Cheap Auto Insurance in South Dakota for 2025 (10 Most Affordable Companies)

Cheap auto insurance in South Dakota starts at $9 per month. Geico, USAA, and State Farm are the best options. Geico offers the lowest rates, military families by USAA, and State Farm features excellent agent assistance. All of these satisfy South Dakota auto insurance requirements and provide trusted coverage.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Licensed Insurance Agent

UPDATED: Mar 28, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage in South Dakota

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 6,589 reviews

6,589 reviewsCompany Facts

Min. Coverage in South Dakota

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 18,154 reviews

18,154 reviewsCompany Facts

Min. Coverage in South Dakota

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviewsThe top picks for cheap auto insurance in South Dakota are Geico, USAA, and State Farm. Geico’s lowest rates begin at only $9 per month.

Geico offers low-cost coverage, while USAA specializes in military families. StateFarm excels with excellent local agent service.

Our Top 10 Company Picks: Cheap Auto Insurance in South Dakota

| Insurance Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $9 | A++ | Low Rates | Geico | |

| #2 | $10 | A++ | Military Focus | USAA | |

| #3 | $11 | B | Local Agents | State Farm | |

| #4 | $12 | A+ | Teen-Friendly | Nationwide |

| #5 | $16 | A++ | Telematics Program | Travelers | |

| #6 | $17 | A+ | Budgeting Tools | Progressive | |

| #7 | $18 | A | Accident Forgiveness | Farmers | |

| #8 | $22 | A+ | Driving Discounts | Allstate | |

| #9 | $24 | A | Tailored Policies | American Family | |

| #10 | $37 | A | Custom Options | Liberty Mutual |

All three cheap auto insurance companies meet South Dakota’s auto insurance standards, providing solid and affordable protection.

- USAA provides excellent coverage options tailored for military families

- Affordable policies meet South Dakota’s required minimum liability coverage

- Geico offers comprehensive coverage and reliable service to South Dakota drivers

Enter your ZIP code to compare affordable auto insurance rates in South Dakota and find the best coverage options tailored to your needs.

#1 – Geico: Top Overall Pick

Pros

- Affordable Monthly Rates: Geico offers extremely low monthly rates, starting at just $9 for minimum coverage auto insurance in South Dakota.

- Strong Financial Stability: With an A++ rating from A.M. Best, Geico provides high confidence in their ability to cover claims.

- Excellent Low-Cost Options: Geico’s affordable pricing structure makes it an excellent choice for budget-conscious drivers seeking cheap auto insurance in South Dakota.

Cons

- Limited Local Agents: Geico operates mainly online and through phone services, but it lacks local agents in some areas of South Dakota.

- Fewer Specialized Discounts: Geico’s discounts may not be as varied or specialized as those of other providers in certain situations.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#2 – USAA: Military Focus Expert

Pros

- Affordable Rates for Military Families: USAA provides highly competitive rates starting at $10 for minimum coverage auto insurance, focusing on military members and their families.

- A++ Financial Strength: USAA’s A++ rating from A.M. Best reflects its strong financial standing, ensuring reliable service for military families in South Dakota.

- Exclusive Military Benefits: USAA offers specialized benefits and discounts, making it the best choice for military personnel looking for affordable insurance in South Dakota.

Cons

- Membership Requirement: USAA is only available to military members and their families, which limits accessibility for non-military individuals in South Dakota.

- Fewer Physical Locations: USAA’s online-only model may limit face-to-face service. For a comprehensive understanding, consult our article titled “USAA Auto Insurance Review.”

#3 – State Farm: Local Agent Expert

Pros

- Strong Local Agent Network: State Farm has an extensive network of local agents, making it easy for drivers in South Dakota to get personalized advice and assistance.

- Competitive Pricing: State Farm offers minimum coverage starting at $11 monthly with flexibility for SD drivers. Explore this further in our article titled “State Farm Auto Insurance Review.”

- Bundling Discounts: State Farm offers significant savings for bundling auto and home insurance policies, which is ideal for customers who need multiple types of coverage.

Cons

- Limited Discounts for Teen Drivers: While State Farm offers some discounts, its options for teen drivers may not be as extensive as competitors’.

- Higher Rates for Certain Drivers: Some drivers may find their rates slightly higher than other budget-friendly insurers in South Dakota.

#4 – Nationwide: Teen-Friendly Expert

Pros

- Great for Teen Drivers: Nationwide offers special discounts and coverage options for teen drivers, making it a top choice for families in South Dakota with young drivers.

- Affordable Rates: Minimum coverage auto insurance starts at just $12 per month, providing an affordable option for drivers seeking budget-friendly coverage.

- A+ Financial Stability: With an A+ rating from A.M. Best, Nationwide ensures financial stability and reliable claim handling in South Dakota.

Cons

- Fewer Comprehensive Discounts: Nationwide’s discount offerings may be more limited than other insurers, particularly for customers with low-risk profiles.

- Potential for Higher Premiums: Some drivers may face higher premiums due to coverage needs or vehicle type. To enhance your knowledge, read our “Nationwide Auto Insurance Review.”

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#5 – Travelers: Telematics Program Expert

Pros

- Telematics Program for Lower Rates: Travelers offers a telematics program, allowing drivers to save money based on safe driving behaviors, starting at $16 for minimum coverage.

- Excellent Customer Service: Travelers have an A++ rating from A.M. Best, Which Means It provides reliable customer service and claims assistance in South Dakota.

- Flexible Coverage Options: Travelers offers a wide range of coverage options, making it easy for drivers to customize policies to fit their needs.

Cons

- Limited Availability of Discounts: Some Travelers’ discounts may be less effective without telematics participation. Our article ” Travelers Auto Insurance Review” will expand your understanding.

- Rates May Be Higher for Some Drivers: Depending on their driving habits, some drivers might find Travelers’ rates to be higher than those of other providers in South Dakota.

#6 – Progressive: Budgeting Tools Expert

Pros

- Comprehensive Budgeting Tools: Progressive offers a variety of budgeting tools to help drivers manage their monthly premiums effectively, starting at $17 for minimum coverage.

- A+ Financial Strength: With an A+ rating from A.M. Best, Progressive ensures reliable coverage and support for drivers in South Dakota.

- Wide Range of Discounts: Progressive provides discounts for safe driving, bundling, and more, helping customers lower their premiums.

Cons

- Higher Premiums for Certain Drivers: Some drivers, particularly those with less-than-ideal driving histories, may find Progressive’s rates to be higher than those of other insurers.

- Fewer Local Agent Options: Progressive’s service is primarily handled online, which may be inconvenient for customers who prefer in-person assistance.

#7 – Farmers: Accident Forgiveness Expert

Pros

- Accident Forgiveness: Farmers offers accident forgiveness, meaning a customer’s first accident won’t affect their premiums, starting at $18 monthly for minimum coverage.

- Strong Financial Stability: With an A rating from A.M. Best, Farmers offers reliable claims handling and customer service in South Dakota.

- Personalized Service: Farmers offer tailored insurance policies to fit drivers’ needs. For additional insights, refer to the “Farmers Auto Insurance Review.”

Cons

- Higher Rates for Some Drivers: Farmers’ premiums can be higher for certain drivers or vehicle types compared to more budget-friendly options.

- Limited Discounts: While Farmers offers accident forgiveness, it may offer fewer discounts overall than competitors in South Dakota.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#8 – Allstate: Driving Discounts Expert

Pros

- Excellent Driving Discounts: Allstate offers several discounts for safe driving, including its Safe Driving Bonus, with minimum coverage starting at $22 per month.

- A+ Financial Strength: Allstate has an A+ rating from A.M. Best, which means it offers policyholders a strong and reliable financial foundation.

- Comprehensive Coverage Options: Allstate offers a wide array of coverage options, making it easier to customize a policy to fit individual needs.

Cons

- Higher Base Premiums: Allstate’s base premiums, starting at $22 per month, can be relatively higher than other insurers in South Dakota.

- Less Flexibility in Discounts: Allstate’s discounts may be less flexible than those of competitors. Read our “Allstate Auto Insurance Review” to find out more.

#9 – American Family: Tailored Policies Expert

Pros

- Tailored Insurance Policies: American Family offers tailored coverage starting at $24 for minimum protection. Explore further with our article entitled “American Family Auto Insurance Review.”

- Financial Strength: American Family’s A rating from A.M. Best ensures economic stability and reliable coverage in South Dakota.

- Additional Coverage Options: American Family offers additional coverage options, such as roadside assistance and rental car reimbursement, enhancing policyholder value.

Cons

- Higher Premiums: Some drivers may find that American Family’s premiums are higher than those of other South Dakota insurance companies.

- Limited Discount Options: American Family may offer fewer discounts than other major insurers, limiting potential savings.

#10 – Liberty Mutual: Custom Options Expert

Pros

- Highly Customizable Coverage: Liberty Mutual offers flexible and customizable coverage options, starting at $37 for minimum coverage, catering to a wide range of driver needs.

- A Financial Strength: Liberty Mutual’s A rating from A.M. Best ensures solid financial backing for South Dakota drivers.

- Multiple Discounts: Liberty Mutual offers a variety of discounts, including bundling policies and insuring multiple vehicles. Explore further details in our “Liberty Mutual Auto Insurance Review.”

Cons

- Higher Base Rates: Liberty Mutual’s base premiums, starting at $37 per month, can be considerably higher than some competitors in South Dakota.

- Less Competitive Pricing for Low-Risk Drivers: Drivers with low risk profiles may find Liberty Mutual’s pricing less competitive than that of other insurers with more affordable rates.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

The Ultimate South Dakota Car Insurance Guide (Costs + Coverage)

With more shoreline than Florida, rolling hills, mountains, and plains, it’s no wonder that camping is South Dakota’s favorite pastime. Often referred to as the “Land of Plenty,” the “Land of Infinite Variety,” and “the blizzard state,” South Dakota is home to the Mount Rushmore National Memorial, which hosts over two million tourists and visitors per year.

Auto Insurance for learner’s permit / provisional license question – South Dakota

byu/sodakdave inInsurance

South Dakota is the fifth least populated state in America while simultaneously being the fifth least densely populated state in the U.S. South Dakota has approximately 880,000 residents and more than 940,000 registered vehicles. But while driving a car, a motorcycle, or an RV up and down South Dakota’s scenic shoreline, you must remember one very important driving detail: You need car insurance.

Finding the right type of car insurance and a decent provider can be daunting and time-consuming- and that’s exactly why we put together this ultimate guide to South Dakota car insurance. Scouring the web for South Dakota automobile insurance? Sometimes, looking for a provider can be difficult. But with AutoInsuranceEZ.com, it’s as simple as entering your zip code.

We can supply you with the top 8 insurance providers in your area, whether you live in a big city like Sioux Falls, Rapid City, or Aberdeen, or a lesser-populated area such as Watertown or Brookings. In this guide, we’ll cover car insurance coverage, laws, risks of the road, and more. Don’t go away! Car insurance coverage, rates, and the best Aberdeen, SD, auto insurance options are up first.

South Dakota Car Insurance Coverage and Rates

How do you know what type of insurance is right for you? Do you think you might be paying too much for your car insurance policy? We want you to know exactly what you’re paying for and why you’re paying for it. But before we get into insurance coverage laws and regulations, let’s explore South Dakota’s car culture.

South Dakota’s Car Culture

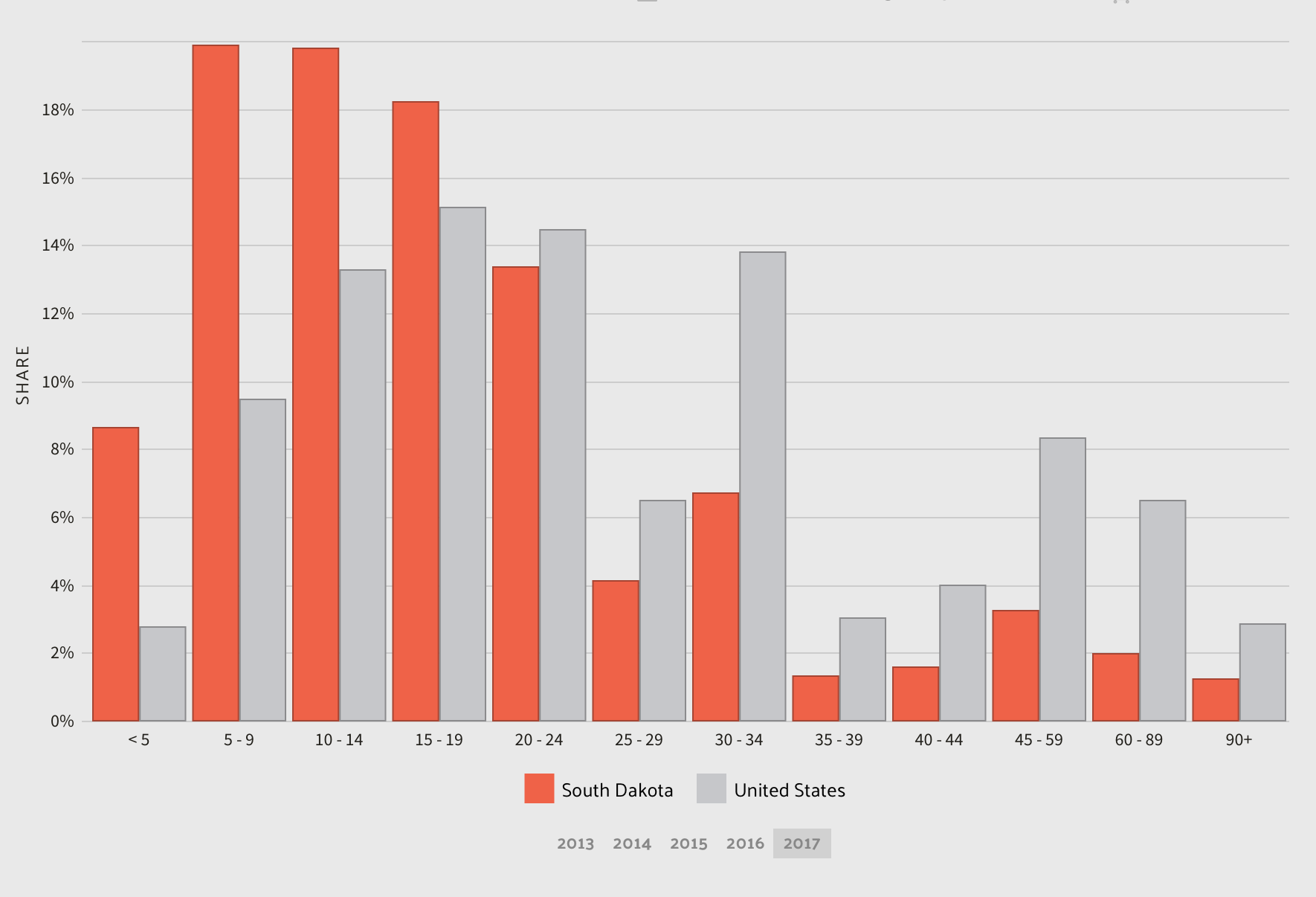

South Dakota has two major sections: East River and West River. Most of the state’s population lives in East River, so the back roads in West River are often lonely.

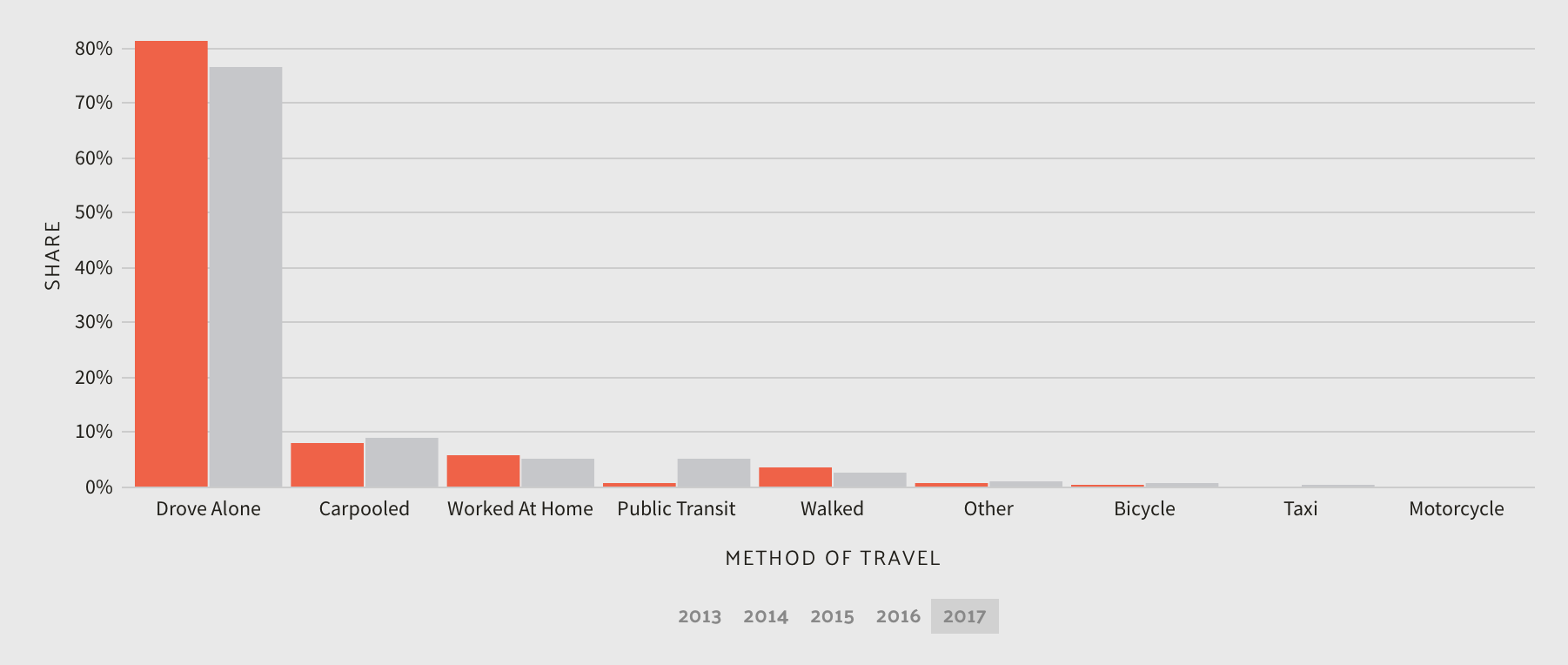

With a state this size, South Dakota drivers rely heavily on their vehicles to get from East River to West River and back. Many workers commute to bigger cities like Pierre and Sioux Falls, but the popular mode of transportation remains the automobile. South Dakota is a popular destination for campers and skiers, making vehicles sturdy enough to pull a pop-up trailer or carry a roof rack a common choice among locals.

With this in mind, understanding the different types of car insurance is crucial to ensure the right coverage. The Ford F150, the most purchased vehicle in the state, often requires policies that meet auto insurance South Dakota requirements and align with the average cost of car insurance in South Dakota.

South Dakota Minimum Coverage

Every driver in the state of South Dakota must have car insurance. This is a law set up to protect every driver from going bankrupt if and when they are involved in an accident. But there are many different policies, so how do you know which one is right for you?

What is the best way to get the cheapest auto insurance quote?

byu/CheetahDesperate6146 inInsurance

That part is easy! Drivers in South Dakota are required to carry at least a minimum liability insurance policy. This insurance policy is there to work as a safety net- it’s not guaranteed to make sure you escape all injuries when you fall, but it’s there to keep you from cracking open your skull on the pavement.

In other words, minimum coverage helps you cover the costs of damages resulting from an accident, but it is likely not going to cover all of the costs of incurred damages. The requirements for minimum liability coverage in the state of South Dakota are as follows:

- $25,000 liability coverage for bodily injury or death of one person in an accident caused by the owner/driver of the insured vehicle

- $50,000 liability coverage for total bodily injury or death liability in an accident caused by the owner/driver of the insured vehicle

- $25,000 liability coverage for property damage per accident caused by the owner/driver of the insured vehicle

This is also sometimes referred to as the 25/50/25 policy. Note that South Dakota requires twice as much money for personal injury as it does for property damage.

South Dakota drivers must carry minimum liability coverage since the state is considered at-fault, ensuring financial protection in accidents caused by the driver.

Scott W. Johnson Licensed Insurance Agent

Now that you know you need to carry at least the minimum amount of insurance required, don’t you want to know why you need to take it? When we say South Dakota is an at-fault state, we mean that anyone who causes a car accident is liable for covering any costs of property damages and personal injury bills that resulted from that accident.

If you caused an accident and three people were injured, you’re responsible for their medical bills. Hopefully, your minimum liability policy covers the costs, but $100,000 won’t go far with hospital bills. That’s why we recommend exploring auto insurance coverage options through the best South Dakota auto insurance company, even if you’re seeking cheap car insurance in South Dakota.

Forms of Financial Responsibility

A form of financial responsibility is just a form that proves you can be and will be held liable in the case of an accident. This is also known as “proof of insurance.” Have you ever been pulled over and the police officer asked for your registration and proof of insurance? He’s checking to see that you obey the law by carrying insurance.

Acceptable forms of proof of insurance are:

- Valid liability insurance ID cards

- Copy of your current car’s insurance policy

- Valid insurance binder (a temporary form of car insurance)

- Electronic insurance ID cards

You could face serious penalties if caught driving without proof of insurance.

According to the South Dakota Department of Public Safety Motor Vehicle Division, a conviction for driving without proof of insurance is considered a “Class 2 Misdemeanor” punishable by 30 days in jail, a $100 fine, or both.

In addition, the offender’s driver’s license will be suspended for at least 30 days and for up to one year, depending on how to get insurance on your driver’s license to meet state requirements and regain driving privileges.

Premiums as a Percentage of Income

Your insurance premium is the amount you will pay for your yearly insurance policy. But what is the average premium in South Dakota, and what percentage of a person’s income is spent on car insurance annually?

In 2014, South Dakota residents spent an average of $744.28 per year on their car insurance policy.

South Dakota’s average income per capita in the same year (2014) was $41,825.00. This means drivers in South Dakota spend an average of 1.78 percent of their total disposable income a year on car insurance alone. When comparing this average to surrounding states, North Dakotans pay about $20 more yearly, and Nebraskans pay about $60 more per year for car insurance.

This rate isn’t that high, considering the national average car insurance premium is around $981 annually. In 2012, South Dakotans only paid 1.67 percent of their income for their car insurance policy. The trend shows rates increase every year due to various factors that affect your car insurance premium. Since these statistics were recorded in 2014, rates are likely higher now.

Core Car Insurance Coverage in South Dakota

The above data is pulled directly from the National Association of Insurance Commissioners. This data is from 2015, so you can expect rates to be higher in 2019 and so on. Carrying minimum coverage will keep you out of prison, but it might not keep you from owing thousands of dollars to repair someone’s car when an accident happens.

| Coverage Type | Annual Costs (2015) |

|---|---|

| Liability | $300.22 |

| Collision | $208.58 |

| Comprehensive | $258.11 |

| Combined | $766.91 |

It’s always a great idea to carry more than the minimum required—your wallet will thank you down the road. Looking to enhance your existing policy? Up next, we will cover the types of auto insurance coverage, add-ons, and endorsements.

Additional Liability Coverage in South Dakota

| Loss Ratio | 2012 | 2013 | 2014 |

|---|---|---|---|

| Medical Payments (MedPay) | 70.74% | 73.03% | 70.57% |

| Uninsured/Underinsured Motorist Coverage (UUM) | 52.2% | 46.32% | 58.45% |

Medpay, uninsured, and underinsured motorist coverage are all optional plans to add to your minimum insurance policy. At the moment, it’s easy to disregard them because you think you’ll never need them.

But really, these add-ons are very important to have.

Here’s why:

7.70 percent of motorists in South Dakota are uninsured. This means the state is ranked 42nd in the U.S. for uninsured drivers.

Let’s say you’re minding your own business one day, and suddenly, you’re hit by an uninsured driver. You need to go to the hospital because you broke your leg and you have pieces of shard stuck in your hands. Your car was totaled. Since South Dakota is technically an at-fault state, the person who hit you must call his or her insurance company.

This person is an uninsured driver, so there is no insurance company to call. This person doesn’t have thousands of dollars for your medical bills and a totaled vehicle, so what happens? The driver that hit you goes bankrupt while they’re attempting to pay your bills. This is where uninsured or underinsured motorist insurance coverage steps in. But what is loss ratio?

The loss ratio shows how many claims, including automobile liability coverage, were paid versus unpaid. This matters because insurers don’t always pay 100% of claims. For example, MedPay and uninsured claims typically see 50-80% payouts.

If a company is paying too many claims (over 100 percent usually) than that company could be at serious risk of going bankrupt, and you don’t want that because then, you’ll never get your claim paid. On the other hand, if a company hasn’t paid out enough claims (under 50 percent), your insurance company might scam you.

This could mean that the company receives premiums from thousands of clients yearly and does not pay out half of the filed claims it receives. So, what should you look for when finding a new provider? Ensure the provider’s loss ratio is between 60 and 100 percent, and you should be good to go.

Add-ons, Endorsements, and Riders

MedPay and uninsured liability insurance are just two options to add to a basic policy.

Click on the links below to learn more about each type of car insurance.

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-As-You-Drive or Usage-Based Insurance

Buy one add-on, or buy them all! You’re never limited to how much car insurance you can buy: the mor,e the merrier.

Now that you understand all of the different types of car insurance, it’s time to start talking about factors that can affect your insurance rate. How do you get the best rate? Can you control the rate at all? What companies have the best rates? All that and more – up next.

Demographic Rates – Male vs. Female vs. Age

Even though it probably shouldn’t, gender and marital status can affect your rate. Age affects your rate as well, but we understand that the younger you are, the less experience you have, and the less likely you are to be in a car accident.

| Company | Married 35-year old female | Married 35-year old male | Married 60-year old female | Married 60-year old male | Single 17-year old female | Single 17-year old male | Single 25-year old female | Single 25-year old male |

|---|---|---|---|---|---|---|---|---|

| Allstate Insurance | $2,474.54 | $2,528.40 | $2,181.98 | $2,334.16 | $10,197.33 | $12,177.01 | $2,800.88 | $3,063.94 |

| American Family Mutual | $2,914.39 | $2,914.39 | $2,580.51 | $2,580.51 | $6,027.92 | $8,851.26 | $2,914.39 | $3,582.66 |

| Mid-Century Ins Co | $1,971.41 | $1,976.49 | $1,734.99 | $1,804.87 | $8,816.86 | $9,165.82 | $2,203.09 | $2,349.78 |

| Geico General | $2,362.14 | $2,226.34 | $2,259.77 | $2,082.34 | $4,778.02 | $5,636.95 | $2,071.64 | $1,990.07 |

| SAFECO Ins Co of America | $4,228.78 | $4,601.28 | $3,336.53 | $4,056.42 | $16,143.42 | $18,125.24 | $4,449.68 | $4,953.30 |

| AMCO Insurance | $1,944.69 | $2,000.73 | $1,735.99 | $1,858.22 | $4,233.35 | $5,485.68 | $2,181.20 | $2,375.98 |

| Progressive Northern | $2,152.90 | $2,125.17 | $1,771.85 | $1,825.96 | $7,722.52 | $8,789.89 | $2,696.57 | $2,814.42 |

| State Farm Mutual Auto | $1,571.08 | $1,571.08 | $1,353.12 | $1,353.12 | $3,852.54 | $4,946.49 | $1,757.55 | $1,972.63 |

Men typically pay more for car insurance than women, and rates usually decrease once you get married. But what other factors related to auto insurance coverage can affect your car insurance rate?

Cheapest Rates by Zip Codes in South Dakota

Where you live can also affect your rate, making it essential to choose the right coverage. Find your ZIP code on the list below.

| City | Zipcode | Average | Allstate Insurance | American Family Mutual | Mid-Century Ins Co | Geico General | SAFECO Ins Co of America | AMCO Insurance | Progressive Northern | State Farm Mutual Auto |

|---|---|---|---|---|---|---|---|---|---|---|

| PINE RIDGE | 57770 | $4,695.24 | $4,807.75 | $4,063.13 | $4,631.66 | $3,998.12 | $8,955.29 | $3,025.72 | $4,882.80 | $3,197.44 |

| MANDERSON | 57756 | $4,693.59 | $4,807.75 | $4,063.13 | $4,631.66 | $3,998.12 | $8,955.29 | $3,025.72 | $4,855.16 | $3,211.90 |

| OGLALA | 57764 | $4,686.43 | $4,807.75 | $4,063.13 | $4,631.66 | $3,998.12 | $8,955.29 | $3,025.72 | $4,882.80 | $3,126.98 |

| WOUNDED KNEE | 57794 | $4,677.00 | $4,807.75 | $4,063.13 | $4,631.66 | $3,998.12 | $8,955.29 | $3,025.72 | $4,855.16 | $3,079.20 |

| ALLEN | 57714 | $4,673.27 | $4,807.75 | $4,063.13 | $4,631.66 | $3,998.12 | $8,955.29 | $3,201.94 | $4,669.12 | $3,059.13 |

| KYLE | 57752 | $4,651.92 | $4,807.75 | $4,063.13 | $4,631.66 | $3,998.12 | $8,955.29 | $3,025.72 | $4,669.12 | $3,064.57 |

| PORCUPINE | 57772 | $4,633.96 | $4,807.75 | $4,063.13 | $4,631.66 | $3,998.12 | $8,955.29 | $3,025.72 | $4,487.69 | $3,102.35 |

| BATESLAND | 57716 | $4,631.73 | $4,807.75 | $4,063.13 | $4,631.66 | $3,998.12 | $8,955.29 | $3,025.72 | $4,583.01 | $2,989.14 |

| LEMMON | 57638 | $4,630.83 | $4,806.76 | $4,063.13 | $4,244.17 | $3,998.12 | $8,955.29 | $3,201.94 | $4,838.98 | $2,938.24 |

| MARTIN | 57551 | $4,629.23 | $4,807.75 | $4,063.13 | $4,631.66 | $3,998.12 | $8,955.29 | $3,201.94 | $4,309.41 | $3,066.55 |

| BISON | 57620 | $4,628.79 | $4,806.76 | $4,063.13 | $4,244.17 | $3,998.12 | $8,955.29 | $3,201.94 | $4,458.90 | $3,302.00 |

| INTERIOR | 57750 | $4,622.24 | $4,806.76 | $4,063.13 | $4,347.16 | $3,998.12 | $8,955.29 | $3,201.94 | $4,616.40 | $2,989.14 |

| DUPREE | 57623 | $4,609.79 | $4,806.76 | $4,063.13 | $4,244.17 | $3,998.12 | $8,955.29 | $3,201.94 | $4,593.02 | $3,015.88 |

| TUTHILL | 57574 | $4,609.36 | $4,807.75 | $4,063.13 | $4,631.66 | $3,998.12 | $8,955.29 | $3,201.94 | $4,227.82 | $2,989.14 |

| CHERRY CREEK | 57622 | $4,606.45 | $4,806.76 | $4,063.13 | $4,244.17 | $3,998.12 | $8,955.29 | $3,201.94 | $4,593.02 | $2,989.14 |

| WANBLEE | 57577 | $4,604.94 | $4,806.76 | $4,063.13 | $4,347.16 | $3,998.12 | $8,955.29 | $3,201.94 | $4,461.24 | $3,005.89 |

| MEADOW | 57644 | $4,588.70 | $4,806.76 | $4,063.13 | $4,244.17 | $3,998.12 | $8,955.29 | $3,201.94 | $4,451.02 | $2,989.14 |

| MILESVILLE | 57553 | $4,584.42 | $4,806.76 | $4,063.13 | $4,244.17 | $3,998.12 | $8,955.29 | $3,201.94 | $4,416.79 | $2,989.14 |

| BUFFALO | 57720 | $4,578.13 | $4,807.75 | $4,063.13 | $4,025.71 | $3,998.12 | $8,955.29 | $3,201.94 | $4,530.47 | $3,042.66 |

| LONG VALLEY | 57547 | $4,573.67 | $4,806.76 | $4,063.13 | $4,347.16 | $3,998.12 | $8,955.29 | $3,201.94 | $4,227.82 | $2,989.14 |

| BELVIDERE | 57521 | $4,571.86 | $4,806.76 | $4,063.13 | $4,347.16 | $3,998.12 | $8,955.29 | $3,201.94 | $4,213.34 | $2,989.14 |

| CAMP CROOK | 57724 | $4,571.44 | $4,807.75 | $4,063.13 | $4,025.71 | $3,998.12 | $8,955.29 | $3,201.94 | $4,530.47 | $2,989.14 |

| REDIG | 57776 | $4,571.32 | $4,806.76 | $4,063.13 | $4,025.71 | $3,998.12 | $8,955.29 | $3,201.94 | $4,530.47 | $2,989.14 |

| REVA | 57651 | $4,568.41 | $4,806.76 | $4,063.13 | $4,025.71 | $3,998.12 | $8,955.29 | $3,201.94 | $4,507.15 | $2,989.14 |

| MIDLAND | 57552 | $4,565.71 | $4,806.76 | $4,063.13 | $4,244.17 | $3,998.12 | $8,955.29 | $3,201.94 | $4,267.10 | $2,989.14 |

| LUDLOW | 57755 | $4,565.29 | $4,806.76 | $4,063.13 | $4,025.71 | $3,998.12 | $8,955.29 | $3,201.94 | $4,482.22 | $2,989.14 |

| LODGEPOLE | 57640 | $4,562.38 | $4,806.76 | $4,063.13 | $4,025.71 | $3,998.12 | $8,955.29 | $3,201.94 | $4,458.90 | $2,989.14 |

| PRAIRIE CITY | 57649 | $4,562.38 | $4,806.76 | $4,063.13 | $4,025.71 | $3,998.12 | $8,955.29 | $3,201.94 | $4,458.90 | $2,989.14 |

| RALPH | 57650 | $4,562.38 | $4,806.76 | $4,063.13 | $4,025.71 | $3,998.12 | $8,955.29 | $3,201.94 | $4,458.90 | $2,989.14 |

| KADOKA | 57543 | $4,555.31 | $4,806.76 | $4,063.13 | $4,347.16 | $3,998.12 | $8,955.29 | $3,201.94 | $4,160.61 | $2,909.47 |

| PHILIP | 57567 | $4,549.68 | $4,806.76 | $4,063.13 | $4,244.17 | $3,998.12 | $8,955.29 | $3,201.94 | $4,310.30 | $2,817.72 |

| SAINT FRANCIS | 57572 | $4,546.75 | $4,806.76 | $4,063.13 | $4,631.66 | $3,998.12 | $8,077.75 | $3,201.94 | $4,409.26 | $3,185.36 |

| ROSEBUD | 57570 | $4,544.89 | $4,806.76 | $4,063.13 | $4,631.66 | $3,998.12 | $8,077.75 | $3,201.94 | $4,409.26 | $3,170.51 |

| PARMELEE | 57566 | $4,540.76 | $4,806.76 | $4,063.13 | $4,631.66 | $3,998.12 | $8,077.75 | $3,201.94 | $4,409.26 | $3,137.48 |

| MISSION | 57555 | $4,526.62 | $4,806.76 | $4,063.13 | $4,631.66 | $3,998.12 | $8,077.75 | $3,201.94 | $4,400.00 | $3,033.59 |

| WHITE RIVER | 57579 | $4,499.22 | $4,806.76 | $4,063.13 | $4,347.16 | $3,998.12 | $8,077.75 | $3,201.94 | $4,373.66 | $3,125.21 |

| MORRISTOWN | 57645 | $4,492.94 | $4,806.76 | $4,063.13 | $4,244.17 | $3,998.12 | $8,077.75 | $3,201.94 | $4,458.90 | $3,092.74 |

| MC LAUGHLIN | 57642 | $4,489.89 | $4,806.76 | $4,063.13 | $4,244.17 | $3,998.12 | $8,077.75 | $3,201.94 | $4,537.07 | $2,990.15 |

| BULLHEAD | 57621 | $4,489.76 | $4,806.76 | $4,063.13 | $4,244.17 | $3,998.12 | $8,077.75 | $3,201.94 | $4,537.07 | $2,989.14 |

| LITTLE EAGLE | 57639 | $4,489.76 | $4,806.76 | $4,063.13 | $4,244.17 | $3,998.12 | $8,077.75 | $3,201.94 | $4,537.07 | $2,989.14 |

| MC INTOSH | 57641 | $4,489.76 | $4,806.76 | $4,063.13 | $4,244.17 | $3,998.12 | $8,077.75 | $3,201.94 | $4,537.07 | $2,989.14 |

| WHITEHORSE | 57661 | $4,489.76 | $4,806.76 | $4,063.13 | $4,244.17 | $3,998.12 | $8,077.75 | $3,201.94 | $4,537.07 | $2,989.14 |

| OKATON | 57562 | $4,482.21 | $4,806.76 | $4,063.13 | $4,347.16 | $3,998.12 | $8,077.75 | $3,201.94 | $4,373.66 | $2,989.14 |

| ISABEL | 57633 | $4,480.98 | $4,806.76 | $4,063.13 | $4,244.17 | $3,998.12 | $8,077.75 | $3,201.94 | $4,466.84 | $2,989.14 |

| LANTRY | 57636 | $4,480.98 | $4,806.76 | $4,063.13 | $4,244.17 | $3,998.12 | $8,077.75 | $3,201.94 | $4,466.84 | $2,989.14 |

| KELDRON | 57634 | $4,479.99 | $4,806.76 | $4,063.13 | $4,244.17 | $3,998.12 | $8,077.75 | $3,201.94 | $4,458.90 | $2,989.14 |

| TIMBER LAKE | 57656 | $4,479.03 | $4,806.76 | $4,063.13 | $4,244.17 | $3,998.12 | $8,077.75 | $3,201.94 | $4,537.07 | $2,903.27 |

| WATAUGA | 57660 | $4,479.01 | $4,806.76 | $4,063.13 | $4,244.17 | $3,998.12 | $8,077.75 | $3,201.94 | $4,451.02 | $2,989.14 |

| WOOD | 57585 | $4,477.26 | $4,806.76 | $4,063.13 | $4,347.16 | $3,998.12 | $8,077.75 | $3,201.94 | $4,334.11 | $2,989.14 |

| DRAPER | 57531 | $4,470.37 | $4,806.76 | $4,063.13 | $4,347.16 | $3,998.12 | $8,077.75 | $3,201.94 | $4,278.94 | $2,989.14 |

| MURDO | 57559 | $4,468.50 | $4,806.76 | $4,063.13 | $4,347.16 | $3,998.12 | $8,077.75 | $3,201.94 | $4,267.10 | $2,986.05 |

| NORRIS | 57560 | $4,463.98 | $4,806.76 | $4,063.13 | $4,347.16 | $3,998.12 | $8,077.75 | $3,201.94 | $4,227.82 | $2,989.14 |

| GLENCROSS | 57630 | $4,433.14 | $4,806.76 | $4,063.13 | $4,244.17 | $3,998.12 | $8,077.75 | $3,201.94 | $4,084.13 | $2,989.14 |

| TRAIL CITY | 57657 | $4,433.14 | $4,806.76 | $4,063.13 | $4,244.17 | $3,998.12 | $8,077.75 | $3,201.94 | $4,084.13 | $2,989.14 |

| BUFFALO GAP | 57722 | $4,431.12 | $5,035.49 | $3,753.91 | $4,631.66 | $2,728.39 | $8,645.38 | $3,025.72 | $4,435.63 | $3,192.74 |

| EAGLE BUTTE | 57625 | $4,429.66 | $4,806.76 | $4,063.13 | $4,131.04 | $3,998.12 | $8,077.75 | $3,201.94 | $4,153.23 | $3,005.32 |

| RIDGEVIEW | 57652 | $4,422.49 | $4,806.76 | $4,063.13 | $4,131.04 | $3,998.12 | $8,077.75 | $3,201.94 | $4,153.23 | $2,947.96 |

| WAKPALA | 57658 | $4,407.04 | $4,806.76 | $4,063.13 | $4,244.17 | $3,998.12 | $8,077.75 | $3,201.94 | $4,084.13 | $2,780.29 |

| EDGEMONT | 57735 | $4,392.75 | $5,035.49 | $4,063.13 | $4,631.66 | $2,728.39 | $8,955.29 | $3,025.72 | $4,625.17 | $2,077.11 |

| OELRICHS | 57763 | $4,387.20 | $5,035.49 | $4,063.13 | $4,631.66 | $2,728.39 | $8,955.29 | $3,025.72 | $4,489.58 | $2,168.36 |

| SMITHWICK | 57782 | $4,383.42 | $5,035.49 | $4,063.13 | $4,631.66 | $2,728.39 | $8,955.29 | $3,025.72 | $4,459.32 | $2,168.36 |

| WALKER | 57659 | $4,381.37 | $4,806.76 | $4,063.13 | $4,244.17 | $3,130.96 | $8,077.75 | $3,201.94 | $4,537.07 | $2,989.14 |

| ORAL | 57766 | $4,373.12 | $5,035.49 | $4,063.13 | $4,631.66 | $2,728.39 | $8,955.29 | $3,025.72 | $4,459.32 | $2,085.92 |

| CUSTER | 57730 | $4,360.03 | $5,035.49 | $3,753.91 | $4,631.66 | $2,728.39 | $8,645.38 | $3,025.72 | $4,848.12 | $2,211.54 |

| PRINGLE | 57773 | $4,354.63 | $5,035.49 | $3,753.91 | $4,631.66 | $2,728.39 | $8,645.38 | $3,025.72 | $4,848.12 | $2,168.36 |

| HOT SPRINGS | 57747 | $4,334.95 | $5,035.49 | $3,753.91 | $4,631.66 | $2,728.39 | $8,955.29 | $3,025.72 | $4,506.06 | $2,043.08 |

| FAIRBURN | 57738 | $4,306.03 | $5,035.49 | $3,753.91 | $4,631.66 | $2,728.39 | $8,645.38 | $3,025.72 | $4,459.32 | $2,168.36 |

| HERMOSA | 57744 | $4,299.73 | $4,807.75 | $3,753.91 | $4,631.66 | $2,728.39 | $8,645.38 | $3,025.72 | $4,541.81 | $2,263.24 |

| UNION CENTER | 57787 | $4,281.38 | $4,844.70 | $3,753.91 | $4,244.17 | $2,728.39 | $8,955.29 | $3,025.72 | $4,522.58 | $2,176.29 |

| MUD BUTTE | 57758 | $4,275.34 | $4,844.70 | $3,753.91 | $4,244.17 | $2,728.39 | $8,955.29 | $3,025.72 | $4,482.22 | $2,168.36 |

| ENNING | 57737 | $4,271.69 | $4,844.70 | $3,753.91 | $4,244.17 | $2,728.39 | $8,955.29 | $3,025.72 | $4,453.02 | $2,168.36 |

| HOWES | 57748 | $4,271.59 | $4,806.76 | $3,753.91 | $4,244.17 | $2,728.39 | $8,955.29 | $3,025.72 | $4,490.15 | $2,168.36 |

| WHITE OWL | 57792 | $4,271.57 | $4,843.69 | $3,753.91 | $4,244.17 | $2,728.39 | $8,955.29 | $3,025.72 | $4,453.02 | $2,168.36 |

| FAITH | 57626 | $4,266.70 | $4,806.76 | $3,753.91 | $4,244.17 | $2,728.39 | $8,955.29 | $3,025.72 | $4,451.02 | $2,168.36 |

| PIEDMONT | 57769 | $4,262.16 | $5,072.43 | $3,753.91 | $4,177.06 | $2,728.39 | $8,645.38 | $3,025.72 | $4,517.40 | $2,176.96 |

| WASTA | 57791 | $4,260.73 | $4,844.70 | $3,753.91 | $4,347.16 | $2,728.39 | $8,645.38 | $3,025.72 | $4,572.19 | $2,168.36 |

| PRESHO | 57568 | $4,257.65 | $4,806.76 | $4,063.13 | $4,347.16 | $3,130.96 | $8,077.75 | $2,765.57 | $4,062.60 | $2,807.29 |

| OWANKA | 57767 | $4,253.65 | $4,807.75 | $3,753.91 | $4,347.16 | $2,728.39 | $8,645.38 | $3,025.72 | $4,593.27 | $2,127.62 |

| LOWER BRULE | 57548 | $4,250.74 | $4,806.76 | $4,063.13 | $4,347.16 | $3,130.96 | $8,077.75 | $2,765.57 | $4,131.20 | $2,683.38 |

| HILL CITY | 57745 | $4,247.17 | $5,072.43 | $3,753.91 | $3,944.59 | $2,728.39 | $8,645.38 | $3,025.72 | $4,541.81 | $2,265.12 |

| LEAD | 57754 | $4,245.38 | $5,072.43 | $3,753.91 | $4,025.71 | $2,728.39 | $8,645.38 | $3,025.72 | $4,514.58 | $2,196.91 |

| VALE | 57788 | $4,242.81 | $5,072.43 | $3,753.91 | $4,025.71 | $2,728.39 | $8,645.38 | $3,025.72 | $4,522.58 | $2,168.36 |

| SCENIC | 57780 | $4,241.55 | $4,807.75 | $3,753.91 | $4,347.16 | $2,728.39 | $8,645.38 | $3,025.72 | $4,455.71 | $2,168.36 |

| WALL | 57790 | $4,241.46 | $4,806.76 | $3,753.91 | $4,347.16 | $2,728.39 | $8,645.38 | $3,025.72 | $4,415.68 | $2,208.69 |

| DEADWOOD | 57732 | $4,241.35 | $5,072.43 | $3,753.91 | $4,025.71 | $2,728.39 | $8,645.38 | $3,025.72 | $4,500.93 | $2,178.29 |

| NEW UNDERWOOD | 57761 | $4,239.51 | $4,807.75 | $3,753.91 | $4,347.16 | $2,728.39 | $8,645.38 | $3,025.72 | $4,515.75 | $2,092.05 |

| HAMILL | 57534 | $4,237.84 | $4,806.76 | $4,063.13 | $4,347.16 | $3,130.96 | $8,077.75 | $2,765.57 | $4,350.59 | $2,360.77 |

| QUINN | 57775 | $4,236.42 | $4,806.76 | $3,753.91 | $4,347.16 | $2,728.39 | $8,645.38 | $3,025.72 | $4,415.68 | $2,168.36 |

| WHITEWOOD | 57793 | $4,236.00 | $5,072.43 | $3,753.91 | $4,025.71 | $2,728.39 | $8,645.38 | $3,025.72 | $4,522.58 | $2,113.88 |

| NEMO | 57759 | $4,234.80 | $5,072.43 | $3,753.91 | $3,980.82 | $2,728.39 | $8,645.38 | $3,025.72 | $4,455.62 | $2,216.09 |

| STURGIS | 57785 | $4,229.44 | $4,844.70 | $3,753.91 | $4,177.06 | $2,728.39 | $8,645.38 | $3,025.72 | $4,482.02 | $2,178.29 |

| NISLAND | 57762 | $4,228.54 | $5,072.43 | $3,753.91 | $4,025.71 | $2,728.39 | $8,645.38 | $3,025.72 | $4,408.44 | $2,168.36 |

| SAINT ONGE | 57779 | $4,228.51 | $5,072.43 | $3,753.91 | $4,025.71 | $2,728.39 | $8,645.38 | $3,025.72 | $4,408.15 | $2,168.36 |

| FORT MEADE | 57741 | $4,228.19 | $4,844.70 | $3,753.91 | $4,177.06 | $2,728.39 | $8,645.38 | $3,025.72 | $4,482.02 | $2,168.36 |

| WINNER | 57580 | $4,226.71 | $4,806.76 | $4,063.13 | $4,347.16 | $3,130.96 | $8,077.75 | $2,765.57 | $4,158.09 | $2,464.25 |

| POLLOCK | 57648 | $4,220.51 | $4,806.76 | $4,392.82 | $3,692.38 | $3,130.96 | $8,077.75 | $2,765.57 | $4,537.07 | $2,360.77 |

| COLOME | 57528 | $4,220.37 | $4,806.76 | $4,063.13 | $4,347.16 | $3,130.96 | $8,077.75 | $2,765.57 | $4,003.46 | $2,568.20 |

| SPEARFISH | 57783 | $4,210.77 | $5,072.43 | $3,753.91 | $4,025.71 | $2,728.39 | $8,645.38 | $3,025.72 | $4,320.97 | $2,113.60 |

| CAPUTA | 57725 | $4,209.97 | $4,807.75 | $3,753.91 | $4,002.87 | $2,728.39 | $8,645.38 | $3,025.72 | $4,547.40 | $2,168.36 |

| BONESTEEL | 57317 | $4,209.20 | $4,806.76 | $4,063.13 | $4,347.16 | $3,130.96 | $8,077.75 | $2,765.57 | $4,044.19 | $2,438.07 |

| BURKE | 57523 | $4,206.38 | $4,806.76 | $4,063.13 | $4,347.16 | $3,130.96 | $8,077.75 | $2,765.57 | $3,960.01 | $2,499.73 |

| GREGORY | 57533 | $4,205.94 | $4,806.76 | $4,063.13 | $4,347.16 | $3,130.96 | $8,077.75 | $2,765.57 | $4,003.46 | $2,452.74 |

| KEYSTONE | 57751 | $4,205.47 | $4,844.70 | $3,753.91 | $3,944.59 | $2,728.39 | $8,645.38 | $3,025.72 | $4,532.71 | $2,168.36 |

| VIVIAN | 57576 | $4,201.84 | $4,806.76 | $4,063.13 | $4,347.16 | $3,130.96 | $8,077.75 | $2,765.57 | $4,062.60 | $2,360.77 |

| NEWELL | 57760 | $4,197.28 | $4,844.70 | $3,753.91 | $4,025.71 | $2,728.39 | $8,645.38 | $3,025.72 | $4,416.33 | $2,138.06 |

| RAPID CITY | 57702 | $4,197.13 | $4,844.70 | $3,753.91 | $4,002.87 | $2,728.39 | $8,107.21 | $3,025.72 | $4,804.36 | $2,309.87 |

| KENNEBEC | 57544 | $4,196.92 | $4,806.76 | $4,063.13 | $4,347.16 | $3,130.96 | $8,077.75 | $2,765.57 | $4,023.24 | $2,360.77 |

| IDEAL | 57541 | $4,196.26 | $4,806.76 | $4,063.13 | $4,347.16 | $3,130.96 | $8,077.75 | $2,765.57 | $4,017.94 | $2,360.77 |

| WITTEN | 57584 | $4,196.26 | $4,806.76 | $4,063.13 | $4,347.16 | $3,130.96 | $8,077.75 | $2,765.57 | $4,017.94 | $2,360.77 |

| FAIRFAX | 57335 | $4,195.86 | $4,806.76 | $4,063.13 | $4,347.16 | $3,130.96 | $8,077.75 | $2,765.57 | $4,014.77 | $2,360.77 |

| DALLAS | 57529 | $4,194.45 | $4,806.76 | $4,063.13 | $4,347.16 | $3,130.96 | $8,077.75 | $2,765.57 | $4,003.46 | $2,360.77 |

| HIGHMORE | 57345 | $4,192.18 | $4,806.76 | $4,392.82 | $4,131.04 | $3,130.96 | $8,077.75 | $2,765.57 | $3,684.48 | $2,548.08 |

| HERRICK | 57538 | $4,189.01 | $4,806.76 | $4,063.13 | $4,347.16 | $3,130.96 | $8,077.75 | $2,765.57 | $3,960.01 | $2,360.77 |

| SAINT CHARLES | 57571 | $4,189.01 | $4,806.76 | $4,063.13 | $4,347.16 | $3,130.96 | $8,077.75 | $2,765.57 | $3,960.01 | $2,360.77 |

| OKREEK | 57563 | $4,186.71 | $4,806.76 | $4,063.13 | $4,631.66 | $2,663.59 | $6,737.42 | $3,201.94 | $4,400.00 | $2,989.14 |

| SPEARFISH | 57799 | $4,179.18 | $4,807.75 | $3,753.91 | $4,025.71 | $2,728.39 | $8,645.38 | $3,025.72 | $4,320.97 | $2,125.58 |

| FORT THOMPSON | 57339 | $4,174.59 | $4,806.76 | $4,063.13 | $3,729.99 | $3,130.96 | $8,077.75 | $2,765.57 | $4,231.34 | $2,591.24 |

| BELLE FOURCHE | 57717 | $4,172.20 | $4,807.75 | $3,753.91 | $4,025.71 | $2,728.39 | $8,645.38 | $3,025.72 | $4,327.70 | $2,063.05 |

| STEPHAN | 57346 | $4,168.77 | $4,806.76 | $4,392.82 | $4,131.04 | $3,130.96 | $8,077.75 | $2,765.57 | $3,684.48 | $2,360.77 |

| HOLABIRD | 57540 | $4,168.77 | $4,806.76 | $4,392.82 | $4,131.04 | $3,130.96 | $8,077.75 | $2,765.57 | $3,684.48 | $2,360.77 |

| BLACK HAWK | 57718 | $4,165.25 | $5,072.43 | $3,753.91 | $3,980.82 | $2,728.39 | $8,107.21 | $3,025.72 | $4,455.62 | $2,197.87 |

| RELIANCE | 57569 | $4,154.27 | $4,806.76 | $4,063.13 | $3,729.99 | $3,130.96 | $8,077.75 | $2,765.57 | $3,919.54 | $2,740.48 |

| CHAMBERLAIN | 57325 | $4,144.46 | $4,806.76 | $4,063.13 | $3,729.99 | $3,130.96 | $8,077.75 | $2,765.57 | $4,034.54 | $2,546.97 |

| OACOMA | 57365 | $4,143.50 | $4,806.76 | $4,063.13 | $3,729.99 | $3,130.96 | $8,077.75 | $2,765.57 | $4,004.53 | $2,569.28 |

| HERREID | 57632 | $4,142.91 | $4,806.76 | $4,392.82 | $3,692.38 | $3,130.96 | $8,077.75 | $2,765.57 | $3,690.36 | $2,586.65 |

| HAYES | 57537 | $4,136.17 | $4,806.76 | $4,063.13 | $4,131.04 | $3,130.96 | $7,535.11 | $2,765.57 | $4,296.04 | $2,360.77 |

| GETTYSBURG | 57442 | $4,121.15 | $4,806.76 | $4,063.13 | $3,692.38 | $3,130.96 | $8,077.75 | $2,765.57 | $3,737.28 | $2,695.35 |

| LEBANON | 57455 | $4,120.54 | $4,806.76 | $4,392.82 | $3,692.38 | $3,130.96 | $8,077.75 | $2,765.57 | $3,737.28 | $2,360.77 |

| HARROLD | 57536 | $4,115.87 | $4,806.76 | $4,063.13 | $4,131.04 | $3,130.96 | $8,077.75 | $2,765.57 | $3,591.01 | $2,360.77 |

| RAPID CITY | 57703 | $4,110.05 | $4,807.75 | $3,753.91 | $4,002.87 | $2,728.39 | $8,107.21 | $3,025.72 | $4,275.92 | $2,178.64 |

| RAPID CITY | 57701 | $4,104.09 | $4,844.70 | $3,753.91 | $4,002.87 | $2,728.39 | $8,107.21 | $3,025.72 | $4,280.25 | $2,089.69 |

| MOUND CITY | 57646 | $4,103.33 | $4,806.76 | $4,392.82 | $3,692.38 | $3,130.96 | $8,077.75 | $2,765.57 | $3,599.63 | $2,360.77 |

| HOVEN | 57450 | $4,099.51 | $4,806.76 | $4,392.82 | $3,692.38 | $3,130.96 | $8,077.75 | $2,765.57 | $3,569.07 | $2,360.77 |

| JAVA | 57452 | $4,099.51 | $4,806.76 | $4,392.82 | $3,692.38 | $3,130.96 | $8,077.75 | $2,765.57 | $3,569.07 | $2,360.77 |

| TOLSTOY | 57475 | $4,099.51 | $4,806.76 | $4,392.82 | $3,692.38 | $3,130.96 | $8,077.75 | $2,765.57 | $3,569.07 | $2,360.77 |

| BOX ELDER | 57719 | $4,093.69 | $4,807.75 | $3,753.91 | $4,002.87 | $2,728.39 | $8,107.21 | $3,025.72 | $4,260.11 | $2,063.56 |

| FORT PIERRE | 57532 | $4,079.37 | $4,806.76 | $4,063.13 | $4,131.04 | $3,130.96 | $7,535.11 | $2,765.57 | $3,888.18 | $2,314.21 |

| ELLSWORTH AFB | 57706 | $4,077.29 | $4,844.70 | $3,753.91 | $4,002.87 | $2,728.39 | $8,107.21 | $3,025.72 | $4,079.22 | $2,076.27 |

| ONIDA | 57564 | $4,072.93 | $4,806.76 | $4,063.13 | $3,692.38 | $3,130.96 | $8,077.75 | $2,765.57 | $3,559.39 | $2,487.50 |

| SELBY | 57472 | $4,072.67 | $4,806.76 | $4,063.13 | $3,692.38 | $3,130.96 | $8,077.75 | $2,765.57 | $3,600.69 | $2,444.15 |

| AKASKA | 57420 | $4,062.25 | $4,806.76 | $4,063.13 | $3,692.38 | $3,130.96 | $8,077.75 | $2,765.57 | $3,600.69 | $2,360.77 |

| AGAR | 57520 | $4,057.09 | $4,806.76 | $4,063.13 | $3,692.38 | $3,130.96 | $8,077.75 | $2,765.57 | $3,559.39 | $2,360.77 |

| BLUNT | 57522 | $4,057.09 | $4,806.76 | $4,063.13 | $3,692.38 | $3,130.96 | $8,077.75 | $2,765.57 | $3,559.39 | $2,360.77 |

| GLENHAM | 57631 | $4,056.36 | $4,806.76 | $4,063.13 | $3,692.38 | $3,130.96 | $8,077.75 | $2,765.57 | $3,553.56 | $2,360.77 |

| GANN VALLEY | 57341 | $4,055.18 | $4,806.76 | $4,063.13 | $3,729.99 | $3,130.96 | $8,077.75 | $2,765.57 | $3,506.53 | $2,360.77 |

| PUKWANA | 57370 | $4,050.57 | $4,653.54 | $4,063.13 | $3,729.99 | $3,130.96 | $8,077.75 | $2,765.57 | $3,474.90 | $2,508.73 |

| KIMBALL | 57355 | $4,043.47 | $4,653.54 | $4,063.13 | $3,729.99 | $3,130.96 | $8,077.75 | $2,765.57 | $3,506.53 | $2,420.31 |

| MOBRIDGE | 57601 | $4,043.38 | $4,806.76 | $4,063.13 | $3,692.38 | $3,130.96 | $8,077.75 | $2,765.57 | $3,553.56 | $2,256.94 |

| PIERRE | 57501 | $3,943.45 | $4,806.76 | $4,063.13 | $3,692.38 | $3,130.96 | $7,535.11 | $2,578.42 | $3,426.66 | $2,314.21 |

| EUREKA | 57437 | $3,938.35 | $4,806.76 | $4,392.82 | $3,692.38 | $2,663.59 | $7,324.61 | $2,765.57 | $3,691.42 | $2,169.70 |

| LEOLA | 57456 | $3,936.12 | $4,806.76 | $4,392.82 | $3,692.38 | $2,663.59 | $7,324.61 | $2,765.57 | $3,708.06 | $2,135.14 |

| ROSCOE | 57471 | $3,923.91 | $4,806.76 | $4,392.82 | $3,692.38 | $2,663.59 | $7,324.61 | $2,765.57 | $3,617.33 | $2,128.24 |

| HOSMER | 57448 | $3,922.91 | $4,806.76 | $4,392.82 | $3,692.38 | $2,663.59 | $7,324.61 | $2,765.57 | $3,659.79 | $2,077.74 |

| LONG LAKE | 57457 | $3,922.91 | $4,806.76 | $4,392.82 | $3,692.38 | $2,663.59 | $7,324.61 | $2,765.57 | $3,659.79 | $2,077.74 |

| BOWDLE | 57428 | $3,919.50 | $4,806.76 | $4,392.82 | $3,692.38 | $2,663.59 | $7,324.61 | $2,765.57 | $3,569.07 | $2,141.22 |

| IPSWICH | 57451 | $3,879.39 | $4,806.76 | $4,392.82 | $3,692.38 | $2,663.59 | $7,324.61 | $2,765.57 | $3,286.85 | $2,102.55 |

| SENECA | 57473 | $3,864.62 | $4,806.76 | $4,392.82 | $3,769.87 | $2,663.59 | $6,737.42 | $2,765.57 | $3,703.18 | $2,077.74 |

| UTICA | 57067 | $3,859.56 | $4,609.89 | $4,063.13 | $3,389.01 | $2,663.59 | $7,565.94 | $2,503.95 | $4,042.49 | $2,038.44 |

| ORIENT | 57467 | $3,857.22 | $4,806.76 | $4,392.82 | $3,729.99 | $2,663.59 | $6,737.42 | $2,765.57 | $3,683.85 | $2,077.74 |

| ONAKA | 57466 | $3,853.89 | $4,806.76 | $4,392.82 | $3,769.87 | $2,663.59 | $6,737.42 | $2,765.57 | $3,617.33 | $2,077.74 |

| MILLER | 57362 | $3,848.77 | $4,806.76 | $4,392.82 | $3,729.99 | $2,663.59 | $6,737.42 | $2,765.57 | $3,562.61 | $2,131.38 |

| FAULKTON | 57438 | $3,847.13 | $4,806.76 | $4,392.82 | $3,423.70 | $2,663.59 | $6,737.42 | $2,765.57 | $3,774.02 | $2,213.14 |

| MISSION HILL | 57046 | $3,836.15 | $4,609.89 | $4,063.13 | $3,389.01 | $2,663.59 | $7,565.94 | $2,503.95 | $3,891.28 | $2,002.40 |

| REE HEIGHTS | 57371 | $3,833.57 | $4,806.76 | $4,392.82 | $3,729.99 | $2,663.59 | $6,737.42 | $2,765.57 | $3,494.68 | $2,077.74 |

| SAINT LAWRENCE | 57373 | $3,833.57 | $4,806.76 | $4,392.82 | $3,729.99 | $2,663.59 | $6,737.42 | $2,765.57 | $3,494.68 | $2,077.74 |

| FREDERICK | 57441 | $3,830.61 | $4,733.44 | $4,392.82 | $3,395.11 | $2,663.59 | $7,324.61 | $2,503.95 | $3,529.00 | $2,102.34 |

| HOUGHTON | 57449 | $3,827.53 | $4,733.44 | $4,392.82 | $3,395.11 | $2,663.59 | $7,324.61 | $2,503.95 | $3,529.00 | $2,077.74 |

| AMHERST | 57421 | $3,818.60 | $4,733.44 | $4,392.82 | $3,390.87 | $2,663.59 | $7,324.61 | $2,503.95 | $3,461.80 | $2,077.74 |

| CLAREMONT | 57432 | $3,818.47 | $4,733.44 | $4,392.82 | $3,390.87 | $2,663.59 | $7,324.61 | $2,503.95 | $3,489.49 | $2,048.98 |

| ROSHOLT | 57260 | $3,818.22 | $4,733.44 | $4,392.82 | $3,390.87 | $2,663.59 | $7,324.61 | $2,503.95 | $3,378.77 | $2,157.69 |

| HECLA | 57446 | $3,816.55 | $4,733.44 | $4,392.82 | $3,395.11 | $2,663.59 | $7,324.61 | $2,503.95 | $3,461.80 | $2,057.09 |

| YANKTON | 57078 | $3,814.45 | $4,653.54 | $3,729.54 | $3,389.01 | $2,663.59 | $7,565.94 | $2,584.03 | $3,902.26 | $2,027.66 |

| VEBLEN | 57270 | $3,813.41 | $4,733.44 | $4,392.82 | $3,390.87 | $2,663.59 | $7,324.61 | $2,503.95 | $3,378.77 | $2,119.22 |

| WESTPORT | 57481 | $3,811.86 | $4,806.76 | $4,392.82 | $3,395.11 | $2,663.59 | $7,324.61 | $2,503.95 | $3,330.27 | $2,077.74 |

| ANDOVER | 57422 | $3,811.51 | $4,733.44 | $4,392.82 | $3,390.87 | $2,663.59 | $7,324.61 | $2,503.95 | $3,389.13 | $2,093.65 |

| NEW EFFINGTON | 57255 | $3,811.38 | $4,733.44 | $4,392.82 | $3,390.87 | $2,663.59 | $7,324.61 | $2,503.95 | $3,378.77 | $2,102.97 |

| LANGFORD | 57454 | $3,810.72 | $4,733.44 | $4,392.82 | $3,390.87 | $2,663.59 | $7,324.61 | $2,503.95 | $3,398.76 | $2,077.74 |

| STICKNEY | 57375 | $3,809.92 | $4,653.54 | $4,063.13 | $3,729.99 | $2,663.59 | $6,675.85 | $2,765.57 | $3,688.63 | $2,239.07 |

| CLAIRE CITY | 57224 | $3,808.22 | $4,733.44 | $4,392.82 | $3,390.87 | $2,663.59 | $7,324.61 | $2,503.95 | $3,378.77 | $2,077.74 |

| EDEN | 57232 | $3,808.22 | $4,733.44 | $4,392.82 | $3,390.87 | $2,663.59 | $7,324.61 | $2,503.95 | $3,378.77 | $2,077.74 |

| GRENVILLE | 57239 | $3,808.22 | $4,733.44 | $4,392.82 | $3,390.87 | $2,663.59 | $7,324.61 | $2,503.95 | $3,378.77 | $2,077.74 |

| LAKE CITY | 57247 | $3,808.22 | $4,733.44 | $4,392.82 | $3,390.87 | $2,663.59 | $7,324.61 | $2,503.95 | $3,378.77 | $2,077.74 |

| SISSETON | 57262 | $3,807.38 | $4,733.44 | $4,392.82 | $3,390.87 | $2,663.59 | $7,324.61 | $2,393.43 | $3,354.78 | $2,205.51 |

| FERNEY | 57439 | $3,806.90 | $4,733.44 | $4,392.82 | $3,390.87 | $2,663.59 | $7,324.61 | $2,503.95 | $3,368.18 | $2,077.74 |

| CRESBARD | 57435 | $3,806.08 | $4,806.76 | $4,392.82 | $3,389.09 | $2,663.59 | $6,737.42 | $2,765.57 | $3,615.64 | $2,077.74 |

| GEDDES | 57342 | $3,804.36 | $4,653.54 | $4,063.13 | $3,729.99 | $2,663.59 | $6,675.85 | $2,765.57 | $3,805.47 | $2,077.74 |

| WILMOT | 57279 | $3,804.13 | $4,580.21 | $4,392.82 | $3,390.87 | $2,663.59 | $7,324.61 | $2,503.95 | $3,376.90 | $2,200.12 |

| WAUBAY | 57273 | $3,802.98 | $4,733.44 | $4,392.82 | $3,390.87 | $2,663.59 | $7,324.61 | $2,503.95 | $3,333.43 | $2,081.18 |

| BARNARD | 57426 | $3,802.69 | $4,733.44 | $4,392.82 | $3,395.11 | $2,663.59 | $7,324.61 | $2,503.95 | $3,330.27 | $2,077.74 |

| SUMMIT | 57266 | $3,802.57 | $4,536.56 | $4,392.82 | $3,390.87 | $2,663.59 | $7,324.61 | $2,503.95 | $3,467.62 | $2,140.51 |

| ROCKHAM | 57470 | $3,802.23 | $4,806.76 | $4,392.82 | $3,441.33 | $2,663.59 | $6,737.42 | $2,765.57 | $3,532.65 | $2,077.74 |

| BRITTON | 57430 | $3,802.06 | $4,733.44 | $4,392.82 | $3,390.87 | $2,663.59 | $7,324.61 | $2,503.95 | $3,461.80 | $1,945.38 |

| PLATTE | 57369 | $3,800.82 | $4,653.54 | $4,063.13 | $3,729.99 | $2,663.59 | $6,675.85 | $2,765.57 | $3,688.63 | $2,166.25 |

| BIG STONE CITY | 57216 | $3,799.70 | $4,536.56 | $4,392.82 | $3,390.87 | $2,663.59 | $7,324.61 | $2,503.95 | $3,534.55 | $2,050.62 |

| PIERPONT | 57468 | $3,797.06 | $4,733.44 | $4,392.82 | $3,390.87 | $2,663.59 | $7,324.61 | $2,503.95 | $3,289.44 | $2,077.74 |

| LAKE ANDES | 57356 | $3,796.73 | $4,653.54 | $4,063.13 | $3,729.99 | $2,663.59 | $6,675.85 | $2,765.57 | $3,678.52 | $2,143.69 |

| ORTLEY | 57256 | $3,794.72 | $4,536.56 | $4,392.82 | $3,390.87 | $2,663.59 | $7,324.61 | $2,503.95 | $3,467.62 | $2,077.74 |

| BRISTOL | 57219 | $3,794.47 | $4,733.44 | $4,392.82 | $3,390.87 | $2,663.59 | $7,324.61 | $2,503.95 | $3,268.76 | $2,077.74 |

| ROSLYN | 57261 | $3,794.47 | $4,733.44 | $4,392.82 | $3,390.87 | $2,663.59 | $7,324.61 | $2,503.95 | $3,268.76 | $2,077.74 |

| SOUTH SHORE | 57263 | $3,792.10 | $4,536.56 | $4,392.82 | $3,390.87 | $2,663.59 | $7,324.61 | $2,503.95 | $3,446.67 | $2,077.74 |

| COLUMBIA | 57433 | $3,790.43 | $4,733.44 | $4,392.82 | $3,395.11 | $2,663.59 | $7,324.61 | $2,503.95 | $3,226.33 | $2,083.56 |

| WALLACE | 57272 | $3,789.01 | $4,689.79 | $4,392.82 | $3,390.87 | $2,663.59 | $7,324.61 | $2,503.95 | $3,268.76 | $2,077.74 |

| WEBSTER | 57274 | $3,788.91 | $4,689.79 | $4,392.82 | $3,390.87 | $2,663.59 | $7,324.61 | $2,503.95 | $3,290.74 | $2,054.95 |

| PEEVER | 57257 | $3,788.84 | $4,580.21 | $4,392.82 | $3,390.87 | $2,663.59 | $7,324.61 | $2,503.95 | $3,376.90 | $2,077.74 |

| STRATFORD | 57474 | $3,788.49 | $4,733.44 | $4,392.82 | $3,395.11 | $2,663.59 | $7,324.61 | $2,503.95 | $3,216.67 | $2,077.74 |

| PICKSTOWN | 57367 | $3,788.49 | $4,653.54 | $4,063.13 | $3,729.99 | $2,663.59 | $6,675.85 | $2,765.57 | $3,678.52 | $2,077.74 |

| MANSFIELD | 57460 | $3,786.66 | $4,806.76 | $4,392.82 | $3,395.11 | $2,663.59 | $7,324.61 | $2,355.48 | $3,277.18 | $2,077.74 |

| CORSICA | 57328 | $3,785.64 | $4,653.54 | $4,063.13 | $3,729.99 | $2,663.59 | $6,675.85 | $2,503.95 | $3,729.91 | $2,265.21 |

| BATH | 57427 | $3,784.76 | $4,733.44 | $4,392.82 | $3,395.11 | $2,663.59 | $7,324.61 | $2,503.95 | $3,186.81 | $2,077.74 |

| MARVIN | 57251 | $3,783.38 | $4,536.56 | $4,392.82 | $3,390.87 | $2,663.59 | $7,324.61 | $2,503.95 | $3,376.90 | $2,077.74 |

| STRANDBURG | 57265 | $3,782.57 | $4,536.56 | $4,392.82 | $3,390.87 | $2,663.59 | $7,324.61 | $2,503.95 | $3,370.44 | $2,077.74 |

| TWIN BROOKS | 57269 | $3,780.41 | $4,536.56 | $4,392.82 | $3,390.87 | $2,663.59 | $7,324.61 | $2,503.95 | $3,353.17 | $2,077.74 |

| CORONA | 57227 | $3,780.08 | $4,536.56 | $4,392.82 | $3,390.87 | $2,663.59 | $7,324.61 | $2,503.95 | $3,353.17 | $2,075.04 |

| FLORENCE | 57235 | $3,778.98 | $4,689.79 | $4,392.82 | $3,208.95 | $2,663.59 | $7,324.61 | $2,503.95 | $3,446.67 | $2,001.46 |

| NORTHVILLE | 57465 | $3,774.13 | $4,806.76 | $4,392.82 | $3,395.11 | $2,663.59 | $6,737.42 | $2,503.95 | $3,615.64 | $2,077.74 |

| STOCKHOLM | 57264 | $3,770.22 | $4,536.56 | $4,392.82 | $3,390.87 | $2,663.59 | $7,324.61 | $2,503.95 | $3,239.35 | $2,110.01 |

| HARRISON | 57344 | $3,768.69 | $4,653.54 | $4,063.13 | $3,729.99 | $2,663.59 | $6,675.85 | $2,503.95 | $3,781.76 | $2,077.74 |

| WARNER | 57479 | $3,763.35 | $4,806.76 | $4,063.13 | $3,395.11 | $2,663.59 | $7,324.61 | $2,503.95 | $3,277.18 | $2,072.45 |

| NEW HOLLAND | 57364 | $3,762.21 | $4,653.54 | $4,063.13 | $3,729.99 | $2,663.59 | $6,675.85 | $2,503.95 | $3,729.91 | $2,077.74 |

| HENRY | 57243 | $3,759.44 | $4,689.79 | $4,392.82 | $3,208.95 | $2,663.59 | $7,324.61 | $2,503.95 | $3,325.06 | $1,966.75 |

| WHITE LAKE | 57383 | $3,758.96 | $4,653.54 | $4,063.13 | $3,402.88 | $2,663.59 | $6,675.85 | $2,765.57 | $3,567.64 | $2,279.45 |

| WESSINGTON SPRINGS | 57382 | $3,757.10 | $4,653.54 | $4,063.13 | $3,402.88 | $2,663.59 | $6,737.42 | $2,765.57 | $3,545.13 | $2,225.58 |

| REVILLO | 57259 | $3,756.98 | $4,536.56 | $4,392.82 | $3,390.87 | $2,663.59 | $7,324.61 | $2,503.95 | $3,167.91 | $2,075.53 |

| LABOLT | 57246 | $3,754.84 | $4,536.56 | $4,392.82 | $3,390.87 | $2,663.59 | $7,324.61 | $2,503.95 | $3,148.61 | $2,077.74 |

| LESTERVILLE | 57040 | $3,747.57 | $4,653.54 | $4,063.13 | $3,389.01 | $2,663.59 | $6,675.85 | $2,503.95 | $3,953.73 | $2,077.74 |

| TURTON | 57477 | $3,746.13 | $4,536.56 | $4,392.82 | $3,441.33 | $2,663.59 | $6,737.42 | $2,503.95 | $3,615.64 | $2,077.74 |

| DOLAND | 57436 | $3,745.91 | $4,536.56 | $4,392.82 | $3,441.33 | $2,663.59 | $6,737.42 | $2,503.95 | $3,547.97 | $2,143.68 |

| BRENTFORD | 57429 | $3,745.78 | $4,806.76 | $4,392.82 | $3,395.11 | $2,663.59 | $6,737.42 | $2,503.95 | $3,388.86 | $2,077.74 |

| TABOR | 57063 | $3,744.86 | $4,653.54 | $4,063.13 | $3,389.01 | $2,663.59 | $6,675.85 | $2,503.95 | $3,953.73 | $2,056.08 |

| GROTON | 57445 | $3,744.36 | $4,733.44 | $4,392.82 | $3,390.87 | $2,663.59 | $7,324.61 | $2,317.00 | $3,069.59 | $2,062.96 |

| GARDEN CITY | 57236 | $3,743.99 | $4,536.56 | $4,392.82 | $3,441.33 | $2,663.59 | $6,737.42 | $2,503.95 | $3,598.55 | $2,077.74 |

| PLANKINTON | 57368 | $3,743.93 | $4,580.21 | $4,063.13 | $3,402.88 | $2,663.59 | $6,675.85 | $2,765.57 | $3,554.80 | $2,245.46 |

| DANTE | 57329 | $3,742.49 | $4,653.54 | $4,063.13 | $3,729.99 | $2,663.59 | $6,675.85 | $2,765.57 | $3,310.56 | $2,077.74 |

| MARTY | 57361 | $3,742.49 | $4,653.54 | $4,063.13 | $3,729.99 | $2,663.59 | $6,675.85 | $2,765.57 | $3,310.56 | $2,077.74 |

| WAGNER | 57380 | $3,742.26 | $4,653.54 | $4,063.13 | $3,729.99 | $2,663.59 | $6,675.85 | $2,765.57 | $3,310.56 | $2,075.89 |

| TULARE | 57476 | $3,742.11 | $4,806.76 | $4,063.13 | $3,441.33 | $2,663.59 | $6,737.42 | $2,503.95 | $3,494.04 | $2,226.69 |

| OLIVET | 57052 | $3,740.32 | $4,653.54 | $4,063.13 | $3,466.21 | $2,663.59 | $6,675.85 | $2,503.95 | $3,818.59 | $2,077.74 |

| DIMOCK | 57331 | $3,739.13 | $4,653.54 | $4,063.13 | $3,466.21 | $2,663.59 | $6,675.85 | $2,503.95 | $3,729.91 | $2,156.90 |

| CONDE | 57434 | $3,738.74 | $4,763.11 | $4,392.82 | $3,395.11 | $2,663.59 | $6,737.42 | $2,503.95 | $3,368.18 | $2,085.76 |

| ASHTON | 57424 | $3,736.28 | $4,806.76 | $4,063.13 | $3,441.33 | $2,663.59 | $6,737.42 | $2,503.95 | $3,596.32 | $2,077.74 |

| ARMOUR | 57313 | $3,736.19 | $4,653.54 | $4,063.13 | $3,729.99 | $2,663.59 | $6,675.85 | $2,503.95 | $3,452.74 | $2,146.78 |

| VIENNA | 57271 | $3,734.36 | $4,536.56 | $4,392.82 | $3,466.21 | $2,663.59 | $6,737.42 | $2,503.95 | $3,496.58 | $2,077.74 |

| MILBANK | 57252 | $3,732.65 | $4,536.56 | $4,392.82 | $3,390.87 | $2,663.59 | $7,324.61 | $2,221.40 | $3,258.66 | $2,072.72 |

| RAYMOND | 57258 | $3,731.25 | $4,536.56 | $4,392.82 | $3,441.33 | $2,663.59 | $6,737.42 | $2,503.95 | $3,496.58 | $2,077.74 |

| ALEXANDRIA | 57311 | $3,728.59 | $4,653.54 | $4,063.13 | $3,466.21 | $2,663.59 | $6,675.85 | $2,503.95 | $3,609.55 | $2,192.93 |

| HURON | 57350 | $3,727.93 | $4,580.21 | $4,063.13 | $3,441.33 | $2,663.59 | $7,291.43 | $2,345.77 | $3,355.30 | $2,082.68 |

| WILLOW LAKE | 57278 | $3,727.35 | $4,536.56 | $4,392.82 | $3,466.21 | $2,663.59 | $6,737.42 | $2,503.95 | $3,508.42 | $2,009.83 |

| SIOUX FALLS | 57104 | $3,727.06 | $4,609.89 | $3,592.78 | $3,822.49 | $2,423.73 | $6,647.48 | $2,611.64 | $3,622.02 | $2,486.48 |

| MOUNT VERNON | 57363 | $3,726.98 | $4,580.21 | $4,063.13 | $3,402.88 | $2,663.59 | $6,675.85 | $2,503.95 | $3,691.66 | $2,234.55 |

| WESSINGTON | 57381 | $3,723.57 | $4,806.76 | $4,063.13 | $3,441.33 | $2,663.59 | $6,737.42 | $2,503.95 | $3,494.68 | $2,077.74 |

| FRANKFORT | 57440 | $3,721.36 | $4,536.56 | $4,392.82 | $3,441.33 | $2,663.59 | $6,737.42 | $2,503.95 | $3,417.45 | $2,077.74 |

| ETHAN | 57334 | $3,720.84 | $4,653.54 | $4,063.13 | $3,466.21 | $2,663.59 | $6,675.85 | $2,503.95 | $3,662.70 | $2,077.74 |

| SIOUX FALLS | 57103 | $3,720.48 | $4,609.89 | $3,592.78 | $3,808.29 | $2,423.73 | $6,647.48 | $2,611.64 | $3,710.93 | $2,359.11 |

| CLARK | 57225 | $3,719.36 | $4,536.56 | $4,392.82 | $3,441.33 | $2,663.59 | $6,737.42 | $2,503.95 | $3,448.33 | $2,030.88 |

| MELLETTE | 57461 | $3,718.89 | $4,806.76 | $4,063.13 | $3,395.11 | $2,663.59 | $6,737.42 | $2,503.95 | $3,430.01 | $2,151.11 |

| MENNO | 57045 | $3,718.69 | $4,609.89 | $4,063.13 | $3,389.01 | $2,663.59 | $6,675.85 | $2,503.95 | $3,770.33 | $2,073.78 |

| BRADLEY | 57217 | $3,718.10 | $4,689.79 | $4,392.82 | $3,390.87 | $2,663.59 | $6,737.42 | $2,503.95 | $3,268.76 | $2,097.62 |

| SCOTLAND | 57059 | $3,717.62 | $4,653.54 | $4,063.13 | $3,389.01 | $2,663.59 | $6,675.85 | $2,503.95 | $3,773.24 | $2,018.68 |

| SIOUX FALLS | 57105 | $3,715.78 | $4,609.89 | $3,592.78 | $3,679.71 | $2,423.73 | $6,755.61 | $2,611.64 | $3,575.36 | $2,477.56 |

| REDFIELD | 57469 | $3,714.77 | $4,653.54 | $4,063.13 | $3,441.33 | $2,663.59 | $6,737.42 | $2,503.95 | $3,417.45 | $2,237.74 |

| BRYANT | 57221 | $3,712.66 | $4,536.56 | $4,392.82 | $3,466.21 | $2,663.59 | $6,737.42 | $2,503.95 | $3,367.24 | $2,033.49 |

| FULTON | 57340 | $3,711.68 | $4,536.56 | $4,063.13 | $3,466.21 | $2,663.59 | $6,675.85 | $2,503.95 | $3,528.47 | $2,255.73 |

| SPRINGFIELD | 57062 | $3,711.21 | $4,653.54 | $4,063.13 | $3,389.01 | $2,663.59 | $6,675.85 | $2,503.95 | $3,724.98 | $2,015.61 |

| HAYTI | 57241 | $3,710.45 | $4,536.56 | $4,392.82 | $3,466.21 | $2,663.59 | $6,737.42 | $2,503.95 | $3,382.20 | $2,000.84 |

| MITCHELL | 57301 | $3,710.43 | $4,580.21 | $3,729.54 | $3,402.88 | $2,663.59 | $7,190.34 | $2,470.25 | $3,375.76 | $2,270.89 |

| TYNDALL | 57066 | $3,710.39 | $4,653.54 | $4,063.13 | $3,389.01 | $2,663.59 | $6,675.85 | $2,503.95 | $3,724.98 | $2,009.09 |

| AVON | 57315 | $3,704.32 | $4,653.54 | $4,063.13 | $3,729.99 | $2,663.59 | $6,675.85 | $2,503.95 | $3,310.56 | $2,033.98 |

| LAKE NORDEN | 57248 | $3,704.13 | $4,609.89 | $4,392.82 | $3,466.21 | $2,663.59 | $6,737.42 | $2,503.95 | $3,229.84 | $2,029.36 |

| LETCHER | 57359 | $3,699.86 | $4,580.21 | $4,063.13 | $3,402.88 | $2,663.59 | $6,737.42 | $2,503.95 | $3,569.96 | $2,077.74 |

| ARTESIAN | 57314 | $3,699.42 | $4,580.21 | $4,063.13 | $3,402.88 | $2,663.59 | $6,737.42 | $2,503.95 | $3,451.34 | $2,192.81 |

| ESTELLINE | 57234 | $3,698.58 | $4,536.56 | $4,392.82 | $3,466.21 | $2,663.59 | $6,737.42 | $2,503.95 | $3,253.42 | $2,034.67 |

| GOODWIN | 57238 | $3,698.31 | $4,536.56 | $4,392.82 | $3,390.87 | $2,663.59 | $6,737.42 | $2,503.95 | $3,283.57 | $2,077.74 |

| GARY | 57237 | $3,697.59 | $4,536.56 | $4,392.82 | $3,466.21 | $2,663.59 | $6,737.42 | $2,503.95 | $3,167.91 | $2,112.26 |

| SIOUX FALLS | 57197 | $3,695.43 | $4,609.89 | $3,592.78 | $3,679.71 | $2,423.73 | $6,755.61 | $2,611.64 | $3,575.36 | $2,314.76 |

| CARPENTER | 57322 | $3,692.83 | $4,536.56 | $4,392.82 | $3,441.33 | $2,663.59 | $6,737.42 | $2,503.95 | $3,189.28 | $2,077.74 |

| KRANZBURG | 57245 | $3,692.64 | $4,536.56 | $4,392.82 | $3,390.87 | $2,663.59 | $6,737.42 | $2,503.95 | $3,238.20 | $2,077.74 |

| TORONTO | 57268 | $3,692.62 | $4,536.56 | $4,392.82 | $3,466.21 | $2,663.59 | $6,737.42 | $2,503.95 | $3,162.67 | $2,077.74 |

| CASTLEWOOD | 57223 | $3,690.83 | $4,536.56 | $4,392.82 | $3,390.87 | $2,663.59 | $6,737.42 | $2,503.95 | $3,283.57 | $2,017.91 |

| BRANDT | 57218 | $3,690.27 | $4,536.56 | $4,392.82 | $3,466.21 | $2,663.59 | $6,737.42 | $2,503.95 | $3,138.94 | $2,082.67 |

| IRENE | 57037 | $3,690.14 | $4,609.89 | $3,729.54 | $3,389.01 | $2,663.59 | $6,675.85 | $2,503.95 | $3,904.49 | $2,044.78 |

| PARKSTON | 57366 | $3,688.55 | $4,653.54 | $4,063.13 | $3,466.21 | $2,663.59 | $6,675.85 | $2,503.95 | $3,362.03 | $2,120.09 |

| CROOKS | 57020 | $3,687.20 | $4,609.89 | $3,729.54 | $3,426.70 | $2,663.59 | $6,675.85 | $2,586.78 | $3,490.48 | $2,314.76 |

| BALTIC | 57003 | $3,686.61 | $4,609.89 | $3,729.54 | $3,426.70 | $2,663.59 | $6,675.85 | $2,586.78 | $3,554.62 | $2,245.89 |

| KAYLOR | 57354 | $3,685.71 | $4,653.54 | $4,063.13 | $3,466.21 | $2,663.59 | $6,675.85 | $2,503.95 | $3,381.69 | $2,077.74 |

| DELMONT | 57330 | $3,685.56 | $4,653.54 | $4,063.13 | $3,466.21 | $2,663.59 | $6,675.85 | $2,503.95 | $3,310.56 | $2,147.71 |

| CLEAR LAKE | 57226 | $3,683.07 | $4,536.56 | $4,392.82 | $3,390.87 | $2,663.59 | $6,737.42 | $2,503.95 | $3,167.91 | $2,071.46 |

| ALPENA | 57312 | $3,682.56 | $4,580.21 | $4,063.13 | $3,402.88 | $2,663.59 | $6,737.42 | $2,765.57 | $3,169.98 | $2,077.74 |

| LANE | 57358 | $3,682.56 | $4,580.21 | $4,063.13 | $3,402.88 | $2,663.59 | $6,737.42 | $2,765.57 | $3,169.98 | $2,077.74 |

| CHESTER | 57016 | $3,680.77 | $4,609.89 | $3,729.54 | $3,466.21 | $2,663.59 | $6,737.42 | $2,503.95 | $3,575.27 | $2,160.30 |

| HAZEL | 57242 | $3,680.76 | $4,536.56 | $4,392.82 | $3,208.95 | $2,663.59 | $6,737.42 | $2,503.95 | $3,325.06 | $2,077.74 |

| WOONSOCKET | 57385 | $3,677.46 | $4,580.21 | $4,063.13 | $3,402.88 | $2,663.59 | $6,737.42 | $2,503.95 | $3,169.98 | $2,298.54 |

| HARTFORD | 57033 | $3,676.26 | $4,609.89 | $3,729.54 | $3,426.70 | $2,663.59 | $6,675.85 | $2,586.78 | $3,465.05 | $2,252.71 |

| TRIPP | 57376 | $3,675.80 | $4,653.54 | $4,063.13 | $3,466.21 | $2,663.59 | $6,675.85 | $2,503.95 | $3,381.69 | $1,998.47 |

| SIOUX FALLS | 57108 | $3,675.46 | $4,609.89 | $3,592.78 | $3,654.42 | $2,423.73 | $6,647.48 | $2,630.19 | $3,582.54 | $2,262.65 |

| ASTORIA | 57213 | $3,673.98 | $4,536.56 | $4,392.82 | $3,466.21 | $2,663.59 | $6,737.42 | $2,503.95 | $3,013.60 | $2,077.74 |

| EMERY | 57332 | $3,672.59 | $4,653.54 | $4,063.13 | $3,466.21 | $2,663.59 | $6,675.85 | $2,503.95 | $3,207.29 | $2,147.16 |

| CANOVA | 57321 | $3,670.34 | $4,536.56 | $4,063.13 | $3,466.21 | $2,663.59 | $6,737.42 | $2,503.95 | $3,314.14 | $2,077.74 |

| WOLSEY | 57384 | $3,668.67 | $4,653.54 | $4,063.13 | $3,441.33 | $2,663.59 | $6,737.42 | $2,503.95 | $3,169.98 | $2,116.47 |

| HUMBOLDT | 57035 | $3,667.24 | $4,609.89 | $3,729.54 | $3,466.21 | $2,663.59 | $6,675.85 | $2,586.78 | $3,422.53 | $2,183.49 |

| HARRISBURG | 57032 | $3,667.00 | $4,609.89 | $3,729.54 | $3,530.56 | $2,663.59 | $6,675.85 | $2,586.78 | $3,354.25 | $2,185.54 |

| SIOUX FALLS | 57106 | $3,666.87 | $4,609.89 | $3,592.78 | $3,726.16 | $2,423.73 | $6,755.61 | $2,611.64 | $3,379.80 | $2,235.34 |

| RENNER | 57055 | $3,665.33 | $4,609.89 | $3,729.54 | $3,426.70 | $2,663.59 | $6,675.85 | $2,586.78 | $3,315.53 | $2,314.76 |

| HITCHCOCK | 57348 | $3,663.83 | $4,653.54 | $4,063.13 | $3,441.33 | $2,663.59 | $6,737.42 | $2,503.95 | $3,169.98 | $2,077.74 |

| VOLIN | 57072 | $3,663.56 | $4,609.89 | $4,063.13 | $3,389.01 | $2,663.59 | $6,675.85 | $2,503.95 | $3,325.32 | $2,077.74 |

| COLTON | 57018 | $3,663.05 | $4,609.89 | $3,729.54 | $3,426.70 | $2,663.59 | $6,675.85 | $2,586.78 | $3,427.14 | $2,184.89 |

| SIOUX FALLS | 57110 | $3,660.30 | $4,609.89 | $3,592.78 | $3,654.42 | $2,423.73 | $6,647.48 | $2,611.64 | $3,343.65 | $2,398.79 |

| FREEMAN | 57029 | $3,658.57 | $4,609.89 | $4,063.13 | $3,466.21 | $2,663.59 | $6,675.85 | $2,503.95 | $3,191.12 | $2,094.82 |

| LENNOX | 57039 | $3,656.39 | $4,609.89 | $3,729.54 | $3,426.70 | $2,663.59 | $6,675.85 | $2,586.78 | $3,412.06 | $2,146.69 |

| CAVOUR | 57324 | $3,654.25 | $4,580.21 | $4,063.13 | $3,402.88 | $2,663.59 | $6,737.42 | $2,503.95 | $3,179.64 | $2,103.17 |

| CARTHAGE | 57323 | $3,654.17 | $4,580.21 | $4,063.13 | $3,402.88 | $2,663.59 | $6,737.42 | $2,503.95 | $3,204.45 | $2,077.74 |

| HOWARD | 57349 | $3,653.54 | $4,536.56 | $4,063.13 | $3,402.88 | $2,663.59 | $6,737.42 | $2,503.95 | $3,185.15 | $2,135.68 |

| PARKER | 57053 | $3,653.28 | $4,609.89 | $3,729.54 | $3,426.70 | $2,663.59 | $6,675.85 | $2,503.95 | $3,468.02 | $2,148.70 |

| GAYVILLE | 57031 | $3,652.41 | $4,609.89 | $4,063.13 | $3,372.75 | $2,663.59 | $6,675.85 | $2,503.95 | $3,363.89 | $1,966.26 |

| YALE | 57386 | $3,650.42 | $4,536.56 | $4,063.13 | $3,441.33 | $2,663.59 | $6,737.42 | $2,503.95 | $3,179.64 | $2,077.74 |

| VIRGIL | 57379 | $3,649.86 | $4,580.21 | $4,063.13 | $3,402.88 | $2,663.59 | $6,737.42 | $2,503.95 | $3,169.98 | $2,077.74 |

| WENTWORTH | 57075 | $3,649.11 | $4,609.89 | $3,729.54 | $3,466.21 | $2,663.59 | $6,737.42 | $2,503.95 | $3,346.56 | $2,135.72 |

| IROQUOIS | 57353 | $3,646.88 | $4,536.56 | $4,063.13 | $3,402.88 | $2,663.59 | $6,737.42 | $2,503.95 | $3,194.81 | $2,072.70 |

| ABERDEEN | 57401 | $3,643.94 | $4,733.44 | $4,063.13 | $3,395.11 | $2,663.59 | $6,774.14 | $2,355.48 | $3,109.11 | $2,057.54 |

| CANTON | 57013 | $3,643.61 | $4,609.89 | $3,729.54 | $3,372.75 | $2,663.59 | $6,675.85 | $2,586.78 | $3,376.16 | $2,134.31 |

| MONTROSE | 57048 | $3,639.09 | $4,609.89 | $3,729.54 | $3,466.21 | $2,663.59 | $6,675.85 | $2,503.95 | $3,300.00 | $2,163.70 |

| WORTHING | 57077 | $3,638.61 | $4,609.89 | $3,729.54 | $3,426.70 | $2,663.59 | $6,675.85 | $2,586.78 | $3,308.11 | $2,108.42 |

| DAVIS | 57021 | $3,637.12 | $4,609.89 | $3,729.54 | $3,372.75 | $2,663.59 | $6,675.85 | $2,503.95 | $3,463.69 | $2,077.74 |

| GARRETSON | 57030 | $3,637.07 | $4,609.89 | $3,729.54 | $3,293.13 | $2,663.59 | $6,675.85 | $2,586.78 | $3,315.53 | $2,222.22 |

| FEDORA | 57337 | $3,634.96 | $4,536.56 | $4,063.13 | $3,402.88 | $2,663.59 | $6,737.42 | $2,503.95 | $3,094.40 | $2,077.74 |

| WAKONDA | 57073 | $3,633.68 | $4,609.89 | $3,729.54 | $3,389.01 | $2,663.59 | $6,675.85 | $2,503.95 | $3,502.26 | $1,995.34 |

| SPENCER | 57374 | $3,633.67 | $4,653.54 | $3,729.54 | $3,466.21 | $2,663.59 | $6,675.85 | $2,503.95 | $3,298.97 | $2,077.74 |

| NORTH SIOUX CITY | 57049 | $3,631.92 | $4,609.89 | $3,729.54 | $3,372.75 | $2,663.59 | $6,675.85 | $2,597.15 | $3,287.65 | $2,118.93 |

| TEA | 57064 | $3,631.68 | $4,609.89 | $3,729.54 | $3,426.70 | $2,423.73 | $6,675.85 | $2,586.78 | $3,488.79 | $2,112.15 |

| CENTERVILLE | 57014 | $3,629.24 | $4,609.89 | $3,729.54 | $3,372.75 | $2,663.59 | $6,675.85 | $2,503.95 | $3,463.69 | $2,014.70 |

| BRIDGEWATER | 57319 | $3,629.06 | $4,609.89 | $3,729.54 | $3,466.21 | $2,663.59 | $6,675.85 | $2,503.95 | $3,298.97 | $2,084.47 |

| DELL RAPIDS | 57022 | $3,628.54 | $4,609.89 | $3,729.54 | $3,293.13 | $2,663.59 | $6,675.85 | $2,586.78 | $3,315.67 | $2,153.84 |

| VALLEY SPRINGS | 57068 | $3,627.54 | $4,609.89 | $3,729.54 | $3,293.13 | $2,423.73 | $6,675.85 | $2,586.78 | $3,554.12 | $2,147.32 |

| ERWIN | 57233 | $3,625.39 | $4,536.56 | $3,729.54 | $3,466.21 | $2,663.59 | $6,737.42 | $2,503.95 | $3,288.12 | $2,077.74 |

| HURLEY | 57036 | $3,623.59 | $4,609.89 | $3,729.54 | $3,466.21 | $2,663.59 | $6,675.85 | $2,503.95 | $3,241.98 | $2,097.74 |

| VIBORG | 57070 | $3,621.80 | $4,609.89 | $3,729.54 | $3,372.75 | $2,663.59 | $6,675.85 | $2,503.95 | $3,337.21 | $2,081.63 |

| NUNDA | 57050 | $3,621.07 | $4,609.89 | $3,729.54 | $3,466.21 | $2,663.59 | $6,737.42 | $2,503.95 | $3,180.24 | $2,077.74 |

| OLDHAM | 57051 | $3,618.05 | $4,609.89 | $3,729.54 | $3,466.21 | $2,663.59 | $6,737.42 | $2,503.95 | $3,156.10 | $2,077.74 |

| RAMONA | 57054 | $3,618.05 | $4,609.89 | $3,729.54 | $3,466.21 | $2,663.59 | $6,737.42 | $2,503.95 | $3,156.10 | $2,077.74 |

| COLMAN | 57017 | $3,617.19 | $4,609.89 | $3,729.54 | $3,466.21 | $2,663.59 | $6,737.42 | $2,503.95 | $3,143.57 | $2,083.35 |

| CANISTOTA | 57012 | $3,615.92 | $4,609.89 | $3,729.54 | $3,466.21 | $2,663.59 | $6,675.85 | $2,503.95 | $3,159.82 | $2,118.55 |

| CHANCELLOR | 57015 | $3,615.76 | $4,609.89 | $3,729.54 | $3,426.70 | $2,663.59 | $6,675.85 | $2,503.95 | $3,238.87 | $2,077.74 |

| MARION | 57043 | $3,615.45 | $4,609.89 | $3,729.54 | $3,466.21 | $2,663.59 | $6,675.85 | $2,503.95 | $3,179.25 | $2,095.34 |

| ELKTON | 57026 | $3,615.29 | $4,609.89 | $3,729.54 | $3,466.21 | $2,663.59 | $6,737.42 | $2,503.95 | $3,145.27 | $2,066.49 |

| BADGER | 57214 | $3,614.02 | $4,609.89 | $3,729.54 | $3,466.21 | $2,663.59 | $6,737.42 | $2,503.95 | $3,123.80 | $2,077.74 |

| SIOUX FALLS | 57107 | $3,613.50 | $4,609.89 | $3,592.78 | $3,426.70 | $2,423.73 | $6,755.61 | $2,611.64 | $3,246.85 | $2,240.79 |

| SALEM | 57058 | $3,612.87 | $4,609.89 | $3,729.54 | $3,466.21 | $2,663.59 | $6,675.85 | $2,503.95 | $3,110.27 | $2,143.66 |

| TRENT | 57065 | $3,611.95 | $4,609.89 | $3,729.54 | $3,293.13 | $2,663.59 | $6,737.42 | $2,503.95 | $3,279.94 | $2,078.18 |

| RUTLAND | 57057 | $3,611.90 | $4,609.89 | $3,729.54 | $3,466.21 | $2,663.59 | $6,737.42 | $2,503.95 | $3,134.89 | $2,049.70 |

| ARLINGTON | 57212 | $3,611.46 | $4,609.89 | $3,729.54 | $3,466.21 | $2,663.59 | $6,737.42 | $2,503.95 | $3,123.80 | $2,057.32 |

| LAKE PRESTON | 57249 | $3,611.38 | $4,536.56 | $3,729.54 | $3,466.21 | $2,663.59 | $6,737.42 | $2,503.95 | $3,174.30 | $2,079.50 |

| MONROE | 57047 | $3,610.82 | $4,609.89 | $3,729.54 | $3,466.21 | $2,663.59 | $6,675.85 | $2,503.95 | $3,159.82 | $2,077.74 |

| FAIRVIEW | 57027 | $3,603.95 | $4,609.89 | $3,729.54 | $3,372.75 | $2,663.59 | $6,675.85 | $2,586.78 | $3,115.49 | $2,077.74 |

| JEFFERSON | 57038 | $3,603.65 | $4,609.89 | $3,729.54 | $3,372.75 | $2,663.59 | $6,675.85 | $2,503.95 | $3,231.25 | $2,042.40 |

| BRANDON | 57005 | $3,603.57 | $4,609.89 | $3,729.54 | $3,293.13 | $2,423.73 | $6,675.85 | $2,586.78 | $3,315.53 | $2,194.10 |

| DE SMET | 57231 | $3,601.87 | $4,536.56 | $3,729.54 | $3,466.21 | $2,663.59 | $6,737.42 | $2,503.95 | $3,092.37 | $2,085.36 |

| HUDSON | 57034 | $3,599.23 | $4,609.89 | $3,729.54 | $3,372.75 | $2,663.59 | $6,675.85 | $2,586.78 | $3,115.49 | $2,039.94 |

| EGAN | 57024 | $3,598.67 | $4,609.89 | $3,729.54 | $3,293.13 | $2,663.59 | $6,737.42 | $2,503.95 | $3,174.11 | $2,077.74 |

| BROOKINGS | 57007 | $3,597.52 | $4,609.89 | $3,729.54 | $3,466.21 | $2,663.59 | $6,686.48 | $2,503.95 | $3,042.74 | $2,077.74 |

| WHITE | 57276 | $3,596.88 | $4,536.56 | $3,729.54 | $3,466.21 | $2,663.59 | $6,737.42 | $2,503.95 | $3,108.50 | $2,029.29 |

| WINFRED | 57076 | $3,596.12 | $4,536.56 | $3,729.54 | $3,466.21 | $2,663.59 | $6,737.42 | $2,503.95 | $3,053.97 | $2,077.74 |

| BURBANK | 57010 | $3,593.60 | $4,609.89 | $3,729.54 | $3,372.75 | $2,663.59 | $6,675.85 | $2,503.95 | $3,115.49 | $2,077.74 |

| AURORA | 57002 | $3,592.72 | $4,609.89 | $3,729.54 | $3,466.21 | $2,663.59 | $6,737.42 | $2,503.95 | $3,009.17 | $2,022.01 |

| MADISON | 57042 | $3,592.01 | $4,609.89 | $3,729.54 | $3,466.21 | $2,663.59 | $6,737.42 | $2,365.26 | $3,063.81 | $2,100.41 |

| SINAI | 57061 | $3,591.84 | $4,609.89 | $3,729.54 | $3,466.21 | $2,663.59 | $6,737.42 | $2,503.95 | $2,946.42 | $2,077.74 |

| FLANDREAU | 57028 | $3,591.08 | $4,609.89 | $3,729.54 | $3,293.13 | $2,663.59 | $6,737.42 | $2,503.95 | $3,143.57 | $2,047.56 |

| VOLGA | 57071 | $3,586.49 | $4,609.89 | $3,729.54 | $3,466.21 | $2,663.59 | $6,737.42 | $2,503.95 | $2,946.42 | $2,034.93 |

| BERESFORD | 57004 | $3,586.30 | $4,609.89 | $3,729.54 | $3,372.75 | $2,663.59 | $6,675.85 | $2,503.95 | $3,162.94 | $1,971.89 |

| ELK POINT | 57025 | $3,585.49 | $4,609.89 | $3,729.54 | $3,372.75 | $2,663.59 | $6,675.85 | $2,503.95 | $3,175.96 | $1,952.38 |

| BRUCE | 57220 | $3,584.77 | $4,536.56 | $3,729.54 | $3,466.21 | $2,663.59 | $6,737.42 | $2,503.95 | $3,013.60 | $2,027.32 |

| ALCESTER | 57001 | $3,576.44 | $4,609.89 | $3,729.54 | $3,372.75 | $2,663.59 | $6,675.85 | $2,503.95 | $3,115.49 | $1,940.49 |

| BROOKINGS | 57006 | $3,553.41 | $4,609.89 | $3,729.54 | $3,466.21 | $2,663.59 | $6,686.48 | $2,214.29 | $3,042.74 | $2,014.55 |

| VERMILLION | 57069 | $3,550.64 | $4,609.89 | $3,729.54 | $3,372.75 | $2,663.59 | $6,675.85 | $2,386.99 | $3,068.04 | $1,898.45 |

| WATERTOWN | 57201 | $3,467.81 | $4,536.56 | $3,729.54 | $3,208.95 | $2,663.59 | $6,307.96 | $2,246.65 | $3,060.17 | $1,989.02 |

Cheapest Rates by Cities in South Dakota

Below is a list of cities in South Dakota with the cheapest insurance rates, including available car insurance discounts to help you save.

| City | Average Grand Total |

|---|---|

| WATERTOWN | $3,467.81 |

| VERMILLION | $3,550.64 |

| BROOKINGS | $3,575.47 |

| ALCESTER | $3,576.44 |

| BRUCE | $3,584.77 |

| ELK POINT | $3,585.49 |

| BERESFORD | $3,586.30 |

| VOLGA | $3,586.49 |

| FLANDREAU | $3,591.08 |

| SINAI | $3,591.84 |

| MADISON | $3,592.02 |

| AURORA | $3,592.72 |

| BURBANK | $3,593.60 |

| WINFRED | $3,596.12 |

| WHITE | $3,596.88 |

| EGAN | $3,598.67 |

| HUDSON | $3,599.23 |

| DE SMET | $3,601.87 |

| BRANDON | $3,603.57 |

| JEFFERSON | $3,603.65 |

| FAIRVIEW | $3,603.95 |

| MONROE | $3,610.82 |

| LAKE PRESTON | $3,611.38 |

| ARLINGTON | $3,611.46 |

| RUTLAND | $3,611.90 |

| TRENT | $3,611.95 |

| SALEM | $3,612.87 |

| BADGER | $3,614.02 |

| ELKTON | $3,615.29 |

| MARION | $3,615.45 |

| CHANCELLOR | $3,615.77 |

| CANISTOTA | $3,615.92 |

| COLMAN | $3,617.19 |

| OLDHAM | $3,618.05 |

| RAMONA | $3,618.05 |

| NUNDA | $3,621.07 |

| VIBORG | $3,621.80 |

| HURLEY | $3,623.59 |

| ERWIN | $3,625.39 |

| VALLEY SPRINGS | $3,627.55 |

| DELL RAPIDS | $3,628.54 |

| BRIDGEWATER | $3,629.06 |

| CENTERVILLE | $3,629.25 |

| TEA | $3,631.68 |

| NORTH SIOUX CITY | $3,631.92 |

| SPENCER | $3,633.67 |

| WAKONDA | $3,633.68 |

| FEDORA | $3,634.96 |

| GARRETSON | $3,637.07 |

| DAVIS | $3,637.12 |

| WORTHING | $3,638.61 |

| MONTROSE | $3,639.09 |

| CANTON | $3,643.61 |

| ABERDEEN | $3,643.94 |

| IROQUOIS | $3,646.88 |

| WENTWORTH | $3,649.11 |

| VIRGIL | $3,649.86 |

| YALE | $3,650.42 |

| GAYVILLE | $3,652.41 |

| PARKER | $3,653.28 |

| HOWARD | $3,653.54 |

| CARTHAGE | $3,654.17 |

| CAVOUR | $3,654.25 |

| LENNOX | $3,656.39 |

| FREEMAN | $3,658.57 |

| COLTON | $3,663.05 |

| VOLIN | $3,663.56 |

| HITCHCOCK | $3,663.83 |

| RENNER | $3,665.33 |

| HARRISBURG | $3,667.00 |

| HUMBOLDT | $3,667.23 |

| WOLSEY | $3,668.67 |

| CANOVA | $3,670.34 |

| EMERY | $3,672.59 |

| ASTORIA | $3,673.98 |

| TRIPP | $3,675.80 |