Cheap Auto Insurance in Kansas for 2025 (Find Savings With These 10 Companies)

Cheap auto insurance in Kansas is available from USAA, Geico, and State Farm. USAA leads with a monthly rate of $18, but it's only for military members and their families. Geico and State Farm offer competitive Kansas car insurance rates and comprehensive coverage options.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

UPDATED: Jan 31, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

6,589 reviews

6,589 reviewsCompany Facts

Minimum Coverage in Kansas

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 19,116 reviews

19,116 reviewsCompany Facts

Minimum Coverage in Kansas

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,154 reviews

18,154 reviewsCompany Facts

Minimum Coverage in Kansas

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviewsUSAA, Geico, and State Farm offer cheap auto insurance in Kansas. USAA offers the lowest rates, starting at $18 monthly, making it the top pick for military families.

Geico car insurance rates start at $24 per month. The company also provides a variety of car insurance discounts and easy online policy management. State Farm, at $26 per month, offers personalized service through local insurance experts.

Our Top 10 Company Picks: Cheap Auto Insurance in Kansas

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $18 | A++ | Military Families | USAA | |

| #2 | $24 | A++ | Low Rates | Geico | |

| #3 | $26 | B | Local Agents | State Farm | |

| #4 | $28 | A++ | New Drivers | Travelers | |

| #5 | $29 | A+ | Coverage Options | Nationwide |

| #6 | $36 | A | Family Bundles | American Family | |

| #7 | $41 | A+ | Custom Discounts | Progressive | |

| #8 | $46 | A | Personalized Plans | Farmers | |

| #9 | $51 | A+ | Safe Drivers | Allstate | |

| #10 | $56 | A | Flexible Policies | Liberty Mutual |

These three providers are the best options for low-cost Kansas car insurance. Find the best auto insurance company in Kansas by entering your ZIP code into our free quote tool.

- USAA offers the lowest rates starting at $18 monthly for military families

- Geico and State Farm provide affordable options with various discounts

- Kansas drivers benefit from competitive rates and local agent support

#1 – USAA: Top Overall Pick

Pros

- Affordable Rates for Kansas Drivers: If you’re wondering how much car insurance is in Kansas, USAA offers a budget-friendly option for military families at just $18 per month.

- Strong Financial Stability: USAA has an A++ rating from A.M. Best, showing its strength in handling claims, as highlighted in this USAA auto insurance review.

- Military-Focused Benefits: A great advantage for those in Kansas, USAA offers unique benefits and discounts specifically designed for military families.

Cons

- Eligibility Restrictions: Limited access is available for Kansas drivers; only military members and their families are eligible.

- Limited Physical Presence: USAA’s online-only service may not be convenient for Kansas drivers due to its limited physical presence.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#2 – Geico: Best for Low Rates

Pros

- Competitive Rates: Geico offers affordable car insurance in Kansas, with rates starting at just $24 per month. It’s an excellent choice for anyone looking for cheap car insurance in Kansas.

- Variety of Discounts: With Geico, Kansas drivers can enjoy multiple discounts, such as bundling policies, safe driving, and being a federal employee.

- Convenient Online Tools: Geico has an easy app and website, making it convenient to manage your auto insurance in KS.

Cons

- Inconsistent Customer Service: Some drivers have reported varying levels of customer service, as indicated in this Geico auto insurance review.

- Fewer Local Agents: Due to the limited number of local agents, those in more rural areas of Kansas may find it challenging to access in-person support.

#3 – State Farm: Best for Local Agents

Pros

- Personalized Support: State Farm has local insurance agents who provide personalized car insurance support in Kansas to meet drivers’ specific needs.

- Reliable Claims Process: Kansas drivers trust State Farm for its efficient claims process, as highlighted in this State Farm auto insurance review.

- Diverse Coverage Options: State Farm offers a range of add-ons, like roadside assistance, making it a good option for people seeking comprehensive auto insurance coverage options in KS.

Cons

- Higher Rates Than Competitors: State Farm’s rates are a bit higher, at $26/month, compared to other Kansas providers.

- Limited Discounts for Niche Groups: Teachers and first responders may find fewer discounts using State Farm in Kansas.

#4 – Travelers: Best for New Drivers

Pros

- Affordable Rates for New Drivers: Travelers offers auto insurance in Kansas City for new drivers for as low as $28 a month.

- Strong Financial Stability: Travelers Auto Insurance Company, with an A++ rating from A.M. Best, ensures reliability when handling claims in Kansas.

- Discounts for Safety Features: Kansas car insurance customers can receive discounts for vehicles with advanced safety features, as noted in this Travelers auto insurance review.

Cons

- Complex Policy Options: Some Kansas drivers may find Travelers’ add-on options confusing.

- Customer Service: Some Kansas car insurance policyholders believe Travelers’ customer service should improve.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Coverage Options

Pros

- Adaptable Coverage Choices: Accident forgiveness is a versatile feature available on Kansas auto policies, customizing client protection.

- Good Financial Situation: Nationwide’s A+ rating by A.M. Best reflects its stability in paying claims, giving Kansas motorists peace of mind.

- Reasonably Priced: Nationwide offers maximum coverage and premiums as low as $29 per month for car insurance in Kansas City, KS.

Cons

- Limited Discount Options: Relative to other companies, Nationwide doesn’t offer a wide variety of specialty discounts.

- Mixed Support: Our Nationwide auto insurance review demonstrates mixed customer service reports from some Kansas drivers, which affects the overall customer experience.

#6 – American Family: Best for Family Bundles

Pros

- Perfect for Kansas Families: Bundling home and auto insurance in Kansas is an excellent idea for families looking to manage their coverage and better manage those costs.

- Valuable Add-Ons: Adding coverages such as gap insurance can improve the overall insurance experience for Kansas drivers.

- Personalized Service: Kansas drivers can benefit from the knowledge of local agents, which makes selecting vehicle insurance more customized.

Cons

- Higher Premiums: At $36 per month, our American Family auto insurance review reveals that their rates are slightly higher than other KS options.

- Limited Online Tools: When shopping for KS auto insurance, drivers may find fewer online features available with American Family compared to competitors in the market.

#7 – Progressive: Best for Custom Discounts

Pros

- Customizable Discounts: Progressive’s Snapshot program offers customizable discounts to help Kansas drivers meet their auto insurance requirements with lower premiums for safe driving.

- Extensive Coverage Options: Progressive provides huge coverage choices to Kansas drivers with rideshare and flexible options.

- Solid Financial Strength: With an A+ rating, Progressive can ensure dependable claim processing for its drivers in KS.

Cons

- Higher Than Average Premiums: At $41/month, Progressive may not be the most affordable option for Kansas drivers on a tight budget.

- Mixed Reviews on Claims Service: According to Progressive auto insurance reviews, some drivers report delays in claims processing, which could be a concern for those relying on timely service.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#8 – Farmers: Best for Personalized Plans

Pros

- Customized Policies: Farmers provide customized automobile insurance in Kansas, including classic car insurance for local drivers.

- Expert Knowledge: With a deep understanding of regional risks, Farmer’s agents in Kansas are well-equipped to provide the best experience drivers need.

- Great Discounts: Farmers’ car insurance in Kansas provides opportunities for savings, including discounts for good students and policy bundling.

Cons

- High Premiums: At $46 per month, Farmers’ auto insurance is costlier than other Kansas options. Comparing auto insurance quotes in Kansas City may help you find better rates.

- Limited Digital Features: According to our Farmers auto insurance review, tech-savvy Kansas users may find internet resources less user-friendly than anticipated.

#9 – Allstate: Best for Safe Drivers

Pros

- Great Coverage for Safe Drivers: Our Allstate auto insurance review reflects the company’s discounts for safe driving, making it a top pick for people seeking auto insurance.

- Innovative Drivewise Program: Through Allstate’s Drivewise program, Kansas drivers can earn cashback for practicing safe driving habits, which can add extra benefits to their auto insurance.

- Financial Strength: An A+ rating reflects Allstate’s financial strength in offering long-term stability and smooth claims processing for Kansas drivers.

Cons

- Higher Premiums: Allstate may be less affordable than other Kansas auto insurance options, starting at $51/month.

- Complex Discount Structure: The range of discounts Allstate offers can be challenging for Kansas auto insurance customers to navigate, making qualifying for all potential savings harder.

#10 – Liberty Mutual: Best for Flexible Policies

Pros

- Variety of Coverage Options: Liberty Mutual offers various options, such as new car replacements, which are very valuable for those who require comprehensive auto insurance coverage in Kansas.

- Exclusive Discounts: Liberty Mutual offers special savings for Kansas teachers and military personnel, making auto insurance affordable for many drivers.

- Strong Financial Standing: Liberty Mutual is a strong provider with an A rating from A.M. Best. It ensures that your claims are handled in accordance with Kansas car insurance requirements.

Cons

- Higher Premiums: At $56 per month, Liberty Mutual is among Kansas’s more expensive auto insurance options.

- Mixed Customer Feedback: Some Kansas drivers have reported varying satisfaction levels with claims handling, according to our Liberty Mutual auto insurance review.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Kansas Car Insurance Coverage and Rates

Compare the rates when purchasing auto insurance in Kansas. USAA and Geico have the lowest rates, with minimum monthly coverage starting at $18 and $24, respectively. Full coverage ranges from $56 with USAA to $174 with Liberty Mutual.

Kansas Auto Insurance Monthly Rates by Provider & Coverage Level

The average car insurance cost in Kansas may vary, so it’s essential to compare your options. Critical coverage options like liability and UM/UIM auto insurance coverage protect you if the other driver is uninsured or underinsured.

Understanding these concepts will help you select a coverage that fits your budget and offers acceptable road safety. Enter your ZIP code into our free quote tool to find the best auto insurance providers for your needs and budget.

Car Insurance Discounts in Kansas

Kansas drivers can save on car insurance through discounts from top providers. Allstate offers savings for safe drivers and multi-policy holders, while the American Family rewards low mileage and defensive driving.

Auto Insurance Discounts From the Top Providers in Kansas

Farmers provide discounts for bundling, good students, and multi-car policies. Geico offers savings for military members, and Liberty Mutual rewards hybrid vehicles and multi-car policies.

Progressive stands out with its Snapshot program, giving discounts based on driving habits. State Farm offers savings for good drivers, and USAA provides discounts for military members and multi-vehicle policies.

Kansas Report Card: Auto Insurance Discounts

| Insurance Company | Anti-Theft | Bundling | Good Driver | Good Student | UBI |

|---|---|---|---|---|---|

| 10% | 25% | 20% | 10% | 15% | |

| 12% | 22% | 18% | 12% | 10% | |

| 8% | 20% | 15% | 10% | 12% | |

| 10% | 15% | 20% | 10% | 18% | |

| 10% | 25% | 15% | 8% | 12% |

| 10% | 20% | 18% | 10% | 20% |

| 12% | 22% | 20% | 15% | 25% | |

| 15% | 25% | 20% | 15% | 10% | |

| 10% | 18% | 15% | 10% | 12% | |

| 12% | 25% | 20% | 10% | 15% |

Each insurer has unique offers, like Allstate’s 25% off for bundling. A Progressive snapshot program review shows users can earn up to 25% off based on their driving behavior. For more details, check out a Kansas auto insurance guide and compare rates.

Premiums as a Percentage of Income in Kansas

Auto insurance in Kansas has seen a slight increase in premiums as a percentage of disposable income. In 2012, premiums were 1.94% of revenue, rising to 1.98% in 2013 and 2.04% in 2014.

| Details | 2012 | 2013 | 2014 |

|---|---|---|---|

| Disposable Income | $40,424 | $41,140 | $41,634 |

| Full Coverage Premiums | $785.72 | $815.82 | $850.79 |

| Insurance as Percentage of Income | 1.94% | 1.98% | 2.04% |

Factors affecting your car insurance premium in Kansas include moderate weather-related risks, occasional hailstorms, and earning a B+ grade. The traffic density in Wichita and other cities also adds to the rate with a B grade.

The average claim size for the state is about $4,000 per incident, resulting in a B rating. Rates for vehicle theft are higher in metropolitan areas and lower the grade to C+.

Kansas Report Card: Auto Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| Weather-Related Risk | B+ | Moderate risk due to occasional hailstorms. |

| Traffic Density | B | Moderate traffic in urban areas like Wichita. |

| Average Claim Size | B | Claims average around $4,000 per incident. |

| Vehicle Theft Rate | C+ | Higher theft rates in metropolitan areas. |

| Uninsured Drivers Rate | C | Approximately 12% of drivers are uninsured. |

About 12% of Kansas drivers are uninsured, which is a C grade in this category. Understanding these factors will help you search for the cheapest Kansas car insurance.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Finding the Best Car Insurance Companies in Kansas

Choosing the right auto insurance company can be an overwhelming process, but these five steps will help you make an informed decision.

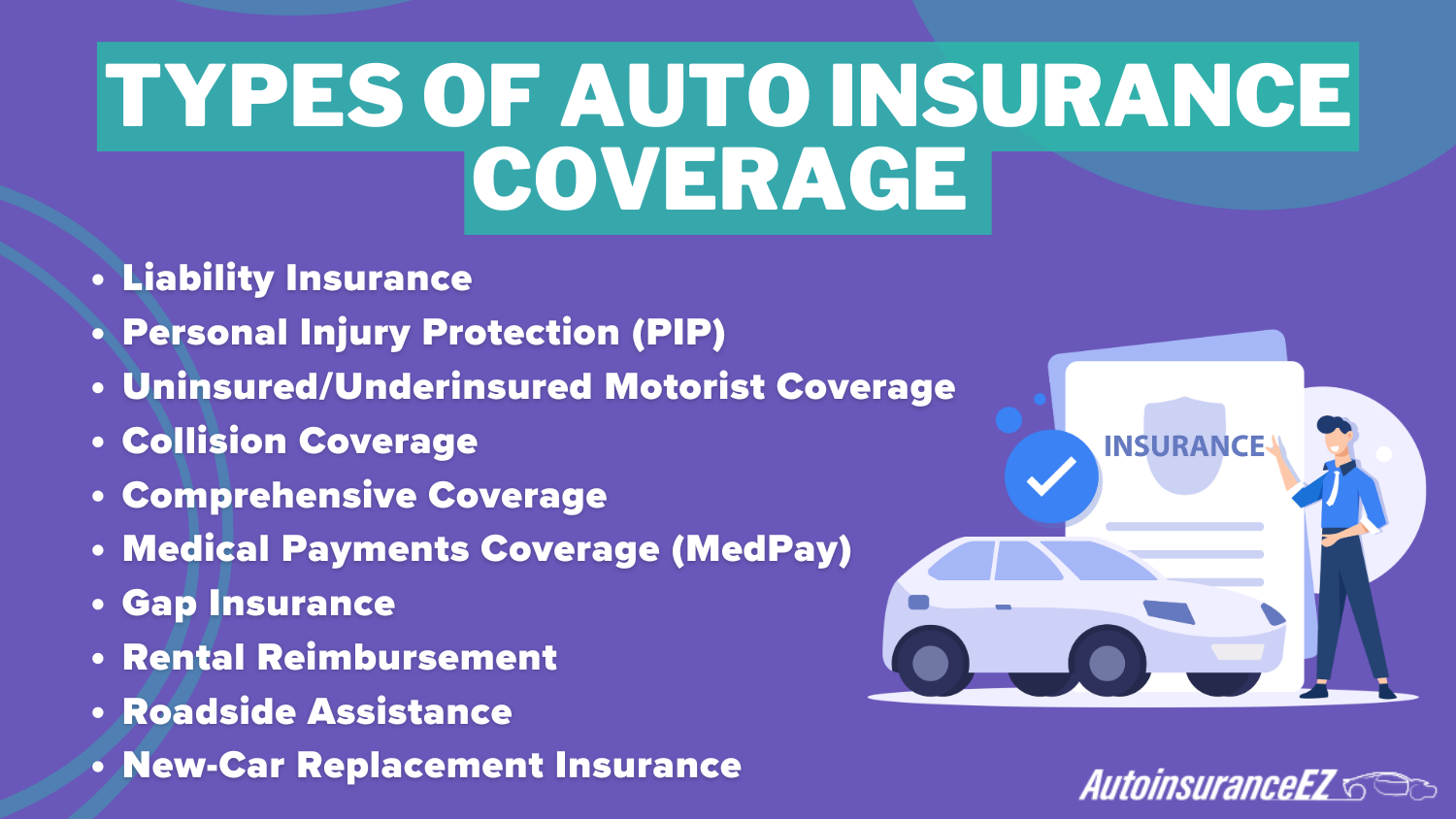

- Understand Coverage Options: Familiarize yourself with different coverage types to select the proper protection.

- Research Average Rates: Know the average car insurance costs in Kansas to understand what’s reasonable.

- Compare Auto Insurance Companies: Find an insurer that can provide the cover you need at a reasonable cost. If you want affordable car insurance in Kansas, compare quotes from different companies.

- Evaluate Financial Strength: Pick an insurer with sound financial stability to ensure that he can pay off claims without defaulting.

- Look at Customer Ratings: Read customers’ reviews and check complaints lodged against the company to know their reputation.

By following these steps, you’ll find the best auto insurance in Kansas, whether you’re seeking cheap car insurance or comprehensive coverage.

Additional Liability Coverage in Kansas

In Kansas, rear-end collisions are the most common type of claim, accounting for 30% of all auto insurance claims with an average cost of $3,500 per incident. Single-vehicle accidents follow, representing 25% of claims at an average cost of $4,200.

5 Most Common Auto Insurance Claims in Kansas

| Claim Type | Portion of Claims | Cost per Claim |

|---|---|---|

| Rear-End Collisions | 30% | $3,500 |

| Single Vehicle Accidents | 25% | $4,200 |

| Side-Impact Collisions | 20% | $5,000 |

| Parking Lot Accidents | 15% | $1,500 |

| Theft Claims | 10% | $8,000 |

Side-impact collisions make up 20% of claims, averaging $5,000 each. Parking lot accidents and theft claims account for 15% and 10% of claims, with average costs of $1,500 and $8,000, respectively.

When considering how accidents change your car insurance rate, location is a key factor. Wichita reports 5,000 accidents and 3,800 claims annually, while Kansas City records 3,200 accidents and 2,700 claims each year.

Kansas Accidents & Claims per Year by City

| City | Accidents per Year | Claims per Year |

|---|---|---|

| Kansas City | 3,200 | $2,700 |

| Lawrence | 1,200 | $950 |

| Overland Park | 2,500 | $2,100 |

| Topeka | 1,800 | $1,500 |

| Wichita | 5,000 | $3,800 |

These accident rates are significantly high and have a huge effect on Kansas auto insurance rates, with areas having more claims being charged higher premiums. Knowledge of such patterns is what makes insurance prices higher in areas of high accidents.

Minimum Auto Insurance Coverage in Kansas

Kansas has a no-fault insurance system, where you can submit a claim directly to the insurer after an accident, regardless of fault. Legal action is allowed only if your injuries exceed a serious injury threshold, such as permanent disfigurement or loss of body function.

To ensure adequate protection in Kansas, consider higher auto insurance coverage limits, as the state's minimum requirements may not cover the full costs of a serious accident.

Brad Larson Licensed Insurance Agent

While the state’s minimum coverage satisfies legal requirements, choosing higher limits is advisable. Comparing car insurance quotes, Derby KS ensures adequate protection, as significant accidents can quickly exceed the minimum coverage, leading to costly out-of-pocket expenses.

Exploring the Best Auto Insurance Deals in Kansas

USAA, Geico, and State Farm are the top providers of cheap auto insurance in Kansas because they provide dependable coverage at affordable rates. While Geico and State Farm provide reasonable rates and excellent customer service, USAA has the cheapest rates for military members and their families, starting at $18 per month.

Kansas drivers can benefit from discounts like the safe driver discount. By comparing car insurance rates in Kansas, drivers can choose policies that best meet their needs and budget. Start comparing KS auto insurance rates by entering your ZIP code here.

Frequently Asked Questions

Why is USAA considered a leading auto insurance provider in Kansas?

USAA is considered a leading provider due to its affordable rates, particularly for military families, starting at $18. Look at our auto insurance coverage options for expanded insights.

How does Geico provide value to Kansas drivers?

Geico is a leading option for Kansas cheap auto insurance, offering competitive rates and excellent customer service, which makes it a popular choice among drivers in the state.

What factors affect auto insurance rates in Kansas?

Factors such as driving history, car type, age, location, and coverage level affect auto insurance rates. Get fast and cheap auto insurance coverage today with our quote comparison tool.

Can Kansas drivers receive discounts on their auto insurance premiums?

Kansas drivers can receive various discounts, including a safe driver discount, which helps lower premiums for those with clean driving records. Explore our car insurance discounts for more insights.

What types of auto insurance coverage should Kansas drivers consider?

Kansas drivers should consider comprehensive coverage, which protects against accidents, theft, and natural disasters, as well as additional liability coverage for added protection.

What’s the minimum auto insurance coverage required by law in Kansas?

Does Kansas offer liability-only auto insurance?

Yes, liability-only auto insurance is available in Kansas, covering damages to other parties but not your vehicle.

How do I choose the right auto insurance policy in Kansas?

To choose the right policy, compare rates, coverage options, and available discounts from different providers. Consider your driving habits, vehicle type, and budget. Find the cheapest auto insurance quotes by entering your ZIP code into our free comparison tool.

Are there any special insurance programs for young drivers in Kansas?

Yes, many auto insurance providers in Kansas offer unique programs or discounts for young drivers, including good student discounts or programs aimed at promoting safe driving.

How do I qualify for military discounts on auto insurance?

Military families can qualify for discounts by choosing USAA as their provider, which offers special rates for active-duty service members and veterans. Learn more about military auto insurance.