Best Bellevue, NE Auto Insurance in 2025 (Check Out the Top 10 Companies)

Best Bellevue, NE auto insurance are Geico, Farmers, and State Farm. These top providers with a starting rate of $27 monthly. Geico offers affordability and has A++ rating. Farmers provides quality service with their local agents. State Farm offers clients 17% bundling discounts and multi-policy discounts

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Apr 14, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in Bellevue NE

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 3,072 reviews

3,072 reviewsCompany Facts

Full Coverage in Bellevue NE

A.M. Best Rating

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviews 18,154 reviews

18,154 reviewsCompany Facts

Full Coverage in Bellevue NE

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviewsGeico, Farmers, and State Farm are among the best auto insurance companies in Bellevue, NE. Geico affordability rates provide clients with lower premium coverages. Farmers’ local agents are here to provide quality services to clients to meet their demands. State Farm multi-policy discounts give clients more options for their policy at a significant discount.

There are more options for selecting the best insurance for your vehicle needs. Check out our table below to see more details about their rates, bundling, A.M. best, and what are their best for.

Our Top 10 Company Picks: Best Bellevue, NE Auto Insurance

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | A++ | Affordable Rates | Geico | |

| #2 | 20% | A | Local Agent | Farmers | |

| #3 | 17% | B | Multi-Policy Discounts | State Farm | |

| #4 | 5% | A+ | Senior Discounts | The Hartford |

| #5 | 25% | A++ | Bundling Discounts | Auto-Owners | |

| #6 | 25% | A | App Management | Liberty Mutual |

| #7 | 25% | A | Regional Expertise | American Family | |

| #8 | 10% | A+ | Snapshot Savings | Progressive | |

| #9 | 20% | A+ | Vanishing Deductible | Nationwide |

| #10 | 25% | A+ | Accident Forgiveness | Allstate |

Auto insurance rates can vary on different factors, but here are the top providers of best and affordable auto insurance. Check our cheap auto insurance to see more about rates and discounts.

- Best Bellevue, NE, auto insurance are Geico, Farms, and State Farm

- Geico offers clients auto insurance choices with affordable rates

- Farmers provide local agents, and State Farm has multi-policy discounts

These auto insurance companies have different rates depending on your location. Enter your ZIP code here to see different rates of best auto insurance companies in Bellevue, NE.

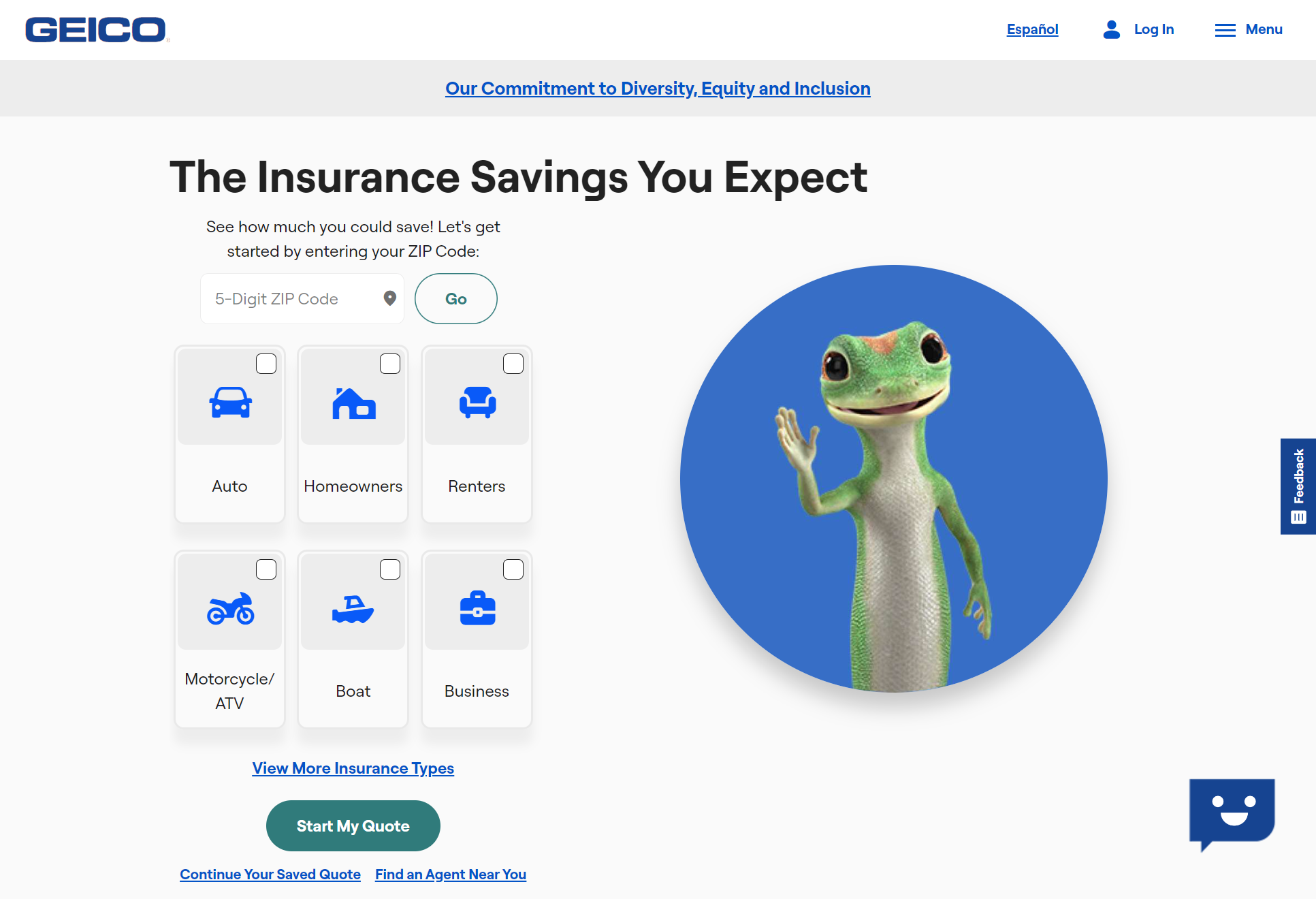

#1 – Geico: Top Overall Pick

Pros

- Affordable Coverage: Geico provides a wide range of coverage options at affordable rates for those on a tight budget. See more of it by reading our Geico auto insurance review.

- Strong Financial Stability: Offers reliable coverage for major claims, perfect choice for those who value the security of a well-established insurer.

- Advanced Digital Tools: Allows drivers to conveniently access their policy at any time and from any location by managing and tracking it online.

Cons

- Limited Personal Assistance : The digital approach may feel impersonal to drivers who prefer one-on-one consultations for managing their vehicle protection.

- Fewer Package Options : Few choices might be available to those who want to combine their auto insurance with other combined coverage.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#2 – Farmers: Best for Local Agent

Pros

- Personalized Guidance: Ideal for drivers who appreciate having a local representative guide them in choosing the right coverage for their vehicle’s needs.

- Flexible Protection: Perfect for customizing coverage based on a car’s age, mileage, or specific features.

- Convenient for Family Cars: Local agents can help families with multiple vehicles get the best coverage and discounts for all.

Cons

- Higher Premiums for Some : Not the most cost-effective for those seeking the lowest price for basic vehicle insurance.

- Outdated Online Services : Digital tools may fall short for tech-savvy individuals who prefer managing their car insurance through apps. Read our Farmers insurance review for more details.

#3 – State Farm: Best for Multi-Policy Discounts

Pros

- Bundling Savings: Ideal for drivers who want to save money on insurance for both their car and other assets, such as homes or life insurance. vehicle and other assets like homes or life policies.

- Wide Coverage Network: Offers extensive options for vehicle owners needing both local support and comprehensive protection across various regions.

- Reliable Claims Support: Guarantees that when an accident occurs and a driver wants to replace or repair their vehicle, they can rely on their insurance.

Cons

- Eligibility for Discounts May Vary: Drivers may not always qualify for multi-policy discounts, leading to higher premiums for some.

- Limited Loan Protection: Not ideal for those with outstanding car loans, as certain financial coverage options might be restricted.

#4 – The Hartford: Best for Senior Discounts

Pros

- Age-Specific Benefits: Perfect for more experienced car owners who want lower premiums due to their safe driving history.

- Increased Loyalty Benefits: Offers attractive rewards for individuals who have maintained and insured their vehicle for many years. Discover more through our The Hartford auto insurance.

- Great for Long-Term Vehicle Owners: Seniors who have owned their car for a long time can benefit from competitive rates tailored to their needs.

Cons

- Excludes Younger Drivers: Not a great option for younger car owners, as the insurer focuses heavily on senior discounts.

- Higher Costs for Non-Seniors: Rates may not be competitive for those outside the target demographic, like new or young drivers.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#5 – Auto-Owners: Best for Bundling Discounts

Pros

- Comprehensive Coverage Options: Ideal for drivers who want to bundle various types of insurance (home, life, auto) into one affordable policy for their car. See how it’s done through our Auto-Owners insurance.

- Custom Coverage: Offers flexible options for insuring a vehicle based on usage, whether for daily commuting or recreational purposes.

- Great for Classic Cars: Ensures that the coverage of owners of vintage or restored cars is as unique as their vehicle by offering them customized insurance.

Cons

- Offline-Only Services: For drivers who prefer the convenience of online quotes and services for their vehicle could find this limitation frustrating.

- Limited Coverage in Some Areas: If you’re insuring a car and planning to travel outside the provider’s service regions, you might face coverage restrictions.

#6 – Liberty Mutual: Best for App Management

Pros

- Mobile-Friendly Features: Ideal for tech-savvy vehicle owners who prefer managing their car’s coverage on the go via a mobile app.

- Highly Customizable Options: Flexibility to adjust protection for your vehicle based on your unique driving habits or needs. To understand better, read our, Liberty Mutual auto insurance review.

- Multiple Discounts Available: Drivers can save by linking their car coverage with other benefits such as bundling or vehicle safety features.

Cons

- Potential for Rate Increases: Even with savings, car owners may notice rate hikes after multiple claims.

- Expensive Add-Ons: Additional coverage, especially for new or high-end vehicles, can increase your premiums significantly

#7 – American Family: Best for Regional Expertise

Pros

- Local Knowledge: Great for vehicle owners who want to work with an insurer that understands the regional risks associated with their driving environment.

- Flexible Coverage Plans: Perfect for individuals insuring both daily drivers and seasonal vehicles such as RVs or motorcycles.

- Loyalty Rewards for Vehicle Owners: Offers additional benefits to drivers who have been with the insurer for an extended period, especially for car owners in the same location.

Cons

- Limited Availability: If you relocate to another area, it might be difficult to transfer your car insurance coverage to a new provider.

- Higher Rates for Younger Drivers: Teen drivers or those new to the road may face higher insurance rates for their car. Check more on our American Family auto insurance for more details.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#8 – Progressive: Best for Snapshot Savings

Pros

- Behavior-Based Savings: A great fit for drivers who want their vehicle insurance rates to be based on safe driving habits, such as braking gently and avoiding heavy acceleration.

- Flexible Coverage for All Vehicles: Whether you own a compact car or a high-performance model, Progressive offers adaptable coverage options.

- Instant Rate Comparison: Compare quotes and rates for your car’s coverage quickly through their tools.

Cons

- Snapshot Could Backfire: According to our Progressive auto insurance review, aggressive or nighttime driving may result in higher premiums, even for careful car owners.

- Long Claims Processing Times: Some vehicle owners report slower claims processing, particularly for extensive damage or unusual claims.

#9 – Nationwide: Best for Vanishing Deductible

Pros

- Deductible Reduction for Safe Drivers: Ideal for careful drivers, as every claim-free year could reduce your deductible, saving you money on car repairs.

- Flexible Mileage-Based Discounts: Perfect for drivers who don’t use their car as much, allowing them to save on insurance premiums.

- User-Friendly App: Helps vehicle owners easily access and manage their car coverage from any location.

Cons

- Fewer Local Offices: Based on our Nationwide auto insurance review, some car owners may find it inconvenient to locate an agent close by for in-person support.

- Limited Bundling Discounts: The savings potential may be lower for those looking to bundle their vehicle insurance with home or life coverage.

#10 – Allstate: Best for Accident Forgiveness

Pros

- Accident Protection for Drivers: Perfect for drivers who want peace of mind knowing their first accident won’t lead to a higher premium on their car.

- Helpful Driving App: Provides information and advice on how to drive better, which could lower your future auto insurance premiums. See more of it by reading our Allstate auto insurance.

- Optional Coverage for Unique Cars: Great for insuring specialized or high-performance cars, with tailored protections to match.

Cons

- Price Hikes After Multiple Claims: Multiple claims can still lead to significant increases in your car’s premium.

- Mixed Customer Service: Car owners might encounter inconsistencies with claims or support, depending on the agent or location.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Auto Insurance Costs and Discounts in Bellevue, NE

Finding the right auto insurance in Bellevue, NE means balancing quality coverage with affordable monthly premiums. Check out rates from the top 10 providers to see which fits your budget best.

Bellevue, NE Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $48 | $160 | |

| $34 | $112 | |

| $30 | $105 | |

| $33 | $115 | |

| $27 | $92 | |

| $45 | $158 |

| $28 | $98 |

| $39 | $126 | |

| $29 | $97 | |

| $36 | $121 |

If your auto insurance feels too expensive, there are several ways to lower your premium. Explore the discount options below offered by top providers.

Auto Insurance Discounts From the Top Providers in Bellevue, NE

| Insurance Company | Available Discounts |

|---|---|

| Safe Driving Club Discount, Anti-Theft Discount, Multiple Policy Discount, TeenSMART Discount | |

| Loyalty Discount, Low Mileage Discount, Multi-Car Discount, Early Signing Discount | |

| Paid-in-Full Discount, Multi-Policy Discount, Safety Features Discount, Low Mileage Discount | |

| Bundling Discount, Safe Driver Discount, Signal App Discount, Distant Student Discount | |

| Multi-Policy Discount, Good Student Discount, Military Discount, Defensive Driving Discount | |

| RightTrack Discount, Multi-Policy Discount, New Graduate Discount, Paperless Billing Discount |

| SmartRide Discount, Accident-Free Discount, Family Plan Discount, Defensive Driving Discount |

| Snapshot Discount, Multi-Car Discount, Good Student Discount, Continuous Insurance Discount | |

| Multi-Car Discount, Accident-Free Discount, Drive Safe & Save, Good Driver Discount | |

| AARP Member Discount, Bundle Discount, Paid-in-Full Discount, Good Driver Discount |

Compare car insurance rates from top providers in Utah. Just enter your ZIP code to find the best deals and start saving today.

Auto Insurance Coverage Options Available in Nebraska

Bellevue, Nebraska’s first capital by the Missouri River, is known for Fontenelle Forest, Offutt Air Force Base, and its growing economy. As the city thrives, ensure your car insurance coverage keeps up by comparing rates from top providers.

Bellevue, NE Auto Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| Vehicle Theft Rate | A- | Low vehicle theft rate (approx. 1.8 per 1,000 vehicles). |

| Traffic Density | B+ | Generally moderate traffic; lower congestion than urban centers. |

| Average Claim Size | B | Average claim cost around $4,750, slightly below the national average. |

| Weather-Related Risk | B | Moderate risk due to seasonal snow, ice, and hail, but not extreme overall. |

| Uninsured Drivers Rate | B | Around 9.3% of drivers are uninsured — lower than national average (~12%). |

When considering what coverage to buy, keep in might that state mandatory minimums are only suited for older, inexpensive vehicles which have already been paid off. If your vehicle doesn’t fit that description, you might want to invest in a more extensive policy.

Auto Insurance Coverage Requirements in Nebraska

| Coverage | Limits |

|---|---|

| Bodily Injury Liability | $25,000 per person / $50,000 per accident |

| Property Damage Liability | $25,000 per accident |

Legal requirements are crucial for finding affordable auto insurance in Nebraska. In Bellevue, the minimum coverage includes $25,000 for bodily injury per person, $50,000 per accident, and $25,000 for property damage.

To find the best car insurance for your vehicle and budget, enter your ZIP code and compare rates from top providers.

Factors Affecting Auto Insurance Rates in Bellevue, NE

Car insurance rates are influenced by many factors, but not all are beyond your control. You can take steps to qualify for discounts and lower your premium. Here are some key elements that may affect your rate:

Auto Insurance Monthly Rates in Bellevue, NE by Provider, Age, & Gender

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| $290 | $310 | $165 | $172 | $130 | $135 | $110 | $112 | |

| $275 | $295 | $160 | $168 | $126 | $130 | $108 | $110 | |

| $260 | $285 | $155 | $163 | $122 | $125 | $105 | $108 | |

| $295 | $320 | 170 | $178 | $135 | $140 | $115 | $117 | |

| $250 | $270 | $150 | $157 | $120 | $124 | $102 | $105 | |

| $300 | $325 | $175 | $183 | $138 | $142 | $118 | $120 |

| $280 | $305 | $165 | $172 | $130 | $134 | $110 | $113 |

| $270 | $290 | $158 | $165 | $126 | $130 | $107 | $110 | |

| $265 | $285 | $160 | $167 | $128 | $132 | $108 | $111 | |

| $285 | $310 | $168 | $175 | $132 | $136 | $112 | $115 |

Gender-based premiums are becoming less common, as many insurance providers now offer the same rates regardless of gender.

Teen drivers in Bellevue. NE face higher insurance rates, but Good Student and Driver’s Ed discounts can help.

| ZIP Code | Monthly Rate |

|---|---|

| 68005 | $110 |

| 68123 | $112 |

| 68147 | $109 |

| 68133 | $113 |

| 68157 | $114 |

| 68107 | $118 |

| 68117 | $116 |

| 68127 | $117 |

| 68128 | $115 |

| 68111 | $119 |

Where you live in Bellevue, NE can impact your car insurance rates. More traffic and a higher risk of accidents in busy areas often lead to higher premiums.

Auto Insurance Monthly Rates in Bellevue, NE by Provider & Credit Score

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $78 | $94 | $130 | |

| $75 | $89 | $125 | |

| $72 | $88 | $122 | |

| $80 | $96 | $134 | |

| $70 | $85 | $119 | |

| $82 | $98 | $140 |

| $77 | $93 | $129 |

| $73 | $90 | $128 | |

| $76 | $92 | $126 | |

| $79 | $95 | $132 |

To find the best car insurance policy for your vehicle and budget, enter your ZIP code to compare rates from top providers. This will help you make an informed decision based on your needs and location.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Bellevue’s Best Auto Insurance Companies

This car insurance guide helps you find the best provider for your vehicle needs. It highlights Geico, State Farm, and Progressive as top auto insurance options in Bellevue, NE.

Bellevue, NE Auto Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| Vehicle Theft Rate | A- | Low vehicle theft rate (approx. 1.8 per 1,000 vehicles). |

| Traffic Density | B+ | Generally moderate traffic; lower congestion than urban centers. |

| Average Claim Size | B | Average claim cost around $4,750, slightly below the national average. |

| Weather-Related Risk | B | Moderate risk due to seasonal snow, ice, and hail, but not extreme overall. |

| Uninsured Drivers Rate | B | Around 9.3% of drivers are uninsured — lower than national average (~12%). |

To secure the best auto insurance in Bellevue, NE, focus on comparing rates, available discounts, and your driving record.

Use these tips to find the right auto insurance in Bellevue that meets both your budget and coverage needs. This will ensure you get the best protection at an affordable price. Enter your ZIP code and start comparing rates.

Comparing auto insurance policies is essential to finding the best coverage at the best price. Take the time to explore your options and ensure you’re fully protected without paying more than necessary.

Daniel Walker Licensed Insurance Agent

Use these guidelines to secure the best auto insurance for your vehicle in North Dakota, ensuring both great value and safety. Simply enter your ZIP code to start.

Frequently Asked Questions

What makes Geico stand out as the top overall pick for auto insurance in Bellevue, NE?

Geico stands out in Bellevue, NE for its affordability and A++ rating, making it a top choice for budget-conscious drivers seeking reliable coverage.

What specific multi-policy discounts does State Farm offer to its clients in Bellevue, NE?

State Farm offers multi-policy discounts, allowing Bellevue residents to bundle home, auto, and other policies for substantial savings. Enter your ZIP code to see how much you can save.

In what ways can Auto-Owners’ bundling discounts help customers save on auto insurance premiums?

Auto-Owners’ bundling discounts allow customers to combine auto, home, and life insurance policies to lower their overall premiums in Bellevue.

How does The Hartford’s senior discount compare to competitors in Bellevue?

The Hartford’s senior discount program provides specialized savings for older drivers, making it an attractive option for Bellevue’s senior population.

What benefits do Liberty Mutual’s app features offer for managing auto insurance?

Liberty Mutual’s app management features let customers easily track their insurance policies, manage claims, and access support directly from their smartphones. Enter your ZIP code to explore the app’s benefits and start managing your insurance today.

What are the potential savings offered by Progressive’s Snapshot savings program?

Progressive’s Snapshot program offers savings based on a driver’s actual behavior, encouraging safe driving by rewarding those with good driving habits.

How does American Family’s regional expertise benefit auto insurance selection in Bellevue?

American Family’s regional expertise ensures that Bellevue residents receive coverage tailored to local laws and risks, providing better protection and service.

How do Farmers’ local agents improve the auto insurance experience in Bellevue?

Farmers’ local agents provide personalized service, helping customers tailor their auto insurance to specific needs and preferences in Bellevue. Enter your ZIP code to connect with a local agent today.

How does Nationwide’s Vanishing Deductible reduce out-of-pocket expenses over time?

Nationwide’s Vanishing Deductible program gradually reduces your deductible for each year you remain claim-free, helping you save on out-of-pocket costs in case of an accident.

What are the benefits of Allstate’s accident forgiveness policy for drivers in Bellevue, NE?

Allstate’s accident forgiveness policy ensures that your first accident won’t result in a premium increase, providing peace of mind to Bellevue drivers.