Best Fort Collins, CO Auto Insurance in 2025 (Top 10 Companies Ranked)

American Family, State Farm, and Farmers provide the best Fort Collins, CO, auto insurance with starting rates of $46 per month. American Family is ideal for excellent customer satisfaction, State Farm for affordable prices, and Farmers for customizable policies in Fort Collins, CO.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Jan 28, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

2,235 reviews

2,235 reviewsCompany Facts

Full Coverage in Fort Collins CO

A.M. Best

Complaint Level

Pros & Cons

2,235 reviews

2,235 reviews 18,154 reviews

18,154 reviewsCompany Facts

Full Coverage in Fort Collins CO

A.M. Best

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 3,072 reviews

3,072 reviewsCompany Facts

Full Coverage in Fort Collins CO

A.M. Best

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviewsGet the best Fort Collins, CO auto insurance with American Family, State Farm, and Farmers, starting at $46 monthly.

American Family ranks as the top choice for customer satisfaction, while State Farm provides competitive pricing, and Farmers excels in customizable coverage options. Each provides comprehensive coverage suited to Fort Collins residents, including incentives such as safe-driving discounts and various policy options.

Our Top 10 Company Picks: Best Fort Collins, CO Auto Insurance

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | A | Customer Service | American Family | |

| #2 | 17% | B | Competitive Rates | State Farm | |

| #3 | 20% | A | Customizable Policies | Farmers | |

| #4 | 25% | A+ | Safe-Driving Discounts | Allstate | |

| #5 | 25% | A++ | Online Tools | Geico | |

| #6 | 10% | A+ | Snapshot Program | Progressive | |

| #7 | 25% | A | Competitive Premiums | Liberty Mutual |

| #8 | 20% | A+ | Coverage Flexibility | Nationwide |

| #9 | 5% | A+ | Older Drivers | The Hartford |

| #10 | 15% | A | Local Claims | AAA |

Compare these popular companies to find the best coverage and costs in Fort Collins. (Read more: Safe Driver Discount).

To obtain free Fort Collins auto insurance quotes from top providers today, Enter your ZIP code into the quote box on this page.

- Find the best Fort Collins, CO auto insurance with starting rates of $46 per month

- American Family ranks highest for customer satisfaction in Fort Collins

- Fort Collins drivers benefit from safe-driving discounts and flexible policies

#1 — American Family: Top Overall Pick

Pros

- Budget-Friendly Rates: American Family provides the best auto insurance in Fort Collins, CO, with minimum coverage starting at $50 per month.

- Superior Customer Service: They are known for excellent support tailored to best Fort Collins, CO auto insurance clients.

- Safe Driving Discounts: Incentives for good driving records on Best Fort Collins, CO Auto Insurance lower costs further.

Cons

- Limited Nationwide Availability: American Family has limited Best Fort Collins, CO Auto Insurance coverage outside certain regions.

- Higher Deductibles: Some Best Fort Collins, CO Auto Insurance policies may have higher deductibles. Learn more in our guide, “American Family Auto Insurance Review.“

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#2 — State Farm: Best for Competitive Rates

Pros

- Comprehensive Coverage Options: State Farm provides excellent, best Fort Collins, CO, auto insurance with minimum rates of $47 per month.

- Low Monthly Rates: Competitive monthly rates on the best Fort Collins, CO, auto insurance, starting at $47 monthly.

- Bundling Policies: They offers a significant discounts for bundling best Fort Collins, CO auto insurance with other policies. Read more in our guide titled, “State Farm Auto Insurance Review.“

Cons

- Limited Multi-Policy Discount: Multi-policy discount on Best Fort Collins, CO Auto Insurance isn’t as high compared to others.

- Premium Costs: Premiums for best Fort Collins, CO auto insurance can still be relatively higher for certain levels.

#3 — Farmers: Best for Customizable Policies

Pros

- Budget-Friendly Monthly Rates: Farmers offers the best Fort Collins, CO auto insurance with a minimum coverage of $53 per month.

- Policy Customization: Numerous options to tailor best Fort Collins, CO auto insurance coverage.

- Good Student Discounts: Significant best Fort Collins, CO auto insurance discounts for students with a good grades. Check out our “Farmers auto insurance review” for more details.

Cons

- Limited Bundling Discounts: Bundling best Fort Collins, CO auto insurance doesn’t offer as large a discount as some competitors.

- Higher Premiums for Certain Drivers: Best Fort Collins, CO auto insurance premiums can be higher for some profiles.

#4 — Allstate: Best for Safe-Driving Discounts

Pros

- Comprehensive Coverage Options: Allstate offers diverse coverage options for the best Fort Collins, CO, auto insurance, starting at $55 per month.

- Bundle Savings: They provides discounts for bundling home and auto insurance reduce rates for best Fort Collins, CO, auto insurance customers.

- Accident Forgiveness: Allstate’s accident forgiveness program for the best Fort Collins, CO, auto insurance prevents premium hikes after the first accident.

Cons

- High Minimum Coverage Costs: Minimum coverage for best Fort Collins, CO auto insurance is $55, higher than some competitors.

- Limited Online Tools: Allstate’s online tools for the best Fort Collins, CO, auto insurance policy management are less advanced. See more in our guide titled “Allstate Auto Insurance Review.“

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#5 — Geico: Best for Online Tools

Pros

- Lowest Monthly Rates: Geico’s Best Fort Collins, CO auto insurance starts at $46 for minimum coverage.

- Digital Tools and App: Highly rated app for the best Fort Collins, CO auto insurance account management.

- Discount Programs: Best Fort Collins, CO auto insurance offers discounts, including for military and federal employees.

Cons

- Limited Local Agent Network: Fewer agents available for the best Fort Collins, CO, auto insurance support. View more in our guide titled “Geico Auto Insurance Review.“

- Occasional Rate Increases: Best Fort Collins, CO auto insurance rates may increase with minor infractions.

#6 — Progressive: Best for Snapshot Program

Pros

- Flexible Payment Options: Progressive offers the best Fort Collins, CO auto insurance at $48 per month for minimum coverage.

- Snapshot Program: Rewards safe drivers with the best Fort Collins, CO auto insurance rate reductions. Find out more in guide titled, “Progressive Auto Insurance Review.“

- Multiple Discount Options: Best Fort Collins, CO auto insurance includes discounts for online quotes and multi-car policies.

Cons

- Price Increases After Claims: Best Fort Collins, CO auto insurance rates may increase after claims.

- Limited Local Agents: Fewer agents are available for the best Fort Collins, CO, auto insurance support.

#7 — Liberty Mutual: Best for Competitive Premiums

Pros

- Extensive Coverage Options: Liberty Mutual offers a range of the best Fort Collins, CO auto insurance coverage, starting at $56 per month.

- Customizable Policy Options: Options include accident forgiveness for the best Fort Collins, CO, auto insurance.

- Excellent Safety Discounts: Best Fort Collins, CO auto insurance discounts for anti-theft and safety devices.

Cons

- Higher Premiums: The minimum coverage rate for the best Fort Collins, CO auto insurance is $56, higher than some competitors’ rates.

- Restricted Bundling: Limited bundling savings on the best Fort Collins, CO auto insurance. Keep reading our guide titled “Liberty Mutual Auto Insurance Review.“

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#8 — Nationwide: Best for Coverage Flexibility

Pros

- Affordable Rates: Nationwide provides the best Fort Collins, CO auto insurance, with minimum coverage starting at $49 per month.

- Vanishing Deductible: The best Fort Collins, CO auto insurance deductibles decrease with safe driving. Discover more in our guide, “Nationwide Auto Insurance Review.“

- Accident Forgiveness Option: The first accident forgiveness available on some of the best Fort Collins, CO auto insurance policies.

Cons

- Less Flexibility on Coverage: Limited flexibility with the best Fort Collins, CO auto insurance customizations.

- Higher Fees: Additional fees apply for the best Fort Collins, CO, auto insurance policy changes.

#9 — The Hartford: Best for Older Drivers

Pros

- AARP Partner: Exclusive of the best Fort Collins, CO auto insurance discounts for AARP members, minimum coverage at $57 per month.

- Strong Claims Service: Known for being fast and responsive, the best Fort Collins, CO auto insurance claims handling.

- Flexible Payment Plans: Multiple payment options are available for the best Fort Collins, CO, auto insurance. Explore them further in our guide, “The Hartford Company Auto Insurance Review.“

Cons

- Higher Base Rates: Minimum coverage for the best Fort Collins, CO auto insurance starts at $57, higher than other providers.

- Limited Discounts for Younger Drivers: Most of the best Fort Collins, CO auto insurance discounts cater to older demographics.

#10 — AAA: Best for Local Claims

Pros

- Competitive Rates: AAA offers the best Fort Collins, CO auto insurancethe with minimum coverage of $50 per month.

- Roadside Assistance: Membership includes comprehensive roadside assistance for the best Fort Collins, CO, auto insurance.

- Loyalty Discounts: Best Fort Collins, CO auto insurance discounts increase with customer tenure. Our guide, AAA auto insurance review, provides more details.

Cons

- Regional Availability Only: AAA’s best auto insurance is not available to all drivers in Fort Collins, CO.

- Slower Claims Process: Best Fort Collins, CO auto insurance claims process can take longer than others.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Fort Collins, CO Auto Insurance Monthly Rates by Provider & Coverage Level

In Fort Collins, CO, auto insurance rates vary among providers. Geico offers the lowest minimum coverage at $46 per month, while American Family and CSAA charge $50 per month. American Family is the most affordable for full coverage at $165 per month, followed by Progressive at $162 and AAA at $168 per month. Explored further in our guide titled “Auto Insurance Coverage Options.”

Fort Collins, CO Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $55 | $180 | |

| $50 | $165 | |

| $50 | $168 |

| $53 | $175 | |

| $46 | $155 | |

| $56 | $185 |

| $49 | $170 |

| $48 | $162 | |

| $47 | $160 | |

| $57 | $182 |

Comparing the insurers is a crucial due to significant rate differences. Allstate charges $55 per month for minimum coverage and $180 per month for full coverage, it makes pricier than some competitors. Liberty Mutual and Hartford have higher full coverage rates of $185 and $182 per month, respectively. Drivers should be assess their budget and coverage needs to choose the best provider.

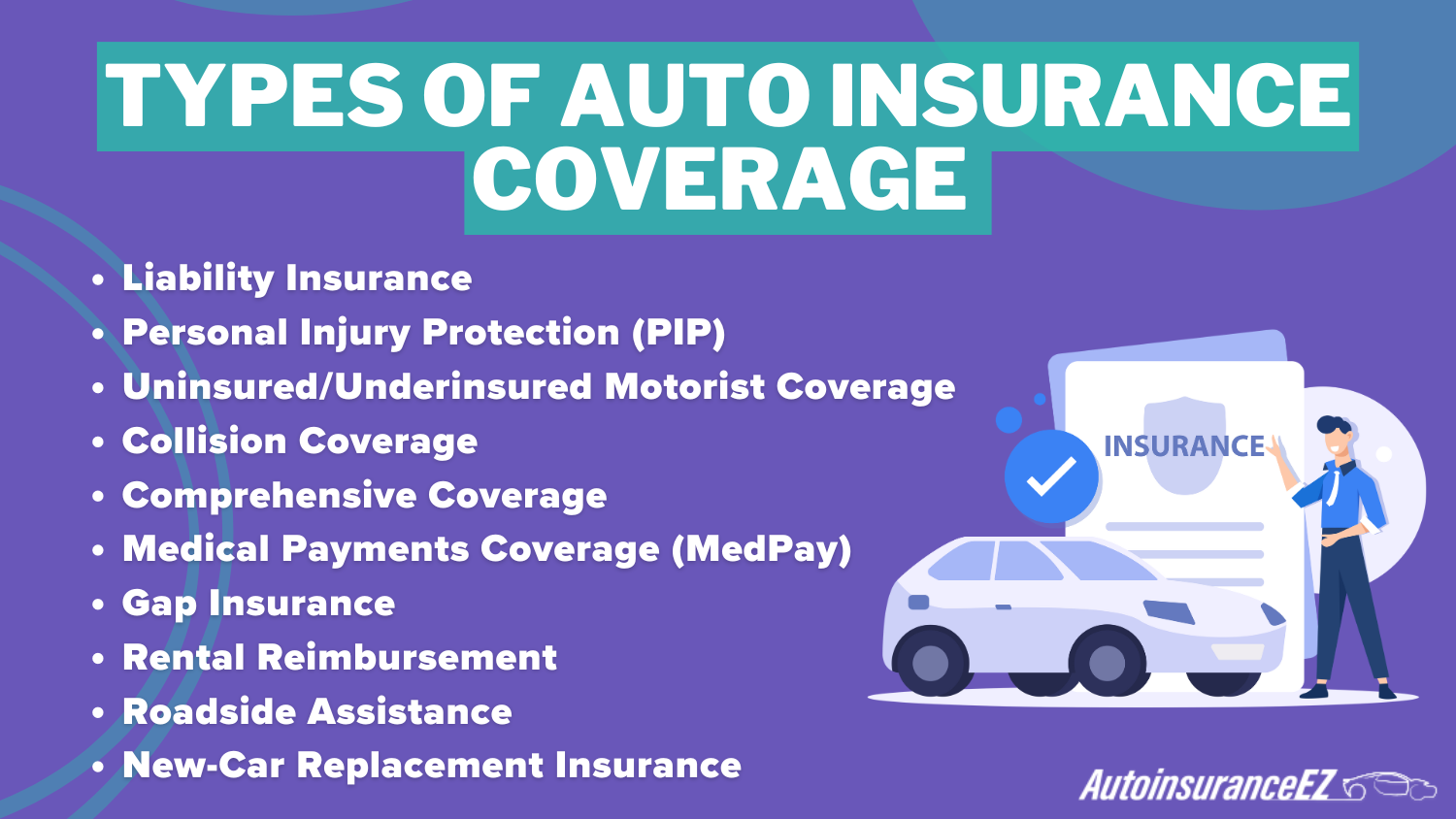

Fort Collins Auto Insurance: Discovering the Best Rates and Coverage Options

The minimum liability coverage for Colorado auto insurance is 25/50/15, but drivers looking for Fort Collins car insurance can discover a variety of solutions at low rates. To get the best bargain on auto insurance in Fort Collins, evaluate several providers, policies, and possible discounts in the local market. Gather more in our guide titled, “Bundling Car Insurance and Renters Insurance to Save Money.”

Auto Insurance Discounts From the Top Providers in Best Fort Collins, CO

| Insurance Company | Available Discounts |

|---|---|

| Accident forgiveness, Good student, Bundling policies, Homeowner discount, New vehicle discount | |

| Young driver, Bundling discount, Smart home technology, Claim-free discount, Vehicle safety features | |

| Loyalty discount, Good student, Bundling, Home security system, Pay-in-full discount |

| Homeowner discount, Smart driver program, Good student, Bundling policies, Early sign-up discount | |

| Membership discounts (e.g., military), Good student, Multi-car, Anti-theft devices, Safe driving | |

| New car discount, Multi-policy discount, Homeowner, Accident forgiveness, Claim-free discount |

| SmartRide (telematics), Multi-policy, Homeowner, Good driver, Safe vehicle discount |

| Continuous insurance, Multi-vehicle, Paid in full, Snapshot program (telematics), Good student discount | |

| Teen driver, Steer Clear program (for young drivers), Multi-car, Homeowner, Driver training discount | |

| AARP discounts, Safe driving discounts, Homeowner discount, Multi-car, Claim-free discount |

Top insurers in Fort Collins offer discounts that can lower premiums significantly. Allstate provides accident forgiveness and bundling discounts, while the American Family rewards young drivers and those with smart home technology. Other companies like Farmers and Geico also have incentives, including the loyalty and safe driving discounts, it hepls consumers to find affordable coverage.

American Family, State Farm, and Farmers are among the top insurers with competitive rates. Farmers’ auto insurance in Fort Collins starts at $46 per month, making it an excellent alternative for budget-conscious drivers. To unnderstand the local alternatives and discounts is a critical to choosing the best coverage at a fair price.

Auto Insurance Coverage Requirements in Colorado

To drive lawfully in Colorado, you must purchase the following minimal requirements:

Colorado Auto Insurance Coverage Requirements

| Coverage | Limits | Limits |

|---|---|---|

| Bodily Injury Liability | $25,000 / $50,000 | $100,000 / $300,000 |

| Property Damage Liability | $15,000 | $100,000 |

Remember that liability insurance only pays out on claims if you caused the situation or were proven accountable for it. In any other case, you shall have financial responsibility for your vehicle. If you are currently financing your car, your lender may require additional coverage beyond the required minimums. To explore more, review our in-depth guide, “How To File An Auto Insurance Claim.”

Although the average Colorado driver spends over $130 per month for auto insurance, Fort Collins residents may be able to drive legally for as little as $40 per month.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Auto Insurance Rates Fort Collins, Colorado

Who has the cheapest car insurance in Colorado? The following table compares rates from top providers. Considering their high reputation, you may wonder, “Is USAA the cheapest auto insurance?” We excluded USAA from this list because their coverage is normally designated for military families. So, who offers the lowest auto insurance in Fort Collins among the insurance firms available to everyone?

Fort Collins, CO Auto Insurance Monthly Rates: Liability vs. Comprehensive

| Insurance Company | Liability | Comprehensive |

|---|---|---|

| $65 | $145 |

| $70 | $150 | |

| $68 | $140 | |

| $66 | $140 | |

| $60 | $135 | |

| $75 | $155 |

| $67 | $143 |

| $63 | $138 | |

| $65 | $142 | |

| $69 | $147 |

Local independent insurance brokers such as Welsh Insurance Fort Collins are among the companies to look into. In particular, farmers, Geico, Amica, and State Farm Fort Collins, have a reputation for offering extremely affordable insurance prices.

However, if you’re considering switching carriers, there’s more to consider than cheap Fort Collins, CO auto insurance rates. Customer service is as crucial as their claims procedure. Remember that the statistics shown above are particular to Fort Collins, so the findings may differ if you’re looking for vehicle insurance in Denver, CO auto insurance or Aurora, CO auto insurance.

In Fort Collins, CO, auto insurance agents and consultants compute insurance rates based on various factors, including the driver’s gender, credit score, experience, career, and current insurance coverage.

Fort Collins, CO Auto Accident & Insurance Claim Statistics

| Factor | Value |

|---|---|

| Total Accidents Per Year | 1,500 |

| Total Claims Per Year | 1,200 |

| Average Claim Size | $5,000 |

| Percentage of Uninsured Drivers | 12% |

| Vehicle Theft Rate 200 thefts/year | 200 |

| Traffic Density | Moderate |

| Weather-Related Incidents | Moderate |

Furthermore, affordable auto insurance in Fort Collins, CO, various per each company. Consult a vehicle insurance broker to receive the best deal. For more information, contact the Colorado Division of Insurance and Financial Services to ensure your chosen provider has the authority to sell insurance in the Centennial State.

Major Factors in Cheap Auto Insurance in Fort Collins, Colorado

Where you live has a significant impact on how much you spend for auto insurance. For example, someone searching, “Who has the cheapest auto insurance in NC?” may have difficulty locating a reputable company in North Carolina. The same may be said for Colorado citizens. To acquire more information, review our in-depth guide named “Cheap Auto Insurance Companies.”

When developing an auto insurance policy, Fort Collins car insurance companies evaluate a variety of criteria. The video below discusses this in greater depth.

State Farm is ideal for Fort Collins drivers seeking reliable coverage at competitive rates.

Dani Best Licensed Insurance Producer

Many of these features, like credit score or where you live, are difficult or impossible to modify. Other criteria that your auto insurance company may evaluate include:

Your ZIP Code

Your auto insurance prices may vary based on where you live.

Colorado Monthly Auto Insurance Rates by City

| City | Minimum Coverage | Full Coverage |

|---|---|---|

| Arvada | $93 | $200 |

| Aurora | $105 | $230 |

| Boulder | $85 | $190 |

| Broomfield | $80 | $188 |

| Colorado Springs | $95 | $205 |

| Denver | $110 | $240 |

| Fort Collins | $78 | $185 |

| Grand Junction | $65 | $165 |

| Greeley | $75 | $183 |

| Lakewood | $100 | $220 |

| Longmont | $74 | $180 |

| Loveland | $70 | $175 |

| Pueblo | $68 | $170 |

| Thornton | $98 | $210 |

| Westminster | $90 | $195 |

In general, heavily populated cities have greater coverage rates since more drivers are on the road, which raises the probability of an accident. Fort Collins has a population of 152,061 and a median household income of $56,464.

Automotive Accidents

Fatal accident rates are extremely low for a city with a population of over 150,000.

Fatal Accidents in Fort Collins, CO

| Category | Count |

|---|---|

| Fatal Accidents | 30 |

| Fatal Crash Vehicles | 40 |

| DUI Fatal Crashes | 10 |

| Fatalities | 35 |

| Fatal Crash Individuals | 40 |

| Fatal Accident Pedestrians | 5 |

As a result, Fort Collins drivers are eligible for reduced rates.

Auto Thefts in Fort Collins

Finding the cheapest auto insurance can be tough if you are prone to auto theft. Certain vehicle models, as well as automobiles parked in densely populated areas, appeal to burglars.

Fort Collins, CO Report Card: Auto Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| Vehicle Theft Rate | A- | Low theft rate |

| Average Claim Size | B+ | Moderate-sized claims |

| Weather-Related Risks | B | Occasional snow and hail |

| Traffic Density | B | Moderate congestion |

| Uninsured Drivers Rate | C+ | Slightly above average |

There were 140 stolen vehicles in Fort Collins in 2013. Comprehensive coverage will help you avoid auto theft. However, because theft in Fort Collins is so low, you may be able to cut or eliminate your comprehensive coverage, resulting in reduced monthly premiums.

Your Credit Score

Auto insurers place a high value on your credit score. The stronger your credit, the lower your rate will be, whereas a bad credit score may result in drastically higher charges.

Fort Collins, CO Auto Insurance Monthly Rates by Credit Score

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $100 | $135 | $175 |

| $110 | $145 | $185 | |

| $95 | $125 | $165 | |

| $105 | $140 | $180 | |

| $85 | $115 | $150 | |

| $115 | $150 | $200 |

| $90 | $120 | $160 |

| $100 | $130 | $170 | |

| $95 | $125 | $165 | |

| $105 | $140 | $180 |

As shown in the figure below, certain companies may charge you double (or more) than someone with excellent credit.

Your Age

When purchasing their first vehicle insurance policy, young drivers confront a particularly difficult task. Because of inexperience, individuals are much more likely to be involved in a serious accident.

Fort Collins, CO Auto Insurance Monthly Rates by Provider, Age, & Gender

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 45 Female | Age: 45 Male | Age: 65 Female | Age: 65 Male |

|---|---|---|---|---|---|---|---|---|

| $107 | $110 | $88 | $85 | $86 | $84 | $82 | $80 |

| $181 | $190 | $162 | $160 | $158 | $157 | $152 | $150 | |

| $124 | $147 | $115 | $117 | $113 | $114 | $109 | $107 | |

| $172 | $180 | $139 | $139 | $136 | $136 | $132 | $130 | |

| $97 | $93 | $80 | $80 | $78 | $78 | $75 | $73 | |

| $187 | $215 | $171 | $174 | $167 | $170 | $165 | $163 |

| $136 | $150 | $113 | $115 | $111 | $112 | $110 | $108 |

| $141 | $146 | $112 | $105 | $109 | $103 | $101 | $99 | |

| $101 | $111 | $86 | $86 | $84 | $84 | $80 | $78 | |

| $135 | $143 | $116 | $113 | $112 | $109 | $106 | $10 |

That is why some companies charge them two to three times the premiums of someone twice their age.

Your Driving Record

Serious driving offenses, such as DUI or dangerous driving fines, can increase your monthly premiums dramatically. Some firms may refuse to cover you if you have these on your record.

Fort Collins, CO Auto Insurance Monthly Rates by Provider & Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $86 | $108 | $133 | $148 |

| $160 | $188 | $225 | $270 | |

| $117 | $136 | $176 | $194 | |

| $139 | $173 | $198 | $193 | |

| $80 | $106 | $132 | $216 | |

| $174 | $212 | $234 | $313 |

| $115 | $137 | $161 | $237 |

| $105 | $140 | $186 | $140 | |

| $86 | $96 | $102 | $112 | |

| $113 | $136 | $165 | $167 |

If you have minor offenses such as a speeding ticket, check with your Fort Collins, CO, vehicle insurance company to see if you can save money through “Accident Forgiveness.”

Your Vehicle

A simple, cheap car is considerably easier to fix or replace than an expensive luxury vehicle.

Fort Collins, CO Auto Insurance Monthly Rates by Vehicle Make & Model

| Insurance Company | 2024 Honda Accord | 2024 Porsche Boxster Spyder |

|---|---|---|

| $114 | $234 |

| $128 | $239 | |

| $117 | $247 | |

| $135 | $258 | |

| $109 | $222 | |

| $138 | $267 |

| $121 | $243 |

| $112 | $229 | |

| $105 | $218 | |

| $132 | $261 |

An affordable car does not necessitate an elaborate, comprehensive insurance policy.

Minor Factors in Cheap Auto Insurance in Fort Collins, CO

Some people in difficult circumstances may turn to Craigslist in Fort Collins to obtain affordable auto insurance. Instead of entrusting your fate to the internet, remember that certain factors beyond your control will affect your prices. For further knowledge, look at our detailed guide titled, “Factors that Affect Your Car Insurance Premium.”

Your Marital Status

Married couples might save money on car insurance by grouping their plans. If you have other types of insurance, such as homeowners or renters, you can save even more money by combining them.

Your Gender

Fortunately, many insurance firms are abandoning the old-fashioned practice of charging significantly different prices depending on gender. Some companies still charge a two to three percent differential, but rarely more.

Your Driving Distance to Work

Work commutes in Fort Collins are quite short, spanning between 15 and 19 minutes on average, with some neighborhoods seeing 20 minutes or longer commutes. Nearly 75% of motorists travel to work daily, with only 6-9% carpooling. Infrequent drivers may only save three to four percent of their monthly expenses. Business car owners are the ones to pay 11% more premiums than business vehicle owners.

Your Coverage and Deductibles

Raising your deductible may allow you to add more coverages to your current policy. While this will result in significantly higher out-of-pocket spending, the lower monthly payments will aid if you need to file a claim.

Your Education

Insurance companies frequently provide lower coverage premiums to drivers who have achieved higher levels of education. In Fort Collins, 30% of drivers hold a bachelor’s degree, while many others pursue a college education or high school diploma.

Despite not being a college town, Colorado State University has a strong presence in the city. CSU has four campuses, all of which are located in Larimer County. CSU provides degrees in various fields, including business and liberal arts, with a strong concentration on environmental sciences.

The typical insurance buyer may find it difficult or impossible to determine their unique financial risk. Insurance firms, on the other hand, have an advantage over consumers because of their statistical and practical knowledge.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Case Studies: Auto Insurance in Fort Collins, CO: Real Experiences from Local Drivers

Drivers in Fort Collins, CO, can choose from a variety of auto insurance coverage, service, and pricing alternatives. Local case studies show how residents got the right coverage for their needs.

- Case Study #1 — Sarah’s Switch to American Family: Sarah, a 34-year-old, resident in Fort Collins, chose American Family for better customer service and lower premiums. With starting rates of $46 per month, she received discounts for safe driving and combining insurance, giving in a more streamlined claims process and consistent coverage.

- Case Study #2 — Mark’s Experience with State Farm: Mark is a young professional, he chose State Farm because of its low rates after he purchase his first car. With a starting premium rates of $46 per month, he valued the user-friendly app and local agent help, which it made a simple to manage his insurance while keeping expenses down.

- Case Study #3 — Emma’s Custom Coverage with Farmers: Emma, a business owner, chose Farmers because of their customizable insurance options. She personalized the insurance coverage that fits her needs, such as $46 per month, and she can continue to adapt her policy over time depending on how much her business changes and her required driving times.

These case studies highlight Fort Collins drivers’ interactions with several insurance providers. Residents can make the best selections for their situation by evaluating options and considering individual needs. For additional insights, check out our guide titled “10-Minute Auto Insurance Buying Guide.”

American Family is the top choice for Fort Collins auto insurance with unbeatable customer satisfaction and affordable rates.

Kristen Gryglik Licensed Insurance Agent

Now that you’ve learned how to find affordable Fort Collins auto insurance use our free online tool to compare quotes.

Frequently Asked Questions

What are the best auto insurance companies in Fort Collins, CO?

American Family, State Farm, and Farmers are the top providers, offering rates starting at $46 per month. Seek additional knowledge in our guide titled, “Car Insurance Discounts.”

What are the minimum coverage rates in Fort Collins?

Geico offers the lowest minimum coverage at $46 per month, while American Family and CSAA charge $50 per month. Get the best auto insurance rates possible by entering your ZIP code below into our free comparison tool today.

What discounts are available for auto insurance in Fort Collins?

Discounts include accident forgiveness and bundling discounts from Allstate, rewards for young drivers from American Family, and loyalty discounts from Farmers and Geico. (Learn more: Claim-Free Discount: How much can you save?)

How much does full coverage cost in Fort Collins?

American Family provides the most affordable full coverage at $165 per month, followed by Progressive at $162 and AAA at $168.

What are Colorado’s minimum auto insurance requirements?

The minimum liability coverage in Colorado is 25/50/15. Check out our guide, “Minimum Car Insurance Requirements.”

How can I find the cheapest auto insurance in Fort Collins?

Comparing rates from different providers and assessing available discounts can help you find the best coverage at competitive rates.

What factors influence auto insurance rates?

Rates are influenced by your ZIP code, driving history, credit score, age, and vehicle type.

Is it important to compare multiple insurance providers?

Yes, comparing multiple providers is crucial as rates and coverage options can vary significantly.

How does my credit score affect my auto insurance rate?

A higher credit score typically results in lower premiums, while a poor credit score can increase rates significantly. (Read more: How Your Credit Score Affects Your Car Insurance Premiums).

How can I get a personalized auto insurance quote?

You can obtain a personalized quote by entering your ZIP code into a comparison tool to see rates from various providers. Protect your vehicle at the best prices by entering your ZIP code into our free auto insurance quote comparison tool below.