Best Columbus, OH Auto Insurance in 2025 (Top 10 Company Ranking)

Allstate, Progressive, and Nationwide offer the best Columbus, OH auto insurance starting at $27/mo. Allstate stands out for its nationwide coverage and deductible perks. Progressive has personalized premiums based on actual driving habits. Nationwide offers up to $400 savings for exclusive loyalty benefits.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

Licensed Agent & Financial Advisor

UPDATED: Apr 14, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

11,638 reviews

11,638 reviewsCompany Facts

Full Coverage in Columbus

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage in Columbus

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 3,071 reviews

3,071 reviewsCompany Facts

Full Coverage in Columbus

A.M. Best Rating

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviewsAllstate, Progressive, and Nationwide offer the best Columbus, OH auto insurance, starting at $27 monthly. Allstate is the top pick for auto insurance in Columbus for its deductible incentives and nationwide coverage.

Progressive excels in its personalized rates based on actual driving. Nationwide has a total loss deductible waiver and exclusive loyalty savings opportunities. Check out the best and most affordable auto insurance in Columbus in the table below.

Our Top 10 Company Picks: Best Columbus, OH Auto Insurance

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $119 | A+ | Safe-Driving Discounts | Allstate | |

| #2 | $72 | A+ | Snapshot Program | Progressive | |

| #3 | $87 | A+ | Loyalty Rewards | Nationwide |

| #4 | $104 | A | Multi-Policy Discounts | Liberty Mutual |

| #5 | $91 | A++ | Theft Protection | Travelers | |

| #6 | $76 | A++ | Affordable Rates | Geico | |

| #7 | $79 | A++ | Agent Network | State Farm | |

| #8 | $108 | A+ | AARP Program | The Hartford |

| #9 | $97 | A | Customizable Coverage | Farmers | |

| #10 | $69 | A+ | Stable premium | Erie |

We aim to inform you so you can find the cheapest auto insurance in Columbus, Ohio. Some of the factors we discuss, like driving records and credit scores, can help you get cheap auto insurance in Columbus, Ohio.

- Allstate has unique deductible savings of up to $500 each year for safe driving

- Several factors determine monthly premiums, including your credit score

- Lower your premiums through various discount options like bundling

Do you need cheap auto insurance in Columbus? Look no further! This cheapest auto insurance guide will give you all you need to know about insurers in your area by entering your ZIP code.

#1 – Allstate: Top Overall Pick

Pros

- Drivewise and Safe Driving Bonus: Safe driving behavior is rewarded, and a bonus is given every six months for continuously having a clean driving record.

- Deductibles Incentives: A $100 immediate discount upon enrollment and another $100 yearly for a clean driving record, up to $500, making it the best Columbus, OH auto insurance.

- Nationwide Coverage: Policyholders can access roadside assistance 24/7, even outside Ohio. Learn more about this coverage in this Allstate auto insurance review.

Cons

- Privacy Concerns on Drivewise: Allstate auto insurance in Columbus uses telematics to track driving habits, which some drivers may feel uncomfortable with.

- Mixed Customer Service Review: While Allstate agents in Columbus provide satisfactory service, there are long wait times and delays in claims resolution.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#2 – Progressive: Best for Snapshot Program

Pros

- Personalized Rates Based on Actual Driving: The Snapshot Program determines premiums based on drivers’ driving habits, such as mileage and acceleration.

- Unique Savings Opportunities: Snapshot offers discounts upon participation and annual savings for safe driving habits. Learn more about this program in Progressive auto insurance review.

- Customizable Deductibles and Coverage Limits: Through the Name Your Price tool, policyholders can adjust the deductibles and coverage limits of car insurance in Columbus to match their budget.

Cons

- Expensive Rates for Some Drivers: Progressive charges high-risk drivers and those with poor credit more than safe drivers.

- Snapshot Risk: The Snapshot feature can raise monthly auto insurance premiums in Columbus for drivers who display risky driving behaviors.

#3 – Nationwide: Best for Loyalty Rewards

Pros

- Exclusive Loyalty Benefits: Car key replacement of up to $400 and $250 for emergency lockout reimbursement. Get more loyalty perks in the Nationwide auto insurance review.

- Safe Driving Incentives: Usage-based insurance perks of 10% upon participation and up to 40% for maintaining safe driving habits, making it the best car insurance in Columbus.

- Total Loss Deductible Waiver: Nationwide auto insurance in Columbus waives the policyholder’s deductibles to avoid paying out-of-pocket for claims when a car is totaled.

Cons

- Higher Base Premiums: Nationwide has higher base premiums in Columbus, OH, than Geico and Progressive, even with loyalty programs in effect.

- Limited Accident Forgiveness: This feature is not available in all states or for all customers since it requires some conditions to be met and costs extra.

#4 – Liberty Mutual: Best for Multi-Policy Discounts

Pros

- Flexible Bundling Options: Bundling your policies, such as home and auto, can result in big savings on monthly rates. Check the Liberty Mutual auto insurance review for more bundling options.

- Additional Policy Discounts: Liberty Mutual offers multiple savings methods, including multi-car, autopay, and online purchase savings, ensuring the best car insurance in Columbus.

- Local Expertise: State Auto Group’s headquarters are in Columbus, which was acquired by Liberty Mutual, strengthening its regional presence.

Cons

- Savings Vary by Customer: Bundling savings is not fixed; it depends on customers’ credit scores, claims history, and more.

- Potential for Price Increases Over Time: Liberty Mutual has affordable auto insurance in Columbus, Ohio, but rates increase later in policy terms.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#5 – Travelers: Best for Theft Protection

Pros

- Comprehensive Coverage: This covers non-collision-related damages and expenses, including theft, to help replace or repair vehicles while ensuring affordable auto insurance in Ohio.

- Personal Property Protection: Premier roadside assistance provides up to $500 in additional personal property coverage. Learn more in our Travelers auto insurance review.

- Identity Fraud Expense Reimbursement: Travelers offers this in case vehicle theft leads to identity fraud, covering up to $25,000 in expenses with no deductibles.

Cons

- Deductibles Apply to Theft Claims: Although the policy covers stolen cars, policyholders must pay the deductible before getting reimbursements.

- No Special Anti-Theft Device Discounts: Other auto insurance in Columbus offer discounts on car features like LoJack, VIN etching, and GPS trackers, but Travelers does not.

#6 – Geico: Best for Affordable Rates

Pros

- Competitive Premiums: Geico auto insurance in Columbus, OH, is known for its low minimum and full coverage rates, which are only $30 and $76 monthly.

- Affordable Options for High-Risk Drivers: Drivers with few violations get affordable auto insurance in Ohio even after a speeding ticket, and the full coverage cost is just $83 a month.

- More Savings Opportunities: To reduce premiums, use discounts like multi-vehicle, good driver, and bundling. The Geico auto insurance review listed all the savings options.

Cons

- Fewer Coverage Add-Ons: New car replacement, vanishing deductibles, and gap insurance are unavailable in Geico auto insurance in Columbus, OH.

- Higher Rates for Some Drivers: Geico charges higher rates for high-mileage and high-risk drivers in Columbus, unlike some insurers with specialized policies.

#7 – State Farm: Best for Agent Network

Pros

- Personalized Service from Local Agents: An extensive network of agents offers policy customization and quick assistance in Columbus.

- Safe Driving Programs: The Steer Clear program is for young drivers who complete safe driving courses. Drive Safe and Save aims to lower premiums through good driving habits.

- Multiple Savings Options: It has bundling, good student, and accident-free discounts. Check the State Farm auto insurance review to learn all the discounts.

Cons

- Claims Denials and Adjustments: Some customers had issues with delays in claims processing and lowball settlements.

- Limited Add-Ons: Unlike other insurance companies, State Farm’s affordable auto insurance in Ohio offers fewer add-ons, such as gap insurance, which is unavailable.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#8 – The Hartford: Best for AARP Program

Pros

- AARP Benefits & Discounts: AARP members can have lifetime renewal and 12-month rate protection, providing cost stability.

- Senior-Focused Coverages & Perks: Seniors get more perks like RecoverCare and 24/7 roadside assistance. Check all senior perks in the Hartford auto insurance review.

- Safety-Focused Savings: Hartford offers discounts for vehicle safety features, low mileage, and defensive driver courses.

Cons

- High Base Rates: The Hartford auto insurance minimum coverage is more expensive than other insurers offering affordable insurance in Columbus, especially for high-mileage drivers.

- Limited Availability: The exclusive perks are for AARP members only, and young drivers tend to get higher premiums.

#9 – Farmers: Best for Customizable Coverage

Pros

- Wide Range of Coverage Options: Farmers auto insurance in Columbus allows the mix and match of various coverage, such as spare parts, new car replacement, and OEM parts.

- Unique Add-On Coverages: Add-ons like rideshare, loss of use coverage, and glass deductibles payback are available. All these and more in Farmers auto insurance review.

- Strong Local Agent Network: Many local agents in Columbus help with policy customization for classic cars, high-risk drivers, and business vehicles.

Cons

- Limited Availability of Discounts: Discounts are fewer, and the Signal program needs telematics tracking, which some drivers do not prefer.

- Higher Rates: Budget-conscious drivers find Farmers auto insurance in Columbus expensive, especially for high-risk drivers.

#10 – Erie: Best for Stable Premiums

Pros

- No Expected Rate Increase: Erie has rate lock features that prevent premiums from increasing due to accidents, claims, and general market fluctuations.

- High Claims Satisfaction: Consistently on top of claims handling and resolution. The steps of the claims procedure are explained in the Erie auto insurance review.

- No Hidden Fees for Coverage: Erie offers comprehensive plans with no additional charges for pet injury, rideshare, and new auto security to ensure the best Columbus, OH auto insurance.

Cons

- No Online Quotes: Erie requires customers to work with an agent to get insurance quotes, unlike competitors that provide online quotes.

- Limited Availability: Erie auto insurance in Columbus, Ohio, is not available in all states, so policyholders moving outside Ohio must switch insurers.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Best Columbus, Ohio Auto Insurance Monthly Rates

Maintaining coverage in Columbus might cost your average motorist around $ 155 monthly. But right now, you can shop around and find $27 monthly coverage. Check the table below for the detailed rates.

Auto Insurance Monthly Rates in Columbus, OH by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $46 | $119 | |

| $27 | $69 |

| $39 | $97 | |

| $30 | $76 | |

| $40 | $104 |

| $34 | $87 |

| $28 | $72 | |

| $32 | $79 | |

| $43 | $108 |

| $36 | $91 |

Erie, Progressive, and Geico offer the lowest rates in Columbus: $27, $28, and $30, respectively. You can also learn more about Ohio auto insurance here.

For Columbus drivers, Erie, Progressive and Geico consistently rank as top choices for budget-conscious drivers.

Tracey L. Wells Licensed Insurance Agent & Agency Owner

Policyholders should also consider customer service, coverage options, and discounts. Comparing multiple providers can help them achieve the best balance of affordability and protection.

Be sure to look into a company before you switch. Basing your decision on price alone could result in less-than-optimal customer service or a poor claim-filing experience.

The Best Columbus, Ohio Auto Insurance Discounts

Auto insurance providers in Columbus, OH, offer different savings options to help policyholders save on premiums. Here is a list of car insurance discounts you can lean on.

Auto Insurance Discounts From Top Columbus, OH Providers

| Insurance Company | Accident-Free | Bundling | Defensive Driving | Good Student | Safe Driver |

|---|---|---|---|---|---|

| 25% | 25% | 18% | 18% | 18% | |

| 25% | 25% | 5% | 15% | 15% |

| 20% | 20% | 10% | 15% | 20% | |

| 22% | 25% | 15% | 26% | 15% | |

| 20% | 25% | 10% | 12% | 20% |

| 20% | 20% | 12% | 12% | 12% |

| 10% | 10% | 31% | 10% | 10% | |

| 17% | 17% | 20% | 20% | 20% | |

| 5% | 5% | 10% | 12% | 8% |

| 13% | 13% | 17% | 17% | 17% |

These options can significantly reduce the overall cost of auto insurance in Columbus. Whether you’re a safe driver, a student, or a teen driver, exploring these discounts with different insurers can help you find the best coverage at the most affordable car insurance in Ohio rate.

Best Columbus, Ohio Auto Insurance Providers

Allstate stands out as the best auto insurance in Columbus for its deductible incentives, which could reach up to $500 a year for maintaining a clean driving record. Moreover, it has 24/7 roadside assistance nationwide, so even outside Ohio, you can still access roadside assistance.

Columbus is Ohio’s capital and the state’s most populous city. It was chosen as the capital because of its strategic location on both the National Highway and the National Canal systems.

Columbus is the home of prosperous industries such as insurance, technology, education, and research. Between the college town atmosphere, the good schools, and the affordable housing, Columbus has earned many awards as an all-American city.

Fun fact: Columbus is #16 on the list of the “Top 100 biggest cities.”

We discuss rates, compare auto insurance companies, and review factors influencing your rates and state auto insurance. By the end, you’ll know all you need to know to decide on auto insurance in Columbus and how to find affordable insurance.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Auto Insurance Coverage Requirements in Ohio

Driving legally in Columbus requires minimum liability insurance. Check the table below.

Auto Insurance Minimum Coverage Requirements in Ohio

| Coverage | Limits |

|---|---|

| Bodily Injury | $12,500 per person / $25,000 per accident |

| Property Damage | $7,500 per accident |

Liability coverage only protects you from accidents and other vehicle damage for which you are deemed responsible. This includes property damage liability insurance coverage that pays for any damage you cause or are found to be at fault for. But if someone else hits you, or if an act of nature damages your vehicle, you may end up paying for everything to get fixed or replaced.

Major Auto Insurance Factors in Columbus

A wide array of things might factor into your rate quotes. While many specific factors aren’t really anything you can do something about, a few are factors you can change for the better. Here are a few elements that might change your automobile insurance premium.

It always helps to know the factors that influence rates to give yourself enough information to make an informed decision about what rates and what company to go with.

Chris Abrams Licensed Insurance Agent

Getting cheap auto insurance in Columbus, Ohio, requires knowing the factors affecting your rates and finding the best way to find that cheap insurance. This involves being aware of how different companies give different rates, often for the very same factor, like driving record.

Comment

byu/teamsneverdie from discussion

inColumbus

There are exceptions, of course. If you’re ready to get free auto insurance quotes for Columbus drivers, simply enter your ZIP code into our online quote comparison tool. It’s an easy and fast way to find the best cheap insurance near me.

Your ZIP code

Your auto insurance rates can vary depending on where you call home. Usually, populous areas have increased auto insurance rates since the additional number of drivers on the highway increases the chance of car accidents and auto claims. Check these ZIP codes below and how auto insurance costs them.

Auto Insurance Monthly Rates in Columbus, Ohio by ZIP Code

| ZIP | Rates |

|---|---|

| 43026 | $106 |

| 43017 | $105 |

| 43004 | $103 |

| 43035 | $103 |

| 43016 | $102 |

Columbus’s total population is 913,175, and the normal household income was $65,327 in 2023. These statistics show that auto insurance premiums vary by only a few dollars.

Your Credit Score

Credit scores are one factor that greatly impacts auto insurance rates. Often, a poor credit score can lead to rates hundreds, if not thousands, of dollars higher than those of some with a good credit score or even an excellent credit score. Some states have better or worse credit scores than others.

Auto Insurance Monthly Rates in Columbus, Ohio by Credit Score

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $120 | $150 | $200 | |

| $115 | $145 | $190 |

| $130 | $160 | $210 | |

| $110 | $140 | $180 | |

| $125 | $155 | $195 |

| $120 | $150 | $200 |

| $135 | $170 | $220 | |

| $118 | $143 | $185 | |

| $122 | $148 | $190 |

| $119 | $145 | $195 |

Some companies, such as Geico, give drivers with poor credit a financial break on their monthly premiums. Other companies, however, consider these types of motorists to be high-risk drivers and might double their premiums or more.

Your Age

Another high-risk group of drivers is young drivers with less experience behind the wheel. There are discounts for students with good grades and those who have taken driving courses, but the rates still might be high.

Auto Insurance Monthly Rates in Columbus, Ohio by Provider, Age, & Gender

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 34 Female | Age: 34 Male |

|---|---|---|---|---|

| $477 | $588 | $194 | $208 | |

| $303 | $307 | $111 | $113 |

| $698 | $698 | $175 | $175 | |

| $245 | $323 | $136 | $138 | |

| $480 | $523 | $187 | $190 |

| $304 | $304 | $63 | $66 |

| $727 | $729 | $144 | $147 | |

| $322 | $366 | $195 | $198 | |

| $358 | $475 | $122 | $126 |

| $380 | $490 | $128 | $130 |

All auto insurance companies in Columbus, Ohio, charge higher premiums for younger drivers (age 17), while Nationwide offers the lowest rates for 34-year-old drivers, which differ greatly at only $66.

Read more: Car Insurance for Students

Your Driving Record

Most automotive insurance companies consider your driving record as a potential predictor of whether you will need to file claims in the future. Look at the table below.

Auto Insurance Monthly Rates in Columbus, Ohio by Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $120 | $135 | $150 | $175 | |

| $115 | $130 | $145 | $170 |

| $128 | $148 | $158 | $185 | |

| $100 | $120 | $130 | $150 | |

| $130 | $145 | $160 | $188 |

| $122 | $138 | $158 | $178 |

| $140 | $155 | $170 | $195 | |

| $125 | $140 | $155 | $180 | |

| $110 | $125 | $140 | $165 |

| $135 | $150 | $165 | $190 |

Therefore, motorists with a checkered record might end up paying higher premiums. But accident forgiveness and similar discounts are available, which could lower your rate.

Although some states prohibit demographic factors like marital status or location based on ZIP code, every state allows auto insurance in Columbus, OH, to factor in driving records when setting insurance rates.

Read more: Cheap Auto Insurance for a Bad Driving Record

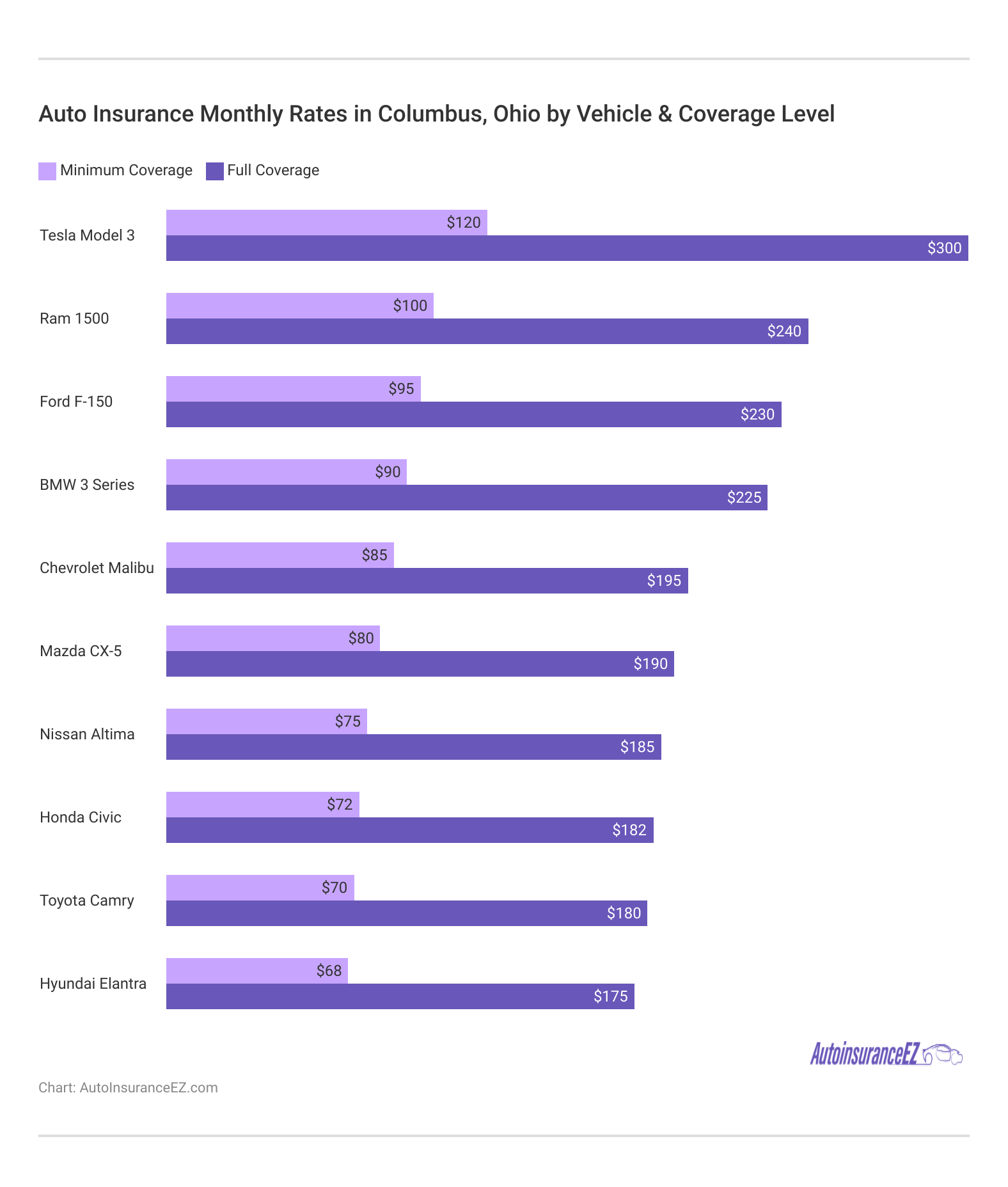

Your Vehicle

Safety features and car alarms might help lower your monthly rate, but the biggest factor is how much it will cost to fix or replace your vehicle and how much coverage you need to purchase. This is why a luxury vehicle will cost much more to insure than an older, used sedan. Here are the rates based on the type of vehicle.

The most expensive cars to insure are the luxury and high-value vehicles like the Tesla Model 3, which have significantly higher premiums than more affordable sedans like the Hyundai Elantra.

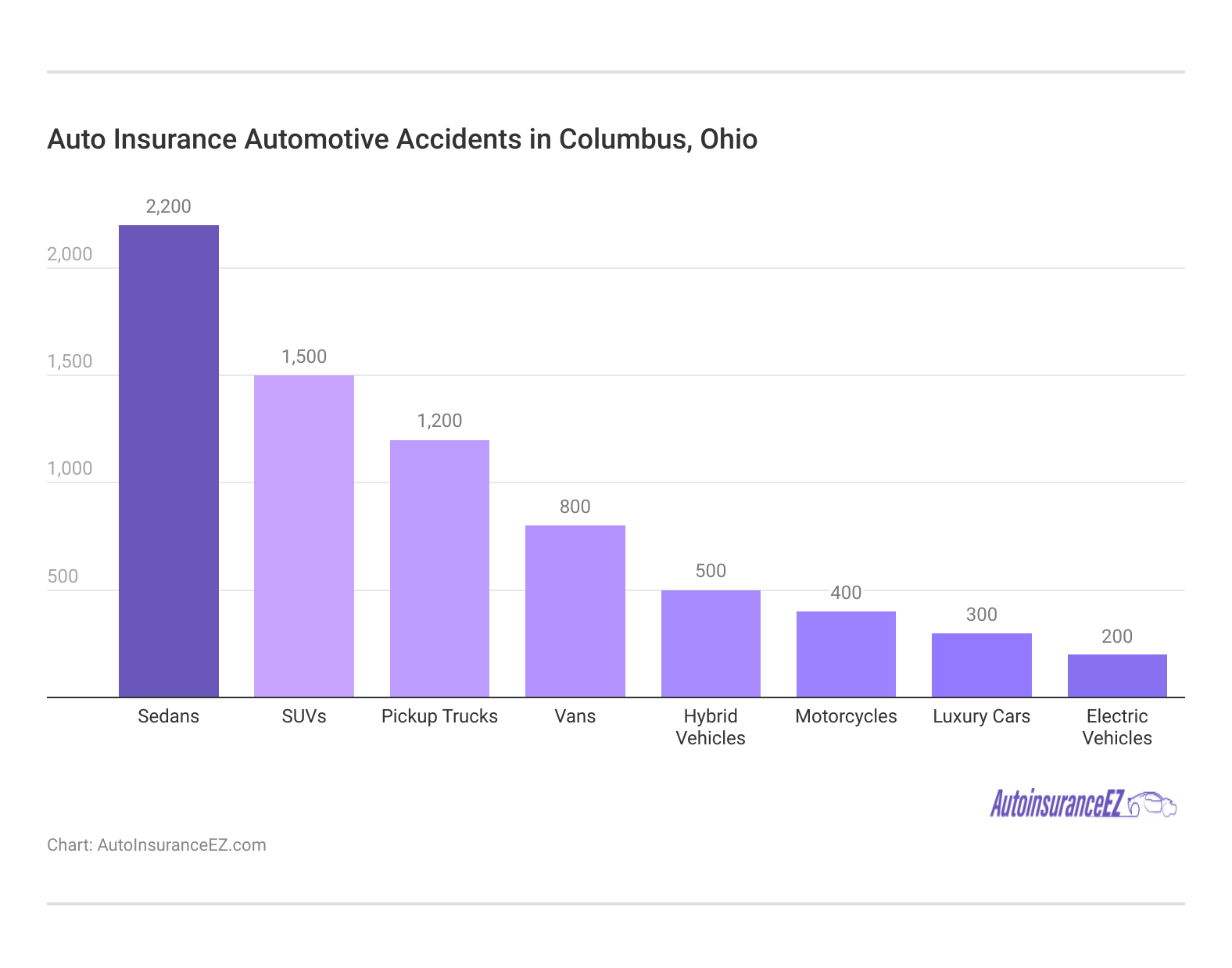

Automotive Accidents in Columbus

No matter where you live, if accident rates are high on the roads you drive each day, your provider will likely raise premiums for your area. In the chart below, you can see the statistics for your ZIP code. If these numbers seem high, talk to your provider about ways to lower your rate, such as safe driver discounts.

Larger vehicle categories like sedans and SUVs are more prone to accidents, possibly due to their higher presence on the roads. Meanwhile, luxury cars and electric vehicles report fewer accidents, which could be due to lower ownership rates or advanced safety features.

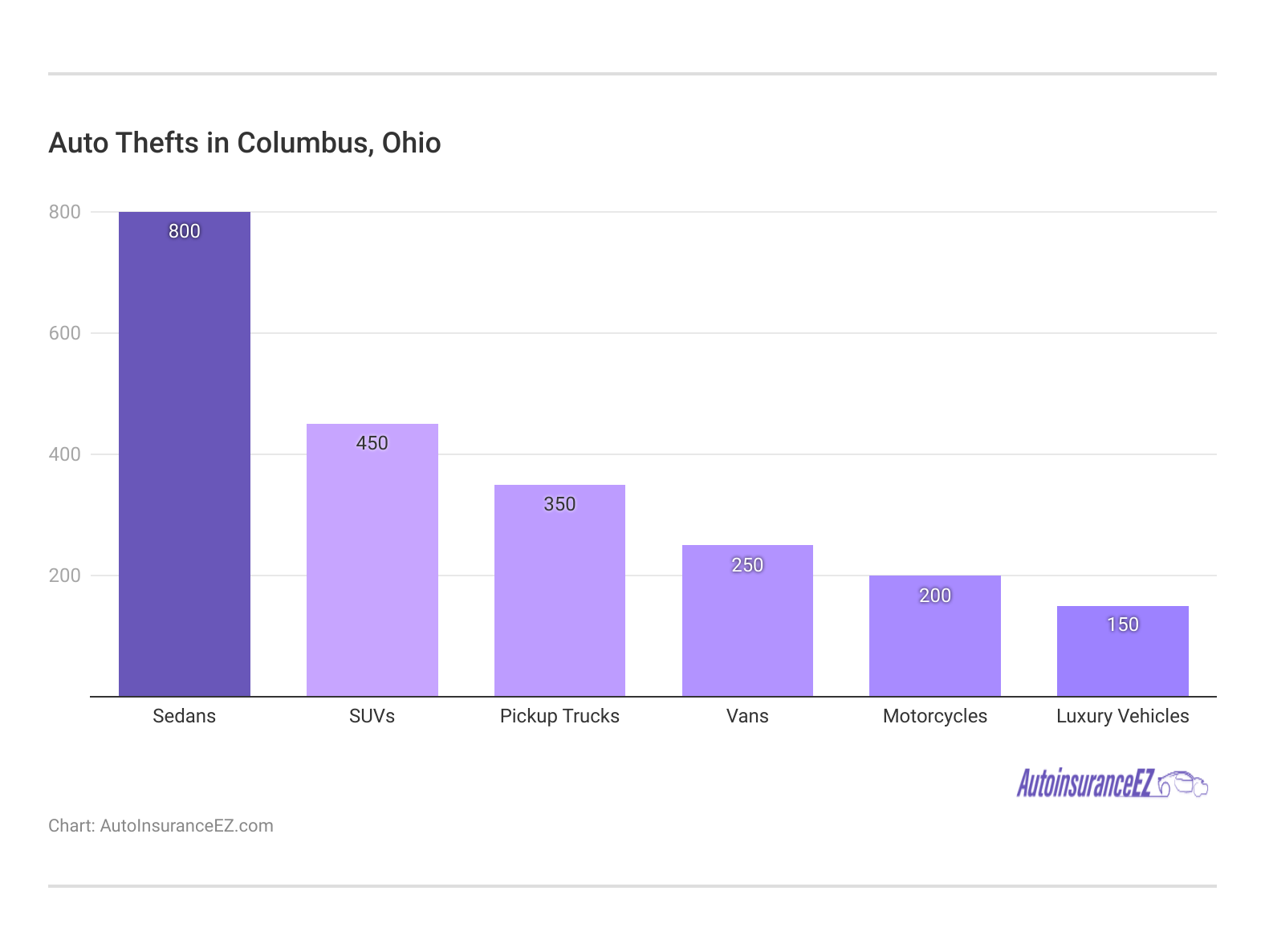

Auto Thefts in Columbus

Vehicle theft can be a serious problem, particularly in densely populated locations. If your location and/or vehicle model place you at a higher risk for theft, you might have issues obtaining low-cost auto insurance in Columbus, Ohio.

The total number of stolen automobiles in 2023 was 10,660 for the city of Columbus. Because auto theft rates are so high, you might want to ensure you have comprehensive and collision coverage on your policy—even if it raises your premiums.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Minor Auto Insurance Factors in Columbus

The factors below might only influence your monthly payment by a few dollars or less, but they can make an impact together. We cover five factors here, including marital status and driving distance to work.

Read more: How does an insurance company determine my premium?

Your Marital Status

There isn’t that much of a price difference between married and single drivers, but married individuals can easily bundle multiple discounts with their spouses. And the more you bundle, the more you can save.

Bundling insurance with a spouse can be smart, but it is essential to weigh the costs and benefits based on both partners’ driving history and insurance needs.

Read more: Newlyweds Discount: How Much Can You Save?

Your Gender

Who do you think gets charged more for insurance: men or women? The answer is it depends on the company. Some companies will charge male drivers more, while others will give discounts to females. Many companies don’t bother to change rates based on gender at all.

Comment

byu/GonnaRainDown from discussion

inAskFeminists

Often, insurance companies react to evidence that males are riskier drivers, leading to more car accidents and auto claims, and costing the insurance company money. So, auto insurance rates are generally higher for males, though this has changed slightly in recent years.

Your Driving Distance to Work Increases Possibilities for Auto Accidents

Like many large cities, Columbus can have lengthy commute times. The average auto insurance cost of commutes can last 16-23 minutes, but they can be longer if you live farther from the city center.

Around 76 percent of motorists drive their own vehicle alone into work, while up to 20 percent carpool.

Many insurance companies view driving distance to work or commute distance as indicative that a driver will drive a certain number of miles per year.

The idea is that drivers who drive more have greater opportunities for an accident and making a claim, which costs the auto insurance company money. Are you wondering what questions your insurance company asks about things like “yearly mileage” or “use of the vehicle”?

Well, don’t lose too much sleep over it. Other than business vehicles, which can see as much as a 10-12 percent increase in premiums, you’d have to make drastic changes in your driving habits just to see a small discount.

Your Coverage and Deductibles

Changing your deductible is a quick and easy way to lower your monthly payment, but it can also be risky. The detailed video below explains deductibles more.

The best strategy is to save money if you must pay that deductible when filing a claim. Also, remember that deductible rules can vary from company to company. Compare cheap Columbus auto insurance estimates online to ensure you still receive the most affordable insurance in Columbus.

Education Can Lower Your Auto Insurance Rates

A solid 90 percent of residents have successfully achieved their high school diploma, while another 35 percent have completed a bachelor’s degree.

Drivers with a college degree are in a good position to save money on their auto insurance because providers have begun offering lower rates to drivers with advanced degrees in recent years.

Columbus is home to Ohio State University, a major institution for higher learning locally as well as on the national level. Students can earn a bachelor’s degree, a graduate degree, or a doctorate. It also offers a branch facility for students who would rather pursue an associate’s degree. Other four-year institutions in the area include Capital University, Franklin University, and the Columbus College of Art and Design.

Obtaining inexpensive auto insurance can be a challenge. There’s a lot of information you need to consider, and figuring out the way in which insurance providers assess your probable risk may be complex.

Don’t let an insurance agent talk you into spending more than you need to. Do your research, compare quotes, know what discounts you qualify for, and get the best coverage for your driving and vehicle use.

Read more: 10 Key Ways College Students Can Save Money on Auto Insurance

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

How We Conducted Our Auto Insurance Analysis in Columbus, OH

We calculated our average rate based on the following metrics: a married, 34-year-old male with good credit, a 12-month history of maintaining auto insurance, a clean driving record, and who owns his own home. Miles driven annually were based on the national average. The average rate was also calculated based on a financed 2015 Honda Accord with a pre-installed anti-theft device.

Customizing your policy based on your unique situation ensures you’re not overpaying while still getting the right level of protection.

Melanie Musson Published Insurance Expert

Comparing rates from different companies is the quickest and easiest way to get the best Columbus, O,H auto insurance. Enter your ZIP code into our free quote tool to find the best coverage options for your needs.

Frequently Asked Questions

Who has the best car insurance in Ohio?

Allstate has the best car insurance in Ohio, offering affordable rates and quality service.

How much is car insurance in Columbus, Ohio?

Car insurance in Columbus starts at $27 monthly for minimum coverage and $69 for full coverage.

Which car insurance coverage is the best?

Car insurance coverage depends on your needs and lifestyle. Assess them and talk to your insurance provider to tailor these to your auto insurance coverage options.

Why is car insurance so cheap in Ohio?

Car insurance is cheaper in Ohio due to low population density, affordable repair costs, and fewer natural disasters. These factors result in fewer claims and lower payouts for insurers.

Is Allstate a good insurance company?

Yes. Allstate is a good company that offers amazing perks, such as safe driving incentives and deductible perks, which allow customers to get bonuses of up to $500.

What are the three requirements for Ohio car insurance?

Ohio mandates liability insurance with minimum coverage requirements of 25/50/25.

Is car insurance high in Ohio?

No, car insurance in Ohio is relatively low compared to the national average. Ohio drivers pay some of the cheapest premiums in the U.S. due to low population density, affordable repair costs, fewer natural disasters, and strong market competition among insurers.

How much is car insurance in Ohio per month?

As of 2025, the average monthly cost of full coverage car insurance in Ohio is approximately $69, totaling around $828 annually. This is essentially lower than the national average, about $175 monthly.

Who gives the best car insurance?

Allstate, Progressive, and Nationwide provide the best car insurance.

Which type of car insurance is the best?

The best type of car insurance coverage is the one that fits your needs. However, it is recommended that you get full coverage for full protection. You can find affordable car insurance rates using our free online comparison tool.