Best Savannah, GA Auto Insurance in 2025 (Find the Top 10 Companies Here)

Geico, State Farm, and Erie are the best Savannah, GA auto insurance with rates starting from $106 per month. Geico offers the best discounts, State Farm provides the most effective service, and Erie has the best coverage options, making all three the ideal choices for quality and cheap insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Tim Bain

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Licensed Insurance Agent

UPDATED: Jan 28, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in Savannah GA

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,154 reviews

18,154 reviewsCompany Facts

Full Coverage in Savannah GA

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 1,883 reviews

1,883 reviewsCompany Facts

Full Coverage in Savannah GA

A.M. Best Rating

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviewsThe top auto insurance in Savannah, GA can be attributed to Geico, State Farm, and Erie, all of whom have well balanced discounts, service and coverage level for their clients.

Geico offers the best deal when it comes to plenty of discounts, State Farm sociability is off the chart and finally, Erie has the best coverage. This guide evaluates multiple businesses and enables you to determine the best auto insurance for your needs.

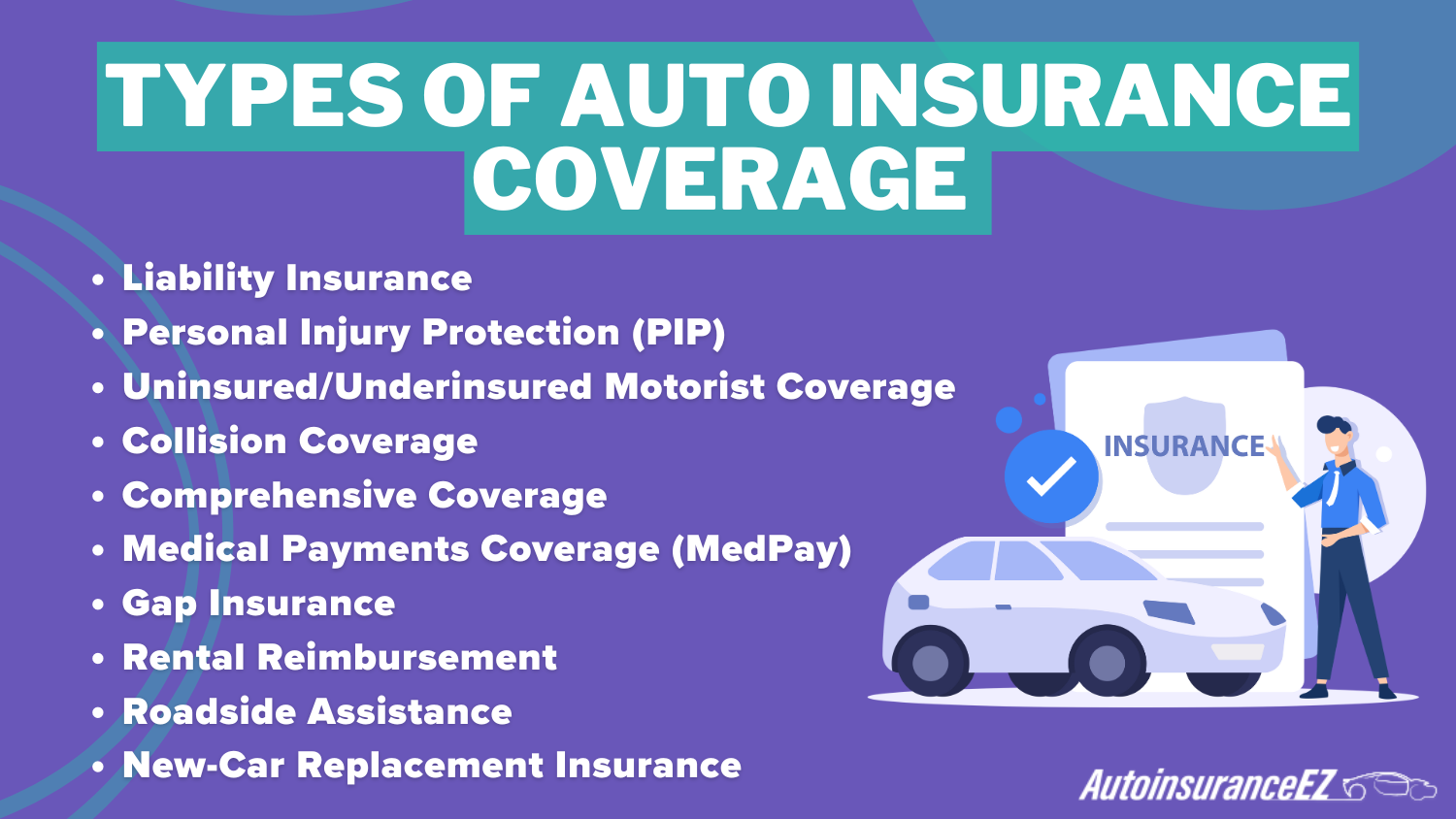

Whether you are looking for just the basic policy or something more, the best companies in this city have great offers. To learn more, explore our comprehensive resource on commercial auto insurance titled “Auto Insurance Coverage Options [Choose and Save]

Our Top 10 Company Picks: Best Savannah, GA Auto Insurance

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | A++ | 25% | Affordable Rates | Geico | |

| #2 | B | 17% | Excellent Service | State Farm | |

| #3 | A+ | 25% | Strong Coverage | Erie |

| #4 | A++ | 10% | Military Discounts | USAA | |

| #5 | A+ | 25% | Diverse Options | Allstate | |

| #6 | A+ | 10% | Innovative Tools | Progressive | |

| #7 | A+ | 20% | Comprehensive Policies | Nationwide |

| #8 | A++ | 13% | Reliable Claims | Travelers | |

| #9 | A | 25% | Extensive Discounts | Liberty Mutual |

| #10 | A | 15% | Minimum Coverage | Safeco |

Protect your vehicle at the best prices by entering your ZIP code into our free auto insurance quote comparison tool above.

- Best Savannah, GA auto insurance plans to fit the local driving environment

- Flexible policies designed for Savannah’s specific weather and road conditions

- Geico is the top choice for affordable and comprehensive auto coverage

#1 – Geico

Pros

- Affordable Rates: Geico is one of the cheapest car insurance providers, making it suitable for drivers on a budget in Savannah.

- Variety of Discounts: Explore our Geico auto insurance review to learn about discounts for military members, students, and good drivers in Savannah, GA.

- Fast Claims Processing: The easy-to-navigate claims management mobile application and the website enable Savannah drivers to file and manage claims quickly.

Cons

- Limited Local Agents: Geico operates mostly online, so those who prefer in-person service may find the lack of local agents in Savannah inconvenient.

- Inconsistent Customer Support: A few of the customers in Savannah complain about delays in how they process their claims.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#2 – State Farm

Pros

- Local Agent Network: State Farm’s local agents propose all the solutions in accordance with the Savannah driver’s satisfaction and are always on time.

- Comprehensive Coverage: Our State Farm auto insurance review highlights a wide array of available improved coverage options, particularly for the Savannah people.

- Reliable Claims Handling: The company is well-regarded for its trustworthy claims service, ensuring swift support for Savannah residents dealing with accidents.

Cons

- Higher Premiums: Rates tend to be on the high side, especially for younger drivers in Savannah.

- Outdated Online Tools: The website and mobile app feel a bit behind the curve, lacking the modern features offered by some competitors in Savannah.

#3 – Erie

Pros

- Affordable Premiums: Due to Erie’s low rates, it has become one of the most preferred companies for Savannah residents looking for cheap vehicle insurance.

- Unique Benefits: With Erie’s “Rate Lock,” Savannah driver’s premium stays the same, even after a minor accident—taking some of the stress out of those little mishaps.

- High Customer Satisfaction: Check out our Erie auto insurance review to see why the organization scores well with customer service and helps out local drivers effectively.

Cons

- Limited Availability: Erie is not available in every state, which in turn makes everything a little bit complicated in case you are considering relocating

- Fewer Discounts: A few drivers in Savannah claim that Erie provides fewer discounts in price than other insurance companies, which can be disappointing if one is looking to minimize expenses more.

#4 – USAA

Pros

- Great Value for Military Families: Discounts and Policies for Military Families in Savannah are offered by USAA at reasonable rates.

- Top Customer Satisfaction: USAA regularly earns high marks for customer service, delivering reliable support when it’s needed most.

- User-Friendly Digital Tools: Based on our USAA auto insurance review, the company provides an easy-to-use app and online tools, making it simple to manage policies and file claims.

- Limited Eligibility: Although USAA is available to Savannah residents, membership is restricted to military members and their families, so it’s not open to everyone.

- Limited Coverage Options: USAA presents a smaller range of coverage to policyholders than bigger insurers, which may seem limiting to some citizens of Savannah.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#5 – Allstate

Pros

- Comprehensive Coverage: Allstate offers a variety of options, including new car replacement and accident forgiveness, which many Savannah drivers appreciate.

- Local Expertise: Our Allstate auto insurance review highlights the personalized service from agents who have a deep understanding of the Savannah community.

- Great Discounts: Allstate helps Savannah drivers save more with their insurance through their discounts for safe driving and bundling.

Cons

- Higher Premiums: Some of Allstate’s services are pricier than those of other insurers, which could be a downside for budget-conscious drivers in Savannah.

Inconsistent Customer Service: Some customers in Savannah are not satisfied with certain aspects of claims and support, which makes them worried about the equality of the service provided.`

#6 – Progressive

Pros

- Innovative Pricing: The ‘Name Your Price’ feature allows Savannah-based drivers to create the most appropriate policy for their needs, easily.

- Affordable Rates: Savannah residents have a high preference for Progressive Insurance because of its highly competitive rates, specifically for safe drivers.

- Flexible Coverage: Explore our Progressive auto insurance review to learn how their coverage options, including usage-based policies, adapt to different driving needs.

Cons

- Complex Policies: There are so many coverage options that some Savannah drivers may find it hard to select the most appropriate coverage plan that fits their needs.

- Mixed Reviews: While some consumers in Savannah have a favorable opinion of Progressive, others have had a bad experience with the business.

#7 – Nationwide

Pros

- Wide Coverage Options: Discover our Nationwide auto insurance review for details on the various coverage plans available to Savannah drivers.

- Bundling Discounts: Customers can buy other forms of insurance, which helps them save through bundling auto insurance with home insurance, making it a great option for families in Savannah.

- Reliable Customer Service: Handling customers is one of the strong points of Nationwide, which is beneficial to drivers in Savannah because they can access the help that they require within the shortest time.

Cons

- Higher Premiums for Some: Somerivers in Savannah, including young drivers and those with histories of claims, may find the rates a bit higher.

- Limited Online Tools: Although they’re improving, Nationwide’s online tools aren’t as easy to use as those of some competitors, which could be frustrating for tech-savvy users.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#8 – Travelers

Pros

- Customizable Coverage: Each driver has a different circumstance; hence, Travelers permits the people of Savannah to tailor the policies to their needs.

- Reliable Financial Stability: With solid financial support, Travelers ensures that claims are settled in a timely manner, assuring drivers in Savannah of their insurance coverage.

- Savings Opportunities: Within our Travelers auto insurance review, we detail how safe driving and bundling discounts help Savannah residents save on premiums.

Cons

- Mixed Reviews: The experiences of drivers in Savannah vary since some clients in Savannah have faced issues regarding the claims and support services

- Limited Local Agents: Travelers may have fewer agents in Savannah, which could make it harder for some customers to get personalized service.

#9 – Liberty Mutual

Pros

- Extensive Discounts: Liberty Mutual offers plenty of ways to save, like bundling home and auto insurance or earning discounts for safe driving, which helps Savannah drivers keep their insurance costs down.

- Customizable Policies: Delve into our Liberty Mutual auto insurance review to understand how policies can be tailored to fit Savannah’s unique driving conditions.

- User-Friendly App: Drivers in Savannah can update coverage, manage policy, or file a claim quickly from anywhere through Liberty Mutual’s app.

Cons

- Higher Premiums: Unfortunately, younger drivers or drivers with few claims on record might end up paying more for coverage, something drivers in Savannah should be aware of.

- Inconsistent Service: While many Savannah customers are satisfied with Liberty Mutual, some drivers have reported frustrating experiences with the claims process.

#10 – Safeco

Pros

- Flexible Coverage: In our Safeco auto insurance review you’ll learn how Savannah residents can customize their coverage for better protection.

- Easy Online Tools: The digital interface of Safeco is designed for the tech-savvy residents of Savannah, enabling them to manage their policies and file claims without any struggles.

- Discount Opportunities: Safeco offers a variety of discounts, including those for safe driving and bundling multiple policies, making it easier for customers to save money.

Cons

- Limited Availability: Some residents of Savannah may experience inconveniences since they may not be able to fully access Safeco, as it is not offered in all locations.

- Mixed Customer Reviews: While many customers are happy, some have shared frustrations with how claims are handled and the level of customer support they receive.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Exploring Best Savannah, GA Auto Insurance Rates

Drivers should take into account a number of variables when selecting the best vehicle insurance in Savannah, GA, such as coverage options, cost, and customer service. Geico is a top option for drivers on a tight budget because of provides exceptional savings and competitive products.

Savannah, GA Auto Insurance Monthly Rates by Provider & Coverage Level

Also, taking in consideration how reliable their coverage is and how far they go to keep their customers happy, State Farm and Erie also remain among the top contenders in offering Savannah residents various options for their auto insurance needs.

To find the best auto insurance in Savannah, GA, There’s an affordable choice for every driver, so be sure to explore different providers to secure the best deal for your needs and lifestyle.

Maximum Savings Best Auto Insurance in Savannah, GA

A variety of leading companies offer great car insurance discounts. Geico excels due to the discounts it offers such as those meant for safe drivers, the military and anti-theft device users making it among the best. Geico auto insurance makes a perfect option for those looking for an inexpensive car cover in Savannah.

Auto Insurance Discounts From the Top Providers in Savannah, GA

State Farm, Allstate, Erie, Nationwide, and USAA have different types of discounts that enhance the experience of being a driver or a passenger, such as safe driving prices, bundle policies, and good student ones. Thanks to the low rates plus a long list of available discounts.

Major Factors Affect Auto Insurance in Savannah, GA

Finding the right auto insurance in Savannah, GA, can be quite a challenge, especially if you do not know what are the factors that affect your rates.

Factors such as where you park the car, the crime rate of the area, driving history, and even the type of the vehicle owned will greatly affect the premiums and how these factors affect rates can be helpful in finding affordable coverage suited for particular conditions in Savannah, for instance.

Zip Code

Where you park in Savannah, GA, directly affects your auto insurance rates, with lower rates for garage parking and higher rates for street parking in high-risk areas.

Savannah, GA Auto Insurance Monthly Rates by ZIP Code

| City | ZIP Code | Monthly Rate |

|---|---|---|

| Savannah, GA | 31401 | $145 |

| Savannah, GA | 31402 | $150 |

| Savannah, GA | 31403 | $147 |

| Savannah, GA | 31404 | $148 |

| Savannah, GA | 31405 | $155 |

| Savannah, GA | 31406 | $152 |

| Savannah, GA | 31407 | $149 |

| Savannah, GA | 31408 | $153 |

| Savannah, GA | 31409 | $151 |

| Savannah, GA | 31410 | $150 |

| Savannah, GA | 31411 | $156 |

Providers like State Farm and Nationwide adjust costs based on location, so comparing auto insurance companies can help you find the best auto insurance in Savannah, GA, for your needs.

Automotive Accidents

Where you leave your vehicle and how you drive greatly determine how much one would pay for car insurance in Savannah, GA. Worse insurance rates may come from having to park the car off a busy street or in high-risk areas, while less aggressive driving may help lessen coverage costs.

| Factor | Value |

|---|---|

| Total Accidents per Year | 3,100 |

| Total Insurance Claims per Year | 2,800 |

| Average Claim Cost | $5,800 |

| Percentage of Uninsured Drivers | 14% |

| Accidents Involving Injuries | 22% |

| Accidents Involving Fatalities | 2% |

| Most Common Accident Type | Side-impact collisions |

| Peak Accident Time | 4 PM - 6 PM |

| Weather-Related Accidents | 12% |

Local accident statistics show the need to embrace appropriate driving skills to obtain the best auto insurance in Savannah, Georgia. To gain in-depth knowledge, consult our comprehensive resource titled “High Risk Drivers”

Auto Theft in Savannah, Ga

Even in smaller towns, auto theft is still a problem within Savannah, GA. Vehicles go missing and sometimes get damaged in the process, but the lowest insurance coverage may not pay for these damages.

Savannah, GA Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Collision Coverage | Comprehensive Coverage |

|---|---|---|

| $120 | $95 | |

| $135 | $110 | |

| $125 | $100 | |

| $140 | $115 | |

| $130 | $105 | |

| $145 | $120 |

| $138 | $112 |

| $128 | $102 | |

| $142 | $118 | |

| $133 | $108 |

As such, providers’ comprehensive car insurance includes theft provisions, which come in handy in Savannah, GA.

Anti-theft systems can reduce costs, making it easy for a client to look for the most affordable car insurance with theft coverage in Savannah, GA. Considering that in 2018, 656 incidents of car theft were recorded in the area, such coverage is indispensable for car owners in this region.

Credit Score

When deciding on the premiums for auto insurance policies, insurance companies consider an individual’s credit score since low scores indicate a higher risk to obtain the most competitive auto insurance prices available.

Savannah, GA Auto Insurance Monthly Rates by Provider & Credit Score

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $110 | $125 | $145 | |

| $115 | $130 | $155 | |

| $120 | $140 | $160 | |

| $125 | $145 | $170 | |

| $105 | $120 | $140 | |

| $130 | $150 | $175 |

| $118 | $135 | $158 |

| $112 | $130 | $150 | |

| $119 | $140 | $165 | |

| $122 | $138 | $162 |

In general, to enhance the credit rating, it is better to leave credit lines open, pay on time, and set up auto-pay. According to the average monthly insurance rates, the chances of getting better premiums increase considerably with higher credit ratings.

For additional details, explore our comprehensive resource titled “How Your Credit Score Affects Your Car Insurance Premiums

Age

When it comes to car insurance for teenage driver in Savannah, GA, one should expect to pay higher premiums, as teens are the costliest group to insure due to their age and inexperience. However, it is possible to trim the costs substantially by taking advantage of discounts such as “Good Student” and Driver’s Ed.

Savannah, GA Auto Insurance Rates by Age

| Insurance Company | 17 Years Old | 34 Years Old |

|---|---|---|

| $350 | $150 | |

| $375 | $160 | |

| $360 | $155 | |

| $400 | $170 | |

| $320 | $140 | |

| $390 | $165 |

| $370 | $155 |

| $365 | $150 | |

| $380 | $160 | |

| $355 | $148 |

As shown by the average monthly auto insurance rates of the states, the adjustment made for a 17-year-old driver versus a 34-year-old driver can be quite high, which is why these discounts are essential in obtaining the affordable auto insurance Savannah, GA, offers.

Driving Record

Your past engagement in car accidents greatly affects your ability to get the proper car insurance or auto insurance in Savannah, Georgia. Careless and reckless actions like speeding may lead to an increase in rates. To lower your premiums, keep a clean record.

Savannah, GA Auto Insurance Monthly Rates by Provider & Driving Record

| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $120 | $145 | $180 | $135 | |

| $130 | $160 | $200 | $150 | |

| $125 | $155 | $195 | $140 | |

| $140 | $175 | $210 | $155 | |

| $110 | $135 | $170 | $125 | |

| $135 | $165 | $205 | $145 |

| $128 | $158 | $198 | $138 |

| $123 | $153 | $190 | $133 | |

| $132 | $162 | $202 | $142 | |

| $126 | $156 | $196 | $137 |

If tickets detrimentally affect you, consider telematics, which vehicles fitted with devices and where data on the driving habits of individuals is collected and offers some discount. You can access cheap car insurance in Savannah by practicing safe driving and looking for available discounts for members.

Vehicle

The vehicle you drive affects your chances of getting the best Savannah, GA, auto insurance. Affordable cars are usually cheaper to repair, so you might not need extensive coverage.

Savannah, GA Auto Insurance Monthly Cost by Make, Model, & Coverage Type

| Make and Model | Minimum Coverage | Full Coverage |

|---|---|---|

| Toyota Camry | $85 | $160 |

| Honda Accord | $82 | $155 |

| Ford F-150 | $90 | $170 |

| Chevrolet Silverado | $88 | $165 |

| Nissan Altima | $84 | $158 |

| Hyundai Elantra | $80 | $150 |

| Jeep Grand Cherokee | $92 | $175 |

| Honda CR-V | $83 | $160 |

| Toyota Corolla | $78 | $145 |

| Ford Explorer | $95 | $180 |

When choosing coverage, think about your budget. A new Porsche may require more coverage than an older pickup. If financing or leasing, lenders often have specific requirements.

Insurance companies tend to charge more for vehicle insurance on newer cars as the cost of servicing and repairing modern cars is often way high. Knowing such information on how the vehicle affects premium rates will help you find cheaper rates in Savannah.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Minor Factors that Affect rates Auto insurance in Savannah, GA

Prioritizing things such as your driving history and the car model you own when looking for car insurance in Savannah, GA, is a common practice among many people. However, lesser-known details tend to affect your rates more than you may expect, thereby creating savings that you have not thought of.

With a 92% customer satisfaction rating, Geico stands out in Savannah for its unbeatable discounts and competitive pricing, making it a top choice for budget-conscious drivers.

Dani Best Licensed Insurance Agent

This part will introduce these other aspects that insurers use to evaluate the risks involved in offering you a policy and explain how you can use this information to your advantage to get a better policy at a more reasonable cost.

Marital Status

Although being married doesn’t directly impact accident risk, it can lead to lower auto insurance rates in Savannah, GA. Married couples often bundle multiple policies—like auto, homeowners, and more—under one plan, which many insurers reward with discounts.

If you’re after the best auto insurance in Savannah, GA, consider bundling as a couple to take advantage of newlyweds discount and save on premiums.

Gender

Gender still affects how much an individual pays for auto insurance. Statistically, young men, particularly those aged between 17 and 24, are regarded as more dangerous drivers in comparison with liberal and risk-tolerant women, and this means they attract higher premiums.

While some companies have begun charging equal rates irrespective of age, sex, or ethnicity, this is, however, not universal throughout the industry.

If you want to get cheap car insurance in Savannah, Georgia, you should compare insurance companies based on their ranging rates irrespective of the client’s gender. To gain in-depth knowledge, consult our comprehensive resource titled “High Risk Insurance.”

Driving Distance to Work

Savannah drivers average a 14-21 minute commute, with some opting to carpool depending on location. Commute distance and annual mileage influence auto insurance rates due to risk assessment.

Savannah, GA Report Card: Car Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| Average Claim Size | B+ | Claims are moderately high, impacting premiums |

| Traffic Density | B | Moderate traffic congestion impacts rates |

| Weather-Related Risks | B | Occasional storms moderately affect claims |

| Vehicle Theft Rate | B- | Moderate theft rate slightly raises premiums |

| Uninsured Drivers Rate | C+ | Higher uninsured rate increases premiums |

Whenever possible, avoid registering your vehicle for business use, as it typically raises premiums by 10-12%. Although mileage impacts rates, the difference is usually minor—about 2-3%.

For the best auto insurance in Savannah, GA, consider how your driving habits affect your premiums. To gain profound insights, consult our extensive guide titled “How does an auto insurance company determine my premium?”

Coverage and Deductibles

To get the best auto insurance in Savannah, GA, consider adjusting your coverage and deductible. An explanation of deductibles can lower your monthly premiums, helping you save overall—but remember, this means higher out-of-pocket costs if you have an accident.

If you’re unlikely to set aside those savings for a future claim, it might be better to pay for a lower deductible.

| Factor | Value |

|---|---|

| Total Accidents per Year | 3,100 |

| Total Insurance Claims per Year | 2,800 |

| Average Claim Cost | $5,800 |

| Percentage of Uninsured Drivers | 14% |

| Accidents Involving Injuries | 22% |

| Accidents Involving Fatalities | 2% |

| Most Common Accident Type | Side-impact collisions |

| Peak Accident Time | 4 PM - 6 PM |

| Weather-Related Accidents | 12% |

Run a local quote to compare companies, balancing minimum coverage with policy limits and additional options. Experienced agents can guide you on the coverage that best fits your needs.

Education

Postsecondary studies would help you obtain advantageous auto insurance rates in Savannah, Georgia. Knowing that most insurers do not care about the job position and income of the driver with a bachelor’s degree, they tend to lower their premiums for such drivers.

Such programs are available at Savannah State University, Armstrong Atlantic State University, and the Savannah College of Art and Design.

Besides helping in the advancement of one’s career, degree programs also help in obtaining reasonably priced insurance coverage, including car insurance for students.

Auto Insurance in Savanna GA

Georgia also demands that all drivers in Savannah have car insurance. The minimum car insurance requirements includes $25,000 for bodily injuries to anyone in the accident, $50,000 in total for all the people in that accident, and $25,000 for coverage on any property damaged.

While uninsured motorist coverage and medical payments coverage are optional, they are beneficial in emergencies. As a reminder, this only applies when you are responsible for the accident.

Georgia's Auto Insurance Requirements

| Coverage | Requirements | Most Common |

|---|---|---|

| Bodily Injury Liability | 25,000/50,000 | 100,000/300,000 |

| Property Damage Liability | 25,000 | 50,000 |

| Uninsured Motorist Bodily Injury | Not required | 25,000/50,000 |

| Medical Payments | Not required | 5,000 |

| Collision | Not required | 500 deductible |

| Comprehensive | Not required | 100 deductible |

Liability insurance does not apply if the accident is caused by another driver. The average monthly cost of premiums is about $183 for the state; however, Savannah has cheaper rates, where some drivers even get insurance for $42 a month.

It is advisable to seek other quotations and buy more insurance than is necessary in order to sense adequacy in covering all eventual stumbling blocks on the road.

The Ideal Auto Insurance in Savannah, Ga

Savannah, GA proves to be an uncomplicated cosmopolitan city when it comes to selecting auto insurance. The competitive prices and types of auto insurance coverage offered by companies like Geico, State Farm, and Erie are more than remarkable.

While Geico has its deals to offer, State Farm is at the top when it comes to servicing the customers. Many drivers can find cheap options with rates starting at around $42 a month.

Think about things such as your location based on the ZIP code, the history of your driving, or your type of car, and make sure to get the quotes of all the providers. That way you can help yourself in getting a policy that is ideal for you and reduces your worries while you are travelling.

Get the best auto insurance rates possible by entering your ZIP code below into our free comparison tooltoday.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

How much is auto insurance in Savannah, GA?

Auto insurance in Savannah, GA, averages around $183 per month for basic coverage. However, rates can be as low as $42 per month with certain providers and discounts.

Which auto insurance coverage is best for a car?

The best coverage varies by need, but comprehensive policies offer solid protection. Geico is great for discounts, State Farm for service, and Erie for coverage options.

Enter your ZIP code into our free quote tool below to find the best auto insurance providers for your needs and budget.

What is the cheapest auto insurance in Georgia?

State Farm offers some of the cheap auto insurance companies in Savannah, GA, with premiums as low as $37 per month. Geico and Erie are also competitive for lower-cost options.

How can I lower my auto insurance in Savannah?

You can reduce your auto insurance in Savannah by maintaining a clean driving record, taking advantage of discounts (such as for good students or safe drivers), bundling policies, and raising your deductible.

Can I have out-of-state car insurance in Georgia?

Georgia drivers must have in-state insurance that meets the state’s minimum coverage limits for registered vehicles; out-of-state insurance is usually not accepted.

Why is it important in Savannah, GA, to have insurance?

Getting car insurance in Savannah is considered important, not only as a law but also due to protection in cases of accidents and damage. To gain in-depth knowledge, consult our comprehensive resource titled “How Accidents Change Your Car Insurance Rate.”

Which insurance company in Savannah, GA, gives the best service?

State Farm is known for its outstanding customer service, making it a top choice for drivers who value reliable and responsive support.

What is the most important type of coverage in Savannah?

Liability coverage is the most essential, as it’s legally required in Georgia. Comprehensive coverage is highly recommended due to risks like theft and accidents.

What are the top three types of auto insurance?

The top auto insurance types are liability (required in Georgia), comprehensive and collision coverage—covering others’ damages, your vehicle, and theft or disasters, respectively.

What is the best-rated home and auto insurance company in Savannah, GA?

State Farm is highly rated for its customer service and comprehensive coverage options. Geico is also a top choice for home and auto insurance due to its discounts.

Get the best auto insurance rates possible by entering your ZIP code below into our free comparison tool today.