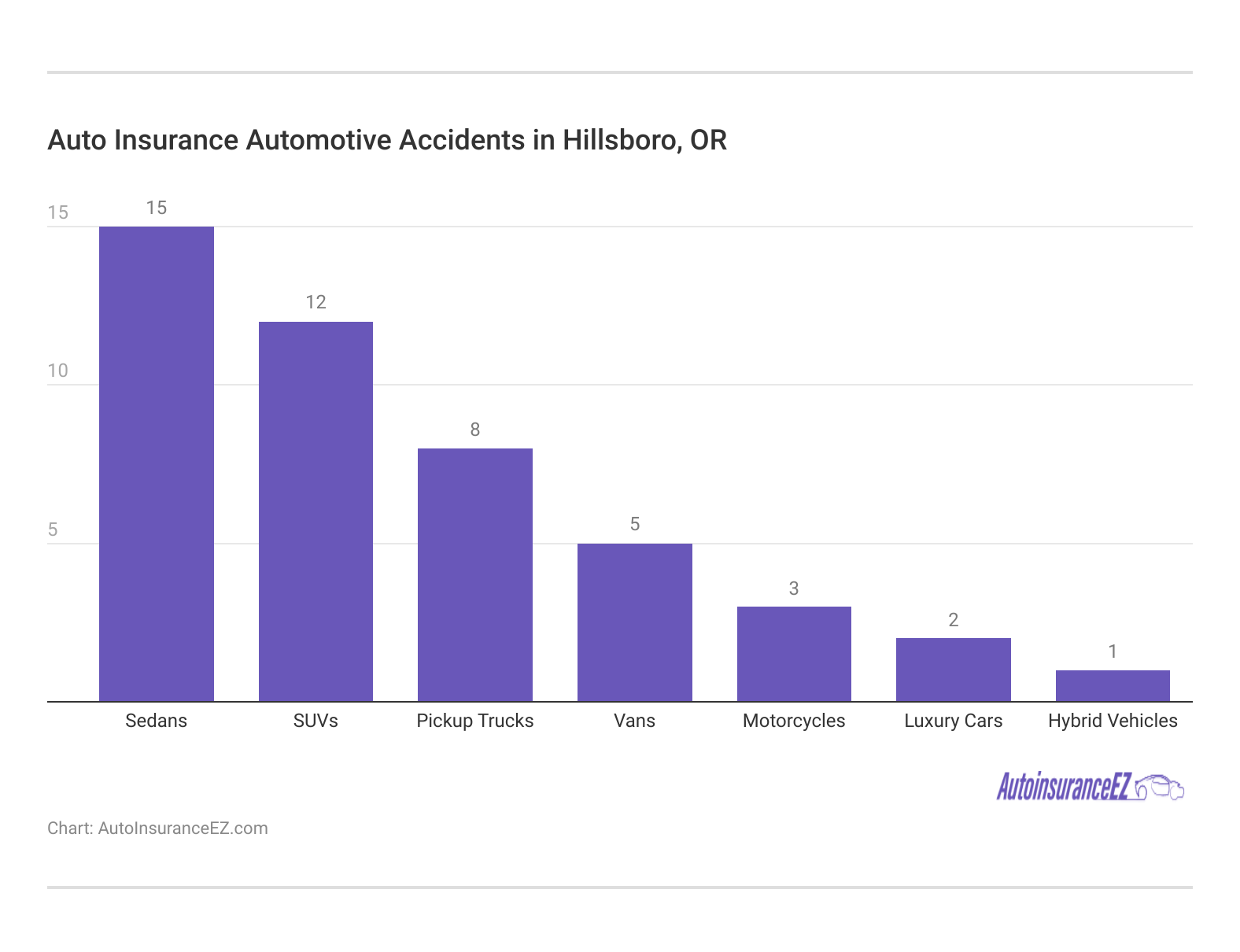

Automotive Accidents

The rate of serious accidents in Hillsboro is very low. This is good news for motorists like you, as insurance providers tend to charge everyone lower when accidents are low in a particular zip code.

Sedans have the highest number of automotive accidents in Hillsboro, OR, with 15 incidents, followed by SUVs with 12. Hybrid vehicles have the lowest number of accidents, with only one reported case. The data above shows how accidents change your car insurance rates in Hillsboro.

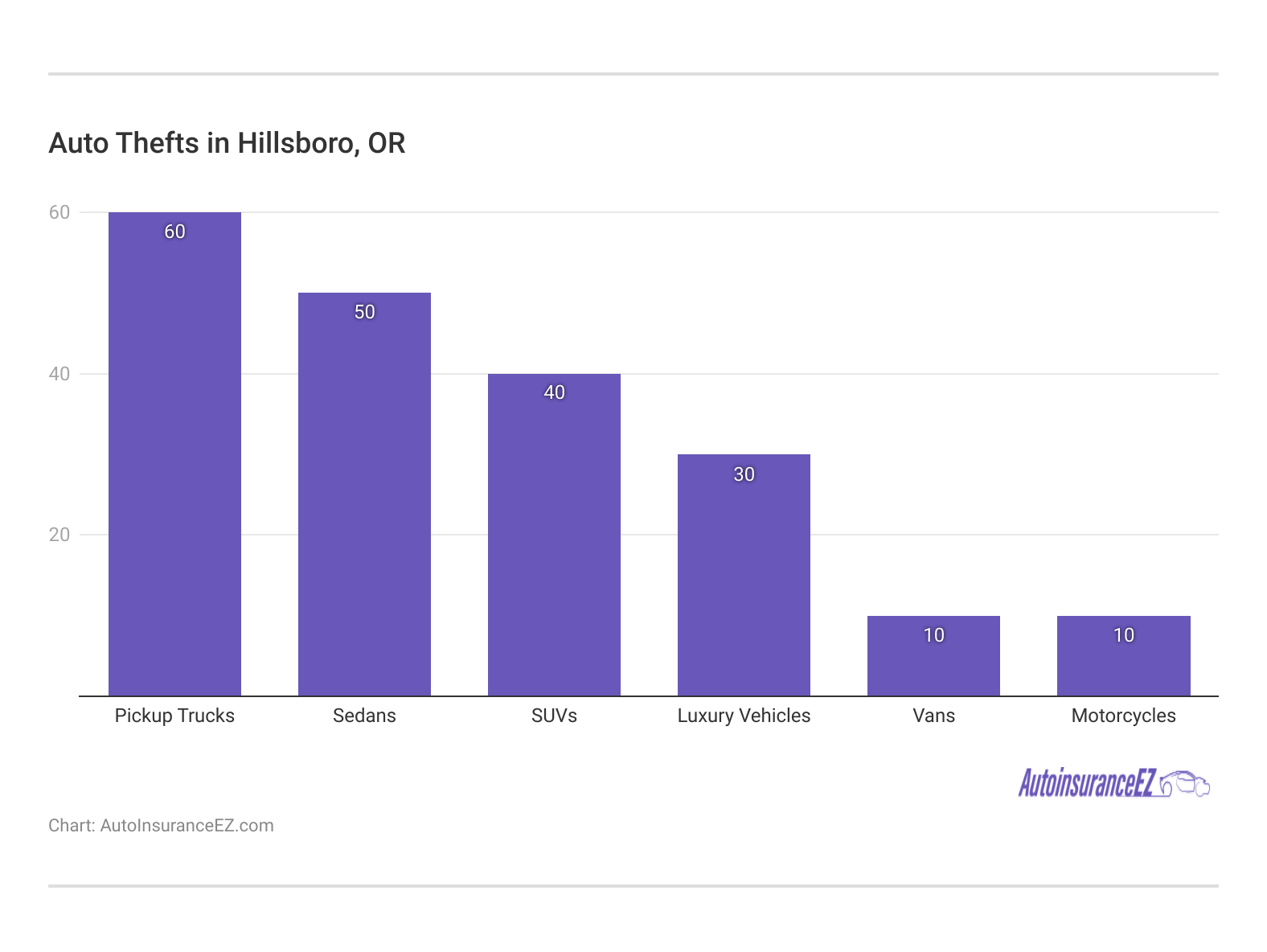

Auto Thefts in Hillsboro

Car theft can sometimes be a dilemma in small cities or non-urban towns. To help make it less of a dilemma in your case, consider installing a passive anti-theft system in your current car. Your auto insurance provider may compensate you with reduced rates!

Within Hillsboro, there were 14,491 auto thefts in 2023. Comprehensive and collision auto insurance coverage is the type of insurance coverage you’ll need if you ever plan to file an auto theft claim. Still, it will also add an extra expense to your monthly bill.

Minor Car Insurance Factors in Hillsboro

Some of the following factors are either difficult to control or won’t make any serious dents in your monthly payment rate:

- Your Marital Status: For individual policies, marital status will only alter the cost of your policy by 2-3%, if at all. However, married couples can get big discounts by bundling their policies together. And if you have homeowner’s or renter’s insurance, you can save even more by bundling those, too.

- Your Gender: Gender has almost no substantial influence on your monthly rate. Many companies don’t charge different premiums based on gender at all. And for those that still do, the rate rarely fluctuates beyond a 2-3% price difference.

- Your Driving Distance to Work: Your typical Hillsboro commute will last between 19 and 32 minutes each way. Nearly 72% of all drivers will prefer to use their own automobile to get around, while an additional 8-11% will carpool.

- Your Coverage and Deductibles: Get the coverage you need and set your deductibles either high or low. This will have a huge impact on your monthly premiums.

If your vehicle is listed on your insurance policy as a business vehicle, you can expect to pay around 10% more, regardless of how often you drive each year. However, the total miles driven and your purpose on the road (work/school/pleasure) won’t alter your monthly premiums by more than 1-2%. Check this expert advice to get the cheapest car insurance in Oregon.

Naturally, your monthly premiums will increase the more insurance coverage you purchase. However, you can purchase the coverage you need and keep your monthly rate relatively low by raising your deductible. Yes, you will have higher out-of-pocket expenses in the event of a claim, but you will have lower monthly premiums as a result.

Education in Hillsboro, OR

Hillsboro is a highly educated city, with nearly one-fifth (or 20%) of its citizens possessing a college degree. If you fall into this group, you can save more on your auto insurance! Highly educated drivers are offered some of the lowest rates around. Another 22% of Hillsboro residents have completed their high school education.

Several major institutions for higher learning have satellite campuses in Hillsboro, including the Oregon Institute of Technology and the Oregon Health & Science University. Students can also consider the University of Phoenix or the Workforce Training Center for a specialized degree in less than four years.

Understanding your risk profile is key to securing the best insurance rates in Hillsboro, OR. Don’t just rely on online searches; compare policies carefully.

Michael Leotta Insurance Operations Specialist

Sadly, for most insurance agencies, a super easy online search can easily uncover many of their industry strategies. But even with the best data, it could still be tricky for you as an individual to determine your current risk user profile and find the cheapest Oregon auto insurance. Ensure you do due diligence before committing to your next auto insurance policy.

Read more: Auto Insurance EZ Scholarship Program

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

How We Conducted Our Car Insurance Analysis in Hillsboro, OR

We calculated our average rate based on the following metrics: a married, 34-year-old male with good credit, a 12-month history of maintaining auto insurance, a clean driving record, and his own home. Miles driven annually were based on the national average. The average rate was also calculated based on a financed 2015 Honda Accord with a pre-installed anti-theft device.

That concludes everything you must know to secure the best Hillsboro, OR auto insurance. We hope this makes you confident in getting the right coverage options. Do not forget to get early quotes from our free tool here by entering your ZIP code.

Frequently Asked Questions

What is the cheapest car insurance in Oregon?

The cheapest car insurance in Oregon is Geico, with a starting monthly rate of $34.

What is the average price for car insurance in Oregon?

The average cost of car insurance in Oregon is about $1,678 per year ($140 per month) for full coverage and $1,140 per year ($95 per month) for minimum coverage. Still, rates vary based on driving history, location, and vehicle type.

What kind of car insurance do I need in Oregon?

The minimum car insurance requirement in Oregon is 25/50/20 liability auto insurance.

Which car insurance coverage is the best in Oregon?

What type of insurance is best for my car? The best car insurance coverage varies and depends on your needs, but getting full comprehensive and collision coverage for your best security is important.

What is the best but cheapest car insurance?

Geico is renowned for being the cheapest and offering the best insurance service across Hillsboro, Oregon.

What is the cheapest car to insure in Oregon?

Honda Civic and Hyundai Elantra auto insurance rates are the cheapest cars to insure in Oregon, with a minimum coverage starting rate of $115 and $12o a month.

What is the average car payment in Oregon?

The average monthly car payment in Oregon is approximately $583. Our free online tool lets you get quick online auto insurance quotes.

How does insurance work in Oregon?

In Oregon, auto insurance requires minimum liability coverage of 25/50/20 for bodily injury and property damage, personal injury protection (PIP), and uninsured motorist coverage. Drivers must carry proof of insurance, and failure to comply can lead to license suspension, penalties, and SR-22 requirements.

What happens if you drive without insurance in Oregon?

It is illegal to drive around Oregon without even the minimum liability coverage it requires; you will be pulled over, which can result in fines of up to $1,000, suspension of your driver’s license and registration, SR-22 insurance requirements for three years, and possible vehicle impoundment if you’re caught multiple times.