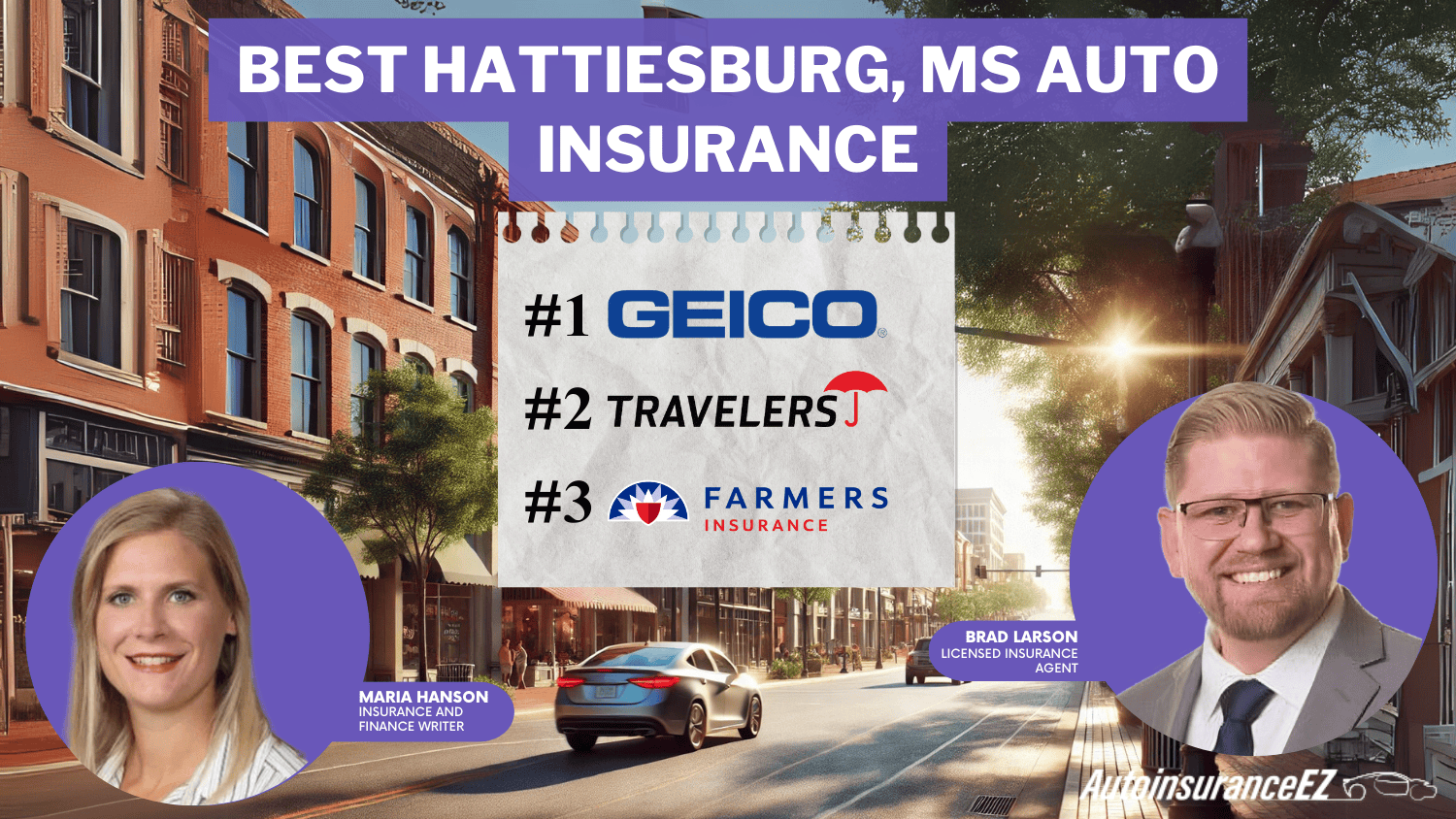

Best Hattiesburg, MS Auto Insurance in 2025 (Find the Top 10 Companies Here)

The best Hattiesburg, MS, auto insurance companies are Geico, Travelers, and Farmers, offering rates starting at $41 monthly. Explore these top providers to find competitive rates and quality service tailored to your needs. Learn more about the best Hattiesburg, MS, auto insurance in this guide.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Jan 28, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

19,116 reviews

19,116 reviewsCompany Facts

Full coverage in Hattiesburg MS

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 1,733 reviews

1,733 reviewsCompany Facts

Full Coverage in Hattiesburg MS

A.M. Best

Complaint Level

Pros & Cons

1,733 reviews

1,733 reviews 3,072 reviews

3,072 reviewsCompany Facts

Full Coverage in Hattiesburg MS

A.M. Best

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviewsThe best Hattiesburg auto insurance providers are Geico, Travelers, and Farmers, as rates start at $41 per month.

To acquire the best auto insurance, an individual must compare how much it will cost, the available types of auto insurance coverage, and the discounts on which factors will influence their actual charge.

Our Top 10 Company Picks: Best Hattiesburg, MS Auto Insurance

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | A++ | Lowest Rates | Geico | |

| #2 | 13% | A++ | Unique Coverage | Travelers | |

| #3 | 20% | A | Safe-Driving Discounts | Farmers | |

| #4 | 17% | B | Cheap Rates | State Farm | |

| #5 | 16% | A++ | Add-Ons Covergae | Auto-Owners | |

| #6 | 10% | A+ | Budgeting Tools | Progressive | |

| #7 | 25% | A | Affinity Discounts | Liberty Mutual |

| #8 | 20% | A+ | Multi-Policy Savings | Nationwide |

| #9 | 10% | A+ | Full Coverage | Allstate | |

| #10 | 10% | A | High-Risk Coverage | The General |

This article discusses prices, advantages, and possible savings for these top vendors. Continue reading to determine the auto insurance plan that best meets your budget and protection needs. Stop overpaying for auto insurance. Enter your ZIP code to find out if you can get a better deal.

- Compare top providers like Geico, Travelers, and Farmers for affordable rates

- Factors like credit score and driving record affect Hattiesburg auto insurance rates

- Geico offers the best value, with rates starting at $41 per month

#1 – Geico: Top Overall Pick

Pros

- Regarding Rates: Geico is considered to offer the lowest automobile insurance in Hattiesburg, MS. Read through our Geico auto insurance review for all the information.

- Great Array of Discounts: Mississippi drivers can select among great driving, military service, and policy bundle discounts.

- Simpler Online Access: In Hattiesburg, Geico also allows users to purchase automobile coverage online.

Cons

- Fewer Local Agents: Geico has fewer local offices in Hattiesburg, MS, which might limit the desire for individuals seeking personally brought support.

- Poor Credit History: Mississippi drivers with a poor credit history or minor recent accidents would pay higher premium rates.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#2 – Travelers: Best for Overall Coverage

Pros

- Flexible Coverage Options: Travelers offers extremely personalized coverage policies to meet individual requirements in Hattiesburg, MS.

- Excellent Customer Service: Mississippi residents often praise Travelers for responsive and helpful customer support. Explore our Travelers auto insurance review for a detailed breakdown.

- Accident Forgiveness: In case of minor accidents, accident forgiveness by Hattiesburg drivers will prevent surcharges in the subsequent renewal.

Cons

- Higher Premiums: Drivers in Mississippi might find Travelers’ full coverage more expensive than the competitor.

- Few Offers: Low offer options compared to other Hattiesburg, MS car insurance companies.

#3 – Farmers: Best for Customized Service

Pros

- Dedicated Agents: Farmers maintain a significant operation in Hattiesburg with dedicated local agents who provide individualized services.

- Customizable Coverage: Mississippi drivers can flex policies to suit their needs and ensure the best protection. Get the details in our Farmers auto insurance review to learn more.

- Safe Driver Discounts: In Hattiesburg, MS, promotions offer great savings to safe drivers.

Cons

- Processing Claims: Processing claims takes an average time above and beyond the rest in Mississippi.

- Higher Premium Rates on Young Drivers: Farmers insurance in Hattiesburg, MS, demands higher premium rates on younger drivers.

#4 – State Farm: Best for Customer Satisfaction

Pros

- Great Reputation: State Farm excels in providing solid customer satisfaction for car owners in Hattiesburg, MS.

- Local Agents: Many local agents are located in Hattiesburg, offering policyholders an excellent opportunity to receive personalized service.

- Good Student Discounts: Mississippi students with good grades may also enjoy discounts. Check out our entire State Farm auto insurance review to discover more.

Cons

- Lacked Internet Features: The online service might appear somewhat antiquated compared with others in Hattiesburg.

- Higher Rates for Older Autos: Mississippi drivers with older autos may be quoted lower rates.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#5 – Auto-Owners: Best for Bundled Policies

Pros

- Good for Bundling: Auto-Owners offers many discounts for combining home and auto insurance for Mississippi drivers in Hattiesburg.

- Excellent Claims Satisfaction: Hattiesburg, MS, customers appreciate the smooth claims process. Find all the details in our Auto-Owners auto insurance review to get the facts.

- Support: It strongly supports its resident Mississippians with a personalized product through local agents.

Cons

- The Weakness: The web tools are less robust for managing web accounts and may offer fewer conveniences for truckers in Hattiesburg.

- Not Available Nationwide: Coverage may be limited for drivers relocating outside Mississippi

#6 – Progressive: Best for Risk-Prone Driver

Pros

- Great Rates for Bad Drivers: Progressive is a low-cost auto insurance company for bad drivers in Hattiesburg. Read our Progressive auto insurance review for in-depth information.

- Snapshot Program: In Mississippi, drivers can use the Snapshot app to earn discounts based on safe driving habits.

- Flexible Payment Plan: Progressive offers flexible payment options that accommodate many budgets. Hattiesburg drivers can enjoy these options.

Cons

- High Mileage for Low-Mileage Drivers: Mississippi drivers who drive low mileage per year are unlikely to decrease much.

- Situations With Fewer Available Coverage Choices: In Hattiesburg, MS, driving may have fewer add-ons from other carriers.

#7 – Liberty Mutual: Best for New Car Owners

Pros

- New Car Replacement: Liberty Mutual assures vehicle drivers in Hattiesburg are covered with new car replacement coverage.

- Deep Discounts: In Hattiesburg, they offer discounts for multi-policy holders, safe drivers, new customers, and more. To expand your knowledge, refer to our full Liberty Mutual auto insurance review.

- Accident Forgiveness: Hattiesburg drivers are protected from rate increases after the first accident.

Cons

- Not the Cheapest: Other companies can be cheaper for Mississippi drivers than Liberty Mutual.

- Limited Local Offices: With fewer local offices in Hattiesburg, MS, in-person support is sometimes inconvenient.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#8 – Nationwide: Best for Safe Drivers

Pros

- Vanishing Deductible: With Nationwide’s program, safe drivers in Hattiesburg, MS, can lower their deductibles over time.

- Good Financial Solvency: Mississippi motorists rely on Nationwide for long-term solvency and claims payout.

- Defensive Driving Courses Discount: Additional discounts are available to Hattiesburg residents after completion of any accepted course.

Cons

- Less Competitive Rates for High-Risk Drivers: A driver with a spotty record may be considered in Hattiesburg, MS.

- Coverage: Fewer coverage options to specialize in than some insurers in Mississippi. Discover everything in our Nationwide auto insurance review to learn more.

#9 – Allstate: Best for Digital Tools

Pros

- Robust Online Tools: Allstate’s digital platform offers easy access to policy management for Hattiesburg, MS drivers.

- Safe Driver Incentives: Allstate’s Drivewise program would reward Mississippi drivers for safe driving. For more details, check our Allstate auto insurance review.

- Extensive Local Agent Network: Hattiesburg residents benefit from the availability of local agents for personalized assistance.

Cons

- Higher Premium for Younger Drivers: Allstate may charge a higher premium for youthful drivers from Hattiesburg, MS.

- Mixed Opinion: There are differing views regarding the company’s customer service in Mississippi, particularly during the claims process.

#10 – The General: Best for Low-Credit Drivers

Pros

- Low-Cost Insurance for the High-Risk Driver: The General offers low-cost auto insurance for high-risk drivers in Hattiesburg, MS.

- Flexible Payment Options: Mississippi drivers appreciate flexible payment schedules tailored to different budgets.

- Quick Online Quotes: Quick online quotes are available to Hattiesburg residents.

Cons

- Low Discounts: Mississippi drivers are discounted less than all other insurers.

- Higher Premiums for High Coverage: Drivers in Hattiesburg, MS, may have to pay much higher premiums. Learn more by exploring our The General auto insurance review.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Cheapest Auto Insurance Rates by Company

Let’s examine the top auto insurance companies in Hattiesburg, MS, and see which offers the most affordable rates.

Hattiesburg, MS Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $47 | $135 | |

| $44 | $126 | |

| $48 | $130 | |

| $41 | $118 | |

| $45 | $131 |

| $45 | $132 |

| $49 | $129 | |

| $43 | $123 | |

| $50 | $140 | |

| $46 | $128 |

Geico, Travelers, and Farmers Insurance offer the most affordable rates in Hattiesburg, MS. While Geico is usually cheaper than Travelers, it’s more expensive in Hattiesburg.

Auto Insurance Discounts From the Top Providers in Hattiesburg, MS

| Insurance Company | Available Discounts |

|---|---|

| Multi-Policy, Anti-Lock Brake, New Car, Safe Driver | |

| Multi-Policy, Paid-in-Full, Good Student, Anti-Theft | |

| Multi-Policy, Homeowner, Signal App, Alternative Fuel | |

| Good Driver, Multi-Policy, Seat Belt, Anti-Theft | |

| Multi-Policy, Safe Driver, New Car, Accident-Free |

| Multi-Policy, Defensive Driving, Accident-Free, Paperless |

| Multi-Policy, Continuous Insurance, Paperless, Online Quote | |

| Good Driver, Multi-Policy, Anti-Theft, Safe Vehicle | |

| Multi-Policy, Safe Driver, Military, Good Student | |

| Multi-Policy, Hybrid/Electric Vehicle, Safe Driver, Good Student |

Additionally, The General auto insurance is more expensive in Hattiesburg, MS. It is essential to compare auto insurance companies to find better rates, even though it may be cheaper in other states.

Hattiesburg, MS Auto Insurance Rates

It might seem inexpensive to drive in Mississippi since the state only requires liability insurance. However, you will be financially responsible for any repairs or medical bills if anything happens to your car which isn’t your fault. Ultimately, it can be expensive to drive in Mississippi.

Hattiesburg, MS Report Card: Auto Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| Traffic Density | B+ | Moderate traffic, manageable congestion |

| Weather-Related Risks | B- | Occasional severe weather events |

| Average Claim Size | B | Moderate claims, manageable costs |

| Vehicle Theft Rate | B | Slightly above national average |

| Uninsured Drivers Rate | D | High percentage of uninsured motorists |

Several factors that affect your car insurance premium can impact the auto insurance quotes you receive. While some are out of your control, others can work to your advantage. Here are a few aspects that might influence your insurance rate.

Age and Gender Affect Auto Insurance Rates in Hattiesburg

Your age will significantly impact how much you pay for your car insurance, but you may be able to offset costs with car insurance discounts. A young person under 25 might end up paying more than double the monthly rate of someone twice their age. Here are the differences in annual rates by age and gender.

Hattiesburg, MS Auto Insurance Monthly Rates by Provider, Age & Gender

| Insurance Company | Age: 18 Female | Age: 18 Male | Age: 25 Female | Age: 25 Male | Age: 30 Female | Age: 30 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| $193 | $223 | $69 | $72 | $64 | $67 | $59 | $60 | |

| $135 | $156 | $40 | $42 | $37 | $39 | $31 | $32 | |

| $258 | $271 | $66 | $68 | $61 | $64 | $47 | $50 | |

| $93 | $107 | $36 | $35 | $32 | $32 | $28 | $29 | |

| $231 | $279 | $72 | $83 | $67 | $77 | $60 | $64 |

| $131 | $167 | $52 | $57 | $48 | $53 | $39 | $41 |

| $251 | $281 | $52 | $54 | $48 | $50 | $35 | $36 | |

| $101 | $125 | $39 | $42 | $36 | $39 | $30 | $30 | |

| $269 | $316 | $104 | $109 | $95 | $99 | $85 | $87 |

| $223 | $310 | $40 | $44 | $37 | $40 | $35 | $35 |

As you can see, teen drivers pay the most for insurance in Hattiesburg, MS. Parents are likelier to be the primary policyholders, so a policy discount for teens would decrease expensive auto insurance rates. Drivers 25 years old and older pay less for auto insurance, so more policy discounts can help them slash rates even more.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

How ZIP Codes Impact Auto Insurance Rates in Hattiesburg

Hattiesburg auto insurance varies from ZIP code to ZIP code, with prices differing based on crime, traffic patterns, and accident rates. These factors directly influence auto insurance coverage premiums. Some ZIP codes offer lower prices, helping local people save on their coverage.

Companies Offer the Best Auto Insurance Rates in Hattiesburg

It’s best to shop for the best auto insurance rates, especially if you are looking for cheap auto insurance. Geico, along with other companies, offers competitive pricing, and the internet has made it very easy to research the cost of coverage.

We’ve done some leg work for you and researched the average annual rates of companies in the Hattiesburg area. If you want a more accurate auto insurance quote, enter your ZIP code in the free comparison tool to compare top Hattiesburg, MS, car insurance companies and find affordable auto insurance rates for Hattiesburg, MS.

Best Auto Insurance for Commute Rates

An insurance company may ask whether someone drives a car in Hattiesburg, MS, for work, school, or pleasure or whether it is a business vehicle. This determines how often you drive your car. If you drive your car less than average, you could pay less for auto insurance in Hattiesburg, MS. The average miles a Mississippi licensed driver travels are 17,699 miles per year.

Hattiesburg, MS Auto Insurance Monthly Rates by Annual Mileage

| Insurance Company | 6,000 Miles | 12,000 Miles |

|---|---|---|

| $393 | $393 | |

| $341 | $344 | |

| $375 | $375 |

| $223 | $223 |

| $351 | $351 | |

| $226 | $237 | |

| $308 | $308 | |

| $153 | $163 |

Geico, Travelers, and Farmers are the three cheapest auto insurance companies in Hattiesburg, MS. All other insurance providers have annual rates exceeding the city’s average annual rate.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Best Auto Insurance for Coverage Level

The only minimum requirement for Mississippi auto insurance is liability insurance coverage, but understanding the different types of car insurance can help you choose the best protection. Within liability insurance is something called coverage level. The coverage level, or coverage rule, determines the limits that will be covered under liability insurance.

Selecting the right auto insurance coverage involves balancing affordability with adequate protection. By comparing rates from top providers like Geico, Travelers, and Farmers, Hattiesburg, MS drivers can use competitive pricing and tailored policies to meet their specific needs.

Justin Wright Licensed Insurance Agent

In Mississippi, the minimum coverage level is $25,000 for bodily injury or death of one person per accident, $50,000 for bodily injury or death of multiple people per accident, and $25,000 for property damage per accident. Under these conditions, a coverage level would be abbreviated by a coverage rule, which is 25/50/25.

Which auto insurance gives best price?

byu/birdfeeder89 inmississippi

Medium and high coverage levels have higher coverage limits. For example, a medium and high coverage level would be 50/100/50 and 100/300/100, respectively. Let’s see how coverage levels affect annual rates.

Hattiesburg, MS Accidents & Claims per Year by City

| City | Accidents per Year | Claims per Year |

|---|---|---|

| Ellisville | 698 | 589 |

| Hattiesburg | 1,432 | 1,215 |

| Laurel | 982 | 812 |

| Petal | 834 | 720 |

| West Hattiesburg | 1,105 | 892 |

Low coverage rates are much cheaper but carry fewer policy limits. Enrolling in medium coverage levels may be in your best interest so you can be sure all medical bills, property damage, and other costs are covered.

Best Auto Insurance for Credit History

A high credit score will entitle you to some financial perks. One such perk is a lower monthly rate on your auto insurance policy. Drivers with lower credit scores are expected to pay more monthly to maintain insurance coverage.

Hattiesburg, MS Auto Insurance Rates by Credit History

| Insurance Company | Good Credit | Fair Credit | Poor Credit |

|---|---|---|---|

| $321 | $403 | $455 | |

| $218 | $293 | $516 | |

| $259 | $329 | $538 |

| $195 | $213 | $261 |

| $317 | $340 | $396 | |

| $159 | $203 | $334 | |

| $289 | $285 | $349 | |

| $118 | $141 | $215 |

You can receive massive savings just for having decent credit. According to the Federal Trade Commission, businesses and auto insurance companies issue lower rates for people with good credit. Auto insurance company statistics show that people with poor credit make more claims than people with good credit.

Best Auto Insurance for Driving Record

Driving violations have a noticeable impact on your monthly rate. You may lose coverage if a violation is severe enough, such as reckless driving or a DUI. Let’s look at how driving records affect annual rates.

Hattiesburg, MS Auto Insurance Monthly Rates by Driving Record

| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $330 | $390 | $476 | $376 | |

| $214 | $324 | $490 | $342 | |

| $266 | $426 | $436 | $374 |

| $179 | $227 | $288 | $198 |

| $300 | $404 | $348 | $352 | |

| $209 | $259 | $229 | $229 | |

| $269 | $281 | $388 | $293 | |

| $124 | $158 | $213 | $137 |

USAA offers the most affordable auto insurance in Hattiesburg, MS, while Allstate and Liberty Mutual have rates that exceed the local average. State Farm in Hattiesburg, MS, applies the same annual rate for drivers with a DUI as those with a speeding violation. However, at State Farm, accidents result in the largest increase in annual rates.

Talk to your insurance agent about less serious violations and see if your provider offers “Accident Forgiveness” discounts. If accidents are common on the roads where you drive most frequently, your insurance company will offset that risk by charging you higher rates.

The risk of being in a car accident in Hattiesburg, MS, is less frequent than in most cities, but auto insurance companies will continue to issue rates based on risk. You may ask, Is there a cheap car insurance company near me?

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Several Factors Affect Auto Insurance Rates in Hattiesburg

Location is a major factor in determining auto insurance rates and significantly affects the average cost. However, additional factors like road conditions, vehicle theft, and traffic can influence auto insurance rates in Hattiesburg, MS.

Let’s look at these factors to understand how they affect auto insurance.

Road Conditions

Road conditions can determine how much you’ll pay for everyday vehicle use. Tripnet, a nonprofit research organization, lists vehicle operating costs (VOCs), which vary based on road conditions. VOCs depend on how much you spend on vehicle use, such as fuel, repairs, maintenance, tires, and additional costs.

Understanding your auto insurance needs is key to finding the best policy. In Hattiesburg, MS, companies like Geico and Farmers provide affordable options with customizable coverage, helping drivers protect their vehicles while managing their budgets effectively.

Brandon Frady Licensed Insurance Agent

The nearest metro area to Hattiesburg is Jackson, MS. Hattiesburg is not a major metro area, but it shares the same road conditions as Jackson. The VOC in Jackson’s metro area is $944.

Vehicle Theft in Hattiesburg, MS

Neighborhood Scout reports that Hattiesburg residents have a one in 499 chance to become a victim of a violent crime and a one in 22 chance to become a victim of a property crime. Let’s look at the number of annual crimes in Hattiesburg.

The average chance a Hattiesburg resident will become a victim of violent crime is less likely compared to the state and national rates. However, property crime rates have doubled in Hattiesburg.

Hattiesburg, MS Crime Summary

| Crime Summary | Statistic |

|---|---|

| Number of Violent Crimes | 92 |

| Number of Property Crimes | 2,119 |

| Violent Crime Rate Per 1,000 Residents | 2 |

| Property Crime Rate Per 1,000 Residents | 46.11 |

| Crime Index | 5 |

| Chances to Become a Victim in a Violent Crime | 1 in 499 |

| Chances to Become a Victim in a Property Crime | 1 in 22 |

| Chances to Become a Victim in a Violent Crime in MS | 1 in 427 |

| Chances to Become a Victim in a Property in MS | 1 in 42 |

According to Neighborhood Scout, the crime index is five, where 100 is the safest. Here are 10 of Hattiesburg’s safest neighborhoods. Living in a major city makes you more prone to auto theft. Should your general locality have higher rates of theft claims, you can expect to spend a lot more on your auto insurance to counteract these prices.

Traffic Congestion in Mississippi

We searched Inrix, TomTom, and Numbeo for the latest traffic forecast in Hattiesburg, but no information was available. However, Hattiesburg has its share of traffic congestion, and the Jackson metro area also has a few traffic issues.

Unfortunately, fatal accidents are fairly high per capita in Hattiesburg, so check with your insurance agent to see if your company offers car insurance discounts.

Quick Commutes and Car Insurance Options in Hattiesburg, MS

Work commutes are typically short for those who live in Hattiesburg. On average, it will only take 17 minutes to drive to work. Hattiesburg, MS, population is less dense than most metropolitan areas. According to Data USA, 78% of commuters choose to get there in their vehicle alone, while another 8.16% prefer carpooling.

For information about auto insurance, visit our main page and browse through other articles, guides, and reviews. We’re among some of the best car insurance comparison sites. Enter your ZIP code to find the cheapest possible Hattiesburg, MS, auto insurance quotes from our free comparison tool!

Frequently Asked Questions

What factors affect car insurance rates in Hattiesburg, MS?

Several factors, including driving history, credit score, and ZIP code, can influence the cost of car insurance in Hattiesburg, MS. Check out our “Automobile Liability Coverage” to learn more.

Who offers the best car insurance in Mississippi?

The best car insurance in Mississippi includes companies like Geico and Farmers, known for their competitive rates and excellent coverage options.

Are there affordable auto insurance options near me?

You can find affordable auto insurance near me by comparing quotes from local providers or using online comparison tools.

How does credit history affect auto insurance rates in Hattiesburg?

Drivers with higher credit scores tend to receive lower rates, as insurers associate good credit with fewer claims. Explore our “Commercial Auto Insurance” to get more details.

Is Direct Auto Insurance a good choice in Hattiesburg, MS?

Direct Auto Insurance in Hattiesburg, MS, offers competitive pricing for drivers with diverse needs. Stop overpaying for auto insurance. Enter your ZIP code to find out if you can get a better deal.

Can I find cheap auto insurance near me for high-risk drivers?

Yes, companies like Progressive specialize in cheap auto insurance near me for high-risk drivers.

What makes State Farm a good option in Hattiesburg, MS?

State Farm in Hattiesburg, MS, is known for excellent customer service and robust policy options. Read our “Comprehensive and Collision Coverage” to find out more.

Are there options for cheap car insurance in Mississippi for young drivers?

Geico and Travelers often provide cheap car insurance for young drivers in Hattiesburg, MS, through discounts and safe driver programs.

What is the minimum auto insurance coverage required in Mississippi?

Mississippi requires liability insurance with minimum coverage of $25,000 per person, $50,000 per accident for bodily injury, and $25,000 for property damage (25/50/25).

Are there Direct auto insurance options in Hattiesburg, MS?

Yes, Direct Auto in Hattiesburg, MS, offers policies for budget-conscious drivers and those with unique needs. Discover our “Cheap Car Insurance Rates” for further insights.

What factors affect car insurance rates in Jackson, MS?

Factors like driving record, vehicle type, and credit score impact the best car insurance rates in Jackson, MS. To save on your auto insurance, enter your ZIP code and compare quotes.