Best Jackson, MS Auto Insurance in 2025 (Review the Top 10 Companies Here)

The best Jackson, MS, auto Insurance options include Nationwide, Travelers, and State Farm. These providers deliver basic monthly coverage starting at $245, offering flexible coverage options. Compare quotes to find the best policy for your needs, and you can identify one that meets your needs and budget.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

UPDATED: Jan 28, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

3,071 reviews

3,071 reviewsCompany Facts

Full Coverage in Jackson MS

A.M. Best Rating

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviews 1,733 reviews

1,733 reviewsCompany Facts

Full Coverage in Jackson MS

A.M. Best Rating

Complaint Level

Pros & Cons

1,733 reviews

1,733 reviews 18,154 reviews

18,154 reviewsCompany Facts

Full Coverage in Jackson MS

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviewsThe three best Jackson, MS, auto insurance companies are Nationwide, Travelers, and State Farm. Their monthly premiums range from $245 to $287.

These companies are great because they offer cheap insurance, many options for coverage, and they are highly rated by their customers.

Our Top 10 Company Picks: Best Jackson, MS Auto Insurance

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 20% | A+ | Financial Safety | Nationwide |

| #2 | 13% | A++ | Safe Drivers | Travelers | |

| #3 | 17% | B | Cheap Rates | State Farm | |

| #4 | 10% | A+ | Budgeting Tools | Progressive | |

| #5 | 25% | A++ | Young Drivers | Geico | |

| #6 | 10% | A+ | Local Agents | Allstate | |

| #7 | 25% | A | Unique Benefits | Liberty Mutual |

| #8 | 16% | A++ | Add-Ons | Auto-Owners | |

| #9 | 20% | A | Safe-Driving Discounts | Farmers | |

| #10 | 10% | A | High-Risk Coverage | The General |

Whether you are in the market for standard liability, total protection, or other types of auto insurance coverage, these top picks will provide you with quality policies at a reasonable cost. Start saving on your auto insurance by entering your ZIP code and comparing quotes.

- Compare quotes to find the best auto insurance in Jackson, MS, for your budget

- Affordable rates depend on credit score, driving history, and vehicle type

- Bundle policies or apply discounts to lower your monthly premiums further

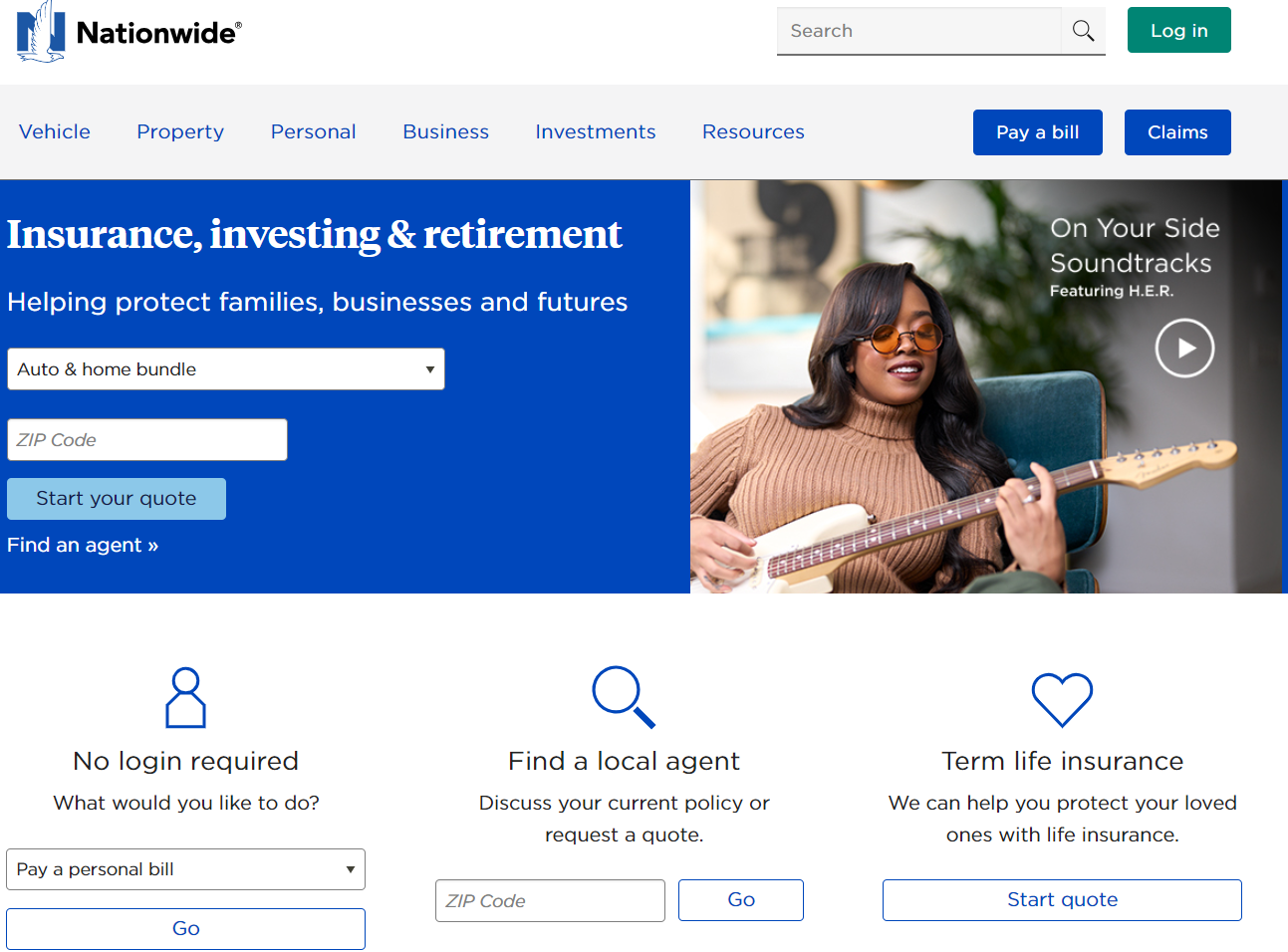

#1 – Nationwide: Top Overall Pick

Pros

- Various Coverage Options: Nationwide offers various coverage options with an extensive range of plans tailored to different needs in Jackson, MS.

- Smooth Claims Process: Mississippi customers appreciate the claims handling process as efficient and hassle-free.

- Bundling Discounts: Bundling together home and auto insurance often saves many thousands of dollars in Mississippi.

Cons

- Slightly Higher Rates: Jackson drivers may pay higher premiums. View our Nationwide auto insurance review to learn more.

- Fewer Local Agents: Some Jackson, MS areas might lack in-person agent availability.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#2 – Travelers: Best for Flexibility

Pros

- Customizable Policies: Travelers allow you to customize coverage to meet your specific needs in Mississippi.

- Savings for Safe Drivers: You can get amazing discounts with a clean record in Jackson. Access our Travelers auto insurance review for deeper details.

- Reliable Financial Support: They are known for being financially sound and bringing comfort to Mississippi.

Cons

- Inconsistent Customer Service: Some drivers in Mississippi report uneven experiences.

- Higher Deductibles: Policies may require a larger upfront payment for coverage in Mississippi.

#3 – State Farm: Best for Affordable Rates

Pros

- Low-Cost Coverage: State Farm offers some of the most budget-friendly options for Jackson, MS, residents.

- Plenty of Local Agents: Their strong local presence in Mississippi makes it easy to get personalized help.

- Great Discounts: Programs like good student and safe driving discounts can save Jackson residents money. For additional insights, read our State Farm auto insurance review.

Cons

- Limited Online Features: Their digital tools don’t match up to some competitors in Mississippi.

- Steep Rates for High-Risk Drivers: Drivers in Jackson with violations may see premiums rise sharply.

#4 – Progressive: Best for Drivers with Violations

Pros

- Best for High-Risk Drivers: Progressive is a go-to for Jackson residents with tickets or accidents.

- Snapshot Program: Safe driving can help you earn discounts through this program in Mississippi. Peruse our Progressive auto insurance review for complete details.

- Easy App and Website: Manage your policy online easily and conveniently.

Cons

- Mixed Reviews on Service: Some customers in Jackson report inconsistent claims experiences.

- Extras Can Be Costly: Adding optional features can increase your premium in Mississippi.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#5 – Geico: Best for Military Families

Pros

- Consistently Low Rates: Geico is renowned for its affordable policies in Jackson, MS. Read our Geico auto insurance review for all the information.

- Military Discounts: Service members and veterans stationed in Mississippi get special savings.

- Great Online Experience: Geico Jackson, MS. Their tools make managing your policy a breeze.

Cons

- Limited In-Person Support: There aren’t as many agents available in certain parts of Jackson.

- Basic Coverage Options: They don’t offer as many extras as some competitors in Mississippi.

#6 – Allstate: Best for Digital Tools

Pros

- Top-Tier App: Allstate covers everything from filing claims to accident support in Mississippi.

- Strong Local Presence: Many agents can help in Jackson, MS. Explore our Allstate auto insurance review for a detailed breakdown.

- Drivewise Rewards: Drivers in Mississippi can earn discounts for good driving habits.

Cons

- Higher Premiums: Allstate policies can be pricier than other providers in Jackson.

- Occasional Claims Delays: Some drivers report slow claim resolutions in Mississippi.

#7 – Liberty Mutual: Best for Customizable Plans

Pros

- Flexible Coverage Options: Liberty Mutual’s plans work well for various needs in Jackson, MS.

- Accident Forgiveness: Your first at-fault accident won’t lead to a rate hike in Mississippi.

- Multiple Discounts: Plenty of ways to save in Jackson, like bundling policies. Get the details in our Liberty Mutual auto insurance review to learn more.

Cons

- Unpredictable Pricing: Premiums can vary quite a bit in Jackson, depending on individual circumstances.

- Customer Service Complaints: Some Mississippi drivers report less-than-ideal experiences.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#8 – Auto-Owners: Best for Personal Service

Pros

- Friendly Local Agents: Auto-Owners is known for offering highly personalized service in Jackson, MS.

- Reasonable Pricing: Their premiums are competitive across Mississippi.

- Bundling Perks: Combining policies in Mississippi can lead to major discounts. Check out our entire Auto-Owners auto insurance review to discover more.

Cons

- Limited Digital Features: Their online tools don’t match up to larger companies in Mississippi.

- Coverage Gaps in Some Areas: Options may be more limited in certain parts of Jackson.

#9 – Farmers: Best for Customer Support

Pros

- Extremely Responsive Agents: Farmers is good at customer service in Jackson, MS.

- Flexible Coverage: The policy offers flexible coverage plans by providing different policy options suitable for Mississippi’s varied needs.

- Teacher discounts: In Jackson, teachers can earn discounted rates. Uncover the specifics in our Farmers auto insurance review to gain more knowledge.

Cons

- Premiums Tend to Be Higher: Farmers’ rates are generally expensive in Mississippi.

- Fewer Discounts: Compared to other providers in Mississippi, there are fewer savings opportunities.

#10 – The General: Best for Non-Traditional Policies

Pros

- Specialized Coverage for High-Risk Drivers: A solid choice for Jackson drivers with past violations.

- Budget-Friendly: Ideal if you’re looking for basic, affordable insurance in Mississippi.

- Quick and Easy Quotes: Getting started is fast and straightforward in Mississippi. Please find all the details in our The General auto insurance review to get the facts.

Cons

- Fewer Add-On Options: They offer fewer extra features than larger insurers in Jackson drivers.

- Financial Strength Concerns: Some Mississippi drivers may worry about their long-term stability.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Jackson, MS Auto Insurance Monthly Rates by Provider & Coverage Level

Based on our collected data, Nationwide, Travelers, and State Farm are the most affordable car insurance providers in Jackson, MS. As a bonus, they are priced well below the state average, a great value for motorists.

Jackson, MS Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $314 | $365 | |

| $320 | $385 | |

| $325 | $390 | |

| $285 | $356 | |

| $298 | $379 |

| $245 | $295 |

| $278 | $348 | |

| $287 | $345 | |

| $335 | $415 | |

| $265 | $310 |

Auto insurance carriers contemplate numerous variables when determining the best car insurance in Jackson, MS, particularly driving experience, where you live, occupation, education, and business use of the vehicle.

Auto Insurance Discounts From the Top Providers in Jackson, MS

| Insurance Company | Available Discounts |

|---|---|

| Multi-Policy, Safe Driving Club, Early Signing, New Car | |

| Multi-Policy, Safe Driver, Paid-in-Full, Student | |

| Multi-Policy, Homeowner, Good Student, Safe Driver | |

| Multi-Vehicle, Safe Driver, Anti-Lock Brake, Daytime Lights | |

| Multi-Policy, Safe Vehicle, Anti-Theft, New Car |

| Multi-Policy, Safe Driver, Anti-Theft, New Car |

| Multi-Vehicle, Continuous Insurance, Good Driver, Paid-in-Full | |

| Multi-Policy, Safe Driver, Good Student, Defensive Driver | |

| Safe Driver, Good Student, Multi-Vehicle, Anti-Theft | |

| Multi-Policy, Safe Driver, Good Student, Hybrid/Electric |

Moreover, affordable Jackson, MS auto insurance differs from provider to provider. To ensure you still receive the most affordable fee, look at low car insurance in Jackson, MS, quotes online.

Auto Insurance Coverage Requirements in Mississippi

Did you know that many drivers in Mississippi pay a significant amount each month for basic car insurance?

Mississippi Minimum Auto Insurance Requirements

| Coverage | Requirements | Most Common |

|---|---|---|

| Bodily Injury Liability | $25,000/$50,000 | 25,000/50,000 |

| Collision | Not required | $500 deductible |

| Comprehensive | Not required | $100 deductible |

| Medical Payments | Not required | $1,000 |

| Property Damage Liability | $25,000 | $25,000 |

| Uninsured Motorist Bodily Injury | Not required | $10,000/$20,000 |

However, in Jackson, you can get insured for less than $245/month if you know all the insurance company’s secrets.

Jackson, MS Report Card: Auto Insurance Premium

| Category | Grade | Explanation |

|---|---|---|

| Weather-Related Risks | A | Minimal weather-related damage, with rare severe storms. |

| Traffic Density | B+ | Moderate congestion in urban areas, with smoother rural traffic flow. |

| Average Claim Size | B | Slightly higher than average due to repair costs in urban zones. |

| Vehicle Theft Rate | C+ | Above-average vehicle theft incidents in high-risk areas. |

| Uninsured Drivers Rate | D | High rate of uninsured drivers, increasing premiums. |

Like most states, you only need Liability coverage to drive legally in Mississippi.

Jackson, MS Auto Accident & Insurance Claim Statistics

| Factor | Value |

|---|---|

| Accidents per Year | 1,500 |

| Claims per Year | 1,200 |

| Average Claim Cost | $7,000 |

| Percentage of Uninsured Drivers | 20% |

| Vehicle Theft Rate | 350 thefts/year |

| Traffic Density | Medium |

| Weather-Related Incidents | Low |

But remember: liability insurance only pays out claims when the accident is considered your fault. So, if your car is stolen, deemed a total loss, or an uninsured motorist hits you, you’ll have to pay for 100% of the repairs unless you have total loss car insurance or similar coverage.

Major Factors in Cheap Car Insurance in Jackson, Mississippi

There are many ways your car insurance rate may be determined. However, not all of it is out of your control; there are steps you can take to learn how to lower your auto insurance premiums and qualify for discounts.

Auto insurance rates in Jackson, MS, depending on factors like your ZIP code, driving history, and credit score. Drivers can lower premiums by maintaining good credit, bundling policies, or opting for higher deductibles to balance coverage and cost.

Ty Stewart Licensed Insurance Agent

The following are some factors to consider for getting great car insurance rates in Jackson, MS:

Your ZIP Code

Your Jackson, MS, auto insurance rates may differ based on where you call home. Generally, populous areas possess increased auto insurance rates because the additional number of drivers on the highway boosts the probability of a car accident! The population of Jackson is 172,638. Plus, the common family income is $29,811.

Automotive Accidents

If you live in an area with a lot of traffic, the odds are that the crash statistics will be higher as well.

Fatal Accidents in Jackson, MS

| Category | Count |

|---|---|

| Fatal Crashes Involving Drunk Persons | 3 |

| Fatalities | 14 |

| Pedestrians Involved in Fatal Accidents | 8 |

| Persons Involved in Fatal Crashes | 23 |

| Total Accident Count | 14 |

| Vehicles Involved in Fatal Crashes | 21 |

As the chart shows, Jackson has moderately high crash rates, especially considering the population.

Auto Thefts in Jackson

Even in small cities or outlying towns, automobile theft remains an issue. To help make it a lesser problem for you, consider investing in a passive anti-theft system on your vehicle. Your actual auto insurance company might compensate you with reduced prices!

In 2013, there were 1,054 auto thefts in Jackson. This is fairly high per capita. Protect yourself from theft by having Comprehensive coverage on your policy.

Your Credit Score

You may not think about your credit score that often, but your auto insurance company sure does. By examining the chart below, you can see what a significant difference your credit score can make.

Auto Insurance by Credit Score

| Insurance Company | Excellent Credit | Poor Credit |

|---|---|---|

| $43 | $74 |

| $43 | $43 | |

| $38 | $48 |

| $76 | $162 |

| $36 | $77 |

For some Jackson, MS, auto insurance companies, your monthly premium could skyrocket by 75% or more if you suffer from poor credit scores.

Your Age

Younger drivers are consistently charged higher monthly rates for their automobile insurance, no matter what insurance company is underwriting the policy. You might say it’s the price of growing up. If you are a new driver, ask car insurance Jackson, Mississippi agents about good student and Driver’s Education discounts.

Auto Policy Age Comparison

| Insurance Company | Age: 35 | Age: 17 |

|---|---|---|

| $37 | $162 |

| $38 | $138 | |

| $36 | $234 |

| $63 | $557 |

| $31 | $153 |

Older drivers, on the other hand, will generally pay much less for coverage. This is because their driving experience makes them less likely to get into an accident.

Your Driving Record

Another major factor that influences your auto insurance premiums is your driving record. For minor violations, such as a speeding ticket or a “fender-bender,” your insurance will increase somewhat (anywhere between 18% and 30%, depending on the violation).

Driving Violations

| Insurance Company | Clean Record | One Ticket | One DUI | One Accident |

|---|---|---|---|---|

| $37 | $49 | $62 | $51 |

| $38 | $55 | $66 | $68 | |

| $36 | $42 | $49 | $245 |

| $63 | $91 | $104 | $120 |

| $31 | $40 | $40 | $45 |

However, some companies with an “Accident forgiveness” policy may ignore past discrepancies from your record. But your car insurance rates could double in price overnight for more serious violations, such as a DUI. Some major providers might discontinue your coverage for being cited with a DUI or a reckless driving violation.

Your Vehicle

Thinking about purchasing insurance for a luxury vehicle? If you can afford it, go right ahead – but remember that you will need an equally luxurious insurance policy to protect yourself from accident- and theft-related expenses.

Car insurance by Make/Model

| Insurance Company | 2015 Honda Accord | 2012 Porsche Boxster Spyder |

|---|---|---|

| $37 | $147 |

| $38 | $181 | |

| $36 | $169 |

| $63 | $289 |

| $31 | $135 |

Economical cars, conversely, don’t require as much coverage and, therefore, have lower monthly rates.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Minor Factors in Cheap Auto Insurance in Jackson, Mississippi

In Mississippi, like in many other states, the factors below might also help you find the cheapest auto insurance and potentially lower your monthly payment for Jackson, Mississippi car insurance:

Your Marital Status

Sometimes, your single, married, or divorced marital status can significantly change your monthly rate. This is especially true for married couples who bundle their insurance policies together. With the right company, some couples can save as much as 32%.

Your Gender

Some providers handle gender differently—it matters to some companies but not others. Again, this fluctuation in price is little more than a few dollars per month. Whether you will be penalized or rewarded for being a member of a certain gender will vary from company to company.

Your Driving Distance to Work

The typical work commute will only last around 14-22 minutes for the average driver in Jackson. More than three-quarters of motorists will use their automobile to get around, while anywhere from 3-25% will likely carpool with friends or coworkers.

While liability insurance meets legal requirements, comprehensive coverage is crucial for protecting against theft or natural disasters. Drivers in Jackson with higher crime rates should consider this option to safeguard their vehicles and avoid out-of-pocket expenses.

Kristine Lee Licensed Insurance Agent

When comparing rates between companies, your premium may vary based on your total annual miles driven and the reason you’re driving (for fun, work, or business).

Your reason for being on the road and the total number of miles driven will generally significantly affect your monthly rate. Most auto insurance companies charge a moderately higher monthly premium for business vehicles.

Your Coverage and Deductibles

Trying to save money every month on your insurance? Many drivers achieve this goal by purchasing less coverage. But you can also purchase a few extra coverage benefits and offset the monthly cost by raising your deductible.

Which auto insurance gives best price?

byu/birdfeeder89 inmississippi

Make sure you put a little money away should you need to shell out the cash if you need to file a claim.

How we Conducted our Car Insurance Analysis

We calculated our average rate based on the following metrics: a married, 34-year-old male with good credit, a 12-month history of maintaining auto insurance, a clean driving record, and his own home. Miles driven annually were based on the national average. The average rate was also calculated based on a financed 2015 Honda Accord with a pre-installed anti-theft device.

Sources:

- Mississippi Insurance Department

- Mississippi Department of Finance and Administration

- Department of Highway Safety and Motor Vehicles

- City-Data.com

- Census.gov

If you want coverage to drive legally, enter your ZIP code to compare cheap auto insurance quotes near you.

Frequently Asked Questions

What are the best auto insurance companies in Jackson, MS?

Nationwide, Travelers and State Farm are the top-rated car insurance providers in Jackson, MS. They offer affordability, customer satisfaction, and coverage flexibility. Check out our “Cheap Pay-Per-Mile Insurance” to learn more.

How much do the top auto insurance providers charge monthly in Jackson, MS?

The best companies, including Nationwide, Travelers, and State Farm, provide options for cheap car insurance in Jackson, MS, with basic coverage starting at $245 per month and above.

What types of coverage do these Jackson, MS, insurance companies offer?

These providers offer various options, such as liability, full coverage, and customizable plans, making them contenders for the best car insurance in Mississippi.

Which provider is best for affordable rates in Jackson, MS?

State Farm stands out as one of the best for cheap auto insurance in Mississippi, offering competitive and reliable driver rates. Explore our “Car Insurance Rental Reimbursement Coverage” to get more details.

What factors influence auto insurance rates in Jackson, MS?

Premiums for auto insurance in Jackson, MS, are influenced by driving history, credit score, age, ZIP code, and the level of coverage chosen. Get fast and cheap auto insurance coverage today with our quote comparison tool.

Are there discounts available for auto insurance in Jackson, MS?

Yes, major Jackson MS auto insurance providers offer discounts such as bundling, good student discounts, and savings for vehicles with anti-theft systems.

Which company is best for drivers with past violations in Jackson, MS?

Progressive is a top choice for drivers with violations. It provides cheap auto insurance in Jackson, MS, with competitive rates and flexible options. Read our “The Most Expensive Cars To Insure” to learn more.

How does location within Jackson, MS, affect auto insurance rates?

The cost of car insurance in Jackson, MS, can vary by neighborhood due to accident rates, traffic density, and crime statistics.

What is the minimum required auto insurance coverage in Mississippi?

Drivers must have liability coverage to meet state laws, a common feature in cheap auto insurance in MS plans.

Which insurance company is best for personalized service in Jackson, MS?

Auto-Owners is well-regarded for its personalized service and has earned a reputation as one of the best Mississippi auto insurance providers. Discover our “Auto Insurance Coverage for Rental Cars.”

How does my vehicle type impact auto insurance rates in Jackson, MS?

Luxury cars generally lead to higher premiums, while economical vehicles are often covered by cheap car insurance in Mississippi plans.

What are some strategies to lower auto insurance premiums in Jackson, MS?

To find cheap full coverage car insurance in Mississippi, consider bundling policies, maintaining a clean driving record, and increasing your deductible. Please find the best auto insurance company near you by entering your ZIP code into our free quote tool.