Best Buffalo, NY Auto Insurance in 2025 (Compare the Top 10 Companies)

Nationwide, Progressive and Geico are the best Buffalo, NY, auto insurance companies, offering rates starting at $95. Nationwide leads with its extensive coverage and local presence. Progressive excels in its UBI program and discounts. Geico offers the most affordable rates and advanced digital services.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Tim Bain

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Licensed Insurance Agent

UPDATED: Apr 10, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

3,071 reviews

3,071 reviewsCompany Facts

Full Coverage in Buffalo NY

A.M. Best Rating

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage in Buffalo NY

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in Buffalo NY

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsNationwide, Progressive and Geico offer the best Buffalo, NY auto insurance with a monthly starting rate of $95. Nationwide excels in its coverage options, offering vanishing deductibles, accident forgiveness, and more.

Progressive is best known for its risk-free trial and discounts of the Snapshot program, while Geico has the most affordable premiums.

Our Top 10 Company Picks: Best Buffalo, NY Auto Insurance

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $240 | A+ | Widespread Availability | Nationwide |

| #2 | $246 | A+ | UBI Discount | Progressive | |

| #3 | $253 | A++ | Low Rates | Geico | |

| #4 | $257 | A++ | Customer Service | State Farm | |

| #5 | $260 | A | Unique Benefits | Liberty Mutual |

| #6 | $265 | A+ | Small Businesses | The Hartford |

| #7 | $273 | A++ | Low-Mileage Drivers | Travelers | |

| #8 | $278 | A | Safe Drivers | Farmers | |

| #9 | $280 | A | Claims Service | American Family | |

| #10 | $284 | A+ | High-Risk Drivers | Allstate |

This 10-minute auto insurance buying guide also presents the best 10 car insurance companies in Buffalo, NY, with their varied strengths and specializations.

- Nationwide has a consistent presence in Buffalo, NY, for local support

- All the auto insurance companies in Buffalo, NY, listed offer a bundling discount

- Different factors, including your driving history, shape your premiums

Are you in need of cheap car insurance in Buffalo, NY? Here, you will find your city’s most affordable insurance rates.

To get free car insurance rates from the top providers, enter your local ZIP code in the quote box.

#1 – Nationwide: Top Overall Pick

Pros

- Coverage Options: Nationwide offers several Buffalo car insurance options, such as accident forgiveness and vanishing deductibles. Check all options in the Nationwide insurance review.

- Consistent Presence in New York: Nationwide has a strong network of agents in Buffalo to support policyholders, resulting in in-person convenience.

- Competitive Discounts and Rates: It offers discounts like good student, bundling, safe driver, and more, with a monthly starting rate of $98, making it one of the auto insurance companies in Buffalo, NY.

Cons

- Fewer Agents: Even with a strong presence, Nationwide has fewer agents than the regional car insurance company in Buffalo, NY.

- High-Risk Drivers Concern: It is not the best choice for high-risk drivers because it entails higher rates than insurers specializing in coverage, like Progressive.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#2 – Progressive: Best for UBI Discounts

Pros

- Value-Packed UBI Program: It rewards safe driving habits through Snapshot, offering a maximum of 47% discount. Buying cheap car insurance in Buffalo, NY is easy.

- Risk-Free Trial: Enrolling in Snapshot does not require committing to long-term participation. Learn more about the rules in the Progressive auto insurance review.

- New York Regulatory Compliance: Progressive based its pricing and UBI model on the state’s insurance rules, such as the prohibition on using education or occupation to determine premiums.

Cons

- Driver Privacy Concerns: Progressive’s auto insurance UBI program’s continuous tracking may make drivers uncomfortable.

- Driving Time Penalties: The Snapshot has penalties for late night and early morning driving that could be unfair to those working night and graveyard shifts.

#3 – Geico: Best for Low Rates

Pros

- Affordable Premiums: Geico offers the cheapest car insurance in Buffalo, NY, at only $95, compared to other auto insurance companies in Buffalo, NY.

- Several Discount Options: 23% off vehicle safety features, 22% off for a clean driving history, and 15% off for good students. All discount options are discussed in the Geico auto insurance review.

- Advance Digital Services: Geico’s mobile app has advanced features, such as making payments, filing and tracking claims, and more.

Cons

- Renewal Rate Increase: Due to credit score changes or general inflation, Geico auto insurance premiums increase over time, especially upon renewal.

- Limited Add-Ons: Geico does not offer other basic add-ons, like new car replacement and vanishing deductibles, for Buffalo, NY auto insurance.

#4 – State Farm: Best for Customer Service

Pros

- High Customer Satisfaction: U.S. News’ recent review shows that State Farm scored 4.3/5 in customer service and ranked fourth in prompt and effective claim resolution.

- Network of Local Agents: Buffalo policyholders can easily access its local office for assistance, which is located in 3 areas. Learn more in this State Farm auto insurance review.

- Exceptional Roadside Assistance: This feature is cheaper and more comprehensive and includes several inclusions, such as lockout service and towing.

Cons

- No Automatic Accident Forgiveness: This feature is not available, and you must be a long-term customer to qualify, unlike other insurers that automatically include it.

- Limited Digital Service: It has an online app and website for car insurance options, but it is not as advanced as Geico and Progressive.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Best for Unique Benefits

Pros

- RightTrack Program: A 10% immediate savings and a 30% additional discount for completing the program. Check more details in the Liberty Mutual auto insurance review.

- Broad Coverage Options: Liberty Mutual includes coverage like gap, rental car reimbursement, lifetime repair guarantee, and original parts replacement.

- Local Presence: Liberty Mutual Car Insurance in Buffalo, NY, established a local office to meet customers’ needs in real time.

Cons

- Higher Rates Than Competitors: Liberty Mutual car insurance in Buffalo, NY, is higher, which makes it less ideal for budget-conscious customers.

- RightTrack Program Drawback: Driving late at night, braking hard, and acceleration result in a lower discount than advertised.

#6 – The Hartford: Best for Small Businesses

Pros

- Specialized Commercial Coverage: This is designed for small businesses with company-owned vehicles. It protects both the vehicle and the employee on the road.

- Easy Access to Local Agents: The Hartford partners with local agencies like the Decker Agency to ensure personalized support for the regional needs of the target customers.

- Extensive Experience With Small Business: For over 200 years, it has insured small businesses and proven its deep-rooted understanding of the needs of varied industries.

Cons

- High-Risk Concerns: Though the company specializes in small businesses, it has strict underwriting guidelines for high-risk drivers. Explore this The Hartford auto insurance review for additional info.

- Fewer Discount Opportunities: Unlike most car insurance companies in Buffalo, the Hartford does not offer pay-in-full discounts and huge bundling savings.

#7 – Travelers: Best for Low-Mileage Drivers

Pros

- IntelliDrivePlus Program: Offers a 10% enrollment discount and a 30% safe driving off upon renewal of Buffalo, NY auto insurance.

- Mileage-Based Premium Adjustments: Travelers premiums are adjusted based on their annual mileage. Check how much you can save in the Travelers insurance review.

- Local Considerations in Buffalo: Buffalo is an urban environment, so drivers can save more by having shorter commutes and reduced annual mileage.

Cons

- High Minimum Rates: Even with low mileage discounts, it has higher auto insurance quotes in Buffalo than Geico and Progressive.

- Telematics Continuous Tracking: Some drivers find it uncomfortable with the constant tracking of the GPS and driving behaviors.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#8 – Farmers: Best for Safe Drivers

Pros

- Extra Savings for Safe Drivers: Signal telematics program rewards up to 30% of safe driving behaviors. Learn more about this in Farmers auto insurance review.

- Personalized Local Support: Farmers has local agents in Buffalo to help customers with claims, especially in areas with unique driving risks, such as high traffic and lake-effect snow.

- Customizable Coverage: Drivers can customize their policies with add-ons like roadside assistance, OEM parts coverage, and new car replacement.

Cons

- Telematics Program Can Raise Premiums: Even though the program is intended to provide savings, bad driving behaviors, such as rapid acceleration, can raise premiums.

- Accident Forgiveness Extra Charge: Farmers offers this feature on car insurance in Buffalo, but it is not free.

#9 – American Family: Best for Claims Service

Pros

- Above-Average Performance: With an 882/1000 score in J.D. Power’s latest claims satisfaction study, American Family has a high level of customer satisfaction.

- Low Complaint Ratio: The American Family scored 0.35 in the complaint index, suggesting customers report fewer complaints against the company.

- Repair Network for a Lifetime: It partners with repair shops and offers a lifetime guarantee of repairs. The list of partner repair shops is in the American Family auto insurance review.

Cons

- Higher Premiums: With a $120 monthly rate, it is way more expensive than other car insurance companies in Buffalo, NY.

- Limited Availability in New York: American Family is not as widely available in New York as Geico and Allstate, limiting customers’ access to their services.

#10 – Allstate: Best for High-Risk Drivers

Pros

- Lenient Underwriting Guidelines: Allstate is willing to insure high-risk drivers, unlike some insurers that refuse to cover them.

- Accident Forgiveness Perks: This feature prevents premiums from increasing upon the first at-fault accident. Learn more about this in the Allstate auto insurance review.

- Safe Driving Incentives: Drivers get a cash bonus for safe driving every six months, including high-risk drivers, who can earn a discount over time.

Cons

- Higher Rates for Some Drivers: Although it is lenient for high-risk drivers, their auto insurance rates in Buffalo are usually higher.

- Limited Availability in Buffalo: The SR-22 auto insurance in Buffalo, NY, may not be available for all high-risk drivers.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Best Buffalo, NY Auto Insurance Monthly Rates

Cheap auto insurance in New York considers many variables when determining car insurance quotes in Buffalo, NY, such as driving experience, driving violations, occupation, driving distance to work, and business use of the vehicle. Also, premiums might vary from one insurance company to another.

Auto Insurance Monthly Rates in Buffalo, NY by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $115 | $284 | |

| $120 | $280 | |

| $109 | $278 | |

| $95 | $253 | |

| $110 | $260 |

| $98 | $240 |

| $105 | $246 | |

| $100 | $257 | |

| $107 | $265 |

| $108 | $273 |

Certain companies specialize in certain groups of drivers, and their monthly rates may fluctuate wildly if your personal circumstances fall into one of these “outlier” groups.

Insurers like Progressive often offer competitive rates for high-risk drivers while providing discounts for safe drivers or bundling policies.

Chris Abrams Licensed Insurance Agent

Assess the cheapest car insurance in Buffalo, NY, and costs online to determine if you are still paying a reasonably affordable price for your policy.

Top Buffalo, NY Auto Insurance Providers and Discounts

Average insurance rates will vary between drivers, but the average monthly cost is around $98. However, if you live in Buffalo, some deals in your area are available now, which could lower your monthly premiums to $ 70 a month or less. We’ll show you how.

Auto Insurance Discounts From Top Buffalo, NY Providers

| Insurance Company | Accident-Free | Bundling | Defensive Driving | Good Student | Safe Driver |

|---|---|---|---|---|---|

| 25% | 25% | 18% | 18% | 18% | |

| 25% | 25% | 18% | 18% | 18% | |

| 20% | 20% | 10% | 15% | 20% | |

| 22% | 25% | 15% | 26% | 15% | |

| 20% | 25% | 10% | 12% | 20% |

| 20% | 20% | 12% | 12% | 12% |

| 10% | 10% | 31% | 10% | 10% | |

| 17% | 17% | 20% | 20% | 20% | |

| 5% | 5% | 10% | 12% | 8% |

| 13% | 13% | 17% | 17% | 17% |

You can take advantage of these discounts for car insurance in Buffalo, NY, to lower your monthly premiums. We encourage you to take advantage of more discounts to save more.

Nationwide is the leading auto insurance company in Buffalo, New York, and is best known for its extensive coverage and add-ons like accident forgiveness.

Moreover, it has established local offices in Buffalo, NY, to provide real-time assistance to customers’ concerns and prompt claims responses.

Buffalo, located on the eastern side of Lake Erie, is the second-biggest city in New York and also the biggest inland port. The National Civic League awarded Buffalo the “All-American City” title in 2002, but it has since faced problems from negative public perception and an unfortunate decline in population. However, it still maintains notoriety for its beautiful parkland and stunning local architecture.

Fun fact: What was that strange noise? Because Buffalo is #5 on the list of “Top 100 cities with oldest houses (pop. 50,000+)”

In this review, we’ll cover the factors determining your auto insurance premiums if you live in Buffalo, NY.

Auto Insurance Coverage Requirements in Buffalo, NY

Driving legally in Buffalo, New York, requires minimum car insurance requirement, as explained below.

Auto Insurance Minimum Coverage Requirements in New York

| Coverage | Limits |

|---|---|

| Bodily Injury | $25,000 per person / $50,000 per accident |

| Property Damage | $10,000 per accident |

| Uninsured Motorist Bodily Injury | $25,000 per person / $50,000 per accident |

Remember that whether you decide to go with the state minimum coverage or purchase more depends on the vehicle you insure. Older, less expensive cars can get away with a bare minimum policy. Newer vehicles, especially those still financed, will need more coverage.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Major Auto Insurance Factors in Buffalo, NY

Various factors could impact the auto insurance quotes in Buffalo, NY. Although many specific issues that affect insurance prices aren’t something you can do about, a few of them are elements you can change for the better to get a cheaper car insurance quote.

While some risk factors are fixed, proactive choices, like adjusting coverage or improving driving habits, can lead to significant savings.

Dani Best Licensed Insurance Producer

Here are some components that may change your automobile insurance premium and their corresponding premiums in Buffalo, NY.

Your ZIP Code

The car insurance quotes in Buffalo, NY, may vary depending on where you live. Generally, large cities feature greater auto insurance rates as the additional amount of drivers on the highway raises the chance of an accident! The total population of Buffalo amounts to 273,720, and the general household earnings are $$48,050 in 2023.

Auto Insurance Monthly Rates in Buffalo, NY by ZIP Code

| ZIP | Rates |

|---|---|

| 14206 | $307 |

| 14213 | $297 |

| 14219 | $231 |

| 14221 | $222 |

| 14220 | $218 |

| 14205 | $175 |

| 14228 | $153 |

| 14215 | $150 |

| 14226 | $150 |

| 14204 | $143 |

| 14231 | $143 |

| 14212 | $140 |

| 14207 | $132 |

| 14224 | $131 |

| 14202 | $130 |

| 14214 | $130 |

| 14208 | $127 |

| 14209 | $127 |

| 14218 | $127 |

| 14217 | $124 |

| 14211 | $120 |

| 14201 | $119 |

| 14216 | $119 |

| 14222 | $117 |

| 14203 | $115 |

| 14227 | $114 |

| 14225 | $108 |

| 14223 | $106 |

| 14210 | $104 |

The 14206 and 14213 ZIP codes are the most expensive in Buffalo, New York, with rates of $301 and $297, respectively. 14204 is the least expensive, at $143 a month. Make sure to have insurance that covers car accidents and auto claims promptly.

Your Credit Score

Are you wondering if your credit score will affect your car insurance premiums? Unfortunately, your insurance premiums will only complicate the issue. Many insurers in New York charge exceptionally high rates for poor credit scores, although it appears as though Nationwide is giving some drivers a break.

Auto Insurance Monthly Rates in Buffalo, NY by Credit Score

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $120 | $145 | $190 | |

| $115 | $135 | $180 | |

| $130 | $160 | $235 | |

| $110 | $150 | $200 | |

| $125 | $155 | $215 |

| $118 | $148 | $208 |

| $140 | $165 | $238 | |

| $122 | $152 | $210 | |

| $135 | $170 | $240 |

| $128 | $158 | $230 |

Auto insurance rates in Buffalo, NY, increase significantly as credit scores decline. For instance, Geico charges $110 per month for drivers with good credit, but this rate rises to $200 for those with bad credit, showing how insurers consider credit scores in pricing policies.

Your Age

Because of their age and experience with driving, older drivers are much less likely to get into an accident. That is why, conversely, their young adult counterparts are charged much more for insurance. Be sure to ask about insurance discounts for teen drivers and students if you are one or are trying to find insurance for one in your family.

Auto Insurance Monthly Rates in Buffalo, NY by Provider, Age, & Gender

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 34 Female | Age: 34 Male |

|---|---|---|---|---|

| $310 | $320 | $115 | $120 | |

| $305 | $315 | $114 | $118 | |

| $325 | $335 | $128 | $140 | |

| $295 | $305 | $110 | $112 | |

| $314 | $324 | $125 | $130 |

| $300 | $310 | $122 | $127 |

| $320 | $330 | $132 | $138 | |

| $285 | $295 | $112 | $115 | |

| $315 | $325 | $130 | $135 |

| $312 | $322 | $120 | $125 |

Auto insurance rates in Buffalo, NY, are significantly higher for 17-year-old drivers than 34-year-olds, with younger males paying more than younger females. This highlights the impact of age and gender on insurance costs.

Read more: Cheap Car Insurance for Young Drivers

Your Driving Record

Most drivers today don’t have perfect records. For minor violations, such as a low-level accident, you might be able to get that factored out with an Accident Forgiveness policy, lowering your monthly premium. Check this comprehensive guide on getting cheap car insurance for drivers with bad credit.

But more serious charges in car insurance after a DUI could eliminate your coverage completely. Safe driving habits can help you get a more affordable rate for your auto insurance premium.

Auto Insurance Monthly Rates in Buffalo, NY by Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $120 | $135 | $150 | $175 | |

| $125 | $140 | $155 | $180 | |

| $130 | $145 | $160 | $185 | |

| $115 | $130 | $145 | $170 | |

| $132 | $147 | $162 | $188 |

| $122 | $137 | $152 | $177 |

| $118 | $133 | $148 | $173 | |

| $127 | $142 | $157 | $182 | |

| $135 | $150 | $165 | $190 |

| $128 | $143 | $158 | $183 |

Geico and Progressive offer the lowest rates for drivers with a clean record, while The Hartford and Liberty Mutual tend to charge the highest premiums. This reinforces the importance of maintaining a good driving history to keep insurance costs low.

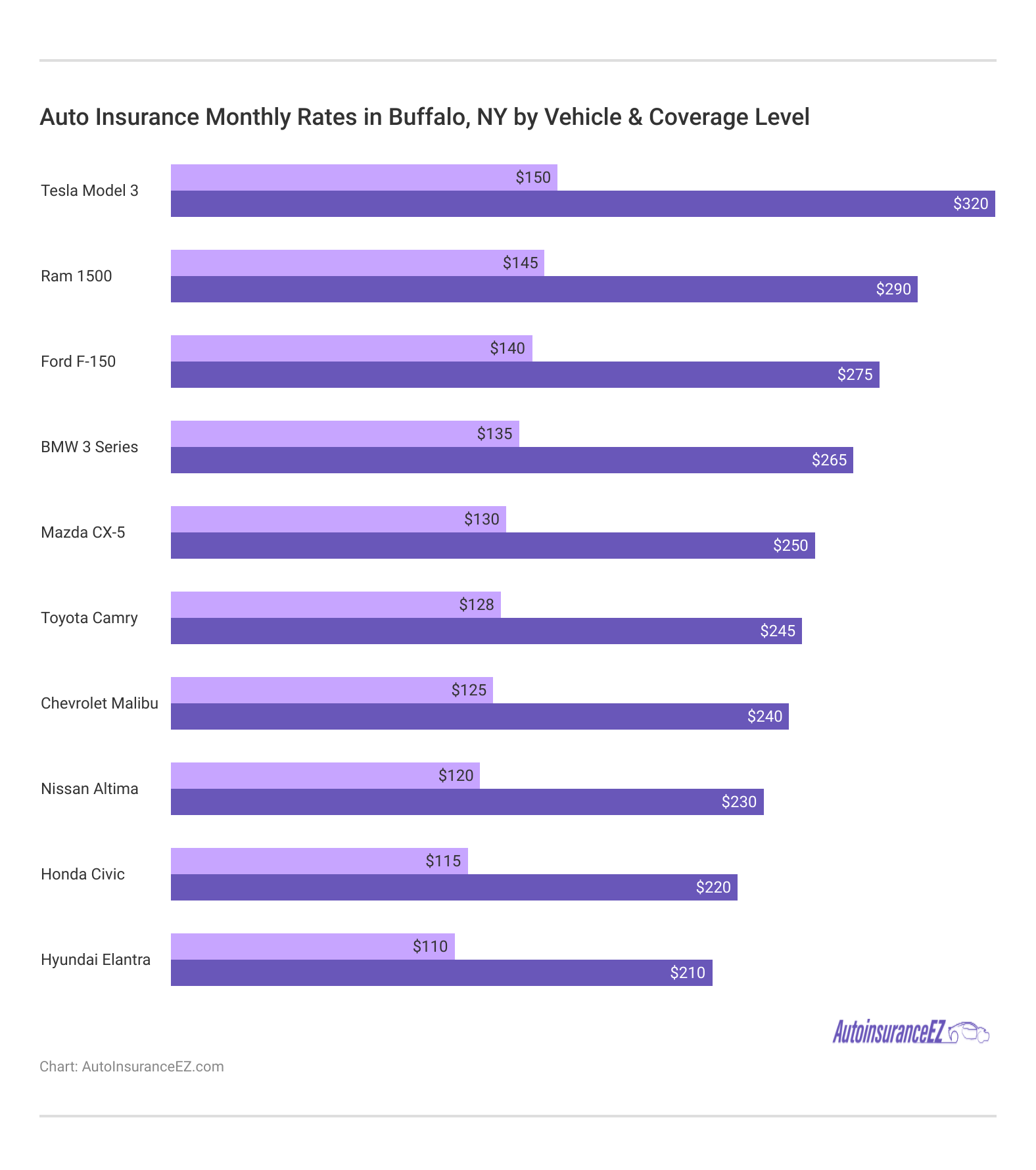

Your Vehicle

The age and overall value of your vehicle will greatly determine how much coverage you need to purchase to protect it adequately—and this, in turn, determines how much you will pay your insurance company for coverage each month.

The difference between minimum and full coverage is substantial across all vehicles, with full coverage costing roughly double the minimum coverage, emphasizing the financial impact of selecting a more comprehensive insurance plan.

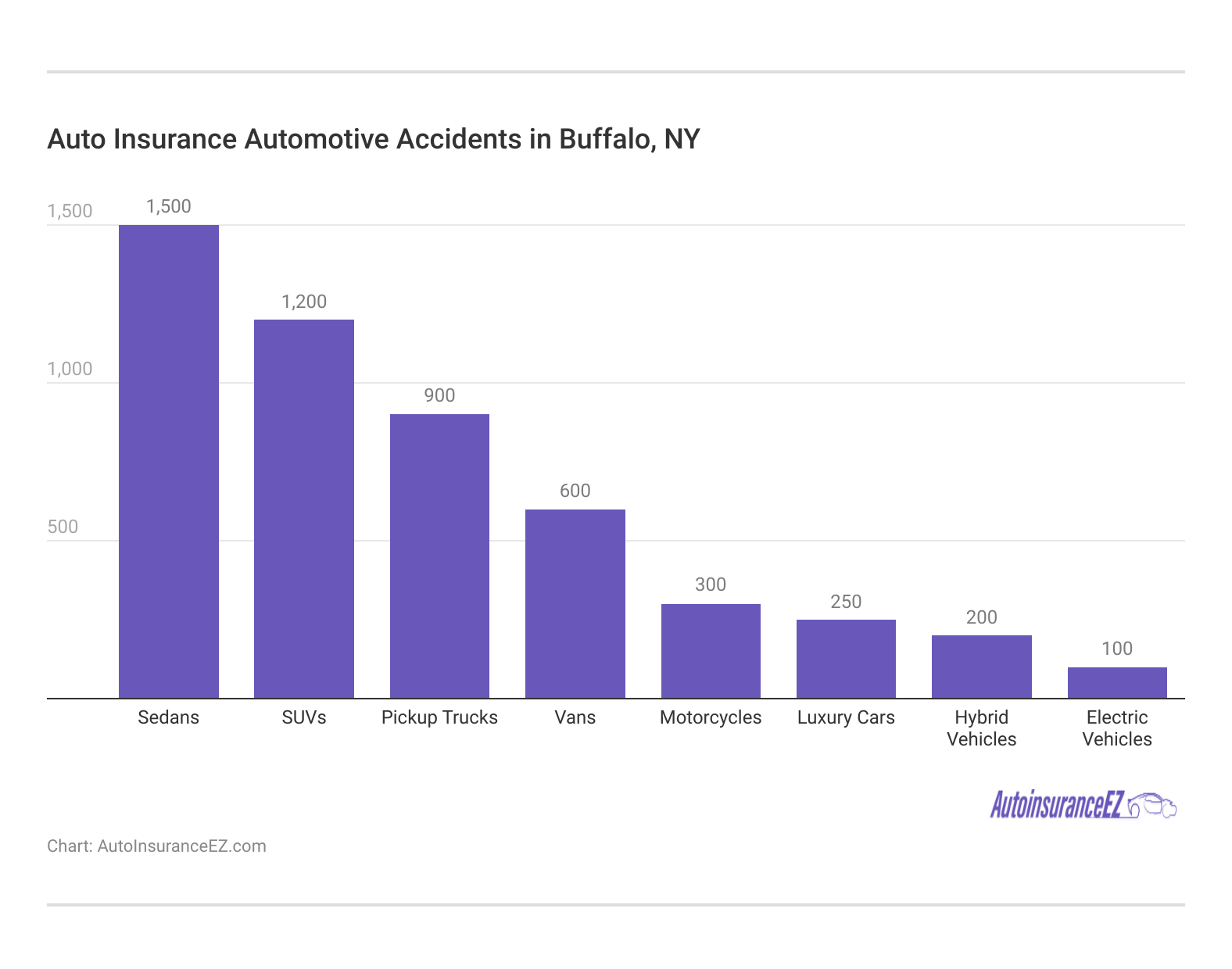

Automotive Accidents

For nearly a quarter of a million residents, some might expect to see more serious accidents in the Buffalo area than what is present in the chart below. Check how accidents change your car insurance rates.

Sedans and SUVs account for the highest number of automotive accidents in Buffalo, NY, with 1,500 and 1,200 incidents, respectively, making them the most accident-prone vehicle types. The low number of accidents should automatically lower rates in your area, but if you are unsure, it would be best to contact your local insurance agent.

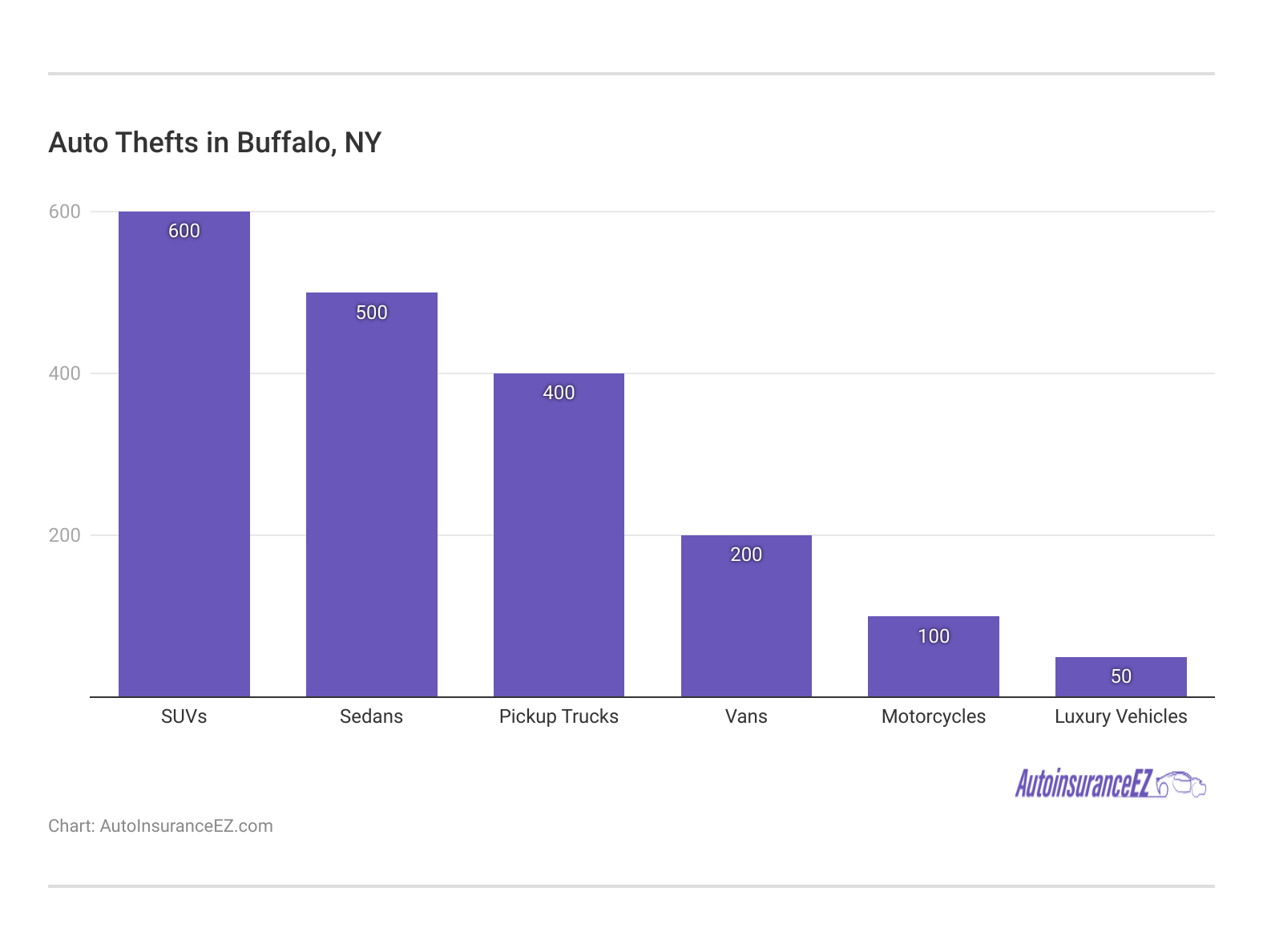

Auto Thefts

The size of your city and its crime rate statistics, especially in relation to auto theft, will significantly affect how your insurer calculates your auto insurance rate. Larger cities and/or cities with higher car theft rates will generally raise your premiums. However, installing a passive anti-theft system gives you an anti-theft device discount, usually resulting in cheaper car insurance.

Within Buffalo, there were 1,523 auto thefts in the year 2023. Theft numbers are increasing by 104% compared to the previous year, and 85% of it targets vehicles like Kia and Hyundai. Protect yourself from theft with Comprehensive insurance coverage on your policy.

Minor Auto Insurance Factors in Buffalo

The factors below can be a little harder to control, but they can also raise or lower your monthly premium:

- Your Marital Status: Generally, there is very little difference between the premiums paid to married people and single people. However, being bundled together on the same auto policy with your spouse can net you some exceptional discounts on insurance coverage.

- Your Gender: Most insurance companies can’t seem to decide what to charge male and female drivers. Most companies have stopped charging different rates based on gender altogether. However, those who still do rarely charge more than a 2-4% difference.

- Your Driving Distance to Work: Commute times for motorists in Buffalo usually last between 17-24 full minutes, give or take about 5 minutes for each trip. Around 65% of drivers will choose to take their own vehicle alone, while 2-8% will likely carpool. 10% typically take the bus.

- Your Coverage and Deductibles: A quick and easy trick for lowering your monthly auto insurance premium is raising your deductible. But save a little money just in case. Because if you don’t pay that deductible first, your insurance company won’t pay out on any claims.

Did you know that insuring a business vehicle will increase your monthly premiums by over 10%? So try to avoid it if you can. Otherwise, your driving habits, such as yearly mileage, reasons for driving, etc., will rarely fluctuate more than 3-5%, no matter how you change your behavior.

Higher deductibles can significantly lower your monthly premiums, but drivers must ensure they have enough savings to cover out-of-pocket costs before their insurance kicks in.

Daniel Walker Licensed Insurance Agent

Balancing affordability with financial preparedness is key to making your monthly insurance bill sustainable.

Education in Buffalo, NY

29% of residents in Syracuse have achieved their high school diploma or a similar equivalent. Meanwhile, 24% have yet to complete all four high school years. And speaking of education, all Syracuse motorists should know that the further you take your education, the more money you can save on your auto insurance policy! It’s even better than what you might get for having a prestigious job or a high salary.

Nearly 50 educational institutions serve the Syracuse area, educating over 215,000 students annually. Syracuse University offers bachelor’s and graduate degrees from 13 different colleges, and LeMoyne College is a private university affiliated with the Catholic Church. SUNY also operates a medical school in Syracuse.

For those who would prefer to spend less time in school, there is Onondaga Community College or Cayuga Community College. Ascertaining one’s financial risk can be challenging or inconceivable for the common insurance shopper.

Insurers have an advantage over shoppers due to their research and experiential expertise. Discover the things that insurance providers don’t really want anyone to learn.

How We Conducted Our Buffalo, NY Auto Insurance Analysis

We calculated our average rate based on the following metrics: a married, 34-year-old male with good credit, a 12-month history of maintaining auto insurance, a clean driving record, and who owns his own home. Miles driven annually were based on the national average. The average rate was also calculated based on a financed 2015 Honda Accord with a pre-installed anti-theft device.

Want to compare auto insurance companies to find the best rates and coverage? Enter your ZIP code into our free comparison tool to start with your best Buffalo, NY auto insurance.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

How much is car insurance in Buffalo, NY?

Car insurance in Buffalo, NY, starts at $95 monthly and will increase depending on coverage needs and add-ons.

Which car insurance company is the best?

Nationwide, Progressive, and Geico are the best car insurance companies in Buffalo, New York.

What is the NYS minimum car insurance requirement?

The minimum liability coverage for car insurance in New York is 25/50/10, so you can drive around the state.

What is the most popular car insurance company in the U.S.?

State Farm is the most popular car insurance company in the U.S., which holds the largest market share and insures more vehicles than any other provider. It is known for its wide agent network, strong customer service, and competitive rates.

Which car insurance coverage is the best?

This depends on your needs, but getting full coverage is the best choice as it has many inclusions. Know the policies you need regarding types of automobile insurance coverage in 2025.

Which type of vehicle insurance is the best?

The best type of insurance depends on your car insurance needs. Still, full coverage (including liability, collision, and comprehensive) offers the most protection by covering both your vehicle and damages to others.

How much is the average car insurance in NY?

The average car insurance cost in New York for minimum coverage is $1,062 per year; full coverage costs $2,020 per year.

Who is cheaper, Geico or Progressive?

Geico is cheaper, with a starting monthly rate of $95, while Progressive’s is $105. Learn more about the comparison of Geico vs. Progressive auto insurance.

To get your online quotes and determine how much yours would cost, enter your ZIP code in the tool.