Best Raleigh, NC Auto Insurance in 2025 (Top 10 Companies Ranked)

State Farm, Geico, and Nationwide provide the best Raleigh, NC auto insurance with an affordable monthly starting rate of $18. State Farm leads for its comprehensive coverage and services. Geico is renowned for its efficient digital tools, and Nationwide simplifies insurance management for bundled policies.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

18,154 reviews

18,154 reviewsCompany Facts

Full Coverage in Raleigh NC

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in Raleigh NC

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 3,071 reviews

3,071 reviewsCompany Facts

Full Coverage in Raleigh NC

A.M. Best Rating

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviewsThe best Raleigh, NC auto insurance companies are State Farm, Geico, and Nationwide, with a monthly starting rate of $18. State Farm outshines with its comprehensive coverage and services while maintaining reasonable rates across the different driver profiles.

Geico excels in its competitive offers and efficient digital tools, and Nationwide has streamlined policy management for bundling policies. The table below lists more insurers in Raleigh, North Carolina, for your preference.

Our Top 10 Company Picks: Best Raleigh, NC Auto Insurance

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 17% | A++ | Local Agents | State Farm | |

| #2 | 25% | A++ | Competitive Rates | Geico | |

| #3 | 20% | A+ | Simple Claims | Nationwide |

| #4 | 10% | A+ | Usage-Based Discounts | Progressive | |

| #5 | 25% | A | Car Replacement | Liberty Mutual |

| #6 | 15% | B | Member Discounts | Farm Bureau | |

| #7 | 25% | A+ | Drivewise Discount | Allstate | |

| #8 | 13% | A++ | Accident Forgiveness | Travelers | |

| #9 | 25% | A+ | Rate-Lock Features | Erie |

| #10 | 10% | A+ | Safe-Driving Courses | National General |

This 10-minute auto insurance buying guide ensures you will find the lowest-priced insurance premiums where you live and the best policy for you and your car.

- State Farm, Geico, and Nationwide lead the quality insurers in Raleigh, NC

- Get bundling, safe driver discount, and more to lower your monthly premiums

- Affordable premiums from the top companies only start at $18 a month

To get free car insurance quotes in Raleigh now, key your local ZIP code into the quote box.

#1 – State Farm: Top Overall Pick

Pros

- Competitive Pricing: State Farm offers reasonable rates for all drivers with different profiles, especially high-risk drivers.

- Comprehensive Coverage and Services: Besides basic coverage, it offers theft, vandalism, animal collision, fire and explosion, and more with its banking partnership to enhance the value proposition.

- Strong Local Presence: Policyholders can access local agents to facilitate their insurance needs and concerns. Check its local offices in State Farm auto insurance review.

Cons

- Higher Deductible Cost: Opting for lower deductibles can raise premiums and high deductibles mostly cost $1,000 or more.

- Slower Claims Processing: While State Farm has stable claims processing, some customers report longer wait times for claims payouts.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#2 – Geico: Best for Competitive Rates

Pros

- Competitive Offer: With a starting rate of $24 a month and discounts such as military & federal employees, good drivers, and student discounts, Geico has the most affordable offer in Raleigh.

- Efficient Digital Experience: Raleigh drivers can access bill payments, digital ID cards, and other advanced features in the mobile app. Learn all the features in the Geico auto insurance review.

- Additional Coverage Options: Geico offers roadside assistance like jump-starts and lockout services, and mechanical breakdown insurance for extended protection.

Cons

- Limited Local Agents: Geico operates mainly as a direct-to-consumer insurance company with fewer local agents than other insurers.

- Fewer Customization Options: Geico lacks some customization add-ons like gap insurance.

#3 – Nationwide: Best for Simple Claims

Pros

- On Your Side Claims Service: Nationwide has dedicated agents in claims support to guide policyholders in their concerns during annual consultations.

- Simplified Insurance Management: Bundling policies enable streamlined management of unified billing and coordinated coverage. Learn this in the Nationwide auto insurance review.

- Localized Expertise in Raleigh: Lcoal agents provide real-time assistance to assess their needs immediately while ensuring they participate in local events to know more about Raleigh.

Cons

- Bundling Restrictions: Although bundling policies are available, older homes and high-value properties may not be included in the bundling coverage to get the best rates.

- Higher Base Rates: Unlike other car insurance company in Raleigh, Nationwide is not the most affordable with a higher base rate.

#4 – Progressive: Best for Usage-Based Discounts

Pros

- Personalized Insurance Rates: The safe driving behaviors like mileage and braking determine the monthly rates. Learn about this to have lower premiums in Progressive auto insurance review.

- Extensive Coverage Offers: For drivers with diverse needs, Progressive offers standard coverage to lease/loan payoff, rental car reimbursement, and roadside assistance to policyholders.

- Specialized Policy for High-Risk Drivers: Progressive handles the filing of SR-22 for high-risk drivers and insuring them despite their previous violations and accidents.

Cons

- Expensive Premiums to Some Drivers: Though Progressive helps with SR-22 filing, drivers with violation records will pay higher premiums.

- Snapshot Limitation: Drivers could get more rewards with Snapshot for their safe driving habits, but it is not offered in North Carolina.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Best for Car Replacement

Pros

- Superior Replacement Benefits: Liberty Mutual compensates one model year newer when a new car is totaled. Learn about this policy in the Liberty Mutual auto insurance review.

- Tailored Coverage for North Carolina: North Carolina drivers can personalize their policies according to their preferences, ensuring drivers do not pay for what they cannot use.

- Additional Coverage Opportunities: Beyond the standard policies, it also offers comprehensive collision and better car replacement.

Cons

- Higher Premiums: Better car replacement coverage is an add-on, so it is not included in your standard policies, which is an additional bill on top of the base rate.

- Claims Complaints: There have been reported delays in customers’ claims and disputes and a complex procedure for total loss evaluation.

#6 – Farm Bureau: Best for Member Discounts

Pros

- Membership Perks and Benefits: Company members can enjoy benefits like travel discounts and vehicle purchase savings. The Farm Bureau auto insurance review lists all the perks.

- Localized Service: Local agents engage in the community to ensure that the company’s services align with the community’s needs.

- Affordable Auto Insurance Rates: Farm Bureau offers lower rates than major insurers like Allstate, with a monthly starting rate of only $30.

Cons

- Membership Fee: To avail of the discounts exclusively, you must pay a $25 annual fee to become a Farm Bureau auto insurance member.

- Fewer Digital Tools: Unlike major insurers, Farm Bureau’s online has limited features that agents are needed when filing a claim or changing a policy.

#7 – Allstate: Best for Drivewise Discount

Pros

- Drivewise Program: This program allows drivers to save up to 40% on safe driving habits while monitoring risky behaviors will prevent the rate from increasing.

- Stackable Discount Opportunities: While enrolling in Drivewise gets you a discount, it is stackable with other savings options like bundling and a new car discount.

- Strong Financial Stability: Allstate has been in business for nearly 90 years and has an A+ rate from A.M. Best. Check the reliability of its claims through the Allstate auto insurance review.

Cons

- Technical Issues of Drivewise: Some drivers reported that the app made mistakes in tracking their behaviors and listing hard braking events.

- Higher Fees for Policy Change: Adjustments to the terms and plans, such as adding or removing a vehicle, entail a service fee that other insurers do not charge.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#8 – Travelers: Best for Accident Forgiveness

Pros

- Accident Forgiveness Program: This program prevents an increase after one accident and one violation. Learn about the premier responsible driver plan in Travelers auto insurance review.

- Customization Coverage Options: It offers more coverage options like gap, rental reimbursement, and roadside assistance.

- IntelliDrive Rewards: This enables safe drivers to save up to 30% for drivers with safe driving behaviors that potentially lower the premiums.

Cons

- Accident Forgiveness Cost: This is not automatically added to the plan unless you purchase it with an additional cost on top of your policy.

- Eligibility Requirements: The feature may exclude other drivers as it requires a clean driving record for many years.

#9 – Erie: Best for Rate-Lock Features

Pros

- Rate Lock Feature: This feature allows rates to freeze and does not change regardless of factors like claims and traffic violations.

- State-Specific Affordability: The rates are consistently low for policyholders and even lower for those with clean records, making it budget-friendly for long-term customers.

- More Perks and Discounts: It offers many savings options, such as a car safety feature discount, to make premiums even more affordable. Learn about these options in the Erie auto insurance review.

Cons

- Rate Lock Feature Exclusions: Some drivers with many history of DUIs and other violations may not qualify for the rate lock perks.

- Policy Change Can Reset Rates: A policy change, such as adding or removing a driver’s or vehicle switch, can cause adjustments in locked rates.

#10 – National General: Best for Safe-Driving Courses

Pros

- DynamicDrive Program: A UBI program that provides safe driving tips to drivers offering 10% off upon enrollment and further discounts over time.

- Recent Rate Reductions in North Carolina: The National General implemented a rate decrease as of August 12, 2024, lowering the quotes.

- Defensive Driving Course Discount: Drivers who complete the defensive driving course can also receive 10% off. Check all the ways you can save on National Gerenal auto insurance.

Cons

- Rate Reduction Not Guaranteed: The recent rate decrease implementation does not guarantee that all policyholders will see a lower monthly rate.

- Discounts Vary: The actual discount depends on individual driving habits. Some may see lesser discounts on their bills.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Best Raleigh, NC Auto Insurance Monthly Rates

The basic step in selecting the best Raleigh, NC auto insurance is looking for the price that you can afford while still getting the best quality of service. Here are the top 10 insurance companies’ monthly premiums for you to check out.

Auto Insurance Monthly Rates in Raleigh, NC by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $58 | $142 | |

| $27 | $71 |

| $30 | $78 | |

| $24 | $68 | |

| $33 | $84 |

| $34 | $85 | |

| $36 | $92 |

| $18 | $41 | |

| $28 | $73 | |

| $31 | $79 |

In Raleigh, Progressive and Geico offer the most affordable policies right now. However, that rate doesn’t reflect their customer service reputation or imply a smooth and simple claims processing service. Ensure you aren’t choosing your provider based on low rates alone—or you might regret it.

Read more: Geico vs. Progressive: Best Auto Insurance for 2025

Top Providers and Discounts for the Raleigh, NC Auto Insurance

Throughout North Carolina, the average monthly rate for most drivers can be as high as $88. However, Raleigh residents may be entitled to pay as low as $28/mo for their insurance policies. Keep reading to learn about car insurance discounts for you.

Auto Insurance Discounts From Top Raleigh, NC Providers

| Insurance Company | Accident-Free | Bundling | Defensive Driving | Good Student | Safe Driver |

|---|---|---|---|---|---|

| 25% | 25% | 18% | 18% | 18% | |

| 25% | 25% | 5% | 15% | 15% |

| 10% | 15% | 10% | 10% | 10% | |

| 22% | 25% | 15% | 26% | 15% | |

| 20% | 25% | 10% | 12% | 20% |

| 10% | 10% | 10% | 15% | 10% | |

| 20% | 20% | 12% | 12% | 12% |

| 10% | 10% | 31% | 10% | 10% | |

| 17% | 17% | 20% | 20% | 20% | |

| 13% | 13% | 17% | 17% | 17% |

This list of savings options is meant to lower your monthly premiums. You can pick as many as you like to maximize this discount program. Though the discount amount varies by auto insurance company in Raleigh, it is good to learn the rules and inclusions of each.

Geico and Erie are among the insurers offering 25% bundling savings while offering good student, anti-theft, and safe driver discounts which are valuable options for you.

Brad Larson Licensed Insurance Agent

To get the most savings, carefully review each discount’s eligibility requirements. Some insurers allow you to stack multiple discounts, while others cap the total amount you can save. Always compare car insurance in Raleigh offers to maximize your benefits.

Best Raleigh, NC Auto Insurance

State Farm leads the insurers in Raleigh, North Carolina, mainly because of its wide network of local agents and comprehensive coverage for vandalism, theft, animal collision, fire, and explosion, among other things. Moreover, regarding monthly rates, State Farm’s competitive premiums start at $28.

State Farm has had avid customers for years. Still, as we suggest, it is good to shop around occasionally and check other valuable options and rates, as policies, premiums, and even the plan package change over time.

Raleigh is one of the prestigious members of the “Research Triangle,” a series of three neighboring cities renowned for their research universities.

- Fun fact: Raleigh is #22 on the list of “Top 100 fastest growing cities from 2000 to 2008 (pop. 50,000+).”

Additionally, the abundance of natural parks, lakes, and agreeable climate make Raleigh a haven for lovers of the outdoors.

Read more: Cheap Auto Insurance in North Carolina for 2025

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Auto Insurance Coverage Requirements in North Carolina

You might think that it is a bad idea to carry minimum auto insurance coverage; however, driving legally around Raleigh, North Carolina, requires 50/100/50. The table below shows this in detail.

Auto Insurance Minimum Coverage Requirements in Raleigh, NC

| Coverage | Limits |

|---|---|

| Bodily Injury Liability | $50,000 per person / $100,000 per accident |

| Property Damage Liability | $50,000 per accident |

| Uninsured/Underinsured Motorist Bodily Injury | $50,000 per person / $100,000 per accident |

| Uninsured/Underinsured Motorist Property Damage | $50,000 per accident |

While purchasing the bare minimum coverage might seem like an affordable car insurance option in Raleigh, NC, remember that your provider will only pay out claims if, for whatever reason, the incident was deemed your fault (a.k.a. you are held “liable”).

In addition, if you are physically harmed by an uninsured motorist. If someone steals or vandals your car or an act of nature causes severe damage, you must pay 100% of the repair/replacement costs.

Major Car Insurance Factors in Raleigh, NC

Auto insurance providers evaluate different elements when figuring out insurance prices, among them marital status, ZIP code, type of vehicle owned, education, and business use of the vehicle. Moreover, premiums can vary from one company to another. To determine if you are still being charged the best premium, assess cheap car insurance in Raleigh, NC.

The moment your car insurance in Raleigh, NC, prepares to come up with your insurance plan, they take several specifics into consideration. Many of these, like your real age or maybe your precise region, are difficult to vary. These factors affecting car insurance rates are discussed in detail below.

Your ZIP Code

Your auto insurance rates can vary depending on your home’s location. Large cities generally have higher rates since more car owners on the streets increase the chance of a car accident! As of 2023, Raleigh’s total population is 482,295, and the common family income is $82,424.

Auto Insurance Monthly Rates in Raleigh, NC by ZIP Code

| ZIP | Monthly Rates |

|---|---|

| 27601 | $155 |

| 27603 | $150 |

| 27604 | $156 |

| 27605 | $132 |

| 27606 | $131 |

| 27607 | $130 |

| 27608 | $133 |

| 27609 | $154 |

| 27610 | $153 |

| 27612 | $137 |

| 27613 | $140 |

| 27614 | $139 |

| 27615 | $138 |

| 27616 | $152 |

| 27617 | $136 |

| 27695 | $135 |

Auto insurance rates by state and by ZIP code differ. The highest monthly rate is $156 (ZIP code 27604), and the lowest is $130 (ZIP code 27607). This variation suggests that location-based risk factors like crime rates and traffic conditions influence insurance pricing.

Your Credit Score

Drivers with excellent credit can enjoy exceptionally low rates, while poor credit motorists can pay twice as much (or more). The lower your credit score, the more it will adversely influence your monthly premiums. Check how your credit score affects your monthly premiums in the table below.

Auto Insurance Monthly Rates in Raleigh, NC by Credit Score

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $252 | $315 | $378 | |

| $167 | $209 | $251 |

| $180 | $225 | $270 | |

| $190 | $238 | $285 | |

| $210 | $263 | $315 |

| $220 | $275 | $330 | |

| $200 | $250 | $300 |

| $230 | $288 | $345 | |

| $175 | $219 | $263 | |

| $195 | $244 | $293 |

Erie, State Farm, and Geico are the insurers that offer lower costs for drivers with good, fair, and bad credit. However, the difference between good and fair credit to bad credit is a hefty sum when you could have affordable rates only if you did not have poor credit. This should remind you that maintaining good credit is a good aspect of keeping your insurance rates low.

Your Age

Are you trying to insure a young teenage driver? Well, it will likely be a difficult and expensive endeavor. This is because accident statistics are highest amongst young and inexperienced teenage drivers.

Teens face higher insurance rates, but parents can reduce costs by choosing a higher deductible, enrolling in usage-based programs, and emphasizing safe driving habits.

Heidi Mertlich Licensed Insurance Agent

However, good grades can qualify them for a good student discount, and driver’s education courses can earn even further discounts.

Auto Insurance Monthly Rates in Raleigh, NC by Provider, Age, & Gender

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 34 Female | Age: 34 Male |

|---|---|---|---|---|

| $603 | $655 | $150 | $155 | |

| $580 | $630 | $145 | $150 |

| $590 | $640 | $148 | $153 | |

| $570 | $620 | $140 | $145 | |

| $610 | $660 | $155 | $160 |

| $604 | $652 | $154 | $156 | |

| $592 | $642 | $149 | $154 |

| $580 | $634 | $146 | $152 | |

| $571 | $622 | $143 | $148 | |

| $600 | $650 | $152 | $159 |

The rates of car insurance in Raleigh are significantly higher for 17-year-olds than 34-year-olds, with male teens facing the highest premiums across all insurers. Among the 34-year-olds, Geico offers the most affordable rates, while Liberty Mutual and National General tend to have slightly higher premiums.

Your Driving Record

For drivers with a few minor citations on their record, some providers might offer you an “Accident Forgiveness” discount, which is a great way to lower your monthly rate if a few speeding tickets are the only reason your premiums are so high.

Auto Insurance Monthly Rates in Raleigh, NC by Provider and Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $157 | $190 | $163 | $897 | |

| $84 | $89 | $82 | $410 |

| $73 | $90 | $82 | $397 | |

| $85 | $104 | $115 | $409 | |

| $72 | $90 | $82 | $397 |

| $67 | $85 | $78 | $389 | |

| $112 | $79 | $87 | $659 |

| $100 | $138 | $127 | $401 | |

| $77 | $94 | $86 | $452 | |

| $53 | $70 | $65 | $350 |

Travelers offer the lowest rates across all categories, while Allstate has the highest premium, especially for drivers with a DUI. Thus, choosing the right insurer based on individual driving history is important to save on premiums.

Read more: How Traffic Violations Increase Car Insurance Rates

Your Vehicle

Luxury vehicles aren’t just more expensive to insure because of their base cost (which means repairs or replacements will be more expensive, too). Take a look at this table that presents rates for expensive vehicles in 2024.

As a result, you’ll also have to pay more for comprehensive and collision coverage for luxury vehicles. After all, most people wouldn’t risk carrying minimum mandatory coverage alone on an expensive, fancy car.

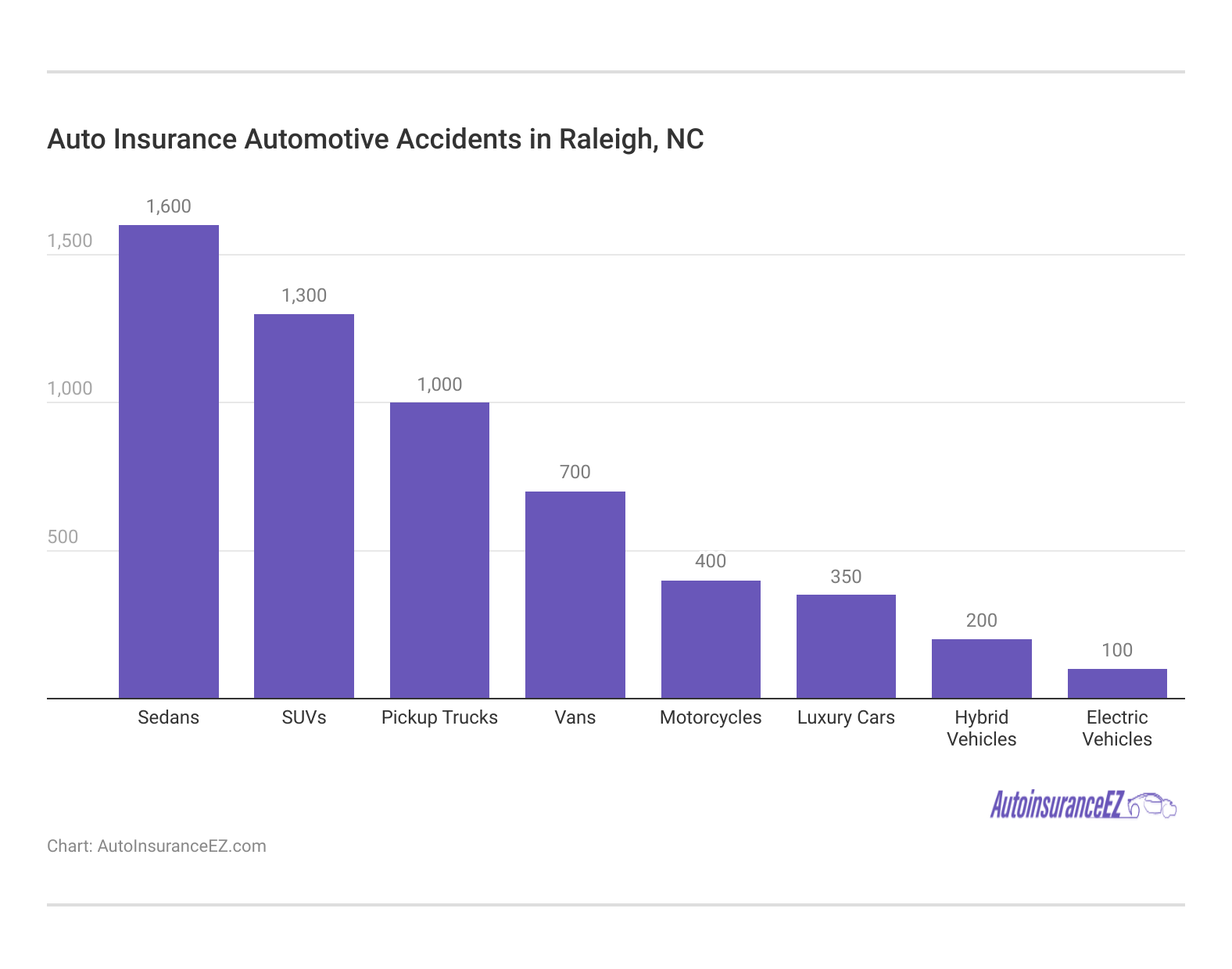

Automotive Accidents

Regarding automotive insurance, a high or low rate of serious accidents in your area can automatically raise or lower your premiums. Take a look at the statistics for Raleigh below.

Sedans, SUVs, and Pickup trucks are mostly involved in accidents in Raleigh, North Carolina. Check and consult your insurance provider to see how much this impacts your premiums. Be careful on the roads; read the ultimate road safety guide.

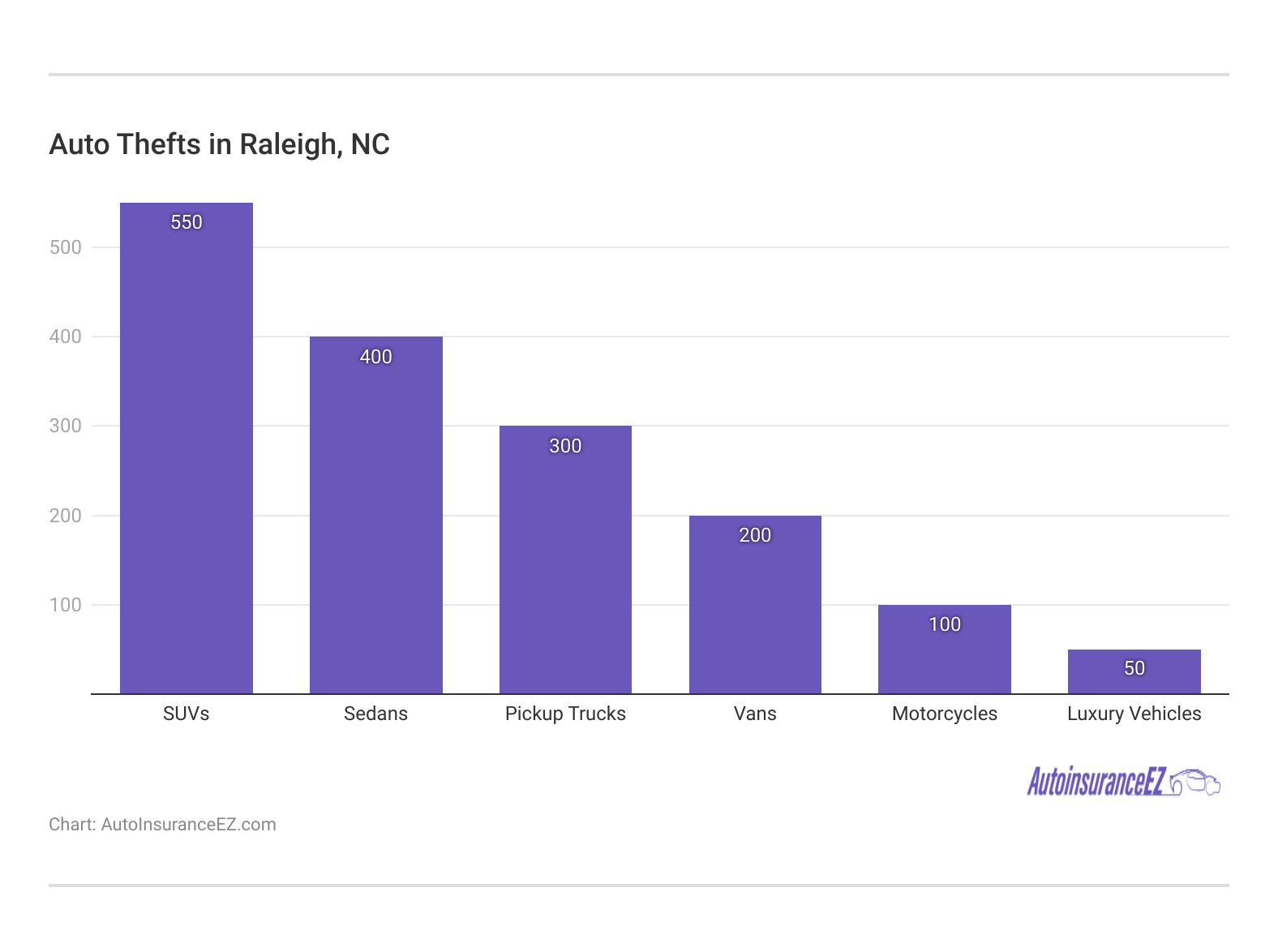

Auto Thefts in Raleigh

Automobile theft can be a significant problem, especially in densely populated cities. If your location and/or vehicle model puts you at a higher risk for theft, you could have trouble acquiring low-cost car insurance.

The total number of stolen vehicles in 2023 was 1,892 in Raleigh, which is so high that the government organized an Auto Theft Task Force in June 2024. This is a reminder that you should check your auto insurance in Raleigh and ensure that it covers auto theft. You can also be protected and discounted through their programs, like anti-theft device discounts.

Minor Car Insurance Factors in Raleigh, NC

While these factors below won’t necessarily make as big of an impact, you can take a look at them for potential savings:

- Your Marital Status: When you and your spouse bundle your policies together, you can get some serious savings. And if you have other forms of insurance – such as homeowners’ or renters’ insurance – you can save even more by bundling those as well.

- Your Gender: All other factors being equal, insurance companies are becoming increasingly rare in charging drastically different rates based on gender alone. Some companies still charge a 2-3% premium difference, but whether that affects males or females depends entirely on the company. Many providers don’t charge a difference based on gender at all.

- Your Driving Distance to Work: Average commute times in Raleigh typically last between 16 and 18 minutes, but some drivers may spend up to 25 minutes behind the wheel. 76% of drivers will likely take their vehicle to work, while 12% will likely carpool.

- Your Coverage and Deductibles: Raising your deductibles for more coverage is another to save in the long run.

Would you like more than the bare minimum coverage on your vehicle but don’t want to pay the full coverage insurance premiums? Talk to your provider about raising your deductible. Yes, it can increase your expenses in the short term if you need to file a claim, but you can save each month over the long term.

While Raleigh provides many opportunities in the great outdoors, residents can still count on spending a good amount of time behind the wheel. Some drivers worry about how many miles they drive yearly or whether they commute for work/school or pleasure.

But the truth is that these factors rarely influence your rate by more than a few percentage points. Whether or not you drive a business vehicle makes a big difference to the tune of 10-12% per month.

Education in Raleigh, NC

Raleigh is a fairly well-educated city, with more than 30% of residents having achieved a bachelor’s degree. If you are a part of this group, you could be in store for some big savings; college graduates are more likely to be offered lower auto insurance in Raleigh, NC than most drivers. 16% of Raleigh residents have also successfully completed their high school diploma.

There are more than a dozen different opportunities to further your education if you live in Raleigh. North Carolina State University is the city’s crown jewel, educating nearly 30,000 students yearly. Additionally, the Baptist church is affiliated with several different universities, including Meredith College and Peace College. And if you’d rather spend less time earning a degree, you can look into Wake Technical Community College.

Discovering inexpensive automobile insurance can certainly become a problem. There’s lots of important information, and understanding how insurance agencies examine your potential risk could be complicated.

But try not to permit the wrong insurance agency to talk you into purchasing the wrong policy. Thinking of finding out more about Raleigh? Click here!

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

How We Conducted Our Car Insurance Analysis

We calculated our average rate based on the following metrics: a married, 34-year-old male with good credit, a 12-month history of maintaining auto insurance, a clean driving record, and his own home. Miles driven annually were based on the national average. The average rate was also calculated based on a financed 2015 Honda Accord with a pre-installed anti-theft device.

To get the best auto insurance rates in Raleigh, compare quotes regularly, take advantage of discounts, and consider bundling policies for maximum savings.

Tim Bain Licensed Insurance Agent

This concludes our guide on the best Raleigh, NC auto insurance. We hope this has been helpful in your quest to find or even switch to the best policy, coverage, and cheap auto insurance. Want to get started with your car insurance quotes in Raleigh? Enter your ZIP code using our online tool for free.

Frequently Asked Questions

How much is car insurance in Raleigh, NC?

Affordable car insurance in Raleigh, NC, starts at the minimum coverage rate of $18, which is considered one of the lowest in the U.S.

Which company is best for car insurance?

State Farm offers the best car insurance in Raleigh, North Carolina. It offers competitive rates and coverage, and it has an extensive network of local agents.

Which insurance cover is best for a car?

The best car insurance coverage depends on your needs, but for the best security, it is recommended that you get a full comprehensive and collision policy.

What is the cheapest full coverage car insurance in NC?

The cheapest full coverage in NC is offered by Progressive for only $41 monthly.

Who has the best car insurance in North Carolina?

State Farm, Geico, and Nationwide offer the best car insurance in North Carolina.

What is the basic car insurance in NC?

The basic car insurance in NC to drive legally around the state is liability insurance of 30/60/25.

Which type of vehicle insurance is best?

Vehicle insurance is based on your needs, so whichever is best suited to your car is the best insurance for you. However, remember that it is recommended that you get full coverage for full protection.

Who is the most popular car insurance company?

The most popular insurance companies are State Farm, Geico, and Nationwide.

Is North Carolina car insurance high?

North Carolina car insurance rates are not high, but they are among the lowest in the US, with a monthly starting rate of $18. Use our free online tool to check your quote now.

How to lower car insurance in NC?

There are many ways how to lower your car insurance premiums in NC, as insurers offer car insurance discount options, such as bundling, safe driver, good student, and good driver.