American Family Auto Insurance Review for 2025

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Kalyn Johnson

Insurance Claims Support & Sr. Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she has similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Insurance Claims Support & Sr. Adjuster

UPDATED: Mar 22, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

| American Family Auto | Stats |

|---|---|

| Founded | 1927 |

| Current Executive | Jack Salzwedel, CEO |

| Number of Employees | 11,000+ |

| Total Assets (2018) | $27.502 billion |

| Headquarters Address | 6000 American Parkway Madison, WI 53783 |

| Phone Number | 1-800-MYAMFAM (1-800-692-6326) |

| Website | www.amfam.com |

| Premiums Written (2017) | $8,363,930 |

| Loss Ratio (2017) | 68.95% |

| Best For | Affordability and Discounts |

Finding the right insurance company can be tough. There are so many available companies out there that it can be hard to find a good fit for your needs.

American Family is currently offered in 19 states, and if you live in one of those states, we want to give you all the information needed to see if American Family could be a good pick for your insurance needs. (For more information, read our “American Family KnowYourDrive Program Review“).

We will cover financial ratings and rates to quotes and filing claims. Buckle up, we have a ton of information for you.

Ready to take the plunge and get some quotes now? Go ahead. Enter your ZIP code here to use our free comparison tool.

Cheap Car Insurance Rates

Rates are usually the determining factor of why you sign with a certain insurance company. Everyone wants the best deals on insurance and get the best rate.

But how do insurance companies come up with their rates?

Well, there are several factors that go into determining your rate. Insurance companies rate each risk according to the probability of a loss on that risk.

So, insurance look at factors like demographics, commute, driving record, credit, and more in determining what the rate will be for the covered risk.

We partnered with Quadrant Data to obtain this information.

American Family Availability and Rates by State

American Family is not available in all 50 states. The map below shows rates in the states they are available.

Are you wondering how American Family rates stack up against the national averages? Have a look:

| State | Overall Average Annual Premium by State | American Family Average Annual Premium | Compared to Overall State Average | Percentage Difference |

|---|---|---|---|---|

| Arizona | $3,421.51 | $4,153.07 | $731.55 | 17.61% |

| Colorado | $3,876.39 | $3,733.02 | -$143.37 | -3.84% |

| Georgia | $4,043.28 | $4,848.72 | $805.44 | 16.61% |

| Idaho | $2,979.09 | $3,728.79 | $749.70 | 20.11% |

| Illinois | $3,305.48 | $3,815.31 | $509.82 | 13.36% |

| Indiana | $3,414.97 | $3,679.68 | $264.71 | 7.19% |

| Iowa | $2,981.28 | $3,021.81 | $40.53 | 1.34% |

| Kansas | $3,279.62 | $2,146.40 | -$1,133.22 | -52.80% |

| Minnesota | $4,403.25 | $3,521.29 | -$881.97 | -25.05% |

| Missouri | $3,328.93 | $3,286.90 | -$42.03 | -1.28% |

| Nebraska | $3,283.68 | $2,215.13 | -$1,068.55 | -48.24% |

| Nevada | $4,861.70 | $5,441.18 | $579.48 | 10.65% |

| North Dakota | $4,165.84 | $3,812.40 | -$353.44 | -9.27% |

| Ohio | $2,709.71 | $1,515.17 | -$1,194.54 | -78.84% |

| Oregon | $3,467.77 | $3,527.28 | $59.51 | 1.69% |

| South Dakota | $3,982.27 | $4,047.47 | $65.20 | 1.61% |

| Utah | $3,611.89 | $3,698.77 | $86.88 | 2.35% |

| Washington | $3,059.32 | $3,713.02 | $653.70 | 17.61% |

| Wisconsin | $3,606.06 | $1,513.27 | -$2,092.80 | -138.30% |

| Median | $3,660.89 | $3,698.77 | $37.88 | 1.02% |

Out of the 19 states, American Family is below average in eight of them.

Comparing the Top 10 Companies by Market Share

Let’s take a look at how American Family compares to the other top insurance providers.

| State | Average by State | Allstate | American Family | Farmers | Geico | Liberty Mutual | Nationwide | Progressive | State Farm | Travelers | USAA |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Alabama | $3,566.96 | $3,311.52 | Data Not Available | $4,185.80 | $2,866.60 | $4,005.48 | $2,662.66 | $4,450.52 | $4,798.15 | $3,697.80 | $2,124.09 |

| Alaska | $3,421.51 | $3,145.31 | $4,153.07 | Data Not Available | $2,879.96 | $5,295.55 | Data Not Available | $3,062.85 | $2,228.12 | Data Not Available | $2,454.21 |

| Arizona | $3,770.97 | $4,904.10 | Data Not Available | $5,000.08 | $2,264.71 | Data Not Available | $3,496.08 | $3,577.50 | $4,756.25 | $3,084.74 | $3,084.29 |

| Arkansas | $4,124.98 | $5,150.03 | Data Not Available | $4,257.87 | $3,484.63 | Data Not Available | $3,861.79 | $5,312.09 | $2,789.03 | $5,973.33 | $2,171.06 |

| California | $3,688.93 | $4,532.96 | Data Not Available | $4,998.78 | $2,885.65 | $3,034.42 | $4,653.19 | $2,849.67 | $4,202.28 | $3,349.54 | $2,693.87 |

| Colorado | $3,876.39 | $5,537.17 | $3,733.02 | $5,290.24 | $3,091.69 | $2,797.74 | $3,739.47 | $4,231.92 | $3,270.77 | Data Not Available | $3,338.87 |

| Connecticut | $4,618.92 | $5,831.60 | Data Not Available | Data Not Available | $3,073.66 | $7,282.87 | $3,672.34 | $4,920.35 | $2,976.24 | $6,004.29 | $3,190.00 |

| Delaware | $5,986.32 | $6,316.06 | Data Not Available | Data Not Available | $3,727.29 | $18,360.02 | $4,330.21 | $4,181.83 | $4,466.85 | $4,182.36 | $2,325.98 |

| District of Columbia | $4,439.24 | $6,468.92 | Data Not Available | Data Not Available | $3,692.81 | Data Not Available | $4,848.98 | $4,970.26 | $4,074.05 | Data Not Available | $2,580.44 |

| Florida | $4,680.46 | $7,440.46 | Data Not Available | Data Not Available | $3,783.63 | $5,368.15 | $4,339.60 | $5,583.30 | $3,397.67 | Data Not Available | $2,850.41 |

| Georgia | $4,966.83 | $4,210.70 | Data Not Available | Data Not Available | $2,977.20 | $10,053.44 | $6,484.90 | $4,499.22 | $3,384.88 | Data Not Available | $3,157.46 |

| Hawaii | $2,555.64 | $2,173.49 | Data Not Available | $4,763.82 | $3,358.86 | $3,189.55 | $2,551.83 | $2,177.93 | $1,040.28 | Data Not Available | $1,189.35 |

| Idaho | $2,979.09 | $4,088.76 | $3,728.79 | $3,168.28 | $2,770.68 | $2,301.51 | $3,032.19 | Data Not Available | $1,867.96 | $3,226.29 | $1,877.61 |

| Illinois | $3,305.48 | $5,204.41 | $3,815.31 | $4,605.20 | $2,779.16 | $2,277.65 | $2,711.81 | $3,536.65 | $2,344.88 | $2,499.76 | $2,770.21 |

| Indiana | $3,414.97 | $3,978.81 | $3,679.68 | $3,437.55 | $2,261.07 | $5,781.35 | Data Not Available | $3,898.00 | $2,408.94 | $3,393.75 | $1,630.86 |

| Iowa | $2,981.28 | $2,965.86 | $3,021.81 | $2,435.72 | $2,296.16 | $4,415.28 | $2,735.44 | $2,395.50 | $2,224.51 | $5,429.38 | $1,852.57 |

| Kansas | $3,279.62 | $4,010.23 | $2,146.40 | $3,703.77 | $3,220.65 | $4,784.42 | $2,475.59 | $4,144.38 | $2,720.00 | $4,341.43 | $2,382.61 |

| Kentucky | $5,195.40 | $7,143.92 | Data Not Available | Data Not Available | $4,633.59 | $5,930.97 | $5,503.23 | $5,547.63 | $3,354.32 | $6,551.68 | $2,897.89 |

| Louisiana | $5,711.34 | $5,998.79 | Data Not Available | Data Not Available | $6,154.60 | Data Not Available | Data Not Available | $7,471.10 | $4,579.12 | Data Not Available | $4,353.12 |

| Maine | $2,953.28 | $3,675.59 | Data Not Available | $2,770.15 | $2,823.05 | $4,331.39 | Data Not Available | $3,643.59 | $2,198.68 | $2,252.97 | $1,930.79 |

| Maryland | $4,582.70 | $5,233.17 | Data Not Available | Data Not Available | $3,832.63 | $9,297.55 | $2,915.69 | $4,094.86 | $3,960.87 | Data Not Available | $2,744.14 |

| Massachusetts | $2,678.85 | $2,708.53 | Data Not Available | Data Not Available | $1,510.17 | $4,339.35 | Data Not Available | $3,835.11 | $1,361.86 | $3,537.94 | $1,458.99 |

| Michigan | $10,498.64 | $22,902.59 | Data Not Available | $8,503.60 | $6,430.11 | $20,000.04 | $6,327.38 | $5,364.55 | $12,565.52 | $8,773.97 | $3,620.00 |

| Minnesota | $4,403.25 | $4,532.01 | $3,521.29 | $3,137.45 | $3,498.54 | $13,563.61 | $2,926.49 | Data Not Available | $2,066.99 | Data Not Available | $2,861.60 |

| Mississippi | $3,664.57 | $4,942.11 | Data Not Available | Data Not Available | $4,087.21 | $4,455.94 | $2,756.53 | $4,308.85 | $2,980.48 | $3,729.32 | $2,056.13 |

| Missouri | $3,328.93 | $4,096.15 | $3,286.90 | $4,312.19 | $2,885.33 | $4,518.67 | $2,265.35 | $3,419.14 | $2,692.91 | Data Not Available | $2,525.78 |

| Montana | $3,220.84 | $4,672.10 | Data Not Available | $3,907.55 | $3,602.35 | $1,326.11 | $3,478.26 | $4,330.76 | $2,417.74 | Data Not Available | $2,031.89 |

| Nebraska | $3,283.68 | $3,198.83 | $2,215.13 | $3,997.29 | $3,837.49 | $6,241.52 | $2,603.94 | $3,758.01 | $2,438.71 | Data Not Available | $2,330.78 |

| Nevada | $4,861.70 | $5,371.62 | $5,441.18 | $5,595.56 | $3,662.09 | $6,201.55 | $3,477.14 | $4,062.57 | $5,796.34 | $5,360.41 | $3,069.07 |

| New Hampshire | $3,151.77 | $2,725.01 | Data Not Available | Data Not Available | $1,615.02 | $8,444.41 | $2,491.10 | $2,694.45 | $2,185.46 | Data Not Available | $1,906.96 |

| New Jersey | $5,515.21 | $5,713.58 | Data Not Available | $7,617.00 | $2,754.94 | $6,766.62 | Data Not Available | $3,972.72 | $7,527.16 | $4,254.49 | Data Not Available |

| New Mexico | $3,463.64 | $4,200.65 | Data Not Available | $4,315.53 | $4,458.30 | Data Not Available | $3,514.38 | $3,119.18 | $2,340.66 | Data Not Available | $2,296.77 |

| New York | $4,289.88 | $4,740.97 | Data Not Available | Data Not Available | $2,428.24 | $6,540.73 | $4,012.93 | $3,771.15 | $4,484.58 | $4,578.79 | $3,761.69 |

| North Carolina | $3,393.11 | $7,190.43 | Data Not Available | Data Not Available | $2,936.69 | $2,182.71 | $2,848.03 | $2,382.61 | $3,078.65 | $3,132.66 | Data Not Available |

| North Dakota | $4,165.84 | $4,669.31 | $3,812.40 | $3,092.49 | $2,668.24 | $12,852.83 | $2,560.35 | $3,623.06 | $2,560.53 | Data Not Available | $2,006.80 |

| Ohio | $2,709.71 | $3,197.22 | $1,515.17 | $3,423.01 | $1,867.19 | $4,429.74 | $3,300.89 | $3,436.96 | $2,507.88 | $3,135.16 | $1,478.46 |

| Oklahoma | $4,142.33 | $3,718.62 | Data Not Available | $4,142.40 | $3,437.34 | $6,874.62 | Data Not Available | $4,832.35 | $2,816.80 | Data Not Available | $3,174.15 |

| Oregon | $3,467.77 | $4,765.95 | $3,527.28 | $3,753.52 | $3,220.12 | $4,334.55 | $3,176.83 | $3,629.13 | $2,731.48 | $2,892.19 | $2,587.15 |

| Pennsylvania | $4,034.50 | $3,984.12 | Data Not Available | Data Not Available | $2,605.22 | $6,055.20 | $2,800.37 | $4,451.00 | $2,744.23 | $7,842.47 | $1,793.37 |

| Rhode Island | $5,003.36 | $4,959.45 | Data Not Available | Data Not Available | $5,602.63 | $6,184.12 | $4,409.63 | $5,231.09 | $2,406.51 | $6,909.45 | $4,323.98 |

| South Carolina | $3,781.14 | $3,903.43 | Data Not Available | $4,691.85 | $3,178.01 | Data Not Available | $3,625.49 | $4,573.08 | $3,071.34 | Data Not Available | $3,424.77 |

| South Dakota | $3,982.27 | $4,723.72 | $4,047.47 | $3,768.80 | $2,940.29 | $7,515.99 | $2,737.66 | $3,752.81 | $2,306.23 | Data Not Available | Data Not Available |

| Tennessee | $3,660.89 | $4,828.85 | Data Not Available | $3,430.07 | $3,283.42 | $6,206.69 | $3,424.96 | $3,656.91 | $2,639.30 | $2,738.52 | $2,739.28 |

| Texas | $4,043.28 | $5,485.44 | $4,848.72 | Data Not Available | $3,263.28 | Data Not Available | $3,867.55 | $4,664.69 | $2,879.94 | Data Not Available | $2,487.89 |

| Utah | $3,611.89 | $3,566.42 | $3,698.77 | $3,907.99 | $2,965.57 | $4,327.76 | $2,986.57 | $3,830.10 | $4,645.83 | Data Not Available | $2,491.10 |

| Vermont | $3,234.13 | $3,190.38 | Data Not Available | Data Not Available | $2,195.71 | $3,621.08 | $2,128.21 | $5,217.14 | $4,382.84 | Data Not Available | $1,903.55 |

| Virginia | $2,357.87 | $3,386.80 | Data Not Available | Data Not Available | $2,061.53 | Data Not Available | $2,073.00 | $2,498.58 | $2,268.95 | Data Not Available | $1,858.38 |

| Washington | $3,059.32 | $3,540.52 | $3,713.02 | $2,962.00 | $2,568.65 | $3,994.73 | $2,129.84 | $3,209.52 | $2,499.78 | Data Not Available | $2,262.16 |

| West Virginia | $2,595.36 | $3,820.68 | Data Not Available | Data Not Available | $2,120.80 | $2,924.39 | Data Not Available | Data Not Available | $2,126.32 | Data Not Available | $1,984.62 |

| Wisconsin | $3,606.06 | $4,854.41 | $1,513.27 | $3,777.49 | $3,926.20 | $6,758.85 | $5,224.99 | $3,128.91 | $2,387.53 | Data Not Available | $2,975.74 |

| Wyoming | $3,200.08 | $4,373.93 | Data Not Available | $3,069.35 | $3,496.56 | $1,989.36 | $3,187.20 | $4,401.17 | $2,303.55 | Data Not Available | $2,779.53 |

| Median | $3,660.89 | $4,532.96 | $3,698.77 | $3,907.99 | $3,073.66 | $5,295.55 | $3,187.20 | $3,935.36 | $2,731.48 | $3,729.32 | $2,489.49 |

American Family holds close to the median rate.

American Family Male vs Female Car Insurance Rates

Age is a huge factor for insurance companies when determining a rate; just ask the parents of a newly licensed driver.

| Company | Single 17-year old female | Single 17-year old male | Single 25-year old female | Single 25-year old male | Married 35-year old female | Married 35-year old male | Married 60-year old female | Married 60-year old male |

|---|---|---|---|---|---|---|---|---|

| American Family | $5,996.50 | $8,130.50 | $2,288.65 | $2,694.72 | $2,202.70 | $2,224.31 | $1,992.92 | $2,014.38 |

| Allstate | $9,282.19 | $10,642.53 | $3,424.87 | $3,570.93 | $3,156.09 | $3,123.01 | $2,913.37 | $2,990.64 |

| Farmers | $8,521.97 | $9,144.04 | $2,946.80 | $3,041.44 | $2,556.98 | $2,557.75 | $2,336.80 | $2,448.39 |

| Geico | $5,653.55 | $6,278.96 | $2,378.89 | $2,262.87 | $2,302.89 | $2,312.38 | $2,247.06 | $2,283.45 |

| Liberty Mutual | $11,621.01 | $13,718.69 | $3,959.67 | $4,503.13 | $3,802.77 | $3,856.84 | $3,445.00 | $3,680.53 |

| Nationwide | $5,756.37 | $7,175.31 | $2,686.48 | $2,889.04 | $2,360.49 | $2,387.43 | $2,130.26 | $2,214.62 |

| Progressive | $8,689.95 | $9,625.49 | $2,697.73 | $2,758.66 | $2,296.90 | $2,175.27 | $1,991.49 | $2,048.63 |

| State Farm | $5,953.88 | $7,324.34 | $2,335.96 | $2,554.56 | $2,081.72 | $2,081.72 | $1,873.89 | $1,873.89 |

| Travelers | $9,307.32 | $12,850.91 | $2,325.25 | $2,491.21 | $2,178.66 | $2,199.51 | $2,051.98 | $2,074.41 |

| USAA | $4,807.54 | $5,385.61 | $1,988.52 | $2,126.14 | $1,551.43 | $1,540.32 | $1,449.85 | $1,448.98 |

Teens, or their parents, pay a much higher premium.

Gender can also affect your car insurance premium. The following states have outlawed gender-based ratings:

American Family Rates by Make and Model

The type of car you drive will also make a difference in your rates.

| Company | 2015 Ford F-150: Lariat SuperCab with 2WD 6.5 foot bed and 2.7L V6 | 2015 Honda Civic Sedan: LX with 2.0L 4cyl and CVT | 2015 Toyota RAV4: XLE | 2018 Ford F-150: Lariat SuperCab with 2WD 6.5 foot bed and 2.7L V6 | 2018 Honda Civic Sedan: LX with 2.0L 4cyl and CVT |

|---|---|---|---|---|---|

| American Family | $3,447.30 | $3,178.82 | $3,326.18 | $3,487.91 | $3,721.32 |

| Allstate | $4,429.74 | $4,753.69 | $4,324.99 | $5,491.12 | $5,380.28 |

| Farmers | $4,093.50 | $4,405.21 | $3,728.22 | $4,390.19 | $4,779.51 |

| Geico | $3,092.11 | $3,092.58 | $3,090.89 | $3,338.40 | $3,338.87 |

| Liberty Mutual | $5,830.16 | $5,869.32 | $5,825.33 | $5,988.85 | $6,682.63 |

| Nationwide | $3,571.01 | $3,547.84 | $3,517.03 | $3,373.64 | $3,361.93 |

| Progressive | $3,914.05 | $4,429.56 | $3,647.22 | $3,962.58 | $4,528.90 |

| State Farm | $3,204.23 | $3,024.24 | $3,226.02 | $3,497.17 | $3,189.99 |

| Travelers | $4,023.47 | $4,420.37 | $4,383.78 | $4,412.42 | $4,661.22 |

| USAA | $2,551.56 | $2,409.67 | $2,454.58 | $2,855.69 | $2,422.66 |

American Family Commute Rates

Do you have a longer commute to work? If so, you may want to take a look at the below rates.

| Company | 10-miles commute / 6,000 annual mileage | 25-miles commute / 12,000 annual mileage |

|---|---|---|

| American Family | $3,401.30 | $3,484.88 |

| Allstate | $4,841.71 | $4,934.20 |

| Farmers | $4,179.32 | $4,209.22 |

| Geico | $3,162.64 | $3,267.37 |

| Liberty Mutual | $5,995.27 | $6,151.63 |

| Nationwide | $3,437.33 | $3,462.67 |

| Progressive | $4,030.02 | $4,041.01 |

| State Farm | $3,175.98 | $3,344.01 |

| Travelers | $4,399.85 | $4,469.96 |

| USAA | $2,482.69 | $2,591.91 |

You can expect to pay a slightly higher premium when you have a longer commute. In some cases, like Progressive, it could be as little as $11 a term.

American Family Coverage Level Rates

Depending on the amount of coverage you want, that will also change your premium. More coverage usually equals more premium — or does it? Check out the rates for American Family.

| Company | High | Medium | Low |

|---|---|---|---|

| American Family | $3,416.40 | $3,544.37 | $3,368.49 |

| Allstate | $5,139.02 | $4,896.81 | $4,628.03 |

| Farmers | $4,494.13 | $4,166.22 | $3,922.47 |

| Geico | $3,429.14 | $3,213.97 | $3,001.91 |

| Liberty Mutual | $6,356.04 | $6,058.57 | $5,805.75 |

| Nationwide | $3,505.37 | $3,449.80 | $3,394.83 |

| Progressive | $4,350.96 | $4,018.46 | $3,737.13 |

| State Farm | $3,454.80 | $3,269.80 | $3,055.40 |

| Travelers | $4,619.07 | $4,462.02 | $4,223.63 |

| USAA | $2,667.92 | $2,539.87 | $2,404.11 |

It actually costs more for medium coverage than for high coverage.

Nationwide may increase the premium as you get more coverage, but the amount may surprise you. It is less than $100 as you raise to a higher level of coverage.

American Family Credit History Rates

Your credit can follow you on bigger purchases, like a home or car, but did you know it can affect your car insurance premium?

| Company | Good | Fair | Poor |

|---|---|---|---|

| American Family | $2,691.74 | $3,169.53 | $4,467.98 |

| Allstate | $3,859.66 | $4,581.16 | $6,490.65 |

| Farmers | $3,677.12 | $3,899.41 | $4,864.14 |

| Geico | $2,434.82 | $2,986.79 | $4,259.50 |

| Liberty Mutual | $4,388.18 | $5,604.24 | $8,802.22 |

| Nationwide | $2,925.94 | $3,254.83 | $4,083.29 |

| Progressive | $3,628.85 | $3,956.31 | $4,737.64 |

| State Farm | $2,174.26 | $2,853.00 | $4,951.20 |

| Travelers | $4,058.97 | $4,344.10 | $5,160.22 |

| USAA | $1,821.20 | $2,219.83 | $3,690.73 |

Poor credit can significantly raise your premium.

American Family Driving Record Rates

One of the most obvious factors in determining your insurance premium is your driving record. Most of us know the sinking feeling of seeing the blue lights in your mirror. How much does it really increase your premium?

| Company | Clean record | With 1 speeding violation | With 1 accident | With 1 DUI |

|---|---|---|---|---|

| American Family | $2,693.61 | $3,025.74 | $3,722.75 | $4,330.24 |

| Allstate | $3,819.90 | $4,483.51 | $4,987.68 | $6,260.73 |

| Farmers | $3,460.60 | $4,079.01 | $4,518.73 | $4,718.75 |

| Geico | $2,145.96 | $2,645.43 | $3,192.77 | $4,875.87 |

| Liberty Mutual | $4,774.30 | $5,701.26 | $6,204.78 | $7,613.48 |

| Nationwide | $2,746.18 | $3,113.68 | $3,396.95 | $4,543.20 |

| Progressive | $3,393.09 | $4,002.28 | $4,777.04 | $3,969.65 |

| State Farm | $2,821.18 | $3,186.01 | $3,396.01 | $3,636.80 |

| Travelers | $3,447.69 | $4,260.80 | $4,289.74 | $5,741.40 |

| USAA | $1,933.68 | $2,193.25 | $2,516.24 | $3,506.03 |

A DUI is usually the most costly violation to have on your record.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Coverages Offered

Companies offer different coverage and bundling options for consumers. Discounts offered can substantially lower your premium.

Let’s take a look at what option American Family offers consumers.

American Family’s Bundling Options

American Family offers consumers a one-stop shop for all your insurance needs.

Vehicle Insurance

Whether you have a car or a motorcycle, American Family has you covered.

- Car Insurance

- Motorcycle Insurance

- RV Insurance

- Boat Insurance

- ATV Insurance

- Snowmobile Insurance

- Classic Car

Property and Business

Consumers can bundle their auto insurance along with their homes. American Family also has business insurance.

- Home Insurance

- Renters Insurance

- Condo Insurance

- Manufactured Home

- Farm and Ranch Insurance

- Business Insurance

- Landlord Insurance

Added Protection

American Family also has the extras. Whether you are looking for life or travel insurance, American Family has a wide variety of options.

- Life Insurance

- Umbrella Insurance

- Identity Theft Insurance

- Credit Monitoring

- Health Insurance

- Travel Insurance

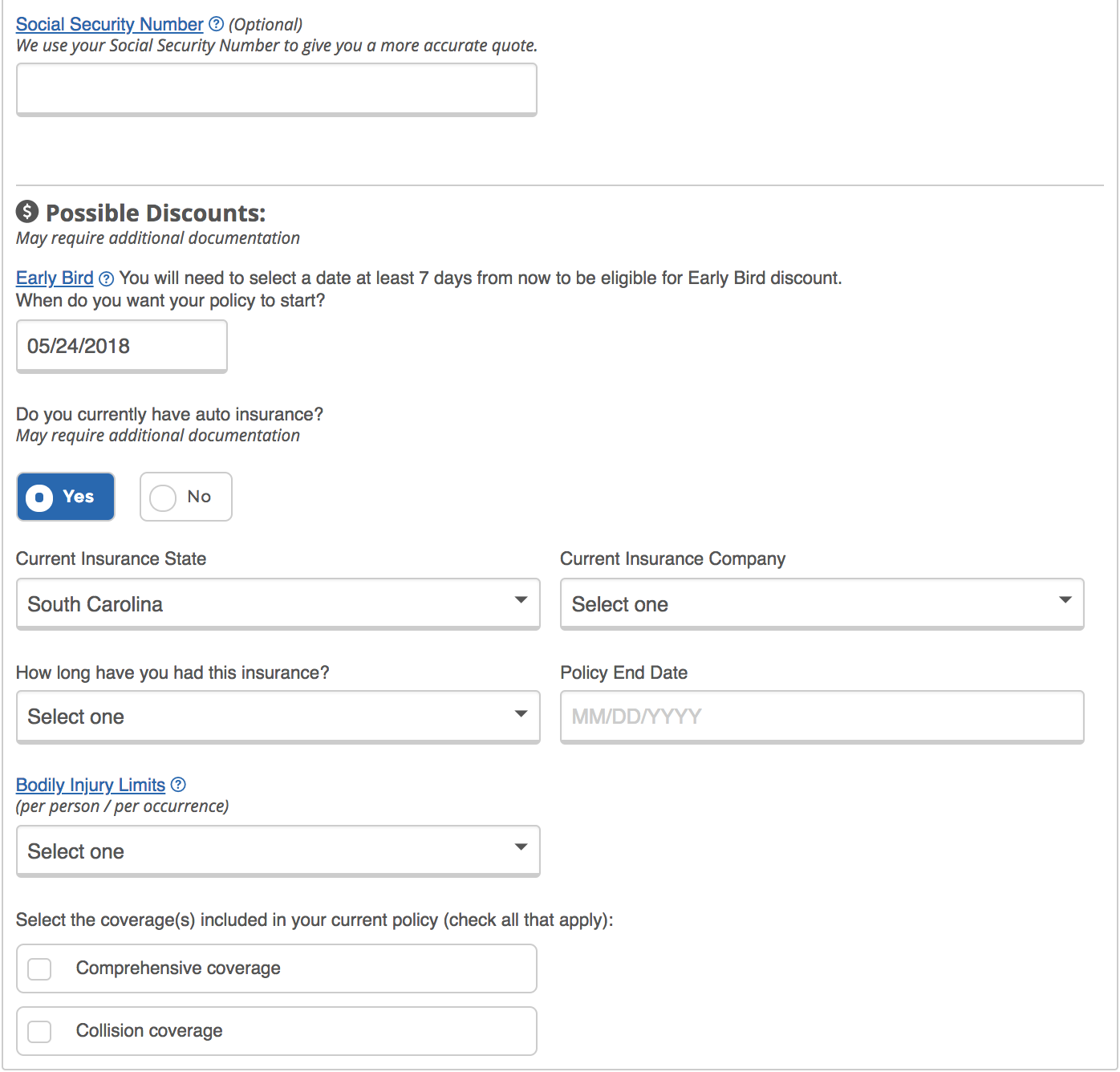

American Family’s Discounts

Here are some popular discounts American Family offers. You can find this listing on the American Family website.

Most Popular

- Multi-Vehicle — If you insure more than one vehicle, you could be eligible for a discount.

- Loyalty — The longer you have been with American Family, the bigger your discount could be.

- Early-Bird — Get a quote seven days or more before your policy with another carrier expires could land you a cheaper rate.

- Multi-Product — More lines of business, like home and business, could bundle to make you have lower rates.

Safe Vehicles and Good Driving

- Auto safety equipment — Have safety equipment in your car? That could get you a 10–30 percent discount.

- Defensive driver — Some states offer drivers 55 years and older a discount of 5–10 percent.

- Good driving — Drivers with no accidents, violations, or claims could get a reduced premium.

- Low mileage — Driving less than 7,500 miles a year could get you a discount.

Young Drivers/Student

- Good student — Good grades could lower your rates.

- Teen safe driver — A free program to auto policyholders with a teenage driver, and you may get a discount on your policy for enrolling.

- Away at school — If you have a child under 25 years old, away at school over 100 miles, you could be eligible for a discount.

- Young volunteer — Are you under age 25 and complete 40 hours of volunteer work per year for a non-profit? Then you could save money on your auto policy.

- Generational — Is mom or dad an American Family customer? Then you could be eligible for a discount.

Billing Discounts

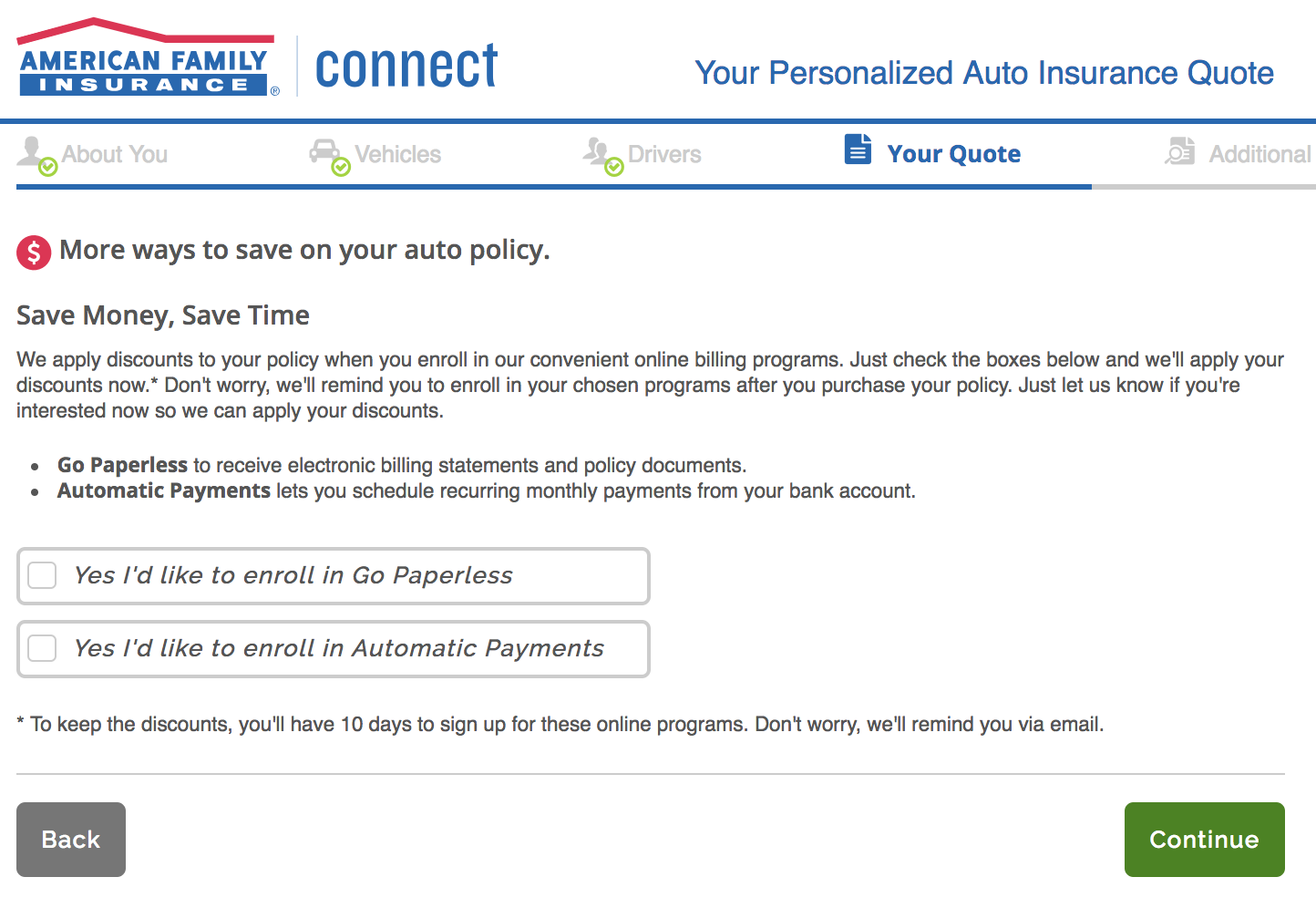

- Autopay — Enroll in automatic funds transfer (AFT) or electronic recurring payments you qualify for a discount.

- Customer full pay — Pay in full can you save you on your annual premium.

- Paperless — Online billing and delivery can make you eligible for the paperless discount.

American Family’s Programs

KnowYourDrive is an app-based program that allows American Family to monitor safe driving habits and give you discounts for those good choices.

https://youtu.be/2-0wrSwbhdQ

American Family Financial Ratings

The job of an insurance company is to take on risk. They evaluate the risk by looking at certain factors and determining a premium.

In the event of a loss, you want to know that the company has evaluated your risk and risks of others properly so that if you suffer a total loss, you will be covered.

This is when you may want to look at the financial ratings of your insurance company. If your company is not financially stable, you could run into an issue with claim payout. Even worse, you could be insured by a company on the verge of bankruptcy, and you could be left high and dry.

We are going to take a look at several third party agencies that look at companies from several different perspectives. We will look at financial standings, customer reviews, claims service, and complaints filed.

| Agency | Rating |

|---|---|

| AM Best | A+ (Stable) |

| Better Business Bureau | A+ |

| Consumer Affairs | 3/5 |

| Consumer Reports | 89 |

| JD Power | Claims Satisfaction 4/5 |

| Moody's | Aa3 (Excellent) |

| NAIC Complaint Index | 0.89 |

| S&P | AA- (Very Good) |

AM Best

AM Best is a unique rating company that solely looks at the insurance industry. They take only the data and market information for insurance companies and provide this information to help the consumer make an informed decision based on the findings.

American Family gets a very stable rating of A+ from AM Best.

Better Business Bureau

The Better Business Bureau is a great place for consumers to look for a potential insurer. Insurance companies, or any other company, has the ability to become an accredited company with the Better Business Bureau.

This means a company that is accredited follows the rules set up by the BBB, known as the Standards for Trust.

If a company chooses not to be accredited, you can still find a rating and complaints about that company.

American Family is not accredited, but you can find that this company gets an A+ with the BBB.

Moody’s

Moody’s also takes a look at debt and the financial standing of a company. Moody’s gives American Family an outstanding score of Aa3, which is excellent in their rating tiers.

Standard and Poor (S&P)

Another very good rating at AA- with another global financial rating company. Standard and Poor rates companies based on a company’s ability to meet financial obligations.

In the case of an insurance provider, you would want to have the informed decision to choose an insurer that could meet your needs if you are involved in a loss.

NAIC Complaint Index

The National Association of Insurance Commissioners is a major component of setting the standard of insurance and helping regulatory support for all 50 states and the District of Columbia.

The NAIC files all complaints about insurers and makes them public knowledge for consumers to make wise decisions when looking at insurance companies.

| Company (NAIC #) | Complaint Index |

|---|---|

| American Family Home Ins Co (23450) | 0.00 |

| American Family Ins Co (10386) | 13.74 |

| American Family Mut Ins Co SI (19275) | 0.89 |

The national complaint average is 1.16, makes American Family under the average with their 0.89 complaints ratio.

Consumer Reports

| Claims Handling | Score |

|---|---|

| Agent Courtesy | Excellent |

| Being Kept Informed of Claim Status | Excellent |

| Damage Amount | Very good |

| Ease of Reaching an Agent | Excellent |

| Freedom to Select Repair Shop | Very Good |

| Promptness of Response - very good | Very Good |

| Simplicity of the Process | Very Good |

| Timely Payment | Very Good |

| Total | 89 out of 100 |

American Family scores very good to excellent in all categories.

American Family’s History

Herman Wittwer had a dream of starting an insurance company that was founded on the dream of protecting their customers’ most valuable possessions. Over 90 years later, American Family boasts that customers are still their driving force.

By the 1950s, American Family introduced more lines of business. Sickness, accidents, and homeowners insurance made the growing company even bigger.

In 1965, the famous American Family jingle was created.

Commercial insurance was introduced in 1975, and by 1977, American Family celebrated 50 years of business with over 2 million policies.

By the 1980s, American Family expanded its business by establishing American Family Brokerage to helo serve customers with hard to place risks. They also developed a new program for catastrophic disasters.

American Family hit milestones of over $1 billion in assets and began to focus on community service.

By 2005, American Family and the Green Bay Packers raised over $1 million for breast cancer treatment, research, and prevention. In 2007, American Family Children’s Hospital opened its doors due to American Family serving as the main donor.

American Family Market Share

Due to their limited availability, American Family doesn’t have a large share of the U.S. insurance market.

However, The National Association of Insurance Commissioners shows a steady increase in market share from 2015 to 2018.

| Year | Premiums Written | Market Share % | Loss Ratio |

|---|---|---|---|

| 2015 | $7,242,621 | 1.22% | 55.25% |

| 2016 | $7,808,873 | 1.27% | 58.63% |

| 2017 | $8,363,930 | 1.30% | 68.95% |

| 2018 | $4,687,909 | 1.90% | 69% |

American Family has had steady growth over the last four years.

American Family’s Position for the Future

American Family is looking good for future growth. Over the last four years, they have continually grown.

They have heavy community involvement and happy employees.

American Family’s Online Presence

American Family has a heavy online presence allowing consumers to get instant quotes online as well as find an agent. There is even an online chatting option so customers can ask questions regarding their quote or their policy.

American Family’s Commercials

Some watch the Super Bowl just for the commercials. Insurance companies realize the importance of great commercials that stick in the mind of the consumer.

We can all recognize Flo from Progressive or Mr. Mayhem from Allstate. If you can instantly picture those characters, then the marketing departments for those insurance companies have done their job.

Can you remember any catchy phrases or actors on American Family commercials?

Chances are you may have heard the American Family jingle.

Or, maybe you see your favorite athlete in American Family commercials.

American Family in the Community

From the commercials to the sponsoring of American Family Children’s Hospital, American Family has shown its dedication and love for the community. Let’s take a look at how American Family gets involved in the community to make it a better place.

Dream Bank was created by American Family to help those in the community dream big. American Family created a safe place for people to figure out their dreams and provide support to help make those dreams a reality.

One Saturday to Dream Fearlessly is an event across major cities to help support and build up the dreamers of the world.

https://youtu.be/a4pszq6oCyY

American Family’s Employees

American Family has heavy involvement in the community, does that level of care transfer to the employees? Let’s take a look at how American Family employees feel about their employer.

Glassdoor takes reviews from employees and gives American Family a rating of 3.3 stars out of five.

The highest rating of 3.6 comes from compensation and benefits and work/life balance categories. As far as referring a friend to this employer, 57 percent of American Family employees would refer a friend.

Awards and Accolades

It is no surprise American Family has a lengthy list of awards.

- Best Employers for Diversity, Forbes, 2019

- Fortune 500, Fortune, 2018, 2015

- Best Places to Work for LGBT Equality, Human Rights Campaign Foundation, 2018, 2017, 2016

- America’s Best Employers For New Graduates, Forbes, 2018

- Fitch Ratings A+ Award, Fitch Ratings, 2018, 2016

- The Candidate Experience (CandE) Award, The Talent Board, 2014

- Highest in Customer Satisfaction with the Auto Insurance Purchase Experience, J.D. Power and Associates, 2011

- Best Employers for Latinos to Work for, Latinos for Hire, 2008

- Corporate 100, Hispanic Magazine, 2007

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Canceling Your Policy

Sometimes you need to cancel your auto insurance policy. Maybe you found a cheaper rate, or you are moving out of state and can not keep your current policy. Whatever the reason may be, you want it to be an easy process.

Cancellation Fee

Usually, American Family does not charge a fee to cancel. You will want to check with your agent to verify their cancellation policy.

Is there a refund?

If you paid for coverage past your cancellation, then yes, you will have premium returned to you. For instance, if you paid the premium in full for six months and cancel in the fourth month, then you will have unused premium returned.

How to Cancel

The best way to cancel with American Family is to call your agent. If you do not have the contact information for your agent, call American Family customer service at 1-800-MYAMFAM (1-800-692-6326) to obtain a cancellation form or contact information for your agent.

When can I cancel?

You are free to cancel your insurance at any time. We advise you not to cancel your insurance with your current provider until you have secured coverage with a new insurance company.

How to Make a Claim

In the unfortunate event of a loss, you want to know you can make a claim, and the process runs smoothly.

Ease of Making a Claim

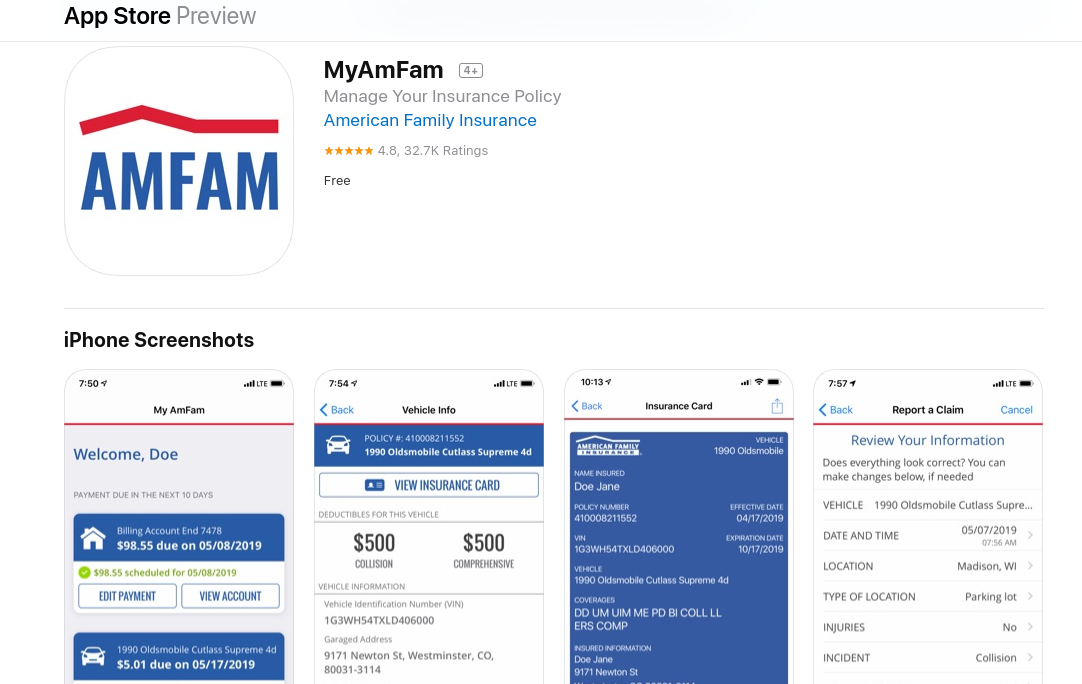

American Family gives you several options to file a claim. The easiest and quickest way to file is to go to your mobile app, MyAmFam, and file the claim on your mobile device.

You can also log in to your online account or by calling 1-800-MYAMFAM (1-800-692-6326) to speak to a customer representative.

Premiums Written and Loss Ratio

We took a look at data from the National Association of Insurance Commissioners showing premium written and loss ratio over the last four years.

| PRIVATE PASSENGER AUTO | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|

| Premiums Written | $3,694,271 | $4,005,549 | $4,381,962 | $4,687,909 |

| Loss Ratio | 55% | 58% | 69% | 69% |

What is the loss ratio?

The loss ratio is how much the company pays out in claim versus getting in premium. For instance, if a company writes $100,000 in premium and pays out $60,000 in claims, they have a loss ratio of 60 percent.

The importance of loss ratio is how a company is paying out claims and their financial status. If a company has a loss ratio of over 100 percent, then they are losing money and maybe in financial distress. If they have a lower percentage, they may not pay out claims.

How to Get a Quote Online

In a world of technology and everything digital, American Family makes obtaining an online quote a breeze.

Most people want the ease of going online in the comfort of their home and getting what they need on the computer. American Family realizes that and makes quoting online very simple.

ZIP Code

The very first thing American Family needs is your ZIP code. Remember, they are not in all 50 states, so they want to make sure you are in an area they are able to write.

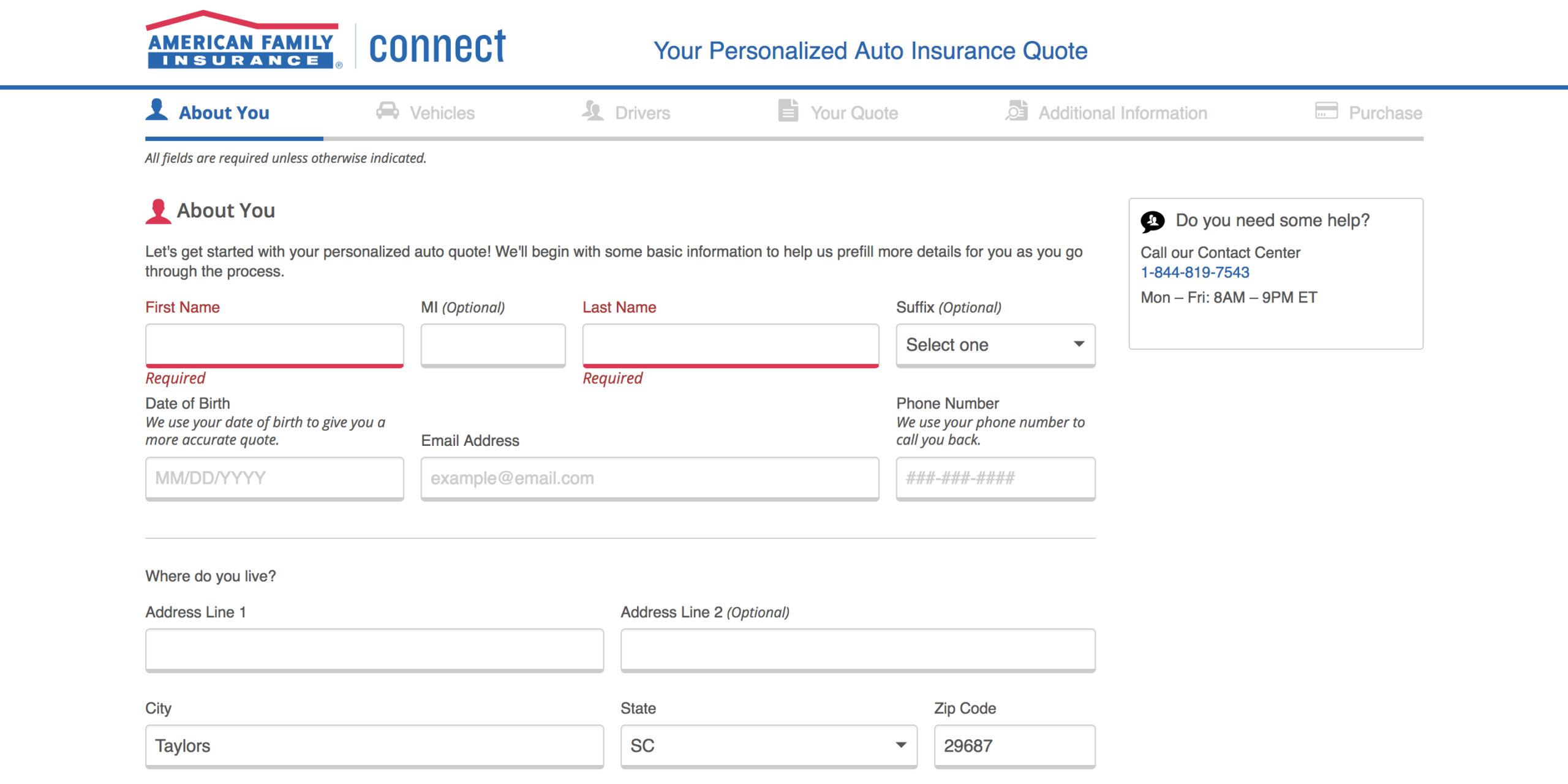

Personal Information

Next, American Family will want to know a little information about you. Name, address, and date of birth are standard questions asked when receiving a quote.

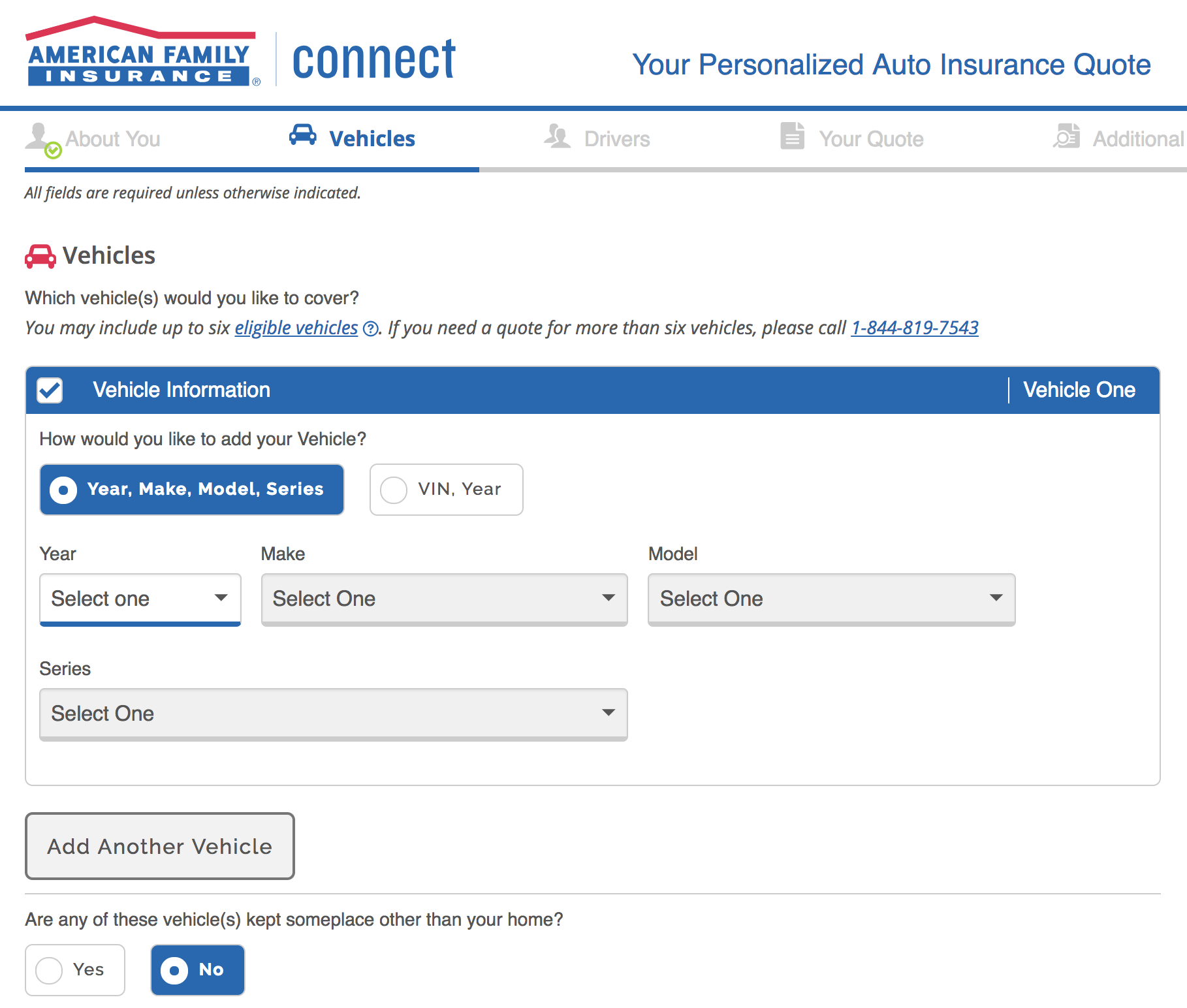

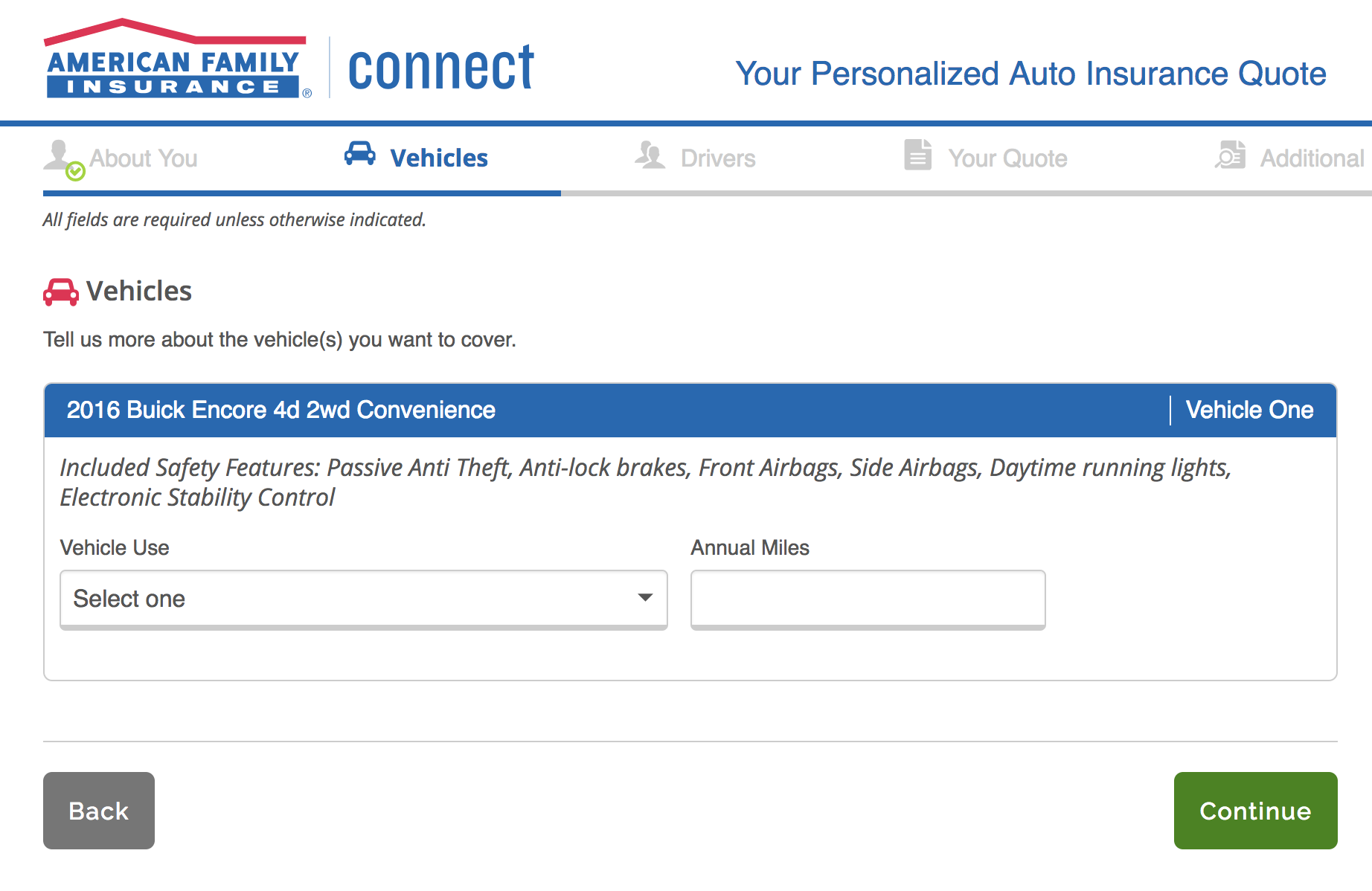

Vehicle Information

You will also want to know your vehicle information. The vehicle identification number, VIN, is the best way to pull the exact car details. If you do not have that on hand, you can enter make, year, and model for the quote.

You will also need to enter some additional information about your vehicles such as usage and annual mileage.

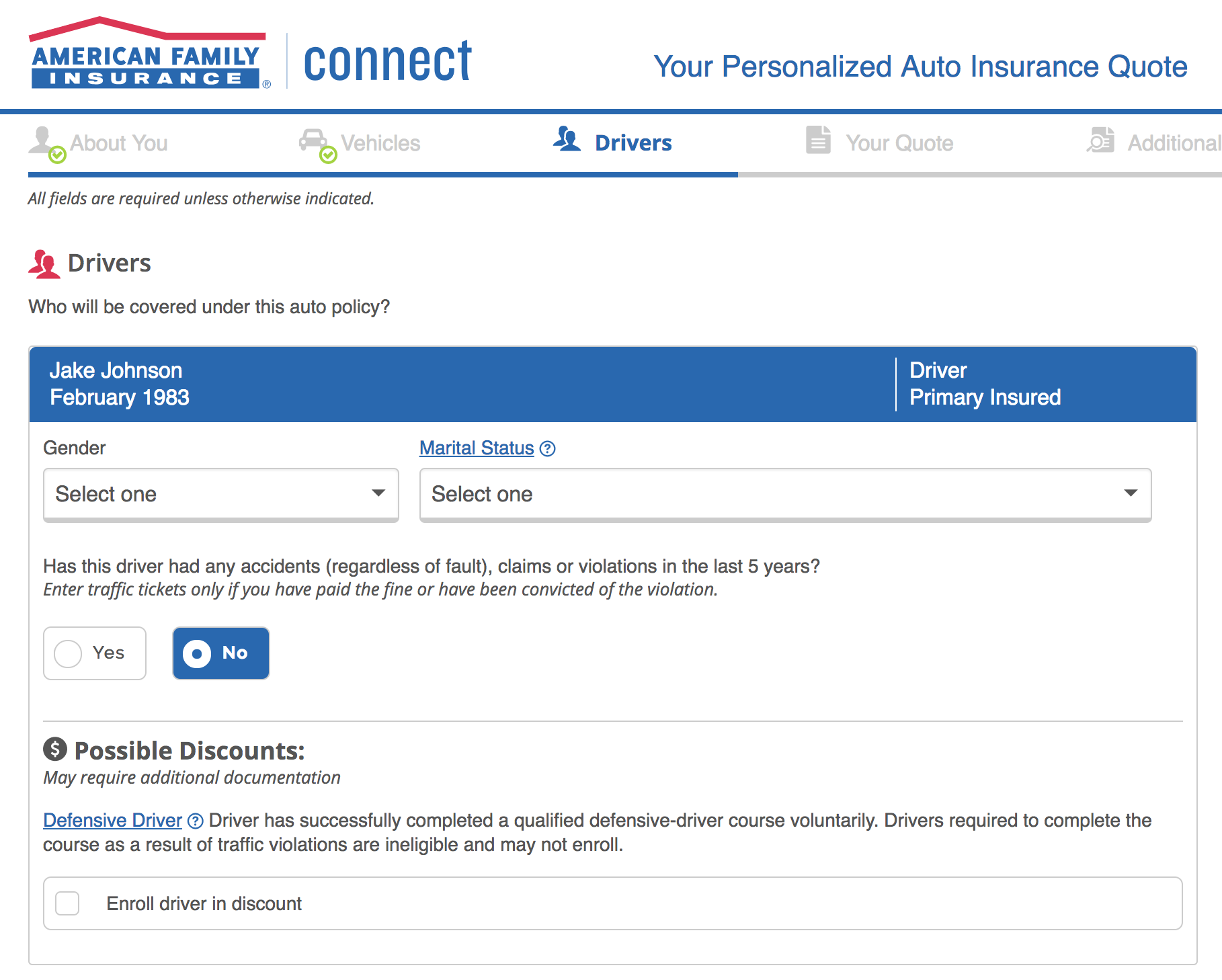

Drivers

Next up, you will need to list all the drivers in the house.

Discounts and Coverage

Before the last step of obtaining the quote, you will need to go through the coverages you would like to add to your policy.

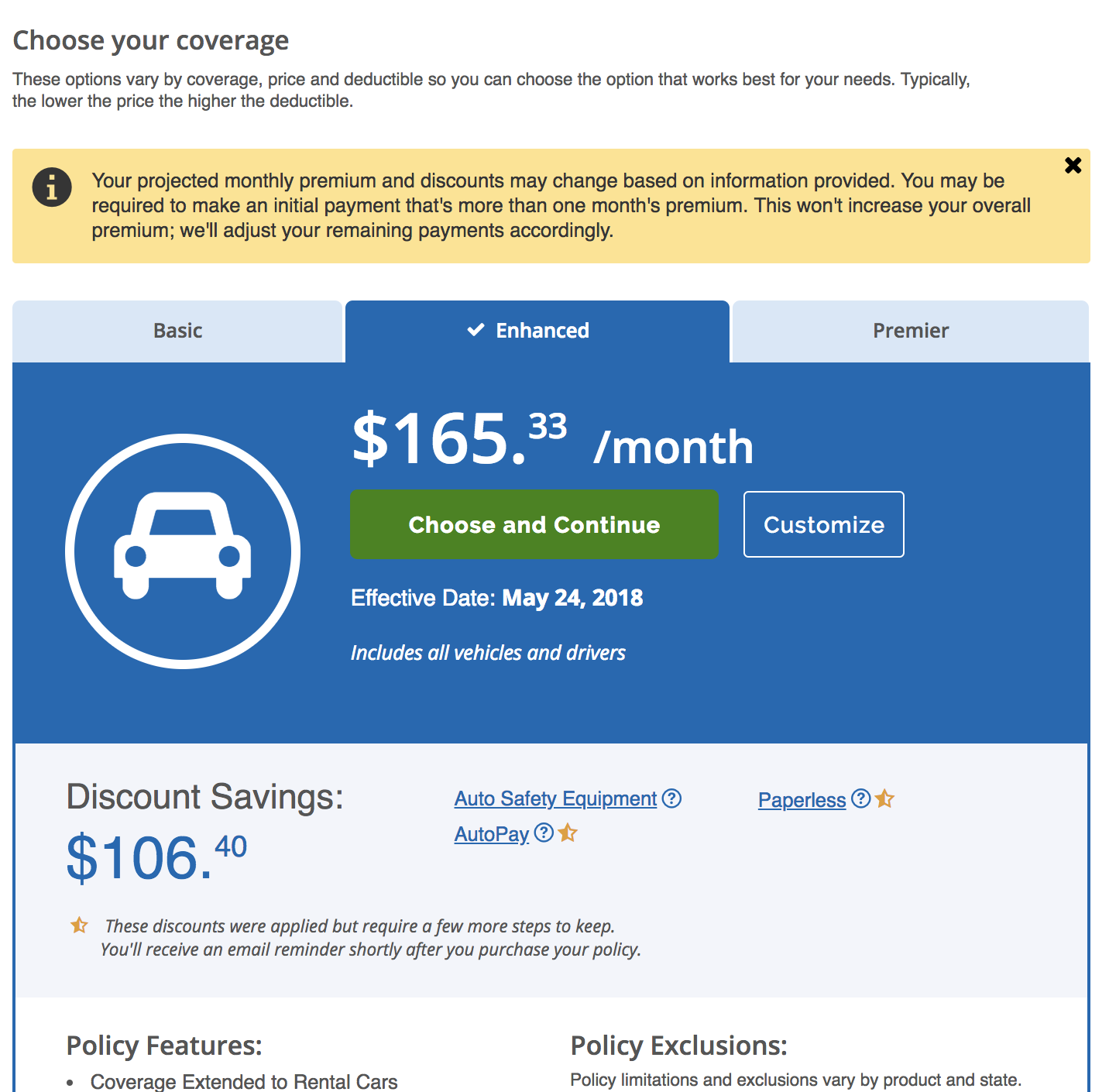

The Quote

Finally, you get the numbers. American Family breaks down the monthly payments along with the savings on your policy.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Design of Website/App

American Family has an easy to use website.

Headers along the top of the site help you see exactly what you are looking to find.

The AmFam app is also very helpful with the ability to view insurance cards, payment info, and even report a claim.

The app provides convenient access to your policy information, billing details, and insurance card.

Pros and Cons

We have covered a lot of information about American Family Insurance. Let’s break it down.

Pros

- Has numerous discount options

- Multiple lines of business

- Strong financial ratings

- Easy to use website

- Great app that allows a customer to file a claim, show proof of insurance, and more.

Cons

- Only available in 19 states

- Higher than some of the other top 10 companies

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

The Bottom Line

You can find issues and complaints with every company because no company is perfect.

American Family offers a large number of discounts. They also have multiple lines of insurance, so all your needs can be met with one company.

Sadly, they do not write in all 50 states. So, if you do not live in a state they write, you can not obtain insurance from American Family.

FAQ

Here are some commonly asked questions regarding American Family.

How do I get a quote from American Family?

American Family makes getting a quote very easy for the consumer. They offer three different ways of obtaining a quote.

- Get a quote online.

- Call 1-800-MYAMFAM(1-800-692-6326) and get a quote over the phone.

- Get in touch with an agent.

How much car insurance coverage should I have?

Each state has required minimum limits of liability. Remember, those limits are the absolute minimum. We advise looking at higher limits.

Will American Family replace or repair my windshield?

The following can be found on the American Family website:

It’s simple! Submitting an auto glass claim only takes a few minutes. You can file a claim with Safelite, where they’ll need your policy number and the date the damage occurred. Then, they’ll collect some facts about your claim and help you set up an appointment to get your glass back in tip-top shape.

If you prefer, Safelite offers a mobile auto glass service — meaning they’ll come to you to repair your broken window or windshield. Now that’s convenient! Or, you can set up an appointment to stop by one of their 700+ facilities nationwide, where services typically take less than an hour.

You can also contact American Family Insurance’s Glass Claims Department at 1-800-MYAMFAM (1-800-692-6326) and they’ll help you through the process.

For even more convenience, download our MyAmFam app to take care of your insurance needs with the touch of a finger.

How can I pay my monthly installments?

American Family offers several ways to pay. You can set up automatic payments drafted from your debit or credit card or checking account. You can even set up the date and amount to be paid.

You can also go online and pay your bill electronically.

A phone is also an option with the automated pay by phone system.

Still wondering if American Family is a good fit? Or maybe you don’t live in one of the 19 states that American Family offers coverage. Enter your ZIP code here for a free, no-obligation quote.