Best Omaha, NE Auto Insurance in 2025

The best Omaha, NE auto insurance providers are Geico, State Farm, and Farmers, with Geico starting rates at $29/month. State Farm is best for multi-policy discounts, while Farmers has great local agent assistance. These leading auto insurance companies in Omaha, NE, offer low-cost, quality coverage.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

UPDATED: Apr 17, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in Omaha NE

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,154 reviews

18,154 reviewsCompany Facts

Full Coverage in Omaha NE

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 3,072 reviews

3,072 reviewsCompany Facts

Full Coverage in Omaha NE

A.M. Best Rating

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviewsThe best Omaha, NE auto insurance companies are Geico, State Farm, and Farmers, with Geico having the lowest rates at $29/month for coverage.

State Farm is a good choice for those seeking car insurance discounts, with competitive prices and further discounts available through multi-policy discounts.

Our Top 10 Company Picks: Best Omaha, NE Auto Insurance

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | A++ | Affordable Rates | Geico | |

| #2 | 17% | B | Multi-Policy Discounts | State Farm | |

| #3 | 20% | A | Local Agent | Farmers | |

| #4 | 25% | A+ | Accident Forgiveness | Allstate | |

| #5 | 10% | A+ | Snapshot Savings | Progressive | |

| #6 | 25% | A | Regional Expertise | American Family | |

| #7 | 25% | A | App Management | Liberty Mutual |

| #8 | 5% | A+ | Senior Discounts | The Hartford |

| #9 | 20% | A+ | Vanishing Deductible | Nationwide |

| #10 | 25% | A++ | Bundling Discounts | Auto-Owners |

Farmers is unique in its individualized service, offering customers the expertise of local agents who can assist with identifying the most suitable policy for their individual requirements.

These businesses are the best in Nebraska car insurance rates, simplifying the process of finding a trustworthy provider who offers decent coverage at a reasonable cost.

- Geico is the top choice for affordable auto insurance in Omaha, NE.

- State Farm offers great discounts for bundling multiple policies.

- Farmers provides excellent local agent support for personalized service.

Whether you want cheap premiums or more control, these leading providers provide a variety of options. Start saving on your auto insurance by entering your ZIP code and comparing quotes.

#1 – Geico: Top Overall Pick

Pros

- Affordable Monthly Rates: Geico provides cheap auto insurance in Omaha, NE for full and bare-bones coverage choices that meet most Omaha, NE drivers’ budgets.

- Strong Bundling Savings: Omaha, NE motorists can receive up to 25% discount with Geico when they combine home and car insurance policies, keeping Omaha, NE insurance rates down.

- Superior Financial Stability: A++ financial stability at Geico means solid Omaha, NE automobile insurance coverage that benefits from long-term stability and claims assistance.

Cons

- Limited Agent Presence: Geico has fewer agents in the local area, which can be inconvenient for those requiring face-to-face assistance with car insurance in Omaha inquiries.

- Fewer Specialized Discounts: The Geico auto insurance review indicates discount options could be limited for Omaha drivers with specialized needs compared to other local carriers.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#2 – State Farm: Best for Multi-Policy Discounts

Pros

- Great Multi-Policy Discounts: Our State Farm auto insurance review indicates Omaha motorists can save as much as 17% by bundling policies, which reduces overall insurance expenses.

- Trusted Local Agents: A significant advantage to Omaha motorists receiving personal attention and quicker claims assistance from local State Farm agents.

- Safe Driver Program: State Farm’s Drive Safe & Save rewards good driving habits, making it a smart choice for affordable car insurance in Omaha, NE.

Cons

- Lower Bundling Discount: State Farm’s bundling discount is less than some competition in Omaha, NE, lowering overall Omaha, NE savings in insurance.

- Financial Rating: Rating A by A.M. Best gives State Farm cause for concern with some Omaha, NE insurance buyers seeking the best-rated insurers.

#3 – Farmers: Best for Local Agent Support

Pros

- Strong Local Agent: Farmers has strong local agent support, offering in-person help with car insurance in Omaha, NE for policy management and claims.

- Good Bundling Opportunities: Omaha, NE drivers can save up to 20% when bundling Farmers home and car insurance policies under one convenient Omaha, NE account.

- Customizable Coverages: Farmers provides personalized coverage, enabling Omaha, NE insurance clients to make protection adaptable to their specific driving circumstances.

Cons

- More for Younger Motorists: In our Farmers auto insurance review, Omaha car insurance plans tend to charge higher premiums to young motorists compared to other Omaha insurers.

- Few Online Tools: The app and portal for Farmers auto insurance exist but with fewer options for digital car insurance management from Omaha policyholders.

#4 – Allstate: Best for Accident Forgiveness

Pros

- Top Accident Forgiveness: Allstate auto insurance review notes accident forgiveness, enabling Omaha auto insurance customers to avoid rate increases following their initial at-fault collision.

- Competitive Bundling Discount: By combining car insurance with homeowners or renters coverage, Omaha customers can save as much as 25%, making it an economical and sensible choice.

- Advanced Tools: Allstate’s Drivewise technology monitors driving to reward Omaha, NE drivers for good driving and provide them with driving tips for improvement.

Cons

- Above-Average Premiums: Omaha, NE motorists can expect to spend more than the average for Omaha, NE car insurance with Allstate, particularly for minimum coverage requirements.

- Mixed Customer Service Reviews: Certain Omaha, NE motorists cite varying service or slow claims processing when dealing with Allstate for Omaha, NE insurance.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#5 – Progressive: Best for Snapshot Savings

Pros

- Snapshot® Program Rewards: Progressive’s Snapshot telematics plan rewards good driving, allowing Omaha, NE motorists to reduce car insurance in Omaha, NE.

- Solid A+ Financial Rating Supports: An A+ rating makes Progressive a financially solid choice for Omaha, NE insurance consumers who prioritize claim-paying capacity.

- Accessible Coverage Options: Progressive provides flexible policy choices, catering to a broad spectrum of Omaha, NE drivers from students to high-risk profiles.

Cons

- Bundling Discount: Our Progressive auto insurance review reveals a 10% bundling discount, which is less than most auto insurance in Omaha, NE companies provide.

- Telematics May Increase Rates: Progressive’s Snapshot monitors driving behavior. Reckless driving will increase rates, so auto insurance will cost more for bad drivers.

#6 – American Family: Best for Regional Expertise

Pros

- Strong Bundling Savings: Drivers in Omaha, NE who purchase home and automobile insurance in Omaha, NE together through American Family receive up to 25% discount on the overall premiums.

- Expertise in Regional: American Family adapts auto insurance in Omaha to local perils and road conditions, presenting tailored coverage to local motorists.

- Excellent Claims Satisfaction: In our American Family auto insurance review drivers in Omaha appreciate the active claims processing of American Family, offering intense support and trustful service.

Cons

- Availability Limited to Selected Areas: American Family might not be offered in every neighborhood, which restricts Omaha, NE insurance choices for some motorists.

- Fewer Digital Tools: Web-based resources are more restricted, making it more difficult for Omaha, NE motorists who prefer online access to handle car insurance.

#7 – Liberty Mutual: Best for App Management

Pros

- Top-Rated App: Our Liberty Mutual car insurance review commends its mobile app, where Omaha, NE auto insurance customers can file claims, pay premiums, and retrieve documents with ease.

- Strong Bundling Discount: Omaha motorists can conserve as much as 25% by combining home and car policies with Liberty Mutual, an excellent choice for customers who want to save on their car insurance.

- Unique Coverage Options: Uncommon services such as Better Car Replacement bring greater value to Omaha, NE motorists with Liberty Mutual coverage.

Cons

- Higher-than-Average Base Rates: Liberty Mutual base prices exceed other Omaha, NE policy quotes for equivalent amounts of protection.

- Discounts Harder to Qualify: Omaha, NE drivers may struggle with accessing multiple Liberty Mutual discounts if it involves complying with rigorous qualifications.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#8 – The Hartford: Best for Senior Discounts

Pros

- Senior-Focused Benefits: Special senior discounts come with AARP from The Hartford, which aids older Omaha, NE drivers in having customized automobile insurance.

- Reliable Claims Support: Great customer service scores make The Hartford a trustworthy one for Omaha, NE automobile insurance claims processing.

- Strong Financial Stability: A+ financial strength gives Omaha, NE customers purchasing insurance comfort in policy support and extended cover.

Cons

- Limited Availability for Younger Drivers: Hartford auto insurance review indicates that the insurer mainly focuses on elderly drivers, reducing choices for young individuals looking for car insurance.

- Smaller Bundling Discount: 5% discount for bundling provided by Hartford auto insurance review is less than what is normally offered for car insurance in Omaha Nebraska plans.

#9 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: Nationwide auto insurance review points out how Omaha, NE motorists can reduce their deductible annually through safe driving, making it a popular choice for most.

- Solid Bundling Savings: Save up to 20% by bundling home and auto policies with Nationwide, providing excellent savings for vehicle insurance in Omaha consumers who want to save money.

- A+ Financial Strength: With an A+ financial grade, Nationwide gives Omaha, NE drivers confidence that their coverage is secure with a financially sound, solid insurer.

Cons

- Discount Eligibility Varies Widely: Discounts are not a certainty for every Omaha driver, so savings for auto insurance in Omaha can be affected by individual circumstances.

- Rates May be Higher: Omaha, NE drivers looking for economical basic coverage may be able to find lower-priced options than through Nationwide auto insurance review, perhaps with more choices.

#10 – Auto-Owners: Best for Bundling Discounts

Pros

- Fantastic Discount Deals: Up to 25% discounts are available for Omaha, NE drivers with combined home, auto, and life insurance plans, as noted in the Auto-Owners auto insurance review.

- Top-Tier A++ Financial Rating: Auto-Owners earns an A++ rating, making it one of Nebraska’s top car insurance companies for Omaha drivers.

- Highly Personalized Coverage: Omaha, NE residents can get their own personalized insurance plans from local Auto-Owners agents with guaranteed coverage suited to their specific requirements.

Cons

- Limited Digital Access: Auto-Owners provides limited online tools, thus providing less convenience for Omaha, NE drivers who would rather access insurance digitally.

- Smaller Agent Network: Omaha, NE motorists can find it difficult to locate local agents because Auto-Owners has a smaller network in the Omaha, NE region.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Omaha, NE Auto Insurance Coverages and Rates

Comparing auto insurance companies in Omaha, coverage type is what differs the rates. Geico has the lowest minimum coverage at $29, and Liberty Mutual comes at a rate of $51. The full coverage range is $97 with Geico to $165 with Liberty Mutual.

Omaha, NE Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $47 | $158 | |

| $35 | $118 | |

| $34 | $123 | |

| $36 | $119 | |

| $29 | $97 | |

| $51 | $165 |

| $31 | $105 |

| $39 | $130 | |

| $32 | $104 | |

| $42 | $135 |

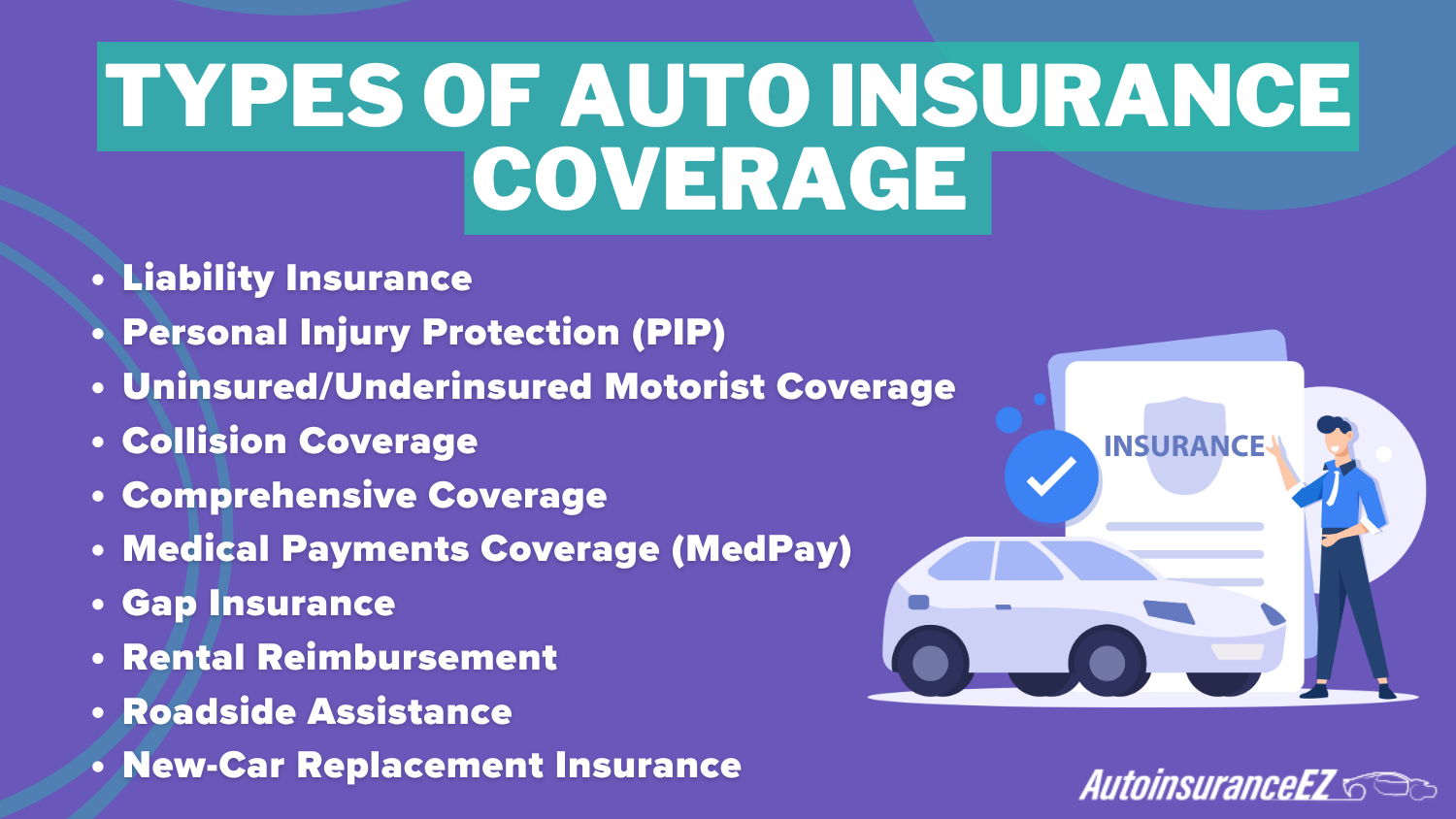

Knowing the different types of car insurance allows you to select the proper coverage. Liability pays for injuries and property damage to others. PIP and MedPay pay for medical costs. Uninsured/underinsured motorist pays if you are hit by someone without insurance.

Optional coverages such as collision, comprehensive, and gap coverage provide additional protection. Rental reimbursement, roadside service, and new-car replacement insurance are excellent choices to provide extra peace of mind and protect against unexpected expenses.

Omaha, NE Auto Insurance Discounts and Premiums

Several of the leading providers in Omaha provide discounts such as multi-policy, safe driving, and bundling. Students are also eligible for a Good Student Discount, which can lower premiums and make insurance more affordable for young drivers.

Auto Insurance Discounts From the Top Providers in Omaha, NE

| Insurance Company | Available Discounts |

|---|---|

| Safe Driving Club Discount, Multi-Policy Discount, Anti-Theft Discount, Early Signing Discount | |

| Low Mileage Discount, Good Driver Discount, Early Bird Discount, Multi-Car Discount | |

| Payment History Discount, Green Vehicle Discount, Multi-Policy Discount, Safe Driver Discount | |

| Signal App Discount, Distant Student Discount, Good Payer Discount, Bundling Discount | |

| Multi-Policy Discount, Good Student Discount, Military Discount, Defensive Driving Discount | |

| RightTrack Discount, Multi-Policy Discount, New Graduate Discount, Hybrid Vehicle Discount |

| SmartRide Discount, Accident-Free Discount, Multi-Policy Discount, Paperless Billing Discount |

| Snapshot Program Discount, Multi-Car Discount, Home & Auto Bundle Discount, Loyalty Discount | |

| Drive Safe & Save, Good Student Discount, Multi-Car Discount, Accident-Free Discount | |

| AARP Member Discount, Bundling Discount, Safe Driver Discount, Vehicle Safety Discount |

Omaha receives an “A” in weather-related safety and a “B+” in traffic. These regional factors reduce risks, which can translate to improved pricing. Reduced congestion and little severe weather are positive for drivers and insurers.

Omaha, NE Report Card: Auto Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| Weather-Related Risks | A | Minimal weather impacts, rare severe events |

| Traffic Density | B+ | Congestion in Omaha, but rural areas help |

| Average Claim Size | B- | Larger claims due to expensive repairs |

| Vehicle Theft Rate | C | Higher-than-average theft rate in urban areas |

| Uninsured Drivers Rate | D | High rate of uninsured drivers, raising premiums |

Omaha claims receive a “B-” for expensive repairs, urban crime rates a “C,” and excessive uninsured drivers a “D,” driving rates higher. It becomes more difficult to find cheap auto insurance in Omaha NE as a result.

Omaha, NE Auto Insurance Minimum Coverage

In Omaha, NE, the Minimum Car Insurance Requirements are a 25/50/25 liability policy: $25,000 per person for bodily injury, $50,000 per accident, and $25,000 for property damage. Most drivers purchase higher coverage for greater security.

For individuals looking for affordable minimum car insurance, Geico provides the cheapest rates in Omaha at a mere $29 per month. Other companies such as Farmers, State Farm and Nationwide also provide affordable rates with various coverage levels.

Opting for higher coverage than Nebraska's minimum car insurance requirements in Omaha can reduce financial risk, especially given the city’s affordable insurance rates.

Chris Abrams Licensed Insurance Agent

Omaha, the largest city in Nebraska, is a telecommunications and insurance hub. The city’s robust economy, low housing costs, and excellent schools make it one of the Top 15 Best Cities for Business and Careers.

| Coverage | Requirements | Most Common |

| Bodily Injury Liability | 25,000/50,000 | 100,000/300,000 |

| Property Damage Liability | 25,000 | 100,000 |

| Uninsured Motorist Bodily Injury | Not required | 100,000/300,000 |

| Medical Payments | Not required | 5,000 |

| Collision | Not required | 500 deductible |

| Comprehensive | Not required | 250 deductible |

If you want cheap coverage in Omaha, you can shop around for insurance quotes from leading companies to get inexpensive minimum car insurance. The average rate is about $110/month, but you can get rates as cheap as $29 per month based on your situation.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Find the Best and Most Affordable Omaha, NE Auto Insurance

Auto insurance is confusing, but it doesn’t have to be costly. If you’re in Omaha and want to obtain cheaper car insurance, you’ve come to the right place.

By following these 5 easy steps, you’ll be on your way to getting the best coverage, unlocking discounts, and saving on your monthly premiums.

Begin With Your ZIP Code: Type in your Omaha ZIP code and get customized car insurance quotes specific to your neighborhood. Location is important, as safety on roads and weather may affect your premiums.

Compare Omaha’s Best Providers: Check out prices from trusty companies like Geico, State Farm, and Farmers. Side-by-side comparisons guarantee you have the best coverage at the lowest price based on your needs.

Tailor Your Policy Options: Select from different types of coverage that are available based on your requirements. From minimum to complete cover, some providers in Omaha offer rates as low as $29 per month. You have choices.

Uncover Discounts That Fit You: Make sure to take out available discounts such as the safe driver discount, bundle policies, or even student discounts. These can assist you in getting less expensive car insurance without sacrificing good coverage.

Select Your Plan and Save: After you’ve identified the policy that meets your budget and coverage requirements, select it, and enjoy the feeling of security knowing that you’re covered at a competitive rate.

Ready to get the best deal? Put in your ZIP code below and instantly compare quotes from leading Omaha auto insurance companies. Lock in your cheaper car insurance today and begin saving.

Major Factors in Cheap Car Insurance in Omaha, Nebraska

There are numerous ways your auto insurance rate may be determined. But not all of it can you control; there are procedures you can make to be able to control what discounts you can qualify to earn. Presented herein are some of these factors in more detail to enable you to obtain what is the best motor vehicle insurance cover in Nebraska:

Average Cost of Auto Insurance by Neighborhood

Your cheap car insurance in Omaha, Nebraska will depend on the location where you reside. Most often, bigger cities have higher car insurance costs because the more car owners you have on the road, the higher the chance of a car accident! Omaha has 434,353 individuals, and also the average family income is $47,512.

Average Monthly Auto Insurance Premiums in Omaha, NE by ZIP Code

| ZIP Code | Rates |

|---|---|

| 68142 | $70 |

| 68118 | $103 |

| 68132 | $105 |

| 68136 | $116 |

| 68138 | $109 |

| 68157 | $112 |

| 68137 | $115 |

| 68130 | $118 |

| 68127 | $119 |

| 68124 | $121 |

| 68152 | $123 |

| 68117 | $126 |

| 68144 | $130 |

| 68110 | $132 |

| 68108 | $136 |

| 68134 | $137 |

| 68105 | $137 |

| 68106 | $143 |

| 68107 | $143 |

| 68154 | $145 |

| 68164 | $150 |

| 68102 | $152 |

| 68104 | $154 |

| 68116 | $164 |

| 68111 | $174 |

| 68122 | $204 |

Automotive Accidents

Look at the accident statistics in the chart below. Those figures may look scary, but for a city of more than 400,000 people, those figures could be worse. When accident levels get too high in any one area, your Omaha, Nebraska car insurance company will be more likely to increase rates. Call your agent to find out if you can reduce your cheap insurance rates in Nebraska with any Safe Driver discounts available.

Omaha, NE Fatal Accident Statistics

| Category | Count |

|---|---|

| Fatal accident count | 33 |

| Vehicles involved in fatal crashes | 56 |

| Fatal crashes involving drunk persons | 0 |

| Fatalities | 35 |

| Persons involved in fatal crashes | 74 |

Auto Thefts in Omaha

Omaha’s got a very serious auto theft issue – and the worse news is, it’s only increasing. 3,080 cars were stolen in 2013, which is a big increase from 2013. But did you realize Comprehensive coverage is the only kind of automotive insurance that pays out on theft-related claims? If you own a car that’s going to get hot, be sure you insulate yourself with a solid auto policy.

Auto Insurance Monthly Rates in Omaha, NE by Provider & Coverage Type

| Insurance Company | Basic Coverage | Comprehensive Coverage |

|---|---|---|

| $105 | $305 | |

| $108 | $224 | |

| $38 | $88 | |

| $135 | $259 | |

| $66 | $144 | |

| $91 | $255 |

| $156 | $537 |

| $86 | $337 | |

| $86 | $293 | |

| $108 | $371 |

Your Credit Score

It will surprise you to know that your credit rating is a major determinant of how much you will pay for your monthly insurance premiums. This is particularly so if your credit score is low. There are some insurers who will make you pay double or more as an insured who has excellent credit. Allstate is slightly less judgmental.

Auto Insurance Monthly Rates in Omaha, NE by Provider & Credit Score

| Insurance Company | Good Credit | Fair Credit | Poor Credit |

|---|---|---|---|

| $174 | $180 | $197 | |

| $142 | $142 | $312 | |

| $129 | $129 | $129 | |

| $199 | $199 | $199 | |

| $147 | $147 | $182 | |

| $212 | $212 | $212 |

| $129 | $129 | $313 |

| $166 | $166 | $260 | |

| $165 | $165 | $165 | |

| $134 | $134 | $134 |

Your Age

The high premiums for young drivers can be daunting. In the example chart below, for instance, Farmers would quote a young driver ten times what they would charge an older, more experienced driver. But a lot of low-cost auto insurance providers in Omaha, Nebraska will provide discounts for good students and young adults who complete driving classes. Contact your local agent for more information so that you can obtain the lowest cost car insurance in Omaha, NE.

Auto Insurance Monthly Rates in Omaha, NE by Provider, Age & Gender

| Insurance Company | Age 17 Female | Age 17 Male | Age 25 Female | Age 25 Male | Age 35 Female | Age 35 Male | Age 60 Female | Age 60 Male |

|---|---|---|---|---|---|---|---|---|

| $470 | $510 | $195 | $210 | $160 | $165 | $150 | $155 | |

| $500 | $540 | $210 | $225 | $170 | $175 | $155 | $160 | |

| $460 | $500 | $185 | $200 | $150 | $155 | $140 | $145 | |

| $490 | $530 | $200 | $215 | $165 | $170 | $155 | $160 | |

| $450 | $490 | $180 | $195 | $145 | $150 | $135 | $140 | |

| $480 | $520 | $195 | $210 | $160 | $165 | $150 | $155 |

| $470 | $510 | $190 | $205 | $155 | $160 | $145 | $150 |

| $460 | $500 | $185 | $200 | $150 | $155 | $140 | $145 | |

| $440 | $480 | $180 | $195 | $145 | $150 | $135 | $140 | |

| $470 | $510 | $190 | $205 | $155 | $160 | $145 | $150 |

Cheap Insurance for Good Drivers in Nebraska

If you have serious traffic tickets on your driving record, you stand to lose much more each month in premiums – or even have your policy cancelled. But some carriers now have good news: they’re providing discounts in the form of “Accident Forgiveness” discounts.

Insurance Company Clean Record One Ticket One Accident One DUI

$105 $125 $222 $224

$86 $112 $180 $180

$61 $86 $86 $86

$103 $130 $130 $130

$99 $92 $92 $92

$179 $179 $179 $179

$125 $77 $77 $77

$95 $95 $95 $95

$69 $69 $69 $69

$102 $102 $102 $102

Your Vehicle

If you wish to drive a costly car, you will need to pay a lot of money to have it insured. If your car is damaged and you have not bought enough insurance to pay for the repairs, then you will be paying that amount.

| Make & Model | Minimum Coverage | Full Coverage |

|---|---|---|

| 2024 Buick Envision | $48 | $162 |

| 2024 Chevrolet Trailblazer | $53 | $143 |

| 2024 Ford Bronco Sport | $45 | $156 |

| 2024 Honda Passport | $50 | $124 |

| 2024 Hyundai Venue | $45 | $155 |

| 2024 Kia Soul | $50 | $149 |

| 2024 Mazda CX-5 | $50 | $155 |

| 2024 Nissan Kicks | $55 | $150 |

| 2024 Subaru Crosstrek | $47 | $149 |

| 2024 Toyota Corolla Cross | $51 | $153 |

Minor Factors in Auto Insurance in Omaha, NE (Marital Status, Gender, Driving Distance, Coverage and Deductibles, and Education)

To lower your premium in Omaha, try bundling policies. Married couples usually receive discounts, and even singles receive discounts if bundling is offered. Commuting in Omaha, which takes 14-17 minutes on average, might slightly affect car insurance rates in Nebraska if mileage decreases significantly.

Education is also a factor—motorists with higher education in Omaha usually pay less. Schools like the University of Nebraska at Omaha can do their part. Realizing these elements is critical on how to lower your auto insurance premiums in Omaha.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Top Providers for the Best Omaha, NE Auto Insurance

The best Omaha, NE auto insurance companies such as Geico, State Farm, and Farmers provide quality coverage at pocket-friendly prices customized for local motorists. Geico’s competitive price begins at $29/month, and State Farm is ideal for multi-policy discount and Farmers for local agent care.

Factors that affects your car insurance premium are your driving record, type of vehicle, and where you live. By comparing car insurance quotes Omaha, NE, you can get the best rates. Safe driving and bundling discounts can also reduce your premiums. Get fast and cheap auto insurance coverage today with our quote comparison tool.

Frequently Asked Questions

What is the lowest-priced company in Omaha, Nebraska?

Though some companies provide low prices, quality Omaha companies tend to balance low prices with service and solid claims handling. Look at our cheap car insurance rates for expanded insights.

What coverages are provided by highly rated Omaha insurers?

Highly rated Omaha insurers offer complete coverage, rental car protection, roadside assistance, and add-ons that can be selected to satisfy local drivers’ varied needs. Start comparing total coverage auto insurance rates by entering your ZIP code here.

How do local Omaha conditions affect top-insurer premium prices?

Omaha insurers charge by city-specific variables such as traffic counts, accident records, and repair estimates to deliver precise, risk-based rates. Explore our high risk drivers for more insights.

What are the discounts for top Omaha auto insurers?

Top insurers discount bundling, good driving, safe cars, and even paperless billing—enabling Omaha drivers to save without sacrificing coverage.

Do I use a local agent or online insurer when buying top-rated coverage in Omaha?

Both local agents and online insurers provide excellent service in Omaha. Decide based on whether you prefer personal counsel or speedy, online convenience.

How does age influence your ability to obtain the best car insurance in Omaha?

Top Omaha insurers tend to provide better rates for veteran drivers and seniors, while teenagers might pay more because of limited driving history and risk factors. Read more in our car insurance for teenagers.

Does your ZIP code in Omaha affect the way top insurers determine rates?

Yes, Omaha providers evaluate risk by ZIP code—locales with fewer claims and lower theft ratios tend to receive better premiums with top-rated companies. Explore your auto insurance options by entering your ZIP code into our free comparison tool today.

How can motorists in Omaha cut premiums with top insurance companies?

Increase deductibles, have a clean record, and bundle policies. Top Omaha insurers offer incentives to low-risk drivers in terms of discounts and premium-saving solutions.

What credit score do Omaha’s best insurers view as best for pricing?

Leading insurers in Omaha employ credit-based insurance scores. Improved scores tend to produce lower premiums as a result of perceived responsibility and reduced claim risk.

Do the best insurers in Omaha provide benefits for older drivers?

Yes, many insurers provide senior discounts, low-mileage rates, and driving course savings—allowing older drivers to receive better coverage in Omaha. Dive into our cheap auto insurance for seniors to gain a deeper insight.