Best South Portland, ME Auto Insurance in 2025 (Top 10 Companies Ranked)

Geico, Allstate, and Safeco offer the best South Portland, ME auto insurance, with monthly rates starting at $26. Geico leads with affordable premiums and A++ claims handling. Allstate excels with personalized agent support, and Safeco stands out for online tools and safe-driving cashback programs.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

UPDATED: Feb 1, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in South Portland ME

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage in South Portland ME

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews 1,277 reviews

1,277 reviewsCompany Facts

Full Coverage in South Portland ME

A.M. Best Rating

Complaint Level

1,277 reviews

1,277 reviewsThe best South Portland, ME auto insurance providers are Geico, Allstate, and Safeco, with monthly rates starting at $26. Geico is the top choice for its affordable rates, excellent customer service, and broad coverage options.

Allstate stands out for local agent support, and Safeco offers vital online tools. Read this article to compare auto insurance coverage options and discover premium plans that fit your needs.

Our Top 10 Company Picks: Best South Portland, ME Auto Insurance

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | A++ | Affordable Rates | Geico | |

| #2 | 25% | A+ | Local Agents | Allstate | |

| #3 | 15% | A | Online Tools | Safeco | |

| #4 | 10% | A+ | Comprehensive Coverage | Progressive | |

| #5 | 25% | A | Safe-Driving Discounts | Liberty Mutual |

| #6 | 20% | A+ | Vanishing Deductible | Nationwide |

| #7 | 13% | A++ | Comprehensive Coverage | Travelers | |

| #8 | 5% | A+ | AARP Members | The Hartford |

| #9 | 17% | B | Bundling Options | State Farm | |

| #10 | 30% | A+ | Dividend Payments | Amica |

If you’re looking to lower your auto insurance premiums, Enter your ZIP code into our free quote comparison tool to compare your rates against the top insurers.

- Discover the best South Portland, ME auto insurance with tailored coverage options

- Geico offers top affordability with rates starting at just $26/month

- Compare quotes to find the best auto insurance in Maine for your budget and needs

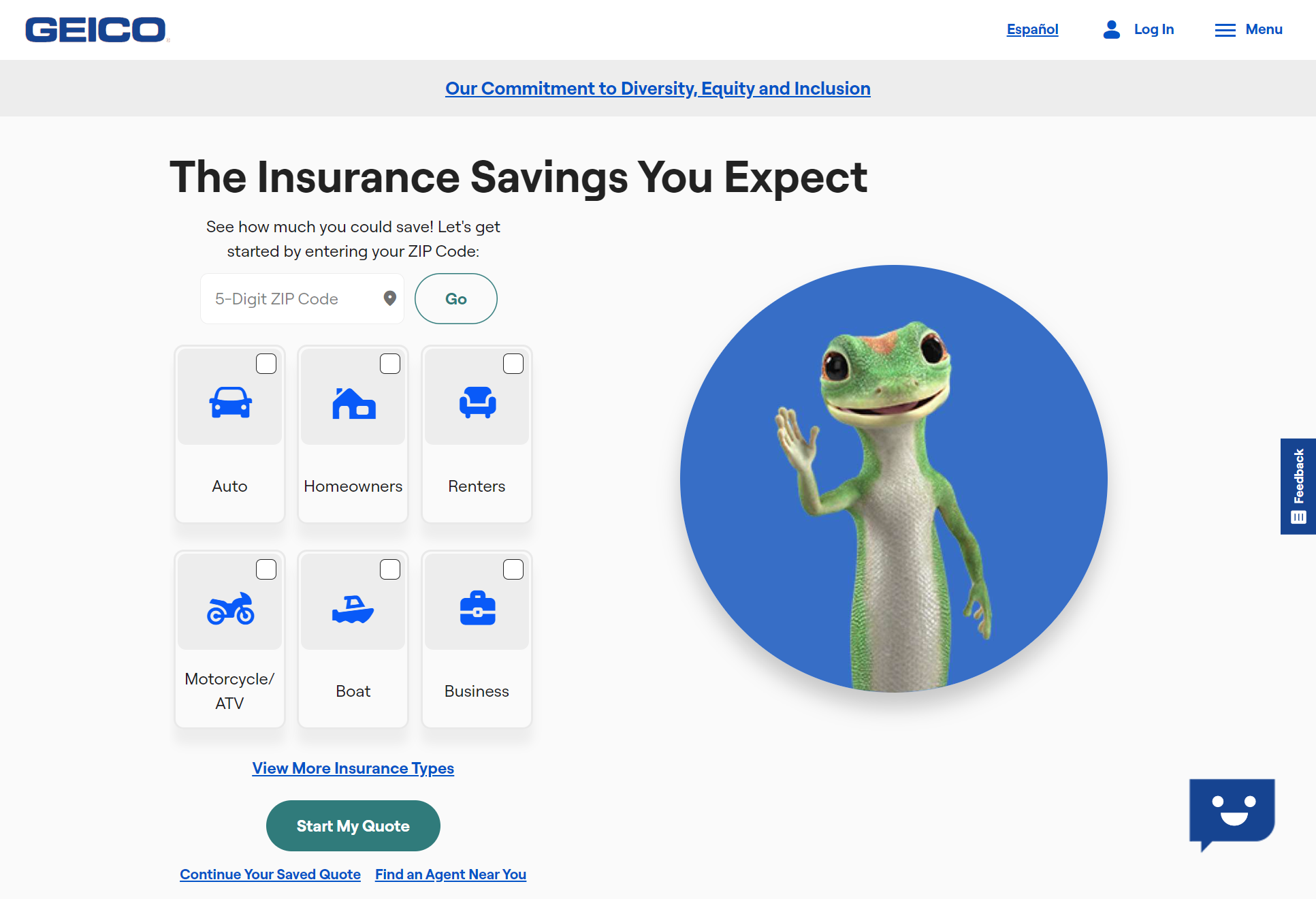

#1 – Geico: Top Overall Pick

Pros

- Cost-Affordable Rates: Geico offers some of the cheapest auto insurance in Maine for South Portland drivers, starting at $26/month for minimum coverage.

- Broad options for discounts: Drivers in Maine can cut costs significantly with their vast discount options, such as good student, military, and multi-vehicle savings.

- Strong Reputation and Reliability: Geico’s A++ rating ensures dependable claim handling for policyholders in South Portland, Maine. Find out more by reading our Geico auto insurance review.

Cons

- Limited Local Agent Support: Residents of South Portland, ME, may find Geico’s online and phone-based service less personal.

- Higher Premiums for High-Risk Drivers: Maine drivers with prior violations face higher rates than competitors.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#2 – Allstate: Best for Local Agents

Pros

- Tailor-Fit Services: Allstate is known for its wide variety of local insurance agents who can offer personalized policies to South Portland, Maine drivers.

- Far-reaching Discounts: South Portland residents may enjoy some of the benefits of Allstate’s auto insurance policy, such as safe driving bonuses, multi-policy discounts, and early signing incentives.

- Excellent Digital Tools: Provides South Portland, ME drivers with convenient apps and online policy management tools. Elevate your knowledge with our Allstate auto insurance review.

Cons

- Higher Base Premium: At $32/month, Allstate’s base rates can be costly for Maine drivers.

- Complex Discount Eligibility: South Portland residents may need to meet stringent requirements to maximize savings.

#3 – Safeco: Best for Online Tools

Pros

- User-Friendly Online Tools: Digital innovations such as the RightTrack program award South Portland motorists for good habits.

- Customizable Coverage Options: Offers flexible plans tailored to meet specific Maine driver needs.

- Safe Vehicle Discounts: South Portland residents with safety-equipped cars enjoy added savings. Uncover more about our Safeco auto insurance review by reading further.

Cons

- Lower Discount Rates: Drivers in South Portland, ME, may find Safeco’s maximum 15% discount less competitive.

- Limited Local Presence: Emphasis on digital services may not appeal to Maine residents seeking in-person interactions.

#4 – Progressive: Best for Comprehensive Coverage Options

Pros

- Comprehensive Coverage Options: Offers policies with gap insurance and roadside assistance tailored for South Portland, Maine drivers.

- Snapshot Program Discounts: Rewards safe South Portland, ME drivers through telematics-based premium reductions. Explore further details in our Progressive auto insurance review.

- Affordable Options for High-Risk Drivers: Provides competitive rates for Maine drivers with prior incidents or violations.

Cons

- Higher Minimum Coverage Costs: Progressive’s base rates in South Portland are above average, starting at $30/month.

- Privacy Concerns with Telematics: Some Maine drivers may feel uneasy about Snapshot’s real-time data tracking.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Best for Safe-Driving Discounts

Pros

- Safe Driving Discounts: South Portland, Maine residents benefit from claims-free and vehicle safety savings.

- Bundled Insurance Savings: Maine drivers can save up to 25% by combining home or renters insurance.

- Exclusive Online Purchase Benefits: Offers discounts for South Portland residents purchasing policies online. Expand your understanding with our Liberty Mutual auto insurance review.

Cons

- Expensive Full Coverage Options: Full coverage starts at $104/month, higher than most competitors in South Portland.

- Limited Local Agent Access: Fewer car insurance agents in South Portland may limit personal service availability.

#6 – Nationwide: Best for Vanishing Deductibles

Pros

- Vanishing Deductibles: Rewards Maine drivers with reduced deductibles for every accident-free year.

- Family Discounts: In South Portland, Maine, households with multiple drivers enjoy unique savings.

- SmartRide Incentives: Encourages safe driving habits with telematics-based rewards. Unlock additional information in our Nationwide auto insurance review.

Cons

- Moderate Starting Rates: Minimum coverage starts at $28/month, not the cheapest car insurance in Maine.

- Limited High-Tech Car Discounts: Fewer savings opportunities for advanced vehicle safety features in South Portland, Maine.

#7 – Travelers: Best for High-Value Vehicle Coverage

Pros

- Extensive High-Value Vehicle Coverage: Offers specialized policies for luxury cars in South Portland, Maine.

- Safe Driver Savings: Rewards Maine drivers consistently with safe driving habits through reduced premiums. Uncover additional insights in our article called Travelers auto insurance review.

- Financial Stability: A++ rating ensures reliable claims handling for South Portland customers.

Cons

- Fewer Discounts for Young Drivers: Limited cost-saving options for younger Maine residents.

- Higher Basic Coverage Rates: Minimum coverage starts at $31/month, above some competitors in South Portland.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#8 – The Hartford: Best for AARP Member Benefits

Pros

- Tailored for AARP Members: Offers South Portland seniors unique benefits like lower rates and specialized coverage.

- Defensive Driving Course Discounts: Maine drivers completing courses can lower premiums. For further details, consult our article named The Hartford auto insurance review.

- Comprehensive Bundling Discounts: South Portland, ME, residents save by bundling multiple policies.

Cons

- Limited Appeal for Non-AARP Drivers: Fewer benefits for South Portland residents outside the senior demographic.

- Higher Rates for Younger Drivers: Younger Maine drivers face higher premiums.

#9 – State Farm: Best for Low Minimum Coverage Rates

Pros

- Affordable Minimum Coverage: Rates start at $26/month, among the lowest in South Portland.

- Drive Safe & Save Program: South Portland, Maine drivers benefit from reduced premiums for safe driving habits.

- Substantial Bundling Savings: Maine households bundling multiple policies enjoy significant discounts. Obtain further insights from our State Farm auto insurance review.

Cons

- Lower Financial Strength: State Farm’s B rating may concern South Portland drivers seeking claim reliability.

- Fewer Perks for High-End Vehicles: Limited discounts for Maine drivers with luxury or tech-focused cars.

#10 – Amica: Best for Dividend Payments

Pros

- Dividend Payments for Policyholders: Can earn returns on premiums, enhancing affordability for South Portland drivers.

- Loyalty Incentives: Maine residents benefit from increasing savings for long-term policy retention. Uncover more by delving into our article entitled Amica auto insurance review.

- Exceptional Customer Service: Known for prompt and reliable support for South Portland, ME customers.

Cons

- Higher Costs for Young Drivers: Amica’s rates are less competitive for younger drivers in Maine.

- Limited Local Presence: South Portland residents may find fewer Amica offices for in-person support.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

South Portland, ME Auto Insurance Monthly Rates by Provider & Coverage Level

Evaluating what events are and are not covered by your policy and the monthly premium for drivers in South Portland, ME, is always advisable because rates can differ sharply depending on the type of coverage and comprehensive premiums.

South Portland, ME Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $32 | $97 | |

| $35 | $96 | |

| $27 | $80 | |

| $34 | $104 |

| $28 | $86 |

| $30 | $92 | |

| $29 | $88 | |

| $26 | $81 | |

| $33 | $93 |

| $31 | $90 |

Understanding these details secures the best South Portland, ME auto insurance and prepares you for any sudden event. From knowing what to cover and aligning it with your priorities, you know how to protect yourself better by making the right decisions.

Top Providers and Discounts for the Best South Portland, ME Auto Insurance

Finding the right provider for South Portland, ME, auto insurance is vital because this will affect coverage, savings, and peace of mind. Portland residents can access top insurers offering competitive rates and valuable discounts, such as safe driving bonuses and multi-policy savings.

Auto Insurance Discounts From the Top Providers in South Portland, ME

| Insurance Company | Anti-Theft | Bundling | Good Driver | Good Student | UBI |

|---|---|---|---|---|---|

| 10% | 25% | 20% | 15% | 30% | |

| 5% | 20% | 25% | 10% | 20% | |

| 10% | 15% | 22% | 10% | 25% | |

| 10% | 25% | 20% | 12% | 30% |

| 7% | 20% | 22% | 10% | 40% |

| 8% | 20% | 20% | 15% | $231/yr | |

| 5% | 15% | 18% | 12% | 30% | |

| 10% | 20% | 25% | 10% | 5% | |

| 7% | 20% | 20% | 12% | 20% |

| 10% | 25% | 22% | 15% | 30% |

The table above highlights the leading providers, available discounts, and tips to choose the right policy for your needs.

There’s no reason choosing the best South Portland, ME auto insurance should be difficult. Compare rates, take advantage of available discounts, and determine what needs to be covered with a policy that balances affordability with essential protection like comprehensive and collision coverage.

Best Car Insurance in South Portland, ME

Geico offers cheap Maine auto insurance, with monthly rates as low as $26. Other cheap Maine car insurance companies like Nationwide, State Farm, and Safeco provide competitive premiums. Maine auto insurance requires a minimum of 50/100/25 automobile liability coverage.

Liability insurance means the driver will pay if he’s responsible for the accident. In a worst-case event, we advise having more than the minimum South Portland, ME auto insurance.

With Allstate’s tailor-specific services through vast network of local agents, Maine drivers who value one-on-one guidance can find this a perfect fit for selecting coverage or filing a claim.

Michelle Robbins Licensed Insurance Agent

South Portland is the 4th largest city in Maine and a major hub for industries and retail establishments in the state. The historical military fort, Fort Preble, began operations in 1808 to protect Portland Harbor, an essential port for travel and commerce. Although it was an active military institution for many years, it is now home to the Southern Maine Community College.

Fun fact: South Portland is also home to Rigby Yard, the biggest railroad yard in the New England area.

Are you looking for cheap auto insurance in South Portland, ME? At AutoInsuranceEZ.com, you can find the cheapest insurance rates close to you. To get free car insurance quotes in South Portland, ME today, enter your ZIP code into the quote box on this page.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Maine Minimum Auto Insurance Coverage Requirements

Maine car insurance requirements tend to be higher than most states, and motorists may see this standard as excessive. However, these requirements are important in securing the best South Portland, ME, auto insurance, guaranteeing protection from future vehicle or road accidents.

Maine Minimum Auto Insurance Coverage Requirements

| Coverage | Requirements |

|---|---|

| Bodily Injury Liability | $50,000 / $100,000 |

| Property Damage Liability | $25,000 |

| Uninsured Motorist Bodily Injury | $50,000 / $100,000 |

| Medical Payments | $1,000 |

These requirements highlight the importance of securing adequate liability coverage to avoid financial burdens and have peace of mind.

South Portland, ME Report Card: Auto Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| Weather-Related Risk | A | Low incidence of severe weather impacting claims. |

| Vehicle Theft Rate | A | Vehicle theft rate is low in South Portland. |

| Uninsured Drivers Rate | B+ | Slightly below the national average of uninsured drivers. |

| Traffic Density | B | Moderate traffic congestion affecting accident rates. |

| Average Claim Size | B | Claims are average compared to national levels. |

When securing the best South Portland, ME, auto insurance, several details affect the creation of your premium. It’s also essential to remember that coverage rates can vary significantly among providers. That’s why it’s worth comparing different quotes online to ensure you get the most affordable rate for the coverage you need.

Major Factors Influencing South Portland, ME Auto Insurance Rates

Auto insurance providers consider various elements that influence the design of drivers’ policies. These include location, credit score, and driving records.

Recognizing what factors affect your car insurance premium will provide you with ideas on formulating informed decisions when securing comprehensive coverage, selecting affordable rates, and finding insurance that suits your lifestyle.

Your ZIP Code

The area you call home is relevant in determining your car insurance rates. With a population of 25,255 and a median household income of $50,374, South Portland offers suitable dimensions for cheap car insurance in Maine— combined with affordability and low accident risk.

South Portland, ME Auto Insurance Rates by ZIP Code

| ZIP Code | Rates |

|---|---|

| 04101 | $93 |

| 04102 | $92 |

| 04103 | $90 |

| 04108 | $86 |

| 04109 | $87 |

| 04210 | $93 |

| 04983 | $94 |

A location with a higher population often encounters elevated premium prices due to an increased chance of accidents caused by plenty of drivers on the road.

Automotive Accidents

Any area with a high rate of accidents, especially deadly ones, will also suffer from higher insurance premiums. Thankfully, the rate of fatal accidents in South Portland is very low. It can only mean you’re paying less for insurance than other Maine motorists.

Fatal Accidents in South Portland, ME

| Category | Count |

|---|---|

| Fatal accident count | 1 |

| Vehicles involved in fatal crashes | 1 |

| Fatal crashes involving drunk persons | 1 |

| Fatalities | 1 |

| Persons involved in fatal crashes | 1 |

| Pedestrians involved in fatal accidents | 1 |

However, we can’t say for sure when unexpected events happen, such as vehicle accidents. It’s better to secure the best types of auto insurance coverage to avoid financial obligations and have peace of mind.

Auto Thefts in South Portland

Auto theft is a significant problem in general. However, dense suburban areas or cities like South Portland, Maine, are often substantial areas for vehicle theft. Although the total number of vehicles stolen in Portland was only 26 in 2013, cases have increased; 46 cars were stolen in 2022, and 66 vehicles were stolen in 2023.

Comprehensive coverage is the only coverage that offers auto theft claims. Raising your deductibles to save money is very helpful in reducing the expensive cost. But it’s also essential to weigh the possible out-of-pocket cost in case of a claim.

Your Credit Score

Drivers should know how credit scores affect car insurance premiums and how they can substantially increase depending on their standing, especially in Maine.

South Portland, ME Auto Insurance Monthly Rates by Provider & Credit Score

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $85 | $110 | $150 | |

| $75 | $100 | $140 | |

| $70 | $95 | $135 | |

| $90 | $120 | $170 |

| $80 | $105 | $145 |

| $78 | $102 | $148 | |

| $82 | $108 | $152 | |

| $76 | $98 | $138 | |

| $88 | $115 | $160 |

| $84 | $112 | $155 |

As you can see from the chart above, top auto insurance providers can peek at your credit score and identify how much the rates would cost you, depending on your standing.

Your Age

South Portland auto insurance considers elements like age when lowering premium rates. As you can see from the table below, the older you are, the lower the premium rates are because you have a more extended driving experience. Conversely, the younger you are, the higher your rates will be, given that you have fewer years of driving experience.

South Portland, ME Auto Insurance Monthly Rates by Provider, Age, & Gender

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| $560 | $620 | $185 | $200 | $130 | $140 | $105 | $110 | |

| $540 | $600 | $175 | $195 | $125 | $135 | $100 | $105 | |

| $480 | $550 | $160 | $180 | $120 | $125 | $95 | $100 | |

| $600 | $680 | $200 | $215 | $145 | $155 | $115 | $120 |

| $520 | $590 | $170 | $190 | $125 | $135 | $100 | $105 |

| $500 | $570 | $165 | $185 | $120 | $130 | $95 | $100 | |

| $530 | $600 | $175 | $195 | $125 | $135 | $100 | $105 | |

| $490 | $560 | $160 | $175 | $115 | $120 | $90 | $95 | |

| $570 | $640 | $190 | $210 | $135 | $145 | $110 | $115 |

| $550 | $620 | $180 | $200 | $130 | $140 | $105 | $110 |

However, you don’t need to worry much if you’re a young driver. Other top auto insurance providers also offer good student discounts if you diligently study, have good grades, and take driving courses.

Your Driving Record

Having a pristine or clean driving record is a significant factor in lowering auto insurance premiums; however, not all drivers are perfect, and insurance companies in Portland, Maine, are beginning to take note of this.

South Portland, ME Auto Insurance Monthly Rates by Provider & Driving Record

| Insurance Company | Clean Record ($) | One Ticket ($) | One Accident ($) | One DUI ($) |

|---|---|---|---|---|

| $120 | $145 | $160 | $200 | |

| $115 | $140 | $155 | $190 | |

| $110 | $135 | $150 | $180 | |

| $125 | $150 | $170 | $220 |

| $118 | $142 | $158 | $195 |

| $112 | $137 | $152 | $185 | |

| $120 | $145 | $165 | $210 | |

| $108 | $130 | $145 | $175 | |

| $122 | $148 | $165 | $205 |

| $119 | $143 | $160 | $200 |

Because of that, accident forgiveness discounts are becoming a trend among providers of the best car insurance in Maine.

Your Vehicle

Take a look at the chart below. That spike in monthly premiums isn’t just from driving a more expensive car. It’s mainly because such a vehicle requires more types of coverage, and in more significant amounts, than your typical compact sedan, and extra insurance costs money.

South Portland, ME Auto Insurance Monthly Rates by Vehicle & Coverage Level

| Make & Model | Minimum Coverage ($) | Full Coverage ($) |

|---|---|---|

| 2024 Buick Envision | $85 | $150 |

| 2024 Chevrolet Trailblazer | $80 | $145 |

| 2024 Ford Bronco Sport | $90 | $160 |

| 2024 Honda Passport | $88 | $155 |

| 2024 Hyundai Venue | $78 | $140 |

| 2024 Kia Soul | $75 | $135 |

| 2024 Mazda CX-5 | $83 | $148 |

| 2024 Nissan Kicks | $77 | $138 |

| 2024 Subaru Crosstrek | $82 | $147 |

| 2024 Toyota Corolla Cross | $79 | $142 |

In addition, knowing the most expensive car to insure gives you an insight into what vehicle you want to use in the future.

Other Factors Influencing South Portland, Maine Auto Insurance Rates

Factors including but not limited to your marriage status, gender, driving distance, deductibles and coverage, and education determine the rate of your auto insurance bill in South Portland, Maine.

Geico’s exceptional claims handling and wide variety of discounts make it the best selection for drivers in Portland, Maine, who want an easy-to-use and reliable insurance experience.

Kalyn Johnson Insurance Claims Support & Sr. Adjuster

Learn how these aspects affect your preferred coverage and policy and compare auto insurance companies that suit you.

Your Marital Status

Your marital status can affect the rate of your auto insurance premium, although only a minor amount. However, couples in South Portland, ME, can take advantage of discounts called “bundling.”

Married people are the ones who will take advantage of these types of auto insurance discounts, and combining car insurance after marriage can also save them twice as much money as single people who sign up for this kind of policy.

Your Gender

Do you want to know how an auto insurance company determines your premium? The good news is that insurance providers aren’t interested in stereotypes. They want relevant, solid data, and their data shows that there’s no good reason to charge men and women different monthly premium rates based on gender alone. That’s why many companies are shifting away from such a practice.

Your Driving Distance to Work

The typical commute to work can last anywhere from 17-23 minutes if you live and work in South Portland. Nearly 80% of motorists prefer to drive alone when they travel to and from work, while the number of carpoolers varies between 7-11%.

You can save money by limiting your mileage, especially since you’re buying less gas and spending less on vehicle maintenance. Some auto insurance companies also offer UBI programs to earn savings, but driving fewer miles or driving only for work won’t save you more than a few monthly dollars on insurance. Registering a business vehicle, though, could raise your premiums by more than 10%

Your Coverage and Deductibles

Car accidents and auto claims go hand-in-hand; raising your collision or comprehensive insurance policy deductible can lower your auto insurance premium.

However, if the worst-case scenario happens, you’ll likely be faced with a massive insurance bill that would be taken out of pocket. Before selecting this option, you should balance your budget saved for a lower premium with the money you will spend in the event of a claim.

Education in South Portland, ME

Education can be one of the factors that may affect your car insurance premium rates. In South Portland, ME, nearly one-third of citizens have a high school diploma; however, the area also has many well-educated motorists with bachelor’s degrees.

Carrying an advanced degree can do more for your car insurance discounts than having a better-paying job or occupation; it can even save you money on your affordable South Portland, ME auto insurance policy.

There’s a lot of information you need to consider, and determining how insurance companies evaluate your potential risk can be complicated. But don’t let the wrong insurance company talk you into buying the wrong policy.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Finding the Best South Portland, ME Auto Insurance: Tips to Get the Most Affordable Premium Coverage

Searching for the best auto insurance in South Portland, ME requires careful analysis by comparing rates, coverage types, and policies. There’s a lot to consider when looking for car insurance companies in Portland, Maine, such as vehicle type, driving habits, and, most importantly, budget.

Top South Portland, Maine car insurance companies such as Geico, Allstate, and Safeco are renowned for their fast claims handling, vast network of in-person local agents, and innovative online tools that promote safe driving habits.

For residents seeking cheap auto insurance in Maine, some of the top companies offer adequate coverage and affordable premiums without sacrificing the quality of the policy. Collaborating with auto insurance agents for in-depth assistance in South Portland may help you better understand specific policies for you and other affordable discounts.

Start comparing the best South Portland, ME auto insurance options by entering your ZIP code into our free quote comparison tool today.

How We Conducted Our Car Insurance Analysis

To get the best South Portland, ME auto insurance companies, we computed the average rates based on the following factors: a married, 34-year-old male with a notable credit score, a 12-month history of maintaining and continuous car insurance, a neat driving record, and his residence.

The miles driven annually were based on the national standard average, and we also calculated the average rate based on his financed 2015 Honda Accord with a pre-installed anti-theft telematics device.

Frequently Asked Questions

What is the best car insurance in Maine?

An A++ rating from A.M. Best, dependable claims handling, and a wide variety of discounts make Geico the best car insurance in South Portland, ME for drivers seeking quality protection at a reasonable price.

What is the most trusted car insurance company?

State Farm is often considered one of the most trusted car insurance companies due to its long-standing reputation, profound network of local agents, and above-average J.D. Power claims satisfaction ratings. Compare insurance rates today by entering your ZIP code into our free comparison tool.

Can you drive in Maine without insurance?

No, driving without insurance in Maine is illegal. Law in Maine requires all drivers to carry a minimum liability coverage to protect against financial responsibility for accidents. If you fail to meet these requirements and standards, it can lead to paying fines, license suspension, and other penalties.

What are the requirements for car insurance in Maine?

Maine’s auto insurance requirements are significantly higher than other states, with a minimum of 50/100/25 liability coverage. This only means $50,000 for bodily injury liability, $100,000 for property damage liability, and $25,000 for uninsured motorist bodily injury.

What happens if the person is at fault in an accident and has no insurance in Maine?

Law in Maine requires you to have a 50/100/25 liability coverage if you’re a registered motorist in the state. However, suppose you were involved in a vehicle accident and were uninsured and at fault. In that case, the court will order you to give proof, such as an SR-22 insurance certificate, within 30 days.

Failure to do so would result in surrendering your driver’s license, registration receipt, and license plate, forfeting your driving privileges altogether.

Which insurance cover is best for a car?

Most drivers’ best car insurance coverage is both liability and comprehensive coverage. This combination provides financial protection for accidents, theft, vandalism, and other unexpected incidents.

Which auto insurance provider has the best customer satisfaction ratings?

According to customer reviews and satisfaction ratings, State Farm consistently ranks high for customer satisfaction. Known for its reliable customer service and easy claims process, State Farm is a trusted choice for many drivers seeking a positive insurance experience.

Is Maine a no-fault insurance state?

No, Maine is not a no-fault state. Like most states, Maine still adheres to the traditional “fault” system, in which the person at fault is legally responsible for settling the damages.

What is the average cost of auto insurance in Maine?

The average cost for Portland drivers in Maine is around $26 to $104 for auto insurance. Enter your ZIP code to compare rates from the top providers near you.

Does Geico cover Maine?

Yes. Geico offers low-premium policies and exceptional customer service to the residents of Maine.