Best Idaho Falls, ID Auto Insurance in 2025 (Your Guide to the Top 10 Providers)

The best Idaho Falls, ID auto insurance options come from State Farm, Geico, and Farmers. They offer excellent coverage and affordability, with rates starting as low as $26 per month. State Farm delivers the best overall value for Idaho Falls drivers. Explore this article to find more options for your needs.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

Licensed Agent & Financial Advisor

UPDATED: Nov 12, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Company Facts

Full Coverage in Idaho Falls ID

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Idaho Falls ID

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Idaho Falls ID

A.M. Best

Complaint Level

Pros & Cons

The best Idaho Falls, ID, auto insurance providers are State Farm, Geico, and Farmers. This is for anyone looking to take advantage of various options, competitive rates, and affordable average auto insurance costs.

State Farm is the best option overall as it offers low insurance rates and great coverage, neck-and-neck, with only $26 a month to get started. Geico has lower rates for frugal drivers, whereas Farmers offers policy customization for those looking to have customizable options.

Our Top 10 Company Picks: Best Idaho Falls, ID Auto Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 17% B Local Discounts State Farm

#2 25% A++ Affordable Rates Geico

#3 20% A Custom Coverage Farmers

#4 25% A Customer Service American Family

#5 25% A+ Accident Forgiveness Allstate

#6 10% A+ Snapshot Discounts Progressive

#7 25% A New Car Liberty Mutual

#8 10% A++ Military Discounts USAA

#9 20% A+ Roadside Assistance Nationwide

#10 5% A+ Senior Discounts The Hartford

Our top picks provide excellent coverage choices, customer service, and discounts for good options for Idaho Falls drivers. Start saving on your auto insurance by entering your ZIP code and comparing quotes.

- Find the best Idaho Falls, ID auto insurance with coverage tailored to local drivers

- Compare affordable options with rates starting at $26 per month

- State Farm is the top pick, offering reliable coverage at competitive rates

#1 – State Farm: Top Overall Pick

Pros

- Well-Respected Brand: State Farm has a strong brand reputation, reflected by the fact that Idaho Falls, ID, has them as one of its prominent agents.

- Convenient Mobile App: State Farm has a mobile app that Idaho Falls drivers can use to manage their policies, file claims, and more. Check out our State Farm auto insurance review for full details.

- Ways to Save: Drivers in Idaho Falls can earn lower rates by taking advantage of available discounts, such as those for bundling and safe driving.

Cons

- Premiums Higher: Idaho Falls drivers could pay more for their rates.

- Expensive for High-Risk Drivers: State Farm Idaho Falls does not offer the best rates if you have a history of accidents or tickets.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#2 – Geico: Best for Affordable Rates

Pros

- Low Base Rates: Geico offers competitive pricing for many Idaho Falls, ID, residents, often beating local competitors.

- Digital Experience: Geico’s app and website make policy management easy for Idaho Falls drivers on the go. View our Geico auto insurance review to find out more.

- Multi-Policy Discounts: Idaho Falls residents can save further by bundling car insurance with renters or homeowners insurance.

Cons

- Less Personalized Service: Geico relies heavily on online tools, which may not suit Idaho Falls residents who prefer in-person interactions.

- Limited Local Agents: Fewer local offices in Idaho Falls may mean less direct support for policy questions.

#3 – Farmers: Best for Customizable Coverage

Pros

- Tailored Policies: Farmers offer various add-ons, making it easy for Idaho Falls, ID, drivers to customize coverage to fit their needs.

- Good for Young Drivers: Farmers provide discounts that benefit Idaho Falls drivers. For deeper details, access our Farmers auto insurance review.

- Potent Local Agents: Farmers’ Idaho Falls agents provide hands-on assistance and guidance.

Cons

- Higher Premiums: Some Idaho Falls residents may find farmers’ rates higher than other insurers.

- Limited Discounts: Fewer discount options might make Farmers less attractive to budget-conscious Idaho Falls drivers.

#4 – American Family: Best for Customer Service

Pros

- Quality Service: Idaho Falls, ID, residents can expect top-notch customer support from American Family. Read more in our American Family auto insurance review.

- An array of Policy Choices: With coverages from American Family, this gives Idaho Falls customers multiple options.

- Discounts for Safe Drivers: Idaho Falls residents with clean driving records can reap the rewards of significant savings.

Cons

- Fewer Online Tools: American Family’s digital services may be more basic, which may not be good for the online-oriented Idaho Falls driver.

- Higher Base Rates: American Family starts its premiums higher than some rival insurers in places including Idaho Falls.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#5 – Allstate: Best for Coverage Options

Pros

- Comprehensive Add-Ons: Allstate offers extensive options, such as accident forgiveness, for Idaho Falls, ID, and drivers seeking extra protection.

- Local Agents: Allstate’s Idaho Falls agents provide personalized assistance for policyholders. Peruse our Allstate auto insurance review for complete details.

- Strong Digital Presence: Idaho Falls residents can easily manage policies through Allstate’s mobile app and website.

Cons

- Above-Average Premiums: Some Idaho Falls residents may find Allstate’s rates on the higher side.

- Limited Discounts: Allstate offers fewer discounts for Idaho Falls drivers than other providers.

#6 – Progressive: Best for High-Risk Drivers

Pros

- Competitive Rates for High-Risk Drivers: Progressive offers affordable options for Idaho Falls residents with less-than-perfect driving records.

- Snapshot Program: Idaho Falls drivers can potentially use Progressive’s Snapshot tool to reduce premiums based on driving habits.

- Good Online Tools: Idaho Falls residents can benefit from Progressive’s robust digital tools for easy policy management. Read through our Progressive auto insurance review for all the information.

Cons

- Mixed Customer Reviews: Some Idaho Falls customers report issues with Progressive’s claims process.

- Rates May Fluctuate: Depending on driving behavior, premiums can vary significantly for Idaho Falls drivers.

#7 – Liberty Mutual: Best for Flexible Coverage

Pros

- Customizable Policies: Liberty Mutual provides Idaho Falls, ID, drivers with many coverage add-ons to meet specific needs.

- Good Bundling Discounts: Idaho Falls residents can save on car insurance by bundling with other policies like homeowners.

- Local Agents Available: Liberty Mutual has agents in Idaho Falls who can offer in-person assistance. Explore our Liberty Mutual auto insurance review for a detailed breakdown.

Cons

- Higher Premiums: Some Idaho Falls residents may find Liberty Mutual’s rates higher than other options.

- Limited Discounts: Liberty Mutual may have fewer discount opportunities for Idaho Falls drivers.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#8 – USAA: Best for Military Families

Pros

- Affordable for Military Members: USAA offers competitive rates for military families in Idaho Falls, ID. Get the details in our USAA auto insurance review to learn more.

- Excellent Customer Service: USAA is highly rated for customer satisfaction, benefiting military families in Idaho Falls.

- Comprehensive Military-Focused Coverage: USAA’s policies cater to the specific needs of military members in Idaho Falls.

Cons

- Military-Only Eligibility: USAA is available only to military members and their families, limiting options for other Idaho Falls residents.

- Few Local Offices: Limited branch locations may be inconvenient for some Idaho Falls residents needing in-person support.

#9 – Nationwide: Best for Safe Drivers

Pros

- Vanishing Deductible Program: Nationwide rewards safe driving in Idaho Falls, ID, with a gradually decreasing deductible.

- Strong Digital Tools: Idaho Falls residents can easily manage policies and claims through Nationwide’s app and website.

- Local Idaho Falls Agents: Nationwide has local agents offering personalized service for Idaho Falls policyholders. Check out our entire Nationwide auto insurance review to discover more.

Cons

- Not Ideal for High-Risk Drivers: Some Idaho Falls residents with less-than-perfect driving records may face higher premiums.

- Rates Can Be High: Idaho Falls drivers may find Nationwide’s premiums higher than budget providers.

#10 – The Hartford: Best for AARP Members

Pros

- Exclusive Benefits for AARP Members: The Hartford offers tailored discounts for Idaho Falls, ID, and AARP members. Read our The Hartford auto insurance review to gain more knowledge.

- Good Customer Support: Known for excellent service, The Hartford ensures Idaho Falls policyholders receive reliable assistance.

- Specialized Coverage Options: Idaho Falls residents can access unique coverages like RecoverCare, supporting them after an accident.

Cons

- Limited Availability: The Hartford’s auto insurance is primarily for AARP members, restricting options for other Idaho Falls residents.

- Potentially Higher Rates: Idaho Falls residents may find The Hartford’s rates higher than average, especially without AARP discounts.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Auto Insurance Coverage Requirements in Idaho

Driving in Idaho? Hopefully, you have the following forms of insurance coverage: Liability coverage is sufficient if you drive around in an old, relatively cheap car. However, newer vehicles require much more coverage. If you are still making payments on a financed vehicle, your lender may even need it.

Idaho Falls residents can trust State Farm for its low rates and exceptional local support, providing unmatched value in auto coverage.

Kristine Lee Licensed Insurance Agent

Did you know that the average Idaho motorist pays less than the national average for car insurance? The good news is that it could be even lower! By following some simple tips, Idaho Falls residents could find cheap auto insurance and reduce their monthly payments even further.

Idaho Falls, ID Auto Insurance Monthly Rates by Provider & Coverage Level

Insurance Company Minimum Coverage Full Coverage

$65 $106

$49 $96

$53 $110

$26 $79

$59 $112

$30 $67

$46 $97

$34 $71

$50 $92

$26 $61

If you’re looking for the lowest possible rate, you’ll want to call Liberty Mutual, State Farm, or Nationwide. But remember that there is more to insurance than just a low rate. You must also consider customer service and claims filing when choosing a provider. There are various companies to research, including State Farm Idaho Falls, Allstate Idaho Falls, and more.

Auto Insurance Discounts From the Top Providers in Nampa, ID

Insurance Company Available Discounts

Accident-Free, Good Driver, Low Mileage, Multi-Policy, New Car, Anti-Theft

Away-From-Home Student, Accident-Free, Good Driver, Low Mileage, Bundling (Home & Auto)

Good Driver, Low Mileage, Multi-Policy, Safety Equipment, Pay-In-Full

Defensive Driver, Telematics-Based (Usage-Based), Low Mileage, Good Driver, Multi-Policy, Vehicle Safety

Telematics-Based, New Car, Good Student, Multi-Policy, Early Shopper, Homeowner

Accident-Free, Good Driver, Multi-Policy, Vehicle Safety, New Car, Paperless Billing

Telematics-Based, Multi-Policy, Good Driver, Continuous Insurance, Homeowner, Online Quote

Good Driver, Accident-Free, Low Mileage, Telematics-Based, Student Away, Defensive Driving

Defensive Driver, Vehicle Safety, Multi-Policy, Bundling, Retiree Discount

Good Driver, Military, Accident-Free, Multi-Policy, Loyalty, Family Discount

Auto insurance carriers evaluate many factors when determining car insurance quotes in Idaho Falls, ID, including driving violations, accident claims, occupation, years of driving experience, and current insurance coverage and limits.

Idaho Falls, ID Report Card: Auto Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| Traffic Density | A | Low congestion |

| Vehicle Theft Rate | A | Very low theft incidents |

| Average Claim Size | B+ | Slightly above national average |

| Uninsured Drivers Rate | B | Lower than national average |

| Weather-Related Risks | B | Moderate winter conditions |

In addition, premiums differ from carrier to carrier. Learn more about Idaho auto insurance requirements here to determine whether you’re still paying the most favorable rate.

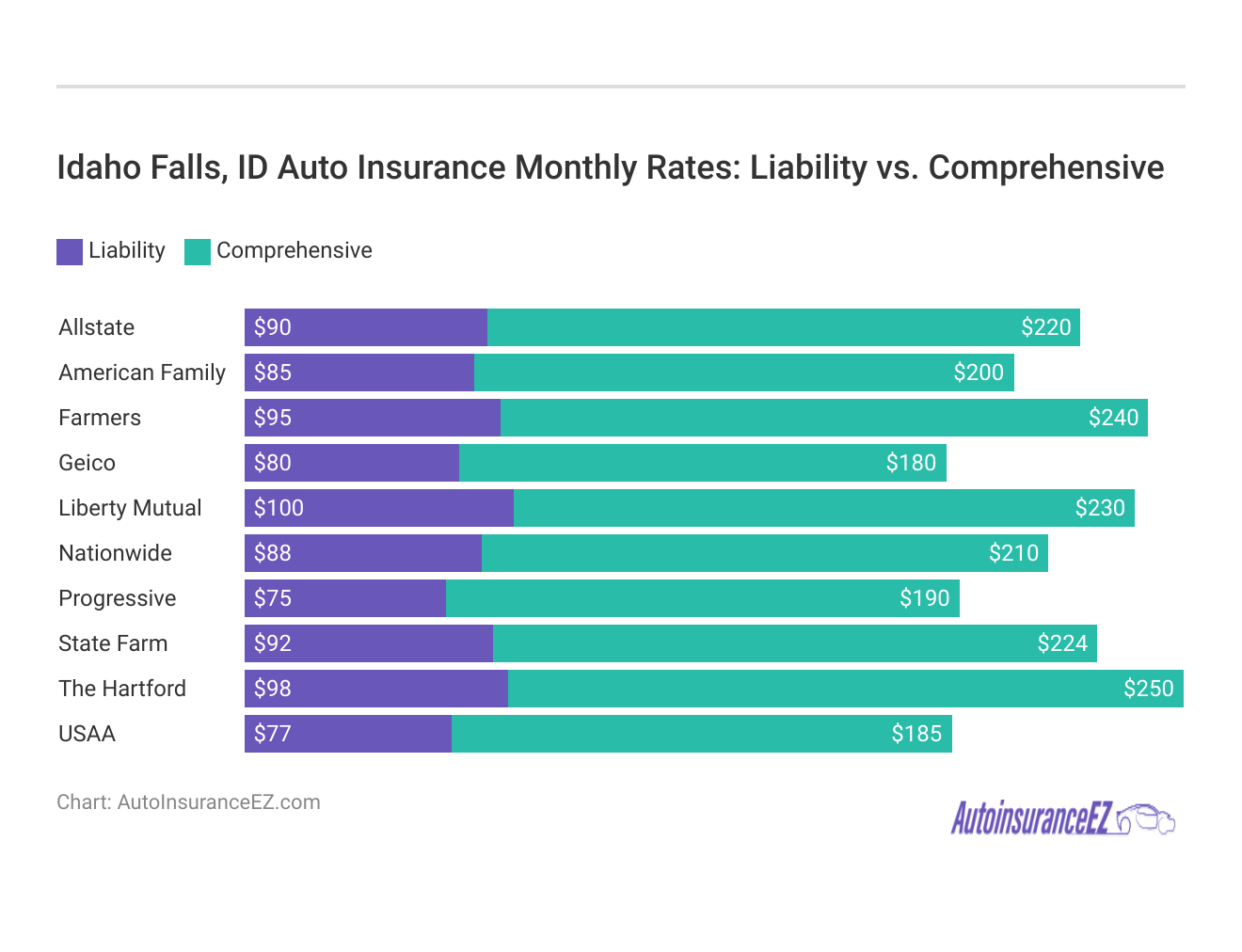

Idaho Falls, ID Auto Insurance Monthly Rates: Liability vs. Comprehensive

Idaho auto insurance requires all drivers to have 25/50/15 in liability coverage. Liability insurance pays if the driver is at fault for the accident. Getting more than the minimum may be advisable if your car is stolen or someone else causes the accident.

Drivers looking for cheap car insurance in Idaho Falls, ID, have several choices. State Farm, Allstate, Allied, Nationwide, and Liberty Mutual are the best companies providing affordable rates. State Farm and Liberty Mutual offer monthly rates of $21 for Idaho Falls, ID auto insurance.

Idaho Auto Insurance Requirements

| Coverage | Requirements |

|---|---|

| Bodily Injury Liability | $25,000 per person $50,000 per accident |

| Property Damage Liability | $15,000 per accident |

The economies of east Idaho and Wyoming are intricately connected to Idaho Falls. Many publications have boasted about the higher quality of life that the city’s citizens enjoy.

Idaho Falls, ID Auto Accident & Insurance Claim Statistics

| Factor | Value |

|---|---|

| Total Accidents Per Year | 1,200 |

| Total Claims Per Year | 900 |

| Average Claim Size | $4,500 |

| Percentage of Uninsured Drivers | 8% |

| Vehicle Theft Rate | 50 thefts/year |

| Traffic Density | Low |

| Weather-Related Incidents | Moderate |

Additionally, the city has various outdoor recreational facilities and a famous minor-league baseball team.

Major Factors in Cheap Car Insurance in Idaho Falls, Idaho

Car insurance companies in Idaho Falls, ID, consider numerous variables when designing an auto insurance policy. These factors affect your auto insurance rates, and many of these factors are difficult or impossible to change, such as your gender or where you live. Other elements your car insurance company may consider include:

Your ZIP Code

Your auto insurance rates may differ depending on where you call home. In general, highly populated cities have higher auto insurance rates because the extra drivers on the road increase the likelihood of an accident! The population of Idaho Falls is 58,292, and the median household income is $44,913.

Idaho Falls, ID Auto Insurance Monthly Rates by ZIP Code

ZIP Rates

83405 $165

83402 $160

83404 $155

83401 $150

83415 $145

83403 $140

83406 $135

This means Idaho Falls residents may benefit from relatively lower rates than those in more densely populated areas, as there is generally less traffic and fewer accidents.

Automotive Accidents

If you live in an area with fewer accidents, you will likely get a lower monthly rate without lifting a finger.

Idaho Falls, ID Fatal Accidents

Category Count

Fatal Crash Individuals 30

Fatal Crash Vehicles 18

Fatalities 13

Fatal Accidents 12

DUI Fatal Crashes 4

Fatal Accident Pedestrians 2

The most recent statistical data for accidents in Idaho Falls are shown in the chart below. Considering the city’s population, you may be eligible for lower premiums.

Auto Thefts in Idaho Falls

Auto theft is a significant problem, especially in densely populated cities. If your location or vehicle model puts you at a greater risk for theft, you may have trouble finding low-cost car insurance.

The total number of stolen vehicles in Idaho Falls was 109 in 2013. Since this indicates a rise in theft from recent years, you might want to consider adding comprehensive coverage—it’s the only coverage that protects against theft.

Your Credit Score

Do you have poor credit? If you want to get lower Idaho Falls ID auto insurance rates, then you should seriously consider taking steps to improve your credit score.

Idaho Falls, ID Auto Insurance Monthly Rates by Credit Score

Insurance Company Good Credit Fair Credit Bad Credit

$70 $85 $110

$65 $80 $105

$75 $90 $115

$60 $75 $100

$80 $95 $120

$68 $83 $108

$62 $77 $102

$55 $70 $95

$78 $93 $118

$50 $65 $90

As the chart shows, drivers with poor credit pay double the rates (or more) of those with good credit.

Your Age

The bad news is that your insurance rates will be some of the highest around if you’re under 25.

Idaho Falls, ID Auto Insurance Monthly Rates by Provider, Age, & Gender

Insurance Company Age: 17 Female Age: 17 Male Age: 34 Female Age: 34 Male

$220 $260 $120 $130

$200 $240 $110 $120

$210 $250 $115 $125

$190 $230 $100 $110

$230 $270 $130 $140

$220 $260 $120 $130

$180 $220 $90 $100

$210 $250 $115 $125

$240 $280 $140 $150

$170 $210 $85 $95

However, there are discounts for students who get good grades and students who have taken driving courses. This might help alleviate your burden.

Your Driving Record

Serious violations, such as a DUI, will raise your insurance rates. They might even get your coverage dropped altogether.

Idaho Falls, ID Auto Insurance Monthly Rates by Provider & Driving Record

Insurance Company Clean Record One Ticket One Accident One DUI

$106 $127 $143 $154

$96 $115 $130 $139

$110 $132 $149 $159

$79 $95 $107 $114

$112 $134 $151 $162

$67 $80 $91 $96

$97 $116 $131 $140

$71 $85 $96 $102

$92 $110 $124 $133

$61 $73 $82 $87

Minor violations, such as your typical “fender-bender” collision, could be forgiven if your provider offers an “Accident Forgiveness” discount.

Your Vehicle

Most people don’t know why luxury vehicles cost so much more to insure – they just assume that it’s because of the expense.

Idaho Falls, ID Auto Insurance Monthly Rates by Vehicle Make & Model

Insurance Company 2024 Honda Accord 2024 Porsche Boxster Spyder

$180 $300

$160 $290

$155 $280

$150 $250

$190 $320

$165 $265

$170 $295

$175 $275

$185 $310

$145 $260

This is true in part. But you also have to purchase more coverage to protect an expensive vehicle, which is why the price of luxury vehicles is so high.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Minor Factors in Cheap Auto Insurance in Idaho Falls, Idaho

Pay careful attention to the factors that affect your car insurance premium below for an extra tweak on your monthly rate:

Your Marital Status

Bundling numerous insurance policies under one company is not a new practice – anyone can do it. Moreover, if you’re married, you can bundle with your spouse, too. This can save you even more money.

Your Gender

Everyone knows the stereotypes about how a particular gender performs behind the wheel…except for insurance companies, that is. More and more providers are offering identical rates, regardless of gender. And if your provider does charge a difference, it’s little more than a few dollars each month.

Your Driving Distance to Work

Most drivers may find their average work commute lasting 14-20 minutes daily. About three-quarters of workers prefer to drive their vehicle to work, while around 8-20% carpool.

Did you know business vehicles are 10% more costly to insure than personal use vehicles? Additionally, your overall yearly mileage doesn’t matter as much as you might think. You’d save maybe 2-3% at best by driving fewer than 6,000 miles yearly.

Your Coverage and Deductible

Raising your deductible is a quick and easy way to lower your monthly premium. Be careful, though, if you decide to go this route. Save up a little money on the side if the worst happens and you need to file a claim.

Education in Idaho Falls, ID

Many drivers in Idaho Falls have a high school diploma or equivalent. Fewer drivers also have a bachelor’s degree or college education under their belts. And if you’re one of these educated few, you could save money on your car insurance – even more than someone with a fancy job and a high salary but little formal education.

For Idaho Falls drivers, State Farm delivers the perfect blend of affordability and personalized service, making it the clear top pick for auto insurance.

Tim Bain Licensed Insurance Agent

Idaho Falls has tried to attract significant university support over the years, but the city has yet to make a home for any traditional, four-year institutions. However, the Eastern Idaho Technical College can be found there, and some online degree programs (such as the University of Phoenix) have opened local centers for students.

Determining your financial risk as a high-risk driver can be very difficult or impossible for the typical insurance shopper. Insurance companies have an advantage over consumers due to their statistics and experiential knowledge. Learn what insurance companies don’t want you to know.

Stop overpaying for auto insurance. Enter your ZIP code to find out if you can get a better deal.

Frequently Asked Questions

What is the cheapest car insurance in Idaho?

State Farm and Geico often offer the cheapest car insurance in Idaho. Consult our “Idaho Auto Insurance Made Easy” to learn more.

How can I find cheap car insurance in Idaho Falls?

Use online comparison tools to find cheap car insurance in Idaho Falls from top providers.

What are the options for cheap auto insurance in Idaho?

Providers like Liberty Mutual and State Farm offer cheap auto insurance in Idaho.

Who has the best car insurance in Idaho?

State Farm, Farmers, and Geico are famous for the best car insurance in Idaho. Dive into our “10-Minute Auto Insurance Buying Guide” for more insights.

Which is the best Idaho auto insurance company?

State Farm is often rated as the best Idaho auto insurance company for affordability and service.

How do I get car insurance quotes in Idaho Falls?

Visit comparison sites to get auto insurance quotes in Idaho Falls, ID from top insurers. Use our free comparison tool to see what auto insurance quotes look like in your area.

What factors impact auto insurance rates in Idaho?

Rates depend on age, driving history, and ZIP code in Idaho. For additional insights, see our ”Types of Auto Insurance Coverage.”

How do I find cheap car insurance in Boise, Idaho?

State Farm and Geico are known for cheap car insurance in Boise, Idaho.

Who provides the best Idaho auto insurance?

State Farm and Farmers are top choices for the best Idaho auto insurance. For complete information, look at our “Compare Auto Insurance Companies.”

Are there discounts for car insurance in Idaho Falls?

Yes, providers like Geico and State Farm offer discounts for car insurance in Idaho Falls.

How much is cheap car insurance in Idaho?

The cost of cheap car insurance in Idaho depends on the provider and their rates. Rates can be as low as $26 per month, depending on the company and coverage options.

How can I get car insurance quotes in Idaho?

Use online tools to compare car insurance quotes in Idaho quickly. View our “Auto Insurance Coverage Options” to find out more.

Does auto insurance in Idaho Falls differ from Boise?

Yes, auto insurance in Idaho Falls is often cheaper than in Boise.

Can I get cheap auto insurance in Idaho with poor credit?

Yes, companies like State Farm offer cheap auto insurance for those with poor credit in Idaho.

What’s the cheapest car insurance in Idaho Falls for young drivers?

Geico and State Farm offer discounts for young drivers in Idaho Falls. To learn more, look at our “Cheap Car Insurance Rates.”

What is the best car insurance in Idaho for military families?

USAA offers excellent rates and benefits for military families in Idaho. Start comparing total coverage auto insurance rates by entering your ZIP code.