Best Boston, MA Auto Insurance in 2026 (Find the Top 10 Companies Here)

The best Boston, MA auto insurance starts at $35/month, with Liberty Mutual offering flexible coverage, Geico providing up to 15% off for safe drivers, and State Farm delivering top customer service. These three providers offer competitive rates and reliable options for drivers in Boston, MA.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Tim Bain

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Licensed Insurance Agent

UPDATED: Dec 26, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

3,792 reviews

3,792 reviewsCompany Facts

Full Coverage in Boston MA

A.M. Best Rating

Complaint Level

Pros & Cons

3,792 reviews

3,792 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in Boston MA

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,157 reviews

18,157 reviewsCompany Facts

Full Coverage in Boston MA

A.M. Best Rating

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviewsLiberty Mutual, Geico, and State Farm are known for offering the best Boston, MA auto insurance. These insurance providers cover a wide array of discounts such as safe driving, young driver, and multiyear policy, among others, all available in Boston.

Each company has unique offerings, such as affordable pricing, solid coverage, and speedy claim processing. Given Boston’s urban environment and specific insurance needs, comparing different types of car insurance options can help drivers find the right policy to meet their needs.

Our Top 10 Company Picks: Best Boston, MA Auto Insurance

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | A | Local Headquarters | Liberty Mutual |

| #2 | 25% | A++ | Competitive Rates | Geico | |

| #3 | 17% | B | Local Agent | State Farm | |

| #4 | 25% | A+ | Accident Forgiveness | Allstate | |

| #5 | 10% | A+ | Snapshot Savings | Progressive | |

| #6 | 30% | A+ | Customer Service | Amica | |

| #7 | 20% | A | Massachusetts Expertise | Mapfre | |

| #8 | 20% | A+ | Vanishing Deductible | Nationwide |

| #9 | 13% | A++ | Comprehensive Coverage | Travelers | |

| #10 | 5% | A+ | AARP Members | The Hartford |

Find the best auto insurance company near you by entering your ZIP code into our free quote tool.

- Boston, MA drivers get coverage suited for urban traffic and winter weather

- Protect your vehicle with affordable policies tailored to local needs

- Liberty Mutual is the top pick for reliable and customizable auto insurance

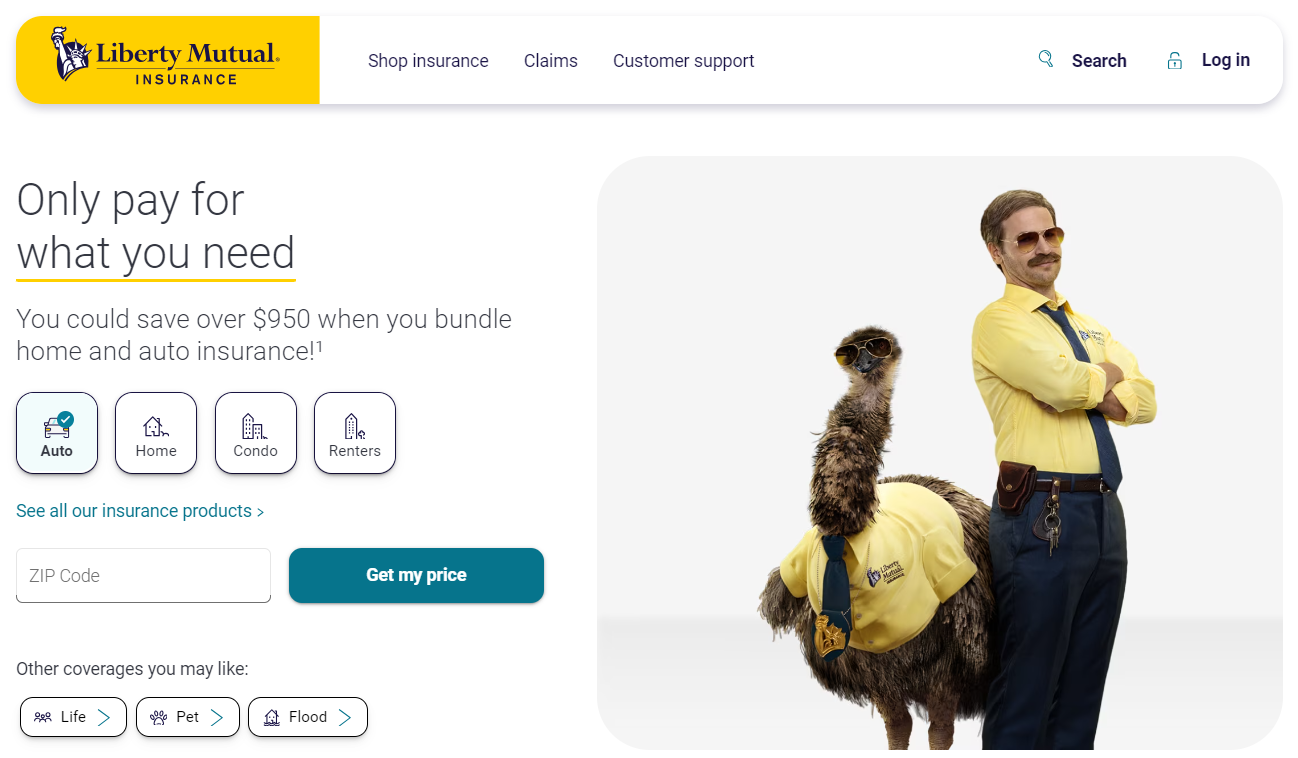

#1 – Liberty Mutual: Top Overall Pick

Pros

- Customizable Coverage: Liberty Mutual in Boston, MA, provides flexible policies with options like no-claims discount protection and new car replacement.

- Vital Customer Service: Explore our Liberty Mutual auto insurance review for Boston, MA, to see how their customer service stands out through multiple support channels.

- Numerous Discounts: Liberty Mutual offers various discounts, including bundling and safe driver discounts for Boston, MA drivers.

Cons

- Increased Rates: Liberty Mutual Boston, MA, tends to have higher rates on average than some other companies.

- Mixed Claim Satisfaction: Customer reviews of claims processing in Boston, MA, are sometimes mixed, with some customers reporting delays.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#2 – Geico: Best for Competitive Rates

Pros

- Value for Money: Geico attracts cost-sensitive motorists to Boston, MA, due to its affordable rates.

- Marvelous Mobile Application: The Geico app in Boston, MA, has excellent ratings and easy access to policy details and claims filing.

- Good Customer Service: Discover our Geico auto insurance review for Boston, MA, to learn about their consistently positive customer service and support.

Cons

- Limited Policies: Geico may offer fewer personalized options than other insurance providers in Boston.

- Fewer Local Agents: Boston has fewer physical agents for those who prefer in-person interactions.

#3 – State Farm: Best for Local Agent

Pros

- Agent Local Support: This service provides the services of local agents and is most suitable for drivers from Boston who require assistance individualized to their needs.

- Excellent Customer Service: Known for reliable customer service, especially during claims and policy management.

- Higher Premiums for Younger Drivers: According to our State Farm auto insurance review, younger drivers in Boston are regarded as higher risk, leading to higher premiums.

Cons

- Higher Rates for Younger Drivers: In Boston, younger drivers are considered a higher risk and, consequently, charged higher premiums.

- Limited Discounts: State Farm offers fewer discount options for Boston drivers than competitors.

#4 – Allstate: Best for Accident Forgiveness

Pros

- Reasonable Claim Satisfaction: Customers in Boston generally report positive experiences with Allstate’s claims process.

- Variety of Coverage Options: Allstate offers drivers in Boston, MA, a variety of coverage options, including accident forgiveness and new vehicle replacement.

- Wide Network of Agents: In our Allstate auto insurance review, we highlight the company’s vast network of agents in Boston, MA, offering personalized service to policyholders.

Cons

- Higher Premiums: Because the rates are higher than those of its competitors, Allstate has higher rates for Boston drivers with clean records.

- Complex Conditions of Discounts: In Boston, some customers need help understanding Allstate’s various discount programs due to their complex conditions.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#5 – Progressive: Best for Snapshot Savings

Pros

- Competitive Rates: View our Progressive auto insurance review to see why the company is known for offering competitive rates, especially for high-risk drivers in Boston, MA.

- Bundle Discounts: Progressive offers discounts for bundling home, auto, and other insurance types, available to Boston drivers.

- Usage-Based Insurance: Their Snapshot program allows Boston drivers to save money based on actual driving behavior.

Cons

- Customer Service Variability: Some customers in Boston report inconsistent experiences with claims and customer service.

- Limited Local Agent Availability: Like Geico, Progressive has fewer local agents in Boston than other insurers.

#6 – Amica Mutual: Best for Customer Service

Pros

- Excellent Customer Service: Amica earns high ratings for customer satisfaction and claim handling in Boston, MA.

- Safe Driver Discounts: This program provides drivers in Boston, MA, with several discounts, such as for safe driving and policy bundling.

- Financial Strength: See our Amica Mutual auto insurance review to explore the economic strength ensuring reliable coverage for Boston, MA, policyholders.

Cons

- Limited Availability: Amica operates in fewer states than some of its competitors, limiting access for drivers in Boston.

- Higher Prices for Some Drivers: Some drivers in Boston, particularly in urban areas, may find Amica’s rates less competitive.

#7 – Mapfre Insurance: Best for Massachusetts Expertise

Pros

- Flexible Payment Plans: Mapfre offers a variety of payment options that allow Boston motorists to manage and pay their premiums quickly.

- b: In our review of Mapfre Insurance car coverage, we found that they provide the most affordable rates, especially for Boston, MA, drivers with no driving violations on their record.

- Custom Coverage for Business Use: Tailored insurance policies are available for Boston residents who use their vehicles for business purposes.

Cons

- Limited Availability: While Mapfre is widely available in Boston, its coverage is more limited in other parts of the U.S.

- Inconsistent Customer Service: Some Boston customers have reported mixed experiences, with occasional delays or issues during the claims process.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#8 – Nationwide: Best for Vanishing Deductible

Pros

- Substantial Discounts: Nationwide offers a range of discounts for bundling, safe driving, and even being a good student in Boston, MA.

- Comprehensive Coverage Options: Offers all standard types of coverage and additional options like vanishing deductible for Boston drivers.

- Excellent Claims Process: According to our Nationwide auto insurance review, the company provides a smooth and efficient claims process in Boston, MA.

Cons

- Above-Average Premiums: Nationwide’s rates can be higher in Boston, especially for younger drivers or those with less-than-perfect records.

- Restricted Internet Resources: The web-based interface and instruments may be less appealing and convenient than for other rival companies serving Boston, MA.

#9 – Travelers: Best for Comprehensive Coverage

Pros

- Strong Reputation for Claims: Delve into our Travelers auto insurance review to learn more about the company’s strong reputation for handling claims efficiently in Boston.

- Numerous Discounts: Boston, MA drivers can get discounts for safe driving, bundling policies, and anti-theft devices.

- Comprehensive Coverage: Specifically for drivers in Boston, MA, travelers have various coverage options, such as gap insurance and rideshare insurance, among others.

Cons

- Higher Prices for Some Drivers: Travelers can be more expensive than other insurers in Boston, especially for younger drivers.

- Mixed Customer Service Reviews: Some customers in Boston report delays in claims and customer service.

#10 – The Hartford: Best for AARP Members

Pros

- Great for Older Drivers: View our Hartford auto insurance review to find out why the company is excellent for older drivers in Boston, MA. It offers specialized discounts and policies for those over 50.

- Excellent Customer Service: Renowned for providing outstanding customer support and efficient claims handling in Boston, MA.

- AARP Discounts: Members of AARP in Boston can receive substantial discounts on auto insurance policies.

Cons

- Limited Coverage Options for Young Drivers: Hartford may offer less flexibility for younger or high-risk drivers in Boston.

- Premium Rates Can Be High: In some instances, such as for young drivers or novices in Boston, the insurance premiums are likely to be high.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Discover the Best Boston, MA, Auto Insurance Options

The best auto insurance companies in Boston, MA, are Geico, Amica, and Liberty Mutual, all with advantages. Geico has become associated with low rates and many discounts, primarily for safe drivers. Amica has the best services when it comes to customer satisfaction but offers very customized policies, allowing clients to choose what they want.

Boston, MA Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $43 | $125 | |

| $40 | $118 | |

| $35 | $108 | |

| $39 | $115 |

| $36 | $110 | |

| $37 | $113 |

| $38 | $112 | |

| $41 | $120 | |

| $44 | $127 |

| $42 | $122 |

Liberty Mutual has high rates but offers firmer coverage and flexibility, which allows one to bundle coverage with other coverage at a discount. The affordability and reliability of these three auto insurance providers make them the best option for most drivers in Boston. Explore our detailed resource titled “Auto Insurance Coverage Options.”

Innovative Ways to Save on Auto Insurance in Boston

Boston drivers can find significant savings on auto insurance through discounts from top providers. Allstate, Amica, and Geico offer rewards for safe driving, loyalty, and multi-car discounts. Liberty Mutual and Nationwide provide discounts for online purchases, safety features, and accident-free records.

Auto Insurance Discounts From the Top Providers in Boston, MA

| Insurance Company | Available Discounts |

|---|---|

| Safe Driving Bonus, New Car Discount, Early Signing Discount, Multi-Policy Discount | |

| Loyalty Discount, Paid-in-Full Discount, Multi-Line Discount, Good Student Discount | |

| Multi-Vehicle Discount, Good Driver Discount, Military Discount, Anti-Theft System Discount | |

| Multi-Policy Discount, Vehicle Safety Features Discount, Online Purchase Discount, Claims-Free Discount |

| Multi-Policy Discount, Accident-Free Discount, Good Driver Discount, Bundled Insurance Discount | |

| SmartRide Program, Accident-Free Discount, Family Plan Discount, Multi-Policy Discount |

| Snapshot Program, Multi-Car Discount, Continuous Insurance Discount, Homeowner Discount | |

| Drive Safe & Save, Good Student Discount, Multi-Car Discount, Anti-Theft Device Discount | |

| AARP Member Discounts, Multi-Vehicle Discount, Defensive Driver Course Discount, Bundled Insurance Discount |

| Multi-Policy Discount, Safe Driver Discount, Continuous Insurance Discount, Hybrid Vehicle Discount |

Progressive and State Farm offer safe-driving programs, while Hartford’s AARP discounts benefit seniors. Travelers round out the offer with eco-friendly and continuous coverage savings. Comparing these options helps Boston drivers find affordable, tailored coverage.

Massachusetts Auto Insurance Coverage Requirements

To operate a motor vehicle lawfully within the city of Boston, MA limits, one must possess bodily injury liability, property damages liability, and Uninsured Motorist Bodily Injury coverages.

Although not legally required, insurers often include medical payment, collision, and comprehensive coverages in policies for additional protection.

Massachusetts Minimum Auto Insurance Coverage Requirements & Limits

| Coverage Type | Minimum Requirement & Limit | Description |

|---|---|---|

| Bodily Injury Liability | $20,000 per person / $40,000 per accident | Covers injury or death of others if you are at fault in an accident. |

| Property Damage Liability | $5,000 per accident | Covers damage to someone else’s property if you are at fault. |

| Personal Injury Protection (PIP) | $8,000 per person | Covers medical expenses, regardless of fault, for you and your passengers. |

| Uninsured Bodily Injury Coverage | $20,000 per person / $40,000 per accident | Covers injuries if you are hit by an uninsured driver. |

Looking for the best car insurance in Boston, Massachusetts, can get a driver a policy that not only conforms to the law but also offers the protection that allows one to drive without fear.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Major Factors in Boston, Massachusetts Auto Insurance Rates

Many factors contribute to the price of car insurance in Boston, MA. While some are beyond your control, others can be modified to help you realize lower rates and appealing discounts. Thus, knowing these key factors will help Boston citizens hunt for the best auto insurance in Massachusetts.

Your ZIP Code

Boston, home to over 645,000 people, has such a high volume of traffic that it tends to raise auto insurance premiums owing to an increased risk of accidents. Nevertheless, exclusive offers from car insurance companies in Boston, MA, such as those presented by Liberty Mutual, Geico, Amica, etc., allow one to secure the cheapest auto insurance. The median household income in the city limits is $53,583, which can also determine the discounts offered.

Boston, MA Auto Insurance Monthly Rates by ZIP Code

| City, State | ZIP Code | Monthly Rate |

|---|---|---|

| Boston, MA | 02108 | $325 |

| Worcester, MA | 01608 | $210 |

| Springfield, MA | 01103 | $195 |

| New Orleans, LA | 70112 | $344 |

| Baton Rouge, LA | 70801 | $346 |

| Shreveport, LA | 71101 | $249 |

Hence, consider the ZIP code outside the city for cheap insurance. Exploring auto insurance rates by state to better understand regional pricing variations is also helpful for broader insight.

Automotive Accidents

Several automotive accidents occur in Boston, which can contribute to elevated auto insurance rates. The growing number of crashes increases the risk for the underwriters, increasing the chances of raising that rate.

Boston, MA Auto Accident & Insurance Claim Statistics

| Factor | Value |

|---|---|

| Average Annual Accidents | 5,800 |

| Claims per 1,000 Drivers | 72 |

| Collision Claims Rate | 20% |

| Comprehensive Claims Rate | 15% |

| Average Claim Amount | $5,100 |

| Uninsured Motorist Rate | 6% |

Several providers, including Liberty Mutual and Geico, have safe driver discount to reduce insurance costs. Inquire about these discounts to ensure you have the best coverage rates possible.

Auto Thefts in Boston

Auto theft remains a concern in Boston, particularly in densely populated areas, which can raise your best Boston, MA, auto insurance premiums. With 1,610 vehicles stolen in 2013, the risk is still significant. Expect higher rates if you live in a theft-prone area or own a high-risk vehicle.

Boston, MA Auto Insurance Monthly Rates by Provider & Coverage Type

| Insurance Company | Collision Coverage | Comprehensive Coverage |

|---|---|---|

| $280 | $280 | |

| $167 | $167 | |

| $221 | $221 | |

| $183 | $183 | |

| $111 | $111 | |

| $193 | $193 |

| $137 | $137 |

| $194 | $194 | |

| $76 | $76 | |

| $232 | $232 |

Installing an anti-theft device and inquiring with their insurance company about related discounts can ease the cost burden. Comprehensive policies that cover theft but still allow for cheap rates are available.

Your Credit Score

In Massachusetts, it is illegal for auto insurance companies to adjust rates based on your credit score, which can save some drivers money. However, this law may lead insurers to slightly raise premiums for all drivers to offset potential losses.

How your credit score affects your car insurance premiums is a concern in other states, but the impact is indirect in Massachusetts.

Boston, MA Report Card: Auto Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| Coverage Options | A | Broad range of customizable policies |

| Discount Availability | A- | Wide variety of discounts offered |

| Claims Handling | B+ | Generally efficient but slightly delayed |

| Affordability | B | Rates are moderate compared to state average |

Understanding this factor and others can help you find affordable coverage for the best Boston, MA, auto insurance. Comparing rates from providers like Liberty Mutual and Geico ensures you get the best deal, even if your credit score isn’t a factor.

Your Age

Young drivers, especially teenagers, are statistically more likely to be involved in accidents, which makes them a higher risk for insurers. As a result, significant providers typically charge higher rates for the best Boston, MA, auto insurance to offset the potential cost of claims.

Boston, MA Auto Insurance Rates by Age

| Insurance Company | Age 17 Female | Age 17 Male | Age 25 Female | Age 25 Male | Age 35 Female | Age 35 Male | Age 60 Female | Age 60 Male |

|---|---|---|---|---|---|---|---|---|

| $500 | $542 | $208 | $225 | $167 | $175 | $150 | $154 | |

| $483 | $517 | $200 | $217 | $163 | $167 | $146 | $150 | |

| $492 | $525 | $204 | $221 | $165 | $169 | $148 | $152 | |

| $508 | $550 | $213 | $229 | $168 | $173 | $149 | $153 | |

| $475 | $508 | $196 | $213 | $161 | $165 | $145 | $149 | |

| $517 | $558 | $217 | $233 | $171 | $175 | $150 | $154 |

| $488 | $525 | $200 | $217 | $163 | $167 | $146 | $150 |

| $500 | $542 | $208 | $225 | $167 | $171 | $148 | $153 | |

| $467 | $500 | $192 | $208 | $158 | $163 | $144 | $149 | |

| $508 | $550 | $213 | $229 | $168 | $173 | $149 | $153 |

Some teenage drivers who attend school can benefit greatly, primarily through car insurance for teenagers, by inquiring about discounts like Good Student and Driver’s Ed.

Choosing the right insurance is about finding the coverage that meets your needs and ensures you’re protected with a reliable provider when it counts.

Chris Abrams Licensed Insurance Agent

Such discounts reduce premium costs, allowing one to get coverage with significant insurance firms like Liberty Mutual and Allstate.

Your Driving Record

For high-risk drivers in Boston, your driving record significantly determines your best Boston, MA, auto insurance rates. Insurance providers like Liberty Mutual, Allstate, and Amica often offer an “accident forgiveness” discount, which can help lower premiums by overlooking recent minor violations such as speeding tickets.

Boston, MA Auto Insurance Monthly Rates by Provider & Driving Record

| Make and Model | Minimum Coverage | Full Coverage |

|---|---|---|

| BMW 3 Series | $155 | $210 |

| Chevrolet Silverado | $125 | $180 |

| Ford F-150 | $130 | $185 |

| Honda Accord | $115 | $170 |

| Hyundai Elantra | $110 | $165 |

| Jeep Grand Cherokee | $140 | $195 |

| Mercedes-Benz C-Class | $160 | $220 |

| Nissan Altima | $118 | $172 |

| Subaru Outback | $123 | $177 |

| Toyota Camry | $120 | $175 |

Things like drinking and driving charges or causing serious accidents with fault on your side will often lead to a considerable increase in your insurance premiums. It would help if you talked with your insurer regarding such policies to mitigate the effect of driving offenses on your rates.

Your Vehicle

Regarding the best Boston, MA, auto insurance, your vehicle’s make and model directly impact your premiums. Luxury cars like the 2012 Porsche Boxster Spyder are typically much more expensive to insure than standard, affordable vehicles like the 2015 Honda Accord.

Boston, MA Auto Insurance Monthly Cost by Make, Model, & Coverage Type

| Make and Model | Minimum Coverage | Full Coverage |

|---|---|---|

| BMW 3 Series | $155 | $210 |

| Chevrolet Silverado | $125 | $180 |

| Ford F-150 | $130 | $185 |

| Honda Accord | $115 | $170 |

| Hyundai Elantra | $110 | $165 |

| Jeep Grand Cherokee | $140 | $195 |

| Mercedes-Benz C-Class | $160 | $220 |

| Nissan Altima | $118 | $172 |

| Subaru Outback | $123 | $177 |

| Toyota Camry | $120 | $175 |

Luxury vehicles and automobiles that are expensive to repair or replace incur a higher risk and, therefore, incur higher insurance rates.

If you choose to use a cheaper car, it will be easy to find more affordable options, thus making it easy to find insurance coverage. For detailed information, refer to our comprehensive report titled “The Most Expensive Cars To Insure.”

Minor Factors in Best Boston, MA Auto Insurance

While several factors influence your auto insurance premiums in Boston, some have a lesser impact on your rates. These minor factors can still play a role in determining the best Boston, MA, auto insurance for your needs. Still, they typically have a minor influence compared to key elements like driving history and vehicle type.

Your Marital Status

Marriage can simplify your insurance needs in Boston, Massachusetts. By bundling policies, couples can save a lot more on car insurance. It’s as easy as combining your car insurance with other policies, such as renters or homeowner’s insurance, giving you peace of mind and confidence in your coverage.

Combining car insurance after marriage is straightforward and can lead to discounts and comprehensive coverage. This simple step can ensure savings without compromising on protection.

Your Gender

The impact of gender on best Boston, MA auto insurance premiums is becoming less significant. While some insurers historically charged different rates based on gender, many now offer the same premiums regardless.

Gender has little influence on securing the best auto insurance in Boston, MA, where other factors like driving history and vehicle type play a more substantial role in determining premiums. To gain further insights, consult our comprehensive guide titled “Factors that Affect Your Car Insurance Premium.”

Your Driving Distance to Work

In Boston, heavy traffic makes commuting time a factor, but reducing your driving distance won’t significantly lower your best Boston, MA, auto insurance premiums. While carpooling or using public transport can save on gas, it won’t offer significant savings on insurance.

However, if your vehicle is for business purposes, expect premiums to rise by up to 10% due to the higher risks requiring commercial auto insurance coverage.

Your Coverage and Deductibles

Increasing your deductible will reduce your monthly rates even if you get the best auto insurance deals in Boston, MA. This way, you can provide additional cover without adding much in terms of costs.

However, you must set aside savings to cover the higher deductible if you need to file a claim. Ensures you’re financially prepared for unexpected events while maintaining affordable coverage.

Education in Boston, MA

Boston residents who have attained a certain level of education can take advantage of the good student discount on Boston auto insurance. Because several insurers give discounts to young drivers with exceptional academic performance, students from the numerous Boston universities, including Harvard and Tufts School of Medicine, will be glad to hear this.

Some discounts help reduce the overall cost of coverage. Ask for them when shopping for different insurance policies.

Unveiling Our Car Insurance Analysis Process

When seeking budget-friendly car insurance in Boston, MA, one should evaluate price, coverage, and service, among other related things. Liberty Mutual, Geico, or State Farm offer attractive prices, discounts, and hassle-free claim service.

Some factors, such as driving history, area code, and type of car, also affect premiums. Explore available discounts (e.g., safe driver discounts or bundling discounts) to get the best coverage and rates. Additional research may be needed to find the best fit based on cost, customer service, and policy options.

Get the best auto insurance rates possible by entering your ZIP code into our free comparison tool today.

Frequently Asked Questions

Do you need a license to buy a car in Boston?

You can buy a car in Boston without a license, but you’ll need one to register and insure it.

Which is the most expensive form of car insurance in Boston?

The most expensive form of car insurance in Boston is comprehensive coverage, which protects against non-collision damages like theft, vandalism, and natural disasters. It is more costly due to its broad range of protection.

Get the best auto insurance rates possible by entering your ZIP code into our free comparison tool today.

Which company gives the best car insurance?

Liberty Mutual, Geico, and State Farm are the top companies offering the best car insurance in Boston, MA. They are known for providing cheap car insurance rates, reliable coverage, and excellent customer service.

Which car insurance covers the most?

Comprehensive car insurance covers the most, including collision and non-collision incidents like theft, vandalism, and natural disasters. It offers the highest level of protection available.

Is collision the same as full coverage?

Collision insurance covers only damages from accidents, while complete coverage includes both collision and comprehensive coverage. Full coverage offers broader protection compared to collision insurance alone.

Do I pay a deductible if not at fault in Boston, MA?

In Boston, under no-fault auto insurance, if you’re not at fault, the other driver’s insurance typically covers your damages without requiring you to pay a deductible. This simplifies the claims process for non-responsible drivers.

What is limited collision coverage in Boston?

Limited collision coverage in Boston only pays for your vehicle’s repairs after an accident if you are not at fault.

What are the disadvantages of fully comprehensive car insurance?

The disadvantages of fully comprehensive car insurance include higher premiums and the fact that it may be unnecessary for older or less valuable vehicles. The cost can outweigh the benefits for some drivers.

What is the recommended car insurance coverage in Massachusetts?

In Massachusetts, recommended coverage includes required liability and uninsured UM/UIM auto insurance coverage, plus optional collision, comprehensive, and medical payments coverage.

Can someone else drive my car in Massachusetts?

In Massachusetts, someone else can drive your car with your permission, and your insurance will typically cover them.

Find the best auto insurance rates no matter how much coverage you need by entering your ZIP code into our comparison tool today.