Cheap Auto Insurance in Oklahoma 2025(Big Savings With These 10 Companies)

Compare cheap auto insurance in Oklahoma from top providers like State Farm, Travelers, and Geico. State farm offers rates starting at $29 per month, while Travelers is $34 and Geico is $35. Explore coverage options, discounts, and customer satisfaction to find the best deal for your budget.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Licensed Insurance Agent

UPDATED: Mar 17, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

18,154 reviews

18,154 reviewsCompany Facts

Min. Coverage in Oklahoma

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 1,733 reviews

1,733 reviewsCompany Facts

Min. Coverage in Oklahoma

A.M. Best Rating

Complaint Level

Pros & Cons

1,733 reviews

1,733 reviews 19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage in Oklahoma

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsUltimate Guide to Cheap Auto Insurance in Oklahoma (Costs + Coverage)

Oklahoma Statistics Summary

| Statistics | Details |

|---|---|

| Road Miles | Total in State: 111,000 miles Vehicle Miles Driven: 60 billion miles annually |

| Driving Deaths | Speeding: 32% Drunk Driving: 28% |

| Vehicles | Registered: 4.4 million Total Stolen: 7,500 vehicles annually |

| Most Popular Vehicle | Ford F-Series |

| Average Premiums (Monthly) | Liability: $75 Collision: $110 Comprehensive: $90 Combined Premium: $275 |

| Percentage of Motorists Uninsured | 21% |

| State Rank | 47th |

| Cheapest Provider | State Farm |

When securing cheap auto insurance in Oklahoma, it’s essential to be well-prepared, especially in a state known for its vast plains and unpredictable weather. Powerful and catastrophic tornadoes often strike from March to August, making the need for reliable car insurance crucial in emergencies.

Finding the right policy may not always be easy if you are looking for cheap auto insurance in Oklahoma. Still, our goal is to assist you in examining reasonably priced options that offer the required coverage.

Staying safe is imperative, particularly given Oklahoma’s erratic weather patterns.

State Farm offers cheap auto insurance in Oklahoma, with rates starting at $29, making it a great choice for budget-conscious drivers seeking reliable coverage.

With affordable rates and comprehensive options, State Farm ensures Oklahoma drivers get the protection they need without overspending.

Our Top 10 Company Picks: Cheap Auto Insurance in Oklahoma

Company Rank Monthly

RatesA.M. Best Best For Jump to Pros/Cons

#1 $29 A++ Customer Service State Farm

#2 $34 A++ Roadside Assistance Travelers

#3 $35 A++ Quick Quotes Geico

#4 $36 A+ Discounts Available Progressive

#5 $38 A Family Plans American Family

#6 $40 A+ Safe Drivers Nationwide

#7 $42 A Customizable Coverage Safeco

#8 $44 A+ High Coverage Allstate

#9 $45 A Farm Owners Farmers

#10 $60 A Comprehensive Plans Liberty Mutual

Searching for cheap auto insurance in Oklahoma? Residents in Oklahoma City,Tulsa,Norman, Lawton, orBroken Arrow,can access up to ten local rate quotes from major insurers. Prices vary by insurer, but top companies like State Farm, Travelers, and Geico offer competitive rates for cheap auto insurance in Oklahoma. Compare options thoroughly to find the best value and coverage for your needs.

You just have to click here for a free quote for the best rates in your area.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Outstanding Customer Attention: State Farm is renowned for its robust local agent network and individualized attention. Read more in our full review of State Farm’s auto insurance.

- Competitive Rates: State Farm offers some of the lowest prices for auto insurance in Oklahoma, making it a top choice for those seeking affordable coverage.

- Strong Financial Stability: With solid financial strength, State Farm ensures reliable and timely claims processing, giving Oklahoma drivers peace of mind when filing claims.

- Safe Driver Discounts: State Farm rewards safe driving with significant savings through programs like Drive Safe & Save, helping Oklahomans lower their premiums.

Cons

- Limited Discounts: Compared to other providers, State Farm offers fewer discount options, potentially limiting ways to save on cheap auto insurance in Oklahoma.

- Average Digital Tools: While functional, State Farm’s website and mobile apps could be improved for a better user experience, especially when managing your policy online.

- High Rates for High-Risk Drivers: Drivers with a poor driving history may face higher rates, which could make it more challenging to find truly cheap auto insurance in Oklahoma if you have violations.

#2 – Travelers: Best for Unique Coverage

Pros

- Competitive prices: Provides reasonable prices, particularly for drivers with spotless records. Read more about Travelers’ ratings in our Travelers insurance review for further details on their offerings and customer satisfaction.

- Numerous Coverage Choices: Travelers offers a variety of coverage options, including collision and comprehensive, which is ideal for those seeking cheap auto insurance in Oklahoma.

- Homeowner Discounts: Travelers makes bundling appealing by providing discounts for homeowners, helping you save money on car insurance and lowering your overall premiums.

- Flexible Payment Options: Travelers allow flexible payment plans, making it easier for customers to manage their insurance costs.

Cons

- Claims Satisfaction Below Average: Some customers have reported dissatisfaction with the claims process, which can be a drawback.

- Limited Support for Local Agents: Travelers rely heavily on digital tools, which may lack the personal touch of local agents.

- Higher Premiums for High-Risk Drivers: Drivers with poor records may see substantial premium increases, which can affect those searching for cheap auto insurance in Oklahoma.

#3 – Geico: Employee Discounts

Pros

- Low Rates: Geico is renowned for providing some of the market’s lowest rates. Learn more about Geico’s rates in our Geico auto insurance company review.

- Strong Web Presence: Geico provides a user-friendly web platform and mobile app for managing policies, making it convenient for Oklahoma drivers seeking cheap auto insurance.

- Variety of Discounts: Geico offers numerous discounts, including multi-policy, good driver, and military discounts, helping to lower insurance costs in Oklahoma.

- Reliable Claims Process: The company generally receives positive feedback for its claims handling, making it a trusted option for budget-conscious drivers.

Cons

-

Limited Agent Network: Primarily relies on digital tools, which may not offer the personalized agent support some customers prefer in Oklahoma.

-

Higher Rates for High-Risk Drivers: Oklahoma drivers with accidents or poor credit may face higher premiums compared to others.

-

Inconsistent Customer Service: Some customers report varying experiences with Geico’s customer service.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#4 – Progressive: Best for Affordable Coverage Pros

Pros

- Reasonably priced rates: Progressive is renowned for providing affordable rates, particularly for high-risk drivers. Our complete Progressive review goes over this in more detail.

- Snapshot Program: This usage-based program offers Oklahoma drivers the opportunity for significant discounts based on safe driving habits, promoting affordable auto insurance.

- Multi-Policy Discounts: Progressive provides big savings for drivers in Oklahoma who bundle their auto, renters, or home insurance policies, lowering overall insurance costs.

- Robust Digital Tools: Oklahoma residents can take advantage of an intuitive mobile app and online platform to easily manage their policies and file claims, ensuring convenience.

Cons

- Claims Satisfaction: Some customers in Oklahoma have reported dissatisfaction with the claims process.

- High Rates for Low-Risk Drivers: Oklahoma drivers with clean driving records may not qualify for the lowest rates available.

- Limited Agent Support: Progressive’s reliance on digital tools may limit the availability of personalized support for Oklahoma customers.

#5 – American Family: Best for Loyalty Savings

Pros

- Personalized Service: Well-known for providing excellent customer service via a network of local agents. Find out more about the American Family in our American Family review.

- Flexible Coverage Options: Offers a wide range of coverage choices, allowing Oklahoma drivers to customize insurance plans based on their individual needs and budget.

- Safe Driving Program: Encourages safe driving habits by offering potential savings through programs like DriveMyWay, helping drivers in Oklahoma secure affordable rates.

- Bundling Discounts: Provides significant discounts for Oklahoma drivers who combine multiple policies, such as auto and home insurance, making it easier to find cheap auto insurance.

Cons

- Restricted Availability: Not available in all states, limiting access for some Oklahoma residents looking for cheap coverage.

- Higher Premiums for High-Risk Drivers: Drivers with bad credit, accidents, or other risk factors may face higher premiums compared to other insurers in Oklahoma.

- Average Claims Process: Some customers have reported delays or challenges in the claims handling process, which can impact customer satisfaction.

# 6 – Nationwide: Best for Accident Forgiveness

Pros

- Variety of Coverage: Provides a wide range of coverage choices, such as vanishing deductibles and accident forgiveness. You can learn more in our Nationwide auto insurance review.

- On Your Side Review: Provides yearly policy evaluations to help Oklahoma drivers ensure they’re getting the most competitive and affordable rates for their auto insurance.

- Fantastic Bundling Discounts: Offers substantial savings when bundling auto insurance with other policies, such as home insurance, making it easier to secure cheap auto insurance in Oklahoma.

- Robust Financial Foundation: Nationwide’s strong financial stability ensures that Oklahoma drivers can rely on timely and dependable claims payments.

Cons

- Average Rates: While Nationwide offers competitive rates, they aren’t always the lowest for those seeking the cheapest auto insurance in Oklahoma.

- Limited Availability: Nationwide is not available in every state, potentially limiting access for some drivers.

- Slower Claims Processing: Some customers have reported delays in claims processing, which could be a drawback for Oklahoma residents seeking quick resolution.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#7 – Safeco: Best for Affordable Premiums

Pros

- Customized Coverage: Safeco offers an array of coverage options, including accident forgiveness, new car replacement, and decreasing deductibles, so customers can customize insurance to meet their needs. More company details are available in our Safeco Car Insurance Review.

- Reasonably Priced Rates: Safeco is known for offering affordable premiums, particularly for Oklahoma drivers with clean driving records, making it a solid choice for those seeking cheap auto insurance in Oklahoma.

- Bundling Discounts: Oklahoma customers can save significantly by bundling auto insurance with other policies, such as renters’ or homeowners’ insurance, for further cost reductions.

- Roadside Assistance: Safeco provides comprehensive roadside assistance as an add-on, offering peace of mind to drivers in Oklahoma during emergencies.

Cons

- Restricted Availability: Safeco’s services are not available in every state, which could limit access for some Oklahoma drivers.

- Average Customer Service: Safeco has received mixed reviews regarding customer service, with some Oklahoma customers expressing dissatisfaction with the claims process.

- Limited Discount Opportunities: While Safeco offers certain discounts, it may not have as many options as larger competitors like Progressive or Geico, which could affect affordability for some drivers.

# 8 – Allstate: Best for Detailed Coverage

Pros

- Large Discounts: Allstate provides several discounts, such as safe driver and excellent student discounts. Read more about this provider in our Allstate auto insurance review.

- Local Agents for Personalized Support: Allstate offers tailored customer service through a wide network of local agents, helping drivers across Oklahoma find the best coverage for their needs.

- Claim Satisfaction Guarantee: If Oklahoma customers are unsatisfied with their claims process, they may be eligible for a refund, ensuring peace of mind when filing claims.

- Accident Forgiveness: Oklahoma drivers can benefit from Allstate’s accident forgiveness, protecting them from premium increases after their first at-fault accident.

Cons

- Higher Premiums: Allstate’s rates are more expensive than other competitors, which may impact those looking for cheap auto insurance in Oklahoma.

- Average Claims Satisfaction: Some Oklahoma customers have expressed mixed feelings about how their claims were handled, citing occasional delays.

- Limited Digital Tools: Allstate’s digital platform and mobile app could be more user-friendly, making policy management less convenient than with competitors.

#9 – Farmers: Best for Comprehensive Coverage

Pros

- Outstanding Customer Service: Farmers offers outstanding customer service, including individualized local agent support and round-the-clock claims assistance. Check out our online Farmers review for more information.

- Numerous Coverage Options: Farmers provides a variety of coverage choices tailored to Oklahoma drivers, including unique add-ons like rideshare insurance and new car replacement coverage, ideal for those seeking flexible options.

- Accident Forgiveness: Farmers’ accident forgiveness program helps Oklahoma drivers avoid premium increases after their first at-fault accident, making it an appealing option for accident-prone individuals.

- Bundling Discounts: By bundling auto and home insurance, Oklahoma customers can access significant discounts, helping them save on overall insurance costs.

Cons

- Higher Premiums: Farmers’ premiums tend to be higher than some competitors, which may impact those searching for cheap auto insurance in Oklahoma.

- Limited Discount Opportunities: Compared to other companies, Farmers offers fewer discounts, which might not appeal to cost-conscious Oklahoma drivers.

- State Availability: Farmers aren’t available in all states, which could limit coverage options for some Oklahoma residents.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#10 – Liberty Mutual: Best for Customizable Policies

Pros

- Customized Coverage: Liberty Mutual provides adaptable plans that can be customized to meet specific requirements, such as new car replacement and accident forgiveness. Learn more about this provider in our thorough Liberty Mutual company review.

- Many Discounts: Liberty Mutual offers several discounts tailored for Oklahoma drivers, including savings for students, military personnel, and those bundling multiple policies, helping to make auto insurance more affordable.

- Robust Digital Tools: Oklahoma drivers can manage their policies and file claims easily through Liberty Mutual’s user-friendly mobile app, making insurance more accessible.

- Financial Stability: Liberty Mutual’s strong financial foundation ensures reliable claims payouts for Oklahoma customers, providing peace of mind when accidents occur.

Cons

- Higher Rates: Some Oklahoma drivers may find Liberty Mutual’s rates higher than other providers, potentially limiting options for those seeking cheap auto insurance.

- Conflicting Claims Reviews: While some Oklahoma drivers report satisfaction, others have voiced frustrations with the claims process, citing delays or complications.

- Limited Agent Support: Relying primarily on digital tools, Liberty Mutual may not offer the personalized agent support some Oklahoma drivers prefer.

Cheap Auto Insurance in Oklahoma

Choosing a car insurance policy is never easy, and it can vary depending on where in the country you live, especially when looking for cheap auto insurance in Oklahoma. If you’re looking for the cheapest auto insurance in Oklahoma, you’ve come to the right place.

As an Oklahoma resident, you are probably looking for a policy to protect you from the severe weather patterns that can hit the Midwest for months. Read more to know the Cheapest Auto Insurance Companies and find the best coverage options.

Keep following along so you can find out which coverage policy is the best fit for you.

Premiums as a Percentage of Income

If you are concerned about how much you will be spending on your premium with your income, you can reference the table below. This will show you what percentage of your income in Oklahoma will go towards your premium.

Oklahoma Auto Insurance Monthly Costs vs. Percentage of Income

| Year | Full Coverage | Disposable Income | Insurance as % of Income |

|---|---|---|---|

| 2024 | $133 | $40,000 | 4% |

| 2023 | $129 | $39,500 | 4% |

| 2022 | $125 | $39,000 | 4% |

Over three years, from 2012 -2014, insurance as a percentage of income stayed relatively the same, only dropping from 2.42 percent in 2012 to 2.41 percent in 2013 and 2014.

Oklahoma’s insurance percentage of income falls somewhere in the middle, maybe slightly higher, compared to surrounding states. In comparison to the countrywide average, Oklahoma’s percentage falls below the average.

For more details on how to save on coverage, see more here to learn about Auto Insurance Premiums and how they impact your overall costs.

Cheapest Rates by ZIP Code

Did you know that the area where you live can be a factor in how expensive your car insurance is? Take a look at the table below to find your ZIP code and compare cheap auto insurance in Oklahoma rates with other areas:

Oklahoma Auto Insurance Monthly Rates by ZIP Code

| Least Expensive ZIP Codes | Rates | Most Expensive ZIP Codes | Rates |

|---|---|---|---|

| 73555 | $304 | 74110 | $429 |

| 73542 | $304 | 74115 | $428 |

| 73521 | $307 | 74106 | $426 |

| 73539 | $308 | 74103 | $419 |

| 73570 | $308 | 74146 | $416 |

| 73537 | $308 | 74120 | $413 |

| 73939 | $309 | 74128 | $412 |

| 73946 | $310 | 74119 | $412 |

| 73549 | $310 | 74129 | $411 |

| 73523 | $310 | 74126 | $410 |

| 73945 | $310 | 74134 | $410 |

| 73937 | $310 | 74116 | $409 |

| 73951 | $310 | 74104 | $409 |

| 73944 | $311 | 74112 | $409 |

| 73552 | $311 | 73119 | $408 |

| 73703 | $311 | 74172 | $408 |

| 73938 | $311 | 73106 | $408 |

| 73950 | $311 | 74130 | $407 |

| 73942 | $311 | 74135 | $407 |

| 73949 | $311 | 73102 | $407 |

| 73931 | $312 | 73108 | $406 |

| 73526 | $312 | 73103 | $406 |

| 73932 | $312 | 74127 | $406 |

| 73538 | $313 | 74105 | $406 |

| 73933 | $313 | 73109 | $406 |

For a list of affordable options, read more to discover the Cheapest Auto Insurance Companies that offer reliable coverage at competitive rates.

Cheapest Rates by City for Cheap Auto Insurance in Oklahoma

You can even figure out how expensive your car insurance will be based on the city you live in. Take a look at the table below and find your city to see how expensive your car insurance will be:

Oklahoma Auto Insurance Monthly Rates by City: Most Expensive vs. Least Expensive

| Most Expensive | Rates | Least Expensive | Rates |

|---|---|---|---|

| Tulsa | $407 | Altus AFB | $310 |

| Oklahoma | $394 | Headrick | $310 |

| Glenpool | $388 | Kenton | $310 |

| Broken Arrow | $385 | Goodwell | $309 |

| Bethany | $384 | Eldorado | $308 |

| Wheatland | $380 | Tipton | $308 |

| Spencer | $379 | Elmer | $308 |

| Bixby | $378 | Altus | $307 |

| Sperry | $378 | Frederick | $304 |

| Jenks | $378 | Manitou | $304 |

The data from both ZIP codes and cities show that Tulsa and Oklahoma City have the most expensive car insurance rates. Smaller, lesser-known areas guarantee cheaper rates, while finding the cheapest auto insurance in Tulsa may require thorough rate comparisons. Which states have the cheapest auto insurance rates can also help guide your search for affordable coverage.

Cheap Auto Insurance in Oklahoma: Minimum Coverage Requirements

Auto Insurance Minimum Coverage Requirements in Oklahoma

| Coverage | Limits |

|---|---|

| Bodily Injury | $25,000 per person / $50,000 per accident |

| Property Damage | $25,000 per accident |

Oklahoma is considered a “fault” car accident state, meaning that the individual who caused the car accident is at fault and under financial responsibility to pay for any damages that result from the accident.

These damages can include injuries, lost income, vehicle damage, and other financial losses from the car accident. When an individual with low income car insurance in Oklahoma suffers any injury or damage, they have three options to proceed with:

- by filing a claim with his or her own insurance company, assuming that the loss is covered under the policy (in this situation, the injured person’s insurance company will likely turn around and pursue a subrogation claim against the at-fault driver’s insurance carrier)

- by filing a third-party claim directly with the at-fault driver’s insurance carrier

- by filing a personal injury lawsuit in civil court against the at-fault driver

If you are responsible for any kind of auto accident, you will need minimum car insurance coverage and cheap auto insurance in Oklahoma to cover the costs that you would be deemed responsible for.

Liability coverage would cover the medical, property damage, and other costs of drivers, passengers, and pedestrians who suffer injuries or vehicle damage from an accident you caused.

Getting cheap auto insurance in Oklahoma doesn’t mean skimping on coverage—compare rates to secure both affordability and the protection you need.

Chris Abrams Licensed Insurance Agent

While cheap liability car insurance in Oklahoma covers these costs for others affected by a car accident that you caused, it does not apply to your own personal injuries or vehicle damage.

In the state of Oklahoma, the required minimum amounts of liability car insurance coverage are as follows:

- $25,000 for bodily injury or death of one person in an accident caused by the owner/driver of the insured vehicle

- $50,000 for total bodily injury or death liability in an accident caused by the owner/driver of the insured vehicle

- $25,000 for property damage per accident caused by the owner/driver of the insured vehicle

If you are in a car accident and no one else’s coverage applies toward your losses, you will need additional coverage since cheap auto insurance in Oklahoma may not provide enough liability coverage for your own damages.

Collision coverage can cover repairs to your damaged vehicle and is optional in Oklahoma.

Forms of Financial Responsibility

In Oklahoma, all drivers must carry a minimum amount of liability car insurance, but finding cheap auto insurance in Oklahoma can help ensure financial responsibility without breaking the bank.

Cheapest Liability-Only Auto Insurance options can provide essential coverage for damages caused by another driver in an accident and vice versa.

Core Coverage for Cheap Auto Insurance in Oklahoma

The table below shows that Oklahoma’s core coverage for an auto insurance policy is higher than the national average.

Oklahoma Auto Insurance Monthly Rates by Provider & Coverage Type

| Insurance Company | Liability | Collision | Comprehensive | Full Coverage |

|---|---|---|---|---|

| $62 | $92 | $82 | $180 | |

| $55 | $85 | $78 | $160 | |

| $58 | $88 | $81 | $165 | |

| $45 | $75 | $70 | $145 | |

| $65 | $95 | $83 | $185 |

| $60 | $90 | $80 | $170 |

| $50 | $80 | $72 | $160 | |

| $63 | $93 | $85 | $178 | |

| $57 | $86 | $79 | $165 | |

| $59 | $89 | $82 | $172 |

As we covered before, liability coverage covers any damage you may have caused to another person and/or their vehicle in an auto accident.

On the other hand, comprehensive and collision auto insurance, which is part of cheap auto insurance in Oklahoma, covers your damages in an accident or any uncontrollable factor, like the weather.

Additional Liability

Loss Ratio in Oklahoma

| Coverage | 2024 | 2023 | 2022 |

|---|---|---|---|

| Medical Payments (MedPay) | 10% | 9% | 8% |

| Uninsured/Underinsured Motorist Coverage (UUM) | 12% | 11% | 10% |

According to the National Association of Insurance Commissioners, Oklahoma’s average car insurance cost per year is slightly higher than the national average. Oklahoma also has the 18th most expensive premiums in the United States.

The loss ratio can be defined as the ratio of paid insurance claims compared to premiums earned.

As of 2014, Oklahoma’s loss ratio compared to its pure premium was about 65 percent. When the loss ratio is over 100 percent, the company loses money, but it isn’t paying claims if it is too low.

Oklahoma’s uninsured motorists make up about 12.6 percent of the nation’s uninsured motorists, and in the state itself, they make up 25.9 percent of motorists.

Oklahoma does not require residents to carry uninsured motorist coverage, but cheap auto insurance in Oklahoma often includes this option as an additional policy feature for an extra charge. For more information on unique coverage options, check Travelers’ website to explore their offerings.

Add-ons, Endorsements, and Riders

There are also additional and affordable add-ons that can be included in your coverage plan in Oklahoma as well! If you want to expand your coverage plan to include these add-ons, you can choose from the list below:

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-As-You-Drive or Usage-Based Insurance

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Cheap Auto Insurance in Oklahoma: Discounts

Auto Insurance Discounts From Top Oklahoma Providers

| Insurance Company | Bundling | Low Mileage | Anti-Theft | Good Driver | Loyalty |

|---|---|---|---|---|---|

| 25% | 30% | 10% | 25% | 15% | |

| 25% | 20% | 25% | 25% | 18% | |

| 20% | 10% | 10% | 30% | 12% | |

| 25% | 30% | 25% | 26% | 10% | |

| 25% | 30% | 35% | 20% | 10% |

| 20% | 20% | 5% | 40% | 8% |

| 10% | 30% | 25% | 30% | 13% | |

| 15% | 25% | 20% | 20% | 12% | |

| 17% | 30% | 15% | 25% | 6% | |

| 13% | 20% | 15% | 10% | 9% |

Drivers can reduce their premiums by combining policies, keeping up good driving records, or enrolling in defensive driving courses, according to auto insurance discounts offered by leading Oklahoma companies. Several insurance companies offer discounts on features like low annual mileage, paperless invoicing, or anti-theft equipment. You can find reasonably priced vehicle insurance options and reduce your premiums by looking into available discounts.

Demographic Rates – Male vs. Female vs. Age

Oklahoma Auto Insurance Monthly Rates by Provider, Age, & Gender

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| $595 | $698 | $202 | $214 | $194 | $195 | $167 | $175 | |

| $550 | $600 | $171 | $202 | $170 | $180 | $143 | $145 | |

| $758 | $777 | $226 | $241 | $199 | $198 | $159 | $170 | |

| $552 | $589 | $133 | $137 | $188 | $205 | $134 | $148 | |

| $590 | $670 | $258 | $270 | $170 | $180 | $186 | $203 |

| $620 | $700 | $197 | $216 | $180 | $190 | $143 | $151 |

| $884 | $992 | $198 | $213 | $223 | $212 | $123 | $132 | |

| $600 | $610 | $200 | $210 | $210 | $210 | $175 | $180 | |

| $406 | $513 | $140 | $157 | $160 | $160 | $107 | $107 | |

| $650 | $720 | $153 | $166 | $200 | $210 | $128 | $129 |

Regarding how much car insurance costs in Oklahoma between males and females and their age, younger male drivers are charged the most while older female drivers are charged the least.

For instance, car insurance for a 25-year-old male will cost the most, followed by insurance for a 25-year-old female, which will cost the second highest, insurance for a 60-year-old male, which will cost the second lowest, and finally, insurance for a 60-year-old female, which will cost the least.

In Oklahoma, younger male drivers are actually expected to be the most irresponsible drivers, which is why their car insurance is higher than that of a younger female.

Even for older drivers, in Oklahoma, a male’s insurance will still cost more than that of an older female around the same age.

It may seem surprising that cheap auto insurance in Oklahoma rates differ between genders, as most would think gender would have nothing to do with your car insurance costs.

Surprisingly, though, the opposite is true in most other states, where females typically have higher insurance rates than males. This Male vs. Female Auto Insurance Rates difference highlights how gender impacts premiums in various regions across the country.

Best Oklahoma Car Insurance Companies

Finding the right car insurance company can be difficult, especially with Oklahoma’s varying auto insurance rates. Researching every company for cheap auto insurance in Oklahoma and comparing their rates can be difficult and time-consuming. But have no fear—we are here to help.

Keep following along with us as we give you information on all the best car insurance companies.

We will cover which car insurance companies in Oklahoma have the best ratings and the most complaints. No matter what you are looking for, we’ve got cheap car insurance in Oklahoma options covered. For more details, check out our guide on the Best Oklahoma Auto Insurance.

We also examine data provided by Quadrant. We examine the average rate per company for coverage level, commute length, credit score, and driving record.

Number of Insurers by State

Number of Licensed Insurers in Oklahoma

| Domestic Companies | Foreign Companies | Total Number of Licensed Insurers |

|---|---|---|

| 31 | 873 | 904 |

The Largest Companies Financial Rating

AM Best is a global credit rating agency and a trusted source of information on insurance companies worldwide.

Their analysis and research of thousands of companies offer a unique perspective on which company to choose when purchasing an insurance policy.

Take a look at the list of companies and the ratings they received from AM Best in this table.

Oklahoma Financial Ratings From Top Companies

| Insurance Company | AM Rating | Direct Premiums Written | Market Share | Loss Ratio |

|---|---|---|---|---|

| A++ | $677,192 | 25.4% | 57.0% | |

| A | $303,207 | 11.4% | 51.4% | |

| A+ | $238,951 | 9.0% | 55.5% | |

| A+ | $186,448 | 7.0% | 48.1% | |

| A++ | $184,196 | 7.0% | 66.8% | |

| A | $174,654 | 6.6% | 57.7% |

| A | $150,000 | 5.50% | 50.0% | |

| A+ | $135,000 | 5.00% | 53.0% |

| A | $120,000 | 4.50% | 55.0% | |

| A++ | $110,000 | 4.00% | 60.0% |

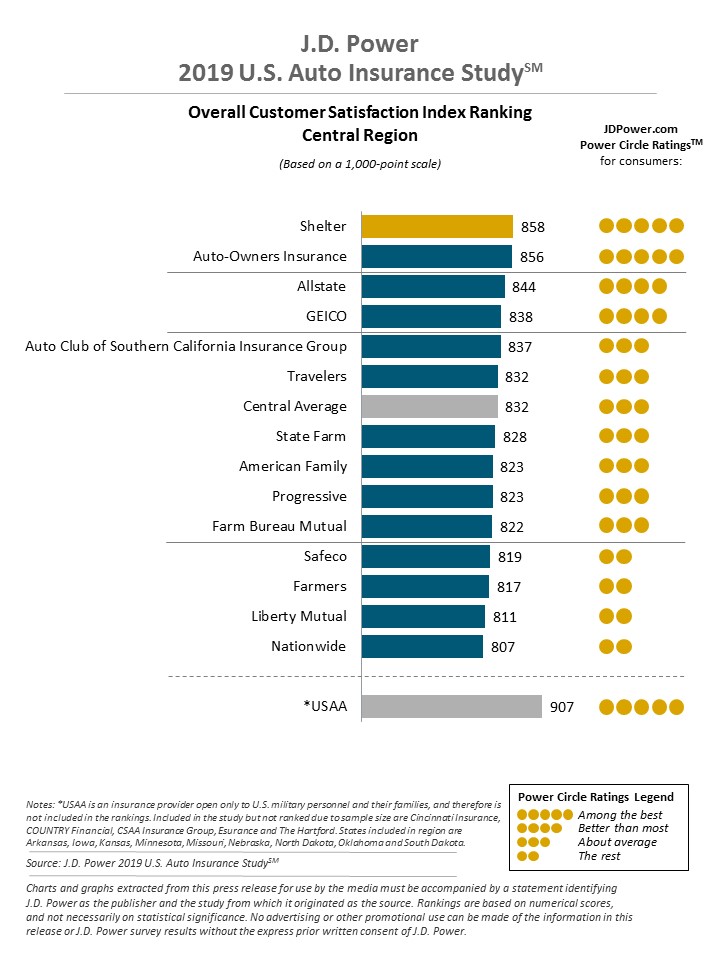

Companies with Best Ratings

According to a study done by J.D. Power, auto insurance customers are the most satisfied with their carriers because of positive customer service experience.

Choosing cheap auto insurance in Oklahoma isn’t just about price—it’s about ensuring you have the right coverage to protect against unexpected risks.

Tracey L. Wells Licensed Insurance Agent & Agency Owner

Despite increasing premiums, customers are happy with digital and live interactions with their carriers, which improves the customer experience when searching for cheap auto insurance in Oklahoma.

Take a look at the table below to find the auto insurance companies in Oklahoma with the best ratings. According to a 2018 J.D. Power auto insurance study:

Companies with Most Complaints in Oklahoma

While it is always good to consider an insurance company’s positives when choosing a carrier, it is also important to consider its negatives when selecting cheap auto insurance in Oklahoma.

The number of customer complaints a company receives can indicate how well it communicates with its customers.

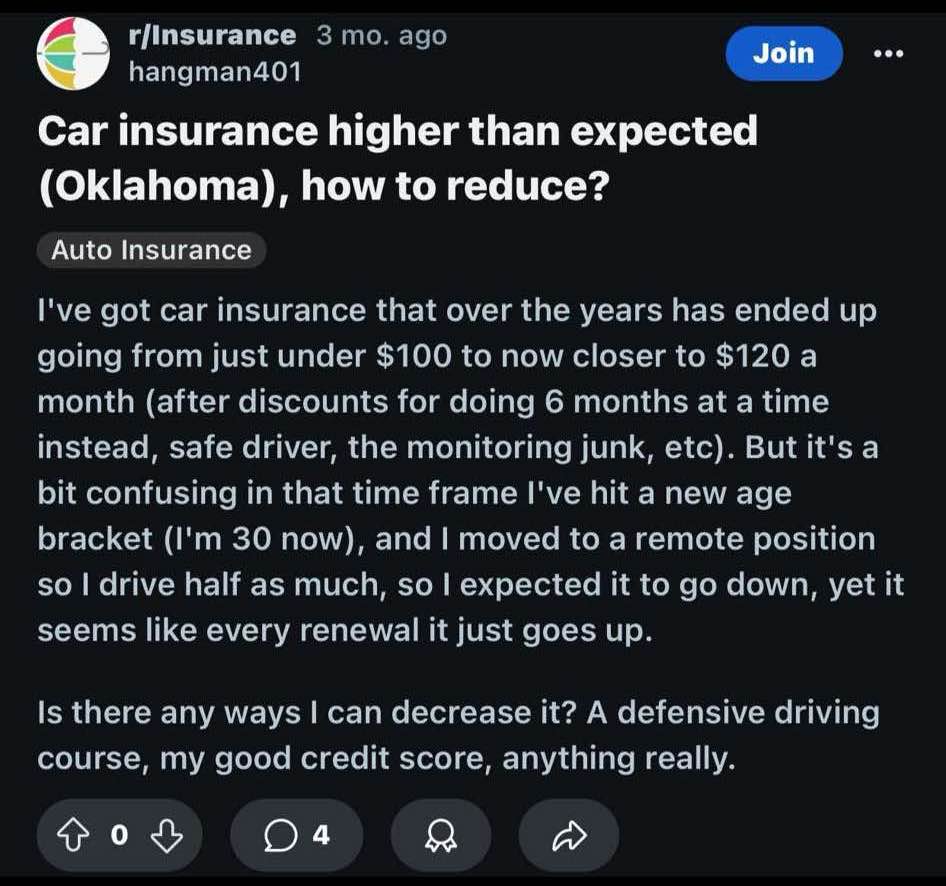

Despite savings and fewer miles driven, a Reddit member voiced their displeasure with Oklahoma’s growing auto insurance premiums. Nonetheless, a variety of coverage levels are available for cheap auto insurance in Oklahoma. Comparing prices and enrolling in a defensive driving course might help reduce costs.

The table below displays complaint data last published in 2017 on the Oklahoma Insurance Commissioner’s site.

Auto Insurance Companies With Most Complaints in Oklahoma

| Providers | Complaint Ratio | Total Complaints |

|---|---|---|

| 0.70 | 1,000 | |

| 0.75 | 900 | |

| 0.65 | 850 | |

| 0.80 | 1,200 | |

| 0.60 | 800 | |

| 0.85 | 1,100 |

| 0.50 | 500 | |

| 0.55 | 600 | |

| 0.40 | 400 |

| 0.45 | 450 |

Cheapest Companies for cheap auto insurance in Oklahoma

The table below indicates the car insurance companies and their rates as a percentage compared to the national average for cheap auto insurance in Oklahoma.

Oklahoma Auto Insurance Monthly Rates From the Provider vs. State Average

| Insurance Company | Monthly Rate | Percentage Compared to State Monthly Average |

|---|---|---|

| $85 | 1.2% | |

| $90 | 4.7% | |

| $92 | 6.6% | |

| $80 | -4.7% | |

| $95 | 9.4% |

| $88 | 3.5% |

| $90 | 4.7% | |

| $85 | 1.2% | |

| $82 | -1.2% | |

| $87 | 2.4% |

For more details, continue reading to discover the Cheapest Auto Insurance Companies and find the best rates that fit your budget.

Commute Rates by Companies

Did you know that the length of your commute can increase your insurance rates? If you have a long commute and are using your car often, some companies will consider this and increase your coverage.

Luckily, though, car insurance providers don’t charge significantly more in Oklahoma just because of a longer commute. This table compares Oklahoma’s average annual rates and annual mileage/commute length.

Oklahoma Commute Distances Car Insurance Monthly Rates by Provider

| Company | 10 Miles Commute | 25 Miles Commute |

|---|---|---|

| $224.92 | $224.92 | |

| Data not available | Data not available | |

| $226.42 | $226.42 | |

| $151.67 | $151.67 | |

| Data not available | Data not available |

| Data not available | Data not available |

| $99.50 | $99.50 | |

| Data not available | Data not available | |

| $155.08 | $155.08 | |

| Data not available | Data not available |

For additional tips, check out this guide on How to Save Money by Comparing Insurance Quotes and secure the best deal for your coverage needs.

Coverage Level Rates by Companies

Oklahoma Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $44 | $135 | |

| $38 | $118 | |

| $45 | $136 | |

| $35 | $109 | |

| $60 | $184 |

| $40 | $122 |

| $36 | $110 | |

| $42 | $140 | |

| $29 | $91 | |

| $34 | $105 |

Are you wondering how your rates will change depending on the amount of coverage you have for cheap auto insurance in Oklahoma? Well, the answer may seem simple. You will usually see costs decrease if you seek out less coverage.

This might seem obvious, but this may not always be in your best interest in the long run. The less coverage you seek out, the less you will be covered in case of a bad accident where you might eventually need that coverage.

Take a look below at the list of some of Oklahoma’s insurance carriers and their auto insurance coverage in Oklahoma compared to their annual rates.

Oklahoma Auto Insurance Monthly Rates by Coverage Level for Top Providers

| Insurance Company | Low Coverage | Medium Coverage | High Coverage |

|---|---|---|---|

| $44 | $90 | $135 | |

| $38 | $79 | $118 | |

| $44 | $91 | $136 | |

| $35 | $72 | $109 | |

| $60 | $122 | $184 |

| $40 | $81 | $122 |

| $36 | $73 | $110 | |

| $45 | $85 | $130 | |

| $29 | $60 | $91 | |

| $34 | $70 | $105 |

As you can see from this table, State Farm is the best combination, as it offers high coverage with the lowest annual average rates compared to the other carriers with high coverage. For more details on available coverage options, check State Farm’s website to get the best plan that suits your needs.

Get full coverage auto insurance for the lowest price by comparing rates from the top companies.

Credit History Rates by Companies

A good credit score is very important when looking for an insurance plan in Oklahoma. Like most things, the higher your credit score, the better. A higher credit score makes you more likely to receive better rates from the providers you want.

Experian reports that Oklahoma drivers’ average credit score is 656. This makes Oklahoma one of the top 10 states in the country with the lowest credit scores.

Oklahoma Auto Insurance Monthly Rates by Provider & Credit Score

| Insurance Company | Good Credit | Fair Credit | Poor Credit |

|---|---|---|---|

| $150 | $175 | $198 | |

| $145 | $170 | $194 | |

| $151 | $175 | $198 | |

| $109 | $130 | $156 | |

| $184 | $210 | $240 |

| $122 | $145 | $170 |

| $110 | $130 | $156 | |

| $130 | $155 | $180 | |

| $91 | $110 | $132 | |

| $105 | $125 | $150 |

Driving Record Rates by Companies

As you probably already know, your driving record will impact your insurance rates. The better the driver you are (little to no car accidents), the lower your rates will be. If you happen to get into a lot of fender-benders, your rates will increase.

The best way to keep your rates low is to follow Oklahoma’s driving laws.

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $135 | $149 | $173 | $350 | |

| $118 | $145 | $170 | $194 | |

| $136 | $151 | $175 | $198 | |

| $109 | $287 | $58 | $156 | |

| $184 | $210 | $240 | $253 |

| $122 | $145 | $170 | $339 |

| $110 | $199 | $248 | $174 | |

| $130 | $155 | $180 | $220 | |

| $91 | $135 | $128 | $263 | |

| $105 | $125 | $150 | $150 |

-Largest Car Insurance Company in Oklahoma

Take a look at this table to see the largest car insurance companies in Oklahoma and their direct premiums.

Oklahoma Financial Ratings From Top Companies

| Insurance Company | AM Rating | Direct Premiums Written | Market Share | Loss Ratio |

|---|---|---|---|---|

| A++ | $677,192 | 25.4% | 57.0% | |

| A | $303,207 | 11.4% | 51.4% | |

| A+ | $238,951 | 9.0% | 55.5% | |

| A+ | $186,448 | 7.0% | 48.1% | |

| A++ | $184,196 | 7.0% | 66.8% | |

| A | $174,654 | 6.6% | 57.7% |

| A | $150,000 | 5.50% | 50.0% | |

| A+ | $135,000 | 5.00% | 53.0% |

| A | $120,000 | 4.50% | 55.0% | |

| A++ | $110,000 | 4.00% | 60.0% |

For additional details, check here to learn How Auto Insurance Companies Check Driving Records and how they can impact your rates.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Car Insurance Laws

Drivers must be aware of Oklahoma car insurance laws. According to these statutes, drivers must maintain minimum liability coverage to guarantee financial accountability in the event of an accident. Liability insurance also shields other people from lawsuits alleging bodily harm and property damage.

Continue reading to learn more about Oklahoma Auto Insurance Laws and how being aware can help you avoid fines while guaranteeing adequate coverage for unanticipated events.

Windshield Coverage

When it comes to windshield coverage in Oklahoma, there isn’t much to it. Some insurers may require a specific repair shop, but it depends on the insurer.

If you’re curious about coverage, read more to know: Does car insurance cover windshield damage or replacement?

High-Risk Insurance

In Oklahoma, “high-risk” drivers are those who have been in an accident. Unfortunately, accidents happen to the best of us, including the most careful drivers.

In Oklahoma, you need to fill out an SR-22 form if:

- Your license has been suspended or revoked due to a DUI/DWI

- You have no insurance and are in a vehicular accident

- You have been involved in an accident that’s caused severe injury to another driver

- You are caught driving while uninsured

- There are a significant number of points on your driving record

For more details, read here to learn about high-risk auto insurance and how it can affect your rates and coverage options.

Low-Cost Insurance

If you want to familiarize yourself with cheap auto insurance in Oklahoma and the state’s car insurance laws, look no further! We’ve got you covered on everything from insurance to the rules of the road.

But there are still plenty of programs available to fit any kind of lifestyle.

To find a car insurance plan that works for you and your family, click here to compare cheap auto insurance in Oklahoma quotes from the top insurance carriers in your area.

Automobile Insurance Fraud in Oklahoma

About 10 percent of the insurance industry’s losses each year can be attributed to fraud. Multiple parties can commit insurance fraud in insurance transactions.

This can include applicants, policyholders, third-party claimants, etc.

Read more: Automobile Liability Coverage

Statute of Limitations

In Oklahoma, you have two years to file a claim to receive compensation from your insurance provider if you get into an accident. This includes both personal injury and property damages.

It is important to file the claim as soon as possible to ensure that all injuries, damages, and losses are recorded.

For more information, read here to learn how to file an auto insurance claim and ensure a smooth process after an accident.

Vehicle Licensing Laws

The REAL ID Act establishes minimum security standards for license issuance and production. It prohibits Federal agencies from accepting driver’s licenses and identification cards from states that do not meet the Act’s minimum standards for certain purposes.

Oklahoma has an extension for REAL ID enforcement, which allows federal agencies to accept driver’s licenses and identification cards from the state of Oklahoma at federal facilities, nuclear power plants, and federally regulated commercial aircraft until October 10, 2019.

Penalties for Driving Without Insurance

In Oklahoma, the penalties for driving without insurance include a $250.00 fine, jail time for up to 30 days, and license suspension with a $275.00 reinstatement fee.

Police can seize license plates and assign temporary plates and liability insurance, which would be in effect for 10 days.

They can also compound the vehicle if they choose to. If the car is compounded, the owner must also pay for the towing and storage fees.

Driving without auto insurance in Oklahoma can lead to penalties. Drivers must have proof of insurance to drive and register a car, and presenting proof of insurance is required to obtain an Oklahoma license plate.

Teen Driver Laws

Oklahoma Teen Driver License Restrictions

| Restrictions | Limitations |

|---|---|

| Nighttime restrictions | 10 p.m. to 5 a.m. |

| Passenger restrictions (family members excluded unless noted otherwise) | no more than 1 passenger |

| Nighttime restrictions | -6 months with driver education -12 months without driver education or until age 18 (minimum age: 16 1/2) |

| Passenger restrictions | -6 months with driver education -12 months without driver education or until age 18 (minimum age: 16 1/2) |

To obtain your learner’s permit in Oklahoma, you have to be at least 15 years and 6 months of age. From here, you have to have your permit for at least another 6 months before going for your license.

To legally take a driving test to obtain your license, you must be at least 16 years old and have supervised driving for at least 50 hours, 10 of which must be at night.

As you work toward your license, it’s crucial to be aware of Auto Insurance Laws. For more information, read here to know how staying informed can help you avoid penalties while ensuring proper coverage during this important time.

Older Driver License Renewal Procedures

Renewing your license in Oklahoma is simple, and there aren’t many rules. Every resident in the state with a driver’s license must renew their license every four years.

You cannot renew your license over the Internet or by mail. Older drivers must also pass a vision test to renew their licenses.

New Residents

If you are new to the Sooner State, you’ll need to secure a license plate and car insurance policy within the state. Share your new address with your provider and ensure you have the Oklahoma car insurance minimums required by law to drive legally.

You should also check with your provider to see if you need to take your vehicle to the Oklahoma Department of Public Safety (DPS) to be inspected to ensure its safety on the road.

For temporary residents living in Oklahoma, securing insurance is essential to stay compliant with state laws. Whether you’re here for a short time or an extended stay, there are affordable options available. To learn more, read here: Cheap Auto Insurance for Temporary Residents and find the best coverage for your needs.

Rules of the Road

Like any other state, it is in your best interest to follow the rules of the road while driving—it’s for your safety. In addition to obeying traffic laws, understanding Oklahoma’s Auto Insurance Law is essential. Every driver is required to carry minimum liability insurance to ensure financial protection in case of an accident. Failure to comply with these insurance requirements can result in fines, suspension of your license, and even legal consequences. Stay informed to avoid penalties and ensure you’re adequately covered while on the road.

State Laws in Oklahoma

As mentioned before, the best way to keep your rates low and in control is to comply with Oklahoma’s driving laws.

Every state is different, as their policies on speed limits, driving under the influence, and even seat belt usage can vary. Becoming acquainted with these laws is important before getting on the road in any state.

By following Oklahoma’s state driving laws, you are taking preventative measures that will save you from getting into any trouble on the road, which will only save you money in the long run.

If you want to familiarize yourself with cheap auto insurance in Oklahoma and the state’s car insurance laws, look no further! We’ve got you covered on everything from insurance to the rules of the road. Check Geico’s site for detailed policy options and coverage specifics.

Fault vs. No-Fault

As we mentioned before, Oklahoma is an at-fault state. To refresh your memory, this means that when you get into an accident, one of the drivers will be determined to be “at fault”.

The at-fault driver is responsible for covering the other driver’s damages with their insurance. This is where understanding an At-Fault Accident Defined becomes crucial. The at-fault driver is responsible for covering the other driver’s damages with their insurance. In Oklahoma, ensuring you have adequate liability coverage is important, as it will be used to cover the costs of the other party’s damages if you are found at fault.

Seat Belt & Car Seat Laws

Oklahoma Car Seat Laws

| Type of Car Seat Required | Age |

|---|---|

| Rear-Facing Child Safety Seat | Younger than 2 years (or until a child outgrows the manufacturer's top height or weight recommendations) |

| Child Restraint System | Younger than four years old |

| Child Restraint or Booster Seat | Four to seven years old (can't be taller than 4'9") |

| Adult Belt Permissible | Over eight years old (or taller than 4'9") |

Each state has its own seat belt and car seat laws to protect drivers and passengers, including young children who may also be in the vehicle.

In Oklahoma, children under 2 must be in a rear-facing child safety seat until they outgrow the manufacturer’s height/weight requirements. Children must also be at least 9 years old to be able to sit in the front passenger seat.

This leads to the important question: Does auto insurance cover passengers in an accident? The answer is yes, in most cases. If you’re involved in an accident, your auto insurance’s medical payments or personal injury protection (PIP) can help cover the medical expenses of any passengers injured in the vehicle. Understanding this coverage can ensure the safety of everyone in your car.

Keep Right and Move Over Laws

In Oklahoma, driving in the left lane is prohibited if you are traveling under the speed limit. Following driving laws and securing proper auto insurance help ensure safety and avoid fines.

Speed Limits

The speed limits in Oklahoma generally hover around 70-75 mph, depending on where you are.

The table below shows the speed limits on different types of roadways:

Oklahoma Speed Limits

| Roadway Type | Speed Limit |

|---|---|

| Rural Interstates | 75 mph |

| Urban Interstates | 70 mph |

| Other Limited Access Roads | 70 mph |

| Other Roads | 70 mph |

Ridesharing

Since Uber and Lyft have become quite popular over the past few years, drivers on these apps have to register their vehicles to be able to ride. The following insurers are the only companies that allow drivers in Oklahoma to register their vehicles to rideshare:

- Allstate

- Farmers

- Geico

- Mercury

- State Farm

- USAA

For those seeking the Best Rideshare Auto Insurance in Oklahoma, only select insurers offer coverage options specifically for rideshare drivers. It’s crucial to ensure you have the proper coverage when driving for these services.

Safety Laws

The most important part of driving on the road is knowing how to stay safe. A huge safety concern of getting on the road is watching out for drivers who may be under the influence of alcohol and/or marijuana. Check out the info here that explains what is a DUI.

DUI Laws

Oklahoma DUI Laws

| Type of Offense | Drinking Limits |

|---|---|

| BAC Limit | 0.08 |

| High BAC Limit | 0.15 |

| Criminal Status | 1st misdemeanor, 2nd+ in 10 years felony |

| Look Back Period | 10 years |

In Oklahoma, if you get caught driving under the influence one time, it usually registers as just a misdemeanor. If it happens a second time, you can receive a felony. DUIs have more severe consequences the more often they happen, so it’s best to avoid driving drunk altogether.

The consequences for drinking and driving are the same as when driving under the influence of marijuana because Oklahoma has not yet legalized the use of THC for medical or recreational purposes.

Oklahoma DUI 1st Offense

| Consequences | Penalty |

|---|---|

| License Revoked | 1 to 6 months |

| Jail Time | 5 days to 1 year |

| Fine | no minimum but up to $1,000 |

| Other | IID (ignition interlock) required for 18 months if BAC is 0.15+ |

Oklahoma DUI 2nd Offense

| Consequences | Penalty |

|---|---|

| License Revoked | 6 months minimum |

| Jail Time | 1-5 years |

| Fine | no minimum but up to $2,500 |

| Other | IID (ignition interlock) required for 5 years |

Oklahoma DUI 3rd Offense

| Consequences | Penalty |

|---|---|

| License Revoked | 1-3 years |

| Jail Time | 1-10 years |

| Fine | no minimum but up to $5,000 |

| Other | IID (ignition interlock) required for 5 years |

Distracted Driving Laws

Oklahoma Cellphone Use Laws

| Law | Who it Affects |

|---|---|

| Hand-held ban | Learner's permit and intermediate license holders |

| Text ban | All drivers |

| Enforcement | Primary |

In today’s world of iPhones and instant messaging, texting while driving can be as dangerous as driving under the influence.

Oklahoma’s driving laws prohibit texting for all drivers, ensuring safety for everyone on the road.

Driving in Oklahoma

Last but not least, we will cover a few more serious topics to ensure your best preparation for the road in Oklahoma.

Navigating cheap auto insurance in Oklahoma means understanding your policy to avoid surprises during a claim.

Aaron Englard Insurance Premium Auditor

We will cover vehicle theft in Oklahoma and different statistics on road fatalities in the state as provided by the National Highway Traffic Safety Administration. These topics are important, but we hope this information is never needed.

Oklahoma’s Car Culture

Oklahoma’s truck culture is reflected in the popularity of vehicles like the Ford F-150 and Dodge Ram, making them practical for the state’s long, flat roads and rocky terrain.

As these vehicles dominate the Sooner State, comparing rates with the Cheapest Auto Insurance Companies ensures you’re covered without overspending on insurance, especially for truck owners and off-roading enthusiasts.

Vehicle Theft in Oklahoma

The table below shows the top 10 vehicles in Oklahoma that get stolen. It appears that the bigger a vehicle you own in Oklahoma, the more likely it is to draw unwanted attention.

Pickup trucks are popular vehicles for auto theft, which may be because they are generally the most popular vehicles to drive in this state.

Top Vehicles Stolen in Oklahoma

| Make & Model | Year of Vehicle | Number of Vehicles Stolen |

|---|---|---|

| Honda Civic | 2021 | 1,300 |

| Chevrolet Silverado | 2021 | 1,200 |

| Ford F-150 | 2022 | 1,150 |

| Dodge Ram 1500 | 2020 | 1,100 |

| Toyota Camry | 2020 | 1,000 |

| Honda Accord | 2021 | 950 |

| Nissan Altima | 2022 | 900 |

| Hyundai Elantra | 2021 | 850 |

| Toyota Corolla | 2021 | 800 |

| Ford Escape | 2020 | 750 |

Oklahoma City and Tulsa, being the two largest cities in the state, also top the list for vehicle theft, which contributes to their higher insurance rates. Does auto insurance cover vehicle theft? Yes, comprehensive auto insurance typically covers vehicle theft, making it essential for drivers in these high-risk areas to ensure their policy includes this coverage to protect against such incidents.

Road Fatalities in Oklahoma

ChatGPT said:

Fatalities (All Crashes) By County

The counties in Oklahoma presented below are home to the most amount of road fatalities in the state:

Oklahoma 10 Counties With the Most Traffic Deaths

| County | 2024 | 2023 | 2022 | 2021 | 2020 |

|---|---|---|---|---|---|

| Oklahoma | 105 | 110 | 100 | 95 | 100 |

| Tulsa | 90 | 85 | 80 | 75 | 85 |

| Cleveland | 65 | 60 | 55 | 50 | 60 |

| Canadian | 55 | 50 | 45 | 40 | 50 |

| Comanche | 50 | 45 | 40 | 35 | 45 |

| Le Flore | 45 | 40 | 35 | 30 | 40 |

| Grady | 40 | 35 | 30 | 25 | 35 |

| McClain | 35 | 30 | 25 | 20 | 30 |

| Mayes | 30 | 25 | 20 | 15 | 25 |

| Ottawa | 25 | 20 | 15 | 10 | 20 |

| Top 10 Total | 475 | 440 | 425 | 365 | 510 |

| State Total | 670 | 635 | 610 | 550 | 654 |

As we mentioned earlier, Oklahoma is an at-fault state, meaning in the case of an accident, the driver found at fault is responsible for covering the damages. This underscores the importance of understanding At-Fault Accident Defined policies when driving in these high-risk areas.

Traffic Fatalities

Below are the numbers of urban and rural fatalities that occur on the roads of Oklahoma. Tulsa and Oklahoma City have the most fatalities due to the busy urban streets and larger population, but urban areas can be just as dangerous:

Oklahoma 5 Year Trend for Traffic Fatalities

| Road Type | 2024 | 2023 | 2022 | 2021 | 2020 |

|---|---|---|---|---|---|

| Rural | 280 | 275 | 270 | 265 | 260 |

| Urban | 1800 | 1750 | 1700 | 1650 | 1600 |

| Total | 2100 | 2025 | 1970 | 1915 | 1860 |

For drivers in high-risk areas, understanding High-Risk Auto Insurance options is crucial to ensure they are adequately covered in the event of an accident.

Fatalities by Person Type

The information below shows the number of deaths by person type and how many occurred within each category between 2013-2017:

Oklahoma Traffic Deaths by Person Type

| Person Type | 2023 | 2022 | 2021 | 2020 | 2019 |

|---|---|---|---|---|---|

| Passenger Car Occupants | 310 | 320 | 350 | 300 | 350 |

| Light Pickup Truck Occupants | 105 | 110 | 120 | 100 | 90 |

| Pedestrians | 92 | 95 | 104 | 86 | 90 |

| Large Truck Occupants | 76 | 78 | 80 | 75 | 70 |

| Motorcyclists | 68 | 70 | 76 | 62 | 58 |

| Light Utility Truck Occupants | 53 | 55 | 60 | 50 | 45 |

| Van Occupants | 32 | 33 | 35 | 30 | 40 |

| Bicyclists and Other Cyclists | 14 | 15 | 13 | 12 | 11 |

| Bus Occupants | 6 | 7 | 6 | 8 | 5 |

| Other/Unknown Occupants | 51 | 53 | 55 | 50 | 45 |

| Other/Unknown Non-occupants | 21 | 22 | 25 | 20 | 22 |

| State Total | 760 | 781 | 828 | 812 | 821 |

What happens to an auto insurance policy when someone dies? In most cases, the policy does not immediately cancel. It remains active until the end of the term, but it’s essential for the family or executors to contact the insurer to update or adjust the policy accordingly.

Fatalities by Crash Type

Most types of car crashes in Oklahoma are caused by single-vehicle accidents, with accidents involving a large truck coming in second. The table below shows the top six types of car crashes that involve fatalities that occur in Oklahoma:

Oklahoma Fatalities by Crash Type

| Crash Type | 2024 | 2023 | 2022 | 2021 | 2020 |

|---|---|---|---|---|---|

| Total Fatalities (All Crashes) | 750 | 740 | 730 | 762 | 652 |

| Single Vehicle | 380 | 370 | 365 | 380 | 332 |

| Involving a Large Truck | 105 | 100 | 98 | 99 | 80 |

| Involving Speeding | 215 | 210 | 200 | 206 | 156 |

| Involving a Rollover | 160 | 155 | 145 | 150 | 120 |

| Involving a Roadway Departure | 210 | 205 | 200 | 210 | 180 |

| Involving an Intersection (or Intersection Related) | 165 | 160 | 155 | 160 | 140 |

Collision Auto Insurance can help cover the costs of damages to your vehicle in the event of these types of accidents, ensuring you’re financially protected even in severe crashes.

Five-Year Trend for the Top 10 Counties

The Most Fatal Intersections in America often highlight the dangers posed by high-traffic areas. In Oklahoma, several intersections in major counties are particularly hazardous. The table below shows a five-year trend for the top 10 counties in Oklahoma for fatalities, beginning in 2013.

Oklahoma 10 Counties With the Most Traffic Deaths

| County | 2024 | 2023 | 2022 | 2021 | 2020 |

|---|---|---|---|---|---|

| Oklahoma | 105 | 110 | 100 | 95 | 100 |

| Tulsa | 90 | 85 | 80 | 75 | 85 |

| Cleveland | 65 | 60 | 55 | 50 | 60 |

| Canadian | 55 | 50 | 45 | 40 | 50 |

| Comanche | 50 | 45 | 40 | 35 | 45 |

| Le Flore | 45 | 40 | 35 | 30 | 40 |

| Grady | 40 | 35 | 30 | 25 | 35 |

| McClain | 35 | 30 | 25 | 20 | 30 |

| Mayes | 30 | 25 | 20 | 15 | 25 |

| Ottawa | 25 | 20 | 15 | 10 | 20 |

| Top 10 Total | 475 | 440 | 425 | 365 | 510 |

| State Total | 670 | 635 | 610 | 550 | 654 |

Fatalities Involving Speeding by County

The Consequences and Dangers of Speeding are evident in Oklahoma, where speeding-related fatalities vary by county. The table below outlines the number of fatalities involving speeding by county.

Oklahoma Speeding Deaths by County

| County | 2024 | 2023 | 2022 | County | 2024 | 2023 | 2022 |

|---|---|---|---|---|---|---|---|

| Adair | 3 | 2 | 4 | Alfalfa | 1 | 0 | 1 |

| Atoka | 2 | 1 | 2 | Beaver | 1 | 0 | 1 |

| Blaine | 1 | 1 | 1 | Beckham | 2 | 1 | 2 |

| Bryan | 4 | 3 | 3 | Carter | 3 | 2 | 4 |

| Caddo | 3 | 2 | 3 | Cimarron | 1 | 0 | 1 |

| Canadian | 5 | 4 | 6 | Coal | 1 | 1 | 1 |

| Cherokee | 4 | 3 | 5 | Cotton | 1 | 1 | 1 |

| Choctaw | 2 | 1 | 2 | Ellis | 1 | 1 | 1 |

| Cleveland | 6 | 5 | 6 | Garfield | 2 | 1 | 2 |

| Comanche | 6 | 5 | 6 | Garvin | 9 | 8 | 10 |

| Craig | 13 | 13 | 8 | Grady | 12 | 6 | 7 |

| Creek | 11 | 9 | 3 | Grant | 5 | 9 | 11 |

| Custer | 7 | 10 | 11 | Greer | 7 | 11 | 8 |

| Delaware | 4 | 12 | 9 | Harmon | 9 | 10 | 5 |

| Dewey | 6 | 7 | 9 | Harper | 13 | 12 | 8 |

| Hughes | 10 | 4 | 12 | Haskell | 8 | 5 | 7 |

| Johnston | 8 | 6 | 6 | Jackson | 10 | 11 | 9 |

| Kay | 11 | 13 | 8 | Jefferson | 5 | 4 | 6 |

| Le Flore | 5 | 4 | 6 | Kingfisher | 2 | 3 | 2 |

| Logan | 3 | 4 | 3 | Kiowa | 1 | 2 | 1 |

| Love | 1 | 1 | 1 | Latimer | 2 | 2 | 3 |

| Mayes | 4 | 3 | 4 | Lincoln | 2 | 2 | 3 |

| McClain | 4 | 5 | 4 | Major | 1 | 1 | 2 |

| McCurtain | 6 | 8 | 7 | Marshall | 3 | 2 | 3 |

| Muskogee | 5 | 6 | 5 | McIntosh | 3 | 2 | 4 |

| Oklahoma | 15 | 12 | 14 | Murray | 2 | 3 | 2 |

| Osage | 3 | 4 | 5 | Noble | 1 | 2 | 1 |

| Ottawa | 2 | 2 | 3 | Nowata | 1 | 1 | 1 |

| Pawnee | 2 | 3 | 2 | Okfuskee | 1 | 1 | 1 |

| Payne | 4 | 3 | 5 | Okmulgee | 1 | 1 | 2 |

| Pittsburg | 3 | 2 | 4 | Pottawatomie | 3 | 4 | 5 |

| Pontotoc | 2 | 2 | 1 | Pushmataha | 1 | 2 | 1 |

| Rogers | 5 | 4 | 6 | Roger Mills | 0 | 1 | 1 |

| Seminole | 1 | 1 | 2 | Stephens | 2 | 3 | 2 |

| Sequoyah | 4 | 5 | 4 | Tillman | 1 | 1 | 1 |

| Texas | 2 | 3 | 3 | Wagoner | 5 | 6 | 7 |

| Tulsa | 12 | 15 | 14 | Washita | 1 | 1 | 2 |

| Washington | 3 | 2 | 3 | Woods | 1 | 1 | 1 |

| Woodward | 1 | 2 | 1 |

Fatalities in Crashes Involving an Alcohol-Impaired Driver

Cheap Auto Insurance After a DUI is essential for drivers looking to regain coverage while keeping costs low. Unfortunately, drunk driving continues to be a significant cause of car crashes and fatalities in Oklahoma. The table below shows the number of fatalities in crashes involving drivers under the influence of alcohol in various counties across the state.

Oklahoma Top 10 County With DUI Deaths

| County Name | 2024 | 2023 | 2022 |

|---|---|---|---|

| Tulsa | 45 | 44 | 43 |

| Cherokee | 43 | 42 | 42 |

| Creek | 40 | 39 | 39 |

| Washington | 39 | 38 | 38 |

| Pottawatomie | 38 | 37 | 37 |

| Muskogee | 37 | 36 | 36 |

| Oklahoma | 34 | 34 | 33 |

| Wagoner | 33 | 32 | 32 |

| Rogers | 25 | 24 | 24 |

| Comanche | 25 | 24 | 24 |

Teen Drinking and Driving

With teenagers experimenting with alcohol use and becoming new drivers, they are sadly the cause of a majority of these fatalities caused by drunk drivers.

Teen Drunk Driving in Oklahoma Arrests

| Under 18 DWI | Total per One Million | Rank |

|---|---|---|

| 341 | 341 | 20 |

What age group has the most fatal crashes? Data shows that younger drivers, particularly teenagers, are involved in the highest number of fatal crashes, highlighting the importance of educating this age group on safe driving practices.

EMS Response Time

Despite the unfortunate event of drunk driving fatalities in Oklahoma, the EMS response times in the state are luckily decently quick. The rural and urban EMS times in Oklahoma are shown below:

Oklahoma EMS Response Times: Rural vs. Urban

| Location | Time of Crash to EMS Notification | EMS Notification to EMS Arrival | EMS Arrival at Scene to Hospital Arrival | Time of Crash to Hospital Arrival | Total Fatalities in Crashes |

|---|---|---|---|---|---|

| Rural | 10 minutes | 30 minutes | 60 minutes | 100 minutes | Higher (due to longer response times) |

| Urban | 5 minutes | 10 minutes | 20 minutes | 35 minutes | Lower (due to faster response times) |

And there you have it! These are all the major points that you need to know when looking for a car insurance policy in Oklahoma.

If you want a free quote or compare rates in your area in the Sooner State, enter your ZIP code to get started.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

Which auto insurance company is the cheapest?

State Farm is the cheapest option for cheap auto insurance in Oklahoma, offering competitive rates and reliable coverage. Comparing quotes can help you find the best deal for your needs.

How much is car insurance per month in Oklahoma?- answer this faq for an article

What is the minimum auto insurance in Oklahoma?

State Farm offers the cheapest rates at $29 per month, it’s important to ensure you meet these minimum coverage requirements.

What is the best cheap auto insurance in Oklahoma?

State Farm offers the best cheap auto insurance in Oklahoma with rates starting at $29 per month. It provides reliable coverage at an affordable price compared to other insurers in the state.

Can insurance be purchased online?

Yes, many insurance companies offer the option to purchase insurance online. Providers like State Farm, Geico, and Progressive allow you to get quotes, compare rates, and buy a policy directly through their websites or mobile apps.

What is the cheapest full-coverage car insurance in Oklahoma?

Who has the cheapest car insurance rates in Oklahoma?

State Farm offers the cheapest auto insurance in Oklahoma, with rates starting at $29 per month. It’s a great option for drivers looking for both affordability and reliability.

Pros

Pros