Progressive vs. State Farm Auto Insurance Review for 2025 (Head-to-Head: Discounts & Coverage)

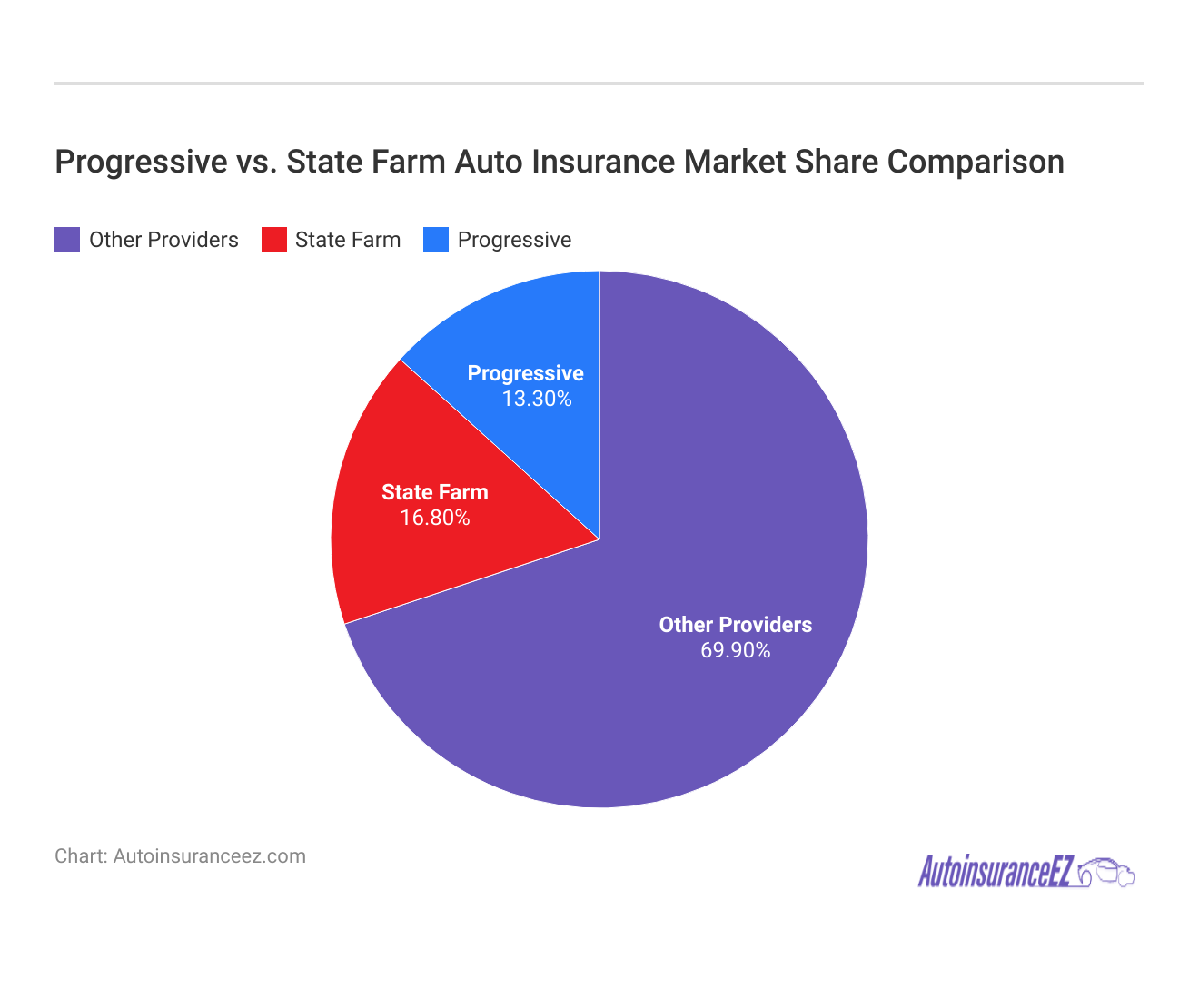

Progressive and State Farm auto insurance differ in pricing, coverage, and discounts. Progressive excels with customizable policies and extensive savings opportunities, averaging $39/month, while State Farm stands out for its lower rates, strong customer support, and reliable claims process at $33/month.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Jan 30, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

13,283 reviews

13,283 reviewsCompany Facts

Min. Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 18,154 reviews

18,154 reviewsCompany Facts

Min. Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviewsWhen comparing Progressive vs. State Farm auto insurance, pricing is generally competitive: State Farm charged $33 per month, and Progressive came in at $39. Progressive excels with Snapshot discounts for safe driving, and State Farm is courteous enough to boast a strong local solid agent network.

Progressive or State Farm offers unique advantages depending on the coverage you’ll need in the future. Progressive is better for people looking for a specific type of discount, like a safe driver discount, but State Farm shines regarding the customer service experience.

Progressive vs. State Farm Auto Insurance Rating

| Rating Criteria | ||

|---|---|---|

| Overall Score | 4.4 | 4.3 |

| Business Reviews | 4.0 | 5.0 |

| Claim Processing | 3.5 | 4.3 |

| Company Reputation | 4.5 | 4.5 |

| Coverage Availability | 5.0 | 5.0 |

| Coverage Value | 4.2 | 4.2 |

| Customer Satisfaction | 4.1 | 4.1 |

| Digital Experience | 4.5 | 4.5 |

| Discounts Available | 5.0 | 5.0 |

| Insurance Cost | 4.3 | 3.9 |

| Plan Personalization | 4.5 | 4.5 |

| Policy Options | 5.0 | 3.8 |

| Savings Potential | 4.5 | 4.3 |

| Progressive Review | State Farm Review |

You can save on car insurance by entering your ZIP code above and comparing Progressive versus State Farm quotes.

- Progressive and State Farm both offer multi-policy discounts

- State Farm provides exclusive benefits through its Drive Safe & Save program

- Progressive’s 24/7 claims support is reliable and provides excellent service

Coverage Costs for Progressive and State Farm Compared

Progressive and State Farm coverage costs are high when comparing Progressive vs. State Farm home insurance or auto policies. Here’s how Progressive Insurance vs. State Farm stacks up:

Progressive vs. State Farm Full Coverage Auto Insurance Monthly Rates by Age & Gender

| Age & Gender | ||

|---|---|---|

| Age: 16 Female | $801 | $311 |

| Age: 16 Male | $814 | $349 |

| Age: 30 Female | $131 | $94 |

| Age: 30 Male | $136 | $103 |

| Age: 45 Female | $112 | $86 |

| Age: 45 Male | $105 | $86 |

| Age: 60 Female | $92 | $76 |

| Age: 60 Male | $95 | $76 |

Progressive offers full coverage at an average auto insurance cost of $39 per month, higher than State Farm. Car insurance rates are affected by driving record, age, and where you live. Progressive scores a 4.3 for affordability, offering competitive pricing based on these factors.

When comparing Progressive vs. State Farm auto insurance, Progressive offers more flexibility in coverage costs, especially with its discount programs for safe drivers.

Chris Abrams Licensed Insurance Agent

State Farm’s average monthly coverage rate is $33, making it more budget-friendly. Its pricing is rated 3.9. Your location and driving behavior will impact your final rate, so consider your specific needs when comparing State Farm.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Exploring Coverage Options With Progressive vs. State Farm

While the Progressive vs. State Farm insurance comparison demonstrates that both offer a wide selection of auto insurance coverages, the types of coverage most suited to individual drivers’ needs are available.

Progressive offers full coverage, minimum coverage, comprehensive protection, gap insurance, SR-22 filings, and many add-ons, such as accident forgiveness and new car replacement, earning a 5.0 rating regarding coverage.

Progressive vs. State Farm Full Coverage Auto Insurance Monthly Rates by Driving Record

| Driving Record | ||

|---|---|---|

| Clean Record | $105 | $86 |

| Not-At-Fault Accident | $186 | $102 |

| Speeding Ticket | $140 | $96 |

| DUI/DWI | $140 | $112 |

Similarly, State Farm offers full coverage, minimum coverage, comprehensive coverage, gap insurance, SR-22 filings, and add-ons like roadside assistance and rental car coverage, earning a 5.0 rating.

State Farm vs. Geico vs. Progressive offers the above options, with even more choices across broader ranges. Liberty Mutual vs. Progressive, Progressive, and State Farm offer comprehensive and flexible coverage options, positioning them firmly in drivers’ minds as contenders for excellent protection.

Discounts Provided by Progressive and State Farm

Regarding saving on car insurance premiums, both Progressive and State Farm provide several discounts. Here’s a closer look at the deals from both companies:

Progressive vs. State Farm Auto Insurance Discounts by Savings Potential

| Discount | ||

|---|---|---|

| Safe Driver | 31% | 40% |

| Multi-Vehicle | 25% | 20% |

| Multi-Policy | 20% | 20% |

| Good Student | 10% | 25% |

| Homeowner | 10% | 17% |

| Paperless | 10% | 10% |

Progressive offers a variety of discounts, including its Snapshot program that rewards safe driving with up to 31% in savings. Other discounts Progressive offers include roadside assistance. Progressive receives a 5.0 for discount offerings.

State Farm also provides appealing discounts, such as the Good Student Discount (up to 25%) and safe driving discounts to reduce up to 40%. What’s more, State Farm is rated 5.0 for its discount programs. All three providers can be differentiated as stand-outs in a Geico versus Progressive versus State Farm comparison, especially regarding generous discount offers.

Progressive versus State Farm auto insurance portrays Progressive as valuable for those who want the flexible, high-tech-savvy discounts drivers seek after Snapshot.

Be sure to ask for any discounts you might be eligible for with a service provider and receive the best possible bargain. If you also wish to have homeowner’s insurance, check to see if you could save more money with State Farm versus Progressive homeowner’s insurance.

Customer Opinions on Progressive vs. State Farm

Progressive’s score is 4.1. Many consumers appreciate its Snapshot feature, which allows them to alter coverage details or get discounts. However, some people experience delays when filing claims and feel that Progressive needs to treat its customers better.

Selecting the right insurance provider depends on your unique needs, such as budget, coverage preferences, and customer service priorities. Progressive excels in offering high-tech solutions and customizable discounts, whereas State Farm stands out for its affordability and hands-on support through local agents.

Eric Stauffer Licensed Insurance Agent

Competitive for those seeking to compare Progressive rates, claims handling is not without issue. If you still have questions about filing an auto claim, Progressive does not leave you in the dark, but the processing sometimes takes a little longer.

State Farm also accepts a rating score of 4.1. Customers value it for its personalized service from local agents. However, some have expressed dissatisfaction with its premiums, which are much higher than those of other insurance companies.

Both companies appear to have good customer service but have numerous complaints about claims and costs. Progressive auto insurance reviews similarly resonate with these sentiments as there are advantages but areas that need improvement.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Business Performance Ratings for Progressive and State Farm

This section concerns the business performance ratings of Progressive and State Farm auto insurance by reliable sources. Progressive received good customer satisfaction ratings with a solid ranking from J.D. Power and an A+ A.M. Best rating Progressive for financial stability.

Insurance Business Ratings & Consumer Reviews: Progressive vs. State Farm

| Agency | ||

|---|---|---|

| Score: 832 / 1,000 Avg. Satisfaction | Score: 877 / 1,000 Above Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices | Score: C- Below Avg. Business Practices |

|

| Score: 72/100 Avg. Customer Feedback | Score: 75/100 Positive Customer Feedback |

|

| Score: 1.11 More Complaints Than Avg. | Score: 0.78 More Complaints Than Avg. |

|

| Score: A+ Superior Financial Strength | Score: B Fair Financial Strength |

While this has a much better BBB rating, and its complaint ratio is higher than State Farm, Progressive excels as an auto insurer for those needing commercial auto coverage.

State Farm shines with almost the perfect rating from J.D. Power alongside an A++ rating by Progressive A.M. Best, which speaks of excellent financial strength and high marks regarding customer satisfaction. Not to mention, its BBB rating is very impressive, revealing a good track record in resolving customer concerns.

Progressive Auto Insurance Pros and Cons

While comparing auto insurance companies, it is essential to compare them with a critical eye. Here are some pros and cons of Progressive auto insurance to help you make a better decision.

Pros

- Discount Variety: Some customers report that handling their claims is slow, which can be frustrating when resolving issues quickly. However, the variety of discounts available, including those for safe driving and bundling, appeals to many drivers.

- Flexible Coverage: Many add-ons and optional coverages are offered, allowing customers to tailor their policies to their needs. This flexibility makes it an excellent choice for those looking for customizable coverage.

- Tech-Driven: This company is known for using technology to track claims and offer discounts. It provides a convenient and modern approach to insurance. Customers can easily manage their policies and file claims through its mobile app or online portal, making it tech-friendly.

Cons

- Slow Claims Processing: Some customers claim the handling of their claims is slow, which may lead to delays in receiving compensation for damages or losses. This can be a significant downside for those in need of prompt assistance.

- Higher Premiums: Premiums for high-risk drivers are relatively high, which can make this option less affordable for individuals with poor driving records. This could result in higher monthly payments for those in this category.

Progressive auto insurance is appropriate for those who value flexible discounts and the latest technology for handling claims. However, this company is unsuitable for individuals looking for lower premium prices, especially those at high risk.

Before investing, check the Progressive Insurance ratings and the Progressive Insurance A.M. Best rating. A Progressive auto insurance review and considering Progressive AM’s Best rating can also be helpful.

State Farm Auto Insurance Pros and Cons

State Farm is one of the largest auto insurance companies, offering personalized service and excellent customer satisfaction. The State Farm auto insurance review examines the pros and cons of having State Farm as your provider.

Pros

- Personalized Service: With the help of local agents.

- Rating Highly for Satisfaction: Customer ratings on good service.

- Safe Driver Discount: 40 percent off for safe drivers.

Cons

- More Expensive: Pricier than some competitors.

- Less Tech Features: There are fewer app-based savings than others. Following State Farm car insurance, the review offers very good personal and high-quality customer service. However, it is not necessarily the cheapest to insure at an affordable rate.

If personalized service and high satisfaction are paramount, consider State Farm. However, you might be better off elsewhere if cheaper or more tech-friendly features are essential.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

A Side-by-Side Look at Progressive vs. State Farm Auto Insurance

The Progressive vs. State Farm offers such car insurance plans. They both seem competitive in pricing and coverage options, including collision and comprehensive plans.

Progressive compare rates show flexibility with discounts, especially for safe drivers, while State Farm is well-known for its personalized service through local agents. For a broader comparison, you can also look at Geico vs. Progressive vs. State Farm, which all provide solid options for affordable auto insurance.

After a side-by-side comparison of Progressive vs. State Farm auto insurance, Progressive stands out for its flexible discounts and competitive comprehensive and collision coverage options.

Measure what’s included in the coverage cost, discount, and consumer reaction to help you decide which one will best suit your needs, especially when choosing between comprehensive and collision coverage.

Get the lowest auto insurance rates in your location by simply typing your ZIP code into our free quote tool below and comparing Progressive vs. State Farm.

Frequently Asked Questions

Are State Farm and Progressive the same company?

No, they are not. The two companies involved are State Farm and Progressive. They are different providers of insurance; they specialize in various kinds of coverage, and they even have their pricing structures, insurance policy premiums, and customer service approaches different from each other.

When comparing State Farm vs. Progressive home insurance, State Farm emphasizes its strong presence of local agents, whereas Progressive is known for its advanced online tools and competitive pricing options.

What is the difference in customer service between State Farm and Progressive?

Progressive and State Farm are vastly different from one another. State Farm is known for having the highest volume of agents doing work at the local level and also for extensive customer service. On the other hand, Progressive is leading in terms of progressive online tools and highly competitive prices.

Which company offers better rates, State Farm or Progressive?

In Progressive vs. State Farm for car insurance, State Farm will usually be cheaper for most of the drivers. Still, many variables would make a lot of difference for that final cost, such as location, age, driving history, etc.

Is Progressive better than State Farm?

If you like receiving services online and would probably get a better rate, Progressive is an ideal option. However, if you desire personal service from your local agents, then State Farm would be the best for you. Compare their rates, coverage options, and reviews to fit your needs.

Is Progressive cheaper than State Farm?

Overall, Progressive might be more affordable for customers concerned about online management and finding a better rate than State Farm. However, insurance depends on the location, age group, driving record, and required coverage.

That means you must obtain quotes from both companies to know which one gives the best price for your circumstances. Please find more information in our article on cheap auto insurance rates for seniors.

Is State Farm more financially stable than Progressive?

State Farm’s rating and financial strength usually are “A++” from A.M. Best, significantly above average in economic strength and dependability. The rating Progressive received was “A+” with A.M. Best.

How do State Farm and Progressive compare in terms of customer satisfaction?

State Farm has a much higher customer satisfaction score, mainly due to its agents’ local locations and personalized service. Progressive receives kudos for being a website and a low-cost option.

Are there significant differences in coverage options between State Farm and Progressive?

Both companies offer numerous coverage options, though the difference lies in the delivery: State Farm through local agents and Progressive through online platforms.

How do credit scores impact rates with State Farm and Progressive?

Both also factor credit scores into the rate decision. The thresholds may differ, so you can save money by asking them how your credit score will affect your premium at each place.

Which company is better for new drivers, State Farm or Progressive?

State Farm is one of the ones that will often get cheaper rates for new drivers compared to Progressive. However, Progressive can appeal to a new driver who prefers managing his policies online. Stop overpaying on your auto insurance. Enter your ZIP code below to see if Progressive vs. State Farm can offer you a better deal.

Can I get a better deal on auto insurance if I have a good driving record with State Farm or Progressive?

Both companies have policies that reward good drivers with low rates. Yet, the specific rate change due to a good driving record varies by company and by the particular features of those companies’ discounts.

How do State Farm and Progressive handle claims processing?

You call your local agent to get the claims process started at State Farm. Progressive offers an easy online claims process that is fast and can track the status of your claim.

Does Progressive offer more discounts than State Farm?

Progressive has more significant discounts than State Farm, especially if you are bundling car and renters insurance. Progressive offers numerous online management of policies and bunching multiple kinds of coverage. Meanwhile, State Farm offers discounts but makes it more of a personal touch with the use of agents rather than a large number of online deals and bundling opportunities.

Does State Farm or Progressive offer better coverage for high-risk drivers?

Frequently, State Farm offers better coverage and value for high-risk drivers than Progressive. Compare the two companies’ high-risk policies.

Which company is better for full coverage, State Farm or Progressive?

State Farm and Progressive both offer fully comprehensive and complete collision coverages. While State Farm prefers lower rates, Progressive has better coverage options.

Are there differences in customer service experiences between State Farm and Progressive?

State Farm delivers personalized customer service through its extensive network of local agents, offering a more tailored experience for policyholders. Progressive’s online customer service might be much more streamlined and accessible for those comfortable with online interfaces.

How do the rates for State Farm and Progressive compare for different types of vehicles?

The rates will depend on the auto type, but both companies have competitive rates. However, this would depend on the model and other security features. Compare quotes from both companies and use some driving tips to keep the road safe and, in turn, reduce your premiums.