Farmers vs. Progressive Auto Insurance in 2025 (Side-by-Side Review)

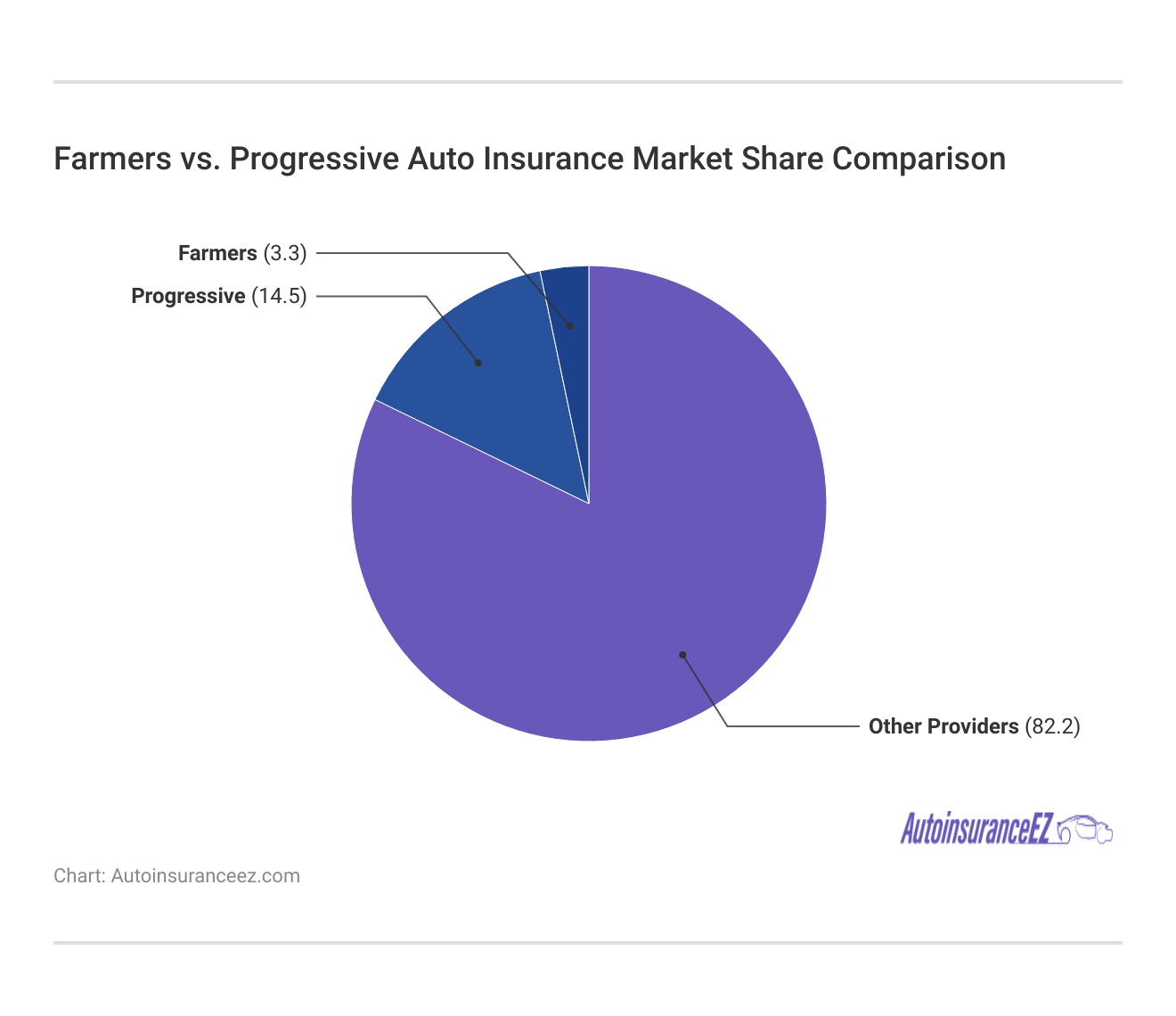

When comparing Farmers vs. Progressive auto insurance, premiums start at just $39/month with Progressive. Progressive offers affordable rates with competitive discounts, while Farmers provides tailored coverage options focusing on personalized service for drivers with specific needs.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

UPDATED: Jan 28, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

3,072 reviews

3,072 reviewsCompany Facts

Min Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviews 13,283 reviews

13,283 reviewsCompany Facts

Min Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsWhen comparing Farmers vs. Progressive auto insurance, Progressive offers low rates at $39/month. At the same time, Farmers provides accident forgiveness and discounts for good students and drivers who have completed traffic school.

Progressive offers affordability with a digital-first approach and comprehensive collision coverage, while Farmers provides competitive rates for teens and accident-prone drivers. Drivers seeking low rates or specific discounts may prefer Progressive, while those needing accident forgiveness may favor Farmers.

Farmers vs. Progressive Auto Insurance Rating

| Rating Criteria | ||

|---|---|---|

| Overall Score | 4.3 | 4.4 |

| Business Reviews | 4.0 | 4.0 |

| Claim Processing | 3.3 | 3.5 |

| Company Reputation | 4.5 | 4.5 |

| Coverage Availability | 5.0 | 5.0 |

| Coverage Value | 4.1 | 4.2 |

| Customer Satisfaction | 4.0 | 4.1 |

| Digital Experience | 4.5 | 4.5 |

| Discounts Available | 5.0 | 5.0 |

| Insurance Cost | 4.2 | 4.3 |

| Plan Personalization | 4.5 | 4.5 |

| Policy Options | 5.0 | 5.0 |

| Savings Potential | 4.4 | 4.5 |

| Farmers Review | Progressive Review |

Progressive Advantage Agency has innovative options, while Farmers excels in personal service. Enter your ZIP code above and find the best auto insurance near you. Check out multiple options today to get tailored coverage and exclusive discounts.

- Progressive offers up to $39 savings for safe drivers, Farmers for bundling

- Farmers give discounts for students and the military, Progressive for loyalty

- Progressive leads in customer service and online tools over Farmers

Farmers Auto Insurance or Progressive Auto Insurance: Which Is Cheaper

Auto insurance companies use many different factors to determine your rates. The most common factors are age, gender, marital status, driving history, and credit score. These factors will help determine how affordable Farmers vs. Progressive auto insurance is for you. Keep in mind that rates will vary by driver.

Farmers vs. Progressive Full Coverage Auto Insurance Monthly Rates by Age & Gender

| Age & Gender | ||

|---|---|---|

| Age: 16 Female | $810 | $801 |

| Age: 16 Male | $773 | $814 |

| Age: 30 Female | $160 | $131 |

| Age: 30 Male | $167 | $136 |

| Age: 45 Female | $139 | $112 |

| Age: 45 Male | $139 | $105 |

| Age: 60 Female | $120 | $92 |

| Age: 60 Male | $128 | $95 |

First, compare Farmers vs. Progressive auto insurance rates based on demographics. You might be surprised to learn how much your age, gender, and marital status affect your car insurance rates. Although Progressive is the more expensive choice if you are a 16-year-old male, it’s cheaper for all other drivers.

Farmers vs. Progressive Full Coverage Auto Insurance Monthly Rates by Driving Record

| Driving Record | ||

|---|---|---|

| Clean Record | $139 | $105 |

| Not-At-Fault Accident | $198 | $186 |

| Speeding Ticket | $173 | $140 |

| DUI/DWI | $193 | $140 |

One of the most critical factors determining your rates is your driving record and the types of auto insurance coverage you choose. Accidents, tickets, and DUIs increase costs. Progressive is more expensive with an accident on your record but cheaper than Farmers for other documents.

Your credit score can also affect your auto insurance rates. Insurance companies tend to believe you are more willing to pay for damages out of pocket and avoid a claim if you have a higher credit score.

Farmers vs. Progressive Average Annual Rates Based on Credit History

| Credit History | ||

|---|---|---|

| Good | $3,677.12 | $3,628.85 |

| Fair | $3,899.41 | $3,956.31 |

| Poor | $4,864.14 | $4,737.64 |

Farmers are less expensive than Progressive if you have fair credit but are more expensive if you have excellent or poor credit. Also, it’s important to note that some states, like California, no longer allow auto insurance companies to use your gender or credit score to calculate your car insurance rates.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Farmers or Progressive: Comparing Their Auto Insurance Discounts

Car insurance discounts can save you money by lowering your rates. Typical discounts offered by most companies include multi-car and good student discounts.

[CA USA] Progressive Auto insurance is 1.5k less than my current policy with Farmers, what am I missing?

byu/736384826 inInsurance

This information outlines the auto insurance discounts available through Farmers and Progressive. If the discount amount for car insurance is specific, Take a moment to see which company provides the most benefits for you.

Although both companies provide many of the same discounts, some are available at only one company. For example, Farmers offers a military discount, and Progressive doesn’t. However, Progressive offers a loyalty discount, and Farmers does not. When you compare Farmers vs. Progressive auto insurance quotes, consider any discounts you might receive.

Farmers and Progressive Comparison for Financial Strength and Customer Satisfaction

A.M. Best ranks companies based on their financial stability. Farmers received an A rating, indicating an excellent ability to meet financial obligations. Progressive received an A+ rating, suggesting a superior ability to meet obligations.

Insurance Business Ratings & Consumer Reviews: Farmers vs. Progressive

| Agency | ||

|---|---|---|

| Score: 846 / 1,000 Lower-Than-Average Satisafaction | Score: 832 / 1,000 Avg. Satisfaction |

|

| Score: A+ Great Complaint Resolution | Score: A+ Excellent Business Practices |

|

| Score: 82/100 High Customer Satisfaction | Score: 72/100 Avg. Customer Feedback |

|

| Score: 1.70 More Complaints vs. Competitors | Score: 1.11 More Complaints Than Avg. |

|

| Score: A Excellent Financial Strength | Score: A+ Superior Financial Strength |

Although Farmers is accredited and Progressive isn’t, both companies received an A+ rating from the Better Business Bureau (BBB). J.D. Power ranked Farmers and Progressive on customer satisfaction, including prices, billing, and claims. Both Farmers and Progressive ranked about average.

Both companies have other similarities. They offer easy-to-use websites and mobile apps that allow customers to access their accounts and information anytime.

You can also get quotes online and compare Progressive vs. Farmers’ homeowner’s insurance, renters insurance, and other services. Both offer additional coverages, such as roadside assistance.

Deciding whether to buy Farmers or Progressive auto insurance can take time and effort. Compare rates, discounts, and ratings to determine which is correct.

You can also compare additional companies to see which is the best fit. If you decide Progressive is a better fit, read more about how to cancel your auto insurance policy with Farmers.

Farmers Pros & Cons

Pros

- Personalized Agent Support: Farmers agents offer one-on-one assistance based on the customer’s requirements.

- Generous Discounts: It discounts combinations, defensive driving, and automobile safety devices.

- Comprehensive Add-Ons: It provides accident forgiveness and rideshare coverage under this plan.

Cons

- Higher Premiums: It costs comparatively more on average monthly than other companies.

- Limited Online Tools: More sophisticated digital tools are needed to handle policies. Enhance your comprehension with our “Farmers Auto Insurance Review. “

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Progressive Pros & Cons

Pros

- Affordable Rates: The average cost for qualifying drivers is $39 monthly.

- Snapshot Program: Adds additional savings for safe drivers. Learn more about our “Progressive Auto Insurance Review” for a broader perspective.

- Extensive Online Tools: Provides quote and claims tools that are user-friendly to customers.

Cons

- Customer Service Variability: Clients split on whether or not representatives were responsive.

- Coverage Limitations: Not all coverage options should offered in every state.

Farmers and Progressive Auto Insurance Overview

Known for personalized service through Farmers agents, Farmers Insurance Group comes with different coverage options, including accident forgiveness, rideshare insurance, and various Farmers insurance discounts for bundling and good drivers. Despite the higher actual premiums, Farmers Insurance Inc. places more value on customized, one-on-one support for policyholders.

Progressive Corporation operates under Progressive Direct and the Progressive Advantage Agency, Inc., offering monthly starting rates at $39. Additional coverages include gap insurance, custom parts replacement, roadside assistance, and the Snapshot program, which rewards good drivers.

Now that you know more about Farmers vs. Progressive auto insurance, you can enter your ZIP code below to compare rates from several companies nearby.

Frequently Asked Questions

What are the critical differences between Farmers vs. Progressive?

Farmers offer personalized service through local agents and various discounts for bundling home and auto insurance. On the other hand, Progressive stands out for its online tools, like the Name Your Price® feature and Snapshot® program, which help drivers customize policies and save based on their driving habits.

How do Progressive vs. Farmers compare in terms of discounts and coverage?

Progressive offers discounts such as good driver and multi-policy savings, while Farmers provides unique perks like affinity group discounts and accident forgiveness. Both companies offer comprehensive and collision coverage but differ in available add-ons, such as Progressive’s rideshare coverage.

What sets Farmers vs. Mercury apart for policyholders?

Farmers excel in customer service, with agents offering tailored advice, while Mercury focuses on affordability and competitive rates for high-risk drivers. Mercury may need more extensive online tools available with Farmers. Discover what lies beyond with our “Mercury Auto Insurance Review.”

Which insurance companies are cheaper than Progressive?

Companies like Geico and State Farm often provide lower premiums than Progressive, especially for good drivers or those bundling policies. Comparing multiple quotes is essential to identify savings. Get started on comparing full coverage auto insurance rates by entering your ZIP code below.

What should a car insurance shopper know before choosing a policy?

Car insurance shoppers should compare premiums, coverage options, and customer service reviews. They should also check for discounts like multi-policy, low mileage, and good driver savings.

Are there auto insurance options that are cheaper than Progressive?

Yes, options like USAA and Erie Insurance often offer lower rates for eligible drivers, particularly those with clean driving records or military affiliations. For a better comparison, explore auto insurance rates by state to find the best deals tailored to your location.

How do I access paperless employee information for Progressive?

You can log into Progressive’s employee portal using the credentials provided by the HR department. Access details for pay stubs, schedules, and updates are available online.

Which companies are similar to Progressive Insurance?

Companies like Geico, Allstate, and State Farm provide services similar to Progressive’s, offering affordable rates, discounts, and online policy management tools.

How does Liberty Mutual vs. Progressive compare for coverage and pricing?

Progressive offers more customization with tools like Snapshot®, while Liberty Mutual stands out with its better coverage for replacement costs and unique accident forgiveness features. Look at our “Liberty Mutual vs. Progressive” for expanded insights.

Is Progressive Insurance expensive compared to its competitors?

Progressive’s rates are competitive but may be higher for drivers with poor credit or high-risk profiles. Discounts and usage-based programs can reduce costs.

How does AAA car insurance vs. Farmers compare in terms of features and rates?

Farmers provide extensive local agent support, while AAA offers competitive pricing for members. AAA’s membership benefits, like travel discounts, add value for drivers.

What is the Progressive good driver discount, and how can you qualify?

The good driver discount pays you back for safe driving habits in the form of a reduced premium. You can also qualify for a volunteer discount if eligible. To earn these savings, you must meet specific requirements, such as having no accidents or violations over a set period.

Are Farmers and Progressive the same company?

No, Farmers and Progressive are separate companies. Farmers Insurance Group operates through local agents, while Progressive emphasizes direct online sales and digital tools.

How does driver’s ed insurance discount work with Progressive?

Progressive discounts young drivers who complete an approved driver education course, helping lower their premiums.

What is the average Progressive car insurance cost for drivers?

The average cost for Progressive insurance varies but is typically around $39 to $53 per month, depending on the location, driving history, and coverage needs. Learn more about our “How do I know if I chose the right coverages?” for a broader perspective.

How can you get an A+ score on the Progressive snapshot program?

To achieve an A+ score on Snapshot, you must maintain safe driving habits, avoid hard braking, and minimize late-night driving. This will lower your premiums.

Does Progressive offer a low mileage discount for drivers?

Yes, Progressive provides a low mileage discount for drivers who drive fewer miles annually, as recorded through the Snapshot program.

How does Plymouth Rock Insurance vs. Progressive compare for drivers?

Plymouth Rock focuses on regional services with personalized coverage, while Progressive offers nationwide availability and advanced digital tools for policy management. Dive deeper into our “Plymouth Rock Auto Insurance” for a comprehensive

What are the main differences between Progressive vs. Esurance?

Progressive offers more extensive discounts and broader coverage options, while Esurance focuses on tech-savvy customers and offers a seamless digital experience.

How do I obtain Progressive insurance quotes quickly?

You can get Progressive insurance quotes by visiting their website, using the online quote tool, or calling customer service for personalized assistance. Start saving on your auto insurance by entering your ZIP code below and comparing quotes.