Best Fresno, CA Auto Insurance in 2025 (Compare the Top 10 Companies)

With the best Fresno, CA auto insurance from insurers; State Farm, Geico and Farmers Insurance, with minimum coverage starting at a low price of $55/mo, it reaches the required minimum liability coverage of 15/30/5 in the California State. Drivers in Fresno can rest assured that their car will be covered with these insurers.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

Licensed Agent & Financial Advisor

UPDATED: Nov 1, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

18,154 reviews

18,154 reviewsCompany Facts

Full Coverage in Fresno CA

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in Fresno CA

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 3,072 reviews

3,072 reviewsCompany Facts

Full Coverage in Fresno CA

A.M. Best Rating

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviewsCalifornia auto insurance requires a base coverage (15/30/5) for all residents. Still, the best Fresno, CA auto insurance companies offer affordable premiums, such as State Farm, Geico, and Farmers, with prices for full coverage starting at a great price of $140/mo.

Fresno is known as the “agribusiness center of the world” outside of California, which makes it fairly busy for overall vehicle traffic and at risk for accidents. Fresno is a crucial area that connects four different farming regions across the US. Depending on your profession or if it’s for tourism, you still need the best auto insurance for your needs.

Our Top 10 Company Picks: Best Fresno, CA Auto Insurance

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 17% | B | Local Agents | State Farm | |

| #2 | 25% | A++ | Affordable Rates | Geico | |

| #3 | 20% | A | Family Plans | Farmers | |

| #4 | 13% | A | Roadside Assistance | AAA |

| #5 | 12% | A+ | Price Flexibility | Progressive | |

| #6 | 10% | A+ | Diverse Coverage | Allstate | |

| #7 | 10% | A+ | Senior Discounts | The Hartford |

| #8 | 10% | A | Flexible Coverage | Liberty Mutual |

| #9 | 15% | A | Low Rates | Mercury | |

| #10 | 20% | A+ | Safe Driving | Nationwide |

If you are in the market for the best auto insurance in Fresno, CA, you can get the very best insurance rates close to you. To find free car insurance quotes from Fresno’s top-rated car insurance companies today, type your ZIP code into the quote box on this page.

- California has a higher than the national average for car insurance

- Fresno is the cheapest area in California for car insurance

- The best insurance companies are State Farm, Geico, and Farmers

#1 – State Farm: Best for Local Agents

Pros

- Wide Network of Agents: State Farm has many agents across Fresno and California, making finding local, personalized service for the best Fresno, CA auto insurance easy.

- Comprehensive Coverage Options: State Farm offers options beyond the minimum required, such as collision, comprehensive, and rideshare insurance.

- Discounts: State Farm offers discounts to help reduce premiums, such as safe driver programs like Drive Safe & Save and good student discounts for young drivers.

Cons

- Higher Premiums: State Farm’s base rates could be higher than a couple of competitors in Fresno. Check the State Farms auto insurance review to investigate State Farm’s average insurance prices.

- Inconsistent Pricing by Location: Auto insurance quotes from State Farm differ based on the higher crime rates and accidents in different parts of Fresno and the wider region.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#2 – Geico: Best for Affordable Rates

Pros

- Affordable Rates: Geico offers competitive rates, which will benefit Fresno drivers, given the city’s high transportation expenses. To check Geico’s cheap rates, read our Geico auto insurance review.

- Discounts: Besides military and federal discounts, Geico offers discounts for multi-policy holders, sound drivers, students with good grade point averages, and others.

- Roadside Assistance and Extra Coverage Options: Geico offers cheap roadside assistance and rental reimbursement, which may be helpful for Fresno commuters.

- Widely Available: Geico is well represented in California, including Fresno. It makes getting coverage within the region’s city or urban areas easy.

Cons

- Limited Local Agents: Geico operates primarily online, which might be important if you prefer face-to-face interactions for personal help in Fresno.

- Not All Coverage Types Available: Geico doesn’t offer coverage for specialty vehicles, or unusual situations may not be covered, which could be an issue if you have specific needs in Fresno.

- Increasing Rates: Like many insurers, Geico’s rates can increase after a claim or a traffic violation. Some Fresno drivers have noted significant rate hikes after minor incidents.

#3 – Farmers Insurance: Best for Family Plans

Pros

- Comprehensive Coverage Options: Farmers sell extra coverage, such as new car replacement and accident forgiveness. This is handy for Fresno drivers with special needs or who own multiple cars.

- Discounts: Farmers offer discounts, such as discounts on good students, safe drivers, and anti-theft devices. Check out the Farmer’s discounts available with the Farmers auto insurance review.

- Accident Forgiveness: Farmers offer accident forgiveness to clients with excellent driving records after their first at-fault accident. This peace of mind is needed in a highly trafficked area like Fresno.

Cons

- Higher Premiums: Farmers tend to have higher premiums than budget insurers. Fresno drivers looking for the most affordable option may find Farmers’ rates higher.

- Customer Service Varies by Agent: Farmers’ service is delivered through local agents, so the customer service experience can vary.

#4 – AAA: Best for Roadside Assistance

Pros

- Strong Local Presence: AAA has offices in Fresno, offering local service and claims with personal assistance for all inquiries. To learn more, check out the AAA auto insurance review!

- Roadside Assistance: AAA is famous for its full-service roadside assistance, which is included with most auto insurance policies. This can be a real savior for commuters traveling around Fresno.

- Flexible Coverage Options: AAA offers various types of coverage, including comprehensive, collision, and gap insurance. Every Fresno driver can get a personalized policy based on his needs.

- Good Customer Service: AAA is known for its primary customer service, including claims handling. Most clients had an easy experience filling out the claims after an accident in Fresno.

Cons

- Membership Requirement: You must join AAA to get AAA auto insurance. The company offers benefits, but some Fresno drivers might not want to pay for them.

- Higher Premiums for High-Risk Drivers: AAA tends to charge more expensive premiums to Fresno drivers with violations on their driving records.

- Rate Increases After Claims: Like all other insurers, AAA increases rates after an at-fault accident or a traffic violation, which may become a concern for some drivers in Fresno.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#5 – Progressive: Best for Price Flexibility

Pros

- Snapshot® Program: Progressive’s usage-based insurance program, Snapshot®, rewards safe drivers with discounts based on their driving habits in Fresno, lowering their premiums over time.

- Wide Range of Coverage Options: Fresno drivers are offered various coverage options, such as comprehensive and collision coverage and custom parts and equipment coverage.

- 24/7 Customer Support: Progressive offers Fresno drivers 24/7 customer service outside regular business hours. For more information about customer service, read Progressive’s auto insurance review.

Cons

- Rate Increases After Claims: Like many other insurers, Progressive may raise your rates after filing a claim, even for minor accidents in Fresno, California.

- Snapshot® May Not Benefit All Drivers: The Snapshot® program rewards safe drivers, but based on the data collected, your rates could increase if you drive during high-risk times in Fresno.

#6 – Allstate: Best for Diverse Coverage

Pros

- Strong Local Presence and Agents: Allstate’s outstanding, long-established local agency network in Fresno enables face-to-face personalized service for advice on the most appropriate policy.

- Wide Range of Coverage Options: Allstate has coverage options for your lifestyle, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage for Fresno drivers.

- Drivewise® Program for Safe Drivers: Allstate’s Drivewise® program offers rewards for safe driving habits in Fresno through discounts based on speed, braking, and mileage.

- Good Customer Service and Claims Satisfaction: Allstate is popular in terms of claims and has commendable customer service. Many clients reported having hassle-free experiences.

Cons

- Higher Premiums: Allstate will charge its customers more premiums. Without those deep discounts, Allstate wouldn’t be the first choice for Fresno budget-conscious drivers.

- Drivewise® Can Increase Rates: The Drivewise® program can reward safe drivers but can also cost more to riskier drivers. To understand the program, check out Allstate auto insurance review.

- Optional Coverage Costs: Allstate offers a range of extra coverages, but these extras can push your premium into the stratosphere, so budget-conscious drivers in Fresno might be deterred.

#7 – The Hartford: Best for Senior Discounts

Pros

- Specialized Coverage for AARP Members: The Hartford is apt for the aging Fresno driver, mainly when that individual is an AARP member. For one, they offer exclusive benefits, such as lifetime renewability.

- Disappearing Deductible: As Hartford’s disappearing deductible goes into effect, your collision deductible will be reduced yearly if you have a clean driving record in Fresno.

- Lifetime Car Repair Assurance: Hartford offers access to its network of trusted repair shops in Fresno and guarantees the work as long as you own the vehicle.

- RecoverCare: This service helps people recover from daily life issues if injured in a car accident. This benefit can prove extremely valuable to elderly Fresno drivers.

Cons

- Not Ideal for Younger Drivers: The Hartford is tailored toward older Fresno drivers. Young drivers may not find the best rates; read The Hartford auto insurance review to see why.

- Membership Requirement for AARP Discounts: To access Hartford’s unique benefits, you must be a part of AARP, which involves paying a fee that may not be ideal for the usual Fresno driver.

- Higher Premiums for Non-AARP Members: Hartford is known for competitive rates for older drivers, especially AARP members, but those without membership may face higher premiums.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#8 – Liberty Mutual: Best for Flexible Coverage

Pros

- Customizable Coverage Options: Liberty Mutual allows you to customize your auto insurance policy, including optional coverages. Fresno drivers can tailor their policy to their driving habits.

- Wide Range of Discounts: Liberty Mutual offers many discounts. These can help Fresno residents lower their premium costs, especially for those with clean driving records or students.

- Accident Forgiveness: After your first at-fault accident in Fresno, your premiums will not increase. This can be peace of mind in case of a mishap. Read more with Liberty Mutual auto insurance review.

- New Car Replacement and Better Car Replacement: Fresno drivers can expect a brand-new car of the same make and model or a newer model in case the vehicle is totaled.

Cons

- Rate Increases After Claims: Liberty Mutual may increase premiums after an at-fault accident or traffic violation. This could lead to higher costs for Fresno drivers with claims history.

- Potentially Costly Add-Ons: Liberty Mutual offers attractive coverage options for Fresno drivers, like accident forgiveness and new car replacement, but these come at an additional cost.

- Annual Rate Adjustments: Some Fresno customers have reported unexpected rate increases upon policy renewal, even without any claims, so they must monitor their policy in case of increases.

#9 – Mercury: Best for Low Rates

Pros

- Affordable Rates: Mercury is always eager to provide the best quote, particularly for California drivers. Mercury would be a much better option if you are a Fresno driver looking for a cheap policy.

- Rideshare Coverage: Rideshare insurance is available for Uber or Lyft drivers. This is helpful for Fresno’s local drivers who use ride-sharing services.

- Mechanical Breakdown Protection (MBI): This car repair coverage is outside typical Fresno auto insurance. For details on MBI, check out the Mercury auto insurance review.

- Flexible Coverage Options: That advantage allows Mercury to provide a wide range of coverage options. Fresno motorists can assemble a policy according to their needs.

Cons

- Availability of Discounts Varies by Agent: Because Mercury operates through local agents, discounts and coverage options can vary in Fresno, which may limit the selection.

- Basic Coverage Options: While Mercury offers standard coverage options, it may lack some additional perks or unique coverages. This might make it less appealing for Fresno drivers.

- Rate Increases After Claims: Mercury may raise your premium after an at-fault accident or traffic violation, like many other insurers. This could be a disadvantage for long-term affordability in Fresno.

#10 – Nationwide: Best for Safe Driving

Pros

- Strong Customer Service and Local Agents: Nationwide is known for its excellent customer service and has local agents in Fresno. Read our Nationwide auto insurance review for more.

- Vanishing Deductible: Nationwide’s Vanishing Deductible program rewards safe Fresno drivers by reducing the deductible by $100 for every accident-free year until the amount becomes fully deducted.

- SmartRide® Program for Safe Drivers: The SmartRide® program tracks driving behavior and provides discounts based on instances of low-risk braking, low miles driven, and safe times driven.

- On Your Side® Review: Nationwide offers an On Your Side® review, where you can review your coverages and needs with one of their Fresno agents to ensure your policy is current.

Cons

- SmartRide® May Not Be Ideal for All Drivers: The SmartRide® program rewards safe driving, but having aggressive driving habits in Fresno could negatively impact your discount potential.

- Possible Rate Increases After Claims: Subsequent claims or traffic violations could lead to significant rate increases. Fresno drivers who file multiple claims may see rising premiums over time.

- Vanishing Deductible May Have Limits: There’s a cap on how much you can reduce your deductible. Some Fresno drivers may not see significant savings if they don’t drive often or file a claim.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Auto Insurance Coverage Requirements in California

Regarding automotive insurance, you want the best coverage for the best deal. So, you must balance getting the coverage you need with your available funds. If you have the extra money, try getting more than just bodily injury liability insurance. It’ll come in handy in case severe weather or an uninsured motorist ever causes damage to your vehicle.

Fresno, CA Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $70 | $160 |

| $72 | $165 | |

| $65 | $155 | |

| $55 | $140 | |

| $75 | $170 |

| $62 | $148 | |

| $66 | $155 |

| $58 | $150 | |

| $60 | $145 | |

| $68 | $160 |

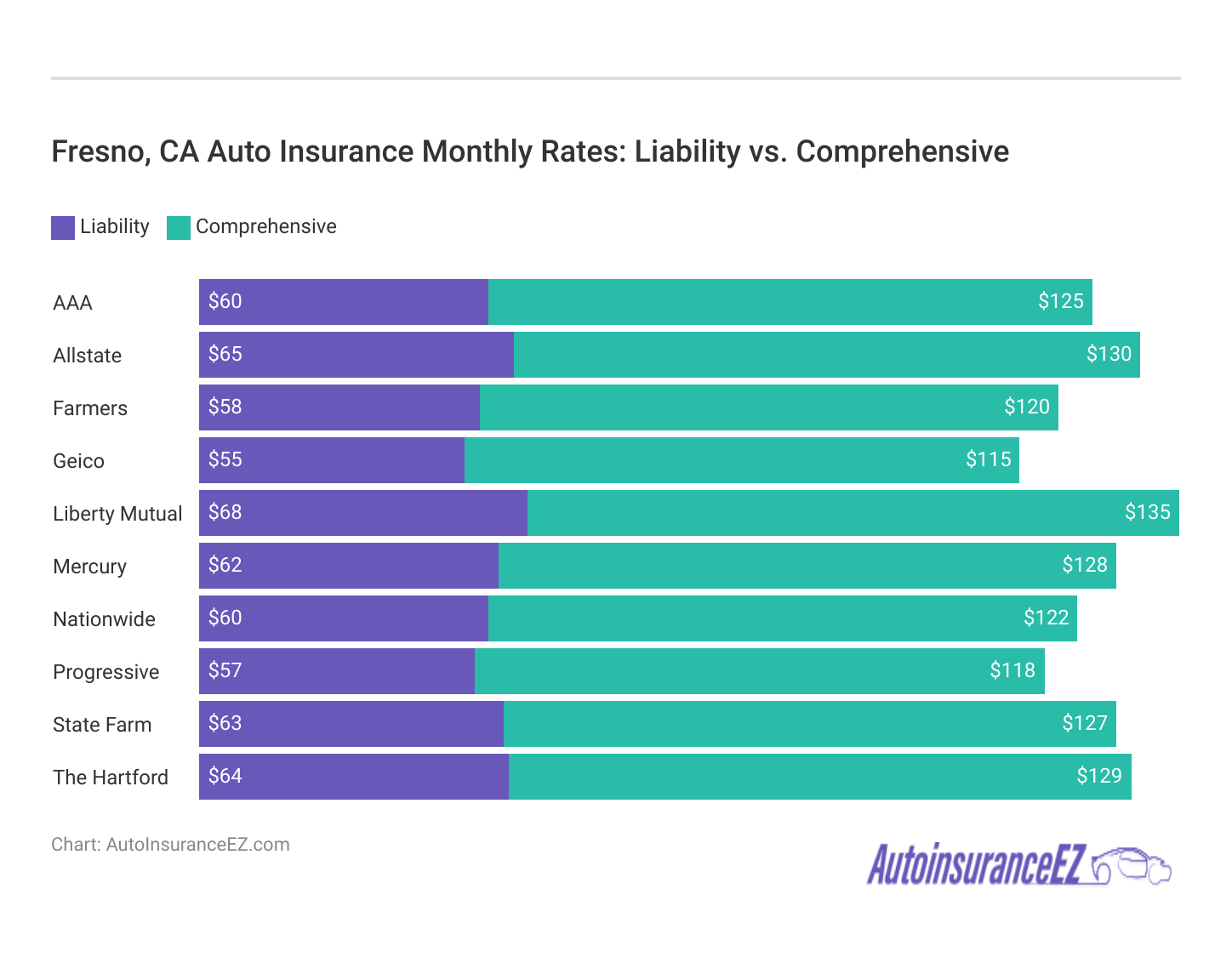

Car insurance in California can be expensive, with average drivers forking over $164 per month for coverage. Luckily, residents can get low-cost auto insurance for as tiny as $55/mo* in Fresno, CA. Keep reading to find great discounts near you.

Auto Insurance Discounts From the Top Providers in Fresno, CA

| Insurance Company | Available Discounts |

|---|---|

| Safe Driver, Multi-Policy, Early Signing, Good Student, Anti-Theft, Responsible Payer, New Car, Drivewise Program |

| Multi-Policy, Good Driver, Good Student, Multi-Car, Signal Program (Safe Driver), Anti-Theft, Homeowner, Affinity Group Discounts | |

| Multi-Policy, Good Driver, Military, Federal Employee, Good Student, Anti-Theft, Defensive Driving, Emergency Deployment, New Vehicle, Multi-Car | |

| Multi-Policy, Multi-Car, Good Student, Military, Safe Driver, Online Purchase, Homeowner, New Car, Anti-Theft, RightTrack (Safe Driving), Alternative Energy Vehicle Discount | |

| Multi-Policy, Good Driver, Good Student, Anti-Theft, AutoPay, E-Signature, Multi-Car, Homeowner, Occupation-Based Discounts |

| Safe Driver, Multi-Policy, Good Student, New Car, Loyalty, Anti-Theft, Mature Driver | |

| Multi-Policy, Good Student, SmartRide (Safe Driving), Accident-Free, Defensive Driving, Anti-Theft, Multi-Car, Homeowner, Paperless Billing, New Vehicle |

| Multi-Policy, Snapshot (Safe Driver), Homeowner, Multi-Car, Good Student, Continuous Insurance, Sign Online, Pay in Full, E-Signature, Paperless | |

| Multi-Policy, Safe Driver, Good Student, Drive Safe & Save Program, Multi-Car, Anti-Theft, Accident-Free, Defensive Driving, Homeowner | |

| Multi-Policy, Safe Driver, AARP Membership, Defensive Driving, Anti-Theft, Bundling, Vehicle Recovery Device |

As you can see in the table, the availability of Fresno, CA auto insurance discounts varies with different providers. Look at our top ten list above for the best Fresno, CA auto insurance; the price isn’t always the selling point, as their coverages can be more key to your needs.

Auto insurance carriers evaluate various aspects of insurance quotes, including driving violations, accident claims, occupation, years of driving experience, and theft protection devices. Also, keep in mind that premiums vary from provider to provider. To ensure you’re still charged the most favorable rate, compare Fresno, CA auto insurance quotes online with our comparison tool below.

Significant Factors in Cheap Auto Insurance in Fresno, California

Fresno, CA auto insurance companies consider several elements when crafting an auto insurance policy. Unfortunately, many of these elements are difficult or impossible to change, such as your credit score or the make/model of your car. Other elements your car insurance company may consider include:

Your ZIP code

Cheap auto insurance is usually found in cities with lower populations. Because fewer automobiles are on the road, you have fewer opportunities to get into a major car accident with another driver. The population of Fresno is 509,924, and the median household income is $40,179.

Fresno, CA Auto Insurance Monthly Rates by ZIP Code

| ZIP | Rates |

|---|---|

| 93701 | $125 |

| 93702 | $130 |

| 93703 | $120 |

| 93704 | $115 |

| 93705 | $125 |

| 93706 | $135 |

| 93710 | $120 |

| 93711 | $110 |

| 93720 | $105 |

| 93722 | $115 |

As you can see, your average auto insurance monthly rate can vary by $30 just by the ZIP code in different areas of Fresno. This can be due to crime rates in that area or the frequency of accidents.

Automotive Accidents

You will also see higher automobile insurance rates whenever you have frequent accidents in a given area because of the extra inherent danger of driving there. It must be fully covered if you’re wondering what happens in an accident, especially when another driver crashes your car.

Fatal Accidents in Fresno, CA

| Category | Count |

|---|---|

| Fatal Accidents | 150 |

| Fatal Crash Vehicles | 230 |

| DUI Fatal Crashes | 40 |

| Fatalities | 160 |

| Fatal Crash Individuals | 250 |

| Fatal Accident Pedestrians | 30 |

In recent years, fatal accident statistics for Fresno have been decreasing. However, it’s always a good idea to have the right coverage if something happens. Use our comparison tool below and enter your ZIP code for quick insurer quotes.

Auto Thefts in Fresno

Living in a large city (Especially one with a high crime rate) will increase your risk of being a victim of auto theft. If your general location has high theft rates and claims, you can expect to pay more for auto insurance to offset these costs.

In 2013, 4,057 vehicles were stolen in Fresno. Although this number has decreased over recent years, you might still want to consider adding an anti theft device for discount to your policy.

Your Credit Score

Luckily for Californians with low credit scores, your state is one of three in the country where it is illegal for automotive insurance companies to charge different rates based on credit scores.

Fresno, CA Report Card: Auto Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| Average Claim Size | B | Moderate repair costs |

| Weather-Related Risks | B | Fewer weather-related claims |

| Vehicle Theft Rate | C | Higher-than-average theft |

| Traffic Density | C | Moderate-to-high traffic |

| Uninsured Drivers Rate | C | Above-average uninsured rate |

However, be prepared to pay a little extra; your provider will likely charge everyone a slightly higher rate to offset their financial risk.

Your Age

Young drivers face a particularly harrowing burden when paying for their first auto insurance policy, especially if the car insurance is for teenagers. Because of their inexperience, they are significantly more likely to get into a severe accident. That’s why some companies charge them 2x-3x higher premiums than someone twice their age.

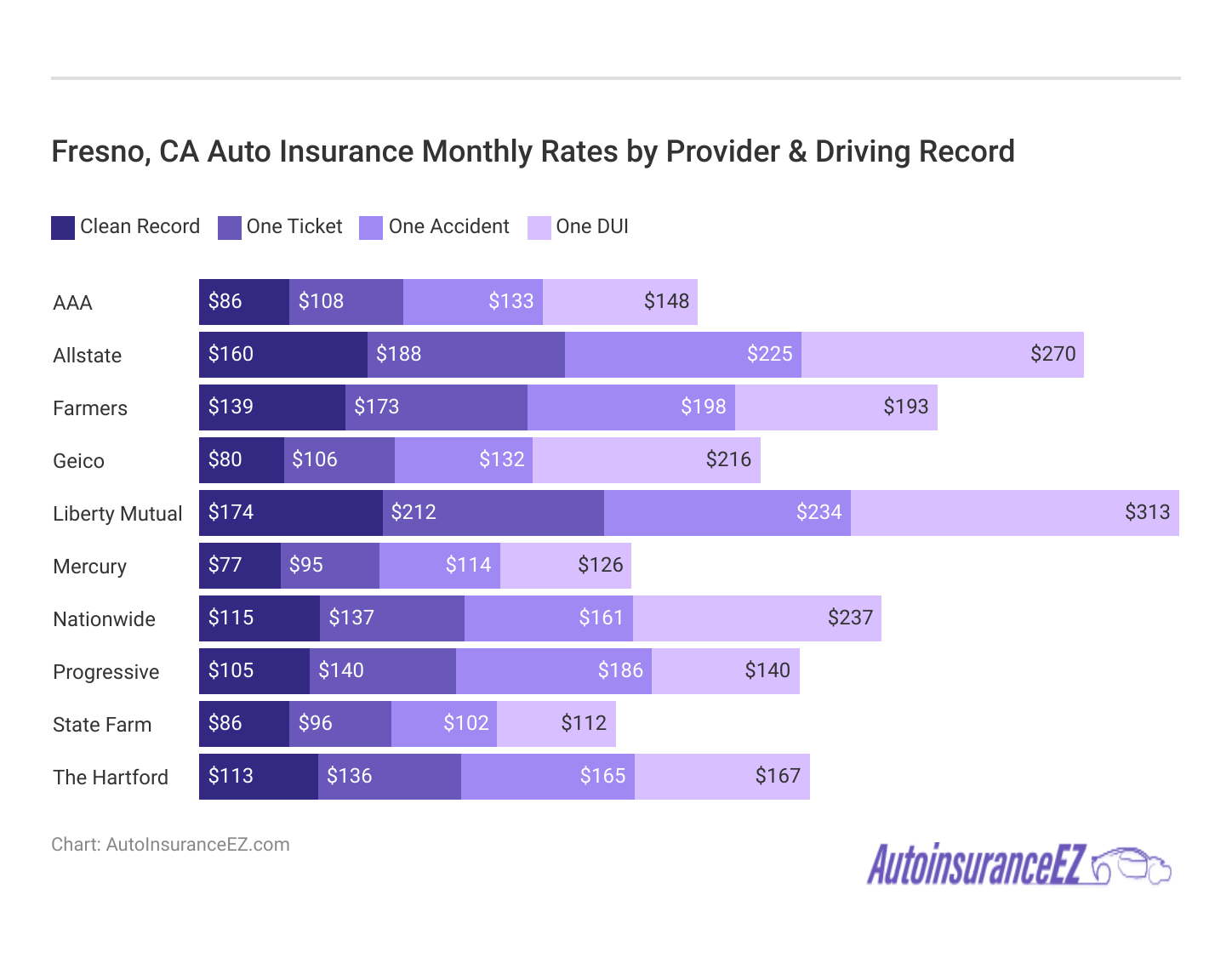

Your Driving Record

You might benefit from an “Accident Forgiveness” discount program if you have a slightly imperfect driving record. Accident Forgiveness can save you money if your provider is willing to ignore minor marks on your record, such as a speeding ticket or a minor accident.

However, more severe violations are more challenging to negotiate. In this case, you may need a new provider focusing more on high-risk drivers’ insurance.

Your Vehicle

The more expensive your vehicle is, the more insurance it will cost. After all, would you trust a luxury vehicle to an auto policy with only the State’s minimum amount of coverage? Probably not. If you make a big, luxurious vehicle purchase, ensure you have the money to cover it with comprehensive and collision auto insurance coverage.

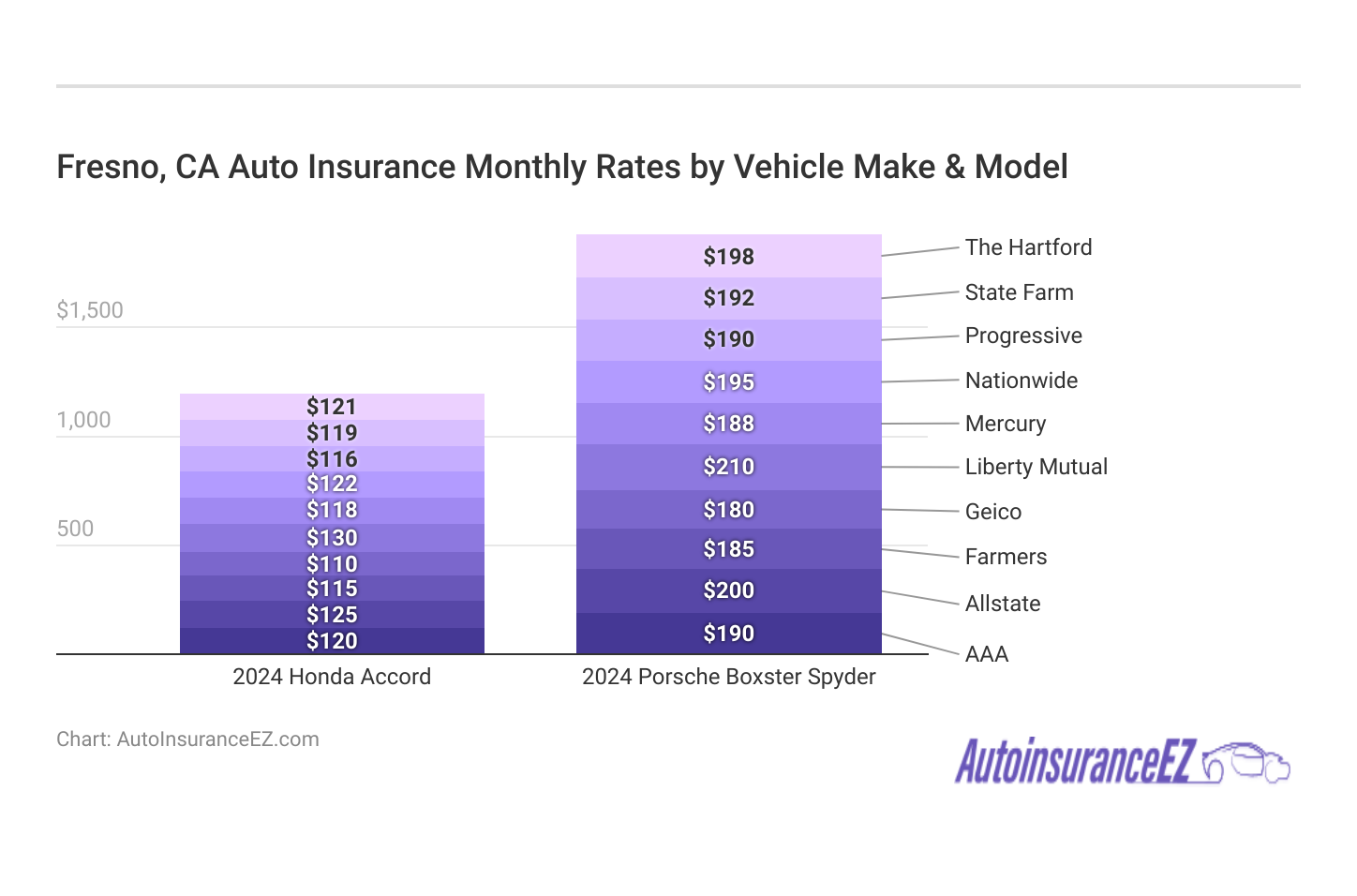

As you can see from the graph above, just comparing the Honda Accord with a Porsche Boxster Spyder, you’ll expect to be paying more with your insurance provider with the Porsche in Fresno, compared to driving a more everyday vehicle like the Honda Accord.

Minor Factors in Cheap Car Insurance in Fresno, California

You might not think much of the following attributes, but they can influence your rates too (in smaller ways):

Your Marital Status

Married couples have an advantage in auto insurance – bundled discounts. By bundling your insurance policy with your spouse, you can save on your premiums each month. The only catch is that you have to bundle with the same company.

Your Gender

Regardless of past misconceptions, the idea that one gender is safer behind the wheel than the other (and therefore deserves to pay less in premiums) is slowly fading away. Many companies don’t charge different premiums if gender is the only factor. It rarely makes more than a 1-2% difference for those that do.

Car insurance can significantly rise in price if your location is in a high theft area. Make your location more secure to reduce the quote price.

Scott W. Johnson Licensed Insurance Agent

Your Driving Distance to Work

If you work in Fresno, you can expect a commute of around 15-25 minutes per trip. Nearly 75% of residents prefer to drive their car to work, while anywhere from 5-18% may carpool on a given day.

Limiting your yearly mileage will certainly save you money on gas and reduce your chances of an accident, but it won’t help much in lowering your monthly premium. Even if you drive fewer miles than average, you’ll only reduce your rate by 2-3% at best. But if you can, avoid insuring your car, truck, or SUV as a business vehicle. That classification can cost you 10% or more in rate hikes.

Your Coverage and Deductibles

If you don’t have a big budget for your insurance premiums, try raising your deductible. The higher your deductible, the lower your monthly premiums will be. This means you can get a basic auto policy for a significantly reduced rate or better coverage for a relatively affordable Fresno, CA auto insurance.

Your Education

Partly because Fresno has such a young population, many drivers have not yet finished their high school education. Others have a high school diploma or some equivalent. But did you know that having a higher education can save you money on your car insurance rates? That’s right; forget having a fancy job or a high salary. Your overall education level gets you the most significant automotive insurance discounts.

Fresno, CA Auto Accident & Insurance Claim Statistics

| Factor | Value |

|---|---|

| Total Accidents Per Year | 12,000 |

| Total Claims Per Year | 9,000 |

| Average Claim Size | $3,500 |

| Percentage of Uninsured Drivers | 14% |

| Vehicle Theft Rate | 800 thefts/year |

| Traffic Density | High |

| Weather-Related Incidents | Moderate |

Determining your financial risk can be difficult or impossible for the typical insurance shopper. Insurance companies have an advantage over consumers due to their statistics and experiential knowledge. Learn what insurance companies don’t want you to know.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

The Best Auto Insurance in Fresno

The best auto insurance company for you in Fresno, California, will depend on your personal needs, driving history, and budget. Geico and Mercury are ideal for drivers looking for affordable rates, while State Farm and Allstate are great for those who want personalized service and agent support.

Read More: Geico auto insurance review

Progressive shines for high-risk drivers or those looking for pricing flexibility, and AAA is perfect for those who value roadside assistance and membership benefits. The Hartford stands out for older drivers, particularly AARP members.

It’s always recommended to compare quotes from multiple providers to find the best policy tailored to your unique situation. To do that, just enter your ZIP code below in our comparison tool to get the best quotes for your area.

Frequently Asked Questions

What are the minimum car insurance requirements in Fresno, California?

In California, the minimum car insurance has requirements that need to be at a 15/30/5. There also other optional choices:

- Bodily Injury Liability: $15,000 per person and $30,000 per accident.

- Property Damage Liability: $5,000.

- Uninsured Motorist Bodily Injury: Optional, but highly recommended.

- Medical Payments (MedPay): Optional but often included.

So check your insurance provider’s policies to find the best deal, and make sure to see if there are extra coverages available as minimum requirements are never enough.

Is car insurance mandatory in Fresno, California?

Yes, California law requires all drivers to carry car insurance to operate a vehicle legally. Proof of insurance is required if you’re pulled over or involved in an accident. To compare the insurance you need, check below with our comparison tool.

What is the average cost of car insurance in Fresno?

The average cost of car insurance in Fresno varies, but it typically ranges from $1,200 to $1,800 per year, depending on your driving record, vehicle type, coverage limits, and other factors.

What factors affect car insurance rates in Fresno?

Several factors can affect your car insurance rates, many that you wouldn’t even consider, some of the factors include:

- Driving History and Accident Record

- Vehicle Make, Model, and Year

- Age, Gender, and Marital Status

- Credit Scores Which Some Insurers Use

- Where You Live Within Fresno

- The Amount of Coverage You Choose

Always consider any factors in your life that can lower your car insurance rates as it’ll help you save costs in the long run.

Are there Discounts available for car insurance in Fresno?

Yes, many insurers offer discounts that can help reduce your car insurance policy quotes that are available to different types of drivers, including:

- Safe Driver Discounts

- Multi-Policy Discounts

- Good Student Discounts

- Defensive Driving Course Discounts

- Discounts are available for paying in full or setting up automatic payments

Always check with your insurance provider through any available agents to see what discounts you are eligible for.

What is uninsured/underinsured motorist coverage, and is it required?

Uninsured/Underinsured Motorist (UM/UIM) coverage protects you if a driver hits you without insurance or insufficient coverage. Although this coverage is not required in California, it is highly recommended because it provides financial protection.

What happens if I drive without insurance in Fresno?

Just like the rest of the country, driving without insurance in California is illegal. If you’re caught, you could face major consequences that not only affect your current situation but also your future insurance policies:

- Fines range from $100 to $200 for the first offense

- Suspension of your driver’s license

- Impoundment of your vehicle

- Higher insurance rates after reinstatement

This is why you should always have auto insurance, the best place to search is just below with our comparison tool to find quotes in seconds.

What should I do if I’m involved in an accident in Fresno?

If you’re involved in an accident, don’t panic, there very simple steps to follow if you keep a calm head and it’ll make the claims process alot easier:

- Stop and exchange information (driver’s license, insurance, and contact details)

- Call law enforcement to report the accident

- Take photos and document the scene

- Notify your insurance company as soon as possible

With all of this done, you’ll then be on your way to get easier claims from your insurance provider with peace of mind that your finances will be safe.

How can I lower my car insurance rates in Fresno?

To lower your car insurance rates, consider maintaining a clean driving record, choose a higher deductible from your auto insurance, ask about discounts and compare quotes from different insurers, bundle your car insurance with other types of insurance like home or renters, and take a defensive driving course.

Can I get car insurance with a suspended license in Fresno?

It can be challenging, but some insurers offer “SR-22” insurance, which is required to reinstate your driving privileges after a suspension. SR-22 is proof that you carry the minimum required coverage.