Best Bear, DE Auto Insurance in 2025 (Review the Top 10 Companies Here)

The best Bear, DE auto insurance includes American Family, Travelers, and State Farm, offering monthly rates starting at $37. These insurance companies offer competitive pricing, excellent customer service, and full coverage options, making them the best auto insurance quotes in Bear.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Tim Bain

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Licensed Insurance Agent

UPDATED: Dec 11, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

2,235 reviews

2,235 reviewsCompany Facts

Full Coverage in Bear DE

A.M. Best Rating

Complaint Level

Pros & Cons

2,235 reviews

2,235 reviews 1,733 reviews

1,733 reviewsCompany Facts

Full Coverage in Bear DE

A.M. Best Rating

Complaint Level

Pros & Cons

1,733 reviews

1,733 reviews 18,154 reviews

18,154 reviewsCompany Facts

Full Coverage in Bear DE

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviewsAmerican Family, Travelers, and State Farm are the best Bear, DE, auto insurance companies. Their lowest rates start at $37 a month to highlight themselves as providing competitive premiums, reliable customer service, and coverage options.

Nationwide leads, but Bear drivers can find affordable insurance by comparing rates. Rates depend on driving history, location, and coverage needs, so balancing cost and coverage is essential.

Our Top 10 Company Picks: Best Bear, DE Auto Insurance

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | A | Customer Satisfaction | American Family | |

| #2 | 13% | A++ | Comprehensive Coverage | Travelers | |

| #3 | 17% | B | Local Agents | State Farm | |

| #4 | 20% | A+ | Strong Financials | Nationwide |

| #5 | 25% | A++ | Competitive Rates | Geico | |

| #6 | 10% | A+ | Innovative Technology | Progressive | |

| #7 | 10% | A++ | Military Focus | USAA | |

| #8 | 25% | A+ | Claims Support | Allstate | |

| #9 | 20% | A | Customizable Policies | Farmers | |

| #10 | 25% | A | Flexible Options | Liberty Mutual |

Find the lowest auto insurance rates in Bear, DE. Kindly enter your ZIP code to compare and save.

- American Family offers the best Bear, DE auto insurance at $37/month

- Travelers and State Farm provide reliable coverage options in Bear, DE

- Compare quotes to find affordable auto insurance in Bear, DE

#1 – American Family: Top Overall Pick

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Pros

- Customer-Friendly Insurance: American Family has excellent auto insurance ratings for outstanding customer service and cherished long-term relationships in Bear, Delaware.

- Multi-Line Discount Insurance: At Bear, we provide a 25% discount for bundling auto insurance, allowing for more significant savings when two or more policies are combined.

- Financial Security in Stable Insurance: American Family received an A rating from A.M. Best; thus, they can count on any insurance claim in Bear, Delaware, for financial security.

Cons

- Limited Insurance Availability: American Family’s auto insurance coverage is available only in select states, restricting access for Bear, Delaware residents.

- Young Driver Insurance Premiums: Due to perceived higher risk, premiums for younger drivers in Bear, DE, can be higher. Explore further details in our “American Family Auto Insurance Review.”

#2 – Travelers: Best for Comprehensive Coverage

Pros

- Wide Range of Insurance Coverage: Travelers provides comprehensive car insurance in Bear for any driving need. Explore our “Travelers Auto Insurance Review” article for an in-depth look.

- Top Tier Insurance Financial Stability: With an A++ rating from A.M. Best, Travelers proves financial strength and dependable insurance claims services in Bear, Delaware.

- Diverse Insurance Discounts: Customers in Bear, Delaware, can save on insurance premiums by bundling policies with Travelers.

Cons

- Fewer Digital Tools for Insurance: Travelers may provide fewer digital tools than other insurance companies in Bear, DE, which can affect overall convenience.

- Auto Insurance Premiums Vary Based on Region: Auto insurance rates in Bear may differ in different areas, which could cause some to pay more in premiums.

#3 – State Farm: Best for Local Agents

Pros

- Personalized Insurance Service: Local agents of State Farm in Bear, DE, are ready for personal consultation with individualized insurance solutions.

- Insurance Discounts for Safety: Bear offers auto insurance discounts for vehicles with anti-theft devices and safety features. Learn more in our “State Farm Auto Insurance Review” article.

- Established Insurance Claims History: State Farm’s efficient claims process ensures a smooth insurance experience for people in Bear, Delaware.

Cons

- Limited Digital Insurance Options: The State Farm app and online management at Bear, DE, are less convenient than our competitors.

- Not Suitable for Tech-Savvy Insurance Consumers: In Bear, DE, the customers who opt for digital insurance services may not find State Farm’s approach very accommodating.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#4 – Nationwide: Best for Strong Financials

Pros

- Solid Financials of Insurance Stability: A.M. Best rates nationwide with an A+ translate to reliable insurance cover and successful claims settlement in Bear, Delaware.

- The flexibility of the Plans for Coverage of Insurance: Nationwide allows Bear, DE, to choose between fully flexible and comprehensive options for their insurance coverage needs.

- Good Discounts for Safe Drivers: In Bear, DE, Nationwide rewards safe drivers with excellent insurance discounts.

Cons

- Higher Rates for High-Risk Drivers: High-risk Bear, DE drivers with bad driving history may have to pay more on their insurance in Nationwide premiums.

- Availability of Insurance Coverage in the State: Nationwide’s insurance coverage is minimal in other states. Enhance your knowledge by reading our “Nationwide Auto Insurance Review.”

#5 – Geico: Best for Competitive Rates

Pros

- Cheap Car Insurance Quotes: Geico offers low-cost car insurance quotes in Bear. For a comprehensive understanding, consult our article titled “Geico Auto Insurance Review.”

- Good Customer Support for Insurance: Geico is acknowledged for excellent customer support and effective claim handling in Bear, DE.

- Excellent Discount Policy for Insurance: Geico offers multiple discounts on car insurance, including good driver and bundling discounts to customers in Bear, Delaware.

Cons

- Limited Insurance Coverage for High-Risk Drivers:< Compared to other coverage in the industry, Geico’s insurance might not cover high-risk drivers full-scale in Bear, Delaware.

- Long Wait for Customer Support: Due to Geico’s continuous growth, a few auto insurance customers in Bear, DE, may experience long waiting periods to reach customer support.

#6 – Progressive: Best for Innovative Technology

Pros

- Personalized Car Insurance with Snapshot: Snap Shot is a car insurance based on telematics. It will develop customized rates for safe drivers in Bear, DE.

- Online Tools to Manage Your Policy: Progressive offers online tools for managing car insurance policies, which are ideal for tech-savvy Bear, DE residents.

- Variety of Options with Coverage: Progressive offers various auto insurance options in Bear, including custom parts and equipment coverage.

Cons

- Higher Premiums: Drivers in Bear, DE, who opt out of Snapshot with Progressive may pay higher insurance rates. For additional insights, refer to our “Progressive Auto Insurance Review.”

- Longer Claims Process: Claims processing of insurance for Progressive in Bear takes longer than expected, resulting in longer customer wait times.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#7 – USAA: Best for Military Focus

Pros

- Exclusive Military Auto Insurance: USAA provides tailored auto insurance to military personnel and their families at Bear, DE, that meets all service-specific needs.

- High customer satisfaction ratings in insurance: USAA gets a perfect score in customer satisfaction at Bear, DE, with significant claims handling and customer service.

- Significant insurance discounts: USAA offers discounts in Bear, DE, for military service, safe driving, and policy bundling. Our “USAA Auto Insurance Review” provides further insights.

Cons

- Exclusive to Military Families: USAA’s insurance services are only available to military members, veterans, and their families in Bear, excluding the general public.

- Limited Insurance Network Outside Military Areas: USAA’s in-person insurance services are less available outside military communities in Bear, DE, limiting face-to-face support.

#8 – All state: Best for Claims Support

Pros

- Efficient Insurance Claims Support: Allstate processes insurance claims efficiently in Bear, Delaware, by delivering prompt customer support.

- Various Insurance Discounts: Allstate also provides discounts in Bear on safe driving, new cars, good students, and bundled policies.

- Outstanding Insurance Fulfillment Service: Allstate was highly complimented for customer care in Bear, DE, as well as for excellent communication and satisfactory claims settlements.

Cons

- Higher Insurance Premiums: Some customers in Bear, DE, may find Allstate’s insurance premiums high, especially those with poor driving records.

- Variable Customer Service of Insurance: Allstate generally provides good service, but some Bear, DE, customers find it inconsistent. Get the complete picture in our “Allstate Auto Insurance Review.”

#9 – Farmers: Best for Customizable Policies

Pros

- Customizable Insurance Products: Farmers provides flexible insurance products in Bear, Delaware, allowing you to customize coverage with add-ons and optional features.

- Bundling Discounts: Bundle multiple insurance policies in Bear and get a 20% discount, resulting in lower overall costs. Get more details in our “Farmers Auto Insurance Review.”

- Strong Insurance Financial Stability: Farmers has an A rating from A.M. Best. It implies a robust financial ability to pay claims in Bear, DE.

Cons

- Limited Insurance Tech: The technology available to Farmers in Bear, DE, may not be as advanced as that of competitors, which can be inconvenient for tech-reliant users.

- Insurance for High-Risk Drivers: Compared to competitors, high-risk drivers in Bear might pay relatively higher prices for their insurance with Farmers.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#10 – Liberty Mutual: Best for Flexible Options

Pros

- Flexible Insurance Coverages: Liberty Mutual in Bear provides many auto insurance policy options, from essential protection to comprehensive coverage.

- Bundle Home and Auto Savings: Liberty Mutual in Bear, DE, offers 25% savings when you combine home and auto insurance. See additional details in our “Liberty Mutual Auto Insurance Review.”

- Financially Stable Insurance Company: Liberty Mutual’s A.M. Best A rating highlights its financial strength and ensures efficient claims service in Bear, DE.

Cons

- Higher Cover Charges to Certain Drivers: Bear’s high-risk drivers, such as those with prior accidents or violations, will pay higher insurance premiums.

- Unpredictable Service for Insurance: Customer reviews of insurance services in Bear, DE, highlight complaints about long wait times and poor claims servicing.

Auto Insurance Rate and Coverage Comparison in Bear

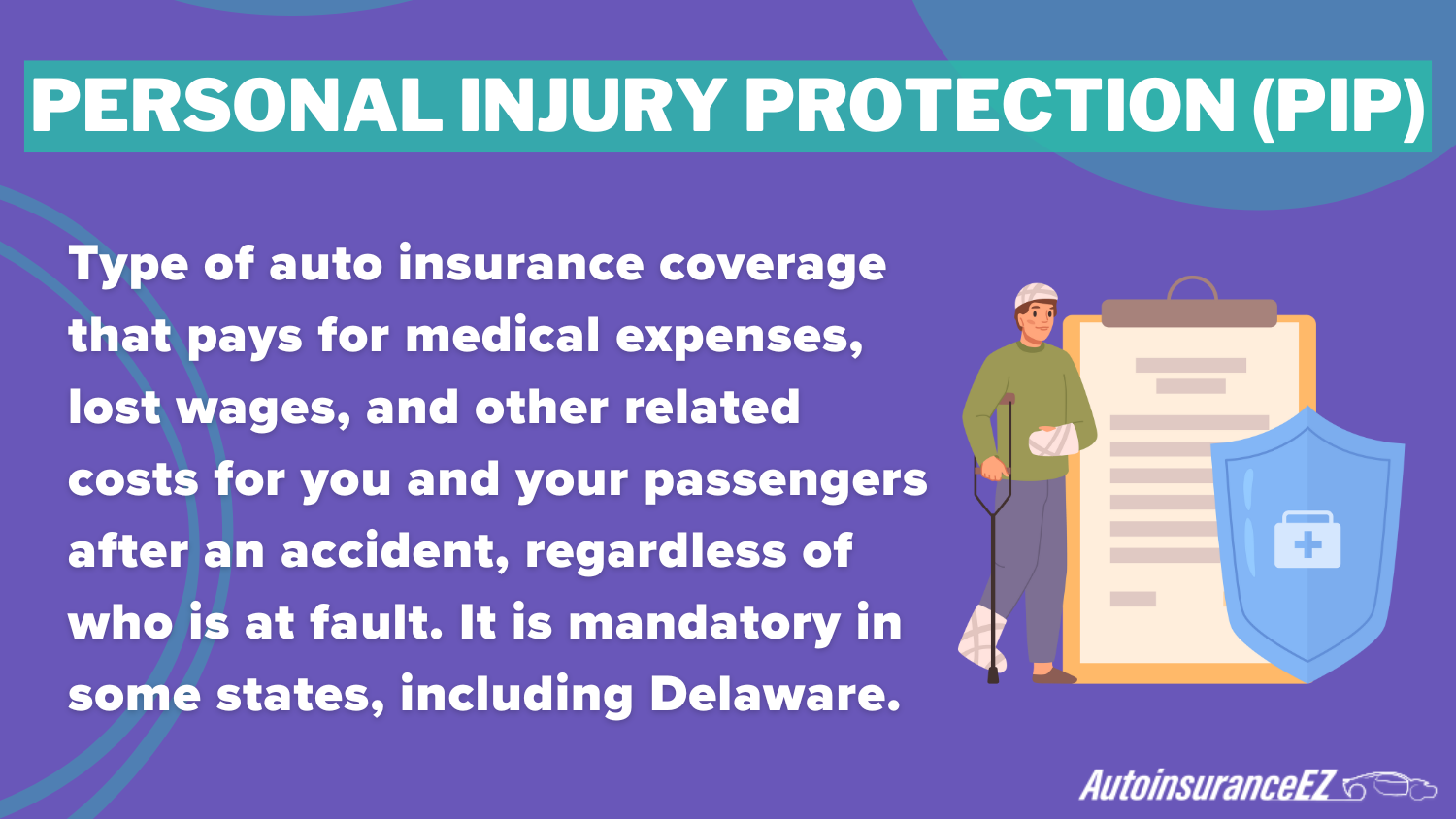

Auto insurance in Bear, DE, tends to be between different companies and on a particular coverage level. Most basic liability coverage tends to be around $37 monthly through American Family and State Farm. Comprehensive plans with collision and PIP tend to run a little higher.

Bear, DE Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $48 | $165 | |

| $45 | $150 | |

| $52 | $158 | |

| $38 | $135 | |

| $49 | $162 |

| $55 | $170 |

| $42 | $155 | |

| $40 | $140 | |

| $50 | $160 | |

| $37 | $130 |

Nationwide’s prices generally start at $69 monthly, symbolizing its long-term stability and vast coverage possibilities. The liability, comprehensive, and collision insurance coverage policies are slightly more expensive than the minimum state requirements.

Residents need to compare prices from various companies to find the price that best serves the balance between the least expensive one and adequate coverage.

Top Auto Insurance Companies and Discounts in Bear, DE

Insurance providers in Bear offer discounts to lower premiums. Allstate, American Family, and Farmers provide savings for bundling, safe driving, and good students, while Geico offers discounts for good drivers, military members, and federal employees.

Auto Insurance Discounts From the Top Providers in Bear, DE

| Insurance Company | Available Discounts |

|---|---|

| Multi-Policy, Safe Driving, New Car, And Good Student Discounts | |

| Multi-Policy, Safe Driver, Good Student, Bundling Discounts | |

| Multi-Policy, Safe Driver, Good Student, And Vehicle Safety Discounts | |

| Good Driver, Multi-Policy, Military, And Federal Employee Discounts | |

| Multi-Policy, Good Student, Homeownership, And Safe Driving Discounts |

| Multi-Policy, Safe Driver, Good Student, And Claims-Free Discounts |

| Multi-Car, Continuous Insurance, Safe Driver, And Bundling Discounts | |

| Good Student, Safe Driving, Multi-Policy, And Vehicle Safety Features | |

| Multi-Car, Bundling, Early Signing, Safe Driver Discounts | |

| Military Affiliation, Multi-Policy, Safe Driver, And Good Student Discounts |

Liberty Mutual, Nationwide, Progressive, and State Farm offer discounts on homeowners insurance, car safety features, and claims-free records. USAA provides extra savings for military members and good students and bundled policies, helping individuals save money while ensuring quality auto insurance coverage.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Online and Digital Insurance Processes for Drivers in Bear

The best companies include American Family and State Farm. These companies offer online services, simplifying policy management and auto insurance quotes in Bear, DE, for users who can quickly compare prices, adjust different types of auto insurance coverage, and even buy insurance from home.

Digital tools streamline the process, cutting through red tape by bringing automated quoting with AI-powered quotes, which give instant estimates. Online comparison tools help residents quickly gather quotes and find competitive coverage deals.

Vehicle Safety Features and Insurance Savings in Bear, DE

In Bear, anti-theft products and airbags in your car may reduce your premiums. Most insurance providers offer discounts on cars with better safety equipment installed—the more sophisticated the safety equipment, the lower the risk of accident and theft. Upgrades on your auto also make insurance less expensive.

American Family offers the best auto insurance in Bear, DE, with comprehensive coverage starting at just $37 a month, combining affordability with top-notch customer service.

Kristen Gryglik Licensed Insurance Agent

Vehicles with high safety ratings also attract lower premium rates. Driving tips for road safety, such as not being distracted and keeping to speed limits, also decrease the chances of accidents and allow you to save money on your insurance policy.

Inexpensive Car Insurance in Bear, Delaware.

Nationwide, State Farm, and National Grange Mutual are some of the best auto insurance companies in Bear, DE, with competitive rates. Price isn’t everything; consider customer service quality and the claims process’s ease when deciding how to lower your auto insurance premiums.

Average Monthly Auto Insurance Premiums

| Insurance Company | Average Monthly Premium |

|---|---|

| $100 | |

| $175 |

| $70 |

| $69 |

| $82 |

Bear-based insurance companies set payments based on driving history, credit status, and car usage frequency. Since rates vary widely between providers, comparing car insurance quotes in Bear, DE, is the best way to find the best coverage at the lowest price.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Significant Factors in Cheap Car Insurance in Bear, Delaware

Bear car insurance companies consider many factors when deciding on an auto insurance policy. Unfortunately, most of these factors, such as gender and location, are outside of your control. Other factors considered by your car insurance company may include the following factors.

Bear, DE Auto Insurance Rates by ZIP Code: Compare Monthly Costs

Where you park your car each night can often significantly affect your auto insurance rate. Generally, insurance is cheaper in rural areas because fewer cars are on the road, lowering the risks of accidents.

Bear, DE Auto Insurance by ZIP Code

| ZIP Code | Monthly Rate |

|---|---|

| 19701 | $187 |

| 19702 | $187 |

Bear, DE, had a population of 19,371 and a median household income of $60,008. It has average rates. Its smaller size and suburban setting might be prerequisites for more affordable premiums than those from highly urbanized metropolises.

Fatal Accident Statistics in Bear

Insurance premiums can be affected by accident rates in your area, often determined by your ZIP code. Locations with a higher frequency of accidents are regarded as more risky, leading to the possibility of higher premiums for coverage.

Fatal Accidents in Bear, DE

| Year | Number of Fatal Accidents | Number of Fatalities |

|---|---|---|

| 2015 | 4 | 4 |

| 2016 | 1 | 1 |

| 2017 | 3 | 3 |

| 2018 | 4 | 4 |

| 2019 | 0 | 0 |

| 2020 | 1 | 1 |

| 2021 | 1 | 1 |

Bear, DE, contains a relatively high number of fatal accidents per capita, which explains higher insurance costs in this area. In general, more accidents explain why insurance rates in Bear can be a bit more costly than they are in surrounding cities.

Auto Theft Rates and Impact on Insurance in Bear

Living in a large city with a high crime rate increases the risk of auto theft, which can lead to higher insurance premiums. Removing comprehensive coverage from your policy may help reduce costs.

Bear, DE, benefits from low auto theft rates, which can help keep premiums lower. Additionally, installing security features like anti-theft devices may qualify you for discounts, reducing insurance costs.

Bear, DE Auto Insurance Rates by Credit Score

Maintaining a good credit score is tough but dramatically affects auto insurance premiums. The car insurance companies in Bear, DE, base this on the metric to know how much you will pay for monthly coverage.

Bear, DE Auto Insurance by Credit Score

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $150 | $180 | $220 | |

| $140 | $170 | $210 | |

| $155 | $185 | $225 | |

| $130 | $160 | $200 | |

| $165 | $195 | $235 |

| $145 | $175 | $215 |

| $148 | $178 | $218 | |

| $135 | $165 | $205 | |

| $150 | $180 | $220 | |

| $120 | $150 | $190 |

The difference in your credit score can make a big difference in the number of rates you pay. Auto insurance customers with higher credit scores pay less, while those with lower scores face higher premiums.

Auto Insurance Rates by Age and Gender in Bear

Insuring a teenage driver tends to be costly because of their limited driving experience and the increased risk of accidents. Insurance companies view young drivers as riskier, resulting in higher premiums.

Bear, DE Auto Policy Age Comparison

| Insurance Company | Age 17 Female | Age 17 Male | Age 25 Female | Age 25 Male | Age 35 Female | Age 35 Male | Age 60 Female | Age 60 Male |

|---|---|---|---|---|---|---|---|---|

| $500 | $550 | $200 | $220 | $150 | $160 | $130 | $135 | |

| $480 | $530 | $190 | $210 | $145 | $155 | $125 | $130 | |

| $510 | $560 | $205 | $225 | $155 | $165 | $135 | $140 | |

| $470 | $520 | $185 | $205 | $140 | $150 | $120 | $125 | |

| $520 | $570 | $210 | $230 | $160 | $170 | $140 | $145 |

| $490 | $540 | $195 | $215 | $150 | $160 | $130 | $135 |

| $495 | $545 | $198 | $218 | $152 | $162 | $132 | $137 | |

| $460 | $510 | $180 | $200 | $135 | $145 | $115 | $120 | |

| $500 | $550 | $200 | $220 | $150 | $160 | $130 | $135 | |

| $450 | $500 | $175 | $195 | $130 | $140 | $110 | $115 |

However, there are ways to reduce these costs. Discounts like “Good Student” and Driver’s Ed can help lower premiums. Parents can also bundle their child’s policy with their own to save even more on auto insurance.

Bear, DE Driving Violations and Penalties

For example, one or two speeding tickets or minor crashes can suddenly multiply to get you very high-priced insurance. Some companies, however, offer an Accident Forgiveness discount for one or two minor violations.

Bear, DE Driving Violations

| Violation | Description | Penalties |

|---|---|---|

| Speeding | Exceeding the posted speed limit | $20 fine + $1/mile over; higher speeds incur more penalties |

| Reckless Driving | Operating a vehicle with willful disregard for safety | $100–$300 fine, 10–30 days jail, or both |

| Driving Under the Influence (DUI) | Operating a vehicle under the influence of alcohol or drugs | $500–$1,500 fine, up to 12 months jail, license revocation |

| Driving Without a License | Operating a vehicle without a valid driver's license | Varies: fines, jail possible |

| Running a Red Light | Failing to stop at a red traffic signal | $137.50 fine; late payment increases cost |

| Aggressive Driving | Committing multiple traffic offenses simultaneously | $100–$300 fine, up to 30 days jail, mandatory course (repeat offenders) |

| Driving Without Insurance | Operating a vehicle without valid insurance coverage | Fines, license suspension, vehicle impoundment possible |

| Passing a Stopped School Bus | Overtaking a school bus with flashing lights indicating a stop | $115–$230 fine, up to 60 days jail |

Severe offenses like reckless driving and auto insurance rates can cause premiums to rise sharply or even result in the loss of coverage altogether. These violations are typically not covered by accident forgiveness programs.

Vehicle Type and Rates in Bear

Luxury vehicles come with high insurance costs for several reasons. Their expensive repair bills make them more costly, and it’s unlikely that someone would only carry Liability coverage on a car worth six figures.

Bear, DE Car Insurance Cost by Make/Model

| Make and Model | Monthly Rate |

|---|---|

| BMW 3 Series | $180 |

| Chevrolet Silverado | $155 |

| Ford F-150 | $160 |

| Honda Accord | $145 |

| Hyundai Elantra | $140 |

| Jeep Grand Cherokee | $165 |

| Mercedes-Benz C-Class | $185 |

| Nissan Altima | $148 |

| Subaru Outback | $152 |

| Toyota Camry | $150 |

As a result, needing more coverage increases monthly premiums. The higher the car’s value, the more comprehensive the insurance required, leading to higher costs.

Top 5 Auto Insurance Claims in Bear, DE

In Bear, DE, common claims include collision, which covers damage from accidents, and comprehensive, for non-collision incidents like theft or weather damage. Liability auto insurance covers costs for damages or injuries you cause to others.

5 Most Common Auto Insurance Claims in Bear, DE

| Claim Type | Portion of Claims | Cost per Claim |

|---|---|---|

| Collision | 30% | $3,500 |

| Comprehensive | 25% | $2,200 |

| Liability | 20% | $4,000 |

| Personal Injury | 15% | $3,000 |

| Uninsured Motorist | 10% | $2,800 |

Other frequent claims are personal injury protection (PIP), which covers medical care costs irrespective of who was at fault, and uninsured motorist coverage, protecting you if the at-fault driver lacks insurance.

Accidents & Claims in Bear, DE vs Nearby Cities

Bear, DE, Accident rates are moderate compared to cities like Wilmington and Newark. Although it’s a suburban area, Bear still sees its share of claims from traffic incidents and weather events. Discover more about “How Accidents Change Your Car Insurance Rate?.”

Bear, DE Accidents & Claims per Year by City

| City | Accidents per Year | Claims per Year |

|---|---|---|

| Bear | 300 | 400 |

| Wilmington | 250 | 350 |

| Newark | 200 | 300 |

| Middletown | 150 | 250 |

| New Castle | 100 | 200 |

Accidents in busier cities such as Wilmington and Newark happen more frequently due to higher traffic volumes. However, Bear has fewer accidents than larger urban areas like New Castle and Middletown, where traffic congestion leads to more claims.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Bear, DE Auto Insurance Discounts Overview

Bear, DE drivers can use car insurance discounts like multi-policy for bundling home and auto coverage and safe driver discounts to maintain a clean record. Good Student discounts are also available for younger drivers with good grades.

Bear, DE Report Card: Auto Insurance Discounts

| Discount Name | Grade | Savings | Participating Providers |

|---|---|---|---|

| Multi-Policy | A | 20% | Allstate, State Farm |

| Safe Driver | A- | 15% | Liberty Mutual, Nationwide |

| Good Student | B+ | 10% | Geico, Nationwide |

| Anti-Theft Device | B | 8% | Progressive, Allstate |

| Low Mileage | B- | 5% | Nationwide, State Farm |

Other discounts include Anti-Theft Device savings for cars with advanced security features and Low Mileage discounts for drivers who don’t drive often. These discounts help lower premiums for qualifying residents.

Bear, DE Auto Insurance Costs & Benefits

Auto insurance in Bear, DE, is relatively cheap, and with so many auto insurance coverage options, it is easy to find one that suits individual needs. Depending on the budget and needs, it offers drivers the choice of basic liability cover or a more comprehensive one.

Bear, DE Report Card: Auto Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| Affordability | A | Competitive rates compared to the state |

| Coverage Options | A | Comprehensive coverage options |

| Discounts Available | A- | Wide range of discount options available |

| Claims Processing | B+ | Quick processing, average complaint ratio |

| Customer Service | B | Satisfactory but room for improvement |

Bear also offers several discounts, such as safe driving and low mileage, to help reduce premiums. Claims processing is efficient, and customer service is highly rated, making it easy for residents to manage their insurance.

Cheap Auto Insurance in Bear: Key Factors and Savings

In Bear, DE, auto insurance rates depend on vehicle safety features, driving history, and location. These factors affect your auto insurance rates; discounts are available for cars with anti-theft devices and safety systems. Safe driving and a clean record can further reduce premiums.

Compare quotes to find the right Bear auto insurance and understand how safety features affect premiums. Discounts can also make coverage more affordable.

These companies offer the lowest rates on auto insurance in Bear, Delaware – Type Your ZIP Code in the Quote Box below & see how much you can save.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

How do I obtain a State Farm auto insurance quote in Bear, DE?

You can quickly get a State Farm auto insurance quote in Bear, DE, by visiting their website or contacting a local agent for personalized assistance.

What are the car insurance costs in Pike Creek Valley compared to Bear, DE?

Car insurance in Pike Creek Valley is typically higher than in Bear due to its proximity to urban areas with more traffic.

How can I get auto insurance in Bear, Delaware?

You can quickly discover affordable auto insurance in Delaware by comparing quotes from top providers such as American Family, State Farm, and Geico. For insurance guidance, visit How To Get Insurance On Your Driver’s License.

What is the most affordable auto insurance in Bear, DE?

Affordable auto insurance in Bear, DE, starts at $37 per month from companies like American Family and State Farm, depending on coverage and driving history.

What is the crime rate like in Bear, Delaware, and how does it affect auto insurance?

Bear, DE, has relatively low crime rates, which helps keep auto insurance premiums more affordable than in high-crime urban areas.

Find these providers’ lowest auto insurance rates in Bear, Delaware. Enter your ZIP code in the quote box below to see how much you can save.

What is the cheapest car insurance in Plano, TX, compared to Bear, DE?

Car insurance in Bear, DE, is generally more affordable than in Plano, TX, due to fewer accidents and lower traffic volumes, which helps you find the cheapest Delaware auto insurance. For more details, check out Best Plano, TX Auto Insurance.

What is Delaware Grange Mutual Insurance Company, and what does it offer?

Delaware Grange Mutual insurance company offers home and auto insurance policies in Delaware. It focuses on providing reliable coverage and customer service.

Can I find car insurance for $29 monthly in Bear, DE?

While rates typically start around $37 per month in Bear, DE, some companies may offer promotions or discounts that could help reduce premiums to as low as $29 for basic coverage.

How can I find affordable car insurance in Bear, Delaware?

To find affordable car insurance in Bear, DE, compare rates from multiple providers like American Family, Geico, and Travelers to get the best coverage at a low cost. For low-cost options, check out the cheap auto insurance rate.

What is the cheapest car insurance in Dover, DE, compared to Bear, DE?

Car insurance costs in Dover, DE, are roughly the same as those in Bear. However, due to fewer car accidents, Bear has a slightly lower price of car insurance- which is very cheap compared to the rest of Delaware’s auto insurance.