Cheap Auto Insurance in Alabama for 2025 (Lower Rates With These 10 Providers)

The best providers of cheap auto insurance in Alabama are Geico, Nationwide, and American Family, with rates starting at $32 per month. Geico offers low rates and discounts, Nationwide features vanishing deductibles, and American Family rewards safe driving, making them ideal for auto insurance in Alabama.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

UPDATED: Apr 13, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage in Alabama

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 3,071 reviews

3,071 reviewsCompany Facts

Min. Coverage in Alabama

A.M. Best Rating

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviews 2,235 reviews

2,235 reviewsCompany Facts

Min. Coverage in Alabama

A.M. Best Rating

Complaint Level

Pros & Cons

2,235 reviews

2,235 reviewsGeico is the overall best choice for cheap auto insurance in Alabama because of its very low rates combined with the full availability of auto insurance discounts.

Among other top contenders for cheap auto insurance in Alabama are Nationwide and American Family. They offer competitive pricing and exclusive rewards, including various combinations of safe-driving incentives and vanishing deductibles. With prices starting at $32 a month, these carriers stand out in terms of affordable Alabama auto insurance rates, balancing value with coverage.

Our Top 10 Company Picks: Cheap Auto Insurance in Alabama

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $32 | A++ | Good Student | Geico | |

| #2 | $34 | A+ | Vanishing Deductibles | Nationwide |

| #3 | $38 | A | Safe-Driving Rewards | American Family | |

| #4 | $39 | A+ | Bundle Policies | Allstate | |

| #5 | $40 | B | Affordable Rates | State Farm | |

| #6 | $41 | A+ | Multi-Policy Discounts | Progressive | |

| #7 | $47 | A | Competitive Discounts | Safeco | |

| #8 | $48 | A | Great Add-ons | Farmers | |

| #9 | $50 | A | High-Risk Coverage | The General | |

| #10 | $58 | A | Accident Forgiveness | Liberty Mutual |

Whether you seek liability-only or full protection, these providers combine low prices with generous discounts to help you save money. Enter your ZIP code above to compare quotes from top-rated Alabama auto insurance companies.

- Cheap auto insurance in Alabama starts at just $32/month

- Affordable coverage options meet diverse driver needs

- Geico leads with top savings and discounts for drivers in Alabama

#1 – Geico: Top Overall Pick

Pros

- Monthly Premiums: According to a Geico auto insurance review, Geico’s monthly rates start at $32, offering affordable auto insurance in Alabama.

- Accessible Online Tools: Alabama customers can easily manage their transactions, such as filing claims and paying bills, in the online app.

- Good Student Incentives: Students in Alabama can earn discounts with good grades, reducing auto insurance costs.

Cons

- Limited Coverage: Geico may not offer the best rates for high-risk drivers, making it less ideal for high-risk auto insurance in Alabama.

- Limited In-Person Agents: Since transactions are primarily made online, some drivers find it unappealing that Geico has limited in-person agents.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#2 – Nationwide: Best for Vanishing Deductibles

Pros

- Vanishing Deductible Feature: Nationwide reduces your deductible by $8 monthly, making it a unique feature for auto insurance in Alabama.

- Solid Financial Backing: With an A+ rating from A.M. Best, Nationwide offers reliable vehicle insurance coverage for Alabama drivers.

- Competitive Pricing: According to a Nationwide auto insurance review, monthly premiums start at $34, making auto insurance affordable in Alabama.

Cons

- Discount Options: Nationwide offers fewer discounts than other Alabama auto insurers, making auto insurance in Alabama less flexible.

- Online Tools: The digital tools are not as intuitive as some competitors’ for Alabama auto insurance policyholders.

#3 – American Family: Best for Safe-Driving Rewards

Pros

- Reward Program: American Family offers discounts for safe driving, making auto insurance quotes in Alabama more affordable.

- Family-focused Savings: Bundle auto and home insurance for discounts on auto insurance in Alabama.

- Reasonable Monthly Rates: Premiums begin at $38, offering affordable auto insurance for Alabama residents.

Cons

- Limited State Availability: American Family auto insurance review shows that it is not available in all parts of Alabama for vehicle insurance coverage.

- Full coverage: Comprehensive coverage can be pricier than other auto insurance options in Alabama.

#4 – Allstate: Best for Bundling Policies

Pros

- Bundling Policies: According to an Allstate auto insurance review, you can save on auto insurance in Alabama by bundling your auto insurance with other policies.

- Accident Forgiveness Benefits: Protects Alabama drivers from premium increases after their first accident with vehicle insurance coverage.

- Strong Financial Foundation: Allstate holds an A+ rating from A.M. Best, ensuring reliable auto insurance for Alabama drivers.

Cons

- Higher Initial Premiums: Starting rates at $39 may be higher for some Alabama auto insurance policyholders.

- Limited Policy Customization: Allstate’s coverage options are less flexible for auto insurance drivers in Alabama.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#5 – State Farm: Best for Affordable Rates

Pros

- Competitive Pricing: Rates starting at $40 offer affordable auto insurance coverage for drivers in Alabama.

- Coverage Options: Drivers in Alabama can tailor their vehicle insurance to meet specific needs with State Farm.

- Excellent Support: Known for strong customer service for Alabama auto insurance policyholders, as highlighted in a State Farm auto insurance review.

Cons

- Lower Financial Strength: State Farm’s B rating from A.M. Best suggests lower financial stability than competitors in Alabama auto insurance.

- Discounts are Limited: There are fewer discount opportunities for auto insurance in Alabama drivers than other providers.

#6 – Progressive: Best for Multi-policy Discounts

Pros

- Bundling Policies: Progressive offers savings when bundling home or renters insurance for auto insurance in Alabama.

- Snapshot Program: The Snapshot program tracks driving habits for potential Alabama auto insurance discounts.

- Financially Stable Provider: Progressive has an A+ rating from A.M. Best and provides solid vehicle insurance coverage in Alabama.

Cons

- Higher Average Premiums: Progressive’s auto insurance rates in Alabama might be higher, at $41 per month, and even higher for high-risk drivers.

- Customer Service: According to a Progressive auto insurance review, some Alabama drivers report poor experiences with Progressive’s claims service.

#7 – Safeco: Best for Competitive Discounts

Pros

- Discount Options: Safeco offers discounts for safe driving, bundling, and more, reducing costs for auto insurance in Alabama.

- Strong Customer Support: Safeco provides excellent service to Alabama auto insurance policyholders.

- Affordable Pricing: Monthly premiums starting at $47 make Safeco a budget-friendly option for vehicle insurance in Alabama.

Cons

- Availability is Limited: A Safeco auto insurance review reveals that Safeco may not offer auto insurance in all areas of Alabama.

- Fewer Coverage Options: Safeco offers less extensive coverage than other auto insurance providers in Alabama.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#8 – Farmers: Best for Great Add-ons

Pros

- Valuable Add-ons Available: Farmers auto insurance review highlights useful add-ons, such as roadside assistance, for auto insurance in Alabama.

- Monthly Premiums: Starting at $48, Farmers offers affordable vehicle insurance in Alabama.

- Good Customer Service: Farmers is recognized for providing excellent service to Alabama auto insurance policyholders.

Cons

- Higher premiums: Young drivers in Alabama may face higher rates with Farmers for auto insurance.

- Limited Discounts: There are fewer discount options for auto insurance for Alabama drivers than for other companies.

- Claim Process Issue: Some customers said the processing and communication during high-demand times are slower.

#9 – The General: Best for High-risk Coverage

Pros

- Tailored for High-risk Drivers: The General specializes in auto insurance in Alabama for high-risk drivers.

- Affordable Premiums: Rates starting at $50 make it an affordable option for high-risk auto insurance in Alabama.

- Simple Online Process: The General auto insurance review highlights an easy process for getting auto insurance quotes in Alabama.

Cons

- Limited Coverage Options: The General’s coverage is basic, with fewer choices than other providers for vehicle insurance in Alabama.

- Higher Premiums: The General may charge higher rates for low-risk drivers seeking affordable auto insurance in Alabama.

#10 – Liberty Mutual: Best for Accident Forgiveness

Pros

- Accident Forgiveness Program: Liberty Mutual helps Alabama drivers avoid premium hikes after their first accident with vehicle insurance coverage.

- Strong Customer Service: Known for providing excellent customer support for Alabama auto insurance policyholders.

- Financial Stability: Liberty Mutual has an A rating from A.M. Best and offers reliable auto insurance in Alabama, as highlighted in the Liberty Mutual auto insurance review.

Cons

- Higher Premiums: Monthly rates starting at $58 may be expensive compared to other auto insurance options in Alabama.

- Fewer Discounts: Liberty Mutual offers fewer discounts than competitors for auto insurance in Alabama.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Alabama Car Insurance Costs by Provider

If you’re comparing auto insurance rates in Alabama, this chart gives you a clear picture of what to expect from top providers. Geico stands out with the lowest rates—$32 for minimum coverage and $89 for full coverage car insurance. On the other hand, Liberty Mutual is the priciest, charging $58 for minimum and $162 for full.

Alabama Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $39 | $108 | |

| $38 | $105 | |

| $48 | $133 | |

| $32 | $89 | |

| $58 | $162 |

| $34 | $96 |

| $41 | $112 | |

| $47 | $130 | |

| $40 | $108 | |

| $50 | $138 |

Most other companies fall somewhere in between, with American Family, Allstate, and Nationwide offering decent mid-range options for car insurance in Alabama. It’s a good reminder to shop around—there’s a big difference in price depending on who you go with.

How Age and Gender Affect Auto Insurance Rates in Alabama

Looking at this rate breakdown, it’s clear that your age, gender, and marital status make a big difference in what you’ll pay for car insurance in Alabama. For example, USAA consistently offers the cheapest car insurance in Alabama across all groups, especially for married drivers.

Male vs. Female Monthly Auto Insurance Rates in Alabama

| Insurance Company | Married 35-year-old female | Married 35-year-old male | Married 60-year-old female | Married 60-year-old male | Single 17-year-old female | Single 17-year-old male | Single 25-year-old female | Single 25-year-old male |

|---|---|---|---|---|---|---|---|---|

| $167 | $159 | $151 | $154 | $576 | $619 | $187 | $192 | |

| $171 | $170 | $162 | $167 | $449 | $440 | $181 | $168 | |

| $199 | $198 | $178 | $189 | $768 | $790 | $227 | $236 | |

| $145 | $147 | $132 | $137 | $380 | $490 | $161 | $180 |

| $201 | $189 | $165 | $176 | $823 | $919 | $235 | $250 | |

| $257 | $278 | $211 | $236 | $938 | $1,043 | $274 | $292 | |

| $245 | $245 | $221 | $221 | $736 | $922 | $276 | $318 | |

| $125 | $127 | $117 | $117 | $670 | $1,053 | $119 | $136 | |

| $110 | $112 | $103 | $101 | $328 | $364 | $144 | $155 |

On the other hand, companies like Safeco and State Farm charge significantly higher premiums, particularly for young male drivers—those rates shoot past $1,000 for 17-year-olds. If you’re in your 30s or 60s and married, you’ll generally find much lower rates across all providers, with Travelers and Nationwide offering some of the better deals.

Ratings of the Largest Auto Insurance Companies in Alabama

When you compare auto insurance companies in Alabama, top providers like Allstate, Geico, Progressive, and USAA boast strong AM Best ratings of A+ or A++. Geico leads with a 10.07% market share and a 74.78% loss ratio. Allstate follows at 10.40% market share and a 49.83% loss ratio. Progressive (7.14%) and USAA (6.99%) also maintain strong financial standings.

Auto Insurance Discounts From the Top Providers in Alabama

| Insurance Company | Available Discounts |

|---|---|

| Signal app (safe driver), multi-policy, good student, pay in full, alternative fuel | |

| New car replacement, multi-policy, homeowner, military, accident-free, paperless billing | |

| SmartRide program, accident-free, multi-policy, easy pay sign-up, good student | |

| Good driver, multi-policy, military, good student, anti-theft, defensive driving | |

| Multi-policy, accident prevention, anti-theft, safe driver, homeowner |

| Snapshot program, multi-policy, continuous coverage, safe driver, teen driver |

| Steer Clear (young drivers), multi-policy, good student, safe vehicle, accident-free | |

| Good driver, multi-vehicle, military, homeowner, prior insurance, continuous coverage | |

| Safe driving, multi-policy, early signing, new car, anti-theft, responsible payer | |

| Loyalty, early bird, low mileage, teen driver, auto safety equipment, good student |

Liberty Mutual and Farmers are also stable, though Farmers has an NR (Not Rated) status. If you’re searching for cheap auto insurance in Alabama online, many companies offer discounts that help lower your premiums. Allstate provides discounts for safe driving, multi-policy bundling, and alternative fuel vehicles. Geico offers discounts for good drivers, military members, and anti-theft devices.

Alabama AM Best Ratings

| A+ | $32,264 | 10.60% | 50.10% | |

| A- | $7,468 | 2.60% | 65.20% | |

| B | $7,119 | 2.40% | 53.40% | |

| A++ | $31,191 | 10.20% | 75.00% | |

| A | $7,334 | 2.50% | 68.20% |

| A+ | $8,408 | 2.80% | 67.50% |

| A+ | $23,427 | 7.30% | 60.00% | |

| A++ | $20,708 | 7.10% | 79.20% |

Through its Steer Clear program, Progressive offers discounts for young drivers, while State Farm, Safeco, and Nationwide offer discounts for safe driving, multi-policy, and continuous coverage. Understanding Alabama’s auto insurance requirements and mandates from its insurers is pretty basic.

Geico is the best choice for affordable auto insurance in Alabama, with rates starting as low as $32 per month.

Jeff Root Licensed Insurance Agent

The average cost of auto insurance in Alabama depends on the kind of provider, your driving record, and the kind of insurance coverage you select. It’s important to balance a competitive price and solid coverage to ensure you meet state requirements while protecting yourself financially.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Auto Insurance Claims in Alabama and Their Average Costs

If you’re wondering what kind of claims are most common in Alabama, this breakdown makes it clear. Collision claims lead the pack at 31%, with an average cost of $3,200, followed closely by property damage liability at 27%, costing about $2,700 per claim—factors that can directly impact your rates for cheap auto insurance in Alabama.

5 Most Common Auto Insurance Claims in Alabama

| Claim Type | Portion of Claims | Cost per Claim |

|---|---|---|

| Collision | 31% | $3,200 |

| Property Damage Liability | 27% | $2,700 |

| Bodily Injury Liability | 21% | $14,000 |

| Comprehensive | 13% | $1,150 |

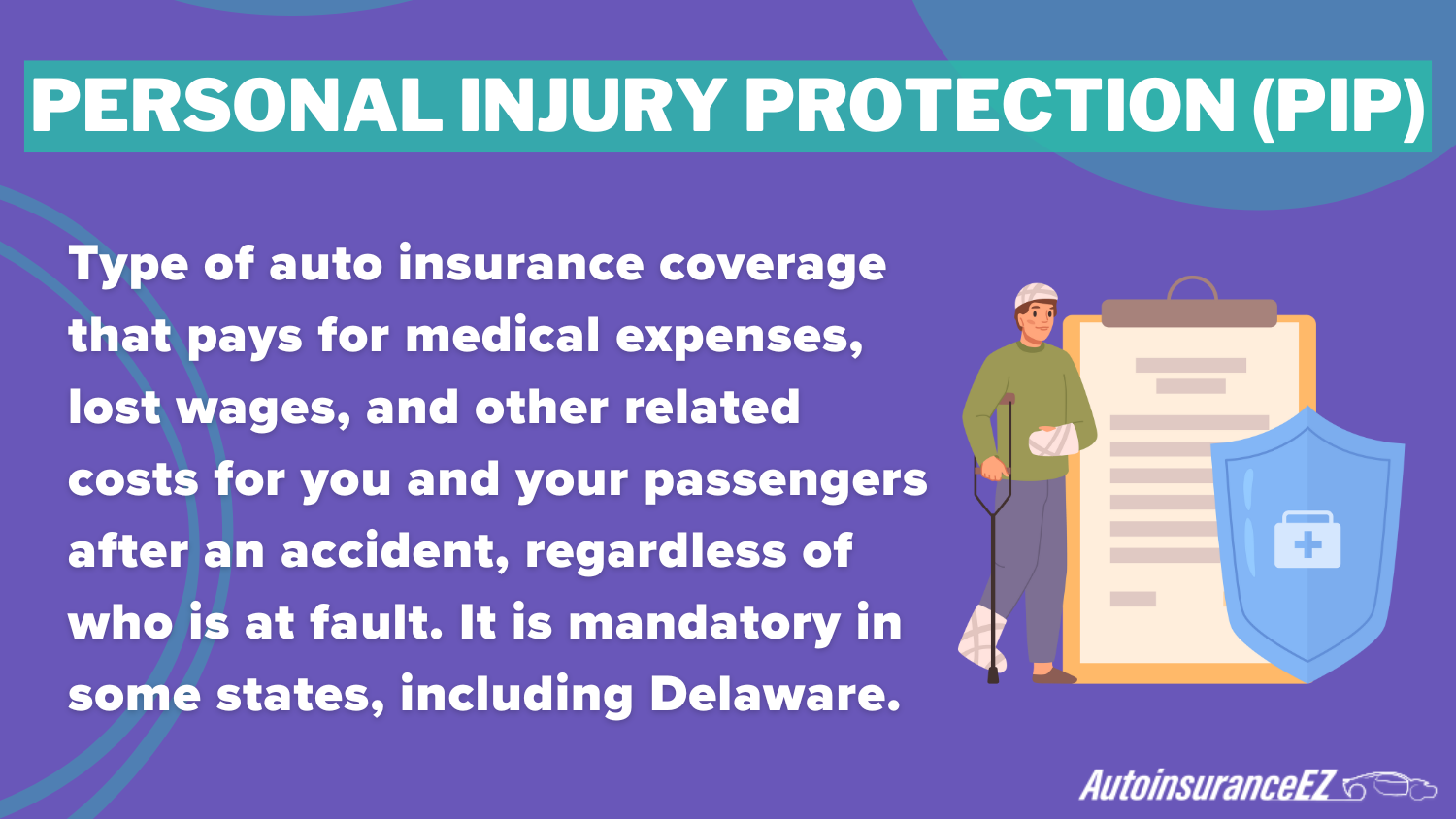

| Personal Injury Protection | 8% | $2,100 |

Bodily injury liability only accounts for 21% of claims, but it’s by far the most expensive, averaging $14,000 each. Even though comprehensive and personal injury protection claims happen less often, they still add up with costs of $1,150 and $2,100.

These numbers really show why having the right coverage matters—it’s not just about frequency, it’s about how costly things get when something goes wrong.

Annual Auto Accidents and Insurance Claims by City in Alabama

Looking at accident and claim numbers across Alabama cities, Birmingham clearly has the highest volume, over 11,000 accidents and nearly 9,000 claims a year. That’s a big jump compared to places like Tuscaloosa, which sees just 3,200 accidents and 2,600 claims. This makes it even more important to shop for affordable car insurance in Alabama based on your location.

Alabama Accidents & Claims per Year by City

| City | Accidents per Year | Claims per Year |

|---|---|---|

| Birmingham | $11,200 | $8,900 |

| Huntsville | $5,400 | $4,200 |

| Mobile | $5,000 | $3,900 |

| Montgomery | $6,000 | $4,500 |

| Tuscaloosa | $3,200 | $2,600 |

Cities like Huntsville, Mobile, and Montgomery fall in the middle, but it’s easy to see how location plays a major role in your insurance risk—and ultimately, what you pay. Areas with more car accidents and auto claims, like Birmingham, tend to have higher premiums due to the increased likelihood of filing a claim.

Alabama Auto Insurance Premiums: Ratings by Category

This report card gives a quick breakdown of how Alabama stacks up when it comes to auto insurance. The state scores high marks for affordability and discount availability, which means most drivers can find lower rates and extra savings by understanding how to lower their auto insurance premiums.

Alabama Report Card: Auto Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| Premium Affordability | A | Alabama offers lower-than-average premiums for most drivers. |

| Discount Availability | A | Many insurers provide a wide range of discounts. |

| Claims Process | B | Most customers report positive claims experiences with major providers. |

| Customer Satisfaction | B | Feedback is generally positive, with few complaints statewide. |

| Coverage Options | B | Standard options available; some providers lack advanced customizations. |

Claims handling and customer satisfaction are solid, earning B grades—so while experiences are mostly good, there’s still room for improvement. Coverage options also get a B, suggesting that while standard policies are available, you might not find as many advanced or customized choices compared to other states.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Quirky Alabama Laws and Auto Insurance Essentials

Celebrating a University of Alabama Football National Championship often spans large revelry, passionate fans, and a lot of confetti in the showers. However, in Mobile, throwing confetti is actually against the law.

This is just one of many quirky Alabama auto insurance laws, alongside strange rules like prohibiting throwing salt on railroad tracks and wearing a fake mustache that provokes laughter in a church. While these outdated laws are unlikely to affect daily life, they reflect the unique legal landscape in Alabama.

As for driving, you should know Alabama auto insurance requirements so that you are obeying the law. From Fault vs. No-Fault auto insurance laws to seatbelt usage and speed limit rules, knowledge in such areas is a must. Whether you’re looking for coverage for your vehicle or just trying to stay compliant, finding the best and cheapest auto insurance in Alabama is key to staying safe and legal on the road.

Required Forms of Financial Responsibility in Alabama

Meeting Alabama’s financial responsibility laws is essential for all drivers and vehicle owners. To drive legally, you must carry at least the minimum auto insurance required in Alabama.

Failure to comply might result in fines, license suspension, or even registration revocation, so it’s better to understand the obligations first and find affordable coverage, such as cheap auto insurance in Phenix City, AL.

- Understand the Requirement: Alabama law requires all drivers and vehicle owners to meet the Minimum Auto Insurance Requirements, which ensure financial responsibility on the road.

- Obtain Proof of Insurance: Proof of compliance can include a current insurance policy, a valid insurance binder, liability insurance ID cards, or a photo of your coverage on a smartphone.

- Keep Proof Accessible: Your insurance details should be available in hard copy or electronic form to meet the law’s standard of being easily accessible.

- Know the Penalties: Failure to meet the Alabama minimum auto insurance requirements can lead to hefty fines, suspended licenses, revoked registrations, and costly reinstatement fees.

- Find Affordable Coverage: Explore options for cheap auto insurance in Phenix City, AL, to stay compliant without exceeding your budget; this can help you manage the average cost of auto insurance in Alabama, which varies based on location and driving history.

Following these steps can prevent legal problems and ensure that you effectively and affordably comply with Alabama’s financial responsibility laws.

Discover Affordable Auto Insurance Coverage in Alabama

Geico, Nationwide, and American Family are the lead providers for those who dream of cheap insurance in Alabama: affordable auto insurance coverage starts at $32 per month, with many discounts for safe driving and bundling policies. Additionally, premiums are influenced by age, gender, and marital status, with young male drivers generally facing higher costs.

If you live in Alabama, bundling home and auto policies or maintaining a clean driving record can lead to noticeable savings on your car insurance.

Dorothea Hudson Insurance and Finance Writer

Now keep in mind, Alabama law requires minimum coverage and not meeting the standards can bring on a fine or suspension of your license. Comparing Alabama car insurance quotes is essential if you want to get the best charge for your dollar and still have enough coverage.

Enter your ZIP code below to get tailored options and meet state regulations.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

What are the Alabama car insurance requirements for drivers?

To legally drive in Alabama, you must carry a minimum of 25/50/25 liability coverage. That includes $25,000 for bodily injury per person, $50,000 per accident, and $25,000 for property damage. Meeting these Alabama car insurance requirements helps you avoid fines and license suspension.

How can I get accurate auto insurance quotes in Alabama?

To get the most accurate auto insurance quotes in Alabama, compare rates by ZIP code, driver history, and coverage level. Online tools let you see estimates from providers like Geico, Nationwide, and American Family, with some starting as low as $32 per month.

What are the options for car insurance for high-risk drivers in Alabama?

Car insurance for high-risk drivers in Alabama, such as those with DUIs or multiple accidents, often costs more. Providers like The General and Dairyland specialize in these policies. Monthly rates can exceed $150, depending on the severity of your record.

What Alabama car insurance laws should I know about?

Alabama car insurance laws require all registered vehicles to maintain liability coverage. The state also uses an Online Insurance Verification System (OIVS) to monitor compliance. Driving without insurance can result in a $500 fine and possible registration suspension.

What are the Alabama minimum car insurance requirements?

The Alabama minimum car insurance requirements include 25/50/25 liability coverage. These limits may not fully cover damages in a serious accident, so consider increasing them or adding uninsured motorist coverage to protect your finances.

Why should I compare auto insurance in Alabama before buying?

When you compare auto insurance in Alabama, you’ll see wide differences in rates and discounts. For example, Geico may offer a good driver discount, while Nationwide rewards safe driving with vanishing deductibles. Comparing saves you money and helps match your needs.

What is the average cost of car insurance in Alabama?

The average cost of car insurance in Alabama is around $1,200 annually or about $100 per month. Your rate may vary depending on your ZIP code, age, driving record, and the company you choose.

Who offers cheap liability car insurance in Alabama?

If you’re only meeting state minimums, Geico and American Family offer cheap liability car insurance in Alabama, starting at around $32 to $48 per month. Liability-only policies are ideal for older vehicles or budget-conscious drivers.

Where can I find cheap full coverage car insurance in Alabama?

For cheap full coverage car insurance in Alabama, consider Geico, Progressive, or State Farm. Rates typically range from $89 to $162 per month, depending on your age, vehicle type, and credit score. Full coverage includes liability, collision, and comprehensive auto insurance.

How do I get car insurance quotes in Alabama quickly?

You can get car insurance quotes in Alabama in minutes through online comparison tools. Enter your ZIP code and basic details to see side-by-side pricing from top companies. This helps you find the best deal based on your driver profile.

What is the cheapest car insurance in Alabama right now?

The cheapest car insurance in Alabama often comes from Geico or Nationwide, with liability-only policies starting at $32 per month. Prices vary, so compare rates based on your ZIP code and driving history to find the lowest premium.

Is temporary car insurance available in Alabama?

Yes, you can get temporary car insurance in Alabama through select providers. Policies typically last 7 to 30 days and are useful for rental cars, short-term vehicle use, or out-of-town drivers, but make sure the coverage meets Alabama’s minimum car insurance requirements to stay legal on the road.

Are there low-income car insurance programs in Alabama?

While Alabama doesn’t offer a formal state-sponsored program, some insurers cater to drivers with budget limits. If you need low-income car insurance in Alabama, look for companies providing monthly payments, usage-based coverage, or minimum liability plans.

Find your cheapest auto insurance quotes by entering your ZIP code into our free comparison tool.

Which are the best cheap auto insurance companies in Alabama?

The top cheap auto insurance companies in Alabama include Geico, Nationwide, and American Family. They combine low monthly rates with discounts for safe driving, bundling, and low-mileage vehicles. All three are rated A or better by A.M. Best.

What does the Alabama windshield replacement law say?

The Alabama windshield replacement law doesn’t require insurers to waive your deductible, even if you have full coverage. While most comprehensive policies do let auto insurance cover a cracked windshield, you could still be on the hook for the cost unless your plan specifically includes full glass coverage.