State Farm Auto Insurance Review for 2025

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Mar 9, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

| STATE FARM OVERVIEW | STATS |

|---|---|

| Year Founded | 1922 |

| Current Executives | Michael L. Tipsord Chairman, President, and CEO |

| Numbers of Employees | Nearly 58,000 employees & 19,000 independent contractor agents |

| Total Revenue and Total Assets | Total Revenue $81.7 billion Total Assets $159.9 billion |

| Headquarters Address | State Farm Insurance One State Farm Plaza Bloomington, IL 61710 |

| Phone Number | 800-STATE-FARM (800-782-8332) |

| Company Website | www.statefarm.com |

| Premiums Written | $65,861,617 |

| Loss Ratio | 62.57% |

| Best For | Property and Casualty Insurance Life and Health Annuities Mutual Funds Banking Products |

You’ve seen their commercials hundreds of times. You know their catchy jingle. You might even be acquainted with Jake — you know, Jake, from State Farm?

With over 44 million auto insurance policies, billions of dollars in assets, and more than 19,000 insurance agents, it’s no shocker that State Farm is the largest insurance company in the U.S.

Whether you need insurance for your brand-new she-shed or you’re in the market for a new auto insurance policy, you might be wondering if State Farm is the right auto insurance company for you.

We know you need more than just a “good neighbor,” so if you’re looking for an honest review of the biggest insurance provider in America, you’ve come to the right place.

To start this State Farm auto insurance review, we’ll let you know what some of the most reputable institutions have to say about State Farm’s dependability, financial strength, and customer service.

Next, we’ll discuss State Farm auto insurance rates, coverage options, discounts, helpful stats, and more.

All you have to do is sit back, relax, and put on your comfy pants as we walk you through this honest and reliable review of State Farm.

Do you want to start comparing rates in your area right now? Use our free comparison tool and enter your ZIP code here to begin.

Rating Agency

Some people ask their mom for advice about everything, but unless your mom works for or with State Farm, we’re guessing she might not be able to give you the best review.

That’s where ratings step into play.

We’ve taken stats from quite a few reliable sources and compiled them all in the table below.

We’ll go into more detail further down the page, but for now, here’s how State Farm is rated and ranked among some of the world’s most prominent organizations.

| AGENCY | RATING |

|---|---|

| AM Best | A++ |

| Better Business Bureau | A+ (Tampa, FL) |

| Moody's Ranking | Aa1 (State Farm Life) |

| S&P Rating | AA |

| NAIC Complaint Index | .49 (2019) |

| JD Power | 4/5 (Overall Satisfaction) |

| Consumer Reports | 89 |

A.M. Best Ratings

A.M. Best ratings measure a company’s financial strength. In ranking a company’s financial strength, A.M. Best assigns ratings ranging from an A++ to a D.

State Farm has an A++ rating, meaning they have superior financial strength. In short, the company has a stable financial future and a superior ability to meet its ongoing financial obligations.

Better Business Bureau (BBB)

The BBB looks at a company’s complaint history. State Farm got an A+ rating from the BBB in Tampa, Florida.

A+ is the highest rating that the BBB gives.

Moody’s

Moody’s ratings are based on creditworthiness.

Moody’s gave State Farm an Aa1 rating, which means that the entity’s obligations are of “high quality, and subject to very low credit risk.”

Standard & Poor (S&P)

S&P also bases its ratings on a company’s financial strength and creditworthiness.

State Farm earned an AA, which means it has “a strong capacity to meet financial commitments.”

The National Association of Insurance Commissioners (NAIC)

The NAIC gives out ratings based on customer complaints and customer satisfaction. In the table below, we want to show you State Farm’s complaint data over the years.

The NAIC tracks this data and partnered with State Farm to bring you the information in the table below.

Here is State Farm’s complaint data shown against the national average:

| PRIVATE PASSENGER POLICIES | 2016 | 2017 | 2018 |

|---|---|---|---|

| Total Complaints | 9,206 | 1,481 | 1,402 |

| Complaint Index (better or worse than National Index) | 2.16 (worse) | 0.52 (better) | 0.57 (better) |

| National Complaint Index | 0.78 | 1.2 | 1.16 |

This table shows that in 2018, there were 1,042 complaints about State Farm. While this may seem like a big number, State Farm’s complaint index was better than the national average.

J.D. Power

When you’re trying to look up a company’s customer satisfaction rankings, J.D. Power is the perfect source.

State Farm received a score of 829 in providing a satisfying purchase experience, ranking it in the top 10 among auto insurers.

This table below shows rankings for State Farm from across different areas of the United States.

| REGION | CUSTOMER SATISFACTION (OUT OF 1,000) | J.D. POWER CIRCLE RANKING |

|---|---|---|

| California | 824 | Better than most |

| Central | 828 | About average |

| Florida | 834 | About average |

| Mid-Atlantic | 834 | About average |

| New England | 844 | Better than most |

| New York | 845 | Better than most |

| North Central | 841 | Better than most |

| Northwest | 820 | About average |

| Southeast | 853 | Better than most |

| Southwest | 831 | Among the best |

| Texas | 835 | About average |

The numbers reveal that State Farm’s Customer Satisfaction Index Ratings range from 820 to 853 points out of 1,000.

Consumer Reports

Consumer Reports bases a rating on the day-to-day functions of a company — like how long you might be on hold while waiting for an agent to pick the phone or just how polite the agent was while on the phone.

Overall, State Farm received a Consumer Reports reader score of 89 out of 100.

Check out this table below to see how State Farm ranked in all different customer service related areas.

| CLAIMS HANDLING | SCORE/RATING |

|---|---|

| Reader Score | 89 out of 100 |

| Agent courtesy | Excellent |

| Being kept informed of claim status | Excellent |

| Ease of reaching an agent | Excellent |

| Damage amount | Very good |

| Freedom to select repair shop | Very good |

| Promptness of response - very good | Very good |

| Simplicity of the process | Very good |

| Timely payment | Very good |

State Farm knocked the ball out of the park and received “very good” to “excellent” reviews across the board.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Company History

We’ve shown you the ratings, but how did State Farm begin?

State Farm, (well known for being a good neighbor), was founded in 1922 by retired farmer and insurance salesman George Jacob (G.J.) Mecherle in Bloomington, Illinois.

G.J. started State Farm to help people manage the risks of everyday life, recover from the unexpected, and realize their dreams.

Why is knowing State Farm’s history important? Have you ever heard the phrase, “history is bound to repeat itself?”

Nearly 100 years later, State Farm offers nearly 100 products and services and, along with its 18,000 exclusive agents, State Farm services over 82 million policies and accounts and processes about 35,000 claims a day.

Even though it’s good to know a company’s history, there’s much more information that is needed to make a good decision when purchasing a new auto insurance policy.

State Farm Market Share

What is a market share?

A market share represents the percentage of an industry or a market’s total sales that are earned by a particular company over a specified time period.

Market share is calculated by taking the company’s sales over the period and dividing it by the total sales of the industry over the same period. This metric is used to give a general idea of the size of a company in relation to its market and its competitors.

Check out this table below showing State Farm’s market share of liability and property damage:

| YEAR | TOTAL MARKET SHARE | MARKET SHARE OF LIABILITY | MARKET SHARE OF PHYSICAL DAMAGE |

|---|---|---|---|

| 2015 | 18.29 % | 18.47 % | 18.02 % |

| 2016 | 18.26 % | 18.35 % | 18.12 % |

| 2017 | 18.07 % | 18.17 % | 17.91 % |

| 2018 | 17.01% | 16.97% | 17.08% |

As you can see, the total market share percentage has decreased from 2015-2018.

State Farm’s Position for the Future

Here are some facts about State Farm’s future:

- State Farm continues to receive excellent ratings in financial strength and creditworthiness from well-respected and reliable sources. These sources also believe State Farm is and will be able to continue to meet financial expectations.

- Reliable sources such as J.D. Power and Consumer Reports also say that State Farm ranks high on the customer service scale.

- State Farm is the biggest insurance provider in the U.S. and continues to grow every day.

- State Farm is focused on its policyholders and handles nearly 36,000 claims per day, which clues us in on the fact that they are an American-based company.

State Farm’s Online Presence

State Farm has a variety of online options available for when you wish to get in contact with an agent via the internet instead of over the phone.

Don’t just pay your insurance bill online; you can put a quote together, chat with an agent, access your policy information, and even pull up your insurance card, all with the click of a mouse (or a cellular touchscreen).

You can also reach a State Farm agent via text or using their mobile app.

State Farm’s Commercials

State Farm has some of the best car insurance commercials in the television universe. Check out the famous “Jake From State Farm” commercial below.

Even though they’re mostly humorous, they are always full of valuable information.

Don’t forget not to mess with Kim’s discount:

https://www.youtube.com/watch?v=yMsmubcvY_k

Seeing as they are the biggest insurance agency in the U.S., their ad campaigns seem to be working.

State Farm in the Community

What does State Farm do for the community?

Watch this commercial below.

https://www.youtube.com/watch?v=MNnCNzsp1OQ

To celebrate its 100th anniversary in 2022, State Farm is challenging each of its employees to do 100 acts of good before 2022.

“State Farm has been doing acts of good since its inception almost 100 years ago. This is not a new concept for us. It’s ingrained in the State Farm culture,” explained Kim Kaufman, public affairs specialist at State Farm.

“Our 100 for Good program is a bit of an expansion to that. It’s a challenge to our employees and our agents to help strengthen communities all over the U.S., and celebrate our 100th anniversary by creating a world of good.”

State Farm’s Employees

Glassdoor says:

- The average employee rating for State Farm is 3.1 out of five.

- Employees start with 15 PTO days

- All federal holidays are paid holidays

Here are some of State Farm’s awards and accolades from 2011-2015:

2011:

- Employees’ Choice — 50 Best Places to Work, Glassdoor, 2011

2012:

- America’s Top Corporations for Multicultural Business Opportunities, DiversityBusiness.com, 2012

- Best Companies for Multicultural Women, Working Mother, 2012

- Top Companies for Executive Women, National Association for Female Executives, 2012

- Best Workplaces in Canada (1000+ Employees), Great Place to Work Institute, 2012

- Top 50 Employers – Readers’ Choice, Equal Opportunity Publications, 2012

2013:

- Diversity Elite 60, Hispanic Business magazine, 2013

- Fit-Friendly Company, American Heart Association (AHA), 2013

- 50 Best Companies for Latinas to Work, LATINA Style, 2013

- LearningElite magazine’s L&D leaders, Chief Learning Officer magazine, 2013

- Top 100 Employers, Black Data Processing Associates (BDPA), 2013

- Top Companies for Asian Americans and Pacific Islanders, Asian Enterprise Magazine, 2013

2014:

- Best Companies for Multicultural Women, Working Mother Magazine, 2014

- Top 100 Most Military–Friendly Employer, G.I. Jobs magazine, 2014

- Top Companies for Executive Women, National Association of Female Executives (NAFE), 2014

- Top Company for Latinos, LATINO Magazine, 2014

- Best Employers for Healthy Lifestyles®, National Business Group on Health, 2014

2015:

- Fortune 500, Fortune, 2015

Payscale says:

- State Farm has an overall satisfaction rating of 3.3 out of five stars.

- Payscale gave managers at State Farm a rating of 3.7 for communication and a rating of four out of five stars for “manager relationship.”

- Fair pay, pay policy, and pay transparency all received ratings of under three stars.

From these ratings, we can assume State Farm employees are treated well, even if they’ve had some negative experiences.

Cheap Car Insurance Rates

For many drivers, the most important thing when finding a new car insurance policy is the cost. But how much does car insurance really cost?

Unfortunately, we can’t give that question with one simple answer. Many different factors can affect your car insurance rate. That’s why we partnered with Quadrant Data to help show you what these factors are and how they can influence your car insurance rate.

Keep reading for more information on how State Farm’s rates compare with other competitors.

State Farm Availability & Rates by State

State Farm will insure any driver in any state, so you don’t have to worry about whether you can get their coverage if you live in Hawaii or Alaska or completely off the grid.

Their rates can be affected by different factors across the board, so this means their rates might be above or below average.

Find your state’s average in the table below.

| STATE | ANNUAL PREMIUM | HIGHER/LOWER THAN STATE AVERAGE | PERCENT HIGHER/LOWER THAN STATE AVERAGE |

|---|---|---|---|

| Alaska | $2,228.12 | -$1,193.39 | -34.88% |

| Alabama | $4,798.15 | $1,231.19 | 34.52% |

| Arkansas | $2,789.03 | -$1,335.95 | -32.39% |

| Arizona | $4,756.25 | $985.28 | 26.13% |

| California | $4,202.28 | $513.35 | 13.92% |

| Colorado | $3,270.77 | -$605.63 | -15.62% |

| Connecticut | $2,976.24 | -$1,642.68 | -35.56% |

| District of Columbia | $4,074.05 | -$365.20 | -8.23% |

| Delaware | $4,466.85 | -$1,519.48 | -25.38% |

| Florida | $3,397.67 | -$1,282.79 | -27.41% |

| Georgia | $3,384.88 | -$1,581.95 | -31.85% |

| Hawaii | $1,040.28 | -$1,515.36 | -59.29% |

| Iowa | $2,224.51 | -$756.77 | -25.38% |

| Idaho | $1,867.96 | -$1,111.13 | -37.30% |

| Illinois | $2,344.88 | -$960.60 | -29.06% |

| Indiana | $2,408.94 | -$1,006.03 | -29.46% |

| Kansas | $2,720.00 | -$559.62 | -17.06% |

| Kentucky | $3,354.32 | -$1,841.09 | -35.44% |

| Louisiana | $4,579.12 | -$1,132.22 | -19.82% |

| Maine | $2,198.68 | -$754.60 | -25.55% |

| Maryland | $3,960.87 | -$621.83 | -13.57% |

| Massachusetts | $1,361.86 | -$1,316.99 | -49.16% |

| Michigan | $12,565.52 | $2,066.88 | 19.69% |

| Minnesota | $2,066.99 | -$2,336.27 | -53.06% |

| Missouri | $2,692.91 | -$636.03 | -19.11% |

| Mississippi | $2,980.48 | -$684.09 | -18.67% |

| Montana | $2,417.74 | -$803.11 | -24.93% |

| North Carolina | $3,078.65 | -$314.46 | -9.27% |

| North Dakota | $2,560.53 | -$1,605.32 | -38.54% |

| Nebraska | $2,438.71 | -$844.97 | -25.73% |

| New Hampshire | $2,185.46 | -$966.32 | -30.66% |

| New Jersey | $7,527.16 | $2,011.94 | 36.48% |

| New Mexico | $2,340.66 | -$1,122.98 | -32.42% |

| Nevada | $5,796.34 | $934.64 | 19.22% |

| New York | $4,484.58 | $194.70 | 4.54% |

| Ohio | $2,507.88 | -$201.84 | -7.45% |

| Oklahoma | $2,816.80 | -$1,325.53 | -32.00% |

| Oregon | $2,731.48 | -$736.29 | -21.23% |

| Pennsylvania | $2,744.23 | -$1,290.27 | -31.98% |

| Rhode Island | $2,406.51 | -$2,596.85 | -51.90% |

| South Carolina | $3,071.34 | -$709.80 | -18.77% |

| South Dakota | $2,306.23 | -$1,676.05 | -42.09% |

| Tennessee | $2,639.30 | -$1,021.59 | -27.91% |

| Texas | $2,879.94 | -$1,163.34 | -28.77% |

| Utah | $4,645.83 | $1,033.94 | 28.63% |

| Virginia | $2,268.95 | -$88.92 | -3.77% |

| Vermont | $4,382.84 | $1,148.71 | 35.52% |

| Washington | $2,499.78 | -$559.55 | -18.29% |

| West Virginia | $2,126.32 | -$469.04 | -18.07% |

| Wisconsin | $2,387.53 | -$1,218.53 | -33.79% |

| Wyoming | $2,303.55 | -$896.53 | -28.02% |

| Median | $2,731.48 | -$929.41 | -25.39% |

According to our data, Michigan has the most expensive rate.

Comparing the Top 10 Companies by Market Share

Let’s compare State Farm’s rates to other car insurance provider’s rates.

| STATE | AVERAGE BY STATE | ALLSTATE | FARMERS | Geico | LIBERTY MUTUAL | PROGRESSIVE | STATE FARM | USAA |

|---|---|---|---|---|---|---|---|---|

| Alaska | $3,421.51 | $3,145.31 | Data Not Available | $2,879.96 | $5,295.55 | $3,062.85 | $2,228.12 | $2,454.21 |

| Alabama | $3,566.96 | $3,311.52 | $4,185.80 | $2,866.60 | $4,005.48 | $4,450.52 | $4,798.15 | $2,124.09 |

| Arkansas | $4,124.98 | $5,150.03 | $4,257.87 | $3,484.63 | Data Not Available | $5,312.09 | $2,789.03 | $2,171.06 |

| Arizona | $3,770.97 | $4,904.10 | $5,000.08 | $2,264.71 | Data Not Available | $3,577.50 | $4,756.25 | $3,084.29 |

| California | $3,688.93 | $4,532.96 | $4,998.78 | $2,885.65 | $3,034.42 | $2,849.67 | $4,202.28 | $2,693.87 |

| Colorado | $3,876.39 | $5,537.17 | $5,290.24 | $3,091.69 | $2,797.74 | $4,231.92 | $3,270.77 | $3,338.87 |

| Connecticut | $4,618.92 | $5,831.60 | Data Not Available | $3,073.66 | $7,282.87 | $4,920.35 | $2,976.24 | $3,190.00 |

| District of Columbia | $4,439.24 | $6,468.92 | Data Not Available | $3,692.81 | Data Not Available | $4,970.26 | $4,074.05 | $2,580.44 |

| Delaware | $5,986.32 | $6,316.06 | Data Not Available | $3,727.29 | $18,360.02 | $4,181.83 | $4,466.85 | $2,325.98 |

| Florida | $4,680.46 | $7,440.46 | Data Not Available | $3,783.63 | $5,368.15 | $5,583.30 | $3,397.67 | $2,850.41 |

| Georgia | $4,966.83 | $4,210.70 | Data Not Available | $2,977.20 | $10,053.44 | $4,499.22 | $3,384.88 | $3,157.46 |

| Hawaii | $2,555.64 | $2,173.49 | $4,763.82 | $3,358.86 | $3,189.55 | $2,177.93 | $1,040.28 | $1,189.35 |

| Iowa | $2,981.28 | $2,965.86 | $2,435.72 | $2,296.16 | $4,415.28 | $2,395.50 | $2,224.51 | $1,852.57 |

| Idaho | $2,979.09 | $4,088.76 | $3,168.28 | $2,770.68 | $2,301.51 | Data Not Available | $1,867.96 | $1,877.61 |

| Illinois | $3,305.48 | $5,204.41 | $4,605.20 | $2,779.16 | $2,277.65 | $3,536.65 | $2,344.88 | $2,770.21 |

| Indiana | $3,414.97 | $3,978.81 | $3,437.55 | $2,261.07 | $5,781.35 | $3,898.00 | $2,408.94 | $1,630.86 |

| Kansas | $3,279.62 | $4,010.23 | $3,703.77 | $3,220.65 | $4,784.42 | $4,144.38 | $2,720.00 | $2,382.61 |

| Kentucky | $5,195.40 | $7,143.92 | Data Not Available | $4,633.59 | $5,930.97 | $5,547.63 | $3,354.32 | $2,897.89 |

| Louisiana | $5,711.34 | $5,998.79 | Data Not Available | $6,154.60 | Data Not Available | $7,471.10 | $4,579.12 | $4,353.12 |

| Maine | $2,953.28 | $3,675.59 | $2,770.15 | $2,823.05 | $4,331.39 | $3,643.59 | $2,198.68 | $1,930.79 |

| Maryland | $4,582.70 | $5,233.17 | Data Not Available | $3,832.63 | $9,297.55 | $4,094.86 | $3,960.87 | $2,744.14 |

| Massachusetts | $2,678.85 | $2,708.53 | Data Not Available | $1,510.17 | $4,339.35 | $3,835.11 | $1,361.86 | $1,458.99 |

| Michigan | $10,498.64 | $22,902.59 | $8,503.60 | $6,430.11 | $20,000.04 | $5,364.55 | $12,565.52 | $3,620.00 |

| Minnesota | $4,403.25 | $4,532.01 | $3,137.45 | $3,498.54 | $13,563.61 | Data Not Available | $2,066.99 | $2,861.60 |

| Missouri | $3,328.93 | $4,096.15 | $4,312.19 | $2,885.33 | $4,518.67 | $3,419.14 | $2,692.91 | $2,525.78 |

| Mississippi | $3,664.57 | $4,942.11 | Data Not Available | $4,087.21 | $4,455.94 | $4,308.85 | $2,980.48 | $2,056.13 |

| Montana | $3,220.84 | $4,672.10 | $3,907.55 | $3,602.35 | $1,326.11 | $4,330.76 | $2,417.74 | $2,031.89 |

| North Carolina | $3,393.11 | $7,190.43 | Data Not Available | $2,936.69 | $2,182.71 | $2,382.61 | $3,078.65 | Data Not Available |

| North Dakota | $4,165.84 | $4,669.31 | $3,092.49 | $2,668.24 | $12,852.83 | $3,623.06 | $2,560.53 | $2,006.80 |

| Nebraska | $3,283.68 | $3,198.83 | $3,997.29 | $3,837.49 | $6,241.52 | $3,758.01 | $2,438.71 | $2,330.78 |

| New Hampshire | $3,151.77 | $2,725.01 | Data Not Available | $1,615.02 | $8,444.41 | $2,694.45 | $2,185.46 | $1,906.96 |

| New Jersey | $5,515.21 | $5,713.58 | $7,617.00 | $2,754.94 | $6,766.62 | $3,972.72 | $7,527.16 | Data Not Available |

| New Mexico | $3,463.64 | $4,200.65 | $4,315.53 | $4,458.30 | Data Not Available | $3,119.18 | $2,340.66 | $2,296.77 |

| Nevada | $4,861.70 | $5,371.62 | $5,595.56 | $3,662.09 | $6,201.55 | $4,062.57 | $5,796.34 | $3,069.07 |

| New York | $4,289.88 | $4,740.97 | Data Not Available | $2,428.24 | $6,540.73 | $3,771.15 | $4,484.58 | $3,761.69 |

| Ohio | $2,709.71 | $3,197.22 | $3,423.01 | $1,867.19 | $4,429.74 | $3,436.96 | $2,507.88 | $1,478.46 |

| Oklahoma | $4,142.33 | $3,718.62 | $4,142.40 | $3,437.34 | $6,874.62 | $4,832.35 | $2,816.80 | $3,174.15 |

| Oregon | $3,467.77 | $4,765.95 | $3,753.52 | $3,220.12 | $4,334.55 | $3,629.13 | $2,731.48 | $2,587.15 |

| Pennsylvania | $4,034.50 | $3,984.12 | Data Not Available | $2,605.22 | $6,055.20 | $4,451.00 | $2,744.23 | $1,793.37 |

| Rhode Island | $5,003.36 | $4,959.45 | Data Not Available | $5,602.63 | $6,184.12 | $5,231.09 | $2,406.51 | $4,323.98 |

| South Carolina | $3,781.14 | $3,903.43 | $4,691.85 | $3,178.01 | Data Not Available | $4,573.08 | $3,071.34 | $3,424.77 |

| South Dakota | $3,982.27 | $4,723.72 | $3,768.80 | $2,940.29 | $7,515.99 | $3,752.81 | $2,306.23 | Data Not Available |

| Tennessee | $3,660.89 | $4,828.85 | $3,430.07 | $3,283.42 | $6,206.69 | $3,656.91 | $2,639.30 | $2,739.28 |

| Texas | $4,043.28 | $5,485.44 | Data Not Available | $3,263.28 | Data Not Available | $4,664.69 | $2,879.94 | $2,487.89 |

| Utah | $3,611.89 | $3,566.42 | $3,907.99 | $2,965.57 | $4,327.76 | $3,830.10 | $4,645.83 | $2,491.10 |

| Virginia | $2,357.87 | $3,386.80 | Data Not Available | $2,061.53 | Data Not Available | $2,498.58 | $2,268.95 | $1,858.38 |

| Vermont | $3,234.13 | $3,190.38 | Data Not Available | $2,195.71 | $3,621.08 | $5,217.14 | $4,382.84 | $1,903.55 |

| Washington | $3,059.32 | $3,540.52 | $2,962.00 | $2,568.65 | $3,994.73 | $3,209.52 | $2,499.78 | $2,262.16 |

| West Virginia | $2,595.36 | $3,820.68 | Data Not Available | $2,120.80 | $2,924.39 | Data Not Available | $2,126.32 | $1,984.62 |

| Wisconsin | $3,606.06 | $4,854.41 | $3,777.49 | $3,926.20 | $6,758.85 | $3,128.91 | $2,387.53 | $2,975.74 |

| Wyoming | $3,200.08 | $4,373.93 | $3,069.35 | $3,496.56 | $1,989.36 | $4,401.17 | $2,303.55 | $2,779.53 |

| Median | $3,660.89 | $4,532.96 | $3,907.99 | $3,073.66 | $5,295.55 | $3,935.36 | $2,731.48 | $2,489.49 |

With the exception of USAA (a company that only services military members and their families), you’ll notice State Farm generally has the lowest car insurance rate out of all top 10 car insurance companies listed in our table above.

Average State Farm Male vs. Female Car Insurance Rates

Age, gender, and marital status can also affect your car insurance rate. Let’s take a look at how State Farm’s rates based on these demographics compare to other car insurance companies’ rates.

| GROUP | ALLSTATE | FARMERS | Geico | LIBERTY MUTUAL | PROGRESSIVE | STATE FARM | USAA | AVERAGE |

|---|---|---|---|---|---|---|---|---|

| Married 35-year old female | $3,156.09 | $2,556.98 | $2,302.89 | $3,802.77 | $2,296.90 | $2,081.72 | $1,551.43 | $2,449.06 |

| Married 35-year old male | $3,123.01 | $2,557.75 | $2,312.38 | $3,856.84 | $2,175.27 | $2,081.72 | $1,540.32 | $2,445.85 |

| Married 60-year old female | $2,913.37 | $2,336.80 | $2,247.06 | $3,445.00 | $1,991.49 | $1,873.89 | $1,449.85 | $2,243.26 |

| Married 60-year old male | $2,990.64 | $2,448.39 | $2,283.45 | $3,680.53 | $2,048.63 | $1,873.89 | $1,448.98 | $2,307.79 |

| Single 17-year old female | $9,282.19 | $8,521.97 | $5,653.55 | $11,621.01 | $8,689.95 | $5,953.88 | $4,807.54 | $7,559.03 |

| Single 17-year old male | $10,642.53 | $9,144.04 | $6,278.96 | $13,718.69 | $9,625.49 | $7,324.34 | $5,385.61 | $9,027.64 |

| Single 25-year old female | $3,424.87 | $2,946.80 | $2,378.89 | $3,959.67 | $2,697.73 | $2,335.96 | $1,988.52 | $2,703.28 |

| Single 25-year old male | $3,570.93 | $3,041.44 | $2,262.87 | $4,503.13 | $2,758.66 | $2,554.56 | $2,126.14 | $2,889.27 |

As of August 1, 2019, California, Hawaii, Montana, Pennsylvania, North Carolina, and places in Michigan have made it illegal for car insurance companies to base a rate on gender.

As you can see in the table above, single, 17-year-old males usually pay the most for car insurance.

Average State Farm Rates by Make & Model

Did you know the vehicle you drive can also influence your car insurance rate? This could be attributed to the fact that some vehicles are more likely to be stolen than others, or some vehicles are more likely to be in or cause an accident than others.

Some vehicles are just more expensive to insure because they are worth more money.

In the table below, we show you what you can expect to pay for five specific models from State Farm and its competitors.

| VEHICLE TYPE | ALLSTATE | FARMERS | Geico | LIBERTY MUTUAL | PROGRESSIVE | STATE FARM | USAA | AVERAGE |

|---|---|---|---|---|---|---|---|---|

| 2015 Ford F-150: Lariat SuperCab with 2WD 6.5 foot bed and 2.7L V6 | $4,429.74 | $4,093.50 | $3,092.11 | $5,830.16 | $3,914.05 | $3,204.23 | $2,551.56 | $3,815.71 |

| 2015 Honda Civic Sedan: LX with 2.0L 4cyl and CVT | $4,753.69 | $4,405.21 | $3,092.58 | $5,869.32 | $4,429.56 | $3,024.24 | $2,409.67 | $3,913.13 |

| 2015 Toyota RAV4: XLE | $4,324.99 | $3,728.22 | $3,090.89 | $5,825.33 | $3,647.22 | $3,226.02 | $2,454.58 | $3,752.42 |

| 2018 Ford F-150: Lariat SuperCab with 2WD 6.5 foot bed and 2.7L V6 | $5,491.12 | $4,390.19 | $3,338.40 | $5,988.85 | $3,962.58 | $3,497.17 | $2,855.69 | $4,079.80 |

| 2018 Honda Civic Sedan: LX with 2.0L 4cyl and CVT | $5,380.28 | $4,779.51 | $3,338.87 | $6,682.63 | $4,528.90 | $3,189.99 | $2,422.66 | $4,206.73 |

| 2018 Toyota RAV4: XLE | $4,947.90 | $3,769.00 | $3,337.18 | $6,244.44 | $3,730.78 | $3,418.33 | $2,529.63 | $3,951.10 |

As you can see, the 2015 Toyota RAV4 can be insured for the least amount of money. State Farm has the third-least expensive rate for this vehicle when compared to the other company rates on our list.

Average State Farm Commute Rates

How far you drive every day can also affect your car insurance rate. But how do State Farm’s rates compare with other companies’ rates?

| COMPANY | 10 MILES COMMUTE. 6000 ANNUAL MILEAGE | 25 MILES COMMUTE. 12000 ANNUAL MILEAGE |

|---|---|---|

| Allstate | $4,841.71 | $4,934.20 |

| American Family | $3,401.30 | $3,484.88 |

| Farmers | $4,179.32 | $4,209.22 |

| Geico | $3,162.64 | $3,267.37 |

| Liberty Mutual | $5,995.27 | $6,151.63 |

| Nationwide | $3,437.33 | $3,462.67 |

| Progressive | $4,030.02 | $4,041.01 |

| State Farm | $3,175.98 | $3,344.01 |

| Travelers | $4,399.85 | $4,469.96 |

| USAA | $2,482.69 | $2,591.91 |

According to the list above, State Farm, Geico, and USAA have the cheapest rates available for people who commute 12,000 miles or more per year.

Average State Farm Coverage Level Rates

The amount of coverage you have could also affect your car insurance rate. For example, a car insurance company might give you a break on your rate if you buy more insurance than what is required by the state.

For just a few hundred dollars more per year, you could go from having minimum liability coverage to comprehensive coverage.

Take a look at the table below to get a better understanding of what we’re talking about.

| COMPANY | LOW | MEDIUM | HIGH |

|---|---|---|---|

| Allstate | $4,628.03 | $4,896.81 | $5,139.02 |

| American Family | $3,368.49 | $3,544.37 | $3,416.40 |

| Farmers | $3,922.47 | $4,166.22 | $4,494.13 |

| Geico | $3,001.91 | $3,213.97 | $3,429.14 |

| Liberty Mutual | $5,805.75 | $6,058.57 | $6,356.04 |

| Nationwide | $3,394.83 | $3,449.80 | $3,505.37 |

| Progressive | $3,737.13 | $4,018.46 | $4,350.96 |

| State Farm | $3,055.40 | $3,269.80 | $3,454.80 |

| Travelers | $4,223.63 | $4,462.02 | $4,619.07 |

| USAA | $2,404.11 | $2,539.87 | $2,667.92 |

State Farm only charges about $400 more per year for high coverage. If you can afford it now, having more coverage could save you thousands of dollars in the long run.

Average State Farm Credit History Rates

Credit history can influence more than just your interest rate or the terms on a loan. It can also affect your car insurance rate.

The table below shows what you’re rate could be based on poor, fair, and good credit.

Keep in mind that these numbers are just estimates.

| COMPANY | GOOD | FAIR | POOR |

|---|---|---|---|

| Allstate | $3,859.66 | $4,581.16 | $6,490.65 |

| American Family | $2,691.74 | $3,169.53 | $4,467.98 |

| Farmers | $3,677.12 | $3,899.41 | $4,864.14 |

| Geico | $2,434.82 | $2,986.79 | $4,259.50 |

| Liberty Mutual | $4,388.18 | $5,604.24 | $8,802.22 |

| Nationwide | $2,925.94 | $3,254.83 | $4,083.29 |

| Progressive | $3,628.85 | $3,956.31 | $4,737.64 |

| State Farm | $2,174.26 | $2,853.00 | $4,951.20 |

| Travelers | $4,058.97 | $4,344.10 | $5,160.22 |

| USAA | $1,821.20 | $2,219.83 | $3,690.73 |

This table shows that if you have poor credit, your rate could be increased by $3,000 or more per year.

Experian says that the average credit score in the U.S. is 675. Is your credit score higher or lower than this number?

Average State Farm Driving Record Rates

The biggest factor that affects your rate is your driving record. If you’re a driver who is prone to accidents or you’ve broken the law by being convicted of a DUI, your car insurance rate could be significantly higher than the average driver’s rate.

Check out this table below.

| COMPANY | CLEAN RECORD | WITH 1 SPEEDING VIOLATION | WITH 1 ACCIDENT | WITH 1 DUI |

|---|---|---|---|---|

| Allstate | $3,819.90 | $4,483.51 | $4,987.68 | $6,260.73 |

| American Family | $2,693.61 | $3,025.74 | $3,722.75 | $4,330.24 |

| Farmers | $3,460.60 | $4,079.01 | $4,518.73 | $4,718.75 |

| Geico | $2,145.96 | $2,645.43 | $3,192.77 | $4,875.87 |

| Liberty Mutual | $4,774.30 | $5,701.26 | $6,204.78 | $7,613.48 |

| Nationwide | $2,746.18 | $3,113.68 | $3,396.95 | $4,543.20 |

| Progressive | $3,393.09 | $4,002.28 | $4,777.04 | $3,969.65 |

| State Farm | $2,821.18 | $3,186.01 | $3,396.01 | $3,636.80 |

| Travelers | $3,447.69 | $4,260.80 | $4,289.74 | $5,741.40 |

| USAA | $1,933.68 | $2,193.25 | $2,516.24 | $3,506.03 |

One DUI with State Farm can raise your rates over $800.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Coverages Offered

What types of coverages does State Farm offer?

After all, the cost of car insurance isn’t the only factor that’s important. You might need a certain type of coverage for your vehicle that is difficult to come by.

We’ll get into all that and more up next.

State Farm’s Bundling Options

You can save up to $854 per year on your insurance policy if you bundle home and auto insurance through State Farm.

This is called a multi-line discount. If two or more vehicles in your household are insured by State Farm and are owned by related individuals, you could save as much as 20 percent.

Save up to 17 percent if you have homeowners, renters, condo, or life insurance in addition to vehicle insurance.

State Farm’s Discounts

As a State Farm customer, you may be eligible for one or more of the many auto insurance discounts offered. You could save money for being a safe driver, student, or a family with multiple household vehicles. Discounts vary by state.

Take a look at some of State Farm’s unique discounts listed below:

- Drive Safe and Save: Enroll in the usage-based Drive Safe & Save program and State Farm will use information from your smartphone or your vehicle’s OnStar communication service to calculate your discount. Safe drivers save more with Drive Safe & Save.

- Steer Clear: If you’re a new driver or under 25 years of age without any at-fault accidents or moving violations within the past three years, you could qualify for our Steer Clear auto insurance discount.

- Accident-Free Discount: You qualify for this discount when your car, or the one it replaced, has been insured by State Farm for at least three continuous years without a chargeable accident. This discount may increase over time if you keep your car insured with State Farm and continue to have no chargeable accidents.

- Defensive Driving Course Discount: Depending on where you live, taking a driver safety course may help you get car insurance discounts. Ask a local State Farm agent for a list of qualifying courses and requirements.

- Student Away at School Discount: You could be eligible for this discount if one of the operators of your vehicle is a student under the age of 25 who moves away to school and only uses the car while at home during school vacations and holidays.

- Driver Training Discount: If all the operators of your vehicle under the age of 21 complete an approved driver education course, you may qualify for this discount.

- Good Student Discount: You can save up to 25 percent just for getting good grades! And the savings last after you graduate from college until you turn 25.

- Passive Restraint Discount: For 1993 and older vehicles equipped with a factory-installed air bag or another passive restraint system, you can receive a discount of up to 40 percent on medical-related coverage.

Read More: Green Commuting: Why It Matters and How to Do It

See how much money you could save by having these discounts in the table below:

State Farm discounts

| Discounts | State Farm Discount Percentage |

|---|---|

| Anti-lock Brakes | 5% |

| Anti-Theft | 15% |

| Claim Free | 15% |

| Defensive Driver | 5% |

| Driver's Ed | 15% |

| Driving Device/App | 50% |

| Good Student | 25% |

| Homeowner | 3% |

| Low Mileage | 30% |

| Multiple Policies | 17% |

| Multiple Vehicles | 20% |

| Newer Vehicle | 40% |

| Paperless/Auto Billing | $2 |

| Passive Restraint | 40% |

| Safe Driver | 15% |

| Vehicle Recovery | 5% |

State Farm’s Programs

As we mentioned above, State Farm Drive Safe and Save discount is offered if you use the Drive Safe and Save app that connects with the Bluetooth beacon sent after enrollment. Keep your Bluetooth and location services on to record trips automatically.

What type of driving feedback do you get?

- Quick acceleration

- Hard braking

- Fast cornering

- Speeding

- Distracted driving

You can also save $2 every month if you enroll in State Farm’s paperless billing and statement plan. Stop wasting paper and just pay your bill online.

State Farm might be a great company for car insurance, but did you know you can also use them as a bank?

Open a new Consumer Money Market Savings account with Banking Benefits — deposit introductory annual percentage yield (APY)1 of 1.85 percent. Limitations apply.

Earning rewards? Building a business? Making a balance transfer? Whether looking for competitive rates, no annual fees or convenience, State Farm has the right credit card for you.

That’s right — you can open a credit card, checking or savings account with State Farm.

Take charge! With a State Farm® Visa ® Credit Card, you stay in control of your money.

Don’t forget: State Farm offers vehicle loans and home loans too.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Canceling Your Policy

There are always different reasons why a person may need to cancel their insurance policy, but here are a few good ones that might apply to you.

- Selling a car and not replacing it

- Storing a classic or antique vehicle

- A teen is heading to college and will no longer be driving the vehicle

- A vehicle has been paid off and no longer requires comprehensive cover

In this next section, we’ll go over how to cancel an insurance policy with State Farm.

Cancellation Fee

You can cancel your insurance policy at any time. Just make sure you have another policy in place before canceling your current one.

Remember, when you cancel your policy, everything is totally up to you — you can pick the date and time when the canceled policy will expire.

There is no cancellation fee to cancel your policy with State Farm.

Is there a refund?

If you cancel your insurance policy early or you have not filed a claim since you’ve had your current car insurance policy, State Farm will give you a pro-rated refund.

While State Farm does not have cancellation fees, drivers are required to have another insurance policy before canceling their current auto insurance policy.

How to Cancel

To cancel your policy, you’ll need to get in contact with a State Farm agent.

Here’s how you can cancel by phone:

- Contact your local State Farm agent and explain you’d like to cancel your policy. You’ll typically need your policy number, name, date of birth, and Social Security number. If you’re canceling because you’ve sold your vehicle, you might also need to provide proof of your vehicle’s plate forfeiture or a bill of sale.

- Cancellations by phone are typically effective immediately, or you can schedule it for a date in the future.

- Many states require you to inform the DMV when you cancel or change your auto insurance, but check your specific state’s guidelines or ask your agent if this is necessary.

- If you’re planning on getting back on the road with a different provider, the agent might ask for your new provider’s name, policy number, and effective date.

Here’s how to cancel by mail:

If you’re canceling a policy by mail, you’ll need to write a letter that includes the following information.

- Your name, address, and phone number.

- Your State Farm policy number and the date and time you want your policy to end.

- If you’re switching providers, your new insurer’s name, policy number and policy start date.

- If you’ve sold your vehicle, proof of plate forfeiture or your bill of sale.

Sign, date, and mail your letter at least two weeks before your intended cancellation date, leaving time for shipping and processing, to the address below.

Corporate Headquarters

State Farm Insurance

One State Farm Plaza

Bloomington, IL 61710

If you’re canceling your policy in person, take this information with you.

- Your name, address, and phone number.

- Your State Farm policy number and the date and time you want your policy to end.

- If you’re switching providers, your new insurer’s name, policy number, and policy start date.

- If you’ve sold your vehicle, proof of plate forfeiture or your bill of sale.

When can I cancel?

As we stated above, you can cancel your State Farm car insurance policy at any time, just make sure you have another policy in its place before or at the time of canceling your current State Farm policy.

How to Make a Claim

You’ve gotten into an accident and you need to file a claim. How does State Farm handle this process?

Stay tuned to find out more.

Ease of Making a Claim

Start your claim online, or with the State Farm® mobile app. You can also file your claim by calling 800-SF-CLAIM (800-732-5246) 24/7, or contact your agent if you prefer.

State Farm will review the details of your claim, determine if the incident is covered, and assess the loss or damage. They will contact you if they need additional information, to explain your coverages, or discuss the next steps.

After the claim is assessed, State Farm will provide you with estimate and repair options so you can make an informed decision.

Payments are based on the terms of your policy. State Farm may pay the repairer directly, send payments to your bank account, or send them to you by mail.

Premiums Written

Let’s take a look at State Farm’s written premiums statistics from the last four years in the table below.

Premiums Written and Loss Ratio

| YEAR | RANK | Insurance Company | DIRECT PREMIUM WRITTEN | LOSS RATION PERCENTAGE | MARKET SHARE |

|---|---|---|---|---|---|

| 2015 | 1 | $35,588,209,000 | 66.1% | 18.68 | |

| 2016 | 1 | $39,194,660,000 | 77.02% | 18.26 | |

| 2017 | 1 | $41,817,416,000 | 68.79% | 18.07 | |

| 2018 | 1 | $41,963,578,000 | 63% | 17.01 |

As you can see from the table above, State Farm’s written premiums amount has increased over the years.

Loss Ratio

Here are State Farm’s loss ratio percentage numbers.

Premiums Written and Loss Ratio

| YEAR | RANK | Insurance Company | DIRECT PREMIUM WRITTEN | LOSS RATION PERCENTAGE | MARKET SHARE |

|---|---|---|---|---|---|

| 2015 | 1 | $35,588,209,000 | 66.1% | 18.68 | |

| 2016 | 1 | $39,194,660,000 | 77.02% | 18.26 | |

| 2017 | 1 | $41,817,416,000 | 68.79% | 18.07 | |

| 2018 | 1 | $41,963,578,000 | 63% | 17.01 |

State Farm’s loss ratio percentage has decreased over the last four years. As the total written premiums have increased and the loss ratio has decreased, we’re able to say that State Farm has done well with balancing earned premiums and paid claims during the time periods shown above.

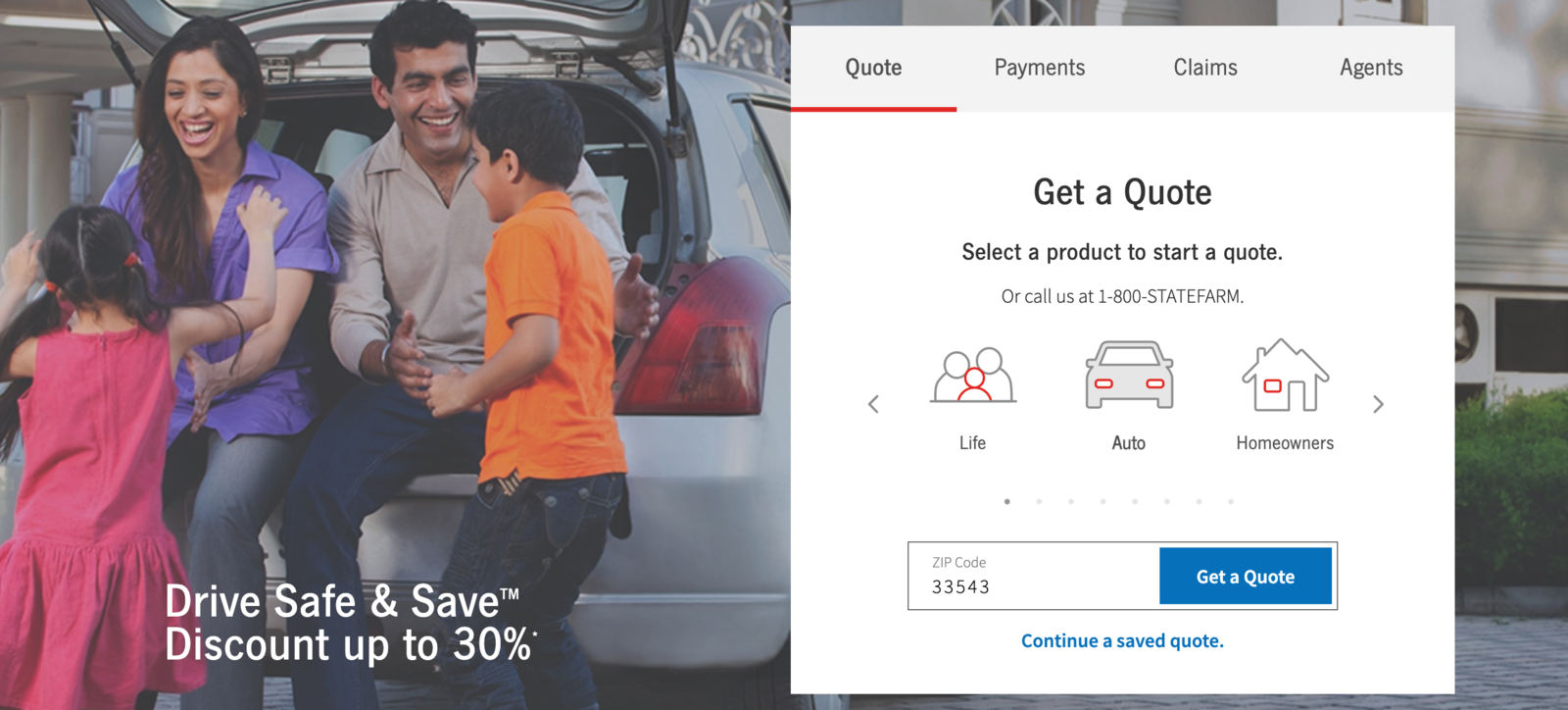

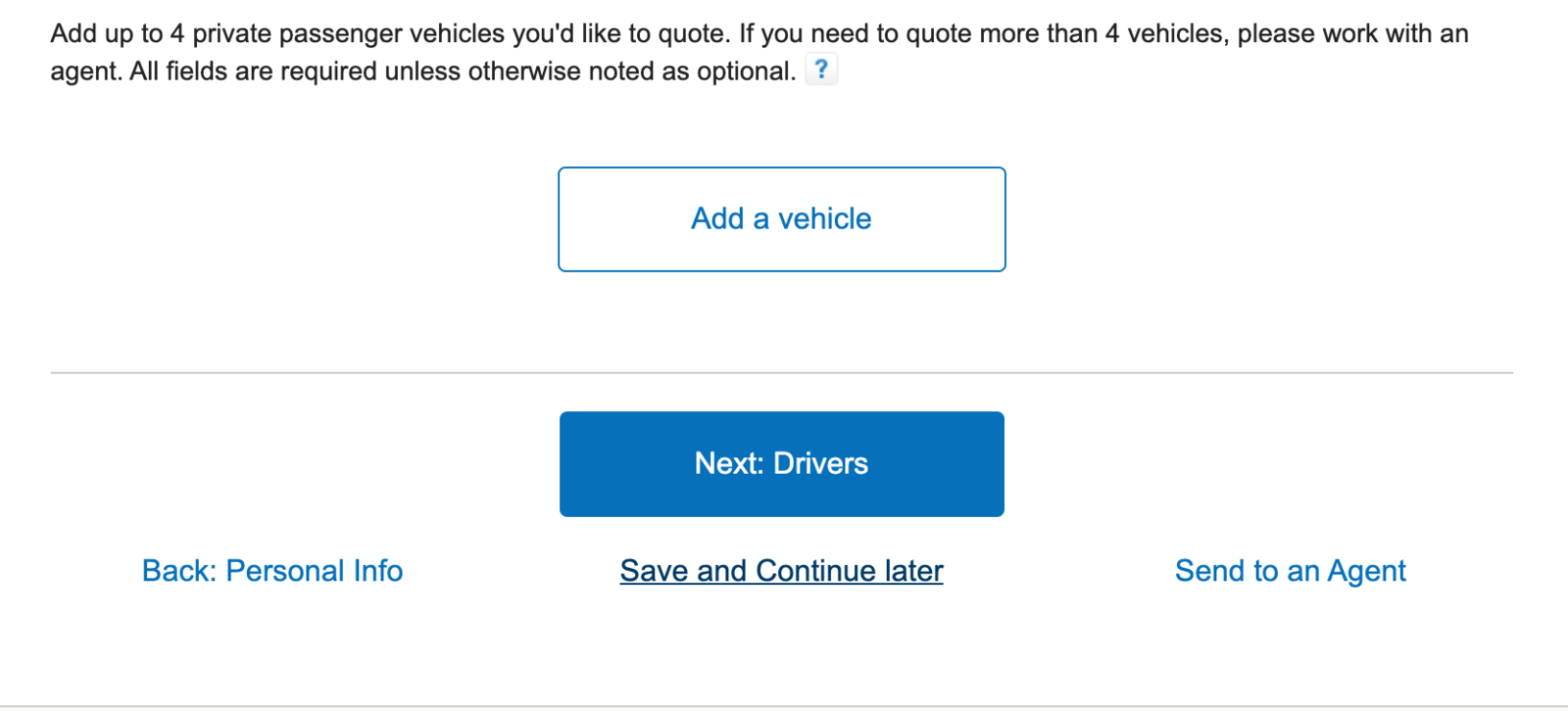

How to Get a Quote Online

Fast, free quotes with State Farm are available to anyone with the click of a mouse.

To start a quote with State Farm, all you have to do is select a product.

Step 1: Who is State Farm?

Find out who State Farm is and what they are all about. You can find this information on their About webpage.

Just like any other company or product, it’s always a good idea to do your research before purchasing a policy.

Read about State Farm’s history, values, and more on their About Page here.

Step 2: Enter your ZIP code.

Once you’ve done your research, it’s time to choose an insurance type and enter your ZIP code. Entering your ZIP code will put you in touch with an agent that is able to sell you insurance in your area.

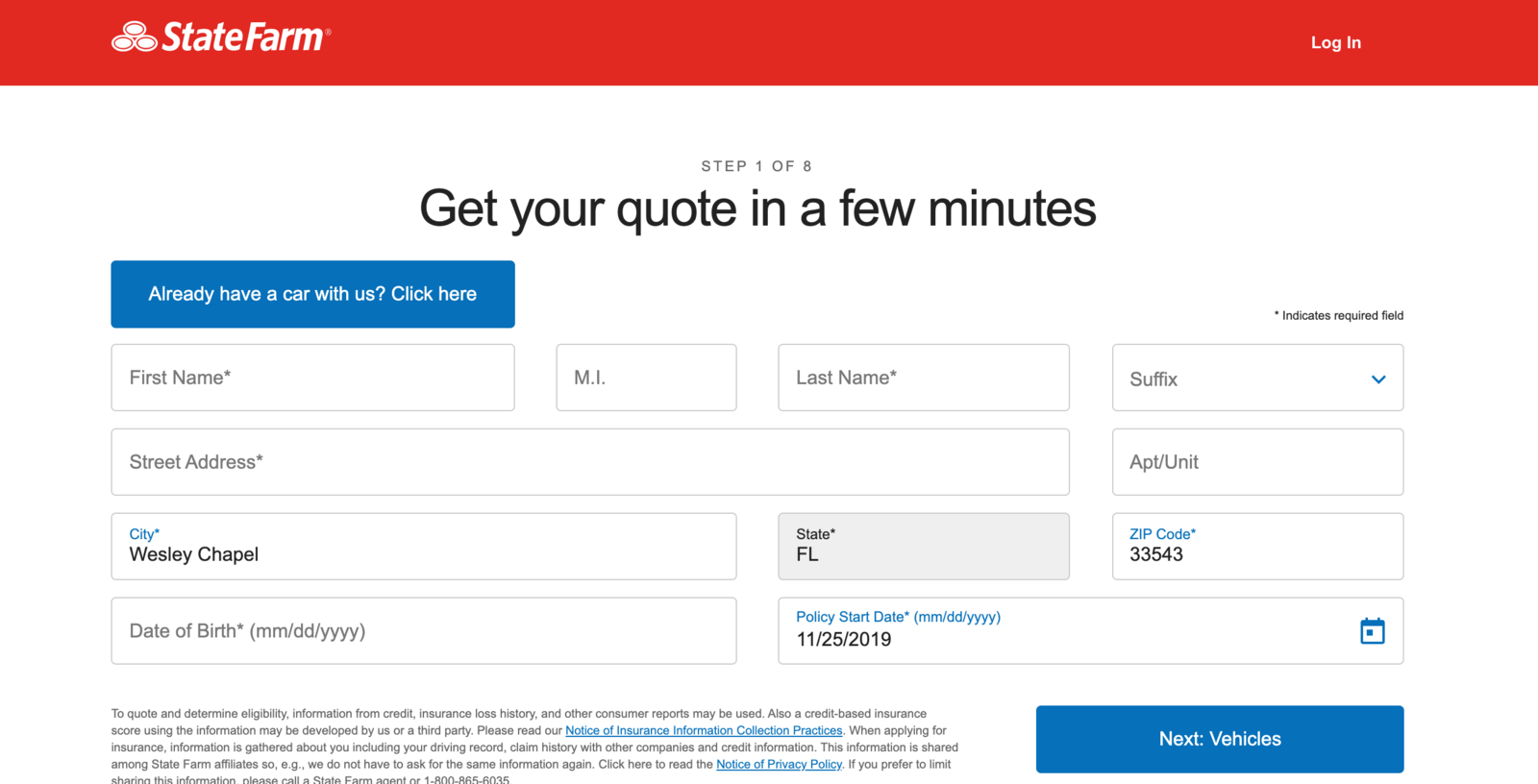

Step 3: Enter your information

Enter your name, address, date of birth, and when you’d like your policy to begin.

When you’re finished, click the “Next: Vehicles” button.

Step 4: Agree to the Private Policy.

Before you click “agree,” make sure you read through State Farm’s terms and conditions.

You can find their Notice of Private Policy page here.

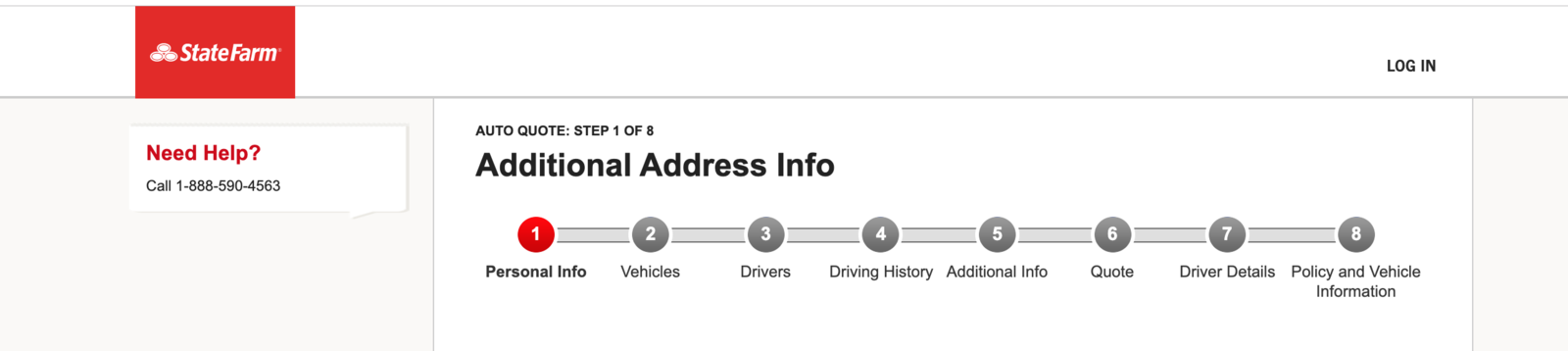

Step 5: Have your vehicle information ready.

Have your vehicle registration, driver’s license, and social security card ready and on hand when you’re filling out this additional address and vehicle information section.

Having the most accurate information will help State Farm give you the most accurate quote for your policy. Remember that insuring more than one car can help you save up to 20 percent or more on your insurance policy.

Joining the Drive Safe & Save program with your car’s OnStar technology can save you up to 50 percent on your insurance rates.

Step 6: Send your info to an agent or save your progress.

Once you’ve filled out all of the information needed, such as vehicle make and model, driver details, and more, all you have to do is send your information to an agent. If you’re not finished and you’d like to come back later to complete your quote, simply click on the “save and continue later” button.

Remember, if you need any help filling out your State Farm quote, all you have to do is pick up the phone and dial the State Farm customer service line at 1-800-590-4563.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Design of the Website & App

State Farm’s website is very easy to navigate. For your convenience, they’ve added a drop-down menu at the very top of the website. Simply scroll and click on whatever you’re looking for.

State Farm also has a mobile app.

It is designed to help manage your accounts, get roadside assistance, file a claim, and more. See for yourself. Download the State Farm mobile app today.

Text MOBILE to 78836 to get a link to the app.

Customer Ratings

State Farm’s mobile app received 4.8 out of five stars in Apple’s App Store, and four out of five stars in Google Play.

The app is rated so high because it is easy to use, it’s convenient, and it has an array of options.

However, the app also had some criticism, as well. Here are some of the common complaints:

- software updates

- the inability to set reminders for bills

- some difficulty navigating multiple policies

But what can you do on the State Farm app that makes it so great?

With a few short clicks and scrolls, you can easily set autopay options, manage your account, pull up your insurance card, view your bank accounts and manage your loans, get roadside assistance, connect with your agent, upload photos and documents for a claim and the list goes on.

If you don’t have the State Farm app, it could be a good use to you, especially if you don’t spend a lot of time on a laptop computer.

Pros & Cons

We’ve have gone over everything you need to know about State Farm, but let’s check out the biggest takeaways in terms of pros and cons.

Check out the table below.

| PROS | CONS |

|---|---|

| Has the third-lowest average premium among the top 10 providers | Rates can be pricey depending on where you live |

| Consistently strong financial standing and solid rankings | Could stand to offer more discounts, like federal employees, green vehicles, and occupational |

| Policies are available in all 50 states | Received an "about average" Power Circle Ranking in 5 out of 11 regions |

| Customers have a variety of online options and an easy-to-use app | Limited add-ons are available |

Even if you move out of state, you don’t have to cancel your policy — just make a phone call and ask State Farm to change the policy from the state you live in to the state you’re moving to.

State Farm has just a few cons:

- Rates can be pricey based on location

- Limited add-on insurance options are available

- Limited occupational discounts

- Received an “average” rating from Power Circle Ranking in five out of 11 regions

On the other hand, here are some pros:

- A mobile app to check your policy info, get roadside assistance and submit a claim.

- Rideshare insurance offered in most states.

- Steer Clear program for drivers under 25 and the Drive Safe & Save program to help good drivers save money on insurance premiums.

Now that we’ve looked at the pros and cons, let’s look at State Farm as a whole.

The Bottom Line

Now that’ we’ve shown you everything you need to know about State Farm car insurance, it’s time to find out for yourself if you’d consider State Farm to be a good neighbor.

Insurance policies should be unique to your personal needs and budget, so make sure these two important are right for you before you sign the dotted line.

It’s always a good idea to shop around for insurance, see which company has the best rates and deals, and then make your decision.

Are you ready to start comparing rates right now? Use our free tool by entering your ZIP code in this box below.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

State Farm Insurance FAQs

Stick around for these frequently asked questions asked by car insurance consumers.

Can I get copies of my State Farm ID card online?

Yes. By logging into your State Farm account with your username and password, you can view, print, and email your insurance card. You can also view your insurance ID card on the State Farm mobile app.

Can I make payments to State Farm online?

Yes. To make a payment online through the State Farm website, just log in to your account and click pay my bill. You can also make a payment over the phone or by mail.

Does State Farm coverage include windshield repair?

Most coverages do not include windshield repair in your policy without a deductible.

Unless you live in a state that requires insurance companies to fix a broken windshield without a deductible or you have a full coverage policy, you will probably have to pay to have your windshield repaired or replaced.

How do I show proof of insurance to law enforcement?

If you’re ever in a jam and you need to pull up your insurance ID car quickly, but you don’t have the physical card with you, just log in to the State Farm app. It will allow you to pull up your card on your phone.

– How much car insurance do I need with State Farm?

Every state has different laws about car insurance coverage. To find out how much car insurance is required in your state, just ask a State Farm car insurance agent in your area.

– Does State Farm cover vehicle flood damage?

If you need vehicle flood damage, you must have a comprehensive car insurance policy. Comprehensive coverage might cost you a couple of hundred dollars per year, but it can potentially save you thousands of dollars in the long run.

Are you ready to save up to 40 percent or more on your car insurance policy?

Use our free tool by entering your zip code in this box below to get started.