Liberty Mutual vs. Travelers: Best Auto Insurance for 2025 (Head-to-Head Review)

Liberty Mutual vs. Travelers auto insurance compares with monthly rates starting at $68 for Liberty Mutual and $37 for Travelers. Travelers offers IntelliDrive and the Premier Responsible Driver Plan, while Liberty Mutual features RightTrack and a Violation-Free Discount for budget-conscious drivers.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

UPDATED: Apr 24, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

3,792 reviews

3,792 reviewsCompany Facts

Min. Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

3,792 reviews

3,792 reviews 1,733 reviews

1,733 reviewsCompany Facts

Min. Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

1,733 reviews

1,733 reviewsLiberty Mutual vs. Travelers auto insurance is a close comparison, but Travelers is the top pick overall for drivers who want broad coverage at competitive prices.

While Liberty Mutual offers standout perks like the RightTrack telematics program and strong digital tools, its premiums tend to run higher.

Liberty Mutual vs. Travelers Auto Insurance Rating

| Rating Criteria |  | |

|---|---|---|

| Overall Score | 4.3 | 4.4 |

| Business Reviews | 4.0 | 4.5 |

| Claim Processing | 3.3 | 4.5 |

| Company Reputation | 4.0 | 4.5 |

| Coverage Availability | 5.0 | 5.0 |

| Coverage Value | 4.1 | 4.3 |

| Customer Satisfaction | 4.0 | 4.1 |

| Digital Experience | 4.5 | 4.5 |

| Discounts Available | 5.0 | 5.0 |

| Insurance Cost | 4.2 | 4.0 |

| Plan Personalization | 4.5 | 4.5 |

| Policy Options | 5.0 | 4.1 |

| Savings Potential | 4.4 | 4.3 |

| Liberty Mutual Review | Travelers Review |

Travelers deliver strong value with features like accident forgiveness, IntelliDrive, and a wide range of standard and optional coverage. If you’re weighing full coverage, roadside help, and policy management ease, Travelers has the edge.

- Liberty Mutual auto insurance features RightTrack and Violation-Free discounts

- Travelers auto insurance uses IntelliDrive to reward safe drivers with savings

- Rates start at $68 for Liberty Mutual and $37 for Travelers auto insurance

Find the best auto insurance company near you by entering your ZIP code into our free quote tool.

Compare Liberty Mutual and Travelers Auto Insurance Rates

Liberty Mutual and Travelers differ significantly when it comes to monthly rates for full coverage auto insurance. Travelers consistently offer lower rates across all age groups and genders. For instance, a 30-year-old female pays $174 with Liberty Mutual but only $99 with Travelers.

Liberty Mutual vs. Travelers Full Coverage Auto Insurance Monthly Rates by Age & Gender

| Age & Gender |  | |

|---|---|---|

| Age: 16 Female | $723 | $719 |

| Age: 16 Male | $785 | $910 |

| Age: 30 Female | $174 | $99 |

| Age: 30 Male | $200 | $108 |

| Age: 45 Female | $171 | $98 |

| Age: 45 Male | $174 | $99 |

| Age: 60 Female | $148 | $89 |

| Age: 60 Male | $159 | $90 |

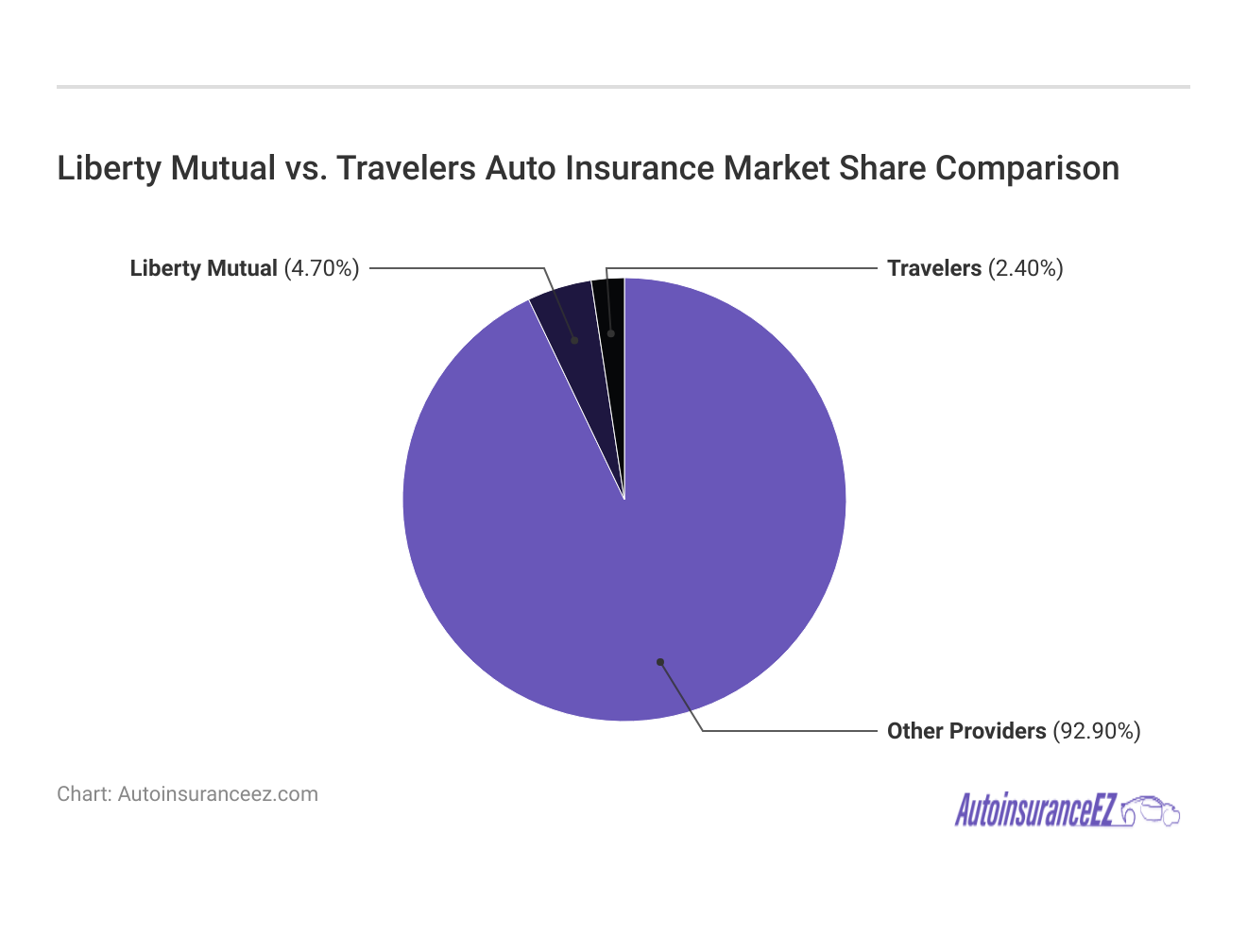

This pattern holds true from young drivers at 16 to older drivers at 60, with Travelers coming out ahead on affordability. In addition to rate differences, Liberty Mutual and Travelers diverge in market presence. Liberty Mutual holds 4.7% of the auto insurance market, while Travelers comes in at 2.4%.

That broader footprint may reflect brand awareness or bundling opportunities, but it doesn’t necessarily mean Liberty Mutual provides better value, especially if cost is your top concern. If you’re looking to get more value out of your premium, Travelers Insurance vs. Liberty Mutual is a clear-cut comparison.

Compare Liberty Mutual and Travelers by looking at your driving history, then use each app to check discounts, file claims, and adjust coverage as needed.

Dani Best Licensed Insurance Producer

Travelers usually offer cheap car insurance rates across all age groups, and the gap grows as you get older; while Liberty Mutual’s RightTrack and coverage options are solid, Travelers is the better pick if keeping costs down is your primary goal.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Travelers vs. Liberty Mutual Auto Insurance Discounts Compared

When it comes to auto insurance discounts, Liberty Mutual usually comes out ahead, especially if you’re a good student or have a clean driving record. For example, they offer up to 22% off for students with good grades, while Travelers caps that discount at 15%. Accident-free drivers can save 23% with Liberty Mutual compared to just 10% with Travelers.

Liberty Mutual vs. Travelers: Auto Insurance Discounts

| Discount Type |  | |

|---|---|---|

| Multi-Policy | 12% | 10% |

| Multi-Car | 10% | 8% |

| Good Student | 22% | 15% |

| Student Away at School | 10% | 7% |

| Accident-Free | 23% | 10% |

| Violation-Free | 15% | 8% |

| New Graduate | 8% | 5% |

| New Vehicle | 12% | 7% |

| Alternative Energy | 10% | 4% |

| Military | 10% | 10% |

| Early Shopper | 7% | 8% |

| Telematics Program | 30% | 30% |

| Homeowner | 5% | 5% |

| Online Purchase | 8% | 7% |

| Preferred Payment | 7% | 5% |

Both companies offer similar savings—up to 30%—through their telematics programs, but Liberty Mutual pulls slightly ahead in areas like multi-policy, violation-free, and new car discounts.

Taking a defensive driving course with Liberty Mutual and Travelers could be a smart way to stack even more savings, especially if you’ve already locked in other discounts.

Travelers vs. Liberty Mutual: Best for Good Credit Drivers

When comparing Liberty Mutual vs. Travelers auto insurance by credit score, Travelers consistently comes out slightly cheaper across the board. For drivers with good credit, Travelers charges $147 per month compared to Liberty Mutual’s $153. That trend holds for fair and poor credit scores, too, though the differences are relatively minor—just a few dollars in each case.

Liberty Mutual vs. Travelers Full Coverage Insurance Monthly Rates by Credit Score

| Credit Score |  | |

|---|---|---|

| Good Credit | $153 | $147 |

| Fair Credit | $164 | $160 |

| Poor Credit | $195 | $193 |

If you’re trying to save and want to understand how your credit score affects your car insurance premiums, Travelers often comes out cheaper for drivers with good credit, even though Liberty Mutual might offer bigger discounts in other areas.

Liberty Mutual vs. Travelers Auto Insurance: Best Rates by Driving History

Travelers consistently delivers lower monthly rates than Liberty Mutual for drivers across all types of driving records. Whether you’ve maintained a clean history or dealt with a not-at-fault accident, speeding ticket, or DUI, Travelers keeps premiums more affordable at every level.

Liberty Mutual vs. Travelers Full Coverage Auto Insurance Monthly Rates by Driving Record

| Driving Record |  | |

|---|---|---|

| Clean Record | $174 | $99 |

| Not-At-Fault Accident | $234 | $139 |

| Speeding Ticket | $212 | $134 |

| DUI/DWI | $313 | $206 |

For example, a clean record gets you a $99 rate with Travelers versus $174 from Liberty Mutual, and even a DUI costs over $100 less per month.

If you’re a safe driver or a student with good grades, you’ll likely save more with Liberty Mutual’s higher discount caps, but Travelers often wins on lower base rates overall.

Tonya Sisler Insurance Content Team Lead

For drivers concerned about cost increases from traffic incidents, Travelers offers more competitive pricing without sacrificing coverage.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Compare Liberty Mutual vs. Travelers Insurance Ratings & Scores

When you’re weighing Liberty Mutual vs. Travelers auto insurance, reviews and ratings from trusted industry sources help paint a clearer picture of how each company performs. Both Liberty Mutual and Travelers received strong J.D. Power scores—857 and 860, respectively—showing above-average satisfaction from policyholders.

Insurance Business Ratings & Consumer Reviews: Liberty Mutual vs. Travelers

| Agency |  | |

|---|---|---|

| Score: 857 / 1,000 Above Avg. Satisfaction | Score: 860 / 1,000 Above Avg. Satisfaction |

|

| Score: A Excellent Business Practices | Score: A+ Excellent Business Practices |

|

| Score: 74/100 Good Customer Satisfaction | Score: 76/100 Good Customer Feedback |

|

| Score: 0.55 Fewer Complaints Than Avg. | Score: 1.12 Avg. Complaints |

|

| Score: A Excellent Financial Strength | Score: A++ Superior Financial Strength |

Travelers edges ahead slightly in financial strength with an A++ from A.M. Best, compared to Liberty Mutual’s still-solid A rating. They also outperform Liberty Mutual in BBB and Consumer Reports ratings, with an A+ for business practices and a 76/100 customer feedback score.

However, Liberty Mutual holds a noticeable advantage when it comes to complaint volume. According to NAIC data, Liberty Mutual has a lower complaint ratio (0.55) compared to Travelers’ 1.12, which suggests customers are generally more content with Liberty Mutual’s claims and service experience.

So if you’re trying to compare auto insurance companies, it really comes down to whether you’d rather have Travelers’ stronger financial backing or Liberty Mutual’s lower volume of customer complaints.

Pros and Cons of Liberty Mutual Auto Insurance

Liberty Mutual auto insurance offers personalized tools like RightTrack and a wide range of discount opportunities. However, its higher base rates and average financial strength rating may be drawbacks for budget-focused drivers.

Pros

- Strong Telematics Savings: RightTrack rewards safe driving with up to 30% off after tracking.

- Low Complaint Ratio: NAIC data shows fewer complaints (0.55) than the industry average.

- Broad Discount Options: Offers higher savings for good students, accident-free, and multi-policy.

Cons

- Higher Base Rates: Monthly premiums are significantly higher than those of Travelers across all profiles.

- Weaker Financial Score: Receives an A from A.M. Best, lower than Travelers’ superior A++ rating.

Liberty Mutual auto insurance offers great savings potential and tools like RightTrack, but if keeping your premium low is your top priority, Travelers might be the better fit.

Yelp reviewers highlight Liberty Mutual’s responsive claims process and helpful representatives, though some cite delays in billing resolution. Compare quotes to see which one works best for your needs.

Pros and Cons of Travelers Auto Insurance

Travelers auto insurance stands out for its budget-friendly rates and driver-friendly features, especially for those with clean records or good credit. While it doesn’t offer the deepest discounts, its tech tools and forgiveness perks make it a smart pick for practical drivers.

Pros

- Lower Premiums: Offers consistently cheaper rates across age, credit, and driving history.

- IntelliDrive Program: Tracks driving for potential savings without requiring extra devices.

- Accident Forgiveness: Premier plan helps avoid rate hikes after a first accident or ticket.

Cons

- Fewer Discounts: Offers smaller savings than Liberty Mutual in most discount categories.

- Higher Complaint Ratio: NAIC data shows Travelers has more service complaints than average.

If you’re focused on value and prefer usage-based savings with fewer frills, Travelers could be the better fit—just make sure the lighter discount options work for your needs.

One recent Yelp post in a Travelers car insurance review called out a specific rep for going above and beyond to resolve a tough claim. It shows that even though Travelers gets more complaints overall, there are still moments of strong, personal service from their team.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Liberty Mutual or Travelers: Find the Right Auto Insurance

For most drivers, including people focused on value and practical coverage, Travelers is the superior option in the Liberty Mutual vs. Travelers auto insurance comparison.

With its low rates, dependable IntelliDrive program, and accident forgiveness features, it’s an excellent option for anyone who wants solid protection without paying too much for it. Liberty Mutual still offers helpful features like the Liberty Mutual App and RightTrack, but if you’re trying to keep costs down while getting solid auto insurance coverage, Travelers usually gives you more for less.

Start comparing total coverage auto insurance rates by entering your ZIP code here.

Frequently Asked Questions

How good is Liberty Mutual car insurance compared to Travelers?

Liberty Mutual offers strong digital tools, various discount options like RightTrack, and customizable coverage, but it’s typically more expensive than Travelers. Travelers is generally considered better for budget-conscious drivers, with rates averaging $37 per month compared to Liberty Mutual’s $68, and it scores higher for financial strength.

Is Liberty Mutual expensive compared to other insurers like Travelers?

Yes, Liberty Mutual tends to be pricier. For example, full coverage from Liberty Mutual can cost $174 per month for a 30-year-old female, while the same coverage from Travelers costs only $99. The higher base rate may be offset slightly by Liberty Mutual’s broader discount offerings, but many drivers still find Travelers more affordable overall.

Does Liberty Mutual offer a defensive driving course discount?

Yes, Liberty Mutual offers a defensive driving course discount, particularly for drivers who complete a state-approved course. This discount typically ranges from 5% to 10%, depending on your state and eligibility, and it’s often available for drivers aged 55 and up.

Can I take the Liberty Mutual defensive driving course online?

In most states, Liberty Mutual accepts online defensive driving courses for its discount program. You’ll need to make sure the course is approved by your state’s DMV and submit a certificate of completion to qualify for savings on your premium.

How much can I save with the Liberty Mutual good student discount?

Liberty Mutual offers a good student discount of up to 22% for full-time high school or college students who maintain a GPA of B or higher. This is one of the most generous academic-based discounts available from a national insurer.

How do Travelers and Liberty Mutual compare in terms of financial strength?

Travelers holds a stronger financial rating from A.M. Best with an A++ (Superior), while Liberty Mutual is rated A (Excellent). Both are financially stable, but Travelers has a slight edge, which can matter when evaluating long-term claims-paying ability.

What are Travelers auto insurance ratings from customers?

Travelers generally receive favorable ratings for value and affordability. It has a J.D. Power score of 860 and an A+ rating from the Better Business Bureau, but some customer reviews mention longer claim resolution times. Still, it outperforms Liberty Mutual in several areas of satisfaction.

Are Travelers car insurance reviews positive overall?

Travelers’ car insurance reviews are mixed but lean positive. Customers appreciate the company’s affordability and discounts, particularly for safe driving, but some report that claims processing can take longer than expected. Overall, it’s rated better than Liberty Mutual in terms of pricing and value.

Does Travelers offer a defensive driving course discount?

Yes, Travelers offers a defensive driving discount for eligible drivers who complete an approved safety course. The average savings is around 10%, though exact percentages can vary by state and policy type.

Where can I take the Travelers defensive driving course?

Travelers do not offer their own courses but accept state-approved defensive driving programs. You can complete these courses online or in person, depending on your location. Make sure to confirm eligibility with Travelers before enrolling.

How does Esurance compare to Travelers for car insurance?

Esurance (now merged with Allstate) tends to offer more tech-forward tools, but Travelers outperforms it in affordability and financial strength. Travelers are more consistent with customer satisfaction, especially drivers with clean records or good credit.

Is Liberty Mutual better than SafeAuto for car insurance?

Liberty Mutual provides broader coverage options, more discounts, and stronger customer service than SafeAuto. However, SafeAuto may be cheaper for high-risk drivers or those seeking bare minimum state-required coverage. Liberty Mutual is a better fit for drivers seeking full-service insurance.

Which is better: Nationwide or Travelers auto insurance?

Travelers generally offer cheaper rates and more flexible discount options than Nationwide. However, Nationwide is known for strong claims satisfaction and bundling opportunities. Travelers may be a better fit for budget-focused drivers, while Nationwide could appeal to those prioritizing customer support.

How does Liberty Mutual compare to Amica auto insurance?

Amica often scores higher than Liberty Mutual in customer service and claims satisfaction, particularly for long-term policyholders. However, Amica’s premiums can be higher and less widely available. Liberty Mutual has more digital tools and is easier to access in all 50 states.

What is the average monthly premium for Travelers vs. Liberty Mutual?

On average, Traveler’s full coverage auto insurance costs around $151 per month, while Liberty Mutual’s average is $226. The actual rate depends on your location, driving history, credit score, and coverage selections, but Travelers consistently ranks as more budget-friendly across most categories.