Best Baltimore, MD Auto Insurance in 2025 (Review the Top 10 Companies Here)

Geico, State Farm, and Erie offer the best Baltimore, MD, auto insurance, with beginning rates of only $107 a month. They are highly focused on providing comprehensive coverage and cost-effectiveness for their customers. Compare their policies to find the ideal option for your vehicle needs in Baltimore, Maryland.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Licensed Insurance Agent

UPDATED: Apr 13, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in Baltimore MD

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,154 reviews

18,154 reviewsCompany Facts

Full Coverage in Baltimore MD

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 1,883 reviews

1,883 reviewsCompany Facts

Full Coverage in Baltimore MD

A.M. Best Rating

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviewsThe best Baltimore, MD auto insurance providers are Geico, State Farm, and Erie, with affordable rates for as low as $107 per month for premiums and dependable coverage.

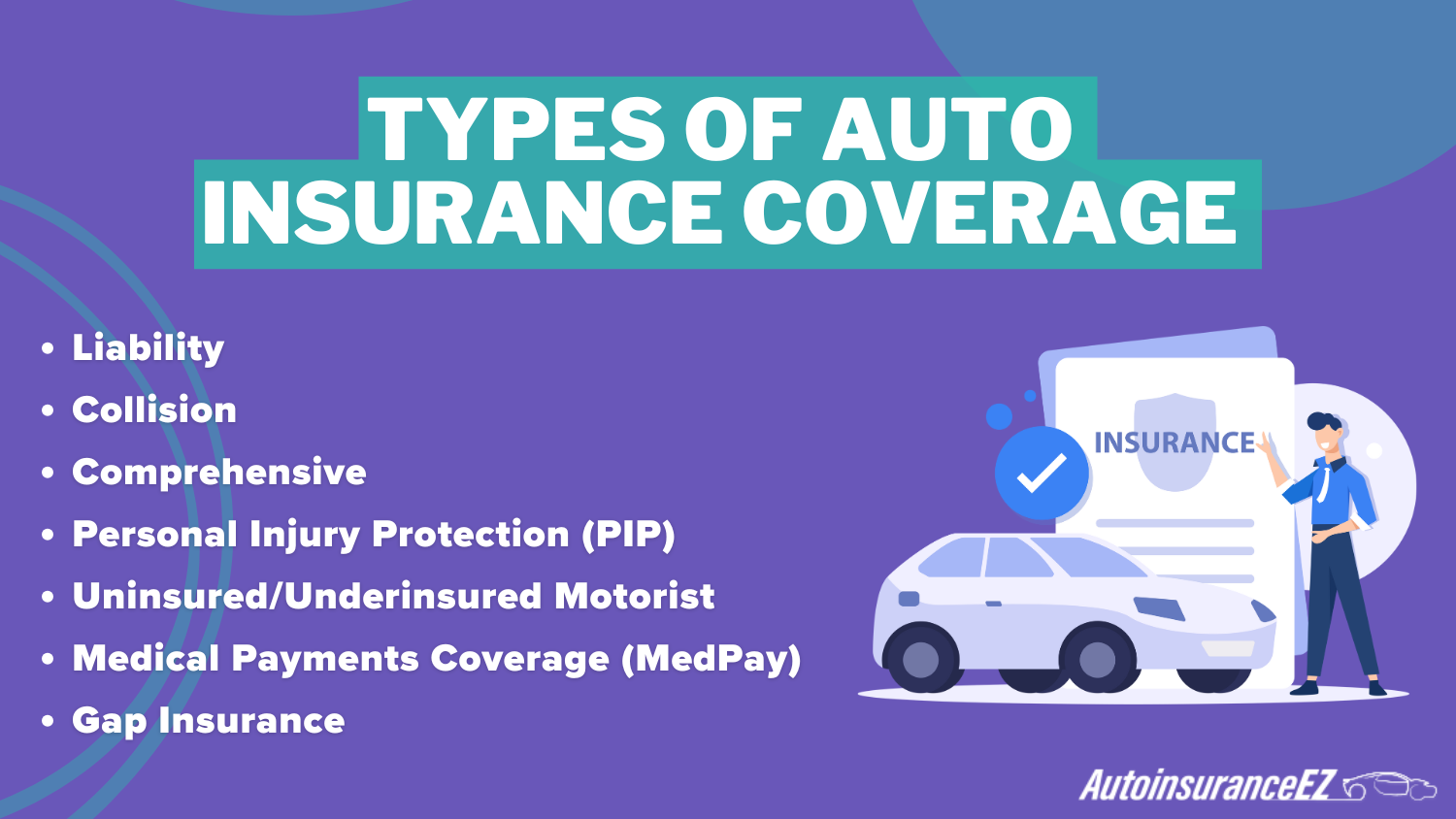

And learn about the different types of auto insurance coverage and decide which option is best suited to your experience in Baltimore, Maryland.

Our Top 10 Company Picks: Best Baltimore, MD Auto Insurance

| Company | Rank | A.M. Best | Monthly Rates | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | A++ | $142 | Affordable Rates | Geico | |

| #2 | B | $149 | Customer Service | State Farm | |

| #3 | A++ | $143 | Local Agents | Erie |

| #4 | A+ | $153 | Coverage Options | Progressive | |

| #5 | A+ | $165 | Agent Network | Allstate | |

| #6 | A++ | $136 | Military Families | USAA | |

| #7 | A+ | $157 | Deductible Perks | Nationwide |

| #8 | A++ | $159 | Custom Coverage | Travelers | |

| #9 | A | $160 | Discount Variety | Liberty Mutual |

| #10 | A+ | $155 | AARP Members | The Hartford |

It’s helpful to understand what these options mean so that you can feel confident when choosing a policy that works for you.

- Find the best Baltimore, MD auto insurance tailored to your needs

- Compare top providers to choose the right fit for Baltimore drivers

- Geico offers dependable coverage starting at just $107 per month

Don’t let expensive insurance stop you from getting the coverage you need. Click on your ZIP code now to start comparing and shopping for affordable premiums from top-caliber companies.

#1 – Geico: Top Overall Pick

Pros

- Affordable Coverage Options: Geico’s low rates make it one of the cheapest choice for auto insurance in the city. For more details, take a look at our Geico auto insurance review.

- Easy Digital Access: With a highly-rated mobile app, Geico offers convenient management of policies and claims for Baltimore residents on the go.

- Fast Claims Processing: Geico’s streamlined process guarantees a quick turnaround on claims, making it a reliable choice for efficient coverage in Baltimore.

Cons

- Limited Personalized Service: When it comes to low-cost insurance policies, Geico is a great option — but might miss the personalized touch that some Baltimore drivers desire.

- Fewer Bundling Opportunities: Compared to other insurers, Geico may not offer as many options for bundling policies to maximize your savings in the Baltimore area.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#2 – State Farm: Best for Customer Service

Pros

- Top-Notch Customer Service: State Farm is consistently ranked as one of the best auto insurance providers for Baltimore drivers.

- Local Expertise: With an extensive network of agents at your service, State Farm provides personalized advice that meets the needs of Baltimore. Read our State Farm auto insurance review for details.

- Discounts for Baltimore Drivers: With various discounts, like being a safe driver or bundling policies, State Farm is a cost-effective option for many in the area.

Cons

- Higher Rates for Younger Drivers: For younger drivers in Baltimore, State Farm may offer less competitive rates compared to other providers.

- Less Customization: Baltimore residents looking for more flexibility in their coverage options might find State Farm’s plans more standardized.

#3 – Erie: Best for Local Agents

Pros

- Great Value for Safe Drivers: Erie typically offers low premiums, especially in the Baltimore area, for policyholders with a clean driving record.

- Local Agents: In Baltimore, Erie has a strong network of agents so you can get in-person, personalized advice.

- Car Rental Coverage: Unique coverage options, such as for car rentals, add value to your auto insurance policy, a key advantage for Baltimore drivers who frequently rent cars. Read more through our Erie auto insurance review.

Cons

- Limited Availability: Erie’s coverage is not available in every state, which can be a drawback if you move outside Baltimore.

- Customer Support Hours: While Erie is reliable, it doesn’t offer 24/7 claims support, which may be inconvenient for some drivers in Baltimore.

#4 – Progressive: Best for Coverage Options

Pros

- Tailored Coverage Plans: Suitable for Baltimore drivers seeking specialized protection, Progressive has flexible coverage options available.

- Best for Cheap car Insurance: Progressive consistently earns top marks for low rates without cutting back on coverage.

- Innovative Tools: With tools like Name Your Price, Progressive allows Baltimore drivers to tailor their coverage to fit their budget and needs. Read our Progressive auto insurance review for breakdown.

Cons

- Complex Pricing Structure: Progressive’s system can be confusing, particularly for Baltimore drivers who are unfamiliar with insurance.

- Limited In-Person Service: Progressive doesn’t have as many local agents as some competitors, which may make it less appealing to those in Baltimore looking for face-to-face support.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#5 – Allstate: Best for Agent Network

Pros

- Extensive Agent Network: Allstate’s vast network of independent agents allows you to access tailored advice and service.

- Multiple Discounts: Allstate offers various discounts for safe driving, bundling, and more, giving Baltimore residents plenty of ways to save.

- Comprehensive Coverage: With features like accident forgiveness, Allstate is a top choice for Baltimore drivers looking for solid coverage. To learn more, read our full Allstate auto insurance review.

Cons

- Higher Premiums for Riskier Drivers: Allstate may charge more than other insurers, making it pricier for high-risk drivers in Baltimore.

- Slower Claims Processing: Baltimore residents have reported slower resolution, which may affect the overall experience.

#6 – USAA: Best for Military Families

Pros

- Best for Military Families: USAA serves Baltimore’s military families with top coverage and service.

- Highly Competitive Rates: USAA is a top pick for Baltimore drivers seeking budget-friendly insurance.

- Best Claims Service: USAA earns high marks for fast, reliable claims support. Read more through our USAA auto insurance review.

Cons

- Exclusively for Military Members: USAA’s services are limited to military families, so it’s not an option for all Baltimore residents.

- Few Local Agents: USAA’s limited network of local agents means that Baltimore drivers may have to rely more on digital service than personalized, in-person consultations.

#7 – Nationwide: Best for Deductible Perks

Pros

- Unique Perks: Perks like disappearing deductibles make Nationwide a smart pick for Baltimore drivers wanting extras.

- Strong Customer Support: Nationwide provides service, with a user-friendly mobile app for managing policies and claims. For deeper details, access our Nationwide auto insurance review.

- Great for Multi-Car Policies: Drivers in Baltimore with multiple vehicles can benefit from significant savings through Nationwide’s multi-car discounts.

Cons

- Higher Rates for Drivers with Claims: Drivers in Baltimore with a history of accidents may find Nationwide’s rates higher than other providers.

- Limited Customization: Baltimore drivers looking for highly customized coverage options may find Nationwide’s plans more restrictive.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#8 – Travelers: Best for Custom Coverage

Pros

- Customizable Coverage: Travelers allows Baltimore drivers to customize plans to fit their needs.

- Mobile Convenience: Use a top-rated app to easily manage policies and file claims anytime.

- Discounts for Safe Driving: Drivers with clean records can unlock discounts that help lower premiums. Read our Travelers auto insurance review for more.

Cons

- Higher Rates for New Drivers: Younger or less experienced drivers in Baltimore may face higher premiums with Travelers.

- Delayed Claims Processing: Some customers in Baltimore have reported longer wait times for claims resolution.

#9 – Liberty Mutual: Best for Discount Variety

Pros

- Wide Range of Discounts: Liberty Mutual offers savings for students, safe drivers, and more—great for affordable coverage in Baltimore.

- Comprehensive Coverage Options: A range of add-ons helps Baltimore drivers find the right fit.

- Strong Financial Stability: Strong finances mean dependable claims support. Learn more in our Liberty Mutual auto insurance review.

Cons

- Higher Premiums for Riskier Drivers: Drivers with poor records in Baltimore might find the rates less competitive.

- Slow Online Customer Support: Some customers in Baltimore report that Liberty Mutual’s online support can be slow, which may be frustrating for policyholders needing quick assistance.

#10 – The Hartford: Best for AARP Members

Pros

- Exclusive Discounts for AARP Members: The Hartford offers retirement-age drivers special rates in Baltimore, making it a good option for seniors who qualify through AARP.

- Great Customer Support: The company is praised for offering timely and dependable customer service when drivers need help the most.

- Unique Coverage Options: Perks like vanishing deductibles add value for those wanting custom protection. Read our The Hartford auto insurance review for details.

Cons

- Limited Discounts for Non-AARP Members: The Hartford’s discounts are mostly geared toward AARP members, making it less ideal for non-members in Baltimore.

- Higher Premiums for Younger Drivers: Like others, The Hartford’s rates may be less favorable for drivers in Baltimore.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Compare Auto Insurance Options in Baltimore, MD

If you’re searching for affordable auto insurance, Maryland drivers have plenty to choose from. Whether you’re an auto insurance shopper comparing plans or exploring auto insurance coverage options, it helps to see what’s available in your area.

This breakdown focuses on auto insurance in Baltimore rates and highlights what leading Baltimore auto insurance companies charge for both minimum and full coverage. It’s a useful guide for anyone researching auto insurance in Baltimore, MD.

Baltimore, MD Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $137 | $165 | |

| $110 | $143 |

| $113 | $142 | |

| $128 | $160 |

| $131 | $157 |

| $125 | $153 | |

| $118 | $149 | |

| $129 | $155 |

| $132 | $159 | |

| $107 | $136 |

Knowing your auto insurance coverage options will help you find a plan that meets your preferences and price. This table gives the auto insurance shopper a clear comparison of monthly rates from top providers.

From affordable auto insurance, Maryland to detailed insights on auto insurance Baltimore, the data highlights what real Baltimore auto insurance companies are offering today. Whether you’re new to the market or reevaluating your current policy, it’s a smart step toward better auto insurance in Baltimore, MD.

Find Great Car Insurance Rates in Baltimore, MD

Want to find affordable auto insurance online without sacrificing coverage? Knowing where the best auto insurance discounts are is key whether you’re a safe driver, a student or just someone looking to save.

The chart below lists auto insurance discounts from top providers in Baltimore, MD — including the anti-theft device discount, bundling policies, clean driving records, and more.

Auto Insurance Discounts From the Top Providers in Baltimore, MD

| Insurance Company | Anti-Theft | Bundling | Good Driver | Good Student | Loyalty |

|---|---|---|---|---|---|

| 10% | 25% | 25% | 25% | 15% | |

| 15% | 25% | 23% | 15% | 10% |

| 25% | 25% | 26% | 15% | 10% | |

| 35% | 25% | 20% | 12% | 10% |

| 5% | 20% | 40% | 18% | 8% |

| 25% | 10% | 30% | 10% | 13% | |

| 15% | 17% | 25% | 35% | 6% | |

| 10% | 5% | 15% | 12% | 7% |

| 15% | 13% | 10% | 8% | 9% | |

| 15% | 10% | 30% | 10% | 11% |

Choosing the right provider could mean hundreds in annual savings, especially if you qualify for multiple discounts. Take advantage of bundling policies, maintaining a good driving record, or simply sticking with one provider.

Baltimore, MD Report Card: Auto Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| Average Claim Size | B | Moderate claim size |

| Weather-Related Risks | B | Occasional severe weather |

| Traffic Density | C | High congestion |

| Uninsured Drivers Rate | C | Notable uninsured rate |

| Vehicle Theft Rate | D | High theft rate |

If you’re ready to buy cheap auto insurance online or just explore options for better auto insurance, this breakdown gives you a great starting point. Happy saving.

Baltimore, MD Automated Insurance

Auto insurance costs in Baltimore, MD, are associated with the provider, driver history, and the risk factor of the overall city. With thousands of accidents annually, a significant amount of vehicle theft, and a large percentage of uninsured drivers to contend with, premiums are often modified accordingly.

For drivers comparing policies, it’s important to understand both the cost and the local risks that influence it — especially when choosing comprehensive and collision auto insurance coverage. The table below shows monthly rates from leading providers in Baltimore:

Baltimore, MD Auto Insurance Monthly Rates by Provider & Coverage Type

| Insurance Company | Collision | Comprehensive |

|---|---|---|

| $80 | $130 | |

| $70 | $125 |

| $65 | $120 | |

| $85 | $135 |

| $75 | $128 |

| $68 | $122 | |

| $72 | $126 | |

| $78 | $129 |

| $82 | $132 | |

| $60 | $180 |

These pricing differences are closely tied to citywide data that impacts how insurers assess risk. The next table highlights important factors, including accident frequency and claims volume, that influence premium rates in the area:

Baltimore, MD Auto Accident & Insurance Claim Statistics

| Factor | Value |

|---|---|

| Total Accidents Per Year | 5,347 |

| Total Claims Per Year | 4,500 |

| Average Claim Size | $6,500 |

| Percentage of Uninsured Drivers | 14% |

| Vehicle Theft Rate | 3,183 thefts/year |

| Traffic Density | High |

| Weather-Related Incidents | Moderate |

Using both the risks and rates to inform their decisions, Baltimore drivers can make more informed choices about their collision and comprehensive auto insurance coverage, to find the right balance between protection and price.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Average Auto Insurance Rates in Baltimore, MD

Baltimore, MD, car insurance rates are determined by many different factors, including a driver’s driving history, the type of vehicle, and the selected types of auto insurance. A clean driving record generally results in lower rates; things like tickets, accidents, and DUIs tend to send premiums soaring. The table below shows how top providers adjust rates according to driving records:

Baltimore, MD Auto Insurance Monthly Rates by Provider & Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $233 | $250 | $300 | $400 | |

| $200 | $215 | $250 | $350 |

| $120 | $150 | $180 | $250 | |

| $210 | $225 | $270 | $375 |

| $190 | $205 | $240 | $340 |

| $180 | $200 | $240 | $330 | |

| $130 | $150 | $180 | $250 | |

| $220 | $235 | $280 | $385 |

| $145 | $160 | $190 | $270 | |

| $101 | $120 | $150 | $200 |

Beyond driving history, vehicle make and model also play a major role in how much drivers pay. High-end or performance vehicles tend to cost more to insure than standard models.

The next table compares monthly premiums for two different cars — a 2024 Honda Accord and a 2024 Porsche Boxster Spyder — to highlight how vehicle choice impacts rates across the same auto insurance types:

Baltimore, MD Auto Insurance Monthly Rates by Make & Model

| Insurance Company | 2024 Honda Accord | 2024 Porsche Boxster Spyder |

|---|---|---|

| $242 | $500 | |

| $181 | $400 |

| $138 | $423 | |

| $173 | $450 |

| $142 | $480 |

| $173 | $440 | |

| $121 | $140 | |

| $150 | $460 |

| $155 | $455 | |

| $165 | $395 |

By comparing rates between driving records and types of vehicles, Baltimore drivers can get insight into their options and find profiles that suit their needs and budgets.

Key Considerations for Affordable Auto Insurance in Baltimore, Maryland

Several lifestyle aspects help manage auto insurance cost in Baltimore, MD. Here’s how each can influence your rate:

- Marital Status: Being married may unlock savings, especially when combining policies or bundling home and auto coverage under the same provider.

- Multi-Policy Discounts: Insurers love to reward customers who bundle auto, home and other coverage under the same company roof with big discounts.

- Multi-Car Households: Insuring more than one vehicle under the same policy can result in discounted premiums.

- Gender Impact: Although less common today, some providers still consider gender in rate calculations — it’s worth asking about when comparing companies.

- Commute Distance: Long daily commutes can affect rates slightly, but listing a car for business use may increase premiums by 10% or more.

- Driving Habits in Baltimore: Around 55% of drivers in Baltimore commute solo, while 35% use carpools or public transit — factors that could influence usage-based pricing.

- Deductible Flexibility: Raising your deductible can lower your monthly premium, but it’s wise to keep emergency funds on hand for unexpected expenses.

- Coverage Choices: Monthly premium costs are reflected directly by the amount of coverage chosen along with limits and extras.

- Education Level: Insurance companies may offer better rates to drivers with higher levels of education, a factor often considered in underwriting.

Basing buying decisions on coverage, bundling, and driving habits, along with understanding the various factors that affect your car insurance premium, can help Baltimore drivers find affordable auto insurance.

Affordable Car Insurance in Baltimore, MD

Understanding what goes into your car insurance premium is the best way to find the coverage-and-cost battleground that works for you. Top providers, including Geico, State Farm, and Erie, for affordable car insurance in Baltimore, offer competitive rates, solid coverage, and valuable discounts for drivers looking for cheap rates.

Whether it’s for the least expensive auto insurance Baltimore has available, or just to get more out of your policy, it’s a good idea to compare rates.

Always compare quotes and choose coverage based on your driving habits and risks—it’s the smartest way to get the protection you need at the best price.

Chris Abrams Licensed Insurance Agent

Some insurers also provide incentives such as a claim-free discount, which can have a considerable impact on your premium if you have a spotless driving record. Taking the time to compare options helps make sure you’re getting the coverage you need — at a price you can afford.

This way, no one will be able to take advantage of you. Enter your ZIP code now to begin comparing rates.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

What is the cheapest car insurance in Baltimore City?

USAA offers the cheapest monthly rate at $136, but it’s only available to military families. For most drivers, Geico is the most affordable widely available option in Baltimore at $142 per month, followed closely by Erie at $143.

Why is Baltimore car insurance so high?

Baltimore car insurance is higher due to heavy traffic, high vehicle theft rates, and frequent claims — even clean records don’t always lower premiums. Compare auto insurance by entering your ZIP code now.

Who has the best auto insurance rates in Baltimore right now?

USAA, Geico, and Erie currently offer the best rates in Baltimore. USAA leads at $136 a month with its military auto insurance for service members and their families, while Geico and Erie offer competitive rates at $142 and $143, respectively.

Is car insurance more expensive in Baltimore?

Yes, insurance is usually more expensive in Baltimore than in suburban or rural Maryland. That’s mostly because of higher accident rates, more frequent claims and an increase in car theft that raises risk profiles and premiums.

Who has the best car insurance rates in Maryland?

In the Baltimore area, Geico, Erie, and USAA consistently rank among the best for low rates and customer satisfaction. Statewide, these companies are also strong contenders, with State Farm and Progressive also being popular for their service and coverage options.

Why is my car insurance so high in Baltimore with a clean record?

Even with a clean record, Baltimore rates stay high due to crime, traffic, and claims — but providers like Geico, Erie, and State Farm remain competitive, and knowing how to file an auto insurance claim can help you navigate the process when needed.

How can I lower my car insurance premium in Baltimore without reducing coverage?

Comparing rates and shopping around can bring down your premium. Geico and Erie are two of the less expensive options. You can also bundle policies, ask about discounts for things like a safe driver or multi-policy and increase your deductible modestly if you can afford it.

Does Baltimore offer any local programs or discounts for low-income drivers?

While there are no city-specific programs listed in the table, companies like Liberty Mutual offer a variety of discounts that may benefit lower-income drivers. It’s best to ask insurers directly about income-based or needs-based assistance.

What coverage is required by law for drivers in Baltimore, MD?

Maryland drivers must carry at least 30/60/15 in liability coverage, along with uninsured motorist and PIP coverage — which often raises the question, what is liability auto insurance, and how does it protect you in the event of an at-fault accident?

How does vehicle theft in Baltimore affect insurance rates?

Vehicle theft drives up insurance costs in Baltimore, and insurers like Geico, Erie, and State Farm adjust comprehensive rates to reflect that risk — especially for street parking or high-theft areas. Type in your ZIP code to find the cheapest auto insurance rates and avoid overpaying.