Best Rockville, MD Auto Insurance in 2025 (Find the Top 10 Companies Here)

The best Rockville, MD, auto insurance providers are State Farm, Geico, and Progressive, costing about $90 a month. State Farm's Drive Safe & Save discounts safe driving, Geico offers multi-policy and military savings via its app, and Progressive's Snapshot rewards good driving habits.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Tim Bain

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Licensed Insurance Agent

UPDATED: Apr 23, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

18,154 reviews

18,154 reviewsCompany Facts

Full Coverage in Rockville MD

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in Rockville MD

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage in Rockville MD

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsState Farm, Geico, and Progressive are the best Rockville, MD auto insurance providers, offering standout coverage at about $90 per month.

State Farm earns top marks for agent-driven service and high claims satisfaction, Geico delivers the lowest rates with generous discounts, and Progressive leads with its snapshot program and flexible, tech-forward policies.

Our Top 10 Company Picks: Best Rockville, MD Auto Insurance

| Company | Rank | A.M. Best | Bundling Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | A++ | 17% | Reliable Coverage | State Farm | |

| #2 | A++ | 25% | Affordable Rates | Geico | |

| #3 | A+ | 10% | Custom Policies | Progressive | |

| #4 | A+ | 25% | Safe Drivers | Allstate | |

| #5 | A++ | 13% | Home Bundles | Travelers | |

| #6 | A+ | 20% | Accident Forgiveness | Nationwide |

| #7 | A | 25% | New Vehicles | Liberty Mutual |

| #8 | A++ | 25% | Rate Stability | Erie |

| #9 | A++ | 10% | Military Families | USAA | |

| #10 | A | 20% | Multi-policy Discounts | Farmers |

This guide ranks the top providers based on cost, customer satisfaction, features, and financial stability. Discover a top selection for the best cheap or best quality auto insurance coverage in Rockville, MD, at these three.

- The best Rockville, MD auto insurance meets local coverage and service needs

- State Farm provides local agents and reliable, personalized claims assistance

- Geico offers fast digital quotes and easy policy management, from $90 a month

In our guide below, we will compare auto insurance companies to find the cheapest Rockville, MD auto insurance with dependable service for your peace of mind. Enter your ZIP code now to begin.

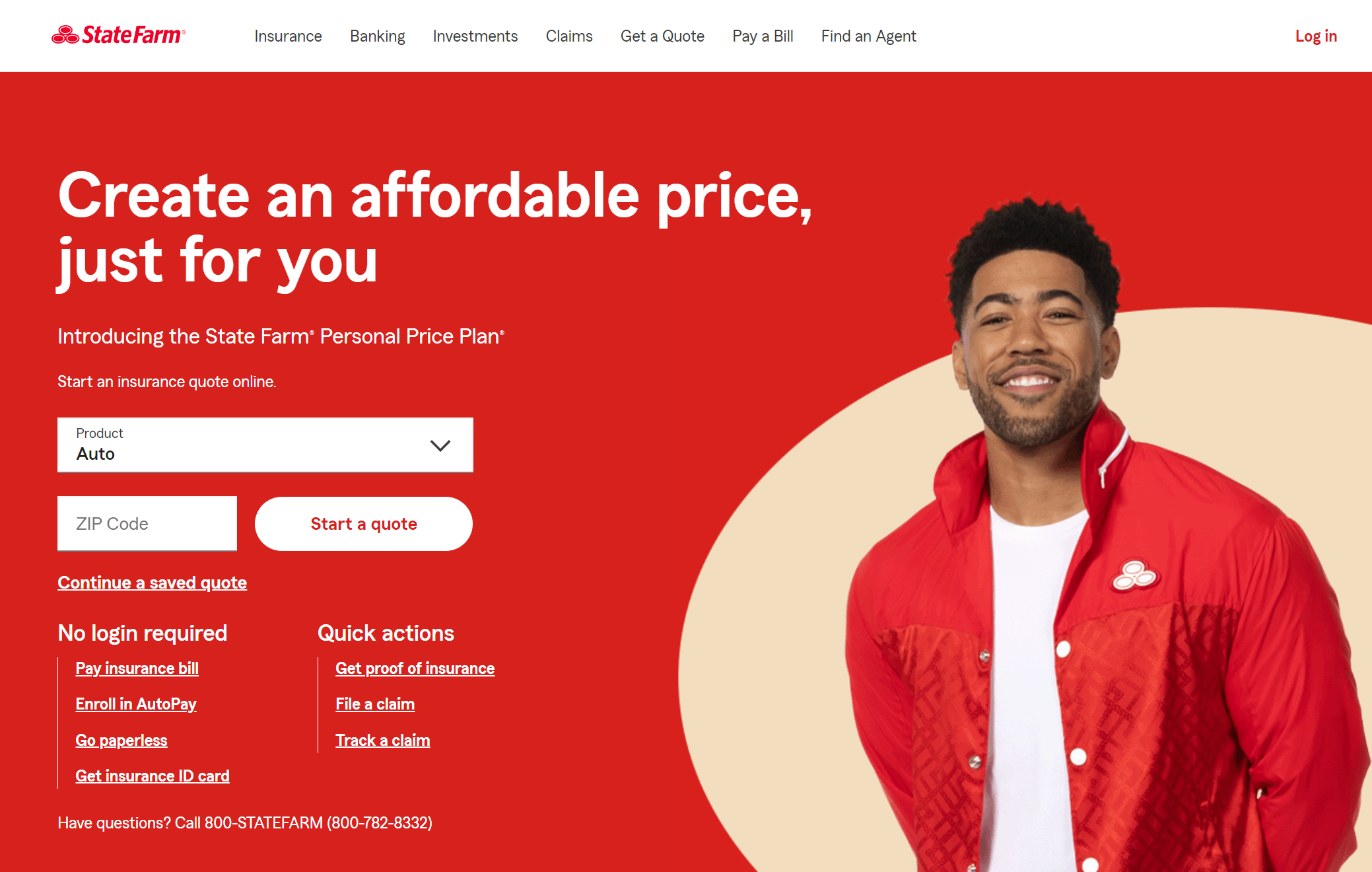

#1 – State Farm: Top Overall Pick

Pros

- Reliable Coverage: With reliable claims handling and long-lasting coverage, State Farm serves Rockville drivers well.

- Strong Financial: State Farm is rated A++ (Superior) by A.M. Best, so claims should be handled quickly and efficiently. Read more in our full State Farm review.

- Wide Agent Network: A strong local presence ensures Rockville drivers have easy access to in-person help from experienced agents.

Cons

- Limited Digital Tools: State Farm’s app and online platform lack the advanced features many modern Rockville drivers expect.

- Higher Rates for High-Risk Drivers: Drivers with past violations or claims may find premiums noticeably higher than with competitors.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#2 – Geico: Best for Affordable Rates

Pros

- Low Prices: Featuring some of the lowest starting APRs in Rockville, Geico is right up there among the most affordable car insurers.

- Bundling: Renters and homeowners insurance can save Rockville homeowners as much as 25% on auto coverage.

- User-Friendly Experience: Locals can manage their policies and claims on Geico’s website and app. To learn more, read the Geico review.

Cons

- Lack of Local Offices: Since Geico primarily operates online, Rockville drivers who prefer face-to-face assistance might find the service less personal.

- Limited Policy Flexibility: The coverage tends to be generic, which may not meet the needs of drivers seeking more customized insurance.

#3 – Progressive: Best for Custom Policies

Pros

- Personalized Coverage: With Progressive, there are plenty of policy features to choose from, so Rockville drivers can customize coverage to suit their unique situation.

- Name Your Price Tool: This tool lets Rockville residents start with a budget and see policy options that fit within what they’re willing to spend. Get a complete view in our Progressive review.

- Accident Forgiveness: Progressive offers accident forgiveness options, which can help protect Rockville drivers from rate increases after their first at-fault accident.

Cons

- Modest Bundling Discount: Progressive’s bundling savings top out at around 10%, which may be lower than other providers in the Rockville area.

- Inconsistent Claims Satisfaction: While some customers have positive experiences, others in Rockville have reported delays or lack of clarity during the claims process.

#4 – Allstate: Best for Safe Drivers

Pros

- Drivewise Safe Driving Rewards: Rockville drivers can get discounts for safe-driving habits through Allstate’s Drivewise program. Read our Allstate review for details.

- Great Bundling Potential: Receive up to 25% off if you bundle your auto policy with a home or renters policy with Allstate.

- Strong Financial Foundation: With an A+ rating, Allstate is well-equipped to manage claims reliably for policyholders in Rockville.

Cons

- Premiums can be High: Without qualifying for discounts, Allstate’s base rates in Rockville may be on the higher side.

- Average Tech Features: Allstate’s app and online tools are serviceable but not as advanced or user-centric as those offered by top competitors.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#5 – Travelers: Best for Home Bundles

Pros

- Ideal for Bundling With Home Insurance: Travelers offers notable savings for Rockville homeowners who bundle auto and home coverage under one policy.

- Excellent Financial Strength: The A++ rating from A.M. Best reinforces Travelers’ reliability in meeting claims obligations. Find the full list in our Travelers review.

- Optional Coverage Add-ons: While building their own policy, Rockville drivers can add extra protections like gap insurance, accident forgiveness, and roadside assistance.

Cons

- Fewer Discounts Available: The list of standard discounts from Travelers is less generous than its peers in Rockville.

- Varied Agent Experience: Service satisfaction may differ depending on the local Rockville agent or office, affecting the overall experience.

#6 – Nationwide: Best for Accident Forgiveness

Pros

- Accident Forgiveness Option: This extra benefit prevents Rockville policyholders from experiencing premium increases after their first at-fault accident. Learn more in our Nationwide review.

- Decent Bundling Savings: Rockville’s best auto insurance companies like Nationwide provide savings of up to 20% on auto coverage for bundling with home or life insurance.

- Annual Policy Review: Nationwide’s On Your Side review helps Rockville policyholders reassess their coverage needs and identify potential savings each year.

Cons

- Limited Online Functionality: The app and website have fewer features than those of some competing services, which could be a negative for tech-savvy Rockville customers.

- Not all Discounts Equal: Some discounts have stricter requirements than others, which may make them less easily obtainable by certain Rockville drivers.

#7 – Liberty Mutual: Best for New Vehicles

Pros

- Good for new Cars: Liberty Mutual includes new car replacement coverage, which is useful for Rockville drivers who are in the market for a new car.

- Bundled Savings Incentives: Rockville drivers often have various insurance needs, bundling multiple policies can help them save up to 25% on overall costs. Read more in our Liberty Mutual review.

- Variety of Coverage Options: Policyholders have a long menu of add-ons from which to choose, including rental car reimbursement and custom parts coverage.

Cons

- Lower Financial Strength Rating: While still stable, the A rating from A.M. Best is below several competitors offering insurance in Rockville.

- Higher Premiums for Younger Drivers: Liberty Mutual often charges higher rates for young or newly licensed drivers in the Rockville area.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#8 – Erie: Best for Rate Stability

Pros

- Rate Lock Program: Erie offers a Rate Lock program, keeping premiums steady unless changes are made — giving Rockville motorists added peace of mind.

- Outstanding Financial Rating: Erie holds an A++ (superior) financial rating from A.M. Best, showing a high degree of reliability in its ability to pay claims. Highlights are in our review of Erie.

- A Good Price to Value Ratio: Erie offers top-tier service at a reasonable price, making it one of the best options for cost-conscious drivers in Rockville.

Cons

- Agents Only: Erie policies are only sold through local agents, which may be less convenient for some Rockville residents.

- Basic Digital Tools: The online experience is minimal, which may not appeal to drivers who prefer managing their policies digitally.

#9 – USAA: Best for Military Families

Pros

- Service-Related Benefits: Because USAA offers special benefits to service members and their families, it is the top auto insurance provider in Rockville, Maryland.

- Best for Financial Stability: A.M. gave USAA an A++ rating, ideal for processing claims in a trustworthy manner. See our USAA review to learn more.

- Excellent Client Satisfaction: If you or your family are in the military, USAA’s first-rate insurance coverage and timely claims assistance are a huge benefit to Rockville’s military community.

Cons

- Restricted Eligibility: Because USAA primarily covers military families, many Rockville residents are not eligible, despite the fact that it provides excellent coverage.

- Limited Physical Presence: Those who prefer in-person service may find USAA’s limited number of physical offices close to Rockville inconvenient.

#10 – Farmers: Best for Multi-Policy Discounts

Pros

- Multi-Policy Discounts: Farmers gives Rockville drivers up to 20% off when they combine home, life, or other insurance policies with their auto. See more in our Farmers review.

- Options for Specialty Coverage: Rising gig economy of Rockville is catered for by unique add-ons including OEM parts and rideshare coverage.

- Local Agent Access: Farmers has agents in Rockville that combine personalized service with local knowledge.

Cons

- Customer Service: Experiences vary across different agents and locations, so the level of service you get in Rockville can be a bit hit-or-miss.

- Greater Base Premiums: Farmers’ rates might be more costly than those of other leading Rockville providers if there are no discounts or bundling.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Cost of Auto Insurance in Rockville, MD

Finding the best Rockville, MD auto insurance starts with comparing rates and understanding the local factors that influence what you pay each month. Whether you’re interested in minimum liability or full coverage, reviewing provider pricing is the first step.

The table below displays average monthly premiums for the best insurers providing both minimum and full coverage in Rockville, where USAA and Geico offer the most affordable coverage, and companies like Liberty Mutual and Farmers have the most expensive rates. So, these figures are crucial to forming a general idea about the average auto insurance, covering the area.

Rockville, MD Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $125 | $185 | |

| $110 | $170 |

| $130 | $190 | |

| $95 | $150 | |

| $140 | $200 |

| $120 | $175 |

| $115 | $165 | |

| $105 | $160 | |

| $132 | $180 | |

| $90 | $145 |

To better understand why these rates vary, the next table breaks down key local factors—such as weather, traffic, and theft—that directly impact insurance premiums in Rockville.

Rockville, MD Report Card: Auto Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| Weather-Related Risks | A | Mild weather patterns |

| Uninsured Drivers Rate | B | Moderate uninsured drivers |

| Vehicle Theft Rate | B | Below-average theft rate |

| Average Claim Size | C | Average claim expenses |

| Traffic Density | C | Moderate traffic volume |

By comparing coverage costs alongside Rockville’s risk profile, you’ll be better equipped to choose the best Rockville, MD auto insurance for your budget and driving needs.

Maryland Coverage Upgrades

Meeting the legal minimums keeps your tags valid, but most drivers add protection so a single wreck—or a random hailstorm—can’t drain the savings account. Here are the five coverages Rockville motorists upgrade most often:

- Higher Liability Limits: Bumping the baseline 30/60/15 to 50/100/50 or 100/300/100 gives you a bigger cushion for other people’s medical bills and property repairs after a major at-fault crash.

- Uninsured/Underinsured Motorist (UM/UIM): Maryland requires at least 30/60/15 for UM, but matching your higher liability limit—or choosing the state’s “Enhanced UIM” option—means your payout won’t shrink when the at-fault driver carries little or no insurance.

- Personal Injury Protection (PIP) Boost: The statutory $2,500 no-fault limit disappears quickly after an ambulance ride; raising it—or pairing basic PIP with inexpensive Medical Payments (MedPay)—covers more medical and wage losses for you and your passengers.

- Collision & Comprehensive: This optional duo fixes or replaces your vehicle after crashes, theft, vandalism, fire, flood, hail, or animal strikes. Lenders and lessors almost always insist on both.

- Supplementary Add-Ons: Gap (loan-lease) coverage, rental-reimbursement, roadside assistance, and higher towing limits plug common gaps for just a few dollars a month.

Get quotes for each add-on and other auto insurance types from at least two insurers; you’ll often find the extra peace of mind costs less than a weekly coffee run.

Maryland Minimum Auto-Insurance Requirements

To title and register a vehicle in Maryland, you must keep these coverages active at all times. A lapse, even one day, triggers fines and a registration suspension.

In Maryland you must keep coverage active at all times—liability of $30k/$60k/$15k, UM/UIM of at least the same (or a $75 k single limit), and $2,500 in PIP unless every adult waives it—while an FR-19 proof can be demanded by the MVA anytime; a single-day lapse triggers a $200 fine plus $7 for each extra day (capped at $3,500) and a registration suspension.

These figures are only the legal floor, so most advisors urge bumping liability to at least 50/100/50 with matching UM/UIM to keep one bad crash from gutting your finances.

Think of these figures as a legal floor, not a financial safety net; most advisors recommend raising liability to at least 50/100/50 and carrying matching UM/UIM auto insurance coverage so a single serious crash can’t wipe out your finances.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Rockville, MD Auto Insurance Discounts

While choosing a monthly premium is an obvious step to saving money on car insurance in Rockville, MD, it’s also important to take advantage of valuable discounts that top providers offer.

The table below gives indication how much drivers can save with major insurers through bundling, safe driving, good student performance, and loyalty incentives. For example, Nationwide provides up to 40% off if you are a good driver, and State Farm has the highest good student discount at 25%.

Auto Insurance Discounts From the Top Providers in Rockville, MD

| Insurance Company | Bundling | Defensive Driving | Good Driver | Good Student | Loyalty |

|---|---|---|---|---|---|

| 25% | 10% | 25% | 20% | 15% | |

| 25% | 20% | 23% | 15% | 10% |

| 20% | 10% | 30% | 15% | 12% | |

| 25% | 15% | 26% | 15% | 10% | |

| 25% | 10% | 20% | 15% | 10% |

| 20% | 10% | 40% | 15% | 13% |

| 10% | 31% | 30% | 10% | 13% | |

| 17% | 15% | 25% | 25% | 7% | |

| 13% | 20% | 10% | 8% | 9% | |

| 10% | 5% | 30% | 10% | 11% |

Coupled with an understanding of local insurance risks, taking advantage of policy savings such as a multi-car discount for insuring multiple vehicles under one plan can significantly lower your premium.

These discounts not only simplify coverage management but also help you secure cheap car insurance without compromising on essential protection.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

What is the best car insurance in Maryland for Rockville, MD auto insurance?

The best car insurance provider in Rockville, Maryland is State Farm. It ranks first overall for offering reliable coverage and has an A++ financial strength rating from A.M. Best, which signals excellent trust and performance.

Who has the best rates for Rockville, MD auto insurance right now?

Geico currently provides the most affordable rates for auto insurance in Rockville. It offers a bundling discount of up to 25 %, making it a top choice for cost-conscious drivers. Need basic coverage? Compare cheap quotes by ZIP code.

Why is car insurance so expensive in MD, especially in Rockville?

Car insurance is often expensive in Maryland and particularly in Rockville because of its dense population, frequent traffic congestion, and higher likelihood of accidents, all of which contribute to how traffic violations increase car insurance rates.

Which company has the best reputation for Rockville, MD auto insurance?

Both State Farm and Geico have outstanding reputations in the Rockville area. Each company holds an A++ rating from A.M. Best, indicating superior financial stability and trustworthy customer service.

What month is auto insurance most expensive in Rockville, MD?

Auto insurance tends to be most expensive during the spring and summer months in Rockville. This is when more people are buying cars or moving, leading to increased demand and in turn higher rates.

What’s the simplest way to lower your premium for Rockville, MD auto insurance?

One easy way to reduce your auto insurance premium in Rockville is by bundling your car policy with renters or homeowners insurance. Geico, Allstate, and Liberty Mutual offer bundling discounts of up to 25 %.

How do I find the best auto insurance deals in Rockville, MD?

To find the best deals, compare quotes from multiple insurance providers. Focus on companies like Geico, State Farm, and Progressive, which are highly rated and offer valuable discounts for safe drivers, bundled policies, and more.

What factors affect auto insurance rates in Maryland?

Several factors influence auto insurance rates in Maryland, including your driving record, location, age, gender, type of vehicle, credit score, how much you drive annually, and your selected level of coverage.

Is it cheaper to get car insurance in Rockville, MD, compared to other Maryland cities?

Insurance is usually more expensive in Rockville than in smaller Maryland cities because of its higher population density, heavier traffic, and increased risk of car accidents and auto claims.

Are there any Maryland-based discounts for auto insurance?

While the data does not specify state-exclusive discounts, companies like Erie and Nationwide offer features such as accident forgiveness and rate stability, which are particularly helpful for Maryland drivers.

What discounts are available for auto insurance in Rockville, Maryland?

Available discounts in Rockville include bundling, safe driver rewards, new vehicle discounts, accident forgiveness, and multi-policy discounts. Providers like Geico, Allstate, Erie, and Liberty Mutual offer some of the most generous savings.

What coverage levels are most common among Rockville, MD drivers?

Many Rockville drivers go with full coverage, which combines liability with comprehensive and collision coverage to offer stronger protection in busy urban areas.

How does traffic or accident data in Rockville, MD, impact insurance rates?

Insurance companies view Rockville as a higher-risk area because of its heavy traffic and frequent accidents, which directly lead to increased insurance premiums.

What’s the average premium for full coverage auto insurance in Rockville, MD?

Full coverage auto insurance in Rockville generally falls within a moderate to high price range annually, with exact costs depending on your provider and personal factors like driving history. Compare quotes for quick, affordable auto insurance today.

Which Maryland insurers offer the best claims support for Rockville residents?

State Farm, Erie, and USAA offer some of the best claims support for Rockville residents. All three have A++ financial ratings and are known for efficient claims processing and strong customer satisfaction, making them ideal if you need to know how to file an auto insurance claim.