#1 – State Farm: Top Overall Pick

Pros

- Strong Local Agent Presence: State Farm is known for having a strong network of local agents who provide personalized service to customers looking for auto insurance in Decatur, Alabama.

- Affordable Rates: State Farm offers competitive rates, starting from as low as $36 per month, making it a solid choice for Decatur, AL, car insurance providers. Readers can check out the “State Farm Auto Insurance Review” for a comprehensive overview to see if it fits their needs.

- Bundling Discount: With a bundling discount of up to 17%, State Farm customers can save significantly on their auto insurance policies in Decatur, Alabama.

- High A.M. Best Rating: State Farm has an A.M. Best rating of B, reflecting its financial stability, a key factor when choosing Decatur, AL car insurance providers.

Cons

- Lower Discount Rate Compared to Competitors: State Farm’s bundling discount (17%) is lower than several competitors, impacting potential savings on auto insurance in Decatur, Alabama.

- Limited Online Policy Management Options: Some users may find State Farm’s online management tools less robust than others when searching for Decatur, AL car insurance providers.

- Not Always the Cheapest: While State Farm is affordable, it may not always offer the lowest premium for car insurance in Decatur, AL, compared to other providers.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#2 – Progressive: Best for Competitive Rates

Pros

- Competitive Rates: Progressive offers rates starting from $40 per month, making it a top choice for customers seeking auto insurance in Decatur, Alabama.

- High A.M. Best Rating: With an A.M. Best rating of A+, Progressive demonstrates strong financial health, a critical factor for those seeking Decatur, AL car insurance providers. For a detailed evaluation of their offerings, visit Progressive Auto Insurance Review.

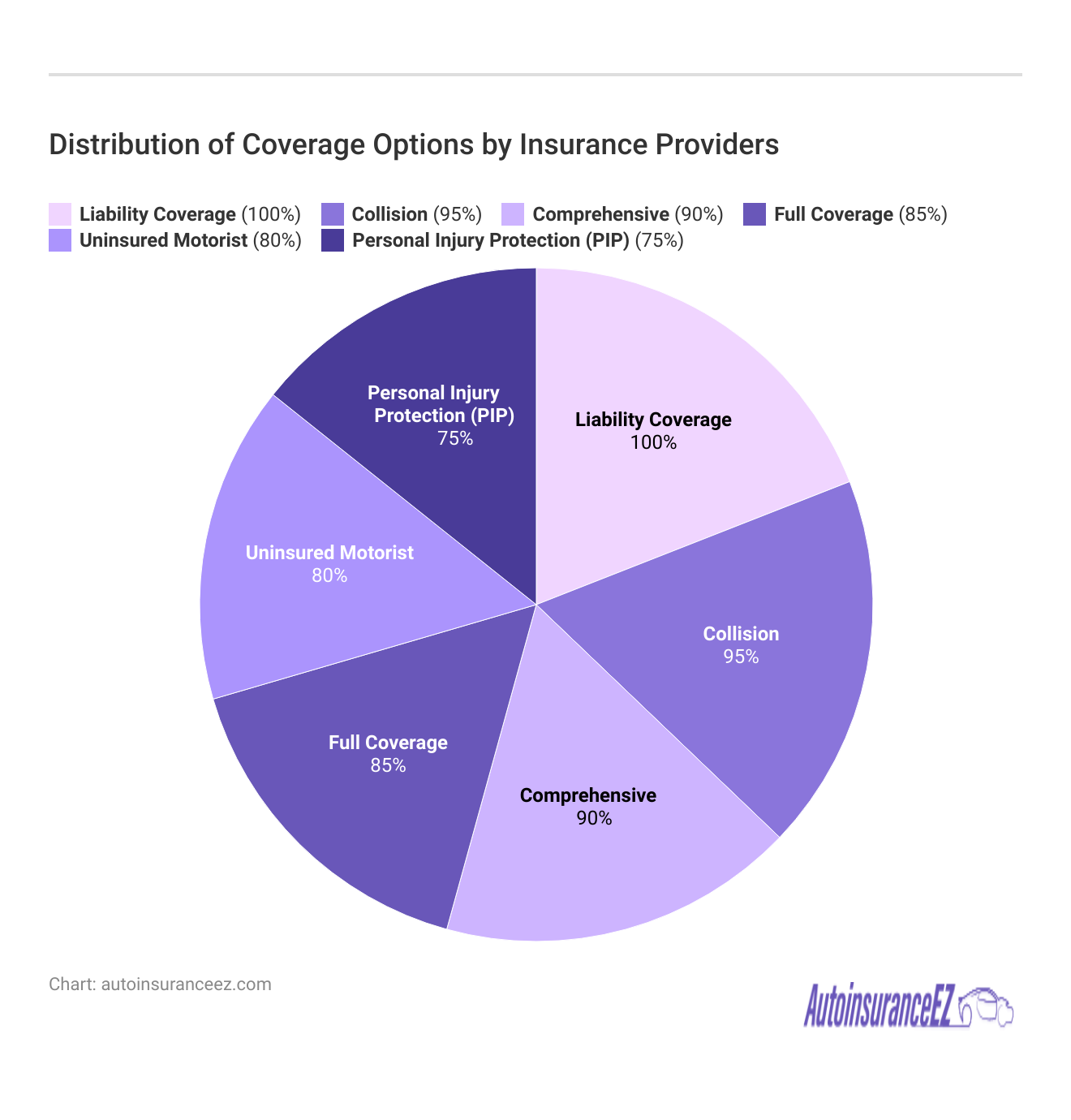

- Customizable Coverage Options: Progressive is known for flexible policy options, ideal for drivers wanting personalized auto insurance in Decatur, Alabama.

- Usage-Based Discount Programs: Progressive offers innovative discounts, such as Snapshot, which rewards safe driving, further enhancing its Decatur, AL car insurance provider offerings.

Cons

- Lower Bundling Discount: Progressive offers a 10% bundling discount, which is lower than many competitors providing auto insurance in Decatur, Alabama.

- Mixed Customer Service Reviews: Some customers report inconsistent service quality when dealing with claims or inquiries from their Decatur, AL car insurance providers.

- Higher Rates for High-Risk Drivers: Progressive may charge higher premiums for high-risk drivers compared to other providers of auto insurance in Decatur, Alabama.

#3 – Geico: Best for Affordable Policy

Pros

- Affordable Rates: Geico offers competitive rates starting from $42 per month, making it a top option for affordable auto insurance in Decatur, Alabama.

- Largest Bundling Discount: Geico provides a 25% bundling discount, one of the largest among competitors for Decatur, AL car insurance providers. For more details, read the “Geico Auto Insurance Review” to see how it stacks up.

- A++ A.M. Best Rating: Geico holds an A++ rating from A.M. Best, reflecting excellent financial strength, which is crucial when selecting auto insurance in Decatur, Alabama.

- User-Friendly Online Platform: Geico’s highly-rated online tools make managing policies and filing claims easy for Decatur, AL car insurance providers’ customers.

Cons

- Limited Local Agents: Geico relies primarily on online and phone support, which may not appeal to those seeking in-person assistance for their auto insurance in Decatur, Alabama.

- Less Flexibility in Coverage Customization: Geico’s coverage options may be less customizable compared to other Decatur, AL car insurance providers.

- Higher Premiums for Some Driver Profiles: Geico may not always offer the lowest rates for drivers with poor credit or driving records when shopping for auto insurance in Decatur, Alabama.

#4 – Allstate: Best for Accident Forgiveness

Pros

- Accident Forgiveness Program: Allstate offers an accident forgiveness feature, which is a great benefit for customers seeking auto insurance in Decatur, Alabama who want to avoid premium hikes after an accident.

- Generous Bundling Discount: With a 25% bundling discount, Allstate allows significant savings for those bundling policies for Decatur, AL car insurance providers.

- Strong Financial Health: Allstate holds an A+ A.M. Best rating, providing peace of mind for customers looking for reliable auto insurance in Decatur, Alabama.

- Safe Driving Rewards: Allstate offers a safe driving rewards program, further incentivizing safe driving habits for Decatur, AL car insurance providers policyholders. For more information on how this program could benefit you, read our Allstate Drivewise Program Review.

Cons

- Higher Premiums for Younger Drivers: Allstate tends to have higher premiums for younger or inexperienced drivers seeking auto insurance in Decatur, Alabama.

- Mixed Customer Service Reviews: Some customers report inconsistent service experiences, particularly when handling claims for their Decatur, AL car insurance providers.

- Higher Costs for Full Coverage: Allstate’s full coverage premiums may be higher than some competitors offering auto insurance in Decatur, Alabama.