Cheap Auto Insurance in North Dakota for 2025 (Save Money with These 10 Companies)

If you're looking for cheap auto insurance in North Dakota, consider USAA, Geico, and State Farm. USAA offers affordable ND car insurance rates as low as $12 a month for military families. Geico is known for budget-friendly pricing, while State Farm provides a wide range of coverage options.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

UPDATED: Apr 30, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

6,590 reviews

6,590 reviewsCompany Facts

Min. Coverage in ND

A.M. Best Rating

Complaint Level

Pros & Cons

6,590 reviews

6,590 reviews 19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage in ND

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,157 reviews

18,157 reviewsCompany Facts

Min. Coverage in ND

A.M. Best Rating

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviewsUSAA, Geico, and State Farm are our top picks for cheap auto insurance in North Dakota. USAA is best for military families, with monthly rates as low as $12.

Geico also offers affordable car insurance rates in ND, while State Farm provides a range of coverage options.

USAA, Geico, and State Farm are the top providers of cheap auto insurance in North Dakota, thanks to their cheap rates you can enjoy military discounts, affordable rates, and broad coverage.

Our Top 10 Company Picks: Cheap Auto Insurance in North Dakota

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $12 | A++ | Military Focus | USAA | |

| #2 | $17 | A++ | Affordable Rates | Geico | |

| #3 | $21 | B | Broad Coverage | State Farm | |

| #4 | $22 | A+ | Reliable Service | Nationwide |

| #5 | $24 | A++ | Innovative Solutions | Travelers | |

| #6 | $30 | A+ | Personal Touch | Farmers | |

| #7 | $31 | A+ | Tech Innovation | Progressive | |

| #8 | $38 | A+ | Comprehensive Options | Allstate | |

| #9 | $40 | A | Family Oriented | American Family | |

| #10 | $110 | A | Customizable Policies | Liberty Mutual |

Here are tips on how to find cheap auto insurance and a review of some of the top providers in North Dakota.

- USAA, Geico, and State Farm are the top providers of cheap ND auto insurance

- USAA has the most affordable ND car insurance rates at $12/mo

- Geico offers affordable rates, and State Farm provides broad coverage

Are you unsure which auto insurance plan is best for you in North Dakota? Enter your ZIP code to find cheap auto insurance deals near you.

#1 – USAA: Top Overall Pick

Pros

- Exclusive Military Discounts: Receive exclusive discounts for service members and their families, providing affordable vehicle protection.

- Exceptional Customer Satisfaction: Regularly praised for offering cheap auto insurance in North Dakota, with customized car coverage and excellent claims assistance.

- Affordable Rates for All Coverage Levels: Affordable pricing on all policy options guarantees wise financial protection for your vehicle.

Cons

- Membership Restrictions: Certain providers of cheap auto insurance in North Dakota exclusively offered to military personnel and their families, restricting access to affordable policies.

- Limited Physical Branches: According to our USAA auto insurance review, fewer in-person service centers make in-depth insurance consultations less accessible.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#2 – Geico: Best for Affordable Rates

Pros

- Budget-Friendly Pricing: Famous for offering some of the cheapest rates in the market, which has led to the widespread availability of affordable auto insurance.

- Easy-to-Use Mobile App: A smooth digital interface enables fast policy updates and straightforward claims monitoring, making it easier to manage your cheap auto insurance in Vermont.

- Diverse Discount Options – Discounts for safe drivers and military personnel and bundling options make it a top choice for budget-friendly coverage. To understand better, read our, Geico auto insurance review.

Cons

- Inconsistent Customer Service: Some people report difficulties with claims processing for cheap auto insurance in Vermont, leading to frustrations for drivers seeking quick resolutions.

- Limited Policy Customization: Less flexibility in customizing automobile coverage options results from fewer add-ons.

#3 – State Farm: Best for Broad Coverage

Pros

- Strong Local Agent Network: Access to a national network of agents offers knowledgeable guidance on auto insurance.

- Comprehensive Policy Add-Ons: Customized driving protection is possible with options like ridesharing insurance and rental reimbursement. See more of it by reading our, State Farm auto insurance review.

- Financially Stable and Trusted: Long-term security and dependable policy payouts are guaranteed by a solid reputation.

Cons

- Rates May Be Higher for High-Risk Drivers: Some drivers may have less affordable premiums, which would impact the affordability of insurance coverage.

- Limited Discount Variety: Fewer opportunities to save money for those seeking customized price breaks with cheap auto insurance in Vermont.

#4 – Nationwide: Best for Reliable Coverage

Pros

- Vanishing Deductible Program: Safe driving reduces your deductible over time, rewarding conscientious car owners with lower rates for cheap auto insurance in Vermont.

- Firm Accident Forgiveness Policy: Helps maintain stable auto insurance rates by preventing rate increases following small events. To see more, read our Nationwide auto insurance review.

- Excellent Home and Auto Bundling Discounts: Significant savings provide all-encompassing financial relief when several plans are combined.

Cons

- Higher Premiums Compared to Budget Insurers: Not all prices for cheap auto insurance in Vermont are the most competitive, which affects affordability for drivers on a tight budget.

- Limited Availability of Local Agents: Not all prices are the most competitive, which affects affordability for drivers on a tight budget.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#5 – Travelers: Best for Innovative Solutions

Pros

- Extensive Optional Coverages: Provides solutions for personalized policy protection, like gap insurance and new automobile replacement. For more information, read our Travelers auto insurance review.

- IntelliDrive Program for Safe Drivers: Keeps track of driving patterns to offer tailored savings, encouraging wise decisions about vehicle insurance.

- Strong Financial Stability: Traveler’s reputable name in cheap auto insurance in Vermont guarantees dependable claims handling.

Cons

- Usage-Based Discounts May Not Suit Everyone: Reckless driving may result in higher rates, impacting the predictability of premiums.

- Fewer Physical Branches: In-person policy support for cheap auto insurance in Vermont may be less accessible due to limited office locations.

#6 – Farmers: Best for Personal Touch

Pros

- Highly Customizable Policies: With cheap auto insurance in Vermont, you can customize your coverage by adding various add-ons, allowing you to tailor your policy to fit specific needs and budget preferences.

- Strong Local Agent Support: A hands-on approach ensures customer-focused vehicle insurance experiences.

- Great Bundling Discounts: A way to achieve more financial flexibility is by combining policies. Check more on our Farmers auto insurance review.

Cons

- Higher Premiums for Basic Coverage: Farmer’s is one of the cheapest auto insurance in Vermont is not usually the most economical option for people who value small monthly installments.

- Lacks Advanced Online Tools: Because digital resources aren’t as smooth, tracking claims and implementing policy changes are more complex

#7 – Progressive: Best for Tech Innovation

Pros

- Snapshot Program Rewards Safe Drivers: Reinforces reward-based policy structures by providing premium reductions for safe driving.

- Name Your Price Tool: Allows policyholders to customize their premiums flexibly, according to their budget. Discover how it works through our Progressive auto insurance review.

- Strong Online and Mobile Experience: A technologically advanced platform for cheap auto insurance in Vermont guarantees convenient insurance management.

Cons

- High-Risk Drivers May Face Rate Increases: Driving behavior may cause pricing to rise, making cost predictability unpredictable.

- Mixed Customer Service Reviews: Some policyholders report delays in service response times and claims processing when dealing with cheap auto insurance in Vermont.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#8 – Allstate: Best for Comprehensive Options

Pros

- Wide Range of Policy Add-Ons: Complete auto protection enhanced by special coverages like accident forgiveness.

- Drivewise Program for Personalized Discounts: Dynamic rate changes directly result from safe driving practices.

- Large Local Agent Network: A broad presence in Vermont allows providers to offer personalized recommendations for cheap auto insurance, helping drivers find the best rates for their needs.

Cons

- Premiums Can Be Higher Than Competitors: Cost-conscious drivers in Vermont may find it more challenging to afford rising prices for cheap auto insurance.

- Some Discounts Require Monitoring Programs: Based on our Allstate auto insurance review. enrollment in tracking-based driving behavior assessments can be necessary to save money.

#9 – American Family: Best for Family Oriented

Pros

- Teen Driver and Multi-Car Discounts: Affordable household coverage is encouraged by family-friendly pricing. Find out more by reading our American Family auto insurance review.

- Great Home and Auto Bundling Options: Cost-effective insurance solutions are produced by combining policies.

- Highly Customizable Policies: Flexible plans offer customized, cheap auto insurance in Vermont, designed to meet various driving requirements while ensuring affordability.

Cons

- Limited Availability: Restricts access to national policy options by only operating in a few states, limiting cheap auto insurance choices in Vermont.

- Digital Tools Are Less Advanced: Online and mobile functions aren’t as strong for smooth policy management.

#10 – Liberty Mutual: Best for Customizable Policies

Pros

- Exclusive Military Discounts: Exclusive discounts for service members and their families provide affordable vehicle protection. Discover more through our Liberty Mutual auto insurance review.

- Exceptional Customer Satisfaction: Regularly praised for offering cheap auto insurance in Vermont, with customized car coverage and excellent claims assistance.

- Affordable Rates for All Coverage Levels: Affordable pricing on all policy options guarantees wise financial protection for your vehicle.

Cons

- Premiums Can Be Higher: Liberty Mutual tends to have higher premiums, especially for drivers seeking basic coverage or more affordable rates.

- Inconsistent Customer Service: Some customers have expressed dissatisfaction with service, especially in handling claims, despite cheap auto insurance options in Vermont.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Affordable North Dakota Car Insurance Costs and Discounts

Finding premium coverage at an affordable price is quite a challenging process of selecting auto insurance. Thankfully, there are cheap auto insurance companies offering premium coverage at a low price here in North Dakota.

North Dakota Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $38 | $136 | |

| $40 | $145 | |

| $30 | $107 | |

| $17 | $61 | |

| $110 | $398 |

| $22 | $77 |

| $31 | $110 | |

| $21 | $76 | |

| $24 | $88 | |

| $12 | $44 |

This car insurance guide will help you compare monthly rates from various providers and coverage options in North Dakota. It also highlights the discounts offered by the top providers in the region.

Auto Insurance Discounts From the Top Providers in North Dakota

| Insurance Company | Available Discounts |

|---|---|

| Safe Driving Club, Anti-Theft, Multi-Policy, Smart Student, Responsible Payer, Drivewise | |

| Loyalty, Multi-Policy, Safe Driving, Teen Driver, Early Bird, Good Student, Generational | |

| Safe Driver, Multi-Policy, Good Student, Bundling, Signal App, Alternative Fuel Vehicle | |

| Multi-Policy, Safe Driver, Good Student, Emergency Deployment, Anti-Theft System, New Vehicle | |

| Multi-Policy, Good Student, Hybrid Vehicle, Accident-Free, Military, Newly Married Discounts |

| Multi-Policy, Safe Driver, Paperless, Anti-Theft, SmartRide, Affinity Discounts |

| Multi-Policy, Snapshot, Continuous Insurance, Homeownership, Teen Driver, Good Student | |

| Safe Driver, Multi-Policy, Steer Clear, Drive Safe & Save, Good Student, Defensive Driving Course | |

| Multi-Policy, Safe Driver, Hybrid/Electric Vehicle, Continuous Insurance, New Vehicle, Home Ownership | |

| Safe Driver, Multi-Policy, Vehicle Storage, New Vehicle, Military Installation, Loyalty, Good Student |

This guide will help you understand how to lower your car insurance premiums and save on auto insurance rates while still meeting your vehicle’s requirements and needs.

North Dakota Auto Insurance Coverage Options

With so many car insurance companies available, selecting the right one to protect you and your family can be challenging especially when you’re also trying to figure out how much car insurance costs in North Dakota.

North Dakota Auto Insurance Monthly Rates by Provider

| Insurance Company | Rates |

|---|---|

| $135 | |

| $128 | |

| $120 | |

| $110 | |

| $140 |

| $130 |

| $115 | |

| $125 | |

| $122 | |

| $105 |

While you may choose a car insurance company strictly based on rates, it could be wise to read about why a car insurance company has low rankings or why they are ranked off the charts.

Read more: Compare cheap auto insurance in North Dakota

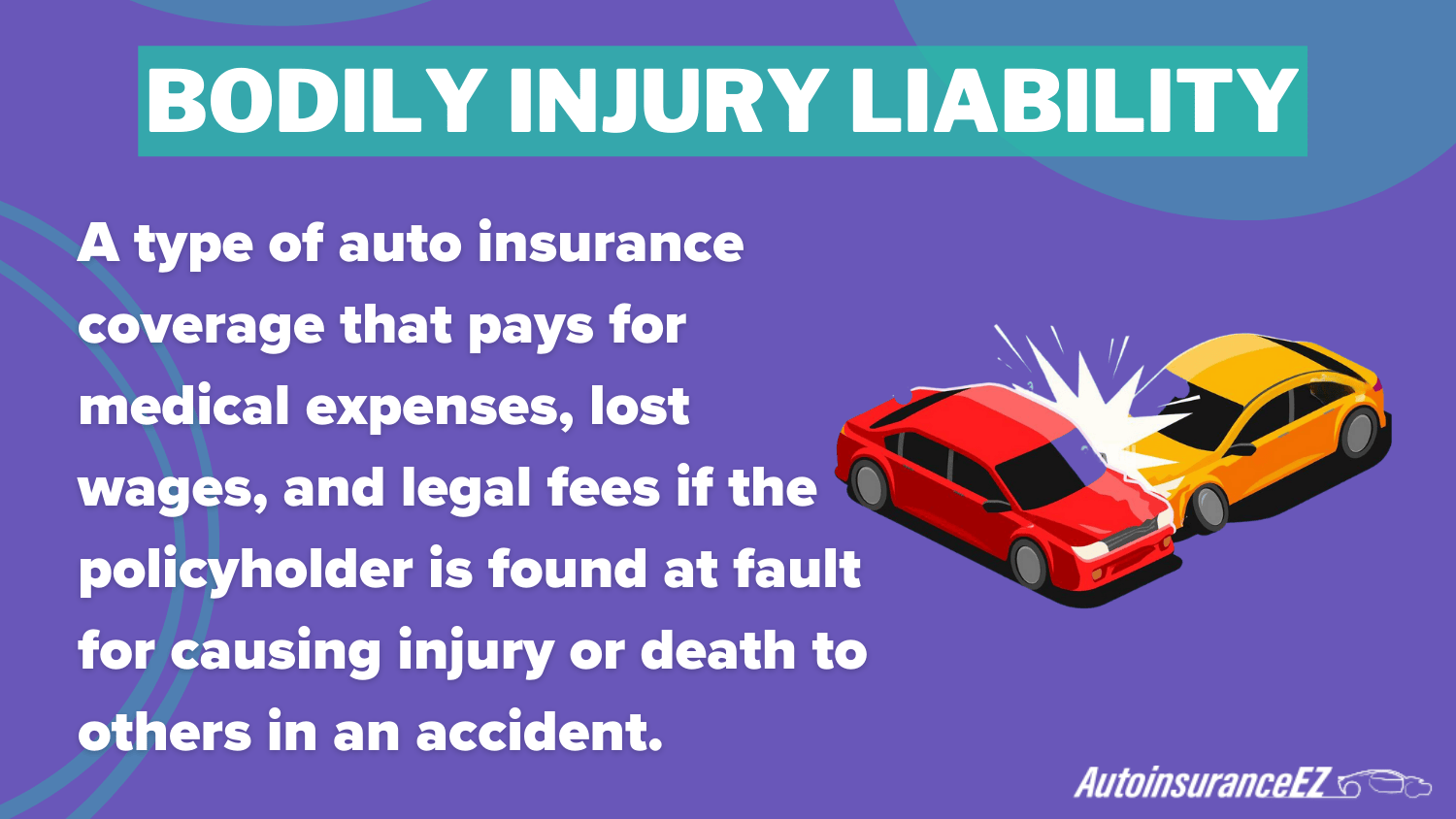

Auto Insurance Minimum Coverage Requirements in North Dakota

| Coverage | Limits |

|---|---|

| Bodily Injury Liability (per person) | 25000 per person / $50,000 per accident |

| Property Damage Liability | 25000 per accident |

| Uninsured/Underinsured Motorist Bodily Injury (per person) | 25000 per accident / $50,000 per accident |

| Uninsured/Underinsured Motorist Property Damage | 25000 per accident |

Better coverage can reduce the financial impact of a car accident, helping with medical bills and vehicle repairs. The average cost of car insurance in North Dakota is around $397 per year for minimum coverage and up to $1,665 for full coverage

Factors Affecting Car Insurance Rates in North Dakota

Road fatalities can occur for various reasons, including weather conditions, traffic accidents, and different crash types involving individuals. Each of these factors contributes to the overall risk of fatal accidents on the road.

North Dakota Report Card: Auto Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| Traffic Density | A | Low population, minimal traffic |

| Vehicle Theft Rate | A | Low theft rate statewide |

| Average Claim Size | B | Moderate repair and medical costs |

| Weather-Related Risks | C | Hailstorms and harsh winters common |

To minimize the risk of fatal accidents, it’s important to drive safely and stay prepared for unexpected situations

and compare North Dakota auto insurance quotes to find the best coverage for your needs.

Better coverage can reduce the financial impact of a car accident, helping with medical bills and vehicle repairs. While finding the cheapest car insurance in North Dakota is important, it’s also essential to ensure that you have enough coverage to protect yourself financially in the event of an accident.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Car Insurance Coverage Options in North Dakota

All drivers in North Dakota must have at least the minimum liability insurance coverage. However, car insurance companies may offer discounts if you have coverage that exceeds the state’s minimum requirements.

Auto Insurance Minimum Coverage Requirements in North Dakota

| Coverage | Limits |

|---|---|

| Bodily Injury Liability (per person) | 25000 per person / $50,000 per accident |

| Property Damage Liability | 25000 per accident |

| Uninsured/Underinsured Motorist Bodily Injury (per person) | 25000 per accident / $50,000 per accident |

| Uninsured/Underinsured Motorist Property Damage | 25000 per accident |

Opting for higher coverage only adds a few hundred dollars to your annual premium, which means you could pay as little as $20 or less per month for your car insurance.

North Dakota Report Card: Auto Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| Traffic Density | A | Low population, minimal traffic |

| Vehicle Theft Rate | A | Low theft rate statewide |

| Average Claim Size | B | Moderate repair and medical costs |

| Weather-Related Risks | C | Hailstorms and harsh winters common |

Having better coverage can ease the financial burden if you’re involved in a car accident in the future and can’t afford the additional medical expenses or vehicle repair costs.

North Dakota car insurance requirements: minimum liability $25K bodily injury per person, $50K per accident, $25K property damage, and PIP coverage.

North Dakota’s Cheapest Auto Insurance Providers

Finding the best North Dakota auto insurance that fits your needs should be much easier if you better understand how auto insurance works and what factors to consider.

To get cheap auto insurance in North Dakota, it’s essential to understand each company’s top offerings and the factors that affect your rates.

TY Stewart Licensed Insurance Agent

Follow these guidelines to find the ideal insurance for your vehicle in North Dakota, ensuring affordability and safety on the roads. Avoid expensive auto insurance premiums by entering your ZIP code to see the cheap auto insurance in North Dakota.

Frequently Asked Questions

What factors make USAA the top overall auto insurance provider in North Dakota?

USAA offers discounted rates for military families, making it one of the most affordable options for cheap car insurance in North Dakota for eligible members.

How does Geico’s reputation for affordable rates compare to its competitors?

Geico offers low premiums and competitive pricing, making it ideal for budget-conscious drivers seeking cheap car insurance in North Dakota. Explore your auto insurance options by entering your ZIP code into our free comparison tool today.

How does North Dakota’s legal environment affect auto insurance costs?

North Dakota auto insurance requirements set a baseline for coverage, and failing to meet these can result in higher costs and penalties.

Read more: Minimum Car Insurance Requirements for cheap auto insurance in Texas

Why is State Farm considered a good option for broad coverage in North Dakota?

State Farm provides a wide range of coverage options, ensuring comprehensive protection in various scenarios, ideal for those searching for the best car insurance in North Dakota.

What factors drive higher car insurance premiums in North Dakota?

Factors like driving history, weather conditions, road fatalities, and coverage levels contribute to higher north dakota auto insurance rates. Find your cheapest auto insurance quotes by entering your ZIP code into our free comparison tool.

What’s the difference between comprehensive and collision coverage in ND auto insurance?

Comprehensive coverage protects against non-collision events like theft and weather damage, while collision coverage covers damage from accidents, both crucial when comparing north dakota car insurance options.

Read more: Comprehensive and Collision Coverage for cheap auto insurance in North Dakota

How do road fatalities and weather affect auto insurance rates in North Dakota?

Road fatalities and extreme weather conditions increase the likelihood of accidents, leading to higher ND car insurance premiums.

What are the advantages and risks of higher auto insurance coverage in North Dakota?

Higher coverage offers better protection but may raise premiums, balancing cost and security in North Dakota car insurance. Start comparing total coverage auto insurance rates by entering your ZIP code here.

How can North Dakota drivers reduce insurance premiums while keeping necessary coverage?

Drivers can take advantage of discounts, raise their deductibles for cheap auto insurance in Texas, or bundle policies to lower premiums while ensuring sufficient coverage, helping to find cheap car insurance in North Dakota.

How much does car insurance cost in North Dakota?

How much is car insurance in North Dakota? Car insurance costs in North Dakota are generally lower than the national average, but rates can vary based on several factors, including coverage level, age, driving history, and credit score. Here’s an overview of the average premiums: