Geico Auto Insurance Review for 2025

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Licensed Insurance Agent

UPDATED: Mar 7, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Geico Auto Insurance Review (Easy Guide to the Best Coverage)

These companies have competitive prices, although they consider factors such as driving records, credit scores, and vehicle types when tailoring their policies. Compare their rates to find the best deal for your needs.

| Geico OVERVIEW | STATS |

|---|---|

| Founded | 1936 (now a wholly owned subsidiary of Berkshire Hathaway, Inc.) |

| Current Executives | Olza M. Nicely, President and Chief Executive Officer-Insurance Operations Louis A. Simpson, President and Chief Executive Officer-Capital Operations Charles R. Davies, Senior Vice President and General Counsel |

| Number of Employees | 40,000 |

| Premiums Written (2017) | $29,596,404,000 ($29.6 billion) |

| Current Assets | Over $32 billion https://www.geico.com/about/corporate/financial-information/ |

| Loss Ratio (2017) | 72.04% |

| Headquarters Address | 5260 Western Avenue Chevy Chase, MD 20815 |

| Local Offices | Find your local office here |

| Phone Number | (800) 841-3000 |

| Website | Geico.com |

| Best For | Online services and low rates |

For 20 plus years, Geico has been charming us with its adorable little green gecko and hysterical commercials, but for the last 80 or so years, its lower-than-average auto insurance rates have saved the lives (and wallets) of many drivers across the country.

Geico is the second-largest insurance company in the insurance industry, and while that is impressive, we’re going to take a look at why and how Geico has grown to be so successful in this easy auto insurance review.

We know finding the right car insurance company can be a daunting task, so that’s exactly why we decided to give you this totally unbiased review of Geico and the services they offer.

In this guide, we will discuss Geico’s position for the future, discounts, rates, complaints, rankings and much more.

So if you’re stuck between a rock and a hard place while trying to find out if Geico is the right car insurance company for you, grab your coffee, give us just a few minutes of your time, and get comfortable as we start our way through this Geico auto insurance review.

Do you want to start comparing auto insurance rates right now? Use our free tool and enter your ZIP code in the box above to begin.

What are the cheapest car insurance rates?

We know the cost of car insurance is the most important thing to the average U.S. driver.

So the real question is, how much is car insurance with Geico going to cost?

While we can’t tackle this question with just one simple answer, we can lead you through different factors that can affect your car insurance rate.

In the next few sections below, we will provide you with average car insurance rates Geico has to offer according to a few different factors. Don’t go anywhere company availability is up first.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

What are Geico Availability and Rates by State?

The following information is brought to you by Quadrant Data.

Geico insurance is available to purchase in all 50 states.

Check out this table to see how your state stacks up against other state rate averages.

| STATE | ANNUAL PREMIUM | HIGHER/LOWER THAN STATE AVERAGE | PERCENT HIGHER/LOWER THAN STATE AVERAGE |

|---|---|---|---|

| Alabama | $2,866.60 | -$700.36 | -0.1963471194 |

| Alaska | $2,879.96 | -$541.56 | -0.1582806078 |

| Arizona | $2,264.71 | -$1,506.26 | -0.3994367163 |

| Arkansas | $3,484.63 | -$640.35 | -0.1552376885 |

| California | $2,885.65 | -$803.28 | -0.2177547305 |

| Colorado | $3,091.69 | -$784.70 | -0.2024307149 |

| Connecticut | $3,073.66 | -$1,545.26 | -0.3345498879 |

| Delaware | $3,727.29 | -$2,259.04 | -0.3773665534 |

| District of Columbia | $3,692.81 | -$746.43 | -0.1681441147 |

| Florida | $3,783.63 | -$896.83 | -0.1916120831 |

| Georgia | $2,977.20 | -$1,989.63 | -0.4005842188 |

| Hawaii | $3,358.86 | $803.22 | 0.3142937358 |

| Idaho | $2,770.68 | -$208.41 | -0.06995787801 |

| Illinois | $2,779.16 | -$526.33 | -0.1592290498 |

| Indiana | $2,261.07 | -$1,153.90 | -0.337894235 |

| Iowa | $2,296.16 | -$685.12 | -0.2298078339 |

| Kansas | $3,220.65 | -$58.98 | -0.01798362728 |

| Kentucky | $4,633.59 | -$561.81 | -0.1081365799 |

| Louisiana | $6,154.60 | $443.25 | 0.07760887805 |

| Maine | $2,823.05 | -$130.23 | -0.04409511475 |

| Maryland | $3,832.63 | -$750.07 | -0.1636739925 |

| Massachusetts | $1,510.17 | -$1,168.68 | -0.4362615281 |

| Michigan | $6,430.11 | -$4,068.53 | -0.3875295561 |

| Minnesota | $3,498.54 | -$904.72 | -0.2054652813 |

| Mississippi | $4,087.21 | $422.64 | 0.1153302289 |

| Missouri | $2,885.33 | -$443.61 | -0.1332575332 |

| Montana | $3,602.35 | $381.50 | 0.1184478288 |

| Nebraska | $3,837.49 | $553.81 | 0.1686542215 |

| Nevada | $3,662.09 | -$1,199.61 | -0.2467470226 |

| New Hampshire | $1,615.02 | -$1,536.76 | -0.4875848701 |

| New Jersey | $2,754.94 | -$2,760.27 | -0.5004835326 |

| New Mexico | $4,458.30 | $994.66 | 0.2871726733 |

| New York | $2,428.24 | -$1,861.64 | -0.4339613515 |

| North Carolina | $2,936.69 | -$456.42 | -0.134514129 |

| North Dakota | $2,668.24 | -$1,497.60 | -0.3594954007 |

| Ohio | $1,867.19 | -$842.53 | -0.3109288002 |

| Oklahoma | $3,437.34 | -$704.99 | -0.1701918609 |

| Oregon | $3,220.12 | -$247.65 | -0.07141452744 |

| Pennsylvania | $2,605.22 | -$1,429.28 | -0.354264908 |

| Rhode Island | $5,602.63 | $599.27 | 0.1197742116 |

| South Carolina | $3,178.01 | -$603.13 | -0.1595094597 |

| South Dakota | $2,940.29 | -$1,041.98 | -0.2616547848 |

| Tennessee | $3,283.42 | -$377.47 | -0.1031083986 |

| Texas | $3,263.28 | -$780.00 | -0.1929134223 |

| Utah | $2,965.57 | -$646.32 | -0.1789416446 |

| Vermont | $2,195.71 | -$1,038.42 | -0.3210815629 |

| Virginia | $2,061.53 | -$296.35 | -0.1256842768 |

| Washington | $2,568.65 | -$490.67 | -0.1603862749 |

| West Virginia | $2,120.80 | -$474.56 | -0.1828510044 |

| Wisconsin | $3,926.20 | $320.13 | 0.08877573998 |

| Wyoming | $3,496.56 | $296.47 | 0.09264590794 |

| Median | $3,073.66 | -$587.23 | -0.160405967 |

From this table, we were able to find out that Louisiana, Michigan, Rhode Island, and Kentucky have the highest rates in the country. However, the average rate for Geico car insurance is around $3,000.

Comparing the Top 10 Companies by Market Share

In the table below, you’ll see how Geico’s average annual premium for each state compares to the rates of other competitors.

Company by Market Share Geico

| STATE | AVERAGE BY STATE | ALLSTATE | AMERICAN FAMILY | FARMERS | Geico | LIBERTY MUTUAL | NATIONWIDE | PROGRESSIVE | STATE FARM | TRAVELERS | USAA |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Alabama | $3,566.96 | $3,311.52 | Data Not Available | $4,185.80 | $2,866.60 | $4,005.48 | $2,662.66 | $4,450.52 | $4,798.15 | $3,697.80 | $2,124.09 |

| Alaska | $3,421.51 | $3,145.31 | $4,153.07 | Data Not Available | $2,879.96 | $5,295.55 | Data Not Available | $3,062.85 | $2,228.12 | Data Not Available | $2,454.21 |

| Arizona | $3,770.97 | $4,904.10 | Data Not Available | $5,000.08 | $2,264.71 | Data Not Available | $3,496.08 | $3,577.50 | $4,756.25 | $3,084.74 | $3,084.29 |

| Arkansas | $4,124.98 | $5,150.03 | Data Not Available | $4,257.87 | $3,484.63 | Data Not Available | $3,861.79 | $5,312.09 | $2,789.03 | $5,973.33 | $2,171.06 |

| California | $3,688.93 | $4,532.96 | Data Not Available | $4,998.78 | $2,885.65 | $3,034.42 | $4,653.19 | $2,849.67 | $4,202.28 | $3,349.54 | $2,693.87 |

| Colorado | $3,876.39 | $5,537.17 | $3,733.02 | $5,290.24 | $3,091.69 | $2,797.74 | $3,739.47 | $4,231.92 | $3,270.77 | Data Not Available | $3,338.87 |

| Connecticut | $4,618.92 | $5,831.60 | Data Not Available | Data Not Available | $3,073.66 | $7,282.87 | $3,672.34 | $4,920.35 | $2,976.24 | $6,004.29 | $3,190.00 |

| Delaware | $5,986.32 | $6,316.06 | Data Not Available | Data Not Available | $3,727.29 | $18,360.02 | $4,330.21 | $4,181.83 | $4,466.85 | $4,182.36 | $2,325.98 |

| District of Columbia | $4,439.24 | $6,468.92 | Data Not Available | Data Not Available | $3,692.81 | Data Not Available | $4,848.98 | $4,970.26 | $4,074.05 | Data Not Available | $2,580.44 |

| Florida | $4,680.46 | $7,440.46 | Data Not Available | Data Not Available | $3,783.63 | $5,368.15 | $4,339.60 | $5,583.30 | $3,397.67 | Data Not Available | $2,850.41 |

| Georgia | $4,966.83 | $4,210.70 | Data Not Available | Data Not Available | $2,977.20 | $10,053.44 | $6,484.90 | $4,499.22 | $3,384.88 | Data Not Available | $3,157.46 |

| Hawaii | $2,555.64 | $2,173.49 | Data Not Available | $4,763.82 | $3,358.86 | $3,189.55 | $2,551.83 | $2,177.93 | $1,040.28 | Data Not Available | $1,189.35 |

| Idaho | $2,979.09 | $4,088.76 | $3,728.79 | $3,168.28 | $2,770.68 | $2,301.51 | $3,032.19 | Data Not Available | $1,867.96 | $3,226.29 | $1,877.61 |

| Illinois | $3,305.48 | $5,204.41 | $3,815.31 | $4,605.20 | $2,779.16 | $2,277.65 | $2,711.81 | $3,536.65 | $2,344.88 | $2,499.76 | $2,770.21 |

| Indiana | $3,414.97 | $3,978.81 | $3,679.68 | $3,437.55 | $2,261.07 | $5,781.35 | Data Not Available | $3,898.00 | $2,408.94 | $3,393.75 | $1,630.86 |

| Iowa | $2,981.28 | $2,965.86 | $3,021.81 | $2,435.72 | $2,296.16 | $4,415.28 | $2,735.44 | $2,395.50 | $2,224.51 | $5,429.38 | $1,852.57 |

| Kansas | $3,279.62 | $4,010.23 | $2,146.40 | $3,703.77 | $3,220.65 | $4,784.42 | $2,475.59 | $4,144.38 | $2,720.00 | $4,341.43 | $2,382.61 |

| Kentucky | $5,195.40 | $7,143.92 | Data Not Available | Data Not Available | $4,633.59 | $5,930.97 | $5,503.23 | $5,547.63 | $3,354.32 | $6,551.68 | $2,897.89 |

| Louisiana | $5,711.34 | $5,998.79 | Data Not Available | Data Not Available | $6,154.60 | Data Not Available | Data Not Available | $7,471.10 | $4,579.12 | Data Not Available | $4,353.12 |

| Maine | $2,953.28 | $3,675.59 | Data Not Available | $2,770.15 | $2,823.05 | $4,331.39 | Data Not Available | $3,643.59 | $2,198.68 | $2,252.97 | $1,930.79 |

| Maryland | $4,582.70 | $5,233.17 | Data Not Available | Data Not Available | $3,832.63 | $9,297.55 | $2,915.69 | $4,094.86 | $3,960.87 | Data Not Available | $2,744.14 |

| Massachusetts | $2,678.85 | $2,708.53 | Data Not Available | Data Not Available | $1,510.17 | $4,339.35 | Data Not Available | $3,835.11 | $1,361.86 | $3,537.94 | $1,458.99 |

| Michigan | $10,498.64 | $22,902.59 | Data Not Available | $8,503.60 | $6,430.11 | $20,000.04 | $6,327.38 | $5,364.55 | $12,565.52 | $8,773.97 | $3,620.00 |

| Minnesota | $4,403.25 | $4,532.01 | $3,521.29 | $3,137.45 | $3,498.54 | $13,563.61 | $2,926.49 | Data Not Available | $2,066.99 | Data Not Available | $2,861.60 |

| Mississippi | $3,664.57 | $4,942.11 | Data Not Available | Data Not Available | $4,087.21 | $4,455.94 | $2,756.53 | $4,308.85 | $2,980.48 | $3,729.32 | $2,056.13 |

| Missouri | $3,328.93 | $4,096.15 | $3,286.90 | $4,312.19 | $2,885.33 | $4,518.67 | $2,265.35 | $3,419.14 | $2,692.91 | Data Not Available | $2,525.78 |

| Montana | $3,220.84 | $4,672.10 | Data Not Available | $3,907.55 | $3,602.35 | $1,326.11 | $3,478.26 | $4,330.76 | $2,417.74 | Data Not Available | $2,031.89 |

| Nebraska | $3,283.68 | $3,198.83 | $2,215.13 | $3,997.29 | $3,837.49 | $6,241.52 | $2,603.94 | $3,758.01 | $2,438.71 | Data Not Available | $2,330.78 |

| Nevada | $4,861.70 | $5,371.62 | $5,441.18 | $5,595.56 | $3,662.09 | $6,201.55 | $3,477.14 | $4,062.57 | $5,796.34 | $5,360.41 | $3,069.07 |

| New Hampshire | $3,151.77 | $2,725.01 | Data Not Available | Data Not Available | $1,615.02 | $8,444.41 | $2,491.10 | $2,694.45 | $2,185.46 | Data Not Available | $1,906.96 |

| New Jersey | $5,515.21 | $5,713.58 | Data Not Available | $7,617.00 | $2,754.94 | $6,766.62 | Data Not Available | $3,972.72 | $7,527.16 | $4,254.49 | Data Not Available |

| New Mexico | $3,463.64 | $4,200.65 | Data Not Available | $4,315.53 | $4,458.30 | Data Not Available | $3,514.38 | $3,119.18 | $2,340.66 | Data Not Available | $2,296.77 |

| New York | $4,289.88 | $4,740.97 | Data Not Available | Data Not Available | $2,428.24 | $6,540.73 | $4,012.93 | $3,771.15 | $4,484.58 | $4,578.79 | $3,761.69 |

| North Carolina | $3,393.11 | $7,190.43 | Data Not Available | Data Not Available | $2,936.69 | $2,182.71 | $2,848.03 | $2,382.61 | $3,078.65 | $3,132.66 | Data Not Available |

| North Dakota | $4,165.84 | $4,669.31 | $3,812.40 | $3,092.49 | $2,668.24 | $12,852.83 | $2,560.35 | $3,623.06 | $2,560.53 | Data Not Available | $2,006.80 |

| Ohio | $2,709.71 | $3,197.22 | $1,515.17 | $3,423.01 | $1,867.19 | $4,429.74 | $3,300.89 | $3,436.96 | $2,507.88 | $3,135.16 | $1,478.46 |

| Oklahoma | $4,142.33 | $3,718.62 | Data Not Available | $4,142.40 | $3,437.34 | $6,874.62 | Data Not Available | $4,832.35 | $2,816.80 | Data Not Available | $3,174.15 |

| Oregon | $3,467.77 | $4,765.95 | $3,527.28 | $3,753.52 | $3,220.12 | $4,334.55 | $3,176.83 | $3,629.13 | $2,731.48 | $2,892.19 | $2,587.15 |

| Pennsylvania | $4,034.50 | $3,984.12 | Data Not Available | Data Not Available | $2,605.22 | $6,055.20 | $2,800.37 | $4,451.00 | $2,744.23 | $7,842.47 | $1,793.37 |

| Rhode Island | $5,003.36 | $4,959.45 | Data Not Available | Data Not Available | $5,602.63 | $6,184.12 | $4,409.63 | $5,231.09 | $2,406.51 | $6,909.45 | $4,323.98 |

| South Carolina | $3,781.14 | $3,903.43 | Data Not Available | $4,691.85 | $3,178.01 | Data Not Available | $3,625.49 | $4,573.08 | $3,071.34 | Data Not Available | $3,424.77 |

| South Dakota | $3,982.27 | $4,723.72 | $4,047.47 | $3,768.80 | $2,940.29 | $7,515.99 | $2,737.66 | $3,752.81 | $2,306.23 | Data Not Available | Data Not Available |

| Tennessee | $3,660.89 | $4,828.85 | Data Not Available | $3,430.07 | $3,283.42 | $6,206.69 | $3,424.96 | $3,656.91 | $2,639.30 | $2,738.52 | $2,739.28 |

| Texas | $4,043.28 | $5,485.44 | $4,848.72 | Data Not Available | $3,263.28 | Data Not Available | $3,867.55 | $4,664.69 | $2,879.94 | Data Not Available | $2,487.89 |

| Utah | $3,611.89 | $3,566.42 | $3,698.77 | $3,907.99 | $2,965.57 | $4,327.76 | $2,986.57 | $3,830.10 | $4,645.83 | Data Not Available | $2,491.10 |

| Vermont | $3,234.13 | $3,190.38 | Data Not Available | Data Not Available | $2,195.71 | $3,621.08 | $2,128.21 | $5,217.14 | $4,382.84 | Data Not Available | $1,903.55 |

| Virginia | $2,357.87 | $3,386.80 | Data Not Available | Data Not Available | $2,061.53 | Data Not Available | $2,073.00 | $2,498.58 | $2,268.95 | Data Not Available | $1,858.38 |

| Washington | $3,059.32 | $3,540.52 | $3,713.02 | $2,962.00 | $2,568.65 | $3,994.73 | $2,129.84 | $3,209.52 | $2,499.78 | Data Not Available | $2,262.16 |

| West Virginia | $2,595.36 | $3,820.68 | Data Not Available | Data Not Available | $2,120.80 | $2,924.39 | Data Not Available | Data Not Available | $2,126.32 | Data Not Available | $1,984.62 |

| Wisconsin | $3,606.06 | $4,854.41 | $1,513.27 | $3,777.49 | $3,926.20 | $6,758.85 | $5,224.99 | $3,128.91 | $2,387.53 | Data Not Available | $2,975.74 |

| Wyoming | $3,200.08 | $4,373.93 | Data Not Available | $3,069.35 | $3,496.56 | $1,989.36 | $3,187.20 | $4,401.17 | $2,303.55 | Data Not Available | $2,779.53 |

| Median | $3,660.89 | $4,532.96 | $3,698.77 | $3,907.99 | $3,073.66 | $5,295.55 | $3,187.20 | $3,935.36 | $2,731.48 | $3,729.32 | $2,489.49 |

From this data, we can see that Geico, USAA, and State Farm have the cheapest median rates.

Average Geico Male vs. Female Car Insurance Rates

Gender can also influence your car insurance rate.

Take a look at the table below to see how.

https://docs.google.com/spreadsheets/d/1nPw7wsF4TkTWRtZhga_7A7tx21yJF7mPBObxE1ZavRY/edit#gid=0

| GROUP | AVERAGE OF ANNUAL PREMIUM |

|---|---|

| Married 35-year old female | $2,302.89 |

| Married 35-year old male | $2,312.38 |

| Married 60-year old female | $2,247.06 |

| Married 60-year old male | $2,283.45 |

| Single 17-year old female | $5,653.55 |

| Single 17-year old male | $6,278.96 |

| Single 25-year old female | $2,378.89 |

| Single 25-year old male | $2,262.87 |

Right away, we can tell that if you’re 25 years of age or older and you’re married, you’re most likely going to pay less than the average person for car insurance.

Car insurance companies know that young drivers have little experience behind the wheel and are more likely to get into a car accident. This is why their rates are generally sky-high.

As you can see, if that young driver keeps a clean record, their rate will decrease with time and experience as they get older.

Average Geico Rates by Make and Model Last 5-Year Average

The make and model of the vehicle you drive can also affect your car insurance rate. Take a look at the table below.

Average Geico Rates by Make and Model Last 5-year Average

| GROUP | AVERAGE OF ANNUAL PREMIUM |

|---|---|

| 2015 Ford F-150: Lariat SuperCab with 2WD 6.5 foot bed and 2.7L V6 | $3,092.11 |

| 2015 Honda Civic Sedan: LX with 2.0L 4cyl and CVT | $3,092.58 |

| 2015 Toyota RAV4: XLE | $3,090.89 |

| 2018 Ford F-150: Lariat SuperCab with 2WD 6.5 foot bed and 2.7L V6 | $3,338.40 |

| 2018 Honda Civic Sedan: LX with 2.0L 4cyl and CVT | $3,338.87 |

| 2018 Toyota RAV4: XLE | $3,337.18 |

If the type of vehicle you drive is a more expensive vehicle, it’s going to take more money to insure it.

On the other hand, if you drive an older car, you might not have to pay a hefty premium.

As you can see from the table above, a vehicle that was made in 2015 is about $300 less to insure than a vehicle that was made in 2018.

While this isn’t a huge difference in cost, it’s still noteworthy.

What are Average Geico Commute Rates?

How far you drive every day can also affect your car insurance rate. It makes sense, doesn’t it? If you drive more than the average driver, the more likely you are to get into a car accident.

| GROUP | Geico'S AVERAGE ANNUAL PREMIUM |

|---|---|

| 10 miles commute. 6,000 annual mileage. | $3,162.64 |

| 25 miles commute. 12,000 annual mileage. | $3,267.37 |

We noticed that the rate increased by about $100 for people who drive an average of 12,000 miles per year.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

What are Average Geico Coverage Level Rates?

The amount of insurance you have on a vehicle can also influence your rate.

Obviously, if you have more insurance, you’re going to pay more for it, but did you know that your car insurance company will sometimes give you a break on your rate if you have more insurance than what your state requires?

Check out this table below to see what we mean.

Coverage level by rate for Geico

| COVERAGE LEVEL | Geico'S ANNUAL PREMIUM RATE |

|---|---|

| High | $3,429.14 |

| Medium | $3,213.97 |

| Low | $3,001.91 |

According to information from the table, for just a few hundred dollars more per year (that’s less than $40 a month) you could go from having low coverage car insurance to high coverage car insurance.

This change in coverage could mean the difference between liability insurance and comprehensive coverage.

If you can pay the extra $30-$40 a month, high coverage could save you thousands of dollars in the long run.

What are Average Geico Credit History Rates?

Credit is another major factor that not only affects your interest rate but also your car insurance rate.

Check out this table below for more insight.

Credit rate for Geico

CREDIT Geico'S ANNUAL PREMIUM RATE

Good $2,434.82

Fair $2,986.79

Poor $4,259.50

The difference in numbers from this table is astounding. If you have poor credit, you will likely pay thousands of dollars more per year for car insurance than someone who has good credit.

Experian says that the average credit score in the U.S. is 675.

Experian goes on to say that “credit scores can help provide insurance companies a basis to determine your financial ability to make premium payments on time. They also help determine the likelihood that you’ll make an insurance claim.”

While your credit score doesn’t determine the probability that you’ll get in a car accident, studies have found there is a correlation between an individual’s credit score and the overall cost to insure that person.

Car insurance companies view drivers with bad credit as irresponsible; they are also considered to be higher risk drivers.

What are Average Geico Driving Record Rates?

The biggest factor that affects your car insurance rate is your driving record. It’s a pretty simple concept to wrap your head around. If you’re a notoriously bad driver and you get into accidents often, your rate is going to be considerably higher.

If you’re generally a good driver, your rate is going to stay pretty low.

Let’s look at this analysis in the table below.

Driving record rate for Geico

| DRIVING RECORD | Geico'S ANNUAL PREMIUM RATE |

|---|---|

| Clean record | $2,145.96 |

| With 1 accident | $3,192.77 |

| With 1 DUI | $4,875.87 |

| With 1 speeding violation | $2,645.43 |

Just as we suspected, if a driver gets into one accident, their rate will likely increase by $1,000 or more.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

What coverages does Geico Offer?

The cost of your car insurance policy isn’t the only thing that’s important. Before buying a policy, you always need to make sure the company you choose has the coverage you need to correctly insure your vehicle.

In this next section, we will talk about bundling options, discounts, company programs, and more.

What are Geico’s Bundling Options?

Below is a list of insurance coverage options that Geico has to offer. Any of these types of insurance can be bundled to save you money on your insurance.

- Car insurance

- Homeowners/condo insurance

- Renters insurance

- Commercial auto insurance

- Business insurance

- Motorcycle insurance

- ATV insurance

- Recreational vehicle insurance

- Boat insurance

What are Geico’s Discounts?

Geico also offers an array of different discounts. Check out the table below to learn more.

| DISCOUNTS | PERCENT SAVED |

|---|---|

| Anti-Lock Brakes | 5% |

| Anti-Theft | 25% |

| Claim Free | 26% |

| Daytime Running Lights | 1% |

| Emergency Deployment | 25% |

| Federal Employee | 8% |

| Good Student | 15% |

| Military | 15% |

| Multiple Policies | 10% |

| Multiple Vehicles | 25% |

| Passive Restraint | 40% |

| Safe Driver | 15% |

| Seat Belt Use | 15% |

| Vehicle Recovery | 25% |

These discounts might vary by state, so make sure you ask Geico if any of the discounts apply to you.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

What are Geico’s Programs?

What kind of programs can help you save even more money on your car insurance policy with Geico?

Before we get into rates, let’s take a look at some handy tools Geico has to offer.

Geico just came out with a new usage-based app called DriveEasy. The app monitors driving habits and scores drivers based on their driving. The better the score, the better the discount.

Here are the main driving habits that Geico looks at to create drivers’ scores.

- Time of Day

- Distance Driven

- Hard Braking

- Distracted Driving

If you want your score to increase, be sure to stay off of your phone while driving.

Geico also offers an accident forgiveness program. If you’ve been accident-free for five years or more, you may already qualify for this program. If not, you can add this program to your coverage for a small fee.

If you decide to pay the fee upfront or roll the dice on having five years’ worth of clean driving, it is entirely up to you; when you have your first accident, it will be forgiven, and your rates will not increase.

Geico also has a car-buying service through TrueCar.

You could get up to a $1,000 rebate after you purchase a new car through this program.

If you are looking to purchase a new or used car, you can use the Geico database to see what others are paying for the vehicle and choose a TrueCar certified dealer to get your guarantee savings.

All you have to do is report the purchase on Geico’s car-buying site.

Last but not least, Geico also has an Auto Repair Express program. After you get into an accident and file a claim, finding a repair shop can be a pain. But it doesn’t have to be with Geico’s super easy three-step repair program.

With this program, you’ll have a claims adjuster with you every step of the way, from the beginning of the claims process to the end. Keep in mind that there will be no fees in using a rental car while your vehicle is being repaired.

Rating Agency

One of your friends might tell you something negative about Geico, while another tells you how great of a company it really is.

Getting advice from people you trust is helpful, but the advice is always going to be biased in some way.

That’s exactly why we want to show you rankings based on facts and data conducted by well-known and trusted organizations like the NAIC, Consumer Reports, J.D. Power, and more.

Let’s take a look at how Geico is rated and ranked among some of the world’s most prominent organizations in the table below.

| RATINGS AGENCY | RATING |

|---|---|

| A.M. Best | A++ (Superior) |

| Better Business Bureau (Northbrook, IL) | B+ |

| Consumer Affairs | 4/5 Overall Satisfaction, 43 Reviews |

| Consumer Reports | 89 |

| J.D. Power | 4/5 Overall Satisfaction |

| Moody's | Aa3 (Excellent) |

| NAIC Complaint Index Ratio | .80 (2018) |

| S&P | AA+ (Very Good) |

You’ve seen the ratings and rankings in the table above, but what exactly do they mean?

A.M Best

Let’s start with A.M. Best. A.M. Best rates a company based on its financial strength. As you can see in the table, Geico received an A++ superior rating from A.M. Best.

This rating tells us that Geico has a superior ability to meet the ongoing insurance policy and contract obligations.

This rating also tells us that Geico is a financially stable company, and it is also able to meet its future financial obligations.

Better Business Bureau

Next up, we have the Better Business Bureau. The Better Business Bureau (BBB) is a private, nonprofit organization that tries to capture how a business interacts with its customers. The highest rating with the BBB is an A+, and the lowest is an F. BBB grades are based upon a number of factors, including:

- Business complaint history with BBB

- Type of business

- Time in business

- Transparent Business Practices

- Failure to honor commitments to BBB

- Licensing and government actions that are known to BBB

As seen in the table above, Geico was given a B+ by the BBB.

Moody’s

Moody’s gave Geico an Aa3 excellent rating, but what exactly does this mean?

Moody’s rankings range from Aaa (the highest quality) to C (the lowest quality). They are one of the biggest credit-ranking agencies in the world. By tracking debt, Moody’s is able to say that Geico is a high-quality company and it is subject to very low credit risk.

Standard & Poor’s (S&P)

Speaking of credit risk, S&P is also one of the largest credit-ranking agencies in the world. S&P Ratings range from an AAA at its highest to a D as its lowest.

Geico has earned an AA+, representing a “very strong capacity to meet financial commitments.”

This ranking also proves Geico’s strong financial stability.

NAIC Complaint Index

Take a look at this table showing the NAIC’s complaint index below. Has Geico improved in these areas over the years?

| PRIVATE PASSENGER POLICIES | 2016 | 2017 | 2018 |

|---|---|---|---|

| Total Complaints | 271 | 333 | 272 |

| Complaint Index (better or worse than National Index) | 0.44 (better) | 0.81 (better) | 0.71 (better) |

| National Complaint Index | 0.78 | 1.21 | 1.15 |

| U.S. Market Share | 2.39% | 2.41% | 2.46% |

| Total Premiums | $5,123,336,205 | $5,572,270,812 | $6,055,079,973 |

Financial strength is very important, but it’s also important to know a company’s history with how they’ve handled complaints in the past.

According to the NAIC, Geico’s total number of complaints increased in 2017 and then decreased in 2018. Its complaint index is better than the national average, and its market share has steadily increased over the last few years.

J.D. Power

Next, let’s take a look at customer satisfaction ratings with J.D. Power.

J.D. Power’s 2019 U.S. Auto Insurance Study ranks auto insurance companies by region and measures customer satisfaction in five areas (in order of importance): interaction; policy offerings; price; billing process and policy information; and claims.

J.D. Power gave Geico a four out of five in overall satisfaction. Check out the table below for an inside look at Geico’s Customer Satisfaction Index Ratings.

| REGION | POWER CIRCLE RANKING | NUMERIC SCORE OUT OF 1,000 | PERCENTAGE OF COMPANIES WITH HIGHER NUMERIC SCORE |

|---|---|---|---|

| California | About average | 807 | 65% |

| Central | Better than most | 838 | 14% |

| Florida | Better than most | 832 | 14% |

| Mid-Atlantic | Better than most | 848 | 8% |

| New England | About average | 827 | 20% |

| New York | About average | 813 | 78% |

| North Central | About average | 830 | 33% |

| Northwest | About average | 805 | 55% |

| Southeast | About average | 839 | 13% |

| Southwest | The rest | 798 | 75% |

| Texas | The rest | 816 | 50% |

If you look at the table above, you’ll see that J.D. Power has rankings from 798 to 848 points out of 1,000. The power circle ratings showed that Geico rated “about average” and “better than most” the majority of the time.

Consumer Reports

Next, let’s move on to Consumer Reports. Similarly to J.D. Power, Consumer Reports rates a company based on its everyday functions. Are the customer service reps helpful? How easy is it to get in contact with a rep in the first place?

Good news for Geico — the company received a Consumer Reports reader score of 89 out of 100.

But how did Geico rank in other areas of customer service? The table below shows ratings for various services provided as part of the claims process.

Consumer Reports for Geico

| CLAIMS HANDLING | SCORE |

|---|---|

| Total | 89 out of 100 |

| Ease of reaching an agent | Excellent |

| Simplicity of the process | Very good |

| Promptness of response - very good | Excellent |

| Damage amount | Very good |

| Agent courtesy | Excellent |

| Timely payment | Excellent |

| Freedom to select repair shop | Very good |

| Being kept informed of claim status | Very good |

Geico usually received scores of “very good” or “excellent” in all of these categories.

Consumer Affairs

Consumer Affairs also gave Geico a score of four out of five for overall satisfaction. This score was based on 43 different reviews on its website.

What is Geico’s history?

Geico was established in 1936 by Leo and Lillian Goodwin. In 1959, Geico opened its doors in Chevy Chase, Maryland, where its headquarters still are today.

Five short years later, Geico passed the one million policies-in-force (PIF) mark.

In 1999, the now-famous and beloved gecko made its debut, and Geico passed the five million PIF mark just three years after.

Today, Geico passed 17 million policies in force in 2019 and now insures more than 28 million vehicles. The company looks forward to more growth, founded on quality coverage and outstanding Geico customer service.

Even though the company had “humble beginnings” in the midst of the Great Depression, Geico really is the essence of the American dream.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

What is Geico’s Market Share?

Let’s take a look at Geico’s market share numbers.

From the chart below, we can see that Geico’s market share has slowly increased since 2015.

| YEAR | MARKET SHARE OF LIABILITY | MARKET SHARE OF PHYSICAL DAMAGE | TOTAL MARKET SHARE |

|---|---|---|---|

| 2013 | 10.62% | 9.64% | 10.24% |

| 2014 | 11.07% | 2.3% | 10.77% |

| 2015 | 11.71% | 10.79% | 11.41% |

| 2016 | 12.12% | 11.57% | 11.89% |

| 2017 | 12.95% | 12.54% | 12.79% |

On the other hand, compared to other companies, Geico’s total in written premiums is high.

How is Geico’s Position for the Future?

After reviewing Geico’s ratings and rankings, it’s safe to say they probably aren’t going anywhere anytime soon. Its financial stability ratings are off the charts.

In fact, according to a recent article by Forbes, “Geico accomplished something historic recently by overtaking Allstate in the hyper-competitive automotive insurance market. It represents a victory of positioning for the challenger brand and a seismic shift in the insurance category.”

In a three year period from 2015 to 2017, Geico’s total in written premiums increased by nearly seven billion when its largest competitor, State Farm, increased by only five billion. Other companies in the top four increased by only 1.5 billion.

If you have a job with Geico, settle in, because you’ll be working there until further notice.

Geico’s Online Presence

If you’re looking for Geico’s fingerprint online, you don’t have to go too far to find it.

Customers can find and get in contact with Geico via Facebook, Twitter, Instagram, LinkedIn, YouTube, and of course, their website, www.geico.com.

Get a free quote or contact an agent at Geico seven days a week, 24 hours a day through the Geico Mobile app, online, or by phone.

Geico’s Commercials

We’ve all seen it: that little adorable, lifelike gecko who gets confused for a lizard often has tugged on our heartstrings for two decades.

Watch the commercials below.

But let’s not forget about these rhetorical questions commercials; after all, Geico could save you up to 15 percent or more on your auto insurance policy.

More than anything else, Geico has shown us over and over again that they have great campaigns that attract the average auto insurance consumer.

Geico in the Community

At Geico, the commitment to provide outstanding community service is no less than the goal to provide excellent customer service to its policyholders.

Geico has several programs to help foster growth and love in the community.

Geico Cares in Action:

Children’s National Hospital is another community program that Geico has.

“For over 40 years, Geico has proudly supported Children’s National Hospital’s mission to ensure that every child in the Washington, D.C. region receives compassionate health care, regardless of a family’s ability to pay. We’ve raised more than $3.4 million dollars for the hospital and will continue to demonstrate our commitment as a trusted community partner and champion of pediatric health and well-being.”

Here are two more programs listed below:

- Geico Encourages Green Efforts

- Environmental Safety and Pollution Prevention

Geico’s Employees

According to Glassdoor, the average age of employees who work at Geico is 28 years of age.

Salaries at Geico range from $26,000 to over $100,000 per year, depending on what your job title is, of course.

We did a little more digging and found the following information about Geico employees:

- The average employee review for Geico is 3.2 out of five

- Employees get great benefits

- Employees have a “poor work-life balance”

Payscale said:

- Geico employees have given the company an average rating of 3.2 out of five in Overall Satisfaction

- Geico’s employees gave the company the highest rated reviews in company outlook (4.4 out of five), manager relationship (4.1 out of five), and manager communication (3.8 out of five)

- Geico employees rated the pay at the company as a three out of five

What’s the bottom line? Employees have some poor experiences as well as some good ones.

Here are some employee awards Geico won in 2017 and 2018:

- Employer Support of the Guard and Reserve (ESGR), a Department of Defense program, awarded Geico with a Patriot Award in 2018. This award was presented to Ted Robey in recognition of his support for employees in the Veteran’s IT Development Program.

- Geico’s Virginia Beach office was recognized by Virginia Values Veterans (V3) for its commitment to hiring veterans.

- n 2017, Geico was recognized as an AnitaB.org Top Company for Women Technologists for a company with a technical workforce between 1,000 and 10,000. This award was presented to Geico at the annual Grace Hopper Celebration.

- Geico’s Buffalo office was named by Buffalo Business First as one of the Best Places to Work in Western New York for 2017.

- The Des Moines Register has ranked Geico’s Coralville office as a Top Workplace for 2015, 2016, and 2017. The Coralville office also received an Outstanding Achievement Award from the United Way of Johnson and Washington Counties in 2017.

- Geico’s Indianapolis office was named by the Indianapolis Star as a Top Workplace for the past three years (2017, 2016, and 2015).

- Geico’s Macon office was awarded Bibb County Schools VIP (Victory in Progress) Industry Award for associate volunteerism in 2017. The Macon office also earned the title of Macon-Bibb Most Generous Workplace in 2016 and 2017.

- BestCompaniesAZ nominated our Tucson office as one of the 100 Best Companies in AZ for 2017.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

How to cancel your policy?

Canceling your car insurance policy with Geico is easy and doesn’t take long at all. Before canceling your policy, make sure you have another policy in its place, as it’s illegal to drive without car insurance.

Hang out with us as we walk you through the steps to canceling your policy with Geico.

Cancellation Fee

You can cancel your Geico auto insurance policy at any time, even if you’re in the middle of your term. Geico’s respectable cancellation policy allows you to easily cancel coverage without unnecessary costs and there is no early cancellation fee.

Is there a refund?

Geico offers pro-rate refunds if you cancel your policy in between billing cycles.

You can backdate your cancellation if, for instance, you sell your covered vehicle and can prove that you did not use your policy.

How to Cancel

You can cancel your policy easily with Geico.

If you want to cancel your policy, Geico makes it easy with no cancellation fee. Just follow the steps below:

- Call (800) 841-1587 to speak with a friendly, licensed agent.

- If prompted to speak to the Interactive Voice Response (IVR), say “cancel insurance policy” and then “auto.”

- You may be asked to say your Geico policy number, so please have that ready.

Keep in mind that Geico only allows cancellation by phone. The phone line is available 24 hours a day, 7 days a week.

When can I cancel?

As we mentioned above, Geico customers may cancel their policy at any time without any fees or penalties.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

How do you make a claim?

Accidents happen, but that’s why you have car insurance, right?

If you find yourself in the midst of an accident, you’ll need to make a claim with Geico. So that there isn’t any confusion, it’s important to know exactly how to file a claim.

We will discuss all that and more up next.

Ease of Making a Claim

After you’ve been in an accident, Geico offers the following advice:

- Check to see if anyone was hurt

- Call 911, to request any needed medical assistance

- Move your car to a safe location, but do not leave the scene

- Do not admit fault or reveal your policy limits

- Contact the police. They’ll send an officer if necessary

- Exchange information with those involved

- If your car isn’t drivable, request roadside assistance

What information should you collect?

- Names, phone numbers, mailing addresses, and email addresses of the other driver(s), all vehicle occupants, and witnesses

- Location of the incident

- Photos of the scene and all vehicles involved, including tag numbers

- Insurance information from others involved: company name, policy number, and phone number

File your claim in as little as five minutes through the Geico mobile app or on geico.com/claims. You can also call Geico at (800) 841-3000.

If eligible, you can schedule a damage inspection, repair, and rental.

It’s important to report your claim as soon as possible for a number of reasons. For example, accidents require a more detailed investigation. It’s also better to investigate quickly after the accident so that everyone remembers the details.

Once you report your claim, if eligible, make an appointment for a damage inspection.

- The inspection typically takes around 30 minutes.

- If your car isn’t safe to drive, they’ll send a Geico adjuster to look at it.

- You don’t have to meet with the adjuster unless you want to.

After the inspection, you can have your vehicle repaired anywhere you wish.

Premiums Written

The total premiums written by Geico indicate intense growth as compared to that of its competitors.

See the table below.

| PRIVATE PASSENGER AUTO | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|

| Premiums Written | $20,520,188,000 | $25,531,762,000 | $29,596,404,000 | $33,075,434,000 |

| Market Share | 10.77 | 11.89 | 12.79 | 13.41 |

Geico experienced a close to seven billion increase in premiums written during a three-year period when other top competitors increased by less than five billion over the same time frame.

See what the number of premiums written has to do with the loss ratio percentage up next.

Loss Ratio

A loss ratio shows how much a company spends on claims to how much money it takes in on premiums. For example, a loss ratio of 70 percent indicates that companies are spending $70 on claims out of every $100 earned in premiums.

A loss ratio of over 100 percent means a company is at risk of bankruptcy. If the loss ratio is too low, a company isn’t paying claims. The remaining goes to overhead and shareholders.

Check out this table below.

| PRIVATE PASSENGER AUTO | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|

| Premiums Written | $20,520,188,000 | $25,531,762,000 | $29,596,404,000 | $33,075,434,000 |

| Market Share | 10.77 | 11.89 | 12.79 | 13.41 |

| Loss Ratio | 69.82% | 74.38% | 77.14% | 71% |

As you can see from the table above, the loss ratio percentages for all four years listed are within a good range. They are between 60-100 percent.

How do you get a quote online?

Are you wondering how to get a car insurance quote from Geico online? Simply follow the steps below to get started.

Step 1: Enter Your ZIP Code

Begin by entering your ZIP code. If you have already started a quote, make sure to login instead.

Step 2: Enter Your Information

In the next few pages, you’ll be asked to enter personal information like your name, date of birth, and your address.

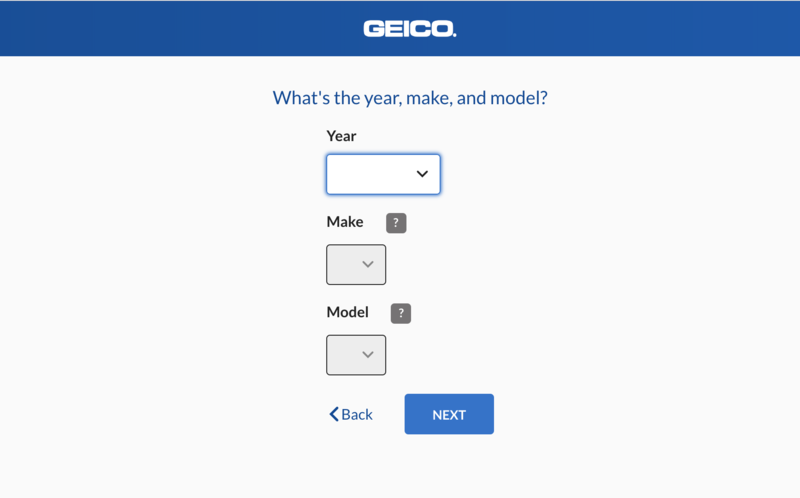

Step 3: Enter Your Vehicle Make and Model

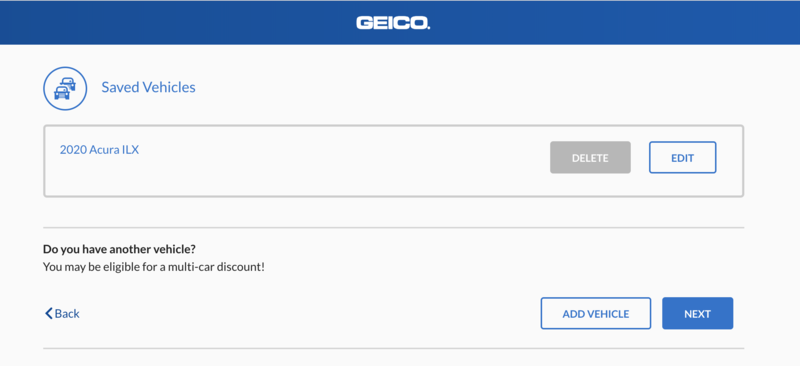

If you have more than one vehicle that will be going on the same policy with Geico, there were be an option to add vehicles as you click the “next” button.

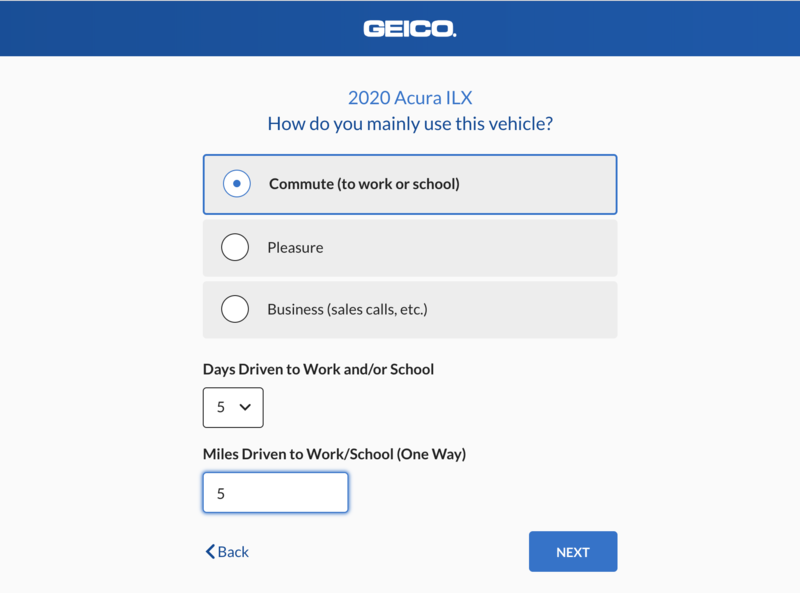

The next few parts of the application will include questions such as “what is the ownership status, how do you mainly use this vehicle and what is the annual mileage?” See this picture below.

Once you’ve answered all of these questions for the first vehicle (or the only vehicle) listed on the policy, you’re able to either add another vehicle to the policy or go back and edit the details of the vehicle that you already entered.

See below.

Step 4: Enter More Personal Information

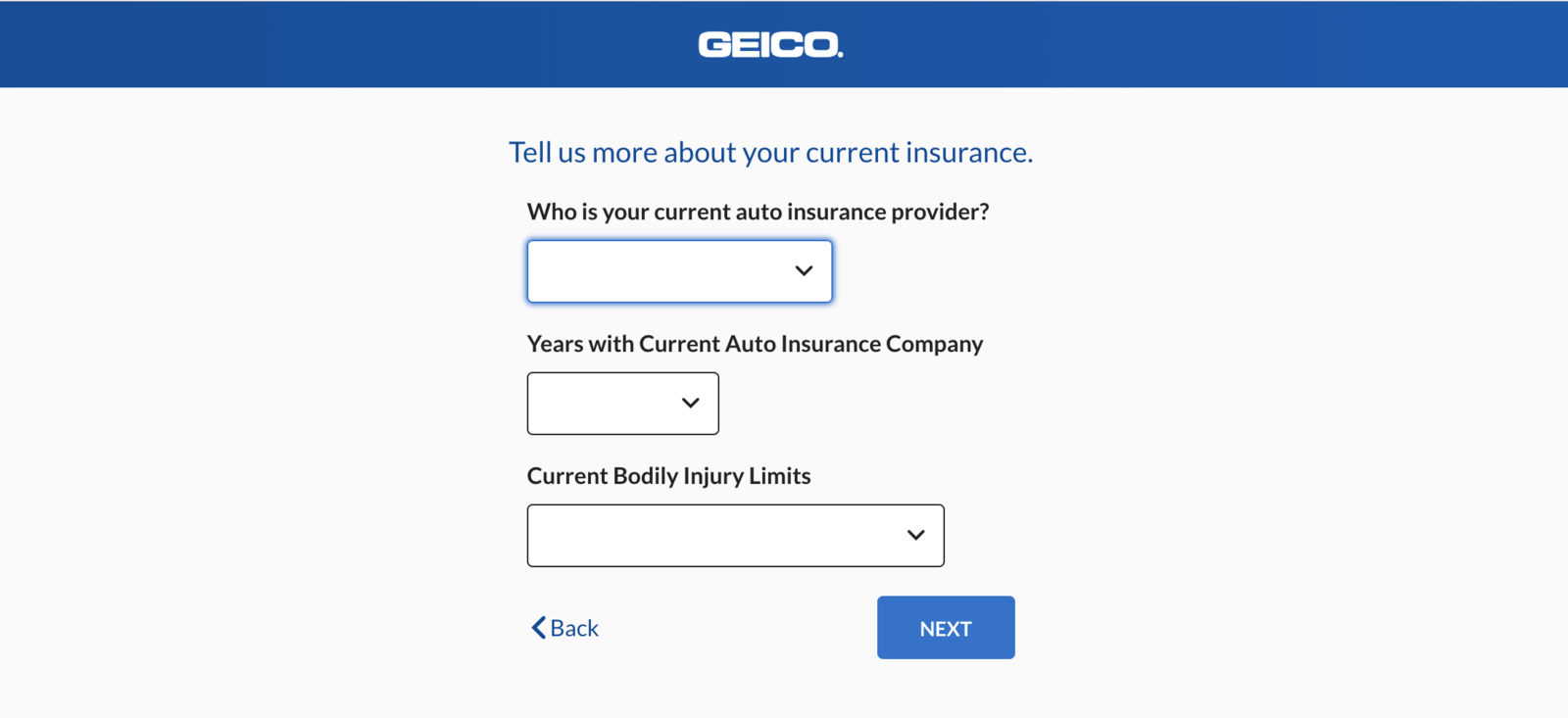

Next, you’ll be prompted to answer questions pertaining to your gender, your marital status, and whether you own a home. You’ll also need to enter your social security number.

If you have a current auto insurance policy, you’ll also need to provide information about that policy.

Next, enter your personal information as prompted. This will include answering questions pertaining to when you received your driver’s license, your education history, employment status and occupation, military affiliation, and government affiliation.

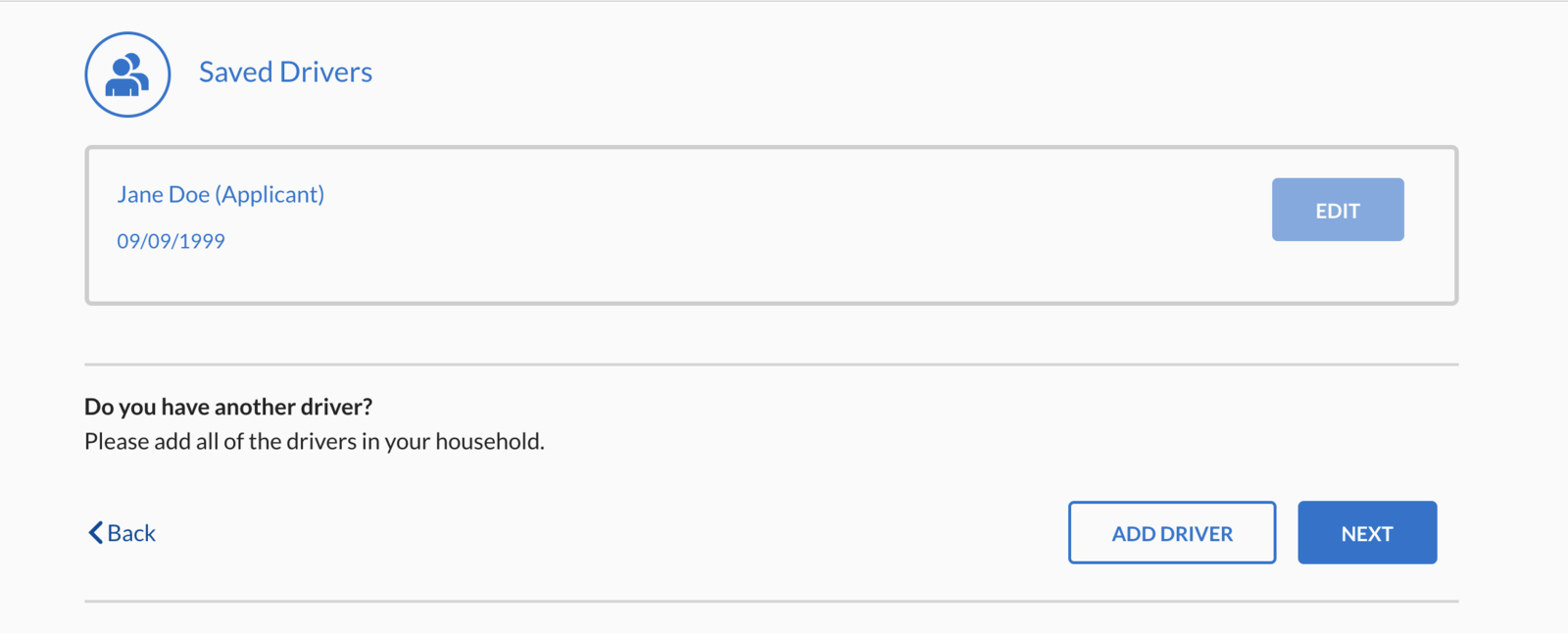

Step 5: Adding a Driver to the Policy

Is anyone else going to be on your insurance policy? If so, enter their information and then click next.

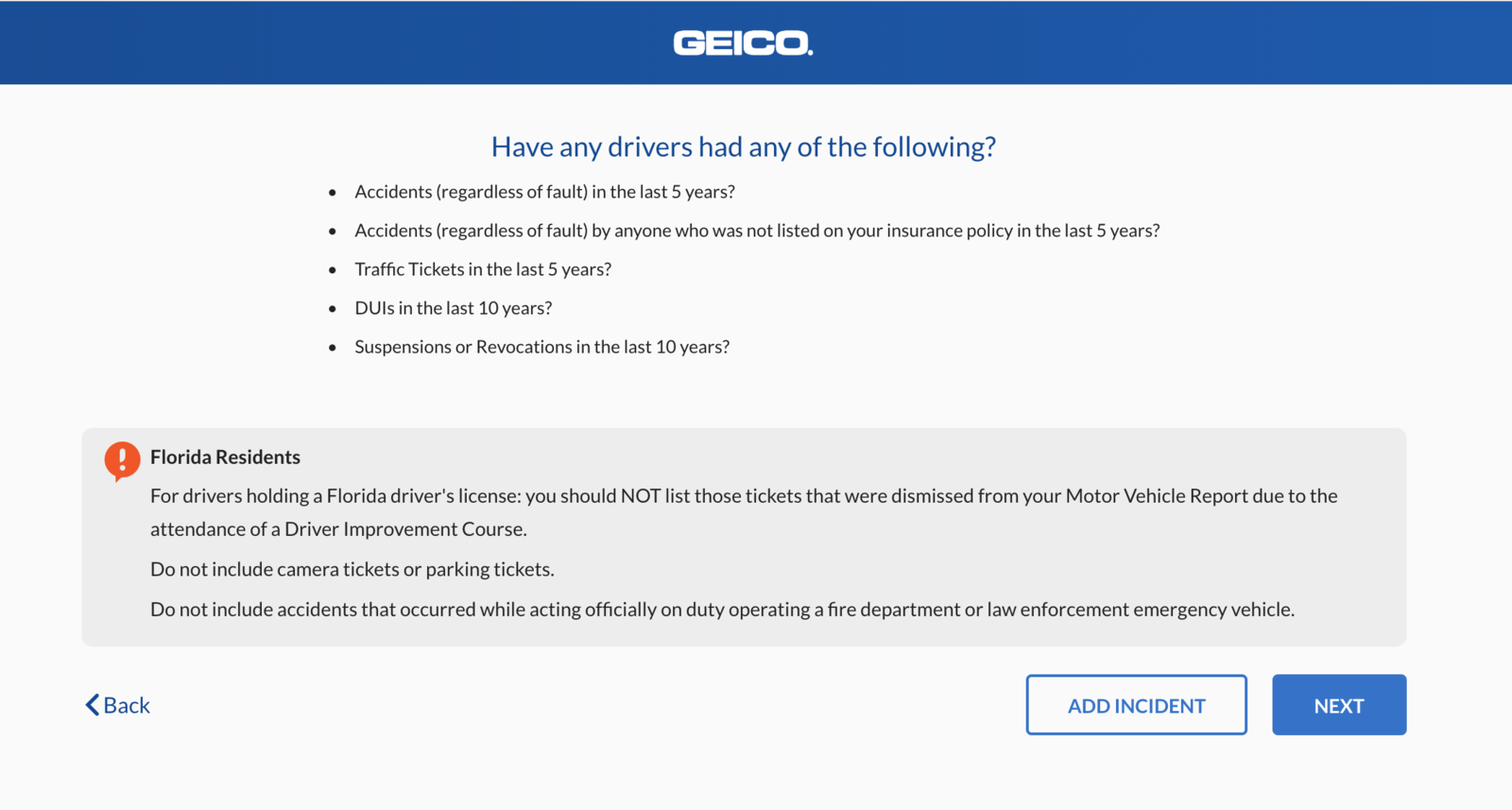

Step 6: Add an Incident

Have you had any accidents in the last five years? If so, make sure you enter those on this page shown below.

Step 7: Enter Your Contact Information

Lastly, enter a contact number and email address so that Geico can send you your quote.

Is the design of the website/app important?

Geico’s mobile app is featured in the app store and rated 4.8 stars out of five with 1.23 million ratings.

Geico’s mobile app was recently awarded #1 rankings according to Dynatrace’s 2018 Q1 Mobile Insurance Scorecard. The company has also won over 19 other awards and honors since 2010 for its web and mobile services.

Here’s what Geico’s app can do:

- Digital ID Card (your real-time electronic insurance card) optimized to fit your screen. Most states accept electronic proof of insurance.

- Pay your bill, get a quote, report and track claims, and get roadside assistance.

- Chat with a licensed agent when you just don’t feel like dialing a number and talking.

- Vehicle Care (in partnership with myCARFAX) offers up to date information about your vehicle’s service history, recall alerts, and helps you find a trusted repair shop close by.

- Easy Estimate allows you to document and report damages to get estimates for repairs.

- Geico Explore offers augmented reality features that use your location to make your life easier. Learn how it can help you by watching the video below.

Let’s talk about Geico’s website.

Geico has a very simple design and it’s easy to navigate, especially when you’re trying to get a quote for an insurance policy.

While putting a quote together, you always have the option to save a quote and come back to it later.

You don’t need to log in to your account to pay your bill, get your ID card, or add a vehicle to your policy. This is a nice feature for people who don’t have time to log in to their account and just want to change something on the fly.

Geico More also has a weekly publication which includes articles, videos, news, and special offers.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

What are the Pros and Cons?

As we come to a close, let’s go over some of Geico’s pros and cons.

Pros:

- Average annual savings of $500 for new policyholders based on a 2018 Geico national survey

- Free and easy online quote and buying process

- The mobile app makes it easy to view policies, request roadside assistance and file claims

- Competitive rates

- Fast claims processing

- Award-winning service

Cons:

- Low credit score can increase premiums in some states

- No discounts for hybrid or electric cars

- Just recently (2019) offers a usage-based app falling a bit behind the other top car insurance companies

- Higher than usual rates for residents of Hawaii, Nebraska, New Mexico, and Rhode Island

It’s not a question as to whether or not Geico typically has the cheapest car insurance rate across the board; however, having a poor driving record or credit score will hurt you badly if you choose Geico as your provider.

What’s the bottom line?

Overall, Geico is an exceptional company to work with. Their ratings and rankings from the BBB, Consumer Reports, the NAIC, and many others all value Geico and esteem them as a company greatly.

So what’s the bottom line?

Geico has proved over and over again that they have outstanding customer service, and their position for the future is projected to be successful.

FAQs

Before we let you go, stick around for this section on Geico’s frequently asked questions.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Can I get copies of my Geico ID card online?

Yes. You can view, print, and email a new insurance card, or request a mailed ID card through the Geico website. You can also pull up your ID through the mobile app.

How do I make a payment online?

Online Payments: Pay your insurance bill using a check, debit or credit card. Simplify future payments by storing your account information online.

Geico Express Services: Take care of your most common insurance transactions, with no login required, like paying your bill and requesting an ID card without having to remember your User ID and password.

The Geico App: Make your payment using a debit or credit card right from your mobile device. Download the Geico App and access your policy even when you’re on the go.

Does Geico include windshield repair?

Geico windshield replacement is part of its comprehensive coverage.

When a windshield is damaged by an object, theft, vandalism, storms, explosions, fire or similar event, Geico will arrange for repair or replacement at no charge to policyholders with comprehensive coverage.

At Geico, windshield damage is not subject to the regular comprehensive deductible.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

How much liability car insurance should I get with Geico?

The minimum amount of liability coverage you’re legally required to have varies by state.

You may also decide to purchase liability coverage beyond your state’s minimum requirements. The Geico agent who handles your policy will be able to advise you on your state’s minimum requirements.

Does Geico cover flooding?

If you’d like a plan that covers flooding, you will need to buy comprehensive coverage insurance.

Well, you’ve made it to the end of our Geico car insurance review. Congratulations on doing all your homework on Geico — you should now be a more confident consumer in the world of car insurance companies.

It’s time for you to start shopping for car insurance rates on your own now. To get started, use our free tool by entering your ZIP code in the box below.

Happy shopping and good luck!