Best Lexington, KY Auto Insurance in 2025 (Find the Top 10 Companies Here)

The best Lexington, KY auto insurance providers are Allstate, Geico, and State Farm, offering rates from $45/month. Allstate provides 20% safe driver discounts, Geico offers multi-policy savings, and State Farm excels in fast claims service, making them top picks for affordable, quality coverage.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

UPDATED: Dec 26, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

11,638 reviews

11,638 reviewsCompany Facts

Full Coverage in Lexington KY

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in Lexington KY

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,154 reviews

18,154 reviewsCompany Facts

Full Coverage in Lexington KY

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviewsAllstate, Geico, and State Farm offer the best auto insurance in Lexington, KY, with various advantages at reasonable prices.

Allstate charges $45 per month, thanks to safe driver discounts. Geico offers multi-policy savings, while State Farm is known for fast claims response in Lexington. To gain further insights, consult our comprehensive guide titled “Auto Insurance Coverage Options.”

Our Top 10 Company Picks: Best Lexington, KY Auto Insurance

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | A+ | Accident Forgiveness | Allstate | |

| #2 | 25% | A++ | Affordable Rates | Geico | |

| #3 | 17% | B | Personalized Service | State Farm | |

| #4 | 20% | A+ | Vanishing Deductible | Nationwide |

| #5 | 20% | A | Flexible Coverage | Farmers | |

| #6 | 13% | A++ | IntelliDrive Program | Travelers | |

| #7 | 10% | A+ | Discount Options | Progressive | |

| #8 | 25% | A | Loyalty Discounts | American Family | |

| #9 | 25% | A | Customizable Add-ons | Liberty Mutual |

| #10 | 10% | A++ | Military Benefits | USAA |

Find the best auto insurance company near you by entering your ZIP code into our free quote tool above.

- Discover top Lexington, KY auto insurance with competitive rates and discounts

- Compare providers for coverage options that fit your driving habits and needs

- Allstate offers affordable rates and discounts for safe and multi-policy drivers

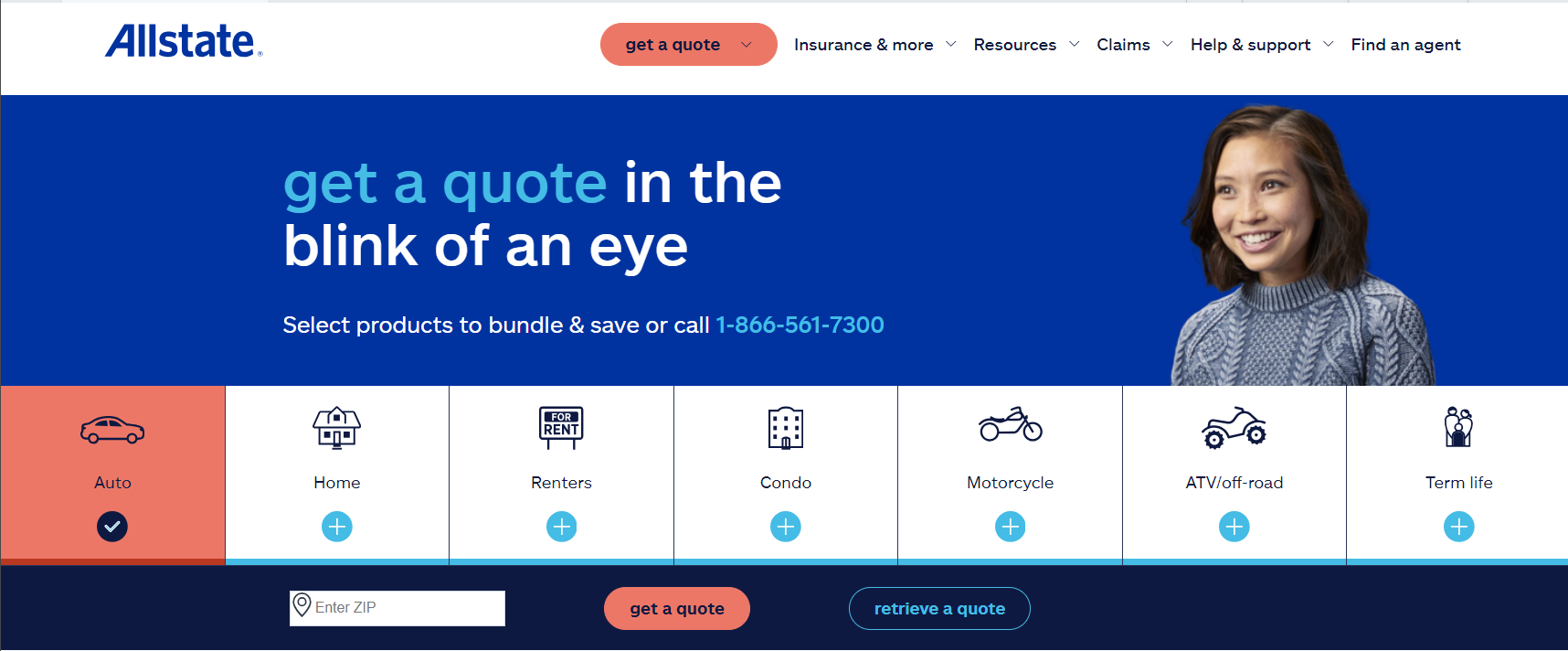

#1 – Allstate: Top Pick Overall

Pros

- Reasonable Pricing Plans: These start at $45 monthly and are suitable for cost-savvy automobile operators in Lexington, KY.

- Safe Driver Discounts: According to our Allstate auto insurance review, drivers with clean records in Lexington, KY, can access significant safe driver discounts.

- Diverse and Adjustable Policy: Provides various tailored policies in Kentucky, including accident and theft covers.

Cons

- Higher Rates for Younger Drivers: Premium rates may remain steep for new or young drivers whose records in safe driving over the years are pretty scanty in Lexington, KY.

- Limited Customer Service: Some drivers in Kentucky have reported delays in claim processing and subpar customer service experiences.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#2 – Geico: Best for Affordable Rates

Pros

- Multi-Policy Discounts: Based on our Geico auto insurance review, bundling auto insurance with other Lexington policies can lead to substantial savings.

- Affordable Options for Safe Drivers: Geico is known in Kentucky for offering low premiums to safe drivers with a clean driving history.

- 24/7 Customer Support: Geico offers round-the-clock support in Lexington, KY, ensuring assistance is available anytime or night.

Cons

- Constrained Geographic Presence: Most of Geico’s online activities limit in-person assistance to a small branch based in Lexington, KY.

- Fewer Local Agent Options: While they have excellent customer service, some customers in Kentucky prefer face-to-face interaction with agents.

#3 – State Farm: Best for Personalized Service

Pros

- Strong Claims Support: Highly rated for its responsive claims service in Lexington, KY.

- Discounts for Safe Drivers: Offers several ways to lower premiums for drivers with good records.

- Nationwide Availability: Within our State Farm auto insurance review, we explore how the company provides coverage across Kentucky.

Cons

- Premiums Can Be Higher: For some Kentucky drivers, rates may be more expensive than those of competitors like Geico or Allstate.

- Limited Customization: Some customers feel the policy options could be more flexible than other significant insurers.

#4 – Nationwide: Best for Vanishing Deductible

Pros

- Excellent Customer Service: Known for attentive customer service and a smooth claims process in Lexington, KY.

- Bundling Options: In our Nationwide auto insurance review, we highlight significant savings through bundling auto, home, and life insurance in Lexington, KY.

- Great Discounts for Safe Drivers: Offers many discounts based on safe driving and vehicle safety features for drivers in Kentucky.

Cons

- Higher Premiums: Rates can be expensive in Lexington, KY, especially for younger drivers or those with less-than-perfect driving records.

- Fewer Discounts Than Others: While Nationwide offers bundling, its discounts in Kentucky aren’t as extensive as those of Geico or Allstate.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#5 – Farmers: Best for Flexible Coverage

Pros

- Multiple Discount Opportunities: With our Farmers auto insurance review, Kentucky drivers can take advantage of various discounts, such as those for anti-theft devices and safe driving habits.

- Many Discounts Available: Drivers in Kentucky take advantage of numerous discounts, including those for anti-theft devices and safe driving records.

- High Level of Client Satisfaction: Recognized for providing customer support at a very high level, particularly during the claims processing in Kentucky.

Cons

- Higher Possible Rates: Kentucky drivers may find premiums higher than competitors, particularly if they have a history of accidents.

- Limited Online Services: While Lexington, KY residents can access in-person solid support, the online platform may not be as user-friendly as others.

#6 – Travelers: Best for IntelliDrive Program

Pros

- Reasonable Rates For Beginner Drivers: In Lexington, KY, insurance companies usually target young, novice drivers with fare prices.

- Flexible Coverage Options: Explore our Travelers auto insurance review to see the flexible coverage options available to drivers in Kentucky.

- Accident Forgiveness: is available in selected geographic areas, including Kentucky, to avoid premium increases after the first road mishap.

Cons

- Limited Discounts: Fewer opportunities to lower your rate beyond introductory discounts.

- Slow Claims Processing.: A portion of havers have experienced denial in the claims process, a dull monotony of no contact.

#7 – Progressive: Best for Discount Options

Pros

- Competitive Rates for High-Risk Drivers: Progressive often provides better rates for drivers with a less-than-perfect record in Kentucky.

- Snapshot Program: A discount program in Lexington, KY, that tracks driving habits to help safe drivers save more.

- Always Available Customer Service: Discover our Progressive auto insurance review to learn about the company’s round-the-clock support for Kentucky drivers during emergencies.

Cons

- Difficulties in Device Prices: Some customers in Lexington, KY, experience difficulties when requesting quotes for prices that encompass many aspects.

- Mixed Customer Service Reviews: While Progressive offers constant support in Kentucky, not all users find it efficient or helpful.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#8 – American Family: Best for Loyalty Discounts

Pros

- Local Solid Presence: View our American Family auto insurance review to understand their strong local presence in Lexington, KY.

- Flexible Coverage Options: Offers a variety of options like rideshare coverage and accident forgiveness.

- Discounts for Careful Drivers: Premiums may reduced for responsible driving behavior, and discounts may offered for young drivers with good academic performance.

Cons

- Higher Premiums for Some Drivers: Those with less-than-ideal driving records may face higher rates.

- Limited Discounts: This insurer offers fewer niche discounts than other insurers like Geico or State Farm.

#9 – Liberty Mutual: Best for Customizable Add-ons

Pros

- Reasonable Rates for Beginner: In Lexington, KY, insurance companies usually target young, novice drivers with fare prices.

- Flexible Coverage Options: Explore our Travelers auto insurance review to see the flexible coverage options available to drivers in Kentucky.

- Accident Forgiveness: is available in selected geographic areas, including Kentucky, to avoid premium increases after the first road mishap.

Cons

- Limited Discounts:

- Claims Process Lags: Some Lexington, KY users have experienced denial in the claims processing and a dull monotony of no contacts.

#10 – USAA: Best for Military Benefits

Pros

- Great Rates for Military Families: USAA offers excellent rates and benefits for military members and their families.

- Exemplary Customer Care Services: Explore the USAA auto insurance review to learn why this company is well known for its unrivaled customer care services.

- All-inclusive Plans: Offers a variety of coverage, including options for military vehicles like motorhomes.

Cons

- Restrictions on Eligibility: Open only to active duty service or veteran personnel and their dependents.

- Limited Physical Locations: In-person support can be scarce as an online-based service.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Affordable Auto Insurance in Lexington: Top Picks

When selecting the best Lexington, KY auto insurance, comparing providers based on coverage options and premiums is essential for finding the most affordable and reliable coverage.

Reliable coverage comes with American Family, while customer services provide high value between Allstate and Geico. Geico is affordable with multi-policy discounts, while Allstate offers discounts for safe drivers and quick claims processing.

Lexington, KY Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $50 | $125 | |

| $45 | $120 | |

| $51 | $128 | |

| $46 | $115 | |

| $55 | $127 |

| $56 | $135 |

| $53 | $126 | |

| $52 | $130 | |

| $58 | $132 | |

| $54 | $124 |

Other companies like State Farm, Nationwide, and Liberty Mutual offer full coverage with additional benefits, though they tend to have higher premiums. USAA is a top choice for military families because of its competitive rates and good coverage.

Finding the best Lexington, KY auto insurance involves comparing providers and selecting coverage that fits your needs and budget.

Save Big on Auto Insurance in Lexington, KY

Discounts are crucial in lowering premiums for the best Lexington, KY auto insurance. Different providers offer various savings to make coverage more affordable without compromising quality.

Allstate provides savings for multi-car, safe drivers, good students, and anti-theft. American Family offers discounts for bundling, low mileage, and loyalty. Farmers reward safe drivers, good student discounts, and homeowners.

Geico offers savings for bundling, defensive driving, and military service. Liberty Mutual provides discounts for military members and early shoppers. Nationwide has savings for bundling and the SmartRide program. Progressive offers discounts for safe driving through Snapshot and pay-in-full.

Auto Insurance Discounts From the Top Providers in Lexington, KY

| Insurance Company | Available Discounts |

|---|---|

| Multi-Car, Safe Driver, Good Student, Early Signing, Anti-Theft | |

| Good Student, Bundling, Low Mileage, Safe Driver, Loyalty | |

| Safe Driver, Multi-Car, Good Student, Bundling, Homeowner | |

| Bundling, Multi-Car, Good Student, Defensive Driving, Military | |

| Safe Driver, Bundling, Military, New Car, Early Shopper |

| Bundling, Good Student, Safe Driver, Multi-Car, SmartRide |

| Safe Driver, Bundling, Multi-Car, Snapshot, Pay-in-Full | |

| Bundling, Good Student, Accident-Free, Safe Driver, Steer Clear | |

| Good Student, Safe Driver, Multi-Car, Bundling, New Car | |

| Safe Driver, Military, Good Student, Bundling, Defensive Driving |

State Farm tends to reward drivers who bundle their policies and those with an accident-free history, while Travelers provides those savings, especially with new cars and student policies. These discounts help drivers lower their premiums while maintaining quality coverage.

Drivers can secure the best possible rates by exploring discounts from top providers in Lexington, KY. Whether you qualify for safe driver, bundling, or military discounts, these savings help tailor coverage to your needs and budget.

Auto Insurance Coverage Requirements in Kentucky

Understanding the state’s minimum coverage requirements and common coverage limits is essential when selecting the best Lexington, KY auto insurance.

In Lexington, Kentucky, drivers must have bodily injury liability coverage of $25,000 per person and $50,000 per accident. However, many choose higher limits, such as $100,000 per person and $300,000 per accident, for better protection.

The state mandates property damage liability of $10,000, but drivers often opt for $50,000. Uninsured motorist bodily injury coverage is optional, though many drivers select limits of $100,000 per person and $300,000 per accident.

Kentucky Minimum Auto Insurance Coverage Requirements & Limits

| Coverage | Requirements | Most Common |

|---|---|---|

| Bodily Injury Liability | 25,000/50,000 | 100,000/300,000 |

| Property Damage Liability | 10,000 | 50,000 |

| Uninsured Motorist Bodily Injury | Not required | 100,000/300,000 |

| Medical Payments | Not required | 100,000 |

| Collision | Not required | 500 deductible |

| Comprehensive | Not required | 500 deductible |

While medical payments, collision, and comprehensive coverage aren’t required, many drivers include them with a $500 deductible for extra security.

By understanding Kentucky’s minimum insurance requirements and opting for higher coverage limits, Lexington drivers can secure better protection and find the best auto insurance.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Affordable Auto Insurance Guide for Lexington, KY

In the quest for the most comprehensive Lexington, KY auto insurance, many auto insurance companies measure the risk involved based on factors such as your driving experience, the area you live in, and the type of car you drive. Other specific discounts, such as safe driver discounts or multi-car insurance in one policy, help reduce the costs. These aspects help assess the proper and possible coverage at the lowest price.

Your ZIP Code

Your ZIP code determines auto insurance rates in Lexington, KY, varying rates based on local risk factors. For example, rural areas tend to have lower premiums due to fewer vehicles on the road. Providers like State Farm and Liberty Mutual in Lexington and nearby cities range from $24 to $73.

Lexington, KY Auto Insurance Monthly Rates by ZIP Code

| ZIP | Rates |

|---|---|

| 40502 | $25 |

| 40503 | $37 |

| 40504 | $41 |

| 40505 | $53 |

| 40506 | $57 |

| 40507 | $62 |

| 40508 | $69 |

| 40509 | $71 |

| 40510 | $73 |

Evaluating auto insurance rates by state is essential, as they vary across different parts of Kentucky. Considering the various trends available for both the ZIP code and the entire state helps Lexington residents locate the most suitable auto insurance rates for their needs..

Automotive Accidents

In Lexington, KY, accident statistics play a significant role in determining auto insurance rates. Areas with higher accident rates often face higher premiums as insurers factor in the increased risk of claims. How accidents change your car insurance rate is crucial, as a history of accidents can lead to higher costs.

Lexington, KY Auto Accident & Insurance Claim Statistics

| Factor | Value |

|---|---|

| Accidents Per Year | 4,872 |

| Claims Per Year | 2,341 |

| Average Claim Cost | $3,100 |

| Percentage of Uninsured Drivers | 14% |

| Vehicle Theft Rate | 320 per 100,000 vehicles |

| Traffic Density | Moderate |

| Weather-Related Incidents | 980 annually (primarily rain and snow) |

Drivers in Lexington should ask about safe driver discounts or accident forgiveness programs to help lower premiums. The fatal accidents table highlights how accident rates influence the best Lexington, KY auto insurance options.

Auto Thefts in Lexington

Auto theft rates in Lexington, KY, are high, which can increase auto insurance premiums. Anti-theft device discounts also help lower expenses. Though more costly, comprehensive insurance offers better protection against car theft than third-party coverage.

The table comparing basic and comprehensive policies from providers like State Farm and Kentucky Farm Bureau highlights the cost difference. Discussing anti-theft options with your insurer can help you secure the best Lexington, KY, auto insurance for your needs.

Your Credit Score

In Lexington, KY, a polished credit score can also influence the rates an individual pays for auto insurance.

Choosing the right insurance company is not just about coverage—it’s about peace of mind knowing you’re backed by experts who truly understand your needs.

Dani Best Licensed Insurance Agent

The exhibits confirm how rates vary in the case of drivers with excellent credit and, on the contrary, with a bad credit rating. It is also apparent that those with lower credit scores pay higher premiums.

How your credit score affects your car insurance premiums is crucial to securing affordable coverage. Maintaining a good credit score will help you get the best rates for the best Lexington, KY, auto insurance.

Your Age

In Lexington, KY, car insurance for teenagers can be significantly more expensive than for older drivers, as shown in the table comparing rates for 17-year-olds and 34-year-olds.

Teen drivers face high premiums due to inexperience, but they can reduce costs through discounts like Good Student and Driver’s Ed.

Lexington, KY Auto Insurance Rates by Age

| Insurance Company | 17 Years Old | 34 Years Old |

|---|---|---|

| $98 | $25 |

| $238 | $62 |

| $160 | $53 |

S | $153 | $49 |

| $153 | $43 |

Companies like Kentucky Farm Bureau and State Farm offer discounts that help reduce premiums for young drivers. Understanding these possibilities is essential when looking for the best auto insurance quotes in Lexington, KY, especially for families with teenage children.

Your Driving Record

In Lexington, KY, car insurance premiums can increase significantly after a DUI, as shown in the table comparing rates for drivers with perfect records, minor violations, and DUIs. A DUI or reckless driving offense can raise rates substantially and, in some cases, lead to coverage dropping altogether.

Lexington, KY Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Collision | Comprehensive |

|---|---|---|

| $25 | $73 |

| $62 | $201 |

| $53 | $93 |

| $49 | $121 |

| $43 | $84 |

Some providers, such as the Kentucky Farm Bureau and State Farm, provide accident forgiveness discounts that could help mitigate the costs incurred after a driving under the influence offense. Ask for these alternatives for the best auto insurance in Lexington, KY, so you have a low insurance rate after a conviction.

Your Vehicle

When considering the most expensive cars to insure in Lexington, KY, luxury vehicles like the 2012 Porsche Boxster Spyder stand out for their higher insurance premiums compared to more standard models like the 2015 Honda Accord.

Lexington, KY Auto Insurance Monthly Cost by Make, Model, & Coverage Type

| Insurance Company | Clean Record | One Ticket | One DUI | One Accident |

|---|---|---|---|---|

| $25 | $25 | $31 | $60 |

| $62 | $66 | $62 | $69 |

| $53 | $62 | $62 | $78 |

| $49 | $62 | $53 | $69 |

| $43 | $48 | $48 | $52 |

Luxury cars typically have higher repair costs, specialized parts, and a greater likelihood of theft, all contributing to their expensive coverage. Hence, while hunting for the best car insurance in Lexington, Kentucky, one must consider the make and model of the car, as the type of car driven plays a crucial role in premium rates.

Minor Factors for Securing Auto Insurance in Lexington

For the best Lexington, KY auto insurance, factors like marital status, gender, commute distance, and education level can affect premiums. Bundling policies and choosing higher deductibles can also lead to discounts, helping reduce costs.

Your Marital Status

Combining car insurance after marriage is a great way to save on the best Lexington, KY auto insurance. Newly married individuals can bundle car insurance with home, boat, or RV coverage, earning substantial discounts from many providers.

Lexington, KY Report Card: Auto Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| Coverage Options | A | Offers a variety of coverage options, including comprehensive and collision. |

| Claims Processing | A- | Claims are processed quickly, ensuring minimal delays for policyholders. |

| Customer Service | B+ | Customer satisfaction is above average, with responsive agents. |

| Discounts | B | Offers common discounts, but limited unique savings opportunities. |

| Affordability | B | Rates are moderately affordable compared to the state average. |

This multi-policy approach significantly lowers premiums. Factors like commute distance and education level can also impact rates, but bundling is one of Lexington’s best strategies for affordable auto insurance.

Your Gender

In finding the best Lexington, KY auto insurance, a person’s gender is not a significant factor in influencing the cost of premiums. Most insurance providers have concluded that they do not distinguish between the two genders pricing-wise, and the little remaining difference is now insignificant.

This situation provides better coverage options where prices are more available to both men and women. For additional details, explore our comprehensive resource titled “Compare Auto Insurance Companies”

Your Driving Distance to Work

Your commute distance can impact premiums when seeking the best Lexington, KY auto insurance. With the average commute in Lexington being 15-25 minutes, it’s important to insure your vehicle for personal use, as commercial auto insurance costs 10-11% more.

Limiting mileage may offer a small discount, but it’s usually minimal. Ensuring the right coverage based on vehicle use is crucial in securing affordable rates.

Your Coverage and Deductibles

For the best Lexington, KY auto insurance, one must also be familiar with the types of coverage and deductibles available. With low motor vehicle accidents and automobile theft rates, you are less prone to making comprehensive or collision claims; therefore, consider increasing your deductible.

This approach enables you to get the same insurance protection but at a lower rate than previously paid. An explanation of deductibles is essential here: a higher deductible means you’ll pay more out-of-pocket if an accident occurs, but it can significantly reduce your premium, helping you save in the long run.

Education in Lexington, KY

When looking for the best Lexington, KY auto insurance, residents might consider getting educated to cut on expenses. Over 20% of its residents are university graduates, so this city’s high academic standards often come into play when negotiating for better insurance rates.

Due to major educational institutions such as the University of Kentucky, the present population is more educated, which means cheap car insurance will be available.

The best insurance company provides clear, straightforward coverage, fair pricing, and reliable support whenever you need it, ensuring you’re protected without confusion.

Daniel Walker Licensed Insurance Agent

Risk assessment can be complex, but education is vital in securing lower premiums. To delve deeper, refer to our in-depth report titled “Car Insurance for Students: Saving 101”

Navigating the Best Lexington, KY Auto Insurance

Finding the right auto insurance in Lexington, KY, can be challenging with so many options. It’s essential to consider factors like coverage options, discounts, and customer service to ensure you get the best value for your money. Allstate, Geico, and State Farm are the top choices.

Allstate offers discounts for safe drivers, Geico provides savings for multi-policy bundles, and State Farm is known for fast claims processing.

Kentucky’s minimum coverage requirements are low, but higher coverage limits recommend better protection. Lexington drivers can save on premiums while ensuring solid coverage by taking advantage of discounts such as bundling, safe driver discount, or military service.

Lexington drivers have access to some of the best auto insurance options in the state. Comparing quotes from multiple providers is key to finding the best coverage at an affordable price.

Start saving on your auto insurance by entering your ZIP code and comparing quotes.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

Is auto insurance high in Lexington, KY?

Auto insurance in Lexington, KY, starts at $45/month but can rise due to driving records, ZIP codes, or high theft and accident rates.

Which insurance in Lexington is best for a ten year old car?

Geico or State Farm may offer the best rates for older cars, especially if opting for liability-only coverage to save on premiums.

Find the best auto insurance rates no matter how much coverage you need by entering your ZIP code below into our comparison tool today.

What auto insurance in Kentucky is required?

Kentucky requires liability insurance: $25,000/$50,000 for bodily injury and $25,000 for property damage, with optional PIP coverage.

Who has the cheapest car insurance in Kentucky?

Geico and Allstate frequently offer some of the cheapest auto insurance rates in Kentucky, with monthly premiums starting as low as $45.

How does car insurance work in Kentucky?

Kentucky mandates minimum liability insurance, with an optional uninsured motorist and medical coverage.

What is Kentucky no-fault rejection?

Kentucky allows drivers to opt out of the no-fault auto insurance system, waiving PIP coverage and retaining the right to sue at-fault parties in accidents.

What is the highest type of car insurance?

The highest type of car insurance is full coverage, which includes bodily injury, property damage, collision, and comprehensive coverage. This insurance offers extensive protection, covering at-fault accidents, vehicle damage from theft, and weather-related events.

Who pays most for car insurance in Lexington?

Teen drivers in Lexington pay the most due to their inexperience. Rates for drivers under 20 are significantly higher than for older, experienced drivers.

Can you drive in Lexington, KY, without insurance?

No, driving in Lexington, KY, is illegal without proof of insurance. Kentucky requires drivers to carry at least the minimum automobile liability coverage.

What is the best car insurance for seniors in Lexington?

State Farm and USAA offer some of the best coverage options for seniors, including discounts for accident-free driving and multi-policy bundling.

Enter your ZIP code into our free quote tool below to find the best auto insurance providers for your needs and budget.