Best Gary, IN Auto Insurance in 2025 (Find the Top 10 Companies Here)

State Farm, Geico, and Progressive are the best Gary, IN auto insurance providers, with average monthly premiums as low as $34. State Farm offers strong local support, Geico is known for low rates and digital tools, while Progressive provides flexible plans for high-risk drivers.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Licensed Insurance Agent

UPDATED: Apr 21, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

18,154 reviews

18,154 reviewsCompany Facts

Full Coverage in Gary IN

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in Gary IN

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage in Gary IN

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsState Farm has the best Gary, IN auto insurance rates for as low as $34 per month. It’s also known for its wide range of coverage options and car insurance discounts.

When selecting the best insurer, consider also Geico and Progressive because they offer competitive rates for fast and friendly service. Our guide below will help you find the lowest rate and best coverage in Gary, Indiana.

Our Top 10 Company Picks: Best Gary, IN Auto Insurance

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $142 | A++ | Local Agents | State Farm | |

| #2 | $129 | A++ | Extensive Discounts | Geico | |

| #3 | $155 | A+ | Competitive Rates | Progressive | |

| #4 | $189 | A+ | Comprehensive Coverage | Allstate | |

| #5 | $173 | A | Customizable Policies | Farmers | |

| #6 | $90 | A+ | Coverage Options | Erie |

| #7 | $129 | A+ | Vanishing Deductible | Nationwide |

| #8 | $144 | A | Flexible Coverage | American Family | |

| #9 | $176 | A | Multi-Policy Discount | Liberty Mutual |

| #10 | $170 | A+ | AARP Members | The Hartford |

Get started today and compare the most reliable insurers to find cheap car insurance in Gary, Indiana.

- State Farm has competitive auto insurance rates in Gary, IN

- Geico and Progressive also offer great coverage for drivers in Gary, Indiana

- Top-rated Gary, IN auto insurance is customized to meet local driver needs

Simply enter your ZIP code to get quotes from top Gary, IN, providers near you. It only takes a few seconds and could help you find a plan that fits your needs and budget.

#1 – State Farm: Top Overall Pick

Pros

- Affordable Local Rates: The average monthly premium for a policy in Gary, Indiana, starts at $34. Read our State Farm review for more.

- Broad Coverage Options: Provides coverage to meet the unique needs of Indiana drivers and help you find the best Gary, IN auto insurance coverage.

- Reliable Service for Indiana Residents: High marks for reliable service that Indiana drivers trust.

Cons

- Limited Youth Discounts: Fewer savings opportunities for younger drivers, which may make it less affordable for some in Gary.

- Basic Digital Tools: Online and mobile services could be more advanced, which might be inconvenient for drivers seeking a fully digital experience.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#2 – Geico: Best for Extensive Discounts

Pros

- Discounts for Good Drivers: Enjoy the best auto insurance in Gary, IN, with great discounts for safe drivers, students, and military personnel.

- User-Friendly Tech: Mobile app and website, great for Gary residents on the go who want to manage policies digitally. Gain further insights from our Geico review.

- Established in Indiana: Quick service that’s essential for Indiana drivers looking to get back on the road fast.

Cons

- Higher Rates for High-Risk Drivers: Drivers from Gary may be charged higher-than-average rates.

- Customer Service Delay: Some Gary customers report that they sometimes have to wait for their claims to be processed.

#3 – Progressive: Best for Competitive Rates

Pros

- Competitive Pricing: Partners with multiple companies to find low quotes, helping drivers save on Gary, IN auto insurance options.

- Snapshot Savings Program: Offers discounts for safe driving habits, which could be helpful to cautious drivers in Gary. Read our review of Progressive for full details.

- Multi-Policy Bundles: Indiana customers can bundle home, auto, and other policies, making this a good choice for those with multiple insurance needs.

Cons

- Renewal Rate Increases: Drivers in Gary may see premiums rise after their first term, affecting long-term affordability.

- Slower Claims Process: Some Indiana drivers report occasional delays, even with top Gary, IN auto insurers.

#4 – Allstate: Best for Comprehensive Coverage

Pros

- Full Coverage Options: Offers full coverage, which can provide Gary, Indiana, drivers with added peace of mind.

- Discount Variety: Offers discounts for new cars, safe drivers, and more, making it a strong option for cost-conscious drivers in Gary.

- Dependable Claims Service: Highly rated for handling large claims, which can be a plus in case of major accidents. Discover details in our Allstate review.

Cons

- Higher Premiums in Some Cases: Monthly rates can be a bit higher, so Gary drivers may need to compare to get the best value.

- Regional Service Variability: In Gary, customer service can differ by location, but top insurers offer more consistent support.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#5 – Farmers: Best for Customizable Policies

Pros

- Customizable Policies: Policy options can be tailored to suit the needs of different drivers, a plus for Indiana’s diverse driving population.

- Multi-Car & Policy Discounts: Known for significant savings for families and multi-policy households in Gary. Find more in our Farmers review.

- Personalized Local Support: Farmers agents offer personalized support that many drivers in Indiana.

Cons

- Higher Base Rates: Farmers’ base rates may be less competitive, especially for single-policy holders in Gary.

- Limited Online Tools: Digital options are not as robust, which could be less convenient for tech-savvy drivers.

#6 – Erie: Best for Coverage Options

Pros

- Flexible Coverage Choices: As one of the best Gary, IN auto insurance providers, Erie allows policyholders to choose the amount of coverage they want.

- Consistent Customer Satisfaction: Repeatedly noted as a top provider with high customer satisfaction in Indiana. Discover more in our Erie car insurance review.

- Affordable Options: A competitive auto insurance choice in Gary, IN, for drivers in search of value and coverage.

Cons

- Availability Limitations: Erie is not available in all areas, so some Gary drivers may not qualify.

- Discount Eligibility Varies: The best Gary, IN auto insurers offer discounts, but many drivers may not qualify due to credit, driving record, or bundling requirements.

#7 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: This program is invaluable for careful drivers seeking the best auto insurance in Gary, IN. For every year you drive safely, your deductible decreases.

- Comprehensive Coverage Options: Offers robust coverage for drivers seeking the most comprehensive protection available.

- Multi-Policy Savings: Renowned for its bundled-policy discounts, which are ideal for Gary households with more than one policy. Learn more in our Nationwide review.

Cons

- Average Customer Service: Service can vary, which may lead to mixed experiences for Indiana residents.

- Higher Premiums for New Drivers: Gary’s younger or less experienced drivers may see higher initial costs.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#8 – American Family: Best for Flexible Coverage

Pros

- Flexible Coverage Levels: AmFam allows Gary drivers to customize their policies, a key feature of the best auto insurance options in Gary, IN.

- Strong Local Presence: AmFam agents know Gary’s roads and drivers, offering personalized service that helps it stand out among the best local auto insurers.

- Affordable Rates With Discounts: Provides discounts for families, safe drivers, and more, helping reduce costs for Indiana residents. Explore our American Family review.

Cons

- Higher Rates for Some Vehicles: Premiums can be higher for luxury cars or new vehicles.

- Fewer Discounts for Young Drivers: There are fewer savings options available for young drivers in Gary compared to some competitors.

#9 – Liberty Mutual: Best for Multi-Policy Discount

Pros

- Multi-Policy Discounts: Gary drivers can unlock savings by combining their home and auto insurance. Check out our Liberty Mutual review for more info.

- Comprehensive Coverage: Drivers who want added protection will appreciate the wide range of coverage options included in Gary, IN auto insurance policies.

- Mobile App with Great Features: Managing your policy is easier than ever with digital tools offered by the best auto insurance providers in Gary, IN.

Cons

- Higher Rates for New Customers: New policyholders may end up paying more than they’re used to compared to previous customers when shopping for auto insurance in Gary, IN.

- Mixed Service Reviews: Service quality can vary, leading to inconsistent experiences, even with top Gary, IN auto insurers.

#10 – The Hartford: Best for AARP Members

Pros

- Special Savings for AARP Members: Discounts tailored for older drivers in Gary who are AARP members.

- Reputation for Customer Service: Highly regarded for its attentive and responsive customer service, particularly praised by senior drivers seeking the best Gary, IN auto insurance.

- Reliable Coverage Options: Known for thorough coverage options that meet the needs of many Indiana drivers. See The Hartford review for further exploration.

Cons

- Limited Discounts for Younger Drivers: Primarily geared toward mature drivers, so fewer options for young drivers in Gary.

- Higher Premiums Without AARP Membership: Rates can be higher if you don’t qualify for AARP discounts.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Gary, Indiana Cheap Car Insurance

Frequently Asked Questions

Which companies offer the best full coverage car insurance in Gary, IN?

Many local drivers recommend Allstate for a solid comprehensive plan, while State Farm remains a go-to option due to its friendly, in-person service from local agents.

Which insurer in Gary, Indiana, is considered the best overall?

State Farm often comes up as a favorite, offering diverse coverage choices and the convenience of nearby agents who are familiar with the area. Get the best Gary, IN auto insurance by comparing rates. Just enter your ZIP code.

Which company provides the most competitive high-risk auto insurance in Gary, IN?

Progressive has a reputation for accommodating high-risk drivers with flexible terms and attractive discount opportunities.

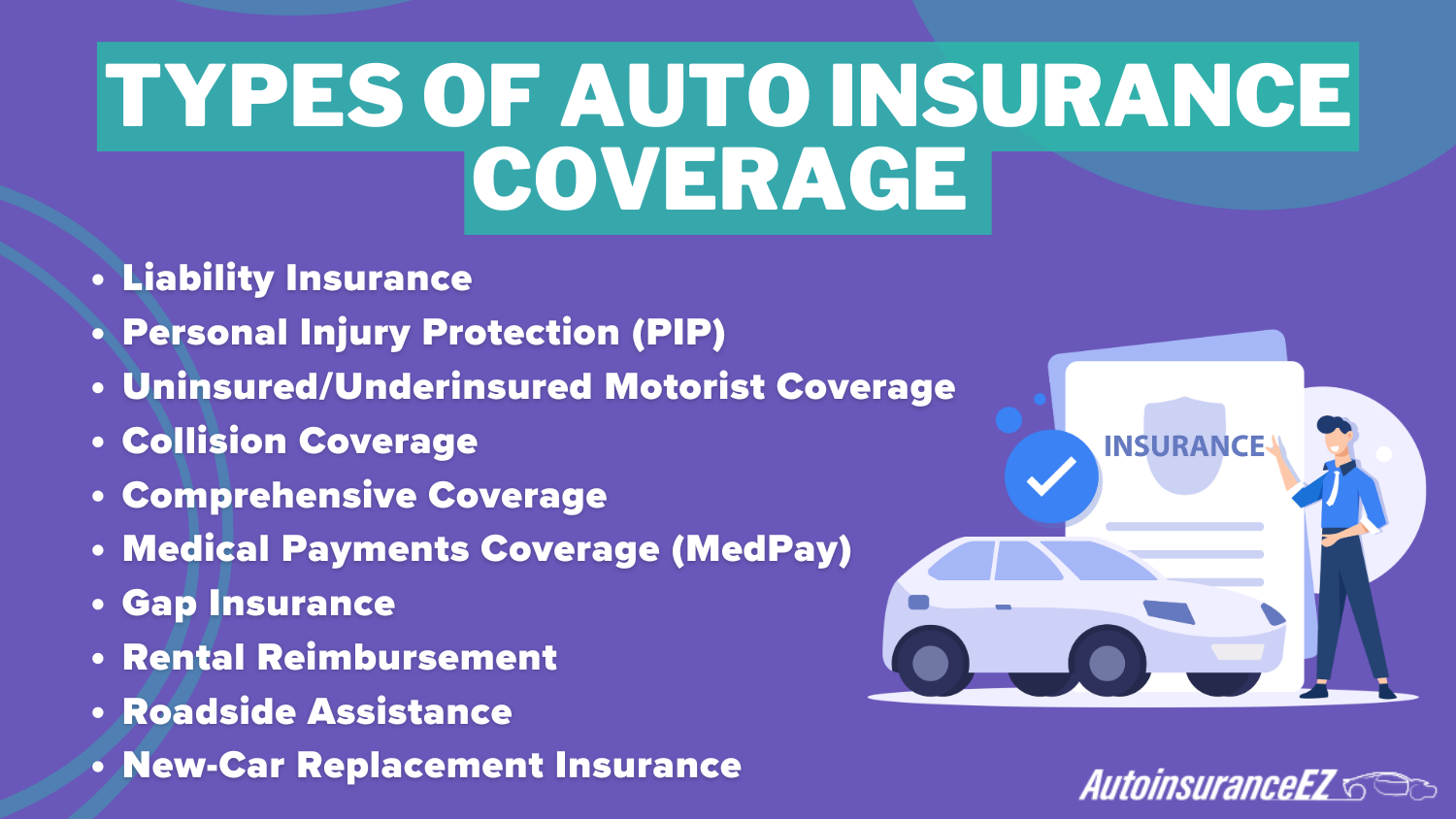

What type of coverage is recommended for drivers in Gary, IN?

A full coverage policy, including liability, collision, and comprehensive coverage, is commonly recommended, especially for drivers who want extra peace of mind.

Which local insurance company stands out in Gary, IN?

State Farm consistently earns praise for its friendly, local agents who can tailor policies to fit a variety of needs.

Which car models have the lowest insurance rates in Gary, IN?

Usually, vehicles that prove to have acceptable safety features and have lower repair costs—mostly sedans and some SUVs—receive more economical premiums, according to the ultimate road safety guide.

What vehicles are generally the easiest to insure in Gary, IN?

Family-friendly sedans and SUVs with strong safety records typically come with more affordable insurance options than high-performance or luxury models.

Which insurer is the most trusted among Gary, IN, drivers?

Geico consistently wins over many drivers with its solid financial backing and wide range of discounts.

Which auto insurance coverage is the most popular in Gary, IN?

While state law may only require liability auto insurance, many drivers opt for full coverage as protection against the most common hazards on the road.

Which company in Gary, IN, offers the best value for coverage and cost?

Nationwide often strikes a nice balance by offering features like a vanishing deductible along with various discounts, making it a good value pick.

Which auto insurer is used most often in Gary, IN?

Large providers like State Farm and Geico often top the list due to their extensive offerings, solid discounts, and local availability.

How do minimum coverage requirements in Gary, IN, compare to nearby areas?

Indiana’s state requirements for various types of auto insurance coverage tend to align with those of surrounding states, though the actual limits may vary slightly.

Which insurance provider has the most complaints in Gary, IN?

Complaint numbers can shift over time. Checking with state insurance resources or consumer reviews can reveal which providers may be falling short.

Which insurers in Gary, IN, offer the best discounts?

Geico, Allstate, and Erie frequently come up as popular choices for discount hunters, whether it’s safe-driver savings or multi-policy deals.

Who provides the best bundling deals (e.g., auto and home) in Gary, IN?

Geico, Allstate, and American Family all typically provide strong savings when you combine auto with other insurance types, like bundling car insurance and renters insurance to save money.

Which local agencies in Gary, IN, are praised for superior customer service?

State Farm stands out thanks to its friendly, local office experiences, although individual service can vary from one neighborhood agent to another.

How do insurance rates differ for new vs. used vehicles in Gary, IN?

New vehicles can be more expensive to insure, mainly due to higher replacement costs. Used cars often enjoy lower rates unless they’re known for frequent or expensive repairs.

Which factors affect auto insurance premiums in Gary, IN?

Different driving histories, types of vehicles you drive, age, credit score, and local neighborhood can all play large roles in how much your insurance ends up costing, which connects to common questions, such as how old do you have to be to drive.

Which insurance company in Gary, IN, handles claims most efficiently?

Erie and The Hartford frequently get positive feedback for quick turnaround times and helpful support when handling claims.

How can drivers in Gary, IN, reduce their auto insurance costs?

Safe driving, keeping a clean record, exploring multi-policy discounts, and occasionally shopping around for quotes are all tried-and-true ways to save on premiums. Compare top auto insurance rates in Gary, IN by entering your ZIP code now.