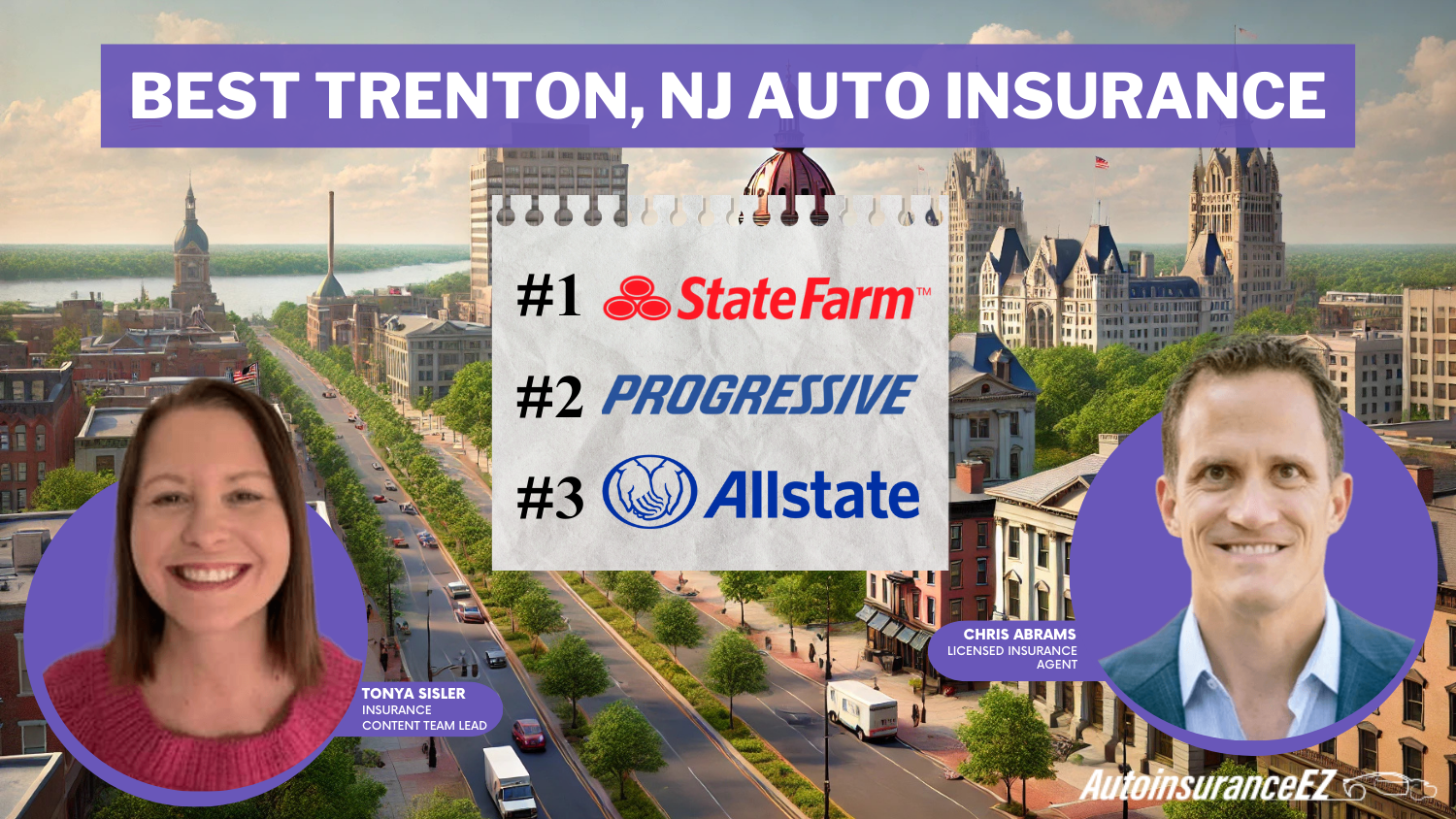

Best Trenton, NJ Auto Insurance in 2025 (See the Top 10 Companies Here)

State Farm, Progressive, and Allstate offer the best Trenton, NJ, auto insurance, with rates as low as $65 monthly. State Farm leads with safe driver discounts of up to 30%. Progressive and Allstate deliver robust coverage options, ensuring affordable and dependable insurance in Trenton, NJ.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Licensed Insurance Agent

UPDATED: Dec 4, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

18,154 reviews

18,154 reviewsCompany Facts

Full Coverage in Trenton NJ

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage in Trenton NJ

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage in Trenton NJ

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviewsFor the best Trenton, NJ auto insurance, companies like State Farm, Progressive, and Allstate offer affordable premiums starting at $65 per month. State Farm tops the bar among the three insurance companies with its low prices, discounts of as much as 30% for safe drivers, and local, trustworthy service.

Progressive and Allstate follow closely with good coverage options and reasonable pricing. This guide evaluates each company to help you choose the best fit for your needs. To gain profound insights, consult our extensive guide titled “Auto Insurance Coverage Options.”

Our Top 10 Company Picks: Best Trenton, NJ Auto Insurance

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 17% | B | Customer Service | State Farm | |

| #2 | 10% | A+ | Snapshot Program | Progressive | |

| #3 | 25% | A+ | Roadside Assistance | Allstate | |

| #4 | 25% | A++ | Competitive Rates | Geico | |

| #5 | 5% | A+ | AARP Members | The Hartford |

| #6 | 20% | A+ | Reliable Claims | Nationwide |

| #7 | 20% | A | Bundling Policies | Farmers | |

| #8 | 25% | A | Hybrid Vehicles | Liberty Mutual |

| #9 | 13% | A++ | Comprehensive Discount | Travelers | |

| #10 | 25% | A | Family Discounts | American Family |

Find the best auto insurance company near you by entering your ZIP code into our free quote tool.

- State Farm leads as the top pick for affordable Trenton, NJ, auto insurance

- Get auto insurance in Trenton, NJ with rates as low as $65/month

- Progressive and Allstate offer competitive coverage and pricing options

#1 – State Farm: Top Overall Pick

Pros

- Safe Driver Discounts: Safe drivers in Trenton can thus avail themselves of up to a 30% discount, obviating the need to cut corners while behind the wheel.

- Local Service: Read our State Farm auto insurance review to learn more about their local solid service in Trenton, which offers personalized support.

- Comprehensive Coverage Options: This includes primary and extensive coverage, from liability to comprehensive policies, to suit various needs.

Cons

- Higher Premiums for Young Drivers: Younger drivers may face higher rates due to perceived risk, which could disadvantage Trenton’s younger population.

- Limited Discounts for Low-Mileage Drivers: State Farm offers fewer mileage-based discounts than some competitors, which could disadvantage drivers who use their cars sparingly.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#2 – Progressive: Best for Snapshot Program

Pros

- Affordable and Competitive: Renowned for providing budget-friendly rates to Trenton drivers, particularly those with a clean driving history.

- Snapshot Program: Explore our Progressive auto insurance review to see how the Snapshot program helps low-mileage drivers save on premiums.

- Many Optional Add-ons: It covers a variety of add-on policies, including coverage for the user, which is fantastic. All these things are available for a customer to buy.

Cons

- Complex Pricing Structure: The variety of options can be overwhelming, requiring careful comparison to ensure the best deal.

- Higher Rates for Drivers with Poor Records: Progressive may not be the best option for those with a history of accidents or traffic violations, as rates can be significantly higher.

#3 – Allstate: Best for Roadside Assistance

Pros

- Bundling Discounts: This company offers discounts when you bundle auto insurance with other types of insurance, making it a cost-effective choice for Trenton residents.

- Reputable Claim services: Very efficient in handling claims to a great extent, and customer satisfaction is high.

- Diverse Coverage Plans: Delve into our Allstate auto insurance review for details on their extensive coverage plans, including accident forgiveness and add-ons.

Cons

- Higher-than-average premiums: Coverage is above average; the rate might be higher than Trenton’s other providers.

- Mixed Customer Service Reviews: Some customers report dissatisfaction with claims processing or customer service, especially during peak times.

#4 – Geico: Best for Competitive Rates

Pros

- Low Rates for Good Drivers: Often provides some of the most competitive rates for Trenton drivers, especially those with a clean driving record.

- Easy Online Management: View our Geico auto insurance review to learn how their easy online tools and mobile app simplify policy management.

- Multiple Discount Packages: Provide a range of good student, military, and anti-theft device discounts, which can significantly lower your insurance rates in Trenton.

Cons

- Limited Local Presence: Geico has fewer local agents, which may make personal customer service less accessible in Trenton.

- Higher Rates for High-Risk Drivers: Geico’s rates can increase for those with a history of accidents or traffic violations, making it less competitive for high-risk drivers.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#5 – The Hartford: Best for AARP Members

Pros

- AARP Discounts: Read our Hartford auto insurance review to learn about the advantages of AARP discounts for seniors in Trenton.

- Super High customer satisfaction: I greatly commended customer service and the claim to the store.

- Fantastic Roadside Assistance: Well-known as a trusted provider of 24/7 roadside assistance, which can be invaluable in emergencies.

Cons

- Higher Premiums for Younger Drivers: Rates can be higher for younger drivers in Trenton, especially those without a long, safe driving history.

- Restricted Coverage for High-Risk Drivers: Some clients will find Hartford more restrictive than others regarding coverage options.

#6 – Nationwide: Best for Reliable Claims

Pros

- The broadest range of coverage options: Offers custom policies to meet diverse coverage needs in Trenton.

- Accident Forgiveness: Provides accident forgiveness after several years of safe driving.

- Strong Financial Stability: Our Nationwide auto insurance review highlights the firm’s financial stability and reliability for Trenton policyholders.

Cons

- Limited Discounts for New Drivers: Fewer discounts are available for new drivers in Trenton, which could raise rates.

- Older Cars Attract More Premiums: The premiums for old cars are considered higher owing to the different levels of coverage or discounts that the older vehicles may include.

#7 – Farmer: Best for Bundling Policies

Pros

- Flexible Payment Plans: This is helpful for Trenton residents who want to adjust the economic impact of premiums for more flexible payments.

- Extensive Coverage Add-Ons: Farmers Insurance offers policyholders specialized offerings such as ride-sharing or custom equipment coverage.

- Good Customer Service: With our Farmers auto insurance review, you can learn about their reputation for friendly and accessible customer service.

Cons

- Equality rates: Although all-inclusive, the farmers’ premiums are more expensive than any other bargain options in Trenton.

- Less Competitive for High-Risk Drivers: High-risk drivers may find farmers’ rates less competitive than other providers.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#8 – Liberty Mutual: Best for Hybrid Vehicles

Pros

- Affordable Rates for Young Drivers: Liberty Mutual offers some of the best rates for young drivers in Trenton, helping to keep premiums lower.

- Customizable Coverage: Based on our Liberty Mutual auto insurance review, their customizable coverage options meet diverse individual needs.

- Replacement of Cars: Offers new car replacement feature; benefits drivers with newer vehicles in Trenton.

Cons

- Restricted Home Agents: Liberty Mutual provides fewer physical agents in Trenton and does not value personal service through agents.

- Complex Discount Structure: The discount structure may require more effort, making it easier for some people to get the best deal by conducting thorough research.

#9 – Travelers: Best for Comprehensive Discount

Pros

- Substantial Discounts: Travelers offer significant discounts, including multi-policy and safe driver discounts, which are ideal for cost-conscious drivers in Trenton.

- Good Customer Reviews: According to our Travelers auto insurance review, the company earns high ratings for customer service and claims handling.

- Roadside Assistance and Rental Coverage: Offers helpful add-ons, including roadside assistance and rental car coverage.

Cons

- Higher Rates for Poor Drivers: Drivers with less-than-perfect records may face higher premiums with Travelers compared to other providers in Trenton.

- Fewer Online Tools: Travelers’ websites and mobile apps are less intuitive and feature-rich than some competitors, making it harder to manage policies online.

#10 – American Family: Best for Family Discounts

Pros

- World-Class Service: Providing excellent customer care through local agents who are valuable to the customer is now fashionable.

- Affordable for Families: Discover our American Family auto insurance review for insights into their family-friendly bundling discounts in Trenton.

- Comprehensive Coverage: Offers a range of coverage options, including specialized coverage for home and auto bundling.

Cons

- Shadowed by Other Services: With some extensions limited in Trenton, one or more optional coverages are worth it; checking American Family coverage against its competitors is crucial.

- Higher Rates for Newer Drivers: Newer drivers or those with minimal driving experience may find American Family’s rates higher than those of other insurers.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Finding the Best Auto Insurance in Trenton, NJ

For the best Trenton, NJ auto insurance, providers like State Farm, Progressive, and Nationwide offer a mix of affordability, discounts, and reliable coverage. State Farm stands out with safe driver discounts, while Geico and Liberty Mutual offer competitive options.

Trenton, NJ Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $72 | $183 | |

| $73 | $187 | |

| $74 | $190 | |

| $68 | $175 | |

| $78 | $200 |

| $66 | $170 |

| $65 | $160 | |

| $70 | $150 | |

| $75 | $185 |

| $71 | $180 |

The Hartford is ideal for AARP members, and Travelers provides balanced coverage with discounts. Trenton drivers have plenty of excellent options to fit their needs.

Exclusive Auto Insurance Discounts for Trenton, NJ

Trenton, NJ, residents can find excellent auto insurance deals through top providers offering various discounts. Allstate, Farmers, and American Family provide savings for multi-policy holders, safe drivers, and good student discounts.

Geico and Liberty Mutual add benefits for military members and accident-free records.

Auto Insurance Discounts From the Top Providers in Trenton, NJ

| Insurance Company | Available Discounts |

|---|---|

| Multi-Policy, Safe Driver, Good Student, Anti-Theft, Vehicle Safety, Pay-in-Full, Defensive Driving, Early Signing, New Car, Multi-Car. | |

| Multi-Policy, Safe Driver, Good Student, Vehicle Safety, Anti-Theft, Homeowner, Defensive Driving, Multi-Car, Paperless, Loyalty. | |

| Multi-Policy, Safe Driver, Claim-Free, Bundling, Green Vehicle, Multi-Car, Defensive Driving, Good Student, Paperless, Homeowner. | |

| Multi-Policy, Safe Driver, Military, Good Student, Defensive Driving, Anti-Theft, Vehicle Safety, Emergency Deployment, Multi-Car, Affinity Group. | |

| Multi-Policy, Safe Driver, New Car, Good Student, Vehicle Safety, Anti-Theft, Multi-Car, Homeowner, Accident-Free, Pay-in-Full. |

| Multi-Policy, Safe Driver, Accident-Free, Good Student, Vehicle Safety, Anti-Theft, Multi-Car, Paperless, Defensive Driving, Pay-in-Full. |

| Snapshot (Usage-Based), Multi-Policy, Safe Driver, Paperless, Good Student, Homeowner, Multi-Car, Pay-in-Full, Defensive Driving, Vehicle Safety. | |

| Safe Driver, Multi-Policy, Vehicle Safety, Accident-Free, Defensive Driving, Multi-Car, Passive Restraint, Drive Safe & Save, Student, Homeowner. | |

| Multi-Policy, Safe Driver, Vehicle Safety, Accident-Free, Defensive Driving, Anti-Theft, Paperless, Homeowner, Hybrid/Electric Vehicle, Pay-in-Full. |

| Multi-Policy, Safe Driver, Anti-Theft, Vehicle Safety, Good Student, Homeowner, Multi-Car, Defensive Driving, Pay-in-Full, Hybrid/Electric Car. |

Progressive and State Farm include discounts for usage-based and safety-related reasons, while The Hartford and Travelers are for green driving incentives for hybrid or electric cars. These options can help Trenton drivers save money while obtaining comprehensive, dependable coverage.

Affordable and Reliable Auto Insurance in New Jersey

For the best auto insurance in Trenton, NJ, State Farm, Geico, and Progressive are top choices. State Farm is known for its reliable service, customizable coverage, and safe driver discounts. Geico offers affordable rates with solid online tools and discounts for bundling and safe driving.

New Jersey Minimum Auto Insurance Coverage Requirements & Limits

| Trenton, NJ | Minimum Auto Insurance Coverage Requirements & Limits |

|---|---|

| Coverage | Requirements |

| Bodily Injury Liability | Minimum $25,000 per person / $50,000 per accident Midwest Information Disclosures |

| Property Damage Liability | Minimum $25,000 per accident Midwest Information Disclosures |

| Uninsured/Underinsured Motorist | Not required by state law Midwest Information Disclosures |

| Medical Payments (MedPay) | Not required by state law Midwest Information Disclosures |

| Collision Coverage | Not required by state law Midwest Information Disclosures |

| Comprehensive Coverage | Not required by state law Midwest Information Disclosures |

Progressive has an edge over its competitors with its flexible coverage options. You can name your price so that a motorist can get a policy that meets their budget. These providers are as good as Trenton drivers could get because they have comparative values as well as customer service and customer service coverage. To delve deeper, refer to our in-depth report titled “Compare Auto Insurance Companies.”

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Top Factors That Influence Trenton Auto Insurance Rates

Here are a few things one might consider while shopping for car insurance in Trenton, NJ: Some are out of the person’s control, while the individual chooses others to increase one’s chances of qualifying for all those sweet discounts. The knowledge of such areas can help ensure coverage affordability without having to compromise on the service.

Your ZIP Code

Your ZIP code plays a significant role in determining your auto insurance rates in Trenton, NJ. Local insurance companies in Trenton assess factors like population density, traffic patterns, and accident rates to calculate your level of risk.

Trenton, NJ Auto Insurance by ZIP Code

| City | ZIP Code | Monthly Rate |

|---|---|---|

| Trenton | 8608 | $53 |

| Trenton | 8609 | $53 |

| Trenton | 8610 | $53 |

| Trenton | 8611 | $53 |

| Trenton | 8618 | $53 |

| Trenton | 8619 | $54 |

| Trenton | 8628 | $52 |

| Trenton | 8629 | $53 |

It has a population of 84,065 and puts $31,592 on average in its annual household income, which affects average premium rates for Trenton. Providers like State Farm and Liberty Mutual adjust rates based on these local statistics when offering the best coverage options.

Automotive Accidents

Trenton, NJ, has recently had only nine fatal accidents, which is relatively few; however, things could constantly improve. Although such statistics might not directly cause a spike in auto insurance rates, they may influence insurers’ overall risk profile for their policyholders.

Trenton, NJ Auto Accident & Insurance Claim Statistics

| Factor | Value |

|---|---|

| Accidents per Year | 1,200 |

| Claims per Year | 900 |

| Average Claim Cost | $6,000 |

| Percentage of Uninsured Drivers | 16% |

| Vehicle Theft Rate | 300 thefts/year |

| Traffic Density | High |

| Weather-Related Incidents | Low |

Bring these numbers with your agent to find the best auto coverage in Trenton, NJ. They’re also likely to provide some general insight into how such factors all figure into calculating your premiums and may help you get better coverage for less money with that information.

Auto Thefts in Trenton

There were 373 reported vehicle thefts in Trenton, NJ, last year. While this number is relatively low compared to New Jersey averages, it’s still a good idea to take proactive measures to protect your vehicle.

Trenton, NJ Report Card: Auto Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| Financial Stability | A | Insurers in NJ are generally financially solid with good reserves |

| Coverage Options | B+ | Offers a wide range of coverage, including add-ons and optional features |

| Claims Satisfaction | B | Good ratings overall, though some complaints about slow service |

| Affordability | C | Premiums are higher than average due to the urban environment |

Installing a passive anti-theft alarm system could lower your monthly premium by earning you a discount. This step enhances security and could make your coverage more affordable, helping you secure the best Trenton, NJ, auto insurance rates.

Your Credit Score

A high credit score can work in your favor when shopping for cheap auto insurance in Trenton, NJ. Insurance companies often offer discounts to drivers with good credit, as they believe they are more likely to pay premiums on time and manage their finances responsibly.

Trenton, NJ Auto Insurance by Credit Score

This positive financial behavior is also assumed to extend to safe driving habits, which can lower your risk and, in turn, your premium costs. Explore our comprehensive resource, “How Your Credit Score Affects Your Car Insurance Premiums.”

Your Age

Age matters when it comes to auto insurance rates in Trenton, NJ. Experienced drivers pay low premiums, but inexperienced young drivers, particularly teenagers, pay high premiums.

High-risk drivers with accident records or offenses must pay their premiums higher than other drivers since they are more likely to have future claim tragedies.

Trenton, NJ Auto Insurance Monthly Rates by Age

Experienced drivers experience less fluctuation in premium rates compared to younger drivers. While age-related impairments exist, they are less significant than those seen in younger drivers. Insurance companies use statistics to offer higher discounts for more years of experience.

Your Driving Record

Your driving record is determining the best Trenton, NJ, auto insurance rates. A clean record with no accidents, claims, or violations can significantly lower your premiums. On the flip side, serious offenses such as DUIs or fatal accidents can cause premiums to soar or even result in disqualification from certain providers.

With its strong discounts and reliable service, State Farm is the top choice for affordable auto insurance in Trenton, NJ.

Chris Abrams Licensed Insurance Agent

Trenton, NJ Auto Insurance Monthly Rates by Provider & Driving Record

If you have record violations, you should sign up for a defensive driving course to prove your commitment to safe driving. The longer you go without incidents, the more likely you’ll qualify for discounts and lower rates, helping you secure the best coverage at an affordable price.

Your Vehicle

If you’re leasing or still paying off a car loan, you’ll need more than minimum coverage, such as gap loss, collision, and comprehensive insurance. Even if you own your vehicle outright, these coverages are essential.

Trenton, NJ Auto Insurance by Make & Model

| Make and Model | Monthly Rate |

|---|---|

| BMW 3 Series | $190 |

| Chevrolet Malibu | $135 |

| Ford F-150 | $150 |

| Honda Accord | $140 |

| Honda Civic | $130 |

| Jeep Grand Cherokee | $160 |

| Nissan Altima | $125 |

| Tesla Model 3 | $210 |

| Toyota Corolla | $120 |

| Volkswagen Jetta | $130 |

Without them, you’ll be responsible for repair or replacement costs if an accident occurs. Ensure you have the proper protection for the best Trenton, NJ, auto insurance.

Minor Elements for Best Trenton, NJ Auto Insurance

It requires deliberation on several factors affecting cheap car insurance in Trenton, NJ. They include marital status, gender, driving habits, and education levels. It would help someone learn about this to save a few bucks while getting proper coverage.

Your Marital Status

If you are married, get your auto insurance policy along with your spouse. A combined policy can save you nearly 10% on your monthly premiums, getting you the best auto insurance in Trenton, NJ, for a lower cost.

Trenton, NJ Auto Insurance Monthly Rates by Provider & Coverage Type

You can even try bundling insurance options if you’re unmarried with a partner or family member and see if you’ll get a bonus. Combining policies can be an intelligent way to maximize your coverage and savings. To expand your knowledge, refer to our comprehensive handbook, “Combining Car Insurance After Marriage.”

Your Gender

While some insurance companies may offer small discounts based on gender, assuming one group is safer on the road, many providers offering the best Trenton, NJ, auto insurance no longer factor gender into premium calculations. To secure the best deal, you must inquire whether gender still affects your rates when shopping for coverage. For detailed information, refer to our comprehensive report titled “Cheap Car Insurance for Young Drivers.”

Your Driving Distance to Work

In Trenton, most residents have short commutes, and many carpools or use public transport to reduce traffic and accident risks. If you’re one of those drivers, consider pay-per-mile insurance or using a mileage tracker program. These options reward low-mileage drivers by offering significant savings, with discounts of up to 33% or more on your premiums. Driving fewer miles, especially during safer times, can help you secure the best Trenton, NJ, auto insurance rates while cutting down on costs.

Your Coverage and Deductibles

Raising your deductible on coverage like Collision or Comprehensive can lower your monthly premiums, helping you secure the best Trenton, NJ auto insurance. However, this can be risky if you’re not a very safe driver, as you may need help to pay your deductible if you need to file a claim. Make sure your deductible aligns with your financial situation to avoid unexpected costs.

Education in Trenton, NJ

Earning a degree could help you qualify for significant auto insurance discounts in Trenton, NJ, as many insurers offer perks for college graduates. Local options like Thomas Edison State College and St. Francis Medical School of Nursing could make this possible.

When shopping for the best Trenton, NJ, auto insurance, consider educational discounts and other factors like customer service and financial stability to ensure you get the best coverage at a great rate.

Navigating the Best Trenton, NJ Auto Insurance

The best auto insurance in Trenton, NJ, comes from top providers like State Farm, Progressive, and Allstate. State Farm leads with affordable premiums and generous safe driver discounts, while Progressive offers flexible pricing through its Snapshot program.

Allstate stands out for its reliable roadside assistance and robust coverage options. The insured person will come equipped with the best deal subject to habits associated with driving, credit scoring, and discounts available, such as safe driving or bundling. The companies made various options available to everyone, ensuring proper coverage using relevant insurance types would be available to all Trenton drivers.

Enter your ZIP code into our free quote tool to find the best auto insurance providers for your needs and budget.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

What is full coverage insurance in New Jersey?

Full coverage in New Jersey includes liability, collision, and comprehensive insurance, offering complete protection for drivers.

What is the minimum auto insurance coverage in Trenton, NJ?

The minimum coverage required in Trenton is 15/30/5 liability insurance, covering bodily injury and property damage.

Find the best auto insurance rates no matter how much coverage you need by entering your ZIP code into our comparison tool today.

Do I need insurance in New Jersey to register a car?

Yes, New Jersey requires proof of insurance before registering a vehicle.

What is the premium insurance in Trenton, NJ?

Premiums in Trenton start around $65 per month, depending on coverage levels and driver factors.

What type of insurance must all New Jersey drivers have?

All drivers in New Jersey must have liability insurance that meets the state’s minimum coverage requirements.

Is insurance mandatory in Trenton, New Jersey?

Yes, auto insurance is mandatory in Trenton, NJ, as required by state law.

How much is car insurance in New Jersey for a new driver?

New drivers in New Jersey typically pay between $100 and $300 per month, depending on their driving record and vehicle.

Can I insure a 10-year-old car in New Jersey?

Yes, you can insure a 10-year-old car, though full coverage may be less cost-effective for older vehicles.

Did Trenton, NJ raise car insurance rates?

Car insurance rates in Trenton have increased slightly due to local accident statistics, but affordable options are still available.

At what age is the cheapest car insurance in Trenton, NJ?

Car insurance is cheapest for drivers aged 30 and older, as younger drivers face higher premiums. For a comprehensive overview, explore our detailed resource titled “Car Insurance for Teenagers”

Get the best auto insurance rates possible by entering your ZIP code into our free comparison tool today.