Cheap Auto Insurance in Texas for 2025 (10 Companies With the Lowest Rates)

These are the budget-friendly, accommodating auto insurance providers in Texas. Top providers like USAA, State Farm, and Travelers are here to meet clients' expectations. USAA starts with a $23 rate per month, and you can have exceptional service. State Farm is known for its extensive nationwide presence, and Travelers is reputable for drivers for its diverse coverage.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

6,589 reviews

6,589 reviewsCompany Facts

Min. Coverage in Texas

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 18,154 reviews

18,154 reviewsCompany Facts

Min. Coverage in Texas

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 1,733 reviews

1,733 reviewsCompany Facts

Min. Coverage in Texas

A.M. Best Rating

Complaint Level

Pros & Cons

1,733 reviews

1,733 reviewsUSAA offers exceptional service for as low as $23 monthly, making it a reputable option for drivers. State Farm and Travelers are also top picks for their nationwide presence and diverse coverage options, which make drivers’ lives more convenient.

These leading auto insurance companies provide affordable and customized coverage to meet your needs. They assist drivers to save a lot of money while staying safe with various services and options. Get the ideal policy right now!

Our Top 10 Company Picks: Cheap Auto Insurance in Texas

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $23 | A++ | Exceptional Service | USAA | |

| #2 | $33 | B | Nationwide Presence | State Farm | |

| #3 | $37 | A++ | Diverse Coverage | Travelers | |

| #4 | $39 | A++ | Affordable Rates | Geico | |

| #5 | $45 | A+ | Innovative Options | Progressive | |

| #6 | $51 | A | Comprehensive Policies | Farmers | |

| #7 | $57 | A+ | Flexible Discounts | Nationwide |

| #8 | $65 | A | Customer Focus | American Family | |

| #9 | $66 | A | Customizable Plans | Liberty Mutual |

| #10 | $75 | A+ | Trusted Reputation | Allstate |

Other top providers are also offering add-ons, bundling, benefits and many more to suit your needs within your limit. Discover our insurance guide by entering your ZIP code to explore different offers of auto insurance with top providers in Texas.

- USAA, State Farm and Travelers are the best among cheap auto insurance providers in Texas

- USAA offers exceptional services for drivers for as low as $23 monthly rate

- State Farm is known for nationwide presence and Travelers offers diverse coverage

#1 – USAA: Top Pick Overall

Pros

- Affordable for Military Members – Perfect for military personnel seeking affordable roadside safety coverage.

- Exceptional Customer Support – Guarantees a seamless policy management and claims processing experience.

- Specialized Military Perks – Provides benefits designed to meet the needs of military people. See more of it by reading our USAA auto insurance review.

Cons

- Exclusive Membership – USAA access is limited because it is inaccessible to the general public. Making membership exclusive.

- Fewer Physical Locations – It is more difficult to locate in-person services than other large providers. Making it harder to accommodate clients in some local places than other large providers.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#2 – State Farm: Best for Nationwide Presence

Pros

- Widespread Agent Network – In State Farm, locating a representative for one-on-one assistance is simple for drivers.

- Financially Strong – For those who appreciate long-term coverage dependability, State Farm is a solid choice.

- Broad Discount Selection – Offers several strategies to reduce monthly costs. Read more through our State Farm auto insurance review.

Cons

- Pricey for High-Risk Motorists – Those clients who have previously broken the law may face greater penalties.

- Limited Availability of Certain Add-Ons – In State Farm there only limited availability of certain add-ons. Not all places provide optional coverage.

#3 – Travelers: Best for Diverse Coverage

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Pros

- Extensive Policy Options – Perfect for drivers who wish to customize their desired insurance with personalized coverage solutions.

- Smart Savings Program – Offers discounts in exchange for safer driving practices. Drivers can now enjoy discounts just by driving safely.

- Eco-Friendly Incentives – Drivers with hybrid and electric vehicles can now enjoy cost reductions by using this insurance.

Cons

- Mixed Service Feedback – During the claims processing process, some users complain about sluggish services.

- Higher Costs for Younger Drivers – According to our Travelers auto insurance review, the cost of protection may be higher for teenagers and young adults.

#4 – Geico: Best for Affordable Rates

Pros

- Competitive Pricing – An affordable solution for those seeking monthly expenses that are within their means.

- Convenient Digital Tools – Drivers can now manage their policies with our user-friendly platform, which is designed to help them with ease.

- Exclusive Savings for Certain Groups – Military personnel and government employees receive special discounts. See more of it by reading our Geico auto insurance review.

Cons

- Limited Coverage Personalization – Drivers may experience fewer add-ons available compared to other insurance providers.

- Fewer Local Offices – Drivers may experience difficulties accessing in-person service or face-to-face service in some localities.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#5 – Progressive: Best for Innovative Options

Pros

- Flexible Pricing Feature – This feature assists clients in customizing their plans to suit their financial constraints. Drivers will enjoy personalized coverage within financial limits.

- Safe Driving Rewards – Progressive auto insurance gives discounts for good drivers. Those who drive safely are eligible for discounts.

- Unique Coverage Enhancements – Progressive also includes protections for their drivers that are not commonly found with other providers.

Cons

- Potential Price Hikes After Tracking Program – After evaluation, some of the clients report higher rates in their insurance.

- Inconsistent Customer Service – Some customer service response times, specially for claims and inquiries may take some time to meet clients expectations.

#6 – Farmers: Best for Comprehensive Policies

Pros

- Robust Coverage Choices – Farmer’s coverage includes benefits like car replacement and accident forgiveness to drivers.

- Diverse Discount Opportunities – Farmer also provides discounts for cautious drivers, homeowners, and professionals.

- OEM Part Coverage Available – Farmer guarantees that original manufacturer parts are used for repairs, preserving vehicles’ authenticity.

Cons

- Higher Initial Costs – According to Farmers auto insurance , base rates are typically higher than those of other auto insurance companies.

- Limited Discounts for Young Motorists – Young motorist such as student drivers have fewer money-saving alternatives.

#7 – Nationwide: Best for Flexible Discounts

Pros

- Lower Deductibles Over Time – Safe driving will lower the rates of deductions. This benefit is advantageous to safe drivers. See more of it by reading our Nationwide auto insurance review.

- Bundling Opportunities – Nationwide offers bundling coverage that offers substantial cost savings when combining auto and home insurance.

- Annual Policy Reviews – Nationwide guarantees coverage remains in line with evolving regulations or requirements.

Cons

- Expensive for Those with Past Claims – Nationwide rates may tend to increase after an accident. There may be additional charges if not driving safely.

- Fewer Local Representatives – Nationwide customer service agents are fewer in local areas. Making face-to-face assistance challenging.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#8 – American Family: Best for Customer Focus

Pros

- Superior Customer Service – American Family customer service is highly recommended. Excellent reputation for processing claims and providing support to clients.

- Discounts for Young Drivers – American Family is student-friendly. Offers first-time policyholders and students cost savings. Read more through our American Family auto insurance review.

- User-Friendly Mobile App – American Family provides a mobile app to manage policies for drivers. Making filing claims and managing policies easier.

Cons

- Limited Availability Nationwide – American Family is not available for some of the regions. Not all areas can access coverage.

- Higher Base Premiums – The initial costs could be higher than those of other auto insurance prior to discounts.

#9 – Liberty Mutual: Best for Customizable Plans

Pros

- Usage-Based Discount Program – Liberty Mutual encourages responsible driving practices. Giving discounts to drivers who maintain responsible driving.

- Comprehensive Replacement Policies – Liberty Mutual provides possibilities for new and improved car replacements.

- Multiple Bundling Choices – Offers savings by combining renters’ or homeowners’ insurance with auto insurance.

Cons

- Pricey Without Discounts – Based on our Liberty Mutual auto insurance review, if no savings or discounts are used, base rates may tend to be higher.

- Slow Claims Resolution – In Liberty Mutual, delays in claim reimbursements have been reported by some of several clients.

#10 – Allstate: Best for Trusted Reputation

Pros

- Financial Stability & Longevity – Allstate is a reputable supplier with a strong track record. Giving trustworthy suppliers to clients.

- Tech-Based Driving Discounts – Through tracking programs, safe practices result in reduced expenses. Persuading safe driving discounts to clients.

- Accident Forgiveness Perk – Allstate aids in avoiding sudden rate spikes following an initial incidence to clients.

Cons

- Premiums Without Discounts Are High – According to our Allstate auto insurance review, without discounts, premium rates can be expensive.

- Gradual Cost Increases Over Time – Despite having no claims, some policyholders see their rates increase over time.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Texas Car Insurance Coverage and Rates

By picking the right provider and level of coverage, you may significantly decrease your monthly premiums. By quickly comparing options, you can find a good deal that still provides decent coverage. Look at the table below to compare rates.

Texas Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $75 | $201 | |

| $65 | $176 | |

| $51 | $137 | |

| $39 | $105 | |

| $66 | $178 |

| $57 | $154 |

| $45 | $121 | |

| $33 | $90 | |

| $37 | $101 | |

| $23 | $62 |

Insurance rates change, but you don’t have to overpay. Comparing options can help you secure a more affordable rate. Follow this guide to find coverage that fits your budget.

Auto Insurance Discounts From the Top Providers in Texas

| Insurance Company | Available Discounts |

|---|---|

| Safe Driving Club, Early Signing, Multi-Policy, Good Student, New Car | |

| Steer Into Savings, Safe Driver, Early Bird, Multi-Policy, Low Mileage | |

| Multi-Policy, Signal, Good Student, Safe Driver, Affinity Group | |

| Multi-Policy, Military, Federal Employee, Good Student, Defensive Driving | |

| Multi-Policy, RightTrack, Military, Good Student, Safe Vehicle |

| SmartRide, SmartMiles, Good Student, Defensive Driving, Multi-Policy |

| Multi-Policy, Snapshot, Continuous Insurance, Teen Driver, Homeowner | |

| Safe Driver, Multi-Policy, Good Student, Steer Clear, Defensive Driving | |

| Multi-Policy, Good Payer, Safe Driver, Hybrid/Electric Vehicle | |

| Military, Safe Driver, Multi-Policy, Good Student, New Vehicle |

Bills can change in amount over time, but you don’t have to overpay. Checking for better deals can help you save money. Follow this guide to keep your costs low.

Saving on insurance is easier than you think! Many Washington providers offer discounts for safe driving, bundling, and more. A quick check with your insurer might help you save money. Enter your ZIP code to see how much you could save.

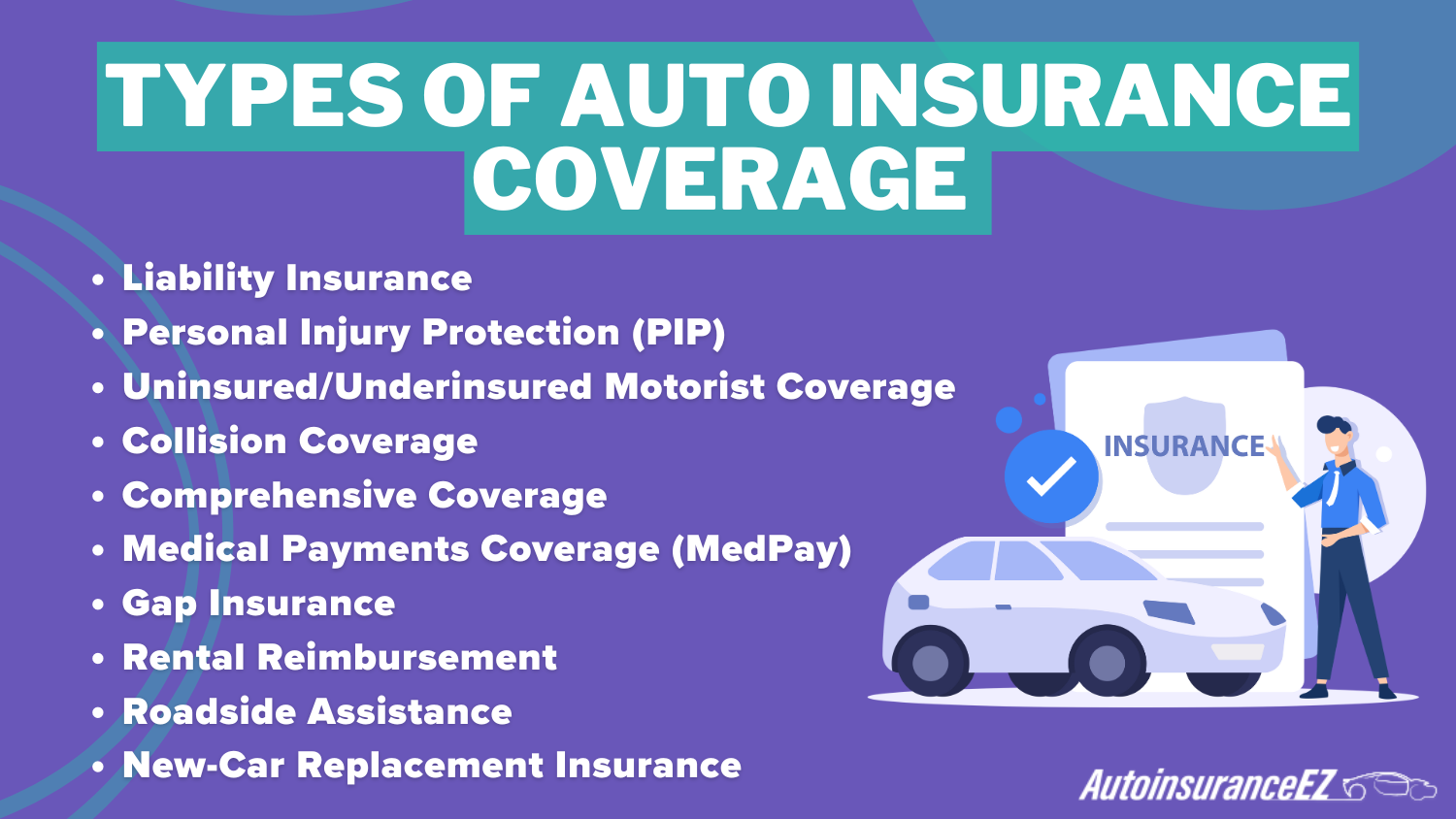

Liability Coverage in Texas

Explore affordable auto insurance options in Texas. With this table, comparing providers by coverage details and annual accident claim data to help you find the best fit.

Texas Accidents & Claims per Year by City

| City | Accidents per Year | Claims per Year |

|---|---|---|

| Austin | 20,000 | 10,000 |

| Dallas | 40,000 | 20,000 |

| Fort Worth | 15,000 | 7,500 |

| Houston | 50,000 | 25,000 |

| San Antonio | 30,000 | 15,000 |

Road fatalities are preventable, but factors like weather, traffic accidents, and collision types increase the risk. Stay informed, drive safely, and help reduce these tragic incidents.

5 Most Common Auto Insurance Claims in Texas

| Claim Type | Portion of Claims | Cost per Claim |

|---|---|---|

| Weather-Related Damage | 25% | $3,500 |

| Rear-End Collisions | 20% | $4,000 |

| Single-Vehicle Accidents | 15% | $5,500 |

| Theft | 10% | $7,000 |

| Vandalism | 5% | $2,000 |

Having the right insurance matters, but things like coverage limits and deductibles affect your protection. Know your options, choose wisely, and stay covered.

Get the coverage you need without overpaying. Enter your ZIP code to use this comparison and find the right insurance policy that protects your car and fits your budget.

Best Texas Car Insurance Companies

With so many car insurance companies, choosing the right one for your budget and peace of mind can be a tough decision. Read more about Car insurance discounts.

Auto Insurance Discounts From Top Texas Providers

| Insurance Company | Anti-Theft | Bundling | Good Driver | Good Student | Loyalty |

|---|---|---|---|---|---|

| 10% | 25% | 25% | 22% | 15% | |

| 25% | 25% | 25% | 20% | 18% | |

| 10% | 20% | 30% | 15% | 12% | |

| 25% | 25% | 26% | 15% | 10% | |

| 35% | 25% | 20% | 12% | 10% |

| 5% | 20% | 40% | 18% | 8% |

| 25% | 10% | 30% | 10% | 13% | |

| 15% | 17% | 25% | 35% | 6% | |

| 15% | 13% | 10% | 8% | 9% | |

| 15% | 10% | 30% | 10% | 11% |

It’s important to compare coverage, premiums, and customer reviews to find the best value. Look at factors like how claims are processed, available discounts, and the option to bundle insurance for lower costs.

Find the perfect plan for your needs and drive with confidence. Enter your ZIP code to get the best auto insurance rates in Texas today!

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Affordable Auto Insurance in Texas

Driving in Texas doesn’t have to come with high insurance costs. Leading providers offer budget-friendly plans with excellent coverage. Compare rates today and find an affordable policy that meets your needs.

Don’t overpay for car insurance in Texas. There are good providers with affordable plans that offer excellent coverage. You can stay protected while saving money, whether driving in the city or on the highway.

Peace of mind shouldn’t come at a high cost. Texas’s top providers offer quality coverage and service at affordable rates.

Insurance providers are here to help us in our auto insurance needs. Providing better options for us to meet our expectations with a flexible coverage meeting your personal policies to enjoy premium insurance within your financial capability.Jeff Root Licensed Insurance Agent

These top providers of auto insurance that will offer you with the best deals to have bigger discounts while enjoying your auto insurance premiums. Pick now with these top auto insurance providers by entering your ZIP code to see the best deals within your area.

Frequently Asked Questions

What factors contribute to USAA being ranked as the top choice for auto insurance in Texas?

USAA is ranked as the top choice for auto insurance in Texas due to its exceptional customer service, low rates (as low as $23/month), and exclusive availability for military members and their families, making it a budget-friendly Texas automotive insurance option.

How does State Farm’s nationwide presence impact its reputation and coverage options for Texas drivers?

State Farm’s nationwide presence ensures extensive coverage options, strong financial stability, and a vast network of agents, making it a reputable option for drivers looking for extensive nationwide presence and diverse coverage options. Enter your ZIP code to know more details.

What specific features make Travelers stand out in terms of diverse coverage options?

Travelers stands out for its diverse coverage options, including accident forgiveness, new car replacement, and extensive add-ons, making it one of the top picks for drivers around the state.

Read more: Allstate vs. Travelers: Best Auto Insurance for 2025

What types of discounts do major Texas auto insurance providers offer to help customers save on premiums?

Major Texas auto insurance providers offer auto insurance discounts for safe driving, bundling policies, military service, good student performance, and installing anti-theft devices, which assist drivers to save a lot of money while staying safe.

How do Texas auto insurance rates compare across different providers and coverage levels?

Texas auto insurance rates vary by provider and coverage level, with companies like USAA and Geico offering some of the lowest premiums, while full coverage policies generally cost more, proving that picking the right provider and level of coverage can significantly decrease your monthly premiums. To better know what providers offers the best coverage, enter your ZIP code now.

What are the most common auto insurance claims in Texas, and how do they affect policy pricing?

The most common auto insurance claims in Texas include collision damage, weather-related incidents, theft, uninsured motorist accidents, and liability claims from at-fault accidents, all of which emphasize why having the right insurance matters.

How do liability coverage requirements in Texas influence insurance costs for drivers?

Texas requires drivers to carry at least 30/60/25 liability coverage, which affects costs by ensuring minimum financial protection but may lead to higher premiums for additional coverage, making it essential to compare auto insurance rates.

What role do factors like traffic accidents and road conditions play in determining insurance rates in Texas cities?

Traffic accidents, severe weather, high urban congestion, and population density in Texas cities contribute to fluctuating insurance rates and increased claims, making road fatalities preventable with the right precautions. Enter your ZIP code here to learn more factors affecting your insurance rates.

What advantages and disadvantages are associated with choosing Progressive for innovative insurance options?

Progressive is known for its innovative options like Snapshot, which tracks driving habits for potential discounts, making it one of the best Texas car insurance companies for tech-savvy drivers.

How does the article’s advertiser disclosure impact the objectivity of the insurance recommendations provided?

The article’s advertiser disclosure suggests that while the recommendations aim to be objective, they may be influenced by partnerships with insurance providers, reinforcing the importance of using a free auto insurance comparison tool to explore unbiased options.